Healthpeak Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

Navigate the complex external forces shaping Healthpeak Properties's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements present both opportunities and challenges for the healthcare real estate giant. Gain a critical advantage by downloading the full analysis to unlock actionable intelligence for your strategic planning.

Political factors

Government healthcare spending and policy are critical for Healthpeak Properties. Changes in Medicare and Medicaid reimbursement rates, for example, directly affect the financial stability of healthcare providers who are Healthpeak's tenants. In 2024, ongoing debates around healthcare affordability and access continue to shape policy, potentially impacting tenant revenue and their capacity to lease space.

New healthcare legislation or modifications to existing frameworks like the Affordable Care Act (ACA) can significantly alter the operational landscape for Healthpeak's clients. For instance, shifts in how services are covered or reimbursed can influence tenant demand for specific types of healthcare real estate. The Centers for Medicare & Medicaid Services (CMS) sets reimbursement rates, and any adjustments in 2024 or projections for 2025 will be closely watched by the industry.

The regulatory environment significantly shapes Healthpeak's operational landscape. Licensing, zoning, and Certificate of Need (CON) laws are paramount for facility development and acquisitions. For instance, states with robust CON requirements can restrict new healthcare facility construction, influencing supply and demand, which directly impacts Healthpeak's strategic growth opportunities.

A notable trend is the ongoing reform efforts in several CON states. These reforms aim to ease restrictions, potentially allowing for the development of new ambulatory surgery centers, rural hospitals, and behavioral health facilities without the need for CON approval. This shift could unlock new avenues for Healthpeak's portfolio expansion and development pipeline.

Political stability significantly impacts Healthpeak Properties by influencing investor sentiment and capital availability. Election cycles, particularly in the United States, can introduce volatility as new administrations may alter healthcare policies, tax structures, and regulatory frameworks affecting real estate investment trusts (REITs).

For instance, shifts in government could lead to changes in Medicare reimbursement rates or Affordable Care Act (ACA) provisions, directly impacting the revenue streams of healthcare facilities that Healthpeak owns and leases. The 2024 US presidential election, for example, could bring about policy adjustments that either encourage or deter investment in healthcare real estate.

Healthcare Industry Mergers and Acquisitions (M&A)

Government regulations significantly influence mergers and acquisitions (M&A) within the healthcare sector, directly impacting Healthpeak Properties. For instance, increased antitrust scrutiny by bodies like the Federal Trade Commission (FTC) could lead to stricter approval processes for large-scale healthcare consolidations, potentially affecting Healthpeak's tenant base and its ability to expand its portfolio through strategic acquisitions or partnerships.

Specific legislative proposals, such as those aimed at limiting private equity firms' involvement in hospital real estate transactions, pose a direct challenge. Reports from late 2023 and early 2024 indicate ongoing discussions around such measures, which could restrict Healthpeak's opportunities in sale-leaseback arrangements, a key growth strategy. This heightened regulatory environment necessitates careful navigation of deal structures and partnership agreements.

- Increased Scrutiny: Regulatory bodies are intensifying their review of healthcare M&A, particularly concerning private equity involvement.

- Legislative Proposals: Bills are being considered to curb private equity's ability to lease back hospital properties after acquisitions, potentially impacting Healthpeak's deal pipeline.

- Impact on Partnerships: Government oversight can alter the feasibility and structure of Healthpeak's strategic partnerships with healthcare providers.

- Market Uncertainty: Potential regulatory changes create a degree of uncertainty for future M&A activity within the healthcare real estate market.

Labor Policy and Healthcare Workforce Issues

Policies affecting healthcare workforce availability and labor costs, like nursing shortages or minimum wage adjustments, directly impact the operational success of Healthpeak's tenant operators. For instance, the U.S. experienced a registered nurse shortage estimated to be between 200,000 and 450,000 by 2025, a trend that continues to strain the system.

This persistent labor scarcity is driving increased investment in new technologies aimed at easing the burden on healthcare professionals. As of early 2024, healthcare organizations are actively exploring AI-driven administrative tools and telehealth solutions to improve efficiency and patient care delivery.

- Nursing Shortage: Projections indicate a significant deficit in registered nurses across the U.S. for the foreseeable future, impacting staffing levels.

- Labor Costs: Rising wages and benefits for healthcare workers, driven by demand, increase operational expenses for tenant operators.

- Technological Adoption: The need to mitigate workforce pressures is accelerating the adoption of automation and digital health solutions within the sector.

- Policy Impact: Government policies on minimum wage, immigration of foreign healthcare workers, and training programs can directly influence labor availability and cost structures.

