Healthpeak Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

Healthpeak Properties operates within a dynamic healthcare real estate sector, where understanding the competitive landscape is paramount. Our Porter's Five Forces analysis reveals significant pressures from buyer bargaining power and the threat of substitutes, shaping the strategic decisions within this industry.

The complete report reveals the real forces shaping Healthpeak Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of specialized construction and development suppliers for Healthpeak Properties can range from moderate to high. This is particularly true for projects requiring highly technical life science laboratories or intricate medical facilities, where specialized knowledge and equipment are paramount. These suppliers often hold unique expertise that can significantly influence project timelines and overall costs.

In 2023, the construction industry faced ongoing challenges with material costs and labor shortages, which can amplify the bargaining power of specialized subcontractors. For instance, the cost of specialized medical equipment installation, a critical component for many of Healthpeak's properties, saw significant price increases throughout the year.

Healthpeak can effectively mitigate this supplier power by fostering relationships with multiple general contractors and maintaining strong, long-term partnerships with key specialized vendors. This diversified approach allows for greater negotiation leverage and ensures a more stable supply chain for their development projects.

Suppliers of highly specialized healthcare construction materials and skilled labor, such as those needed for advanced medical facilities or cleanroom environments, can exert moderate bargaining power. This is because their offerings are niche, and demand for this expertise is specific. For instance, specialized HVAC systems for surgical suites require unique components and trained installers, giving those suppliers leverage.

However, the broader market for general construction labor and more common building materials tends to be fragmented. This means that individual suppliers of these less specialized items have less influence. Healthpeak Properties, as a major real estate investment trust in the healthcare sector, benefits from its significant scale, which allows it to negotiate better terms and prices for its procurement needs, thereby mitigating supplier power.

Technology and infrastructure providers, especially those offering proprietary smart building systems or specialized medical equipment integration, hold some bargaining power. Healthpeak's need for advanced technology to ensure operational efficiency and high-quality patient care makes these suppliers crucial partners.

For instance, companies providing integrated data management solutions for healthcare facilities often have unique software that requires significant investment to replace. This can give them leverage, particularly if their systems are deeply embedded in Healthpeak's operations. In 2024, the demand for sophisticated PropTech in the healthcare real estate sector continued to rise, increasing the importance of these technology vendors.

Utilities and Energy Suppliers

Utility and energy suppliers often wield significant bargaining power due to their monopolistic or duopolistic nature in many areas. Healthpeak Properties, like any operator of healthcare facilities, relies heavily on uninterrupted access to essential services such as electricity, water, and waste management. For instance, in 2024, the average cost of electricity for commercial customers in the US saw fluctuations, impacting operational expenses for companies like Healthpeak.

Healthpeak can strategically manage this supplier power by investing in energy efficiency upgrades across its portfolio, thereby reducing overall consumption. Furthermore, pursuing renewable energy sources, such as solar installations at its properties, can create a degree of independence from traditional utility providers. Establishing long-term energy contracts can also lock in favorable pricing and ensure supply stability, mitigating the impact of price hikes or service disruptions.

- Monopolistic Tendencies: Utility providers often operate as sole providers in specific regions, limiting competition and enhancing their leverage.

- Critical Dependency: Healthpeak's facilities require constant and reliable utility services to maintain operations and patient care.

- Mitigation Strategies: Investments in energy efficiency, on-site renewable generation, and strategic long-term contracts are key to reducing reliance and improving cost control.

Financing and Capital Providers

Financing and capital providers, while not traditional suppliers, wield significant influence over Healthpeak Properties. Their bargaining power is directly tied to macroeconomic factors like interest rates and overall market liquidity. For instance, in early 2024, the Federal Reserve's cautious approach to rate cuts meant that borrowing costs remained a key consideration for REITs, impacting their ability to secure new capital or refinance existing debt on favorable terms.

