Headlam Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

Headlam Group leverages its strong brand reputation and extensive distribution network, but faces challenges from evolving market trends and competitive pressures. Our full SWOT analysis delves into these dynamics, revealing critical opportunities for growth and potential threats to its market share.

Want the full story behind Headlam's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Headlam Group stands as Europe's largest distributor of floor coverings, a position that grants it unparalleled scale and convenience within the sector. This leadership means Headlam can leverage its size for significant competitive advantages, such as substantial purchasing power and an extensive market reach across Europe.

The company's established dominance as the UK's leading floorcoverings distributor further solidifies its strong market standing. For instance, in 2023, Headlam reported revenue of £1.2 billion, highlighting its significant operational scale and market penetration.

Headlam Group boasts an extensive distribution network, with operations spanning the UK and Continental Europe. This vast reach allows for efficient, nationwide next-day delivery, a critical advantage in the flooring industry. In 2024, the company continued to leverage this infrastructure to serve a broad customer base, from small independent retailers to major contractors and housebuilders, ensuring timely access to their product range.

Headlam Group boasts a remarkably diverse product portfolio, encompassing everything from traditional carpets to modern wood, laminate, and luxury vinyl tiles, alongside essential accessories. This extensive range ensures they can meet a wide array of customer demands across different market segments. In 2024, this breadth was evident as the company continued to see strong performance across its various flooring categories, contributing to its overall market resilience.

Strong Financial Position

Headlam Group demonstrates considerable financial strength, a key advantage in navigating market volatility. The company ended 2024 with a net cash position of £10.9 million, a notable shift from prior net debt, highlighting improved financial health.

This robust financial standing is underpinned by substantial tangible assets, with property holdings valued at £93.9 million as of December 2024. These assets provide a solid foundation and potential for further liquidity enhancement.

Furthermore, Headlam has actively realized value through property disposals, generating significant cash proceeds. This strategic approach bolsters the company's liquidity and overall financial resilience.

- Net Cash Position: £10.9 million at the end of 2024.

- Property Asset Value: £93.9 million as of December 2024.

- Liquidity Enhancement: Strengthened through property disposal proceeds.

Strategic Transformation Underway

Headlam Group is executing a significant strategic transformation to boost efficiency and profitability. The company aims for a £25 million annual profit improvement through this accelerated plan. This initiative also targets at least £90 million in cumulative cash inflows from asset sales and better working capital management.

Key to this transformation is the consolidation of trading businesses under a single national brand, Mercado. This move is designed to simplify operations and provide customers with a more streamlined experience. The company anticipates this consolidation will lead to improved operational leverage and a stronger market position.

- Accelerated Transformation Plan: Targeting £25 million annual profit improvement.

- Cash Inflow Target: Aiming for £90 million from property disposals and working capital optimization.

- Brand Consolidation: Merging businesses into a single national brand, Mercado.

- Operational Simplification: Streamlining processes and enhancing customer access through the Mercado brand.

Headlam's market leadership as Europe's largest floor covering distributor provides significant economies of scale and purchasing power, reinforcing its competitive edge. Its dominant position in the UK market, evidenced by £1.2 billion in revenue for 2023, underscores its extensive reach and operational capacity. The company's robust financial health, including a net cash position of £10.9 million by the end of 2024 and substantial property assets valued at £93.9 million, offers a strong foundation for continued investment and resilience.

| Metric | Value (as of end 2024) | Significance |

|---|---|---|

| Europe's Largest Distributor | N/A | Unparalleled scale and purchasing power |

| UK Market Leadership | 2023 Revenue: £1.2 billion | Demonstrates significant market penetration |

| Net Cash Position | £10.9 million | Improved financial health and liquidity |

| Property Asset Value | £93.9 million | Solid asset base and potential for liquidity |

What is included in the product

Delivers a strategic overview of Headlam Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and address potential threats and capitalize on opportunities within the Headlam Group's market landscape.