Government policies on healthcare reimbursement, such as Medicare and Medicaid rates, directly influence the financial health of Healthpeak's tenants. For example, the Centers for Medicare & Medicaid Services (CMS) announced a 2.4% increase in the Medicare Physician Fee Schedule for 2024, a modest adjustment that impacts provider revenue. Future adjustments in 2025 will be closely monitored for their effect on leasing demand.

What is included in the product

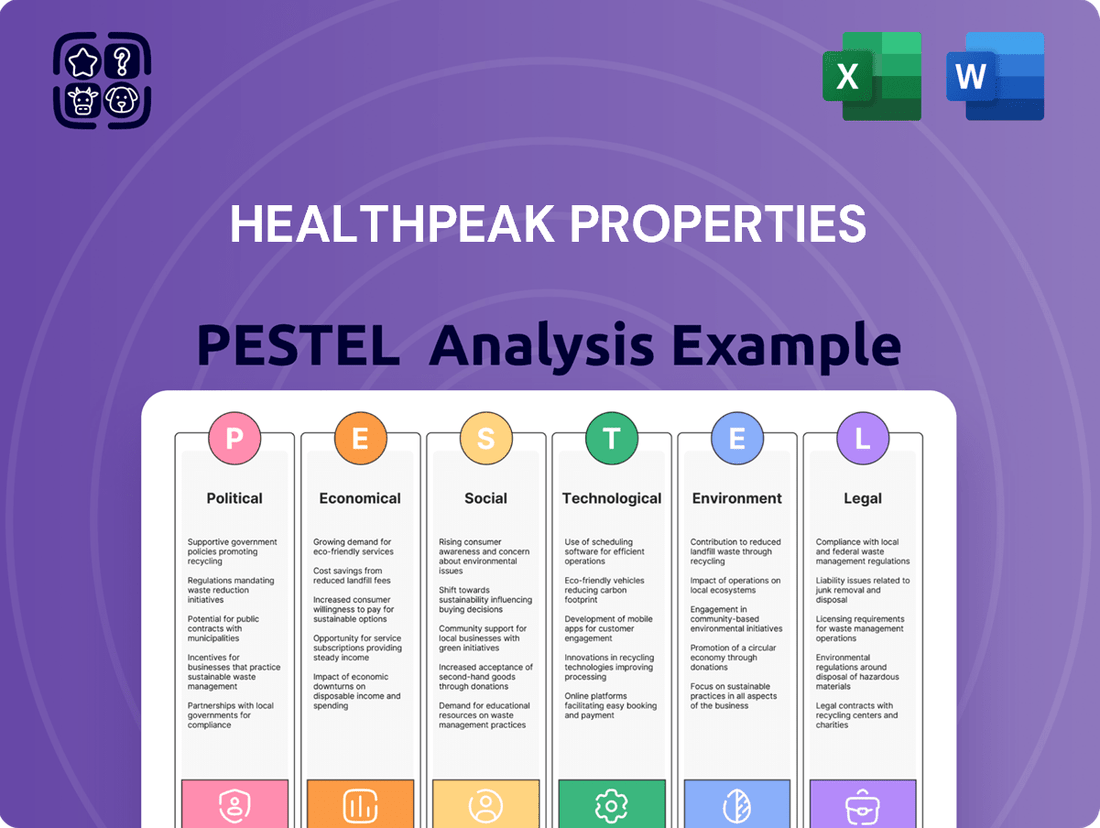

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Healthpeak Properties, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the healthcare real estate sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of Healthpeak Properties' external environment to mitigate potential disruptions.

Easily shareable summary format ideal for quick alignment across teams or departments, enabling prompt identification and response to factors impacting Healthpeak Properties' strategic direction.

Economic factors

Interest rates play a crucial role in Healthpeak's financial strategy. Changes in these rates directly affect how much it costs to borrow money for new projects or to buy more properties. When rates go up, borrowing becomes more expensive, and the value of existing properties might decrease. Conversely, the anticipation of potentially lower interest rates in 2025 is a positive signal, likely encouraging more investment in Medical Outpatient Buildings (MOBs).

The market for MOBs shows resilience. While capitalization rates (cap rates) for these properties have seen a slight increase, they generally remain lower than those for traditional office spaces. This indicates that investors find the steady income generated by medical tenants particularly attractive, valuing that stability in their portfolios.

Inflationary pressures significantly impact Healthpeak Properties by increasing construction costs, labor expenses for healthcare providers, and property maintenance budgets. For instance, the Producer Price Index for construction inputs saw a notable increase in late 2023 and early 2024, directly translating to higher development and refurbishment costs.

