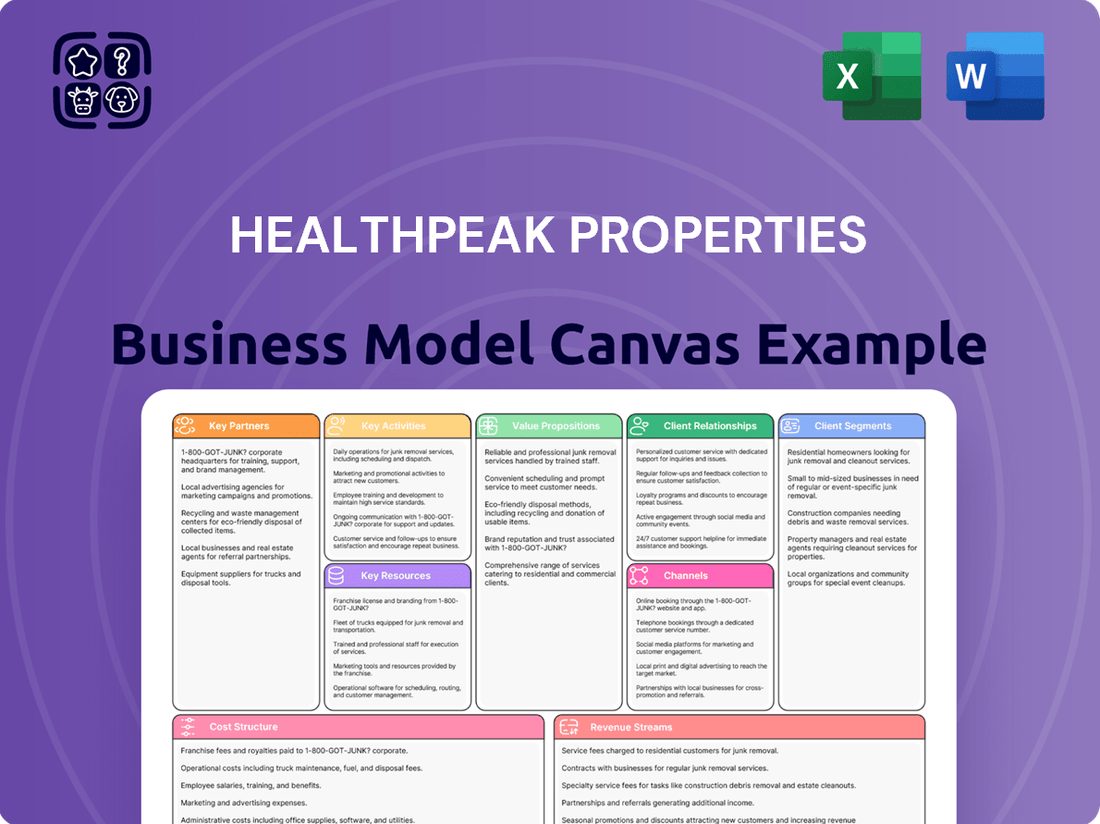

Healthpeak Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

Unlock the strategic blueprint behind Healthpeak Properties's success with our comprehensive Business Model Canvas. Discover how they connect with healthcare providers, leverage key partnerships, and manage their vast real estate portfolio to generate consistent revenue. This detailed analysis is essential for anyone looking to understand the dynamics of healthcare real estate investment.

Ready to dissect Healthpeak Properties's winning formula? Our full Business Model Canvas provides an in-depth look at their value propositions, customer relationships, and cost structures, offering actionable insights for investors and industry professionals. Download the complete, professionally crafted document to gain a competitive edge.

Partnerships

Healthpeak Properties cultivates vital relationships with premier healthcare operators and institutions. These collaborations are fundamental to securing tenants for their specialized real estate, which includes facilities for cutting-edge medical research, comprehensive patient care, and high-quality senior living. These partnerships directly influence the consistent occupancy and overall prosperity of Healthpeak's diverse property portfolio.

A prime illustration of this strategic alignment is Healthpeak's development agreement with Northside Hospital. This partnership is specifically designed to facilitate Northside Hospital's significant outpatient expansion in Atlanta, underscoring Healthpeak's role in supporting critical healthcare infrastructure growth.

Healthpeak Properties' lab segment thrives on its collaborations with life science companies. These partnerships are foundational, as Healthpeak develops and manages purpose-built lab campuses specifically designed to accelerate medical research and discovery.

By fostering strong relationships with these crucial tenants, Healthpeak ensures robust leasing activity and high tenant retention within its specialized lab facilities. This focus on tenant success directly fuels the growth and stability of its lab portfolio, a key driver of its overall business model.

Healthpeak Properties (PEAK) strategically partners with seasoned senior living operators for its Continuing Care Retirement Communities (CCRCs). These operators handle the daily management, resident care, and services, aiming for top-tier senior living experiences. For instance, Healthpeak's collaboration with LCS as an operator has been instrumental in enhancing the performance of its CCRC portfolio, demonstrating the value of experienced management in this sector.

Financial Institutions and Lenders

Healthpeak Properties maintains crucial relationships with financial institutions and lenders to fuel its growth and operational needs. These partnerships are essential for securing the capital required for property acquisitions, development projects, and ongoing management.

The company utilizes various financing instruments, including loans and credit facilities, to ensure adequate liquidity and support its real estate investment strategy. For instance, Healthpeak recently extended the maturity of its substantial $3 billion revolving credit facility, pushing the expiry date to 2029. This strategic move underscores the strong backing from its financial partners and provides long-term financial flexibility.

