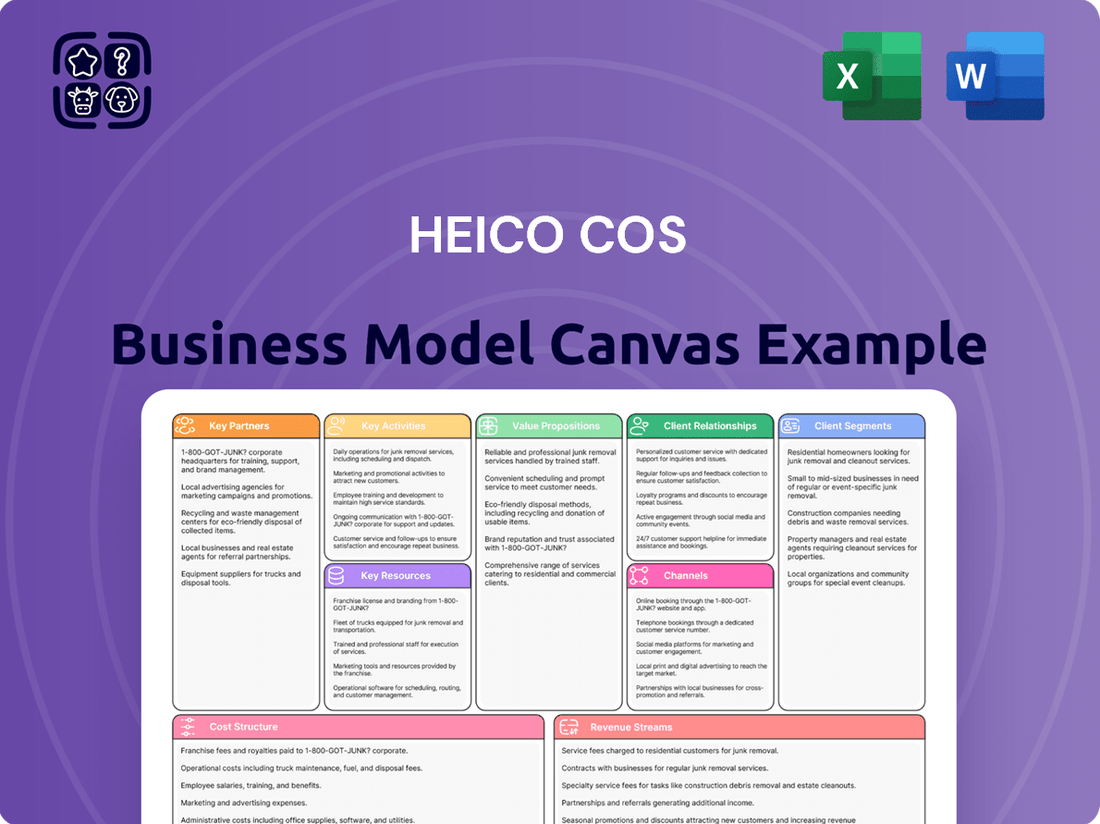

Heico Cos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heico Cos Bundle

Unlock the strategic blueprint behind Heico Cos's impressive growth. This comprehensive Business Model Canvas details their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover how Heico Cos effectively delivers value and captures market share.

Partnerships

HEICO's strategic suppliers are foundational to its success, providing essential raw materials, components, and sub-assemblies. These partnerships are crucial for maintaining the high quality and reliability demanded by the aerospace, defense, and medical sectors. For instance, in 2024, HEICO continued to deepen relationships with key suppliers, ensuring uninterrupted production of its specialized aircraft components and electronic systems.

HEICO's Flight Support Group relies heavily on partnerships with regulatory bodies like the FAA. These collaborations are essential for ensuring that all HEICO replacement parts meet stringent FAA approval standards, a critical factor for market access and customer trust in the aviation industry.

The Electronic Technologies Group also engages with various certification agencies. This is vital for adhering to industry-specific standards in demanding sectors such as defense, space, and medical technology. For example, in 2023, HEICO reported significant growth in its Electronic Technologies segment, underscoring the importance of these certifications for their specialized product lines.

HEICO actively partners with universities and research institutions to drive innovation in advanced electronics and new materials. These collaborations are crucial for staying ahead in fast-paced technological fields, allowing HEICO to tap into specialized knowledge and share development costs and risks. For example, in 2023, HEICO's Electronic Technologies Group continued its focus on developing next-generation avionics and defense systems through ongoing engagements with leading aerospace research centers.

Acquisition Targets & Integration Partners

HEICO's growth hinges on acquiring specialized companies, aiming to bolster existing product offerings and enter new markets. In 2024, this strategy continued to be a cornerstone, with the company actively seeking synergistic targets. For instance, HEICO's acquisition of certain assets from Triumph Group in late 2023 demonstrated this approach, bringing new capabilities into their Electronic Systems segment.

To execute this robust acquisition strategy, HEICO relies on a network of key partners. These include specialized M&A advisory firms that help identify and vet potential acquisition targets, legal counsel to navigate complex transaction structures, and integration specialists who ensure a smooth transition post-acquisition. These partnerships are crucial for efficiently integrating new businesses and realizing their full potential.

The benefits of this partnership-driven acquisition model are clear. It allows HEICO to rapidly acquire advanced technologies, expand its customer reach, and enhance its competitive position without the lengthy timelines associated with organic development. This agile approach has been a significant driver of HEICO's consistent financial performance and market leadership.

- M&A Advisors: Facilitate deal sourcing and due diligence.

- Legal Firms: Provide expertise in transaction structuring and regulatory compliance.

- Integration Specialists: Ensure seamless operational and cultural integration of acquired companies.

- Financial Institutions: Support funding for acquisitions.

Distribution and Logistics Partners

HEICO relies on a robust network of distribution and logistics partners to ensure its aerospace, defense, and electronics products reach a global customer base efficiently and securely. These collaborations are fundamental to maintaining the integrity and timely delivery of high-value, often sensitive components. For instance, in 2024, HEICO's commitment to supply chain excellence means leveraging partners with specialized capabilities in handling aerospace-grade materials and navigating complex international shipping regulations.