While healthcare REITs, including Healthpeak, have generally shown resilience in operational performance, escalating labor costs, particularly in the senior housing and medical office building sectors, have begun to compress profit margins for their tenants. This can limit the ability of tenants to absorb rent increases, potentially affecting Healthpeak's rental income growth.

These rising operational expenses for tenants can influence the negotiation of future rent escalations and impact the overall profitability and financial health of Healthpeak's diverse tenant base, from life science companies to senior housing operators.

Overall economic growth and consumer spending on healthcare services are fundamental drivers of demand for Healthpeak's properties. An aging population and increasing disease prevalence continue to drive the overall need for care, with U.S. outpatient volumes anticipated to grow by approximately 20% by 2029, according to industry forecasts.

Improved U.S. economic growth, projected to reach around 2.5% in 2025, and a decline in inflation to near 2% by year-end 2025 are expected to support resilient consumer healthcare spending, directly benefiting Healthpeak's revenue streams.

Supply and Demand Dynamics in Healthcare Real Estate

The interplay between new construction and demand for specialized healthcare spaces like life science labs, medical offices, and continuing care retirement communities (CCRCs) directly impacts vacancy rates and rental appreciation. For instance, while some life science markets experienced a surplus of lab and R&D space, the development pipeline is projected to contract by the end of 2025, potentially tightening supply.

Medical office building vacancy rates are anticipated to reach their highest point in late 2024. Following this peak, a downward trend is expected in 2025 as demand for modern, high-quality medical facilities outpaces new supply. This shift suggests a more favorable leasing environment for landlords of well-located and amenity-rich medical office properties.

- Life Science Construction Pipeline: Expected to ease by year-end 2025 after a period of increased development.

- Medical Office Vacancy: Forecasted to peak in late 2024, with a subsequent decline in 2025.

- Rental Growth Influence: The balance between new supply and absorption directly affects rental income potential across healthcare real estate segments.

Investment Trends in Healthcare REITs

Investor sentiment towards healthcare Real Estate Investment Trusts (REITs) has been notably positive, directly influencing Healthpeak Properties' stock performance and its capacity for capital raising. This positive outlook is underpinned by the sector's resilience and growth prospects.

Healthcare REITs demonstrated robust performance throughout 2024, with many continuing to deliver strong returns into early 2025. This trend is largely attributed to favorable demographic shifts, particularly an aging population, and the inherently defensive characteristics of healthcare real estate, which tend to be less sensitive to economic downturns.

The sector's appeal to investors seeking stable, predictable cash flows remains a significant driver. This consistent demand helps to stabilize valuations and provides a reliable avenue for capital deployment. For Healthpeak, this translates into a more favorable environment for financing growth initiatives and managing its existing portfolio.

- 2024 Performance: Healthcare REITs were a leading sector, outperforming many other real estate categories.

- 2025 Outlook: Projections indicate continued strong returns driven by demographic tailwinds.

- Investor Attraction: The sector is favored for its stable cash flow generation and defensive qualities.

- Capital Flows: Positive investor sentiment facilitates easier access to capital for companies like Healthpeak.

Economic growth and consumer spending directly fuel demand for Healthpeak's healthcare facilities. With U.S. economic growth projected around 2.5% for 2025 and inflation potentially easing to 2%, consumer healthcare spending is expected to remain robust, benefiting Healthpeak's revenue. The healthcare sector's defensive nature, coupled with favorable demographics like an aging population, continues to attract investors, leading to strong performance for healthcare REITs and facilitating capital access for Healthpeak.

| Economic Factor | 2024 Trend/Outlook | 2025 Outlook | Impact on Healthpeak |

|---|---|---|---|

| Economic Growth | Moderate growth | Projected ~2.5% | Supports healthcare spending and property demand |

| Inflation | Elevated, then moderating | Targeting ~2% | Impacts construction costs but may stabilize operating expenses |

| Interest Rates | Rising, then potentially stabilizing/decreasing | Anticipated decrease | Lower borrowing costs, potential property value appreciation |

| Consumer Spending (Healthcare) | Resilient | Expected to remain strong | Drives tenant revenue and ability to pay rent |

| Investor Sentiment (Healthcare REITs) | Positive | Continued strength | Facilitates capital raising and stable valuations |

What You See Is What You Get

Healthpeak Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Healthpeak Properties delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the real estate investment trust. Understanding these external forces is crucial for strategic planning and risk management within the healthcare real estate sector.