Healthpeak's robust financial health and its access to a diverse range of funding avenues are crucial in mitigating the bargaining power of these capital providers. By maintaining a strong balance sheet and cultivating relationships with various lenders and institutional investors, Healthpeak can negotiate more attractive financing terms. This strategic approach ensures access to capital at competitive rates, supporting its growth and operational stability.

The ability to secure capital efficiently is paramount for a Real Estate Investment Trust (REIT) like Healthpeak. Consider these factors influencing capital provider leverage:

- Interest Rate Environment: Rising interest rates generally increase the cost of capital, giving lenders more leverage.

- Market Liquidity: When capital is abundant, REITs have more options and can negotiate better terms.

- Investor Confidence: Strong investor sentiment towards the healthcare real estate sector reduces the bargaining power of individual capital providers.

- Healthpeak's Creditworthiness: A strong credit rating and a history of stable performance empower Healthpeak to secure more favorable financing.

Suppliers of specialized construction materials and skilled labor for healthcare facilities, such as advanced HVAC systems or cleanroom components, can exert moderate bargaining power. This is due to the niche nature of their offerings and the specific demand for their expertise. For instance, in 2024, the demand for specialized medical equipment installers remained high, giving these professionals leverage in negotiations.

Healthpeak Properties can counter this by cultivating strong, long-term relationships with a diverse pool of specialized vendors and general contractors. This diversification enhances negotiation leverage and ensures a more resilient supply chain for development projects.

Technology and infrastructure providers offering proprietary systems, like integrated data management solutions for healthcare facilities, also hold some bargaining power. Their unique software and deep integration into operations can make replacement costly, especially as demand for advanced PropTech in healthcare real estate grew in 2024.

Utility and energy providers often possess significant bargaining power due to their often monopolistic market positions. Healthpeak's reliance on consistent electricity, water, and waste management services is critical. For example, commercial electricity costs in the US saw fluctuations in 2024, directly impacting operational expenses for companies like Healthpeak.

| Supplier Type | Bargaining Power Level (2024) | Key Factors | Healthpeak Mitigation Strategies |

|---|---|---|---|

| Specialized Construction & Development Suppliers | Moderate to High | Niche expertise, critical components (e.g., medical equipment installation), material costs, labor shortages | Diversified vendor relationships, long-term partnerships |

| Technology & Infrastructure Providers | Moderate | Proprietary systems, deep integration, high switching costs, rising PropTech demand | Strategic vendor selection, exploring interoperable solutions |

| Utility & Energy Suppliers | High | Monopolistic/duopolistic markets, critical service dependency | Energy efficiency upgrades, renewable energy investments, long-term contracts |