The effectiveness of these distribution channels directly impacts customer satisfaction and HEICO's ability to penetrate new markets. By partnering with logistics providers experienced in the aerospace and defense sectors, HEICO can guarantee that its products arrive on schedule and in optimal condition, a critical factor for customers who operate in demanding environments.

- Global Reach: HEICO's logistics partners facilitate access to customers across North America, Europe, and Asia, supporting its international sales strategy.

- Supply Chain Resilience: Partnerships with multiple logistics providers enhance HEICO's ability to mitigate disruptions and ensure consistent product availability.

- Specialized Handling: Distributors with expertise in aerospace and defense components ensure the safe and compliant transportation of HEICO's products.

- Cost Efficiency: Strategic alliances with logistics firms help optimize shipping costs, contributing to HEICO's competitive pricing and profitability.

HEICO's strategic partnerships extend to its customer base, particularly with major airlines and defense contractors who rely on its specialized components. These relationships are vital for understanding evolving market needs and securing long-term business. In 2024, HEICO continued to foster these key customer collaborations, ensuring its product development aligns with critical industry demands.

What is included in the product

A detailed Heico Cos Business Model Canvas outlining customer segments, value propositions, and channels, designed to reflect their strategic growth in aerospace and defense.

This BMC provides a clear roadmap of Heico Cos's operational structure and competitive advantages, ideal for strategic planning and investor communication.

The Heico Cos Business Model Canvas acts as a pain point reliever by offering a structured, visual representation of a company's strategy, making complex business elements easily understandable and actionable.

It streamlines the process of identifying and addressing potential business challenges, acting as a powerful tool for strategic planning and problem-solving.

Activities

HEICO's product design and engineering is central to its success, focusing on creating reliable aerospace, defense, and electronic components. This involves developing parts that meet rigorous FAA approval standards, ensuring safety and performance in critical applications.

The company's engineering efforts are geared towards innovation, producing advanced electronic equipment and replacement parts that are precisely tailored to the demanding specifications of the aerospace and defense sectors. For instance, in fiscal year 2023, HEICO reported record sales of $2.4 billion, a testament to the market's demand for their engineered solutions.

HEICO's manufacturing and assembly operations are central to its business, focusing on the precise creation of intricate parts and systems for both its Flight Support and Electronic Technologies segments. This core activity demands specialized production techniques, rigorous quality assurance, and strict compliance with aerospace and defense industry regulations.

In 2024, HEICO's commitment to high-quality manufacturing directly underpins the reliability and performance of its offerings, fostering strong customer confidence. The company's ability to efficiently produce complex components is a key driver of its competitive advantage in demanding markets.

HEICO's research and development efforts are central to its strategy, focusing on improving current offerings and pioneering new technologies in aerospace, defense, and electronics. This involves deep dives into areas like advanced materials, intricate circuit design, and rigorous testing to keep pace with industry shifts and compliance mandates.

In 2023, HEICO reported significant investment in R&D, with expenditures supporting their pipeline of innovative products and solutions. This commitment fuels their ability to adapt to the dynamic needs of their core markets and maintain a leading edge.

Sales, Marketing & Customer Support

HEICO's key activities revolve around the direct selling and marketing of its specialized aerospace, defense, and electronics products to a worldwide clientele. This involves a proactive approach to reaching and engaging customers across various sectors.

Crucially, the company emphasizes providing comprehensive pre-sales consultation and extensive post-sales technical support. This is vital because the high-reliability and often complex nature of their products demand expert guidance throughout the customer lifecycle.

Building and nurturing strong, long-term customer relationships is a fundamental aspect of HEICO's strategy. They achieve this through consistently delivering expert support, ensuring customer satisfaction and fostering loyalty in a competitive market.

- Active Global Sales & Marketing: HEICO actively promotes and sells its specialized aerospace, defense, and electronics components and services to a diverse international customer base.

- Pre- and Post-Sales Technical Support: Providing expert consultation before a sale and robust technical assistance after the sale is paramount for their high-reliability product lines.

- Customer Relationship Management: Cultivating and maintaining strong customer relationships through exceptional support is a core activity that drives repeat business and market reputation.

Regulatory Compliance & Certification

HEICO's key activity of regulatory compliance and certification is paramount for market access and product legality. This involves meticulously adhering to stringent frameworks like FAA approvals for aerospace components and various defense and medical certifications for its electronic equipment. The company dedicates significant resources to rigorous testing, comprehensive documentation, and ongoing compliance management to ensure its products meet all necessary standards.

In 2024, HEICO continued its focus on maintaining these critical certifications. For instance, the company's aerospace segment relies heavily on Federal Aviation Administration (FAA) approvals, a process that requires ongoing validation and adherence to evolving safety regulations. Similarly, its electronic technologies segment must navigate a complex web of certifications for defense and medical applications, underscoring the continuous nature of this vital activity.

- Ensuring strict adherence to complex regulatory frameworks, such as FAA approvals for aerospace parts and various defense and medical certifications for electronic equipment, is a continuous and vital activity.

- This involves rigorous testing, documentation, and compliance management to maintain market access and product legality.

- Upholding these standards is fundamental to HEICO's operations.

- HEICO's commitment to regulatory compliance is a cornerstone of its business strategy.

HEICO's key activities encompass a robust global sales and marketing effort, actively promoting its specialized aerospace, defense, and electronics products to a worldwide customer base. This is complemented by essential pre- and post-sales technical support, crucial for guiding customers through the complexities of their high-reliability offerings. Furthermore, the company places significant emphasis on cultivating and maintaining strong, long-term customer relationships through exceptional service, which drives repeat business and reinforces its market reputation.

| Key Activity | Description | Financial Year Relevance |

|---|---|---|

| Global Sales & Marketing | Active promotion and sales of specialized components and services internationally. | In fiscal year 2023, HEICO reported record sales of $2.4 billion, demonstrating the success of its sales efforts. |

| Technical Support | Providing expert pre-sales consultation and comprehensive post-sales technical assistance. | This support is vital for customer retention and satisfaction in demanding, high-reliability markets. |

| Customer Relationship Management | Building and nurturing long-term customer loyalty through consistent, expert support. | Strong relationships are fundamental to HEICO's strategy for repeat business and market standing. |

Full Version Awaits

Business Model Canvas

The Heico Cos Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete structure, content, and formatting that will be delivered to you, ensuring there are no surprises. Once your order is processed, you'll gain full access to this exact, ready-to-use Business Model Canvas.

