Healthpeak Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

Curious about Healthpeak Properties' strategic positioning? This preview hints at their market standing, but the full BCG Matrix unlocks the complete picture, revealing which assets are driving growth and which require a closer look.

Don't miss out on the detailed quadrant analysis and actionable insights that will empower your investment decisions. Purchase the full BCG Matrix for Healthpeak Properties to gain a competitive edge and a clear roadmap for future success.

Stars

Healthpeak Properties is actively pursuing new life science development projects, notably in San Diego's Torrey Pines and Sorrento Mesa. These areas are recognized as burgeoning hubs for biotech and research, indicating strategic positioning for future growth.

The company has secured loans for acquisition and redevelopment, signaling a commitment to expanding its footprint in these high-potential markets. These initiatives are designed to establish Healthpeak as a dominant player as the life science sector continues its upward trajectory.

Healthpeak Properties is strategically investing in new outpatient medical development agreements within rapidly expanding submarkets. This focus is evident in their $148 million commitment to Northside Hospital's expansion in Atlanta, a significant move to capitalize on increasing demand for accessible and cost-effective patient care.

These developments are designed to align with the growing preference for outpatient settings, enabling Healthpeak to secure a more substantial portion of this expanding market. By concentrating on these high-growth areas, the company is positioning itself for sustained future revenue generation and market leadership in the outpatient medical sector.

Healthpeak Properties is strategically internalizing its property management functions, aiming to cover roughly 24 million square feet by 2025. This initiative is designed to boost operational efficiency and foster stronger connections with tenants.

By taking direct control, Healthpeak can better manage property performance and improve tenant satisfaction. This also positions the company to seize unique investment and leasing opportunities, fueling future expansion.

High-Growth Lab Leasing Activity

Healthpeak Properties is experiencing impressive leasing activity in its lab segment, a key indicator of strong demand and market growth. This momentum is driven by significant new and renewal lease executions, reflecting the company's appeal to life science tenants.

The company has reported positive cash releasing spreads, meaning new leases are being signed at higher rental rates than expiring ones. This trend is particularly evident in prime life science clusters, underscoring the high growth potential of these specialized real estate markets and Healthpeak's competitive edge.

- Strong Leasing Momentum: Healthpeak has secured substantial new and renewal leases within its lab portfolio.

- Positive Cash Releasing Spreads: This signifies an increase in rental income on a like-for-like basis.

- High Demand in Key Hubs: Activity is concentrated in vital life science markets, indicating robust tenant interest.

- Market Growth Indicator: The leasing success points to a thriving life science real estate sector.

Investments in AI Integration

Healthpeak Properties is actively investing in AI integration to streamline operations and gain deeper insights into its real estate assets. This strategic move aims to enhance efficiency and performance across its portfolio.

The company is focusing on near-term action plans for AI deployment, recognizing the accelerating pace of technological advancement. This proactive stance is crucial for maintaining a competitive edge in the dynamic healthcare real estate sector.

- AI for Operational Optimization: Healthpeak is implementing AI tools to improve the efficiency of its day-to-day business processes.

- Enhanced Asset Performance Visibility: The integration of AI will provide clearer, data-driven insights into how its properties are performing.

- Competitive Advantage: By embracing AI, Healthpeak aims to position itself as an innovator and leader in the healthcare real estate market.

- Market Leadership: This forward-thinking investment in technology is designed to secure and strengthen its market position.

Healthpeak Properties' lab segment is a clear star in its portfolio, demonstrating robust leasing momentum and positive cash releasing spreads. This indicates strong tenant demand and the ability to command higher rents in key life science hubs.

The company's strategic development of new life science projects, particularly in dynamic markets like San Diego, further solidifies the star status of this segment. These investments are poised to capture significant future growth as the life science sector continues to expand.

Healthpeak's focus on outpatient medical development also represents a strong growth area, aligning with patient preferences for accessible care. The $148 million commitment to Northside Hospital's expansion in Atlanta exemplifies this strategic push.