What is included in the product

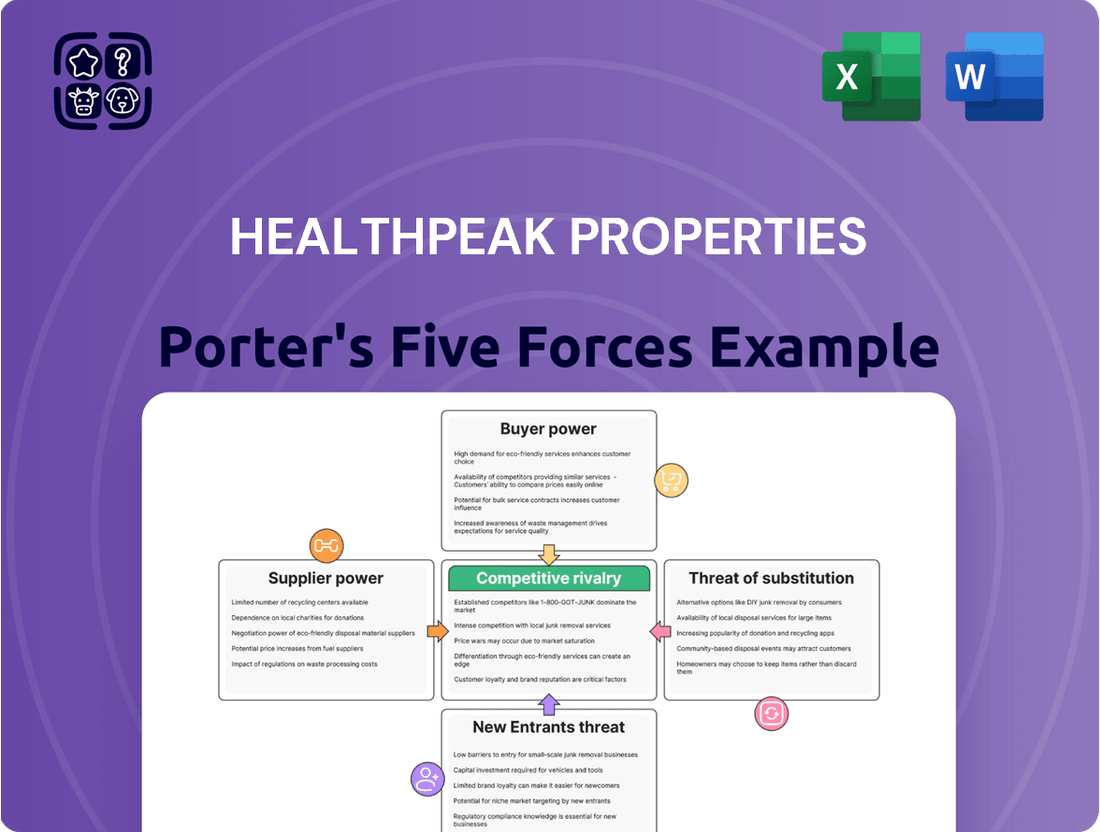

This Porter's Five Forces analysis for Healthpeak Properties dissects the competitive landscape, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare real estate sector.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying complex competitive dynamics for Healthpeak Properties.

Customers Bargaining Power

Healthpeak's customer base is anchored by substantial entities like large healthcare systems, leading research institutions, and major senior living operators. These significant tenants wield considerable bargaining power, often stemming from their sheer scale, the duration of their lease agreements, and their capacity to negotiate advantageous terms.

For instance, a large hospital network might represent a substantial portion of a Healthpeak medical office building's revenue, giving it leverage in lease negotiations. In 2023, Healthpeak reported that its top ten tenants accounted for approximately 25% of its total rental revenue, highlighting the concentration and potential influence of its larger clients.

While these large customers possess strong negotiating positions, their deep-seated relationships with Healthpeak also foster a degree of mutual reliance. This interdependence can temper the extent to which customers might exercise their bargaining power, creating a more balanced negotiation dynamic.

For tenants of Healthpeak Properties, moving a medical office, life science lab, or CCRC involves significant expenses. These can include costs for tenant improvements, relocating specialized equipment, obtaining new licenses, and the inevitable disruption to patient care or ongoing research. These substantial barriers to switching significantly diminish a tenant's bargaining power once a lease agreement is finalized, creating tenant stickiness for Healthpeak.

Healthpeak Properties' emphasis on acquiring and developing high-quality, well-located assets significantly curtails the bargaining power of its customers, primarily tenants in the healthcare and life sciences sectors. By concentrating on properties situated in supply-constrained markets, particularly those adjacent to major academic medical centers or within thriving life science hubs, Healthpeak establishes a strong negotiating position. This strategic advantage is further amplified by the specialized nature of its facilities, which are often tailored to the unique operational needs of its tenant base.

Diversified Tenant Base

Healthpeak Properties benefits from a diversified tenant base across its life science, medical office, and CCRC (Continuing Care Retirement Community) segments. This broad exposure means that while a large tenant in any single sector might wield some influence, the overall impact of any one customer's demands or potential departure is significantly lessened. For instance, as of the first quarter of 2024, Healthpeak's top ten tenants represented approximately 20% of its total rental revenue, showcasing a relatively low concentration.