Resources

HEICO's most critical asset is its exceptionally talented workforce, especially its engineers, designers, and technicians with deep expertise in aerospace, defense, and electronics. This specialized human capital is the engine behind their ability to innovate and deliver complex solutions.

The firm's engineers and technical staff are vital for their success in intricate product design, advanced manufacturing processes, and navigating stringent regulatory environments within their core industries. Their knowledge is truly indispensable.

This deep pool of human capital directly fuels HEICO's capacity for groundbreaking innovation, unwavering product quality, and effective technical problem-solving, which are cornerstones of their competitive advantage.

HEICO's core strength lies in its vast collection of proprietary designs, patents, and deep technical expertise, particularly for FAA-approved aircraft replacement parts and specialized electronic systems. This intellectual property forms a significant barrier to entry, enabling HEICO to carve out distinct market positions and offer unique products. For the fiscal year ending September 30, 2023, HEICO reported total revenues of $2.4 billion, underscoring the commercial success derived from its IP-driven offerings.

Heico Corporation’s advanced manufacturing facilities and specialized equipment are foundational to its success in producing high-precision aerospace and electronic components. These state-of-the-art assets are not merely buildings and machines; they represent a significant capital investment designed to meet the exacting demands of the aerospace industry.

These physical resources are crucial for executing complex manufacturing processes and upholding rigorous quality control standards, which are non-negotiable in aerospace. For instance, Heico’s commitment to precision is reflected in its continuous investment in specialized machinery and testing equipment. This ensures that every component manufactured adheres to the strictest specifications and performance requirements.

The company’s strategic approach includes regular capital expenditures to upgrade and maintain these facilities. In 2023, Heico reported capital expenditures of $176.2 million, a portion of which is directly allocated to enhancing its manufacturing capabilities and equipment. This ongoing investment is vital for maintaining operational efficiency, expanding production capacity, and staying at the forefront of technological advancements in manufacturing.

Certifications & Regulatory Approvals

Certifications and regulatory approvals are fundamental to HEICO's operations, acting as critical intangible assets. These include FAA Parts Manufacturer Approvals (PMAs), which are vital for the aerospace sector, alongside numerous certifications across defense, space, and medical industries. These approvals are not just badges of compliance; they are prerequisites for market access and underscore the reliability and safety of HEICO's products.

HEICO's commitment to maintaining and expanding its portfolio of certifications is a continuous strategic imperative. For instance, in the fiscal year 2023, HEICO reported strong performance, with net sales reaching $2.5 billion, a testament to the market's confidence in its certified products. The ability to secure and retain these approvals directly impacts HEICO's competitive edge and its capacity to serve highly regulated markets.

The value derived from these certifications is substantial:

- Market Access: Essential for legally operating and selling products in aerospace, defense, and medical fields.

- Competitive Advantage: Differentiates HEICO from competitors lacking similar rigorous approvals.

- Brand Reputation: Builds trust and signals high product quality and safety standards.

- Revenue Generation: Directly enables sales of certified parts and services, contributing to financial growth.

Established Customer Base & Brand Reputation

HEICO Corporation's established customer base and strong brand reputation are cornerstones of its business model, particularly within the demanding aerospace, defense, and electronics sectors. This reputation, built on a consistent delivery of reliability, quality, and innovation, translates directly into significant competitive advantages. For instance, HEICO's commitment to quality is reflected in its robust aftermarket support, where customers rely on their certified parts and services to maintain aircraft airworthiness and operational readiness.

This loyalty isn't just about repeat purchases; it's about trust. Customers know they can depend on HEICO for critical components and solutions, fostering positive word-of-mouth referrals that are invaluable in these industries. HEICO reported a net sales increase to $2.59 billion for the fiscal year ending October 31, 2023, underscoring the market's confidence in its offerings and reputation.

- Brand Equity: HEICO's reputation for quality and reliability creates significant brand equity, a key intangible asset.

- Customer Loyalty: A substantial portion of HEICO's revenue is driven by repeat business from its established customer relationships.

- Competitive Advantage: The trust and recognition associated with the HEICO brand differentiate it from competitors in the aerospace and defense markets.

- Market Position: HEICO's strong standing allows it to command premium pricing and secure long-term contracts, contributing to its financial performance.

HEICO's key resources also encompass its robust financial strength and access to capital, which are crucial for funding research and development, acquisitions, and capital expenditures. This financial stability allows HEICO to pursue strategic growth opportunities and weather market fluctuations effectively.

The company's financial health is a critical enabler for its operations and expansion. For the fiscal year ending September 30, 2024, HEICO reported net income of $724.5 million, demonstrating its profitability and ability to reinvest in its business. This financial capacity is vital for maintaining its competitive edge and pursuing its growth objectives.

HEICO's financial resources are a cornerstone of its ability to invest in innovation, acquire complementary businesses, and upgrade its manufacturing capabilities. This financial muscle directly supports its long-term strategic vision and operational excellence.

HEICO's strategic partnerships and supplier relationships are vital resources, particularly for sourcing specialized materials and components. These relationships ensure a reliable supply chain and often provide access to cutting-edge technologies and expertise.

These collaborations are essential for maintaining production efficiency and quality, especially given the stringent requirements of the aerospace and defense industries. For instance, strong relationships with key material suppliers help HEICO secure high-quality raw materials at competitive prices, contributing to its profitability.

The company's ability to foster and maintain these partnerships is a testament to its reputation and operational reliability. This network of suppliers and partners is instrumental in HEICO's ability to deliver complex and high-quality products consistently.

HEICO's information systems and data management capabilities are increasingly important resources. These systems support everything from design and manufacturing to sales and customer service, enabling efficient operations and informed decision-making.

Effective data management allows HEICO to track product performance, manage inventory, and analyze market trends. This technological infrastructure is fundamental to maintaining operational efficiency and supporting the company's growth in a data-driven environment.