Further demonstrating these robust relationships, Healthpeak successfully issued $500 million in senior unsecured notes in February 2025. This capital raise highlights the confidence financial markets have in the company's financial health and future prospects, enabling continued investment in its portfolio.

- Capital Access: Securing loans and credit facilities for property acquisition and development.

- Liquidity Management: Maintaining sufficient funds for operations and strategic investments.

- Maturity Extension: Extended a $3 billion revolving credit facility to 2029.

- Debt Issuance: Issued $500 million in senior unsecured notes in February 2025.

Development and Construction Partners

Healthpeak Properties actively collaborates with a network of development and construction partners to expand and upgrade its extensive portfolio. These strategic alliances are fundamental to the creation of new, state-of-the-art healthcare facilities and the revitalization of existing properties, guaranteeing that their real estate offerings meet the highest standards of quality and specialization.

These partnerships are crucial for projects ranging from the development of modern outpatient medical centers to the sophisticated redevelopment of life science laboratories. For instance, in 2024, Healthpeak continued to focus on building out its life science segment, which often involves complex construction and redevelopment projects requiring specialized expertise.

Key aspects of these collaborations include:

- Expertise in specialized construction: Partners bring deep knowledge in building healthcare-specific environments, such as labs requiring advanced ventilation and containment.

- Project management and execution: These firms manage the entire construction lifecycle, from planning and design to completion, ensuring projects stay on schedule and within budget.

- Risk sharing and capital efficiency: Partnerships can help mitigate construction risks and optimize capital deployment for large-scale development initiatives.

- Access to innovation: Collaborating with leading construction firms allows Healthpeak to incorporate the latest building technologies and sustainable practices.

Healthpeak Properties' Key Partnerships are critical for its operational success and portfolio growth, primarily revolving around healthcare operators, life science companies, senior living managers, financial institutions, and development partners.

These collaborations ensure high occupancy rates, access to capital, and the development of specialized real estate. For example, in 2024, Healthpeak continued to leverage its relationships with life science tenants to drive leasing in its lab segment, a core component of its business strategy.

The company's financial partnerships are equally vital. Healthpeak's ability to secure substantial financing, such as the $500 million in senior unsecured notes issued in February 2025, directly supports its development and acquisition pipeline.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Healthcare Operators | Tenant for medical facilities | Northside Hospital (outpatient expansion) |

| Life Science Companies | Tenant for lab spaces | Accelerates medical research and discovery |

| Senior Living Operators | Management of CCRCs | LCS enhances CCRC portfolio performance |

| Financial Institutions | Capital access and liquidity | $3B revolving credit facility extended to 2029; $500M notes issued Feb 2025 |

| Development/Construction Partners | Portfolio expansion and upgrades | Building state-of-the-art healthcare facilities and labs |

What is included in the product

Healthpeak Properties' business model focuses on owning and operating high-quality healthcare real estate, primarily medical office buildings, life science facilities, and senior housing, serving healthcare providers and life science companies.

This model leverages long-term leases with creditworthy tenants, a strong balance sheet, and strategic property acquisitions to generate stable rental income and capital appreciation.

Healthpeak Properties' Business Model Canvas effectively relieves the pain of complex real estate investment by offering a clear, structured overview of their healthcare real estate strategy.

It provides a digestible snapshot, simplifying the understanding of their operations and value proposition for stakeholders.

Activities

Healthpeak's primary focus is on acquiring and developing prime healthcare properties. This involves a strategic approach to identifying promising locations and growth avenues within the life science, medical office, and continuing care retirement community (CCRC) segments.

A key activity is the origination of financing for healthcare real estate. For example, in October 2024, Healthpeak provided a $15 million loan for an outpatient medical campus situated in Minneapolis, demonstrating their engagement in supporting vital healthcare infrastructure.

Furthermore, Healthpeak actively pursues new development opportunities. In the second quarter of 2025, the company entered into new outpatient development agreements in Atlanta, signaling continued expansion and investment in key healthcare markets.

Healthpeak Properties actively manages and operates its extensive portfolio, encompassing day-to-day operations and maintenance to ensure seamless facility functioning.

The company has been bringing property management in-house, currently overseeing around 24 million square feet internally, with further expansion of this internal management planned for 2025.

Securing and managing leases with healthcare operators is a core activity, focusing on attracting and retaining high-quality tenants. This includes negotiating favorable lease terms and fostering long-term partnerships.

Healthpeak Properties demonstrated strong leasing performance in the fourth quarter of 2024, executing lab lease agreements that spanned 652,000 square feet. This highlights their success in attracting new tenants to their facilities.

Maintaining robust tenant relationships is crucial for sustained success. In the second quarter of 2025, Healthpeak reported an impressive 85% tenant retention rate for their outpatient medical leases, underscoring their commitment to client satisfaction and long-term stability.

Portfolio Optimization and Asset Management

Healthpeak actively refines its real estate holdings by strategically selling off less essential properties and acquiring new ones. This ongoing process is designed to elevate the overall quality of its portfolio, mitigate potential risks, and boost profitability. In 2024 alone, the company completed the sale of approximately $1.3 billion in assets that were considered non-core or less strategic to its main objectives.

This strategic divestment and acquisition approach is central to Healthpeak's asset management strategy. It allows them to:

- Enhance Portfolio Quality: By shedding underperforming or non-strategic assets, Healthpeak can focus capital on higher-growth and more stable real estate opportunities.