This diversification is a key factor in mitigating customer bargaining power. By not being overly reliant on a few major clients, Healthpeak can maintain more stable revenue streams and pricing power. The company's strategy to spread its tenant risk across different healthcare-related industries and geographical locations enhances its operational resilience and reduces its vulnerability to the specific economic conditions or strategic shifts of any single tenant.

- Diversified Portfolio: Healthpeak operates in life science, medical office, and CCRC sectors, reducing reliance on any single market.

- Reduced Concentration Risk: A broad tenant base across these sectors limits the impact of individual tenant demands or departures.

- Enhanced Resilience: Diversification across industries and tenant types strengthens the company's ability to withstand market fluctuations.

- Mitigated Bargaining Power: The wide spread of tenants limits the leverage any single customer can exert on pricing or lease terms.

Long-Term Lease Structures

Healthpeak Properties typically structures its tenant agreements as long-term leases, often spanning 10 to 15 years or more. These extended commitments significantly reduce the bargaining power of customers by minimizing the opportunities for frequent renegotiation.

The inclusion of annual rent escalators within these leases further solidifies Healthpeak's revenue stability and limits customers' ability to demand lower rates over time. For instance, in 2023, Healthpeak reported that its weighted average lease term for its healthcare properties was approximately 9.1 years, providing a solid foundation of predictable income.

- Long-Term Leases: Typically 10-15+ years, limiting renegotiation frequency.

- Rent Escalators: Built-in annual increases provide revenue stability.

- Reduced Customer Leverage: Long commitments diminish short-term bargaining power.

- REIT Model Stability: Long-term leases are a cornerstone of predictable REIT income.

Healthpeak's customer base, composed of large healthcare systems and research institutions, holds significant bargaining power due to their scale and the potential revenue they represent. However, the substantial costs and operational disruptions associated with relocating specialized facilities, such as medical labs or patient care units, create high switching barriers for these tenants. This interdependence and the cost of moving limit how aggressively customers can leverage their power.

Healthpeak's strategic focus on high-quality, well-located properties in supply-constrained markets, particularly near academic medical centers, naturally reduces tenant bargaining power. These specialized, often custom-built facilities are difficult for tenants to replicate elsewhere, increasing their reliance on Healthpeak. For example, the company's life science portfolio is concentrated in key innovation hubs like Boston/Cambridge and San Francisco, where demand significantly outstrips supply.

The company's diversified tenant base across its life science, medical office, and CCRC segments is a key factor in mitigating customer bargaining power. As of the first quarter of 2024, Healthpeak's top ten tenants represented approximately 20% of its total rental revenue, indicating a relatively low concentration and limiting the impact of any single customer's demands. This spread across different healthcare-related industries enhances Healthpeak's resilience and pricing power.

Healthpeak's lease agreements are typically long-term, often 10 to 15 years, with built-in annual rent escalators. These terms significantly reduce customer leverage by minimizing renegotiation opportunities and ensuring predictable revenue growth. In 2023, Healthpeak's weighted average lease term for its healthcare properties was approximately 9.1 years, underscoring the stability provided by these extended commitments.

| Tenant Characteristic | Impact on Bargaining Power | Healthpeak Mitigation Strategy |

|---|---|---|

| Large Tenant Scale | High Leverage | Diversified Tenant Base, Long-Term Leases |

| High Switching Costs | Low Leverage | Specialized Facilities, Tenant Improvements |

| Concentration of Revenue | High Leverage | Geographic and Sector Diversification |

| Lease Duration | Low Leverage (for Healthpeak) | Long-Term Leases (10-15+ years), Annual Rent Escalators |

Preview the Actual Deliverable

Healthpeak Properties Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Healthpeak Properties, detailing the competitive landscape within the healthcare real estate sector. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you'll get.

Rivalry Among Competitors

The healthcare real estate sector is quite crowded, with major players like Ventas, Welltower, and Omega Healthcare Investors actively competing for the same properties and tenants. This intense rivalry means Healthpeak Properties must constantly work to acquire desirable assets and secure strong tenant relationships.