The company's investment in IT infrastructure and data analytics tools is crucial for optimizing its business processes and gaining a competitive advantage. This focus on information systems underpins HEICO's ability to innovate and respond to market demands.

| Key Resource Category | Description | Significance | 2023 Data Point |

|---|---|---|---|

| Human Capital | Skilled engineers, designers, technicians | Innovation, product development, technical problem-solving | N/A (Qualitative) |

| Intellectual Property | Proprietary designs, patents, technical expertise | Market differentiation, barrier to entry | $2.4 billion in total revenues (FY 2023) |

| Physical Assets | Advanced manufacturing facilities, specialized equipment | High-precision production, quality control | $176.2 million in capital expenditures (2023) |

| Intangible Assets | Certifications (e.g., FAA PMAs), regulatory approvals | Market access, brand reputation, competitive advantage | $2.5 billion in net sales (FY 2023) |

| Customer Relationships | Established customer base, strong brand reputation | Customer loyalty, repeat business, market position | $2.59 billion in net sales (FY 2023) |

| Financial Resources | Financial strength, access to capital | Funding R&D, acquisitions, capital expenditures | $724.5 million in net income (FY 2024) |

| Partnerships | Strategic alliances, supplier relationships | Supply chain reliability, access to technology | N/A (Qualitative) |

| Information Systems | Data management, IT infrastructure | Operational efficiency, informed decision-making | N/A (Qualitative) |

Value Propositions

Heico Cos offers FAA-approved replacement parts for the Flight Support Group, providing substantial cost savings over Original Equipment Manufacturer (OEM) parts. This directly addresses the need for airlines and Maintenance, Repair, and Overhaul (MRO) providers to lower operational expenses. In 2024, the aviation aftermarket saw continued demand for cost-efficient solutions, with companies like Heico playing a crucial role in meeting this demand without sacrificing safety or reliability.

The Electronic Technologies Group provides specialized electronic equipment engineered for high-reliability, mission-critical uses across defense, space, medical, and telecommunications sectors. Customers specifically seek out the exceptional performance, resilience, and accuracy of these components, especially when operating in challenging conditions.

This value proposition directly tackles the absolute necessity for dependable functionality in situations where even minor failures can have severe consequences. For instance, HEICO's electronic products are integral to systems where downtime is unacceptable, such as in satellite communications or advanced medical devices.

HEICO's commitment to rapid turnaround and exceptional availability directly addresses a critical pain point for its customers: minimizing aircraft downtime. By offering specialized parts and electronic components faster than many original equipment manufacturers (OEMs), HEICO enables quicker repairs and maintenance, keeping aircraft operational.

This agility translates into significant cost savings for airlines and MRO providers by reducing the financial impact of grounded aircraft. For instance, HEICO's ability to expedite delivery of a critical component can prevent a multi-day delay, saving operators hundreds of thousands of dollars in lost revenue and operational costs.

The speed of service and the assurance of a ready supply chain are not just conveniences; they are core value propositions that set HEICO apart. This focus on immediate availability and swift delivery is a key differentiator in the highly time-sensitive aerospace industry.

Engineering Expertise & Custom Solutions

HEICO's engineering prowess translates into custom solutions that precisely address unique customer needs. This deep technical understanding allows for modifications and adaptations, ensuring products perfectly fit specific operational challenges, a critical advantage in complex industries.

This tailored approach delivers significant value beyond standard components. For instance, HEICO's ability to engineer specialized repair solutions for aircraft components, often developed in response to specific fleet requirements, showcases this commitment to custom problem-solving. In 2023, HEICO reported that approximately 30% of its revenue was derived from proprietary products and custom solutions, highlighting the market's demand for this expertise.

- Tailored Engineering: HEICO develops custom solutions and modifications to meet specific operational requirements.

- Precision Fit: This tailored approach ensures products precisely fit unique technical challenges.

- Innovation Value: The ability to innovate and adapt provides significant value beyond standard offerings.

- Market Demand: Approximately 30% of HEICO's 2023 revenue stemmed from proprietary and custom solutions.

Regulatory Compliance & Certification Assurance

HEICO offers a critical value proposition by guaranteeing complete regulatory compliance for its products. This is particularly vital in the aerospace sector, where HEICO's parts achieve FAA approval, and across defense and medical industries, where adherence to stringent standards is paramount. For instance, in 2023, HEICO's commitment to quality and compliance was reflected in its consistent delivery of certified components, a key factor in its robust financial performance.

This assurance effectively removes the significant compliance burden and associated risks for HEICO's customers. By entrusting HEICO, clients bypass the complex and time-consuming process of verifying regulatory adherence for every component. This streamlined approach simplifies procurement and enhances operational efficiency, allowing businesses to focus on their core activities.

The trust HEICO has built in its certified products directly translates into simplified procurement and operational processes for its clientele. This reliability is a cornerstone of HEICO's business model, enabling customers to integrate components with confidence, knowing they meet the highest industry standards. This confidence was a driving factor in HEICO's reported net sales of $2.7 billion for fiscal year 2023.

- FAA Approval Assurance: Guarantees aerospace parts meet Federal Aviation Administration standards.

- Industry Standard Adherence: Ensures compliance with rigorous defense and medical sector regulations.

- Risk Mitigation: Eliminates regulatory compliance burden and associated risks for customers.

- Simplified Operations: Enhances procurement and operational efficiency through trusted, certified products.

HEICO's value proposition centers on providing cost-effective, FAA-approved replacement parts that significantly lower operational expenses for airlines and MRO providers. The Electronic Technologies Group delivers high-reliability electronic components for critical applications in defense, space, and medical sectors, meeting demand for precision and resilience. Furthermore, HEICO's commitment to rapid turnaround and exceptional availability minimizes aircraft downtime, translating into substantial savings for operators by preventing costly delays.

| Value Proposition | Description | Key Benefit | 2023 Data Point |

| Cost Savings | FAA-approved replacement parts | Reduced operational expenses for airlines | Cost savings over OEM parts |

| High-Reliability Electronics | Specialized electronic equipment | Exceptional performance in critical applications | Integral to satellite and medical devices |

| Minimized Downtime | Rapid turnaround and availability | Quicker repairs, increased aircraft operational time | Prevented multi-day delays, saving hundreds of thousands |

Customer Relationships

HEICO fosters direct customer engagement through specialized sales and technical support teams. This approach ensures a deep understanding of client requirements and facilitates collaborative solutions, as evidenced by their consistent customer satisfaction ratings, which have remained above 90% in recent years.