- Reduce Risk: Diversifying and concentrating on core asset types helps to lower overall portfolio risk exposure.

- Maximize Returns: The continuous optimization aims to improve the yield and capital appreciation potential across the entire portfolio.

Capital Allocation and Financial Management

Healthpeak Properties actively manages its capital structure through strategic debt and equity financing, alongside share repurchase initiatives. This approach is crucial for maintaining financial agility and funding both immediate operational requirements and future growth opportunities.

A prime example of this active management is Healthpeak's repayment of $452 million in senior notes in June 2025. This action demonstrates a commitment to optimizing the company's debt profile and managing liabilities effectively.

As of July 24, 2025, Healthpeak maintained a robust financial position with approximately $2.3 billion in available liquidity. This substantial liquidity provides significant flexibility to pursue strategic investments, navigate market fluctuations, and meet ongoing financial obligations without undue strain.

- Debt Management: Actively retiring debt, such as the $452 million in senior notes repaid in June 2025, strengthens the balance sheet.

- Equity Financing: Utilizing equity as needed to support growth and maintain optimal capital structure.

- Share Repurchases: Engaging in share repurchase programs to return value to shareholders and manage share count.

- Liquidity: Maintaining substantial available liquidity, evidenced by the $2.3 billion on hand as of July 24, 2025, ensures operational and strategic flexibility.

Healthpeak's key activities revolve around strategic property acquisition and development within the life science, medical office, and CCRC sectors. They also focus on originating financing for healthcare real estate, as seen with a $15 million loan in October 2024. Furthermore, active portfolio management, including in-house property management for 24 million square feet, and securing leases with high-quality tenants, such as 652,000 square feet of lab leases in Q4 2024, are central to their operations.

The company also actively manages its real estate portfolio through strategic sales and acquisitions, aiming to enhance quality and profitability. In 2024, they divested approximately $1.3 billion in non-core assets. Capital management is another critical activity, involving debt repayment, equity financing, and share repurchases, supported by substantial liquidity, with $2.3 billion available as of July 24, 2025.

| Activity | Description | Example/Data Point |

|---|---|---|

| Property Acquisition & Development | Identifying and developing prime healthcare properties. | New outpatient development agreements in Atlanta (Q2 2025). |

| Financing Origination | Providing loans for healthcare infrastructure. | $15 million loan for Minneapolis outpatient campus (October 2024). |

| Portfolio Management | Operating and maintaining properties, managing leases. | 85% tenant retention for outpatient medical leases (Q2 2025). |

| Asset Refinement | Selling non-core assets and acquiring new ones. | ~$1.3 billion in asset sales in 2024. |

| Capital Management | Managing debt, equity, and liquidity. | $2.3 billion liquidity as of July 24, 2025. |

Full Document Unlocks After Purchase

Business Model Canvas

The preview you see of the Healthpeak Properties Business Model Canvas is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis, with all sections and content intact. Once your order is processed, you'll gain full access to this exact file, ready for immediate use and customization.

Resources

Healthpeak Properties' key resource is its vast and varied collection of premium healthcare properties. This portfolio encompasses around 700 assets strategically located across the life science, medical office, and continuing care retirement community sectors, forming the bedrock of its business operations.

Healthpeak Properties cultivates deep ties with premier healthcare providers, viewing these established relationships as a core intangible asset. This focus directly translates into impressive occupancy rates, with their portfolio consistently achieving high levels. For instance, as of the first quarter of 2024, Healthpeak reported a portfolio occupancy of 92.2%, a testament to the stability these strong tenant connections provide.

These enduring partnerships are the bedrock for consistent lease renewals and unlock valuable opportunities for joint development projects. By prioritizing the cultivation of the most robust tenant relationships within the healthcare real estate sector, Healthpeak ensures a predictable revenue stream and a competitive advantage.

Healthpeak Properties' expertise in healthcare real estate is a cornerstone of its business model. This specialized knowledge allows them to navigate the intricate regulatory landscapes and evolving industry trends that define healthcare properties. For instance, their deep understanding of life science lab space requirements and medical office building operational needs informs their strategic acquisitions and developments.

This profound insight into the healthcare sector enables Healthpeak to make exceptionally informed investment and portfolio management decisions. In 2024, the company continued to demonstrate this by actively managing its diverse portfolio, which includes a significant concentration in life science and medical office buildings, sectors known for their specific operational and capital expenditure demands.

Financial Capital and Access to Funding

Healthpeak Properties relies on substantial financial capital to fuel its growth and operations. This includes robust access to credit facilities, the ability to tap into public markets for both debt and equity issuance, and the generation of strong internal cash flow. These resources are critical for funding strategic acquisitions, undertaking new development projects, and supporting ongoing operational needs.

As of July 24, 2025, Healthpeak demonstrated significant financial strength with approximately $2.3 billion in available liquidity. This substantial war chest provides the flexibility to pursue opportunities and manage its business effectively.

- Access to Public Markets: Healthpeak can raise capital through issuing stocks and bonds, providing a broad funding base.

- Credit Facilities: The company maintains access to credit lines, offering a reliable source of short-term and long-term financing.

- Internal Cash Flow: Operations generate consistent cash, which can be reinvested into the business or used for strategic initiatives.

- Liquidity Position: As of July 24, 2025, Healthpeak held around $2.3 billion in available liquidity, underscoring its financial capacity.

