Healthpeak Properties Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

Healthpeak Properties strategically leverages its diverse portfolio of healthcare real estate, focusing on life science, medical office, and senior housing. Their pricing reflects premium locations and specialized facilities, while their distribution channels prioritize long-term leases with reputable healthcare providers. To truly grasp how these elements converge to drive their market dominance, delve into the complete 4Ps analysis.

Unlock a comprehensive understanding of Healthpeak Properties' marketing engine. This full analysis dissects their product offerings, pricing strategies, distribution networks, and promotional activities, providing actionable insights for your own business planning or academic research. Get the complete, editable report today!

Product

Healthpeak Properties' product, its high-quality healthcare real estate portfolio, is central to its marketing mix. This portfolio encompasses specialized assets like life science lab campuses, modern medical office buildings (MOBs), and continuing care retirement communities (CCRCs). In 2024, Healthpeak continued to focus on these growth sectors, aiming to align its real estate with the dynamic needs of healthcare providers and life science innovators.

Healthpeak Properties' product offering is strategically diversified across life science, medical office, and continuing care retirement communities (CCRCs). This multi-pronged approach, a key element of their marketing mix, mitigates risk by not over-relying on any single healthcare segment.

This diversification allows Healthpeak to capture growth opportunities driven by distinct market forces. For instance, the life science sector benefits from increased R&D spending, while medical office buildings are bolstered by an aging population and demand for outpatient services.

As of the first quarter of 2024, Healthpeak reported that its portfolio was approximately 44% life science, 35% medical office, and 21% CCRCs, showcasing a balanced distribution designed to weather varied economic conditions and capitalize on the evolving healthcare landscape.

Healthpeak Properties actively cultivates strategic partnerships with premier healthcare operators and renowned institutions. These collaborations are crucial, as Healthpeak provides the foundational facilities necessary for advancing medical research, delivering critical patient care, and supporting senior living communities. This focus on essential services underscores their commitment to the healthcare ecosystem.

A core element of Healthpeak's strategy involves an unwavering dedication to tenant satisfaction through superior property management. By prioritizing high-quality services, the company fosters strong tenant relationships, encouraging both retention and expansion opportunities. This tenant-centric approach directly translates into higher occupancy rates and, consequently, enhanced property valuations, demonstrating a clear link between service and financial performance.

Development and Redevelopment Capabilities

Healthpeak Properties actively pursues development and redevelopment to grow its portfolio and boost asset worth. This strategy involves significant investments in new outpatient medical buildings and advanced lab facilities, frequently collaborating with top healthcare providers. This ensures a steady supply of contemporary, sought-after properties.

For instance, in the first quarter of 2024, Healthpeak reported approximately $1.4 billion in development and redevelopment projects underway. These projects are strategically located in high-growth markets, focusing on life science and medical office buildings. This proactive approach solidifies their market position and anticipates future healthcare demands.

- Strategic Expansion: Healthpeak’s development pipeline focuses on expanding its footprint in key life science and medical office markets.

- Partnerships: Collaborations with leading healthcare systems are crucial for identifying and executing high-demand projects.

- Asset Enhancement: Redevelopment efforts aim to modernize existing properties, increasing their value and tenant appeal.

- Future-Proofing: Investments in new facilities ensure Healthpeak remains at the forefront of evolving healthcare infrastructure needs.

Focus on Essential Healthcare Infrastructure

Healthpeak Properties' product is the essential physical foundation for healthcare, encompassing life science labs, medical office buildings, and senior housing. These facilities are critical for both medical innovation and patient care delivery. The company's focus on this infrastructure places it in a sector with enduring demand, bolstered by demographic shifts.

The aging global population is a significant driver for Healthpeak's product. By 2030, it's projected that 1 in 6 people worldwide will be 65 or older, increasing the need for healthcare services and the infrastructure to support them. This trend underpins the resilience of Healthpeak's portfolio.

Healthpeak's commitment to essential healthcare infrastructure is evident in its strategic investments. For instance, in the first quarter of 2024, the company reported approximately $2.7 billion in total investments and development, with a significant portion allocated to its life science and medical office segments.