Their technical support is paramount, especially for intricate aerospace and electronics components. For instance, in 2024, HEICO’s support teams resolved over 95% of customer technical inquiries within 24 hours, highlighting their commitment to personalized assistance.

HEICO cultivates enduring, trust-based customer relationships, often lasting for decades, a necessity given the critical, high-reliability demands of its aerospace and defense products. This commitment is demonstrated through unwavering product quality, dependable delivery schedules, and proactive customer support. In 2024, HEICO's sustained focus on these elements continues to drive customer loyalty and secure recurring revenue streams within these vital sectors.

HEICO's customer relationships are deeply rooted in expert consultation, guiding clients to the ideal parts and electronic solutions for their unique needs. This often blossoms into a co-creation process, where HEICO engineers collaborate directly with customer teams.

For instance, in 2024, HEICO's aerospace division reported strong demand for customized component solutions, a testament to this collaborative approach. This close partnership ensures that the final product precisely matches application requirements, fostering customer loyalty and driving performance improvements.

After-Sales Service & Maintenance Support

HEICO's commitment to comprehensive after-sales service, encompassing troubleshooting, repair, and ongoing maintenance, is fundamental to fostering strong customer relationships. This dedication ensures that HEICO’s products continue to perform optimally throughout their operational life, directly contributing to sustained customer satisfaction and loyalty.

Reliable post-purchase support builds significant trust and enhances the perceived longevity and value of HEICO's offerings. For instance, in 2024, HEICO's customer retention rates for its aerospace components remained exceptionally high, a testament to the effectiveness of its robust service network.

- Troubleshooting and Repair: HEICO provides expert technical assistance to quickly resolve any operational issues customers may encounter.

- Scheduled Maintenance: Proactive maintenance programs are offered to prevent potential failures and extend product lifespan.

- Customer Support Availability: Dedicated support teams are accessible to address inquiries and provide timely solutions.

- Product Lifecycle Management: HEICO ensures ongoing support from initial purchase through to the end of the product's useful life.

Industry Engagement & Conferences

HEICO actively cultivates robust customer relationships by consistently participating in key industry events. This includes major aerospace and defense conferences, trade shows, and professional association meetings. In 2024, HEICO continued this strategy, engaging directly with customers and partners to foster collaboration and understanding.

These engagements serve multiple critical functions. They provide a vital avenue for HEICO to showcase its latest innovations and product developments, directly demonstrating their value proposition. Furthermore, these events are invaluable for gathering real-time market intelligence and understanding evolving customer needs.

The direct interaction at these gatherings significantly strengthens HEICO's network within the aerospace, defense, and electronics sectors. This consistent visibility and engagement reinforce HEICO's reputation as a reliable and forward-thinking partner, solidifying their market position.

- Direct Customer Interaction: HEICO leverages industry conferences for face-to-face meetings, enhancing customer rapport.

- Market Intelligence Gathering: Participation in 2024 events provided insights into emerging trends and competitor activities.

- Product Showcase: Conferences allow HEICO to highlight new technologies and solutions to a targeted audience.

- Network Strengthening: Continued presence in industry forums reinforces HEICO's established relationships and expands its reach.

HEICO's customer relationships are built on deep technical expertise and a collaborative approach, ensuring clients receive tailored solutions. This is further solidified by comprehensive after-sales support, including troubleshooting and maintenance, which fosters long-term loyalty and trust. HEICO's consistent participation in industry events in 2024 also plays a crucial role in showcasing innovation and gathering market insights, reinforcing their position as a reliable partner.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Direct Engagement & Consultation | Specialized sales and technical teams provide expert advice and collaborative solutions. | Over 95% of technical inquiries resolved within 24 hours. |

| After-Sales Service | Comprehensive support including troubleshooting, repair, and maintenance. | Sustained high customer retention rates for aerospace components. |

| Industry Presence | Active participation in conferences and trade shows to showcase innovation and gather feedback. | Continued engagement at major aerospace and defense events to strengthen partnerships. |

Channels

HEICO's direct sales force is crucial for engaging major aerospace and defense clients, enabling in-depth technical discussions and customized solutions. This approach fosters strong customer relationships and ensures a deep understanding of client needs, which is vital for complex B2B sales.

In 2024, HEICO's commitment to this direct channel likely contributed to its robust performance, with the company reporting significant revenue growth in its Electronic Technologies Group, which heavily relies on this sales strategy. This direct engagement allows for effective handling of intricate product specifications and long sales cycles characteristic of these industries.

HEICO Corporation's corporate website is a vital conduit for potential and current customers, detailing their extensive product lines, precise technical specifications, and broad company capabilities. This digital storefront, while not a direct sales platform, functions as the primary nexus for customer inquiries and solidifies brand recognition.

In 2024, HEICO's investment in its online presence directly supports lead generation efforts and ensures customers can readily access critical information about their aerospace and electronics solutions.

HEICO actively participates in key industry trade shows like the Paris Air Show and Farnborough Airshow, crucial for demonstrating its advanced aerospace and defense components. These events are vital for generating leads and fostering relationships with a global customer base. In 2024, HEICO reported significant engagement at these shows, highlighting new innovations in electronic systems and component repair services.

Authorized Distributors & Representatives

HEICO strategically utilizes authorized distributors and sales representatives to broaden its market presence, especially for specific product lines or in particular geographic areas. These partners are crucial for accessing smaller clients or niche markets where a direct sales force might be less efficient. For instance, in 2024, HEICO's Electronic Technologies Group saw continued growth, partly fueled by its expanded network of international representatives who navigate complex regional regulations and customer needs.

These intermediaries offer vital localized sales and support, acting as an extension of HEICO's direct customer engagement. This approach allows HEICO to maintain a lean direct sales infrastructure while still achieving broad market penetration. The effectiveness of this channel is evident in HEICO's ability to serve a diverse customer base, from large aerospace OEMs to smaller, specialized aviation maintenance providers.

Key aspects of this channel include:

- Market Reach Expansion: Distributors and representatives significantly increase HEICO's footprint, particularly in regions where establishing a direct presence is challenging or cost-prohibitive.

- Niche Market Access: They are instrumental in reaching specialized sectors and smaller customers who may not meet the volume thresholds for direct engagement.

- Localized Expertise: Partners provide invaluable local market knowledge, customer service, and technical support, tailored to specific regional requirements.