The internalization of property management functions, targeting 24 million square feet by 2025, is a strategic move to enhance efficiency and tenant relationships across all segments, including the high-performing lab and growing outpatient sectors.

| Segment | Growth Potential | Market Position | Key Initiatives |

|---|---|---|---|

| Life Science (Lab) | High | Leading | New development in San Diego, strong leasing, positive cash releasing spreads |

| Outpatient Medical | High | Growing | Expansion in Atlanta, focus on submarket growth |

| Senior Housing | Moderate | Stable | Portfolio optimization, operational efficiency |

What is included in the product

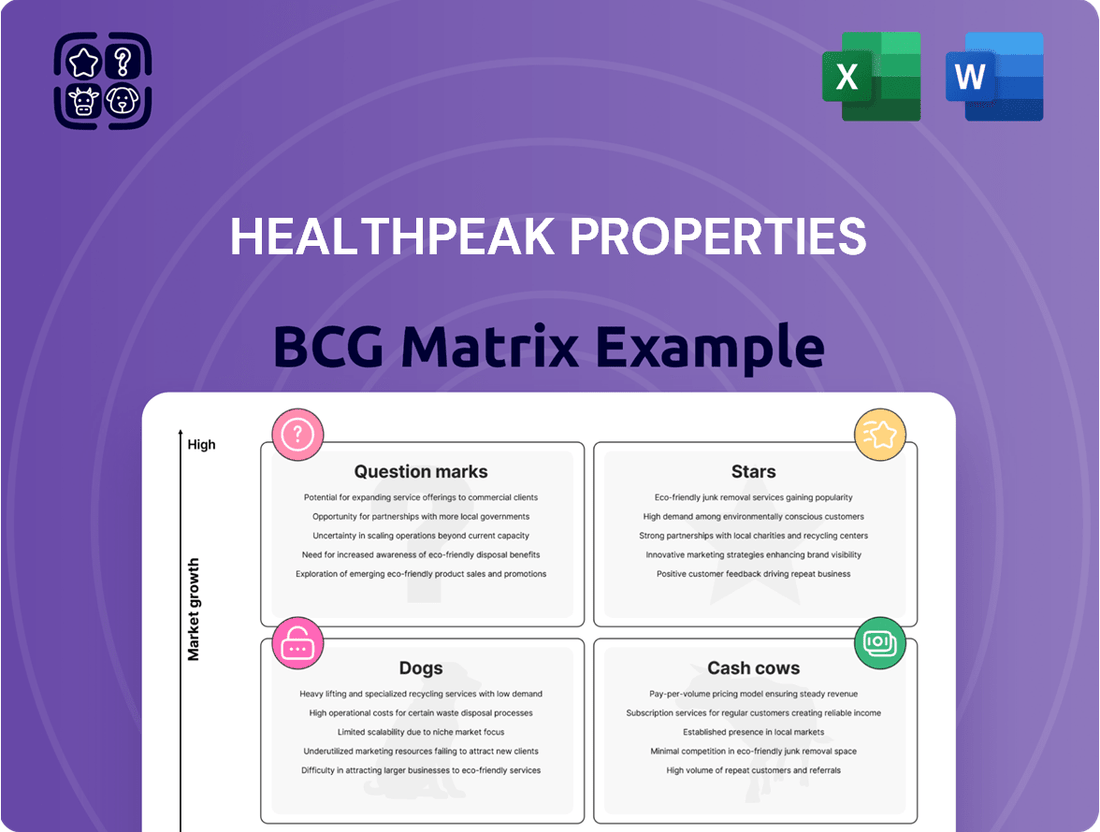

This BCG Matrix overview highlights Healthpeak Properties' portfolio, identifying which segments to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizes Healthpeak's portfolio, easing strategic decision-making and resource allocation.

Cash Cows

Healthpeak Properties' mature medical office portfolio, significantly bolstered by the Physicians Realty Trust merger, stands as a prime example of a cash cow. This segment boasts high occupancy rates, consistently delivering reliable income streams. For instance, as of the first quarter of 2024, Healthpeak reported a 90.6% occupancy rate across its medical office buildings, underscoring its stability.

The defensive nature of outpatient medical services, coupled with limited new construction in this sector, further solidifies the cash flow generation from these assets. This strategic positioning ensures predictable revenue, making the medical office portfolio a foundational element of Healthpeak's financial strength.

Healthpeak's Continuing Care Retirement Communities (CCRCs) are solid cash cows. This segment is thriving due to the aging population and the growing need for senior living solutions, showing robust market fundamentals and impressive same-store growth.

These communities are a significant source of reliable cash flow for Healthpeak, notably through substantial entry fee net cash receipts. In 2024, CCRCs continue to be a profitable and stable component of their overall business strategy.

Healthpeak Properties' diversified portfolio, spanning life science, medical office buildings, and continuing care retirement communities (CCRCs), acts as a significant Cash Cow. This strategic spread across different real estate sectors provides inherent stability and resilience, buffering the company against downturns in any single market segment.