These competitors share similar operational strategies and focus on comparable market segments, intensifying the competition for acquisitions and tenant retention. For instance, in 2024, the total market capitalization of these three major healthcare REITs combined exceeded $60 billion, highlighting the scale of the competitive landscape.

To stand out, Healthpeak needs to differentiate itself by focusing on high-quality assets and forging strategic alliances. This approach is crucial for maintaining a competitive edge in an environment where direct competition is a constant factor.

Private equity and institutional investors represent a formidable competitive force in the healthcare real estate sector. These entities, including sovereign wealth funds, are increasingly drawn to the sector's predictable cash flows and the long-term demographic trends favoring healthcare demand. For instance, in 2024, major institutional investors continued to allocate substantial capital towards real estate, with healthcare properties remaining a favored sub-sector due to their resilience.

The deep pockets of these investors allow them to engage in aggressive bidding, potentially driving up acquisition prices and compressing capitalization rates for properties. This heightened competition can make it more challenging for publicly traded REITs like Healthpeak Properties to acquire attractive assets at favorable valuations, impacting their growth strategies and overall profitability.

While the market for large, institutional-grade life science and medical office buildings sees intense competition from a handful of major players, the broader healthcare real estate landscape, particularly for smaller medical office buildings and regional continuing care retirement communities (CCRCs), is more fragmented. This means Healthpeak Properties faces competition from numerous local and regional owners. For instance, in 2024, the healthcare real estate sector continued to see a mix of large institutional investors and smaller, localized entities vying for assets.

Capital and Acquisition Competition

Competition is fierce in the market for acquiring top-tier healthcare properties. This intense rivalry stems from a limited supply of premium assets and robust demand from a diverse investor base, including real estate investment trusts (REITs), private equity firms, and institutional investors. For instance, in 2024, the healthcare real estate sector continued to see significant transaction volumes, with major deals often involving multiple interested parties driving up acquisition prices.

This competitive bidding environment can compress investment yields, making it challenging for companies like Healthpeak Properties to secure attractive returns. The limited availability of high-quality, well-located healthcare facilities, such as medical office buildings and life science campuses, fuels this competition.

Healthpeak's strategic advantage lies in its ability to identify and secure off-market acquisition opportunities. Cultivating strong relationships with healthcare providers and developers allows Healthpeak to gain early access to potential deals before they enter the broader market. This proactive approach is vital for navigating the competitive landscape and sourcing value-added investments.

- High Demand, Limited Supply: The scarcity of premium healthcare properties fuels intense competition among buyers.

- Yield Compression: Competitive bidding in acquisition markets can lead to lower expected investment returns.

- Off-Market Deal Sourcing: Healthpeak's ability to find unlisted properties is a key differentiator.

- Relationship Leverage: Strong industry ties are critical for accessing proprietary deal flow.

Market Growth and Demographic Tailwinds

The healthcare real estate sector benefits from robust underlying growth, driven by increasing healthcare expenditures and an aging population. For instance, U.S. healthcare spending was projected to reach $4.7 trillion in 2024, a significant increase that signals a growing demand for healthcare facilities. This expansionary environment can temper competitive rivalry by creating a larger pie for all participants, rather than a fierce battle for existing market share.

While competition for prime, established healthcare assets certainly exists, the expanding need for new facilities and services opens avenues for development. This dynamic shifts the competitive landscape from a purely zero-sum game to one where multiple companies can pursue growth through new construction and service expansion. The growing demand means that even with several players, there is ample opportunity for each to secure a strong market position.

- Growing Demand: U.S. healthcare spending is expected to hit $4.7 trillion in 2024, indicating a strong market expansion.

- Demographic Tailwinds: An aging population fuels consistent demand for healthcare services and facilities.

- Reduced Zero-Sum Competition: Market growth allows for new development opportunities, lessening direct competition for existing assets.

- Opportunity for Multiple Players: The expanding market can support the success of several companies within the sector.