Sociological factors

The aging population, often termed the 'silver tsunami,' is a significant demographic shift directly boosting demand for healthcare real estate. Specifically, the over-80 age group is experiencing rapid growth, fueling the need for senior living communities and specialized medical facilities. This trend is further amplified as all Baby Boomers will have reached age 65 by 2030.

By 2034, projections indicate that individuals aged 65 and older will surpass the under-18 population. This demographic inversion is a powerful catalyst for increased demand in the senior housing sector, directly benefiting companies like Healthpeak Properties that focus on these specialized real estate assets.

Patients increasingly prefer care outside traditional hospitals, favoring outpatient settings and community-based locations for convenience and potentially lower costs. This trend, amplified by technological advancements enabling less invasive procedures, is reshaping healthcare demand.

For example, elective outpatient surgeries saw a significant increase, with some estimates suggesting a rise of over 15% in the 2024-2025 period compared to pre-pandemic levels, highlighting the shift away from inpatient settings.

Healthpeak Properties' strategic investment in medical office buildings (MOBs) directly addresses this evolving preference, positioning them to benefit from the growing demand for accessible, patient-centric healthcare delivery models.

Growing public emphasis on preventative care and wellness is directly shaping demand for healthcare real estate. This shift means facilities focusing on outpatient services, diagnostics, and wellness programs are increasingly sought after. For instance, Healthpeak Properties (PEAK) has noted a rise in demand for life sciences facilities, which often cater to research and development in preventative and specialized treatments.

The trend towards co-locating services and expanding specialty providers is a significant driver in the medical office sector. Healthcare systems are consolidating services to improve operational efficiency and enhance the patient experience, leading to a greater need for integrated medical office buildings. Healthpeak's portfolio, heavily weighted in medical office buildings, benefits from this consolidation as tenants seek modern, well-located facilities.

Lifestyle and Housing Preferences of Seniors

Seniors' evolving lifestyles are significantly shaping housing preferences. There's a growing desire for a continuum of care, meaning communities that offer independent living, assisted living, and skilled nursing all in one place, alongside integrated wellness programs. This trend directly impacts the Continuing Care Retirement Community (CCRC) sector.

Many older adults are opting to remain in their current homes for longer periods. When they do move, it's often into standalone assisted living facilities driven by more immediate needs, rather than making a proactive decision to move into a CCRC. This shift in decision-making can alter the traditional CCRC model.

Despite this, CCRCs that successfully integrate independent living, assisted living, and nursing care are experiencing robust growth. This expansion is largely driven by the sheer increase in the senior population. For instance, the number of individuals aged 65 and over in the U.S. is projected to reach approximately 80.8 million by 2040, up from 54.1 million in 2020.

- Demand for Continuum of Care: Seniors increasingly seek communities offering a range of services from independent living to skilled nursing.

- Aging in Place Trend: A significant portion of seniors prefer to stay in their homes longer, delaying moves to retirement communities.

- CCRC Growth Drivers: CCRCs providing a comprehensive care model are benefiting from the expanding senior demographic.

- Projected Senior Population: The U.S. senior population is expected to grow by nearly 50% between 2020 and 2040, presenting a substantial market.

Social Equity and Healthcare Access

Societal emphasis on social equity is increasingly shaping healthcare real estate. This means a growing demand for facilities that ensure equitable access to care, irrespective of a patient's financial standing or where they live. Healthpeak Properties, like others in the sector, must consider how their developments can address disparities in healthcare access.

This focus translates into tangible considerations for Healthpeak's portfolio. For instance, the affordability and accessibility of healthcare services are paramount. In 2024, the U.S. uninsured rate was around 7.9%, highlighting a significant population segment that relies on accessible and affordable care options, which directly impacts the demand for specific types of healthcare real estate.

- Accessibility: Designing facilities in underserved areas or improving public transport links to existing ones.

- Affordability: Supporting models that offer lower-cost care, potentially influencing the type of medical office buildings developed.

- Inclusivity: Ensuring facilities cater to diverse patient needs, including language services and culturally competent care.

Societal shifts toward preventative health and wellness are increasing demand for outpatient facilities and specialized care centers. Healthpeak Properties' focus on life sciences and medical office buildings aligns with this trend, as these spaces support research and early intervention strategies. The growing emphasis on patient convenience also drives demand for accessible, community-based healthcare locations.

The increasing preference for care outside traditional hospital settings, driven by convenience and cost-effectiveness, is a significant sociological factor. This shift is evident in the rise of elective outpatient surgeries, which saw an estimated increase of over 15% in the 2024-2025 period, directly benefiting Healthpeak's medical office building portfolio.