- Life Science Facilities: Enabling groundbreaking medical research and development.

- Medical Office Buildings: Providing accessible locations for outpatient care.

- Senior Housing: Catering to the growing needs of an aging demographic.

- Strategic Location: Properties are often situated in key innovation hubs and population centers.

Healthpeak Properties' product is its specialized healthcare real estate portfolio, a critical component of its marketing mix. This portfolio is strategically divided into life science campuses, medical office buildings (MOBs), and continuing care retirement communities (CCRCs), catering to essential healthcare needs. The company's focus on these sectors ensures alignment with evolving healthcare demands and demographic trends.

| Portfolio Segment | Q1 2024 Allocation | Key Drivers |

|---|---|---|

| Life Science | ~44% | Increased R&D spending, innovation hubs |

| Medical Office | ~35% | Aging population, outpatient care demand |

| CCRCs | ~21% | Growing senior demographic, demand for senior living |

What is included in the product

This analysis provides a comprehensive breakdown of Healthpeak Properties' marketing mix, detailing their strategic approach to Product, Price, Place, and Promotion within the healthcare real estate sector.

Provides a clear, concise overview of Healthpeak Properties' 4Ps marketing strategy, simplifying complex analysis for quick leadership comprehension.

Streamlines understanding of Healthpeak's marketing approach, acting as a vital tool for rapid decision-making and stakeholder alignment.

Place

Healthpeak Properties focuses its real estate portfolio in key growth markets, often clustering properties near major healthcare systems and research institutions. This geographic concentration, particularly in areas like Boston, San Francisco, and San Diego, facilitates collaboration and accessibility for its life science and medical office tenants. For instance, as of Q1 2024, Healthpeak reported a significant portion of its rental income derived from these prime metropolitan areas, underscoring the strategic advantage of this approach.

Healthpeak Properties largely utilizes a direct ownership model, which gives them significant sway over how their properties are managed and how they interact with their tenants. This hands-on approach is a cornerstone of their strategy.

In recent years, Healthpeak has been actively bringing property management functions in-house. This internalization aims to streamline operations and elevate the quality of customer service they provide across their diverse real estate holdings.

For instance, by the end of 2024, Healthpeak anticipates having internalized the management of a substantial portion of its portfolio, aiming for over 90% of its properties to be managed directly. This move is projected to improve operational margins by an estimated 50 basis points annually.

Healthpeak's strategic positioning within healthcare ecosystems is a significant advantage. Many of its medical office buildings and life science facilities are situated adjacent to or within close proximity to leading hospitals and renowned research universities. For instance, as of early 2024, Healthpeak's portfolio includes a substantial number of properties directly connected to major health systems, facilitating seamless patient flow and encouraging collaborative research initiatives.

Accessibility and Convenience for Patients

Healthpeak Properties excels in placing its outpatient medical buildings in highly accessible and convenient locations for patients. This strategic 'place' element is crucial, especially as healthcare increasingly shifts towards outpatient settings. By situating facilities near residential areas, Healthpeak ensures patients have easy access to cost-effective care options.

This approach directly supports the growing demand for outpatient services, making healthcare more manageable for individuals. Healthpeak's portfolio, as of early 2024, includes a significant number of medical office buildings (MOBs) in prime urban and suburban markets, facilitating patient convenience.

- Strategic Locationing: Healthpeak's portfolio prioritizes proximity to patient populations and major transportation routes.

- Outpatient Focus: The company's 'place' strategy is tailored to the rise of outpatient care, emphasizing accessibility for routine and specialized treatments.

- Market Penetration: As of Q1 2024, Healthpeak operated over 600 healthcare properties, many of which are strategically located outpatient medical buildings designed for patient convenience.

Diversified Distribution Channels for Space

Healthpeak Properties, while fundamentally a real estate owner, strategically distributes its physical 'place' through diverse channels. This involves direct leasing of its medical office buildings, life science labs, and senior housing facilities to a variety of healthcare and life sciences organizations. For instance, in 2024, Healthpeak continued to focus on securing long-term leases with leading healthcare systems and innovative biotech companies, ensuring stable occupancy and revenue streams.