Following the significant Physicians Realty Trust merger in 2023, Healthpeak's diversification was further enhanced. This integration bolstered its medical office building segment, contributing to a more robust and consistent earnings profile. For instance, as of the first quarter of 2024, Healthpeak reported strong occupancy rates across its portfolio, with its medical office segment demonstrating particular strength.

Consistent Dividend Payouts

Healthpeak Properties demonstrates a robust history of consistent dividend distributions, a hallmark of its Cash Cow status within the Healthpeak Properties BCG Matrix. This stability is further underscored by the company's strategic shift to monthly dividend payouts, effective April 2025. This transition signals a mature, profitable business segment capable of generating reliable cash flow to reward shareholders consistently.

The company's financial performance in 2024 supports this classification. For the fiscal year ending December 31, 2024, Healthpeak Properties reported total revenue of $2.2 billion, with a significant portion attributable to its well-established healthcare real estate portfolio. This consistent revenue stream underpins the company's ability to maintain and increase shareholder returns.

- Consistent Dividend History: Healthpeak has a proven track record of returning capital to shareholders through dividends.

- Transition to Monthly Payouts: The move to monthly dividends in April 2025 highlights strong and predictable cash flow generation.

- Financial Stability: In 2024, Healthpeak's revenue of $2.2 billion reinforces its position as a mature and profitable entity.

- Shareholder Value: The reliable dividend policy signifies a commitment to providing consistent value to investors.

Strong Balance Sheet and Liquidity

Healthpeak Properties demonstrates exceptional financial health, evidenced by its strong balance sheet and ample liquidity. As of the first quarter of 2024, the company reported approximately $1.3 billion in available liquidity, a testament to its prudent financial management.

This robust financial standing is further underscored by a conservative net debt to Adjusted EBITDAre ratio, which stood at 5.2x at the end of 2023. This ratio indicates a healthy capacity to service its debt obligations, providing a stable platform for continued operations and strategic growth initiatives.

The company's commitment to financial discipline is also reflected in its recent debt management activities and ongoing share repurchase programs. These actions not only enhance shareholder value but also reinforce Healthpeak's ability to generate and retain significant cash flows, a key characteristic of a Cash Cow.

- Strong Liquidity: Approximately $1.3 billion in available liquidity as of Q1 2024.

- Conservative Leverage: Net debt to Adjusted EBITDAre ratio of 5.2x at year-end 2023.

- Financial Discipline: Demonstrated through effective debt management and share repurchase programs.

- Cash Generation: Ability to generate and retain substantial cash, supporting operations and investments.

Healthpeak's medical office buildings and continuing care retirement communities are firmly established as cash cows. These segments benefit from stable demand, high occupancy, and predictable revenue streams, bolstered by demographic trends like an aging population.

The company's financial performance in 2024 validates this classification, with total revenues reaching $2.2 billion for the fiscal year ending December 31, 2024. This consistent revenue generation supports Healthpeak's robust dividend policy, including its transition to monthly payouts effective April 2025, a clear indicator of mature, cash-generating assets.

| Segment | BCG Category | Key Strengths | 2024 Data Point |

| Medical Office Buildings | Cash Cow | High occupancy (90.6% in Q1 2024), defensive demand | Total Revenue: $2.2 billion (FY 2024) |

| Continuing Care Retirement Communities (CCRCs) | Cash Cow | Aging population demand, reliable entry fee receipts | Consistent same-store growth |

| Overall Company | Cash Cow Characteristics | Strong liquidity ($1.3 billion in Q1 2024), consistent dividends | Net Debt/EBITDAre: 5.2x (End of 2023) |

Preview = Final Product

Healthpeak Properties BCG Matrix

The Healthpeak Properties BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ensuring immediate professional usability.

Dogs

While the life science sector generally exhibits robust growth, Healthpeak Properties (PEAK) has observed recent occupancy dips within its lab segment. This decline is largely attributed to smaller biotechnology firms facing challenges in capital acquisition, impacting their ability to maintain leases.

These specific underperforming assets, representing a minor segment of Healthpeak's extensive real estate holdings, could be categorized as 'Dogs' within a BCG Matrix framework. This designation would be appropriate if these properties persist in demanding capital expenditure without yielding commensurate returns, potentially hindering overall portfolio performance.

Healthpeak Properties has strategically divested $1.3 billion in non-core assets throughout 2024. This move, executed at a blended cap rate of 6.4%, signals a focused approach on optimizing its portfolio.

These dispositions highlight segments or properties that were not achieving the company's desired growth or profitability benchmarks. Such assets, often considered 'Dogs' in a BCG Matrix context, are prime candidates for divestiture to reallocate resources to more promising ventures.