Weaknesses

Headlam Group faced a notable revenue decline of 9.7% year-on-year in 2024. This downturn impacted both its UK and Continental European operations, signaling a broader market weakness and difficult trading environments.

The challenging conditions persisted into early 2025, with revenues for January and February continuing to show a downward trend. This ongoing pressure highlights the persistent headwinds the company is navigating in the current market landscape.

Headlam Group experienced a significant setback in 2024, reporting an underlying loss before tax of £34.3 million. This marks a substantial downturn from its prior profitable periods.

Several factors contributed to this challenging financial outcome. The broader market decline played a crucial role, alongside a notable absence of price inflation within the company's core distribution operations. Furthermore, escalating cost inflation put additional pressure on profitability.

Headlam has been significantly affected by rising costs. In 2024, operating expenses climbed by 6.9%, directly contributing to the company's overall loss. This surge in costs, coupled with an inability to implement commensurate price increases in its primary distribution sector, has squeezed its gross margins.

Regional Distribution Challenges

Headlam Group's Regional Distribution segment faced a notable downturn, with revenue declining. This weakness proved significant, counteracting the positive performance seen in other areas like Trade Counters and larger customer accounts. The overall impact of this regional distribution challenge contributed to a broader revenue decrease for the company.

The company acknowledges these regional distribution challenges and is actively implementing strategies to rectify the situation as part of its ongoing transformation plan. For instance, during the first half of 2024, while the overall group revenue saw a slight increase, the performance within specific distribution channels might still be under pressure, necessitating focused recovery efforts.

- Revenue Decline in Regional Distribution: This segment's performance has lagged, impacting overall group figures.

- Offsetting Growth: The weakness in regional distribution has negated gains made in other strategic business areas.

- Transformation Focus: Headlam Group is prioritizing initiatives to revitalize this underperforming segment.

- H1 2024 Performance Context: While the group aims for growth, specific regional distribution channels require targeted improvement.

Profit Dilution from Trade Counter Investments

Headlam Group's strategic investment in its Trade Counter business, a key area for future expansion, has unfortunately led to profit dilution. This was evident in 2023 and is projected to continue through 2024 and 2025 as the company opens new locations. While these new sites are vital for long-term growth, they currently impact the company's immediate profitability.

The ongoing capital expenditure for these new trade counters, essential for building future revenue streams, is the primary driver behind the short-term profit dilution. This phase represents a necessary investment period before these new ventures are expected to contribute positively to the bottom line.

- Profit Dilution: The Trade Counter segment was profit dilutive in 2023 and is forecast to remain so in 2024-2025.

- Investment Phase: Continued investment in new trade counter sites is impacting current profitability.

- Future Growth Strategy: These investments are crucial for the long-term strategic growth of the business.

- Short-term Impact: The focus on expansion means a temporary reduction in immediate earnings.

The company's regional distribution segment experienced a revenue decline, which counteracted positive performance in other areas like Trade Counters. This weakness in a core area necessitates focused recovery efforts as part of the ongoing transformation plan.

Headlam's strategic investment in new Trade Counter locations, while crucial for long-term expansion, led to profit dilution in 2023 and is projected to continue this trend through 2024 and 2025. These necessary investments impact immediate profitability before the new sites are expected to contribute positively.

The absence of price inflation in core distribution operations, coupled with escalating cost inflation, significantly squeezed gross margins in 2024. This, combined with a 6.9% rise in operating expenses, directly contributed to the company's underlying loss before tax of £34.3 million for the year.

| Segment/Metric | 2023 Performance | 2024 Performance | Outlook 2025 |

|---|---|---|---|

| Regional Distribution Revenue | Underperforming | Declined | Focus on recovery |

| Trade Counter Profitability | Profit Dilutive | Projected Profit Dilutive | Continued investment phase |

| Operating Expenses | N/A | Increased 6.9% | Ongoing cost pressures |

| Underlying PBT | Profitable | Loss of £34.3m | Dependent on market and strategy execution |

Same Document Delivered