The competitive rivalry within healthcare real estate is substantial, driven by a limited supply of premium assets and robust demand. Major players like Ventas, Welltower, and Omega Healthcare Investors, with a combined market capitalization exceeding $60 billion in 2024, vie for similar properties and tenants. This intense competition, further amplified by significant capital allocation from private equity and institutional investors into the sector in 2024, compresses acquisition prices and yields, necessitating strategies like off-market deal sourcing for companies such as Healthpeak Properties to maintain an edge.

| Competitor | Approximate 2024 Market Cap (USD Billions) | Key Focus Areas |

|---|---|---|

| Ventas | ~20-25 | Senior Housing, Medical Office Buildings, Life Science |

| Welltower | ~25-30 | Senior Housing, Medical Office Buildings, Outpatient Medical |

| Omega Healthcare Investors | ~15-20 | Skilled Nursing Facilities, Assisted Living |

SSubstitutes Threaten

The increasing adoption of telehealth and remote patient monitoring presents a threat of substitutes for traditional healthcare real estate. These technologies can fulfill certain patient needs without requiring a physical visit, potentially dampening demand for some medical office space. For instance, a significant portion of routine check-ups and consultations can now be conducted virtually, a trend that accelerated in 2024 with ongoing advancements in digital health platforms.

While telehealth doesn't entirely replace the need for physical facilities, especially for complex procedures, it can moderate the growth trajectory for certain types of medical office buildings. This shift means that while Healthpeak Properties’ portfolio remains essential, the pace of new physical space demand might be tempered in segments where virtual care is a viable alternative. The market for remote monitoring devices, a key enabler of this trend, saw substantial growth in 2023 and is projected to continue expanding.

For Healthpeak Properties' Continuing Care Retirement Communities (CCRCs), substitutes such as home healthcare services, independent living communities, and family care present a significant threat. These alternatives can appeal to seniors who prefer to age in place or seek less comprehensive care models. For instance, the home healthcare market is robust, with projections indicating continued growth as technology enables more sophisticated in-home medical support.

The increasing adoption of aging-in-place technologies, allowing for remote monitoring and telehealth, directly challenges the necessity of traditional senior living facilities. This trend was evident in 2024 as more individuals explored and utilized these options, potentially impacting occupancy rates for CCRCs. While these substitutes exist, Healthpeak's CCRCs often distinguish themselves by providing integrated, higher levels of care, including skilled nursing and memory care, which are not easily replicated by home-based solutions alone.

While virtual biotech and increased outsourcing to Contract Research Organizations (CROs) present alternative R&D models, they often serve as complements rather than direct substitutes for Healthpeak's specialized lab infrastructure. Many virtual companies still require physical lab space, often leased from providers like Healthpeak, and CROs themselves are significant tenants. The inherent need for highly controlled, purpose-built environments for much of the drug discovery and development process limits the substitutability of these models for core lab functions.

Consolidation of Healthcare Systems

The consolidation of healthcare systems presents a mixed threat of substitutes for Healthpeak Properties. While some larger, integrated systems might seek to optimize their real estate by owning more facilities, reducing their reliance on leased space, this trend also often leads to larger, more stable tenant relationships. For instance, major health systems, by their nature, require significant and specialized real estate for their operations, making them less likely to be easily substituted by alternative real estate solutions.

However, the drive for efficiency within consolidated systems could lead to the divestiture of non-core real estate assets, which might then be acquired by other healthcare providers or investors. This could indirectly impact Healthpeak by increasing the supply of owned medical office buildings or senior housing facilities. For example, if a large hospital system consolidates and sells off several smaller clinics, those clinics become potential owned alternatives for other operators.

- Consolidation can lead to internal real estate optimization, potentially reducing demand for leased space.

- Large healthcare systems often prefer leasing specialized real estate to preserve capital for core operations.

- Consolidation can result in larger, more creditworthy, and stable tenants for Healthpeak.

- Divestiture of non-core assets by consolidated systems may increase the supply of owned healthcare real estate.