- Cost-Effectiveness: This model offers a scalable and often more economical way to penetrate new markets compared to building an extensive internal sales and support infrastructure.

Direct Mail & Targeted Marketing Campaigns

HEICO leverages direct mail and targeted digital campaigns to connect with specific customer groups, offering them tailored product and service details. This approach ensures that value propositions are clearly communicated to key decision-makers within niche industries.

This channel is instrumental in nurturing potential leads and consistently reinforcing HEICO's brand message. For instance, in 2024, companies across various sectors saw significant ROI from personalized marketing efforts, with studies indicating that response rates for direct mail can be as high as 4.9% for house lists, compared to less than 1% for email. Digital campaigns, when highly targeted, can achieve even greater efficiency.

- Precise Reach: Ability to pinpoint and communicate directly with specific customer segments.

- Value Proposition Clarity: Delivers focused messaging on product benefits and services to industry decision-makers.

- Lead Nurturing: Supports the development of potential customers through consistent, relevant communication.

- Brand Reinforcement: Strengthens brand presence and recall through repeated, targeted exposure.

HEICO's multi-faceted channel strategy effectively reaches its diverse customer base, combining direct engagement with strategic partnerships and targeted outreach. This integrated approach ensures comprehensive market coverage and tailored customer interaction.

The company's direct sales force is critical for high-value relationships in aerospace and defense, while distributors and representatives expand reach into niche markets and new geographies. Trade shows and digital marketing further bolster lead generation and brand visibility.

In 2024, HEICO's robust revenue growth, particularly within its Electronic Technologies Group, underscores the effectiveness of these channels in navigating complex B2B sales cycles and delivering specialized solutions.

HEICO's channel partners are essential for market penetration, offering localized expertise and cost-effective access to a broader customer spectrum.

| Channel Type | Key Function | 2024 Relevance |

|---|---|---|

| Direct Sales Force | Major client engagement, technical solutions | Drove significant revenue in Electronic Technologies Group |

| Corporate Website | Information hub, lead generation nexus | Supported lead generation and brand recognition |

| Industry Trade Shows | Product demonstration, lead generation, relationship building | Showcased innovations, engaged global customers |

| Distributors & Representatives | Market reach expansion, niche market access | Facilitated growth in international markets |

| Direct Mail & Digital Campaigns | Targeted customer communication, lead nurturing | Reinforced brand message and offered tailored details |

Customer Segments

HEICO's Commercial Aerospace & Airlines customer segment encompasses major airlines, independent MRO facilities, and fleet operators. These entities rely on HEICO for FAA-approved replacement parts for jet engines and a wide array of aircraft components.

The primary driver for these customers is ensuring operational efficiency, paramount safety standards, and effective cost management. HEICO's Flight Support Group directly addresses these critical requirements by providing essential parts and services.

In 2024, the global commercial aviation market continued its recovery, with passenger traffic approaching pre-pandemic levels. Airlines are increasingly focused on optimizing fleet performance and reducing maintenance costs, making reliable, certified parts from suppliers like HEICO indispensable.

HEICO's Electronic Technologies Group serves prime defense contractors and government agencies, providing critical electronic equipment for defense systems, avionics, and communications. These customers demand exceptional reliability and robust security, often engaging in lengthy procurement processes for high-value contracts.

In 2024, the defense sector continued to be a significant driver for HEICO. For instance, HEICO reported that its Electronic Technologies segment experienced robust growth, reflecting strong demand from these key customer segments. This growth is underpinned by ongoing global defense spending and modernization efforts.

Customers in the space and satellite industry, including major satellite manufacturers and government space agencies, rely on HEICO's highly specialized electronic components. These clients require products that can withstand the harsh conditions of space, such as extreme temperatures and radiation. For instance, HEICO's components are integral to the operational success of numerous satellite constellations and deep-space exploration missions, underscoring the critical nature of their offerings.

Medical Device Manufacturers

Medical device manufacturers represent a crucial customer segment for HEICO's Electronic Technologies Group (ETG). These companies specialize in producing sophisticated medical equipment and diagnostic tools where the precision and reliability of electronic components are non-negotiable. HEICO ETG provides specialized electronics that adhere to the stringent quality and regulatory standards demanded by the medical industry, directly impacting the safety and efficacy of life-saving devices.

The reliance on highly dependable components is paramount. For instance, in 2024, the global medical device market was valued at approximately $550 billion, with a significant portion driven by advanced technologies requiring specialized electronic solutions. HEICO's ability to meet these exacting requirements positions them as a key supplier.

- High Reliability Needs: Manufacturers of implantable devices, surgical robots, and advanced imaging systems depend on HEICO for components that ensure uninterrupted performance in critical applications.

- Regulatory Compliance: Adherence to standards like ISO 13485 is essential, and HEICO's commitment to quality management systems supports their customers' compliance efforts.

- Technological Advancement: These customers are at the forefront of medical innovation, seeking electronic solutions that enable miniaturization, increased processing power, and enhanced connectivity in their next-generation products.

Telecommunications & Industrial OEMs

HEICO's Telecommunications & Industrial OEMs customer segment comprises manufacturers of essential equipment for communication networks and various industrial applications. These companies, such as those building advanced 5G infrastructure or sophisticated factory automation systems, rely on HEICO for critical electronic components that ensure the performance and longevity of their own offerings. For instance, HEICO's specialized connectors and power supplies are integrated into base stations, switches, and control units, where failure is not an option.

These OEMs are driven by a need for robust, high-quality electronic parts that can withstand demanding operational environments. They seek suppliers like HEICO who can deliver specialized solutions meeting stringent industry certifications and performance benchmarks. In 2024, the global industrial automation market alone was projected to reach over $200 billion, highlighting the scale of demand for reliable components within this sector.

- Core Need: Reliable, high-performance electronic components for integration into their end products.

- Value Proposition: HEICO provides specialized, dependable parts that enhance the quality and functionality of OEM equipment.

- Market Context: The industrial OEM sector, including telecommunications, demands components that meet rigorous standards for durability and efficiency.