Societal emphasis on social equity is also shaping healthcare real estate, creating demand for facilities that ensure equitable access to care. Healthpeak must consider how its developments can address healthcare disparities, particularly for the approximately 7.9% of the U.S. population that remained uninsured in 2024.

The aging demographic, with the over-80 age group rapidly expanding, directly fuels demand for senior living and specialized medical facilities. By 2034, those aged 65 and older are projected to outnumber individuals under 18, underscoring the long-term need for Healthpeak's senior housing assets.

| Sociological Factor | Impact on Healthpeak Properties | Supporting Data/Trend |

| Aging Population | Increased demand for senior living and specialized medical facilities. | Over-80 age group growth; 65+ population to exceed under-18 by 2034. |

| Shift to Outpatient Care | Growth in demand for medical office buildings (MOBs). | 15%+ rise in elective outpatient surgeries (2024-2025 est.). |

| Preventative Care Focus | Demand for life sciences and wellness-oriented facilities. | Healthpeak notes rising demand for life sciences facilities. |

| Social Equity in Healthcare | Need for accessible and affordable care facilities. | 7.9% U.S. uninsured rate (2024) highlights need for accessible care. |

Technological factors

Innovations in medical technology, like advanced imaging and surgical robotics, demand specialized real estate. Healthpeak Properties, a major healthcare REIT, must consider how these evolving needs translate into requirements for adaptable lab and medical office spaces capable of housing cutting-edge equipment and research facilities.

The rapid growth of telemedicine and Remote Patient Monitoring (RPM) is fundamentally altering healthcare delivery. This shift could decrease the need for traditional in-person doctor's visits, potentially impacting demand for physical medical office space. For instance, by the end of 2024, it's projected that over 80% of healthcare providers will be offering virtual care options.

However, these technological advancements also unlock new avenues for real estate investment. Healthpeak Properties can explore opportunities in developing or acquiring facilities designed to support virtual care ecosystems. This might include specialized telehealth hubs or modernizing existing properties with integrated RPM systems, catering to the evolving needs of healthcare providers and patients.

The integration of AI and machine learning is significantly enhancing healthcare delivery, leading to more precise diagnoses and customized treatment strategies. This technological shift is also boosting operational efficiency within healthcare facilities.

AI's ability to automate routine administrative duties allows medical professionals to dedicate more time to direct patient interaction. Furthermore, AI is being deployed to optimize the management of hospital resources and the upkeep of healthcare infrastructure.

By 2024, the global AI in healthcare market was valued at an estimated $20.9 billion, with projections indicating substantial growth. For instance, AI-powered diagnostic tools are showing accuracy rates comparable to, and in some cases exceeding, human experts in fields like radiology.

Smart Building Technologies and IoT in Healthcare Real Estate

The integration of smart building technologies and the Internet of Medical Things (IoMT) presents significant opportunities for Healthpeak Properties. These advancements can streamline operations, elevate the patient and resident experience, and bolster sustainability across its portfolio. For instance, smart sensors can optimize energy consumption, leading to reduced utility costs. By 2024, the global IoMT market was projected to reach over $200 billion, highlighting the widespread adoption and potential impact of these technologies.

These technologies offer tangible benefits for facility management and decision-making. Real-time data from connected devices can provide insights into building performance, occupancy levels, and environmental conditions, enabling proactive maintenance and resource allocation. This data-driven approach can enhance operational efficiency, a key factor in the profitability of healthcare real estate assets. Research indicates that smart buildings can achieve energy savings of up to 30%.

- Enhanced Operational Efficiency: IoMT devices can automate tasks like environmental monitoring and patient tracking, freeing up staff time.

- Improved Patient Experience: Smart systems can personalize environments, improve safety, and facilitate communication within healthcare facilities.

- Sustainability Gains: IoT-enabled energy management systems can significantly reduce a building's carbon footprint and operational expenses.

- Data-Driven Decision Making: Real-time analytics from smart building systems provide actionable insights for facility managers and investors.

Biotechnology and Life Science Innovation

The relentless pace of innovation in biotechnology and life sciences directly fuels the demand for sophisticated lab and R&D spaces. This sector is experiencing a transformative era of discovery, underpinned by robust long-term growth drivers.

Despite some short-term headwinds, the life sciences industry's trajectory remains exceptionally strong. For instance, the global biotech market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $3 trillion by 2030, showcasing significant expansion potential.

- Increased demand for specialized lab infrastructure: As discoveries accelerate, companies require cutting-edge facilities equipped for advanced research, driving leasing activity.