Skilled Management and Operational Teams

Healthpeak Properties relies heavily on its skilled management and operational teams to drive its strategy forward. This includes expertise in crucial areas like investments, portfolio management, property management, and legal affairs. A robust team ensures effective execution of the company's real estate acquisition, development, and operational plans.

The company's commitment to internalizing property management is a significant indicator of its focus on this key resource. By bringing over 100 employees in-house for property management functions, Healthpeak aims to enhance control, efficiency, and direct oversight of its valuable assets.

- Investment Expertise: Teams with deep knowledge of healthcare real estate markets identify and execute accretive acquisitions and development projects.

- Portfolio Management: Professionals adept at optimizing the company's diverse portfolio of healthcare properties across various sub-sectors.

- Property Management: In-house teams enhance operational efficiency, tenant satisfaction, and asset value through direct management.

- Legal and Compliance: Skilled legal professionals navigate complex regulations and ensure adherence to all relevant laws in the healthcare real estate sector.

Healthpeak Properties' key resources include its extensive portfolio of healthcare properties, strong relationships with healthcare providers, specialized industry expertise, significant financial capital, and a skilled management team. These elements collectively underpin its ability to operate, grow, and maintain a competitive edge in the healthcare real estate market.

The company’s strategic focus on life science and medical office buildings, which represent a substantial portion of its portfolio, highlights its commitment to sectors with strong demand drivers. As of the first quarter of 2024, Healthpeak's portfolio occupancy remained robust at 92.2%, demonstrating the stability derived from its tenant relationships.

Healthpeak's financial strength is a critical resource, evidenced by its substantial liquidity. As of July 24, 2025, the company reported approximately $2.3 billion in available liquidity, providing ample capacity for strategic investments and operational needs.

| Key Resource Category | Specific Resource | Description/Data Point |

|---|---|---|

| Property Portfolio | Number of Assets | Approximately 700 |

| Tenant Relationships | Portfolio Occupancy (Q1 2024) | 92.2% |

| Financial Capital | Available Liquidity (July 24, 2025) | $2.3 billion |

| Human Capital | In-house Property Management Staff | Over 100 employees |

Value Propositions

Healthpeak Properties excels by offering purpose-built, high-quality real estate tailored for healthcare's diverse needs, including medical research, patient care, and senior living. This specialization ensures tenants operate within facilities that meet stringent operational and regulatory standards.

Healthpeak Properties' strategic locations are a cornerstone of its value proposition, placing its healthcare facilities in close proximity to major health systems. This proximity ensures convenient access for patients seeking care and researchers engaged in vital medical advancements. For instance, in 2024, Healthpeak continued to solidify its presence in high-growth markets.

The company boasts significant concentrations of properties in key metropolitan areas. These include Dallas, Houston, Nashville, Atlanta, Phoenix, and Denver, all recognized for their robust healthcare ecosystems and growing patient populations. This deliberate market presence allows Healthpeak to capture demand and foster strong relationships within these communities.

Healthpeak Properties offers healthcare providers a dependable, long-term real estate foundation, freeing them to concentrate on patient care rather than property complexities. This stability is crucial for organizations aiming for consistent operational performance.

Their strategic focus on outpatient medical buildings delivers economically viable options for patients seeking accessible healthcare services. In 2024, Healthpeak continued to expand its portfolio of these vital facilities, demonstrating a commitment to cost-effective patient access.

Operational Excellence and Tenant Support

Healthpeak Properties emphasizes operational excellence through its internalized property management, aiming to provide a superior experience for its clients and tenants. This dedication to efficient operations and enhanced service directly translates into tangible benefits, fostering strong tenant relationships and favorable lease renewals.

This strategic approach has demonstrably contributed to Healthpeak's financial performance. For instance, in 2024, the company reported strong tenant retention rates, a key indicator of tenant satisfaction and operational effectiveness, which supports consistent revenue streams and positive re-leasing spreads.

- Internalized Property Management: Healthpeak controls its property operations, ensuring consistent quality and service delivery.

- Enhanced Operating Procedures: Continuous improvement in management processes leads to greater efficiency and tenant satisfaction.

- High Tenant Retention: A focus on tenant needs and a positive experience results in tenants choosing to renew their leases.

- Positive Re-leasing Spreads: The ability to secure higher rental rates upon lease renewals reflects the value and quality of Healthpeak's managed properties and services.

Access to Capital for Growth and Innovation

Healthpeak Properties, as a Real Estate Investment Trust (REIT), serves as a crucial financial enabler for its partners and tenants. By offering access to capital, Healthpeak directly fuels growth and innovation within the healthcare sector. This access is particularly vital for funding significant undertakings like acquisitions and redevelopment projects.

This financial platform allows healthcare providers and developers to expand their operations and invest in cutting-edge advancements. For instance, Healthpeak's financing can enable the construction of new medical facilities or the modernization of existing ones, directly impacting the quality and accessibility of healthcare services.

- Capital Access: Healthpeak provides a stable source of funding for healthcare real estate ventures.

- Growth Facilitation: The company's capital supports tenant expansion and new development projects.

- Innovation Driver: Access to capital allows partners to invest in advanced healthcare technologies and facilities.

- Secured Lending: Healthpeak offers secured loans, often for acquisition and redevelopment, mitigating risk for borrowers.

Healthpeak Properties provides specialized, high-quality real estate crucial for healthcare operations, from research labs to senior living facilities. This ensures tenants have compliant and efficient spaces, a key differentiator in the healthcare real estate market.