Beyond direct leasing, Healthpeak actively pursues build-to-suit projects tailored to specific tenant needs, allowing for customized space solutions that attract high-value clients. Furthermore, the company utilizes strategic development loans to expand its presence in key growth markets, effectively increasing its distribution reach and capitalizing on demand for specialized healthcare real estate. This multi-pronged approach ensures efficient deployment of its real estate assets.

- Direct Leasing: Securing tenants like major hospital networks and emerging biotech firms for its existing portfolio.

- Build-to-Suit: Developing custom facilities for specific tenant requirements, enhancing asset value and tenant retention.

- Strategic Development Loans: Funding new construction and expansion projects in high-demand geographic areas to broaden market access.

Healthpeak Properties' 'Place' strategy centers on strategic geographic concentration within key growth markets, particularly those with strong healthcare and life science ecosystems. As of Q1 2024, a substantial portion of its rental income originated from prime metropolitan areas like Boston, San Francisco, and San Diego. This focus on accessibility and proximity to major healthcare systems and research institutions facilitates collaboration and enhances value for its tenants.

The company's placement of outpatient medical buildings prioritizes patient convenience and accessibility, aligning with the shift towards outpatient care. By situating facilities near residential areas and major transportation routes, Healthpeak ensures patients have easy access to cost-effective healthcare options. As of early 2024, Healthpeak's portfolio includes numerous medical office buildings in prime urban and suburban locations, underscoring this commitment to patient convenience.

Healthpeak utilizes a multi-channel distribution approach for its real estate assets, primarily through direct leasing of its medical office buildings, life science labs, and senior housing facilities. In 2024, the company continued to secure long-term leases with leading healthcare systems and biotech firms. Additionally, Healthpeak engages in build-to-suit projects and strategic development loans to expand its reach in high-demand markets, offering tailored space solutions and capitalizing on growth opportunities.

| Key Market Focus Areas (as of Q1 2024) | Property Type Focus | Distribution Channels |