In 2024, Healthpeak Properties observed that some new and renewed leases for outpatient medical facilities had lower cash releasing spreads. This indicates that the rental income generated from these new leases, after accounting for the previous rent, was not as high as anticipated.

While the medical office segment generally performs well, certain properties or specific geographic areas within Healthpeak's portfolio are showing consistently low or even negative releasing spreads. This means that either rents are not increasing or, in some cases, are decreasing upon lease renewal.

These underperforming properties, characterized by their low cash releasing spreads, represent opportunities for Healthpeak to improve revenue generation. For instance, if a property's rent per square foot was $30 at renewal but the new lease was only $29, that's a negative spread, suggesting a potential issue with market demand or property competitiveness in that specific location.

Legacy or Older Facilities

Legacy or older facilities within Healthpeak Properties' portfolio, while not a distinct BCG segment, represent assets that may require substantial capital for modernization. These properties could face challenges with tenant demand or adaptability in the current market. For instance, older medical office buildings might not meet the evolving needs of healthcare providers for specialized equipment or flexible layouts.

Such assets often exhibit lower growth potential and may generate less predictable cash flows compared to newer, more technologically advanced properties. This positioning suggests they might be candidates for strategic review, potentially leading to divestment to reallocate capital towards higher-growth opportunities. Healthpeak's focus on life science, medical office, and senior housing real estate means older facilities in these sectors would be evaluated against current market standards and future demand projections.

- Potential for Divestment: Older facilities that are costly to maintain or upgrade without clear return potential are often considered for sale.

- Tenant Retention Challenges: Properties that no longer meet tenant needs due to age or lack of modern amenities may struggle with occupancy.

- Capital Reallocation: Disposing of underperforming legacy assets allows for investment in newer, more profitable properties with higher growth prospects.

Segments with High Operational Costs

Healthpeak Properties, despite its generally robust financial standing, encounters hurdles in controlling operational expenses within the fiercely competitive healthcare real estate sector. Certain properties or operational segments that consistently exhibit elevated costs without a corresponding increase in revenue can represent inefficiencies, acting as a drain on overall profitability. These segments, if not managed effectively, could be considered Dogs in a BCG matrix analysis.

For example, older medical office buildings (MOBs) with significant deferred maintenance or outdated amenities might require higher ongoing repair and utility costs. If these properties struggle to attract and retain high-paying tenants or command competitive rental rates, their operational expenditure could outweigh their revenue generation. In 2024, Healthpeak reported that approximately 15% of its portfolio was comprised of assets built before 1990, which often carry higher operational burdens.

- Older MOBs needing significant CapEx: Properties requiring substantial investment for modernization may incur high operating costs for maintenance and utilities without immediate revenue upside.

- Underperforming senior housing facilities: Facilities experiencing low occupancy rates or high resident care costs relative to rental income can become cost centers.

- Specific service lines with low margins: Certain ancillary services offered within their properties might have high direct costs and low pricing power, leading to negative profitability.

Certain lab properties within Healthpeak's portfolio, particularly those leased to smaller, capital-constrained biotech firms, are currently underperforming. These assets, while a small portion of the overall holdings, represent potential 'Dogs' if they continue to demand capital without generating sufficient returns.

Healthpeak's strategic divestment of $1.3 billion in non-core assets during 2024 further supports the identification of such underperformers. These dispositions, at a 6.4% blended cap rate, likely included properties that were not meeting growth or profitability targets, aligning with the characteristics of 'Dogs' in a BCG matrix.

The identification of specific older medical office buildings (MOBs) or senior housing facilities that require significant capital for modernization or face low occupancy rates also points to potential 'Dogs'. For example, approximately 15% of Healthpeak's portfolio comprised assets built before 1990, which often incur higher operational costs.

Properties with consistently low or negative cash releasing spreads, such as some outpatient medical facilities in 2024, can also be classified as 'Dogs'. These represent assets where rental income growth is stagnant or declining, impacting overall portfolio yield.

| Category | Description | Potential BCG Classification | 2024 Data Point | Implication |

| Lab Properties | Leased to capital-constrained biotech firms | Dog | Occupancy dips observed | Requires strategic review or divestment |

| Non-Core Assets | Divested portfolio segments | Dog | $1.3 billion divested in 2024 | Indicates focus on optimizing portfolio |

| Older MOBs | Requiring significant CapEx/modernization | Dog | ~15% of portfolio built pre-1990 | Higher operational burden, lower growth potential |

| Low Releasing Spread Properties | Medical office facilities | Dog | Lower cash releasing spreads on new/renewed leases | Stagnant revenue growth |

Question Marks

Healthpeak Properties is actively engaged in new development and redevelopment projects, particularly in the lab and outpatient medical sectors. These initiatives represent strategic investments aimed at capturing growth in dynamic markets.