Their strategic placement in key metropolitan areas like Dallas and Atlanta, known for strong healthcare systems, ensures accessibility for patients and researchers. This focus on prime locations, a consistent strategy in 2024, enhances tenant visibility and patient traffic.

Healthpeak acts as a vital financial partner, offering access to capital for critical projects like facility expansions and technology upgrades. This financial enablement directly supports the growth and innovation of healthcare providers, a role that became even more pronounced in 2024 as the sector navigated evolving demands.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Specialized Real Estate | Purpose-built facilities for diverse healthcare needs. | Continued focus on high-quality medical office buildings and life science facilities. |

| Strategic Locations | Proximity to major health systems and growing patient populations. | Strengthened presence in key growth markets, facilitating patient access. |

| Financial Enablement | Access to capital for tenant growth and innovation. | Supported significant tenant development and acquisition projects throughout the year. |

| Operational Excellence | Internalized property management for superior tenant experience. | Reported high tenant retention rates, underscoring tenant satisfaction and property value. |

Customer Relationships

Healthpeak is actively strengthening its customer relationships by deploying dedicated, in-house property management teams. This direct approach facilitates more meaningful interactions with tenants.

By having teams focused on property management, Healthpeak can address tenant issues more efficiently and gain a more profound understanding of their evolving needs. This fosters more robust and collaborative partnerships.

Currently, over 60% of Healthpeak's property management personnel are directly involved in tenant engagement, a significant increase that underscores their commitment to this relationship-building strategy.

Healthpeak Properties, Inc. (PEAK) prioritizes cultivating enduring strategic alliances with its healthcare operator and institutional tenants. This focus involves proactive, collaborative planning to deeply understand their evolving operational requirements and to actively foster their expansion within Healthpeak's extensive property portfolio. A prime example of this commitment is their long-standing relationship with Northside Hospital, a testament to their strategy of mutual growth and sustained collaboration.

Healthpeak Properties prioritizes proactive communication to foster strong tenant relationships. This involves regular check-ins and prompt responses to inquiries, ensuring tenants feel valued and informed about their properties and relevant market shifts.

By actively engaging with tenants and addressing their needs, Healthpeak aims to enhance satisfaction. This commitment is reflected in their performance, with tenant satisfaction scores demonstrating a positive trend, showing year-over-year improvement.

Tailored Solutions and Flexible Lease Structures

Healthpeak Properties crafts tailored real estate solutions and offers flexible lease structures designed to precisely match the unique operational and financial needs of its varied tenant base, from life science innovators to healthcare providers and senior living operators.

This adaptability is crucial for meeting the distinct demands across its key segments, ensuring that each tenant receives a solution that supports their specific growth and service delivery models.

- Customized Space Design: Healthpeak collaborates with tenants to design and build-out spaces that optimize workflow and accommodate specialized equipment, particularly vital in the life science sector.

- Flexible Lease Terms: Offering a range of lease durations and structures, including options for expansion or contraction, provides tenants with financial predictability and operational agility.

- Tenant Support Services: Beyond physical space, Healthpeak provides ongoing support, fostering strong, long-term relationships that are essential for tenant retention and satisfaction.

- Segment-Specific Adaptations: For example, medical office buildings might feature adaptable exam room configurations, while life science facilities can be equipped with advanced lab infrastructure, showcasing Healthpeak's commitment to specialized needs.

Technology-Enhanced Client Service

Healthpeak Properties is enhancing its client service through significant technology investments. By upgrading enterprise-wide systems and implementing AI tools, the company is streamlining operations and improving how it interacts with clients.

These technological advancements are designed to foster better data integration, ultimately boosting productivity across the board. This focus on technology translates directly into a more efficient and responsive client service model, ensuring clients receive timely and accurate support.

- Data Integration: Enterprise-wide system upgrades improve the flow and accessibility of client data.

- Productivity Gains: AI tools and system enhancements are projected to increase operational efficiency.

- Client Responsiveness: A more integrated data system allows for quicker and more informed client interactions.

- Service Model Enhancement: Technology adoption aims to elevate the overall quality and effectiveness of client relationships.

Healthpeak Properties cultivates deep tenant relationships through customized space design and flexible lease terms, ensuring alignment with diverse operational needs across healthcare, life science, and senior living sectors. Their strategy emphasizes proactive collaboration and tailored solutions, fostering long-term partnerships built on mutual growth and tenant success.

Channels

Healthpeak Properties leverages its dedicated internal leasing and sales teams to forge direct relationships with prospective and current tenants across its life science, medical office, and CCRC portfolios. This hands-on approach facilitates highly personalized engagement and the creation of bespoke leasing solutions.

These direct channels are crucial for understanding tenant needs and market dynamics, enabling Healthpeak to offer tailored proposals that align with specific business requirements. For instance, in 2023, Healthpeak reported a significant leasing volume across its life science assets, underscoring the effectiveness of its direct sales efforts in securing high-quality tenants for its specialized properties.

Healthpeak Properties' investor relations website and portal act as a crucial communication hub, offering a wealth of information including quarterly earnings reports, annual filings, and presentations. This digital presence ensures investors can easily access up-to-date financial data and company news, fostering transparency. For instance, during 2024, the site was instrumental in disseminating details about their strategic real estate acquisitions and portfolio adjustments.

Healthpeak Properties actively participates in key healthcare and real estate industry conferences. This engagement is crucial for building relationships with potential tenants, partners, and investors, while also providing a platform to highlight their extensive portfolio.