|---|---|---|

| Boston | Life Science Labs | Direct Leasing |

| San Francisco | Medical Office Buildings (MOBs) | Build-to-Suit Projects |

| San Diego | Senior Housing Facilities | Strategic Development Loans |

Preview the Actual Deliverable

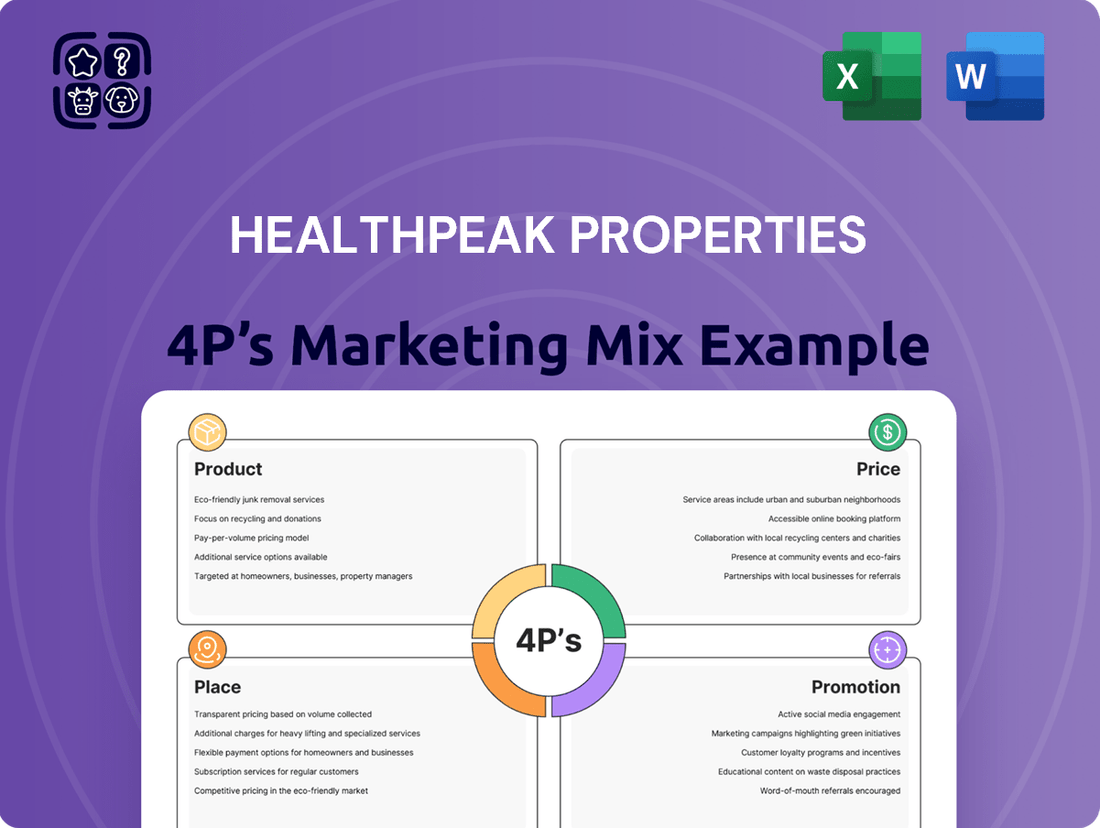

Healthpeak Properties 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Healthpeak Properties 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, providing a comprehensive understanding of their strategy.

Promotion

Healthpeak Properties prioritizes investor relations and financial reporting to foster transparency and trust. The company conducts regular earnings calls, such as the one held on February 8, 2024, to discuss Q4 and full-year 2023 results, providing key performance indicators and outlooks.

Detailed financial reports, including their latest SEC filings, offer in-depth insights into their portfolio performance and strategic initiatives. For instance, their Q1 2024 earnings release on May 2, 2024, highlighted significant leasing activity and reaffirmed their full-year guidance, demonstrating a commitment to keeping stakeholders informed.

Investor presentations further elaborate on their business model and growth strategies, empowering decision-makers with the data needed to evaluate Healthpeak's financial health and future prospects. This proactive communication approach is crucial for attracting and retaining investment capital in the competitive healthcare real estate market.

Healthpeak Properties actively communicates its commitment to sustainability and social responsibility through its annual Corporate Impact Report. This report, formerly known as the ESG Report, details the company's efforts in environmental stewardship, social impact, and robust governance practices.

This transparent reporting directly addresses the growing investor preference for Environmental, Social, and Governance (ESG) considerations. For instance, in its 2023 report, Healthpeak highlighted a 20% reduction in water intensity across its portfolio compared to a 2020 baseline, demonstrating tangible progress in its environmental goals.

By showcasing these initiatives, Healthpeak reinforces its core values and long-term strategic vision to a broad range of stakeholders, including investors, employees, and the communities in which it operates. This proactive approach to ESG reporting is crucial for attracting capital and maintaining a strong reputation in the current investment landscape.

Healthpeak Properties leverages strategic communications to highlight its market position and growth potential. For instance, its Q1 2024 earnings release in May 2024 detailed strong performance in its life science and medical office segments, reinforcing its stability and future prospects. This proactive approach aims to build investor confidence and attract high-quality tenants by showcasing operational excellence and strategic development initiatives.

Industry Conferences and Presentations

Healthpeak Properties actively participates in key industry conferences and presentations, offering a direct channel to engage with financial professionals, potential partners, and the wider real estate investment community. These engagements are crucial for highlighting their extensive healthcare real estate portfolio and demonstrating strategic vision.

These platforms serve as vital opportunities for Healthpeak to articulate its leadership position within the dynamic healthcare real estate sector. By presenting their latest developments and financial performance, they aim to attract investment and foster strategic alliances.

- Showcasing Portfolio Strengths: Healthpeak leverages these events to present a comprehensive overview of its high-quality medical office buildings, life science facilities, and senior housing properties.

- Communicating Strategic Initiatives: Presentations detail Healthpeak's forward-looking strategies, including portfolio growth plans, capital allocation, and commitment to sustainability.