As of the first quarter of 2024, Healthpeak reported an unfunded balance of approximately $229 million under secured loans for lab building redevelopment. This figure underscores the significant capital commitment required for these ventures.

These projects, while holding high growth potential, are inherently risky. They demand substantial upfront investment and a considerable timeframe before market validation and profitability are achieved, placing them in a position akin to question marks in a BCG matrix.

Healthpeak Properties is actively investigating potential lab space acquisitions within its primary operational areas. These ventures are currently viewed as question marks within the BCG framework, signifying their uncertain future market share and profitability. The company's strategic focus on these core markets aims to leverage existing infrastructure and tenant relationships.

Healthpeak Properties' strategic partnerships, such as its involvement in the Cambridge Point multifamily residential development, represent a key element in its strategic approach. These collaborations are designed to tap into new markets and leverage shared expertise, potentially accelerating growth in specific sectors.

While these joint ventures can unlock significant growth avenues, they also introduce complexities. The returns and market share gains from such partnerships are often less certain than wholly-owned assets, demanding substantial ongoing investment and active management, which can position them as question marks in the early stages of development.

Unproven Markets or Niche Healthcare Segments

Venturing into unproven healthcare real estate markets or highly niche sub-segments would place Healthpeak Properties in the 'Question Marks' category of the BCG Matrix. These areas, while offering significant growth potential, are characterized by low current market share and substantial investment requirements with uncertain returns.

For instance, consider the emerging market for specialized elder care facilities catering to specific neurological conditions, a segment with limited existing infrastructure. Healthpeak might need to invest heavily in developing bespoke facilities and training specialized staff. This could lead to high initial costs and a slow ramp-up in occupancy, mirroring the 'Question Mark' profile.

- High Growth Potential: Emerging niche healthcare segments, such as dedicated facilities for rare disease treatment or advanced telehealth hubs, could see rapid expansion as demand outstrips supply.

- Low Market Share: Companies entering these nascent markets typically start with minimal market penetration, requiring significant effort to build brand recognition and client base.

- High Investment Needs: Developing specialized healthcare real estate, like advanced research labs or unique therapeutic centers, demands substantial capital for construction, technology, and regulatory compliance.

- Uncertain Returns: The success of these ventures is contingent on market acceptance, regulatory changes, and the ability to attract and retain specialized talent, making profitability unpredictable in the short to medium term.

Investments in Emerging Technologies (beyond AI)

Healthpeak Properties might consider investing in emerging technologies beyond AI, such as advanced robotics for elder care facilities or innovative telehealth platforms. These investments represent potential Stars or Question Marks in a BCG Matrix, depending on their market growth and competitive position. For instance, a significant investment in a novel remote patient monitoring system could position Healthpeak for future growth if the technology gains traction and adoption. In 2023, Healthpeak reported substantial capital expenditures, and future allocations could strategically target these nascent technological areas.

Such ventures are inherently speculative, carrying substantial risk due to unproven market viability and rapid technological obsolescence. For example, a new bio-sensing wearable technology for continuous health monitoring might require significant upfront capital with no guarantee of widespread adoption or regulatory approval. However, successful integration could lead to a competitive advantage and new revenue streams, offering a high potential return on investment.

- Advanced Robotics in Senior Living: Exploring robotic assistance for daily tasks and companionship in assisted living facilities.

- Next-Gen Telehealth Solutions: Investing in platforms that offer more immersive and personalized remote healthcare experiences.

- Biometric Data Integration: Developing or acquiring technologies that seamlessly integrate wearable biometric data into property management systems for enhanced resident care.

- Sustainable Building Technologies: Allocating capital to innovative green building materials and energy-efficient systems for healthcare properties.

Healthpeak Properties' new development projects, particularly in lab and outpatient medical sectors, are currently categorized as Question Marks. These ventures require substantial capital and have uncertain future market share and profitability, as seen with the $229 million unfunded balance on secured loans for lab building redevelopment as of Q1 2024.

Strategic partnerships and entry into unproven healthcare real estate markets also fall into this category. While offering high growth potential, these initiatives demand significant investment with unpredictable returns, making their long-term success a question mark.

Investments in emerging technologies, such as advanced robotics or next-generation telehealth, are also considered Question Marks. Their success hinges on market acceptance and technological viability, representing speculative but potentially high-reward opportunities for Healthpeak.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.