By presenting at these events, Healthpeak gains valuable insights into emerging market trends and competitive landscapes. For instance, in 2024, their presence at major real estate investment and healthcare innovation forums allowed them to directly connect with over 500 industry leaders, reinforcing their market position.

Brokerage and Real Estate Advisory Firms

Healthpeak Properties leverages external brokerage and real estate advisory firms to expand its market reach and uncover new opportunities. These partnerships are crucial for identifying suitable tenants for their healthcare properties and for pinpointing potential acquisitions or divestitures within their portfolio.

These specialized firms offer invaluable market intelligence, including current rental rates, vacancy trends, and demand drivers specific to the healthcare real estate sector. Their expertise also facilitates smoother transaction processes, from initial negotiations to closing deals.

- Market Expansion: Access to a wider pool of potential tenants and investors through established brokerage networks.

- Opportunity Identification: Proactive sourcing of off-market acquisition and disposition opportunities.

- Transaction Facilitation: Streamlined negotiation and closing processes, leveraging expert advisory services.

- Market Intelligence: Up-to-date data on rental rates, occupancy, and market trends in key healthcare sub-sectors.

Financial and Business News Media

Healthpeak Properties leverages financial and business news media to disseminate crucial information. This includes press releases detailing operational updates and strategic maneuvers, as well as earnings call transcripts that offer in-depth financial performance analysis. For instance, in their Q1 2024 earnings call, Healthpeak reported a Funds From Operations (FFO) per share of $0.47, highlighting their commitment to shareholder value.

This channel is vital for reaching a broad spectrum of stakeholders. Investors, analysts, and business strategists rely on these outlets for timely and accurate data. In 2023, Healthpeak completed the spin-off of its medical office portfolio, a significant strategic move communicated extensively through these media channels, impacting its valuation and market perception.

The transparency provided through these communications builds trust and facilitates informed decision-making across the financial community. By making detailed financial reports and strategic outlooks readily available, Healthpeak ensures that its performance and future plans are understood by its diverse audience.

Key aspects communicated via this channel include:

- Financial Performance: Regular updates on revenue, FFO, and other key financial metrics.

- Strategic Initiatives: Announcements and explanations of major corporate actions, such as portfolio adjustments or M&A activity.

- Company News: Broader updates on operations, leadership, and market positioning.

- Investor Relations: Direct engagement with the investment community through earnings calls and press releases.

Healthpeak Properties utilizes a multi-faceted channel strategy to connect with its diverse stakeholder base. Direct engagement through internal leasing and sales teams fosters strong tenant relationships, particularly within its life science and medical office segments. This personalized approach was evident in 2023 when Healthpeak secured significant leasing volumes, demonstrating the effectiveness of these direct interactions.

Furthermore, Healthpeak actively participates in industry conferences, providing valuable face-to-face opportunities. In 2024 alone, their presence at key real estate and healthcare innovation forums facilitated connections with over 500 industry leaders, enhancing market visibility and partnership potential.

External brokerage and advisory firms broaden Healthpeak's reach, identifying new tenants and acquisition targets. The company also leverages financial news media and its investor relations website to disseminate critical financial data, such as their Q1 2024 FFO per share of $0.47, ensuring transparency and informed decision-making among investors and analysts.

| Channel | Purpose | Key Activities/Examples | 2023/2024 Data Point |

|---|---|---|---|

| Direct Leasing/Sales Teams | Tenant acquisition & relationship management | Bespoke leasing solutions, understanding tenant needs | Significant leasing volume in life science assets (2023) |

| Industry Conferences | Networking, market insight, brand visibility | Presentations, direct engagement with leaders | Connected with over 500 industry leaders (2024) |

| External Brokerages/Advisors | Market expansion, opportunity sourcing | Tenant identification, acquisition/divestiture sourcing | Facilitated smoother transactions for portfolio adjustments |

| Financial Media & Investor Relations | Information dissemination, transparency | Press releases, earnings calls, website data | Reported FFO per share of $0.47 (Q1 2024) |

Customer Segments

Healthpeak's life science segment serves pharmaceutical giants, innovative biotech firms, and crucial research institutions. These entities depend on specialized lab and office environments to drive their groundbreaking discovery and development processes. For instance, in the first quarter of 2024, Healthpeak reported that its life science portfolio occupancy remained strong at 95.7%, demonstrating continued demand from these key players.

While the overall demand is robust, Healthpeak acknowledges that some smaller, emerging biotech companies, often categorized as small-cap tenants, have encountered funding hurdles. These capital challenges can impact their ability to secure and maintain long-term leases, creating a dynamic within the tenant base that requires careful management.

Medical office tenants, including physician groups, clinics, and hospital systems, are crucial to Healthpeak Properties. These entities require modern, well-located facilities to deliver patient care effectively. Healthpeak's success hinges on attracting and retaining these vital healthcare providers.

Healthpeak's medical office portfolio demonstrates impressive tenant loyalty. In 2024, the company reported a strong tenant retention rate within its medical office segment, underscoring the value proposition of its properties. This stability provides a predictable revenue stream.

Furthermore, Healthpeak actively supports the growth of its medical office tenants. The company's strategy involves developing and acquiring properties that meet the evolving needs of healthcare providers, enabling them to expand their services and patient reach. This symbiotic relationship fuels mutual growth.

Healthpeak Properties' Continuing Care Retirement Community (CCRC) segment caters to seniors desiring a complete spectrum of care, encompassing independent living, assisted living, and skilled nursing. This offering provides residents with a stable environment that can adapt to their evolving health needs, ensuring continuity and peace of mind.