- Investor and Analyst Engagement: Direct interaction at conferences allows for in-depth discussions on the company's financial health and market outlook, reinforcing investor confidence. For instance, during 2024, Healthpeak continued its active presence at major REIT and healthcare investment forums.

- Thought Leadership: Healthpeak executives often participate in panels and speaking engagements, establishing the company as a knowledgeable leader in healthcare real estate trends and market analysis.

Tenant Relationship Management and Service Excellence

Healthpeak Properties leverages exceptional tenant relationship management and service excellence as a core promotional strategy. This dedication to high-quality property management and responsive customer service directly enhances the value proposition of their healthcare real estate portfolio.

Positive tenant experiences are a powerful, organic promotional tool, fostering high retention rates and strong tenant satisfaction scores. These metrics act as direct testimonials to the quality of Healthpeak's assets and operational execution.

- Tenant Retention: Healthpeak aims for industry-leading tenant retention, a direct result of superior service.

- Tenant Satisfaction: Consistently high tenant satisfaction scores underscore the effectiveness of their relationship management.

- Brand Reputation: Excellent service builds a strong brand reputation, attracting new, high-quality tenants.

Healthpeak Properties utilizes investor relations and transparent financial reporting as key promotional tools, exemplified by their February 8, 2024, Q4 2023 earnings call and their May 2, 2024, Q1 2024 release. These communications highlight portfolio performance and reaffirm guidance, building stakeholder confidence.

The company's commitment to sustainability is promoted through its annual Corporate Impact Report, detailing ESG efforts like a 20% reduction in water intensity by 2023, appealing to environmentally conscious investors.

Active participation in industry conferences throughout 2024 allows Healthpeak to showcase its healthcare real estate portfolio and strategic vision, engaging directly with investors and fostering partnerships.

Exceptional tenant relationship management and service excellence are central to Healthpeak's promotion, driving high retention rates and a strong brand reputation within the healthcare real estate sector.

| Promotion Aspect | Key Activities | Impact/Data Point |

|---|---|---|

| Investor Relations & Financial Reporting | Q4 2023 Earnings Call (Feb 8, 2024), Q1 2024 Earnings Release (May 2, 2024) | Reaffirmed full-year guidance, showcasing portfolio stability. |

| Sustainability Reporting | Annual Corporate Impact Report | 20% reduction in water intensity by 2023 (vs. 2020 baseline). |

| Industry Engagement | Participation in REIT & Healthcare Investment Forums (2024) | Direct engagement with investors and partners, highlighting portfolio strengths. |

| Tenant Relations | Focus on service excellence and relationship management | Aims for industry-leading tenant retention and high satisfaction scores. |

Price

Healthpeak Properties' pricing strategy centers on rental rates, dynamically adjusted based on market demand, the inherent quality of its healthcare facilities, and prime geographic locations. For instance, in Q1 2024, the company reported rental rate growth on a same-property basis, reflecting strong leasing activity in key markets.

The company predominantly employs net lease structures, a strategic choice that shifts the burden of most variable operating expenses, such as property taxes and maintenance, onto the tenants. This approach is instrumental in securing a predictable and stable income stream for Healthpeak, enhancing financial forecasting and investor confidence.

Healthpeak Properties' capital allocation strategy is a critical component of its pricing, as it directly influences the company's ability to generate returns. By strategically acquiring, developing, and divesting assets, Healthpeak aims to optimize its portfolio for maximum risk-adjusted returns.

For instance, in 2024, Healthpeak continued its focus on high-growth segments like life science and medical office buildings. The company's ability to secure favorable financing and execute accretive transactions directly impacts its earnings per share and, consequently, its valuation and perceived 'price' in the market.

Their approach prioritizes investments that not only boost immediate earnings but also promise sustainable long-term value creation. This strategic deployment of capital, evidenced by their ongoing portfolio adjustments, is key to how Healthpeak positions its assets and, by extension, its overall market 'price'.

Healthpeak's dividend policy is a cornerstone of its investor relations, directly impacting its perceived value and attracting income-focused investors. The company's commitment to a regular cash dividend demonstrates a direct return to shareholders, making it a key component of its overall pricing strategy for capital.