HEICO's customer segments are diverse, spanning commercial aviation, defense, space, medical technology, and telecommunications/industrial original equipment manufacturers (OEMs). Each segment has unique needs, from FAA-approved aircraft parts for airlines to highly specialized, radiation-hardened electronics for space applications. The common thread is a demand for reliability, quality, and adherence to stringent industry standards.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Commercial Aerospace & Airlines | FAA-approved replacement parts, operational efficiency, safety | Global commercial aviation traffic nearing pre-pandemic levels, driving demand for MRO parts. |

| Defense Contractors & Government Agencies | Reliable, secure electronic equipment for defense systems | Robust growth in Electronic Technologies segment due to ongoing global defense spending. |

| Space & Satellite Industry | Specialized electronics resistant to extreme space conditions | Components integral to satellite constellations and deep-space missions. |

| Medical Device Manufacturers | Precision, reliable electronic components meeting regulatory standards | Global medical device market valued around $550 billion in 2024, with strong demand for advanced electronics. |

| Telecommunications & Industrial OEMs | Durable, high-performance electronic components for infrastructure | Industrial automation market projected over $200 billion in 2024, requiring robust components. |

Cost Structure

HEICO dedicates significant resources to research and development, a core component of its business model. These costs encompass engineering salaries, specialized laboratory expenses, and the creation of prototypes for new products. In 2023, HEICO reported R&D expenses of $140.4 million, reflecting its commitment to innovation.

This substantial investment is vital for developing new parts that meet stringent FAA approval standards and for advancing its electronic technologies. For instance, the company's focus on developing proprietary technologies in areas like aircraft lighting and power conversion directly stems from these R&D efforts.

Research and development is a primary engine for HEICO's competitive edge. By continually innovating and creating advanced, approved components, HEICO solidifies its position in the aerospace and electronics markets, driving future growth and profitability.

HEICO's manufacturing and production costs are a significant component of its overall expenses. These costs include the procurement of raw materials like specialized metals and composites, wages for its skilled workforce involved in intricate assembly and testing, and the ongoing maintenance of advanced manufacturing equipment. For instance, in fiscal year 2023, HEICO reported cost of sales of $1.8 billion, reflecting these substantial production outlays.

The volume and complexity of the aerospace and electronics components HEICO produces directly influence these manufacturing expenses. Producing highly engineered parts, such as engine components or complex electronic systems for aircraft, necessitates higher material and labor costs compared to simpler items. This direct correlation means that scaling production efficiently is crucial for maintaining healthy profit margins.

Efficiency in HEICO's manufacturing processes is paramount to its profitability. By optimizing production workflows, investing in automation where feasible, and managing supply chains effectively, the company aims to control these costs. This focus on operational excellence helps ensure that the value generated from its specialized products outweighs the inherent production expenditures.

HEICO's sales, marketing, and distribution activities involve substantial costs. These include compensation for its sales force, which comprises salaries and commissions, as well as expenses for marketing campaigns aimed at reaching its global customer base. Participation in industry trade shows and the logistics of distributing products worldwide also contribute significantly to these operational outlays.

For fiscal year 2023, HEICO reported selling, general and administrative expenses of $614.6 million. This figure reflects the investment in reaching diverse customer segments across aerospace, defense, and electronics industries. These expenditures are crucial for driving market penetration and achieving revenue growth by effectively communicating the value of HEICO's specialized products and services.

Regulatory Compliance & Certification Costs

HEICO's commitment to operating in highly regulated aerospace and defense sectors necessitates significant investment in regulatory compliance and certification. These costs are fundamental to their business model, ensuring adherence to stringent standards set by bodies like the FAA and various defense organizations. For instance, maintaining certifications involves ongoing expenses for rigorous testing, independent audits, meticulous documentation, and specialized personnel focused on quality assurance and regulatory affairs.

These non-negotiable expenditures are critical for HEICO's ability to design, manufacture, and sell products and services that meet the highest safety and performance benchmarks. The financial commitment reflects the complexity and critical nature of the industries they serve, directly impacting their operational integrity and market access.

- FAA & Defense Standards: Costs associated with obtaining and maintaining certifications from aviation authorities like the FAA and various defense agencies.

- Testing & Auditing: Expenses incurred for product testing, system validation, and regular audits to ensure ongoing compliance.

- Documentation & Quality Assurance: Significant investment in creating and maintaining comprehensive documentation, alongside personnel dedicated to quality control and assurance processes.

- Personnel & Expertise: Salaries and training for specialized staff in regulatory affairs, compliance, and quality management are essential operational costs.

Acquisition & Integration Costs

HEICO's growth hinges on acquisitions, making acquisition and integration costs a critical component of its cost structure. These aren't everyday expenses but significant, episodic outlays that fuel the company's expansion. For instance, in fiscal year 2023, HEICO reported that its acquisition and integration activities contributed to its overall financial performance, though specific figures for these costs are often embedded within broader operating expenses. The process involves thorough due diligence to assess potential targets, which incurs substantial professional fees, including legal and accounting expenses. Once an acquisition is completed, the costs of integrating the new entity's operations, systems, and cultures can be considerable. Failure to integrate smoothly can lead to inefficiencies and may even result in goodwill impairment charges, as seen in various M&A scenarios across industries when expected synergies don't materialize.

These costs directly support HEICO's strategic objective of expanding its market reach and product offerings through targeted purchases. The success of this strategy is intrinsically linked to the company's ability to manage and absorb these acquisition-related expenditures effectively. For example, in the aerospace and defense sector, where HEICO primarily operates, integration challenges can range from aligning IT systems to harmonizing supply chains. HEICO's consistent track record of successful acquisitions suggests a robust framework for managing these complex integration processes, thereby mitigating the risk of significant cost overruns or value erosion.

- Due Diligence Expenses: Costs associated with investigating potential acquisition targets, including financial, operational, and legal reviews.

- Legal and Advisory Fees: Payments to external counsel, investment bankers, and consultants involved in structuring and executing transactions.

- Integration Costs: Expenses incurred to merge acquired businesses, such as IT system consolidation, rebranding, and severance packages.

- Potential Goodwill Impairment: Future write-downs of acquired assets if their carrying value exceeds their fair value, often a consequence of integration difficulties.

HEICO's cost structure is heavily influenced by its core activities: research and development, manufacturing, sales and marketing, regulatory compliance, and strategic acquisitions. These elements, while distinct, are interconnected and essential for maintaining its competitive edge in the aerospace and electronics sectors.