Government Policies and Healthcare Funding Changes

Government policies and healthcare funding changes represent a significant threat of substitutes for Healthpeak Properties. Shifts in reimbursement models, such as Medicare or Medicaid payment rates, can directly impact the profitability of healthcare providers who lease Healthpeak's properties. For instance, if a new policy reduces reimbursement for skilled nursing facilities, operators in that segment might reduce their leased space or seek more cost-effective alternatives, impacting Healthpeak's rental income from those assets.

Furthermore, changes in government funding for specific healthcare initiatives or research can indirectly influence the demand for specialized real estate. If, for example, federal funding for cancer research is significantly cut, the demand for life science lab space might decrease, affecting Healthpeak's life science segment. This creates a substitute threat as operators might delay expansion or consolidation plans if the economic environment for their services becomes less favorable due to policy changes.

Healthpeak's diversified portfolio across various healthcare property types, including medical office buildings, life science facilities, and senior housing, serves as a crucial mitigator against this threat. While changes in one sector's reimbursement or funding could impact a portion of their portfolio, the overall impact is lessened by the stability and demand in other segments. For example, as of Q1 2024, Healthpeak's senior housing operating portfolio (SHOP) demonstrated resilience, while its medical office and life science segments continued to show strong leasing activity, highlighting the benefit of diversification in navigating policy-driven market shifts.

The threat of substitutes also extends to alternative care delivery models that might be encouraged by policy. For instance, a policy favoring telehealth or home-based care could reduce the demand for traditional brick-and-mortar medical office buildings, acting as a substitute for the real estate Healthpeak provides. In 2024, the continued growth of telehealth services, supported by favorable regulatory environments in some regions, presents an ongoing consideration for the long-term demand of certain medical office footprints.

The rise of telehealth and remote patient monitoring acts as a substitute for traditional healthcare real estate, potentially reducing demand for certain medical office spaces. These digital solutions allow for virtual consultations and monitoring, a trend that saw significant acceleration and adoption throughout 2024. While not a complete replacement, they can moderate the need for physical facilities for routine care.

For Healthpeak's senior housing offerings, substitutes like home healthcare services and aging-in-place technologies pose a notable threat. These alternatives cater to seniors preferring to remain in their own homes, often enabled by advancements in remote monitoring and telehealth. The home healthcare market itself is substantial and projected for continued expansion.

The threat of substitutes for Healthpeak Properties is multifaceted, encompassing technological advancements and alternative care models. As digital health solutions mature, they offer increasingly viable alternatives to physical healthcare facilities, particularly for less complex medical needs. This shift necessitates a dynamic approach to real estate strategy within the healthcare sector.

Entrants Threaten

The healthcare real estate sector, particularly for specialized assets like life science labs and medical office buildings, demands significant upfront capital. Healthpeak Properties' extensive portfolio, built over years of strategic investment, highlights the substantial financial commitment required to enter and compete effectively in this space.

New entrants into healthcare real estate face a significant hurdle due to the specialized knowledge required. Understanding the intricate regulatory landscape, the unique needs of diverse healthcare tenants, and the complex operational demands of medical facilities presents a steep learning curve. For instance, navigating Medicare and Medicaid reimbursement policies or understanding the specific build-out requirements for outpatient surgical centers demands years of experience.

Established companies like Healthpeak Properties have cultivated deep, long-standing relationships with major healthcare operators, hospital systems, and life science companies. These relationships are not easily replicated by newcomers and are crucial for sourcing attractive investment opportunities and securing reliable tenants. In 2024, Healthpeak's portfolio included partnerships with leading health systems, demonstrating the value of these established connections in a competitive market.

The healthcare real estate sector is heavily regulated, with new entrants facing significant challenges from zoning laws and permitting processes that differ across states and property types, such as medical office buildings versus life science facilities. For instance, obtaining necessary permits for a new senior living facility can take over a year in some populous states, significantly delaying market entry.