The company actively seeks to deliver attractive shareholder returns, a goal supported by its robust financial health and a carefully managed capital structure. This focus on consistent returns is crucial for maintaining investor confidence and the company's market valuation.

For instance, as of the first quarter of 2024, Healthpeak Properties (PEAK) reported a quarterly dividend of $0.32 per share, translating to an annualized dividend of $1.28. This consistent payout reflects their strategy of returning value to shareholders, underpinned by their operational performance and financial discipline.

Debt Management and Cost of Capital

Healthpeak Properties prioritizes debt management and cost of capital to sustain a robust investment-grade balance sheet and ample liquidity. This financial prudence directly impacts its operational 'price' by securing cost-effective funding for growth initiatives and providing stability for its investors.

The company's commitment to financial discipline ensures that its cost of capital remains competitive, enabling Healthpeak to pursue strategic acquisitions and development projects efficiently. This focus on efficient capital structure is crucial for maximizing shareholder value and maintaining a strong market position.

- Debt-to-EBITDA Ratio: Healthpeak aims to maintain a debt-to-EBITDA ratio within a target range, typically around 5.0x to 5.5x, demonstrating a commitment to manageable leverage.

- Interest Coverage Ratio: The company strives for an interest coverage ratio well above 3.0x, indicating a strong ability to service its debt obligations from operating earnings.

- Liquidity Position: As of Q1 2024, Healthpeak maintained significant available liquidity, including cash and undrawn credit facilities, to meet its financial obligations and capital needs.

- Cost of Debt: The weighted average interest rate on its outstanding debt is a key metric, with Healthpeak actively managing this to minimize financing costs and enhance profitability.

Valuation and Market Positioning

Healthpeak Properties' stock price, currently trading around $20-$22 per share in mid-2024, reflects its established market position and growth prospects. This valuation is underpinned by its robust portfolio of healthcare real estate, including life science, medical office, and senior housing properties.

Analyst consensus for fiscal year 2024 estimates Funds From Operations (FFO) per share in the range of $1.75 to $1.85, with a projected Net Operating Income (NOI) growth of 3-4%. These figures directly influence investor sentiment and the company's market capitalization.

- Stock Price Performance: Healthpeak's stock has shown resilience, trading in a range that reflects investor confidence in its diversified healthcare real estate segments.

- Analyst Projections: Consensus estimates for 2024 FFO per share hover around $1.80, indicating steady operational performance.

- NOI Growth: The company anticipates 3-4% NOI growth for 2024, driven by strong occupancy and rental rate increases across its portfolio.

- Market Perception: Healthpeak is viewed as a stable, income-generating REIT with strategic opportunities in growing healthcare sectors.

Healthpeak Properties' pricing is directly tied to its rental income, influenced by market conditions and property quality. Rental rate growth, seen in Q1 2024, supports its pricing power. The use of net leases, which pass on operating expenses to tenants, provides Healthpeak with predictable income, a key factor in its overall valuation and perceived 'price'.

The company's capital allocation strategy, focusing on life science and medical office buildings in 2024, impacts its valuation. Favorable financing and accretive transactions directly influence earnings per share and, consequently, its market price. Their consistent dividend payout, like the $0.32 per share in Q1 2024, also plays a significant role in attracting investors and shaping its stock price.

| Metric | Value (as of Q1 2024/Mid-2024) | Impact on Pricing |

|---|---|---|

| Stock Price Range | $20-$22 | Reflects market perception of portfolio strength and growth prospects. |

| Est. FY 2024 FFO/Share | $1.75 - $1.85 | Key indicator for investor returns and valuation multiples. |

| Projected FY 2024 NOI Growth | 3-4% | Signals operational efficiency and rental income expansion. |

| Quarterly Dividend | $0.32 per share | Attracts income-seeking investors, contributing to stock demand. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Healthpeak Properties is grounded in comprehensive data from SEC filings, investor relations materials, and official company reports. We also incorporate industry-specific research and competitive landscape analyses to provide a holistic view.