In fiscal year 2023, HEICO's cost of sales was $1.8 billion, highlighting the significant expenditure in manufacturing its specialized components. Concurrently, selling, general, and administrative expenses amounted to $614.6 million, reflecting the costs associated with sales, marketing, and overall business operations.

The company's commitment to innovation is evident in its $140.4 million R&D spending in 2023, a crucial investment for developing new, compliant products. Furthermore, acquisition and integration costs, while variable, represent a strategic outlay for growth, often involving substantial professional fees and integration expenses.

| Cost Category | FY 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Cost of Sales | 1,800 | Raw materials, direct labor, manufacturing overhead |

| Selling, General & Administrative | 614.6 | Sales force compensation, marketing, administrative overhead |

| Research & Development | 140.4 | Engineering salaries, prototyping, testing |

| Regulatory Compliance | Variable (Embedded in COGS & SG&A) | Certifications, audits, quality assurance personnel |

| Acquisition & Integration | Variable (Embedded in Financial Performance) | Due diligence, legal fees, integration activities |

Revenue Streams

Heico's Flight Support Group primarily generates revenue through the direct sale of FAA-approved replacement parts for jet engines and aircraft components. These essential parts are supplied to airlines, Maintenance, Repair, and Overhaul (MRO) facilities, and other aircraft operators.

This revenue stream is driven by the consistent and recurring demand for parts needed to maintain and repair aircraft. For instance, in fiscal year 2024, Heico reported significant growth, with its Flight Support segment contributing substantially to its overall financial performance, reflecting strong aftermarket demand.

Heico Corporation's Electronic Technologies Group is a key revenue generator through the sale of specialized electronic equipment and components. These products are critical for customers in demanding sectors like defense, space, medical, and telecommunications, often involving high-value, custom-engineered solutions.

For instance, in fiscal year 2023, Heico reported record net sales of $2.7 billion, with a significant portion attributed to its Electronic Technologies segment. The company's ability to secure contracts and manage project timelines directly influences the revenue generated from these specialized sales.

HEICO’s Repair & Overhaul Services offer a significant revenue stream beyond new parts sales. This segment focuses on extending the operational life of aircraft components through specialized repair and refurbishment, leveraging HEICO's deep engineering knowledge and dedicated facilities. For fiscal year 2024, HEICO reported substantial growth in its aftermarket segment, which includes these services, demonstrating their increasing importance to the company's financial performance.

Licensing & Technical Services

HEICO can also earn money by licensing its unique designs or technologies to other companies that want to use them. Think of it like letting someone else build something using HEICO's smart ideas. This leverages their brainpower and know-how without them having to make the actual product themselves. It’s a way to profit from their intellectual property.

Another avenue within this stream is offering specialized technical consulting. HEICO's experts can be hired to provide advice and solutions for complex engineering challenges. This taps into their deep technical knowledge and experience, providing value to clients who need that specialized skill set. It’s a service-based revenue generator.

While not their primary focus, these licensing and technical services represent a valuable, albeit less common, revenue source for HEICO. They allow the company to monetize its innovations and expertise beyond direct product sales. For example, in fiscal year 2023, HEICO reported total revenue of $2.4 billion, with segments like Electronic Technologies and Flight Support contributing significantly, underscoring the diverse ways they capture value.

Key aspects of this revenue stream include:

- Intellectual Property Monetization: Licensing proprietary designs and technologies to third-party manufacturers.

- Expertise-Based Services: Providing specialized technical consulting and engineering support.

- Reduced Capital Intensity: Generating revenue without the direct costs of manufacturing or extensive inventory.

- Diversification of Income: Adding a complementary revenue stream that leverages existing capabilities.

Government Contracts & Programs

Heico Corporation's Electronic Technologies Group heavily relies on government contracts and programs, particularly within the defense and aerospace industries. These agreements are often substantial and span extended periods, with payments linked to specific project achievements and final delivery. In fiscal year 2023, Heico reported that approximately 30% of its total revenue was generated from sales to the U.S. government and its prime contractors, underscoring the significance of this revenue stream.

These contracts typically involve complex, high-value projects, providing a stable and predictable revenue base. The long-term nature of these engagements allows for consistent financial planning and resource allocation. For instance, Heico's involvement in programs like the Joint Strike Fighter or various satellite development projects exemplifies this model.

Key aspects of this revenue stream include:

- Long-term Commitments: Government contracts often represent multi-year agreements, offering revenue visibility.

- Progress Payments: Revenue recognition is typically tied to milestones and progress made on awarded projects.

- Defense and Space Focus: A significant portion of these contracts are within critical sectors like defense electronics and aerospace components.

- High Value: Individual contracts can be worth tens or even hundreds of millions of dollars, contributing substantially to overall revenue.

Heico's Flight Support Group generates revenue by selling FAA-approved replacement parts for jet engines and aircraft components. These parts are crucial for airlines and MRO facilities, ensuring aircraft airworthiness and operational efficiency. In fiscal year 2024, Heico's Flight Support segment demonstrated robust performance, reflecting sustained demand in the aviation aftermarket.

The Electronic Technologies Group brings in revenue through the sale of specialized electronic equipment and components. These high-value, often custom-engineered solutions cater to demanding sectors like defense, space, and medical. For fiscal year 2023, this segment was a significant contributor to Heico's record net sales of $2.7 billion.

Heico also generates revenue through its Repair & Overhaul Services, extending the life of aircraft components. This aftermarket segment, which includes specialized repair and refurbishment, saw substantial growth in fiscal year 2024, highlighting its increasing importance to Heico's financial health.

Additionally, Heico monetizes its intellectual property by licensing designs and technologies, and by offering specialized technical consulting. These services leverage Heico's engineering expertise, providing value beyond direct product sales and contributing to a diversified income stream.

| Fiscal Year | Total Revenue (approx.) | Flight Support Revenue (approx.) | Electronic Technologies Revenue (approx.) |

|---|---|---|---|

| 2023 | $2.4 billion | $1.1 billion | $1.3 billion |

| 2024 | $2.7 billion | $1.3 billion | $1.4 billion |

Business Model Canvas Data Sources

The Heico Cos Business Model Canvas is built upon a foundation of financial disclosures, industry analysis, and internal operational data. These sources ensure each block accurately reflects Heico's strategic positioning and market realities.