- Growth in pharmaceutical R&D spending: Pharmaceutical companies are significantly increasing their R&D investments, with global spending projected to exceed $250 billion in 2024, directly benefiting real estate providers.

- Advancements in personalized medicine and gene therapy: These emerging fields necessitate highly specialized and adaptable lab environments, creating niche market opportunities.

- Biotech cluster development: The concentration of biotech firms in specific geographic areas, often near academic institutions, creates hubs that require contiguous and advanced life science real estate.

Technological advancements are reshaping healthcare delivery, influencing the demand for specialized real estate. Innovations like AI and IoMT are driving efficiency and creating new investment opportunities in adaptable facilities. The growth of telemedicine and RPM also presents both challenges and avenues for Healthpeak Properties to explore.

The life sciences sector's rapid innovation, particularly in personalized medicine and gene therapy, directly fuels the need for advanced lab and R&D spaces. This trend is supported by substantial increases in pharmaceutical R&D spending, with global figures projected to grow significantly.

By 2024, the global AI in healthcare market was valued at approximately $20.9 billion, underscoring the integration of AI into healthcare operations. Furthermore, the global IoMT market was projected to exceed $200 billion by 2024, highlighting the widespread adoption of smart technologies in healthcare environments.

The life sciences industry's growth is substantial, with the global biotech market valued at around $1.5 trillion in 2023 and expected to double by 2030. Pharmaceutical R&D spending was projected to surpass $250 billion in 2024, directly benefiting real estate providers serving this sector.

| Technology Area | Impact on Healthcare Real Estate | Relevant Data/Projections (2024/2025) |

|---|---|---|

| AI & Machine Learning | Enhanced operational efficiency, improved diagnostics, optimized resource management. | AI in Healthcare Market: ~$20.9 billion (2024). AI-powered diagnostics show high accuracy rates. |

| Telemedicine & RPM | Potential decrease in traditional office space demand, rise of telehealth hubs. | >80% of healthcare providers offering virtual care options by end of 2024. |

| IoMT & Smart Buildings | Streamlined operations, improved patient experience, sustainability gains, data-driven facility management. | IoMT Market: >$200 billion projected by 2024. Smart buildings can achieve up to 30% energy savings. |

| Biotechnology & Life Sciences | Increased demand for specialized lab and R&D spaces, growth in niche markets. | Global Biotech Market: ~$1.5 trillion (2023). Pharma R&D spending: >$250 billion projected (2024). |

Legal factors

The intricate landscape of healthcare regulations, such as HIPAA for patient data protection and the Stark Law, directly influences Healthpeak Properties' operational framework, particularly in its lease agreements and collaborative ventures. Non-adherence to these rules can lead to significant legal repercussions and strain tenant partnerships.

For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine reimbursement policies, impacting the revenue streams of many healthcare providers who lease space from Healthpeak. These policy shifts necessitate adaptive lease structures and tenant support to ensure continued occupancy and operational viability.

Healthpeak's operations are significantly shaped by a complex web of real estate and zoning regulations at both local and federal levels. These laws, including zoning ordinances and building codes, directly govern how Healthpeak can develop, utilize, and maintain its healthcare facilities and life science campuses. For instance, changes in healthcare-specific zoning or stricter environmental impact assessments could introduce delays and escalate construction expenses for new projects.

Lease agreements with healthcare operators, a core component of Healthpeak Properties' business, are governed by a complex web of legal frameworks. These include standard landlord-tenant laws, but also specialized stipulations unique to healthcare real estate, impacting everything from rent escalations to operational requirements.

Healthpeak's financial performance, particularly its ability to secure high tenant retention and achieve positive cash releasing spreads on lease renewals, hinges on the strength and legal enforceability of these contractual agreements. For instance, in 2024, the company reported strong leasing activity, underscoring the importance of well-structured leases that align with evolving healthcare regulations.

Environmental Regulations and Building Standards

Healthpeak Properties must navigate a complex web of environmental regulations, impacting everything from waste disposal to the energy efficiency of its healthcare facilities. Compliance with these standards is not just a legal obligation but a core operational consideration. For instance, evolving building codes often mandate higher levels of sustainability, influencing construction and renovation projects.

Healthpeak's proactive stance on sustainability is a key factor in its compliance strategy. The company has achieved significant recognition, including LEED Gold certifications for numerous properties, underscoring its commitment to environmentally responsible building practices. Furthermore, its designation as a Green Lease Leader highlights its dedication to promoting energy and resource efficiency within its tenant agreements, a critical aspect of managing its environmental footprint.

- Environmental Compliance: Adherence to regulations concerning waste management, emissions, and water usage is paramount for Healthpeak's operations.