The demand for these comprehensive senior living solutions is bolstered by a significant demographic trend: the aging population. In 2024, the number of Americans aged 65 and older is projected to reach over 56 million, representing a substantial and growing market for CCRC services.

Large Healthcare Systems and Networks

Healthpeak Properties actively collaborates with major healthcare organizations and integrated networks. These entities often need a diverse portfolio of properties, including medical office buildings and specialized treatment facilities, to manage their regional growth and operational needs. Northside Hospital stands out as a key, long-term partner, illustrating the depth of these relationships.

These large healthcare systems represent a significant customer segment for Healthpeak. Their demand for real estate solutions is driven by the need to expand patient access and consolidate services. For instance, in 2024, Healthpeak's portfolio included a substantial number of medical office buildings catering to these large networks.

- Extensive Facility Needs: Large healthcare systems require a broad spectrum of real estate, from primary care offices to advanced surgical centers, to serve their patient populations effectively.

- Regional Expansion Support: Healthpeak provides the critical real estate infrastructure that enables these systems to grow their footprint and reach more communities.

- Long-Term Partnerships: The company fosters enduring relationships, exemplified by its collaboration with established partners like Northside Hospital, ensuring stable revenue streams.

- Strategic Real Estate Alignment: These clients seek real estate partners whose offerings directly support their strategic goals of integrated care delivery and market penetration.

Institutional Investors and Shareholders

Healthpeak Properties, as a publicly traded Real Estate Investment Trust (REIT), also serves institutional investors and individual shareholders. These stakeholders are drawn to Healthpeak for its potential to deliver financial returns and provide access to the dynamic healthcare real estate sector. The company's core objective is to enhance shareholder value through strategic asset management and growth.

For these investors, Healthpeak's performance is closely tied to its ability to generate stable rental income and achieve capital appreciation on its portfolio. The company's commitment to maximizing shareholder value is a key driver for attracting and retaining this crucial customer segment.

- Institutional Investors: These include pension funds, mutual funds, insurance companies, and sovereign wealth funds, which often invest significant capital in REITs like Healthpeak for diversification and income generation.

- Individual Shareholders: Retail investors who buy Healthpeak's stock through brokerage accounts, seeking exposure to the healthcare real estate market and potential dividend income.

- Focus on Shareholder Value: Healthpeak is committed to increasing its funds from operations (FFO) and adjusted funds from operations (AFFO) per share, key metrics that directly impact shareholder returns.

- Market Performance: As of early 2024, Healthpeak's stock performance reflects investor confidence in its strategy and the healthcare real estate market's resilience.

Healthpeak's customer base is diverse, encompassing life science companies, medical providers, and senior living residents. These segments are united by their need for specialized, well-located real estate to facilitate their core operations and living needs. The company's strategic focus on these areas ensures a stable and growing demand for its properties.

The company also serves large healthcare systems and institutional investors. These clients are crucial for Healthpeak's growth, seeking strategic real estate solutions to expand their reach and operational efficiency. In 2024, Healthpeak continued to strengthen these relationships, recognizing their importance for long-term stability and expansion.

Healthpeak's success is built on understanding and catering to the distinct needs of each customer segment. From cutting-edge biotech firms requiring advanced lab spaces to seniors seeking comfortable and supportive living environments, Healthpeak's portfolio is designed to meet these varied demands effectively.

Cost Structure

Property operating expenses represent the direct costs Healthpeak incurs to manage and maintain its real estate portfolio. These essential expenditures include real estate taxes, property insurance premiums, utility costs, and routine maintenance and repairs. For the year 2024, Healthpeak reported total property operating expenses amounting to $2.385 billion.

Interest expense on debt represents a significant cost for Healthpeak Properties, primarily stemming from the capital borrowed to fund property acquisitions and ongoing development projects. In 2024, the company's financial reports indicated substantial interest payments, reflecting its leverage in expanding its healthcare real estate portfolio.

General and Administrative (G&A) expenses at Healthpeak Properties encompass essential corporate overhead. These costs include salaries for their administrative teams, everyday office expenditures, and other operational costs that aren't tied to specific properties.

Healthpeak has been actively working to streamline its G&A functions. A notable achievement in this area was a significant 25% increase in efficiency, realized following their merger with Physicians Realty Trust.

Development and Construction Costs

The development and construction costs are a significant component of Healthpeak Properties' business model. These expenses encompass the acquisition of land and the physical building of new healthcare facilities or the substantial renovation of existing ones. For instance, in 2024, Healthpeak reported investing $148 million in new outpatient development projects located in Atlanta, highlighting the capital-intensive nature of their growth strategy.

These costs are crucial for expanding their portfolio and meeting the evolving demands of the healthcare real estate market. Key elements driving these expenditures include:

- Land Acquisition: Securing prime locations for healthcare facilities.

- Construction Materials: The cost of building supplies like steel, concrete, and specialized medical equipment.

- Labor: Wages for construction workers, project managers, and skilled tradespeople.

Merger-Related Costs and Integration Expenses

Healthpeak Properties incurs significant merger-related costs and integration expenses following strategic acquisitions like the one with Physicians Realty Trust. These costs encompass advisory fees, legal and accounting services, IT system integration, and potential post-combination severance packages. In 2024, Healthpeak reported achieving approximately $50 million in merger-related synergies, demonstrating a focus on realizing value from these transactions.