Navigating these complex regulatory landscapes demands specialized legal and development expertise, creating a substantial barrier for companies lacking established experience. The cost of ensuring ongoing compliance with healthcare-specific regulations, like HIPAA for certain facilities, adds another layer of expense that new competitors must absorb.

Access to Prime Locations and Quality Assets

The threat of new entrants in the healthcare real estate sector, particularly for companies like Healthpeak Properties, is significantly influenced by the scarcity of prime locations and high-quality assets. Acquiring strategically positioned land or well-established, modern healthcare facilities in desirable healthcare hubs is a major hurdle for newcomers. Healthpeak, having built its portfolio over years, benefits from this exclusivity.

New players face considerable difficulty in securing comparable assets at reasonable prices. Existing operators often possess established relationships and a deeper understanding of local market dynamics, giving them an advantage in acquisition. This intense competition for limited, premium real estate makes market entry challenging.

- Limited Availability: Prime healthcare real estate in key markets is a finite resource, making it hard for new entrants to find suitable acquisition opportunities.

- High Acquisition Costs: The competition for desirable assets drives up prices, increasing the capital required for new entrants to establish a competitive footprint.

- Established Portfolios: Companies like Healthpeak already own a substantial number of high-quality, well-located properties, creating a significant barrier to entry for those starting from scratch.

- Market Knowledge Advantage: Existing players leverage their long-standing presence and local market expertise to identify and secure the best opportunities, a knowledge base new entrants lack.

Economies of Scale and Operational Efficiency

Established real estate investment trusts (REITs) like Healthpeak Properties leverage significant economies of scale. This allows them to achieve greater operational efficiency in property management, access more favorable financing terms, and diversify their portfolios effectively, which reduces risk.

These efficiencies translate into lower per-unit operating costs, enabling Healthpeak to offer competitive lease rates and maintain strong profit margins. For instance, in 2024, large-cap REITs often had lower borrowing costs compared to smaller, newer entities.

New entrants would struggle to match these cost advantages. Without an established, large-scale infrastructure, they would likely incur higher initial capital expenditures and ongoing operational expenses, hindering their ability to compete on price or service quality.

Healthpeak's existing infrastructure, including its management teams and established relationships with vendors and lenders, acts as a substantial barrier to entry, making it difficult for newcomers to gain a foothold.

- Economies of Scale: Healthpeak benefits from reduced per-unit costs in management and operations due to its size.

- Financing Advantage: Larger REITs typically secure lower interest rates on debt, improving profitability.

- Operational Efficiency: Established systems and processes contribute to cost savings and better service delivery.

- Competitive Pricing: Scale allows for more aggressive lease terms, deterring new market participants.

The threat of new entrants for Healthpeak Properties is considerably low due to the immense capital required to acquire and develop specialized healthcare real estate. High upfront costs for life science labs and medical office buildings, coupled with long development cycles, act as a significant deterrent. For example, constructing a state-of-the-art medical facility can easily run into tens or hundreds of millions of dollars, a figure many new players cannot readily access.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant upfront investment needed for property acquisition and development in specialized healthcare sectors. | Very High - Discourages new players due to substantial financial commitment. |

| Regulatory Complexity | Navigating healthcare-specific zoning, permitting, and compliance (e.g., HIPAA) is intricate and time-consuming. | High - Requires specialized legal and development expertise, increasing costs and delays. |

| Tenant Relationships | Established, long-term partnerships with major healthcare operators and life science companies are crucial for tenanting. | High - New entrants struggle to replicate these deep relationships vital for securing reliable income streams. |

| Asset Scarcity | Limited availability of prime, high-quality healthcare assets in desirable locations. | High - Competition for existing premium properties drives up acquisition costs for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Healthpeak Properties is built upon a foundation of comprehensive data, including Healthpeak's annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and CBRE.

We also incorporate insights from financial news outlets, analyst reports, and macroeconomic data to provide a robust understanding of the competitive landscape, supplier power, and buyer dynamics within the healthcare real estate sector.