- Energy Efficiency Mandates: Increasingly stringent energy efficiency standards for commercial buildings directly affect Healthpeak's portfolio, requiring investments in upgrades and sustainable technologies.

- Green Building Standards: The adoption of frameworks like LEED (Leadership in Energy and Environmental Design) is crucial, with Healthpeak holding multiple LEED Gold certifications as of early 2024.

- Tenant Sustainability Agreements: Healthpeak's Green Lease Leader status reflects its commitment to integrating sustainability into lease agreements, promoting shared responsibility for environmental performance.

Healthcare Reform Legislation

Major healthcare reform legislation can significantly alter the healthcare landscape, affecting insurance coverage, care delivery models, and ultimately the demand for healthcare real estate. For instance, the Inflation Reduction Act of 2022, while not directly targeting real estate, has provisions that could influence healthcare provider revenue streams and operational costs, indirectly impacting their expansion or consolidation strategies.

The potential for legislative changes concerning funding for programs like Medicaid could impact the financial stability of healthcare providers and thus their real estate needs. In 2024, states are still navigating the unwinding of the COVID-19 public health emergency's continuous enrollment provisions for Medicaid, which could lead to millions losing coverage and potentially shifting demand for certain types of care facilities.

- Impact on Provider Revenue: Changes in government reimbursement rates for Medicare and Medicaid can directly affect the profitability of healthcare operators, influencing their ability to invest in or lease new facilities.

- Insurance Coverage Expansion/Contraction: Legislation that broadens or narrows insurance coverage can lead to shifts in patient volumes, impacting occupancy rates and the demand for specific healthcare services and their associated real estate.

- Care Delivery Model Shifts: Reforms encouraging outpatient care or telehealth may reduce the need for traditional hospital beds but increase demand for specialized outpatient centers and life science facilities.

- Regulatory Compliance: New healthcare regulations often impose additional compliance burdens on facilities, which can necessitate costly upgrades or renovations to existing real estate.

Healthpeak Properties operates within a highly regulated sector, where compliance with healthcare laws like HIPAA is critical for tenant relationships and operational integrity. Changes in government reimbursement policies, such as those by CMS in 2024, directly affect tenant revenue, necessitating adaptable lease terms. Furthermore, evolving zoning and building codes, alongside environmental mandates, shape development and operational costs, as seen with the increasing demand for sustainable building practices, evidenced by Healthpeak's LEED Gold certifications.

| Legal Factor | Impact on Healthpeak Properties | 2024/2025 Relevance |

|---|---|---|

| Healthcare Regulations (HIPAA, Stark Law) | Governs lease agreements, data protection, and collaborations. Non-compliance risks legal penalties and tenant strain. | Continued emphasis on data privacy and ethical healthcare practices influences facility design and tenant selection. |

| Reimbursement Policies (CMS) | Affects healthcare provider revenue, influencing their ability to lease and maintain space. | Refinement of Medicare/Medicaid policies in 2024 impacts tenant financial health and demand for specific facility types. |

| Real Estate & Zoning Laws | Dictates development, utilization, and maintenance of properties. Stricter codes can increase costs and timelines. | Ongoing urban development and healthcare zoning changes can affect project feasibility and expansion plans. |

| Environmental Regulations | Mandates waste disposal, energy efficiency, and sustainability standards. | Growing focus on ESG compliance and green building standards, with Healthpeak holding multiple LEED Gold certifications, drives investment in sustainable upgrades. |

Environmental factors

Climate change is escalating the frequency and intensity of extreme weather, posing significant physical risks to Healthpeak's real estate portfolio. This could translate into property damage, operational disruptions, and higher insurance premiums, impacting financial performance.

For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the growing threat. Healthpeak must therefore prioritize resilient building designs and consider strategic diversification across geographic locations to mitigate these escalating environmental risks.

The increasing global focus on environmental sustainability is significantly boosting the demand for green buildings and energy-efficient operations. This trend directly impacts the real estate sector, encouraging developers and operators to adopt eco-friendly practices.

Healthpeak Properties has actively embraced these shifts. Their achievement of LEED Gold certifications for numerous properties and recognition as a Green Lease Leader highlights a strong commitment to sustainable building. For instance, in 2023, Healthpeak reported that 77% of its portfolio was LEED certified, with a notable portion achieving Gold status, underscoring their dedication to environmental stewardship.

These sustainable practices offer tangible benefits. They can lead to reduced operating expenses through lower energy and water consumption, a key advantage in a competitive market. Furthermore, this commitment appeals to a growing segment of environmentally conscious tenants and investors who prioritize ESG (Environmental, Social, and Governance) factors in their decisions, potentially enhancing Healthpeak's market position and access to capital.