These integration costs directly impact the company's short-term profitability but are essential for streamlining operations and achieving long-term strategic goals. The successful integration of acquired entities is crucial for Healthpeak to leverage its expanded portfolio and enhance its market position in the healthcare real estate sector.

- Advisory, Legal, and Accounting Fees: Costs associated with due diligence, transaction structuring, and regulatory compliance.

- IT Integration Expenses: Investments in merging disparate IT systems, software, and data infrastructure.

- Severance and Restructuring Costs: Expenses related to workforce adjustments and operational realignments post-merger.

- Synergy Realization: Healthpeak achieved approximately $50 million in merger-related synergies in 2024, offsetting some integration expenses.

Healthpeak's cost structure is primarily driven by property operating expenses, which totaled $2.385 billion in 2024. Significant investments are also made in development and construction, with $148 million allocated to outpatient projects in Atlanta during the same year. The company also manages interest expenses on debt and general administrative costs, which have seen a 25% efficiency increase post-merger with Physicians Realty Trust.

| Cost Category | 2024 Amount (Billions USD) | Key Components |

| Property Operating Expenses | 2.385 | Real estate taxes, insurance, utilities, maintenance |

| Development & Construction | 0.148 (for specific projects) | Land acquisition, materials, labor |

| General & Administrative (G&A) | N/A (Efficiency increased 25%) | Salaries, office expenses, operational costs |

| Merger-Related Costs | N/A (Achieved $50M synergies) | Advisory fees, legal, IT integration |

Revenue Streams

Healthpeak Properties' main way of making money comes from the rent it collects. This rent is generated from long-term agreements with various healthcare providers and organizations. These agreements cover properties in their life science, medical office, and continuing care retirement community (CCRC) sectors.

In the second quarter of 2025, Healthpeak reported total revenues of $694.3 million. A significant portion of this, $529.7 million, was directly attributed to rental and related income, highlighting its importance as the core revenue driver.

Healthpeak Properties' Continuing Care Retirement Communities (CCRCs) are a significant revenue driver, primarily through resident fees and services. These fees encompass both ongoing monthly charges and, for some communities, an initial entry fee paid by residents.

In the second quarter of 2025, these resident fees and services contributed $148.9 million to Healthpeak's overall revenue. This demonstrates the substantial financial commitment residents make for the comprehensive care and living arrangements provided by the CCRCs.

Healthpeak Properties generates significant revenue through interest income derived from originating secured loans and various investments. This strategy not only diversifies their income but also fosters strategic alliances within the healthcare real estate sector.

In the fourth quarter of 2024 and extending into January 2025, Healthpeak actively originated loans, with figures reaching approximately $126 million. This demonstrates a consistent commitment to this revenue-generating avenue.

Property Sales and Dispositions

Healthpeak Properties also generates revenue through the strategic sale of assets that are no longer considered core to its portfolio. This approach allows the company to optimize its holdings and reinvest capital into higher-growth areas. In 2024, Healthpeak successfully divested approximately $1.3 billion in non-core and less-core assets.

- Strategic Asset Dispositions: Selling off properties that no longer align with core business objectives.

- Capital Optimization: Reallocating funds from asset sales to more promising investments.

- 2024 Performance: $1.3 billion in revenue generated from non/less-core asset sales during the year.

Development and Redevelopment Project Returns

Healthpeak Properties generates significant revenue from its development and redevelopment projects. Once these properties are stabilized and fully leased, they contribute to higher property values and a steady stream of rental income, boosting the company's overall financial performance.

For instance, Healthpeak anticipates achieving cash yields in the mid-7% range on its ongoing outpatient development projects in Atlanta. This focus on strategic development is a key driver of enhanced revenue and profitability.

- Projected Cash Yields: Healthpeak expects mid-7% cash yields on Atlanta outpatient developments.

- Revenue Enhancement: Stabilized and leased projects increase property values and rental income.

- Strategic Growth: Development and redevelopment are core to expanding revenue streams.

Healthpeak Properties' revenue is primarily driven by rental income from its three key segments: life science, medical office buildings, and continuing care retirement communities (CCRCs). In the second quarter of 2025, rental and related income alone accounted for $529.7 million of its $694.3 million total revenue.

Beyond rent, Healthpeak also generates income through interest on secured loans, having originated approximately $126 million in loans by January 2025. Furthermore, strategic asset sales are a notable revenue contributor, with the company divesting about $1.3 billion in non-core assets during 2024.

CCRCs add to revenue through resident fees and services, bringing in $148.9 million in Q2 2025. Development projects are also a growing revenue source, with Healthpeak anticipating mid-7% cash yields on its Atlanta outpatient developments.

| Revenue Stream | Q2 2025 Contribution (Millions USD) | Key Activity |

|---|---|---|

| Rental & Related Income | 529.7 | Leasing properties in Life Science, MOB, and CCRC sectors |

| CCRC Resident Fees & Services | 148.9 | Fees and services from residents in retirement communities |

| Interest Income (Loan Origination) | (Data not directly available for Q2 2025, but ~$126M originated by Jan 2025) | Originating secured loans and investments |

| Asset Dispositions | (Approx. $1.3B in 2024) | Selling non-core and less-core assets |

| Development & Redevelopment | (Yields not directly revenue, but enhance future rental income) | Building and improving properties |

Business Model Canvas Data Sources

The Healthpeak Properties Business Model Canvas is constructed using comprehensive financial disclosures, extensive market research reports, and internal operational data. These sources provide a robust foundation for understanding the company's strategic positioning and financial health.