The availability and cost of essential resources like water and energy directly influence operational expenses for healthcare facilities. For instance, rising natural gas prices in the US, which saw a significant increase in early 2024, could directly impact Healthpeak's utility bills across its portfolio.

Implementing robust energy-efficient systems and proactive water conservation measures within Healthpeak's properties is crucial. These strategies not only mitigate the risks associated with resource scarcity but also offer substantial long-term cost savings, enhancing financial resilience.

Waste Management and Pollution Control

Healthcare facilities, including those managed by Healthpeak Properties, generate unique waste streams that necessitate rigorous management and pollution control. Adherence to evolving environmental regulations is paramount to avoid penalties and maintain a positive corporate image. For instance, the U.S. Environmental Protection Agency (EPA) continuously updates standards for medical waste disposal, impacting operational costs and compliance strategies for real estate investment trusts (REITs) like Healthpeak.

Healthpeak must ensure its properties and the operations of its healthcare tenants meet these stringent environmental standards. Failure to comply can lead to significant fines and damage to the company's reputation. For example, non-compliance with hazardous waste regulations could result in penalties that affect profitability. In 2023, the healthcare industry faced increasing scrutiny over its environmental footprint, with a growing emphasis on sustainable waste disposal practices.

Key considerations for Healthpeak in waste management and pollution control include:

- Compliance with EPA and state-level regulations for medical waste, including sharps, biohazardous materials, and pharmaceutical waste.

- Implementing strategies to minimize waste generation and promote recycling or proper disposal methods for non-hazardous materials.

- Ensuring tenant agreements clearly outline responsibilities for environmental compliance and waste management protocols.

- Monitoring evolving legislative landscapes that could impact waste handling and pollution control requirements in the healthcare real estate sector.

Location and Environmental Risks

Healthpeak Properties' real estate portfolio is inherently tied to its geographical locations, exposing it to a range of environmental risks. For instance, properties situated in coastal areas or low-lying regions face increased threats from flooding, a concern amplified by climate change projections. Similarly, assets in seismically active zones carry the inherent risk of earthquake damage.

The company's strategic approach to site selection and rigorous environmental due diligence are paramount in managing these exposures. By carefully evaluating potential locations, Healthpeak can identify and mitigate risks associated with poor air quality, proximity to hazardous waste sites, or other environmental hazards. This proactive stance is crucial for long-term asset value preservation and operational stability.

For example, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling $177.6 billion in damages, according to NOAA. While specific Healthpeak property exposure data isn't publicly detailed, understanding the broader environmental risk landscape is vital for their portfolio management. This includes monitoring:

- Flood Risk: Assessing properties against FEMA flood maps and considering future sea-level rise models.

- Seismic Activity: Evaluating structural integrity and retrofitting needs for buildings in earthquake-prone regions.

- Air Quality: Monitoring local air pollution levels and their potential impact on tenant health and property desirability.

- Wildfire Risk: For properties in or near fire-prone areas, assessing defensible space and fire-resistant building materials.

Environmental regulations are becoming more stringent, pushing companies like Healthpeak to invest in sustainable practices and compliance measures. For example, the U.S. Environmental Protection Agency (EPA) continues to update standards for emissions and waste management, directly impacting operational costs and requiring ongoing adaptation in the real estate sector.

Healthpeak's commitment to sustainability is evident in its LEED certifications and Green Lease Leader recognition, aiming to reduce its environmental footprint. In 2023, 77% of its portfolio achieved LEED certification, with a significant portion earning Gold status, demonstrating a proactive approach to environmental stewardship and operational efficiency.

The increasing demand for green buildings and energy-efficient operations presents both a challenge and an opportunity for Healthpeak. By embracing eco-friendly practices, the company can reduce operating expenses, attract environmentally conscious tenants, and enhance its market position, aligning with growing investor interest in ESG factors.

Extreme weather events, fueled by climate change, pose physical risks to Healthpeak's properties, potentially leading to damage and increased insurance costs. NOAA data from 2023 highlights 28 billion-dollar weather disasters in the U.S., underscoring the need for resilient building designs and geographic diversification to mitigate these growing environmental threats.

PESTLE Analysis Data Sources

Our Healthpeak Properties PESTLE Analysis is grounded in comprehensive data from government health agencies, real estate market reports, and economic forecasting firms. We incorporate regulatory updates, demographic trends, and technological advancements impacting the healthcare real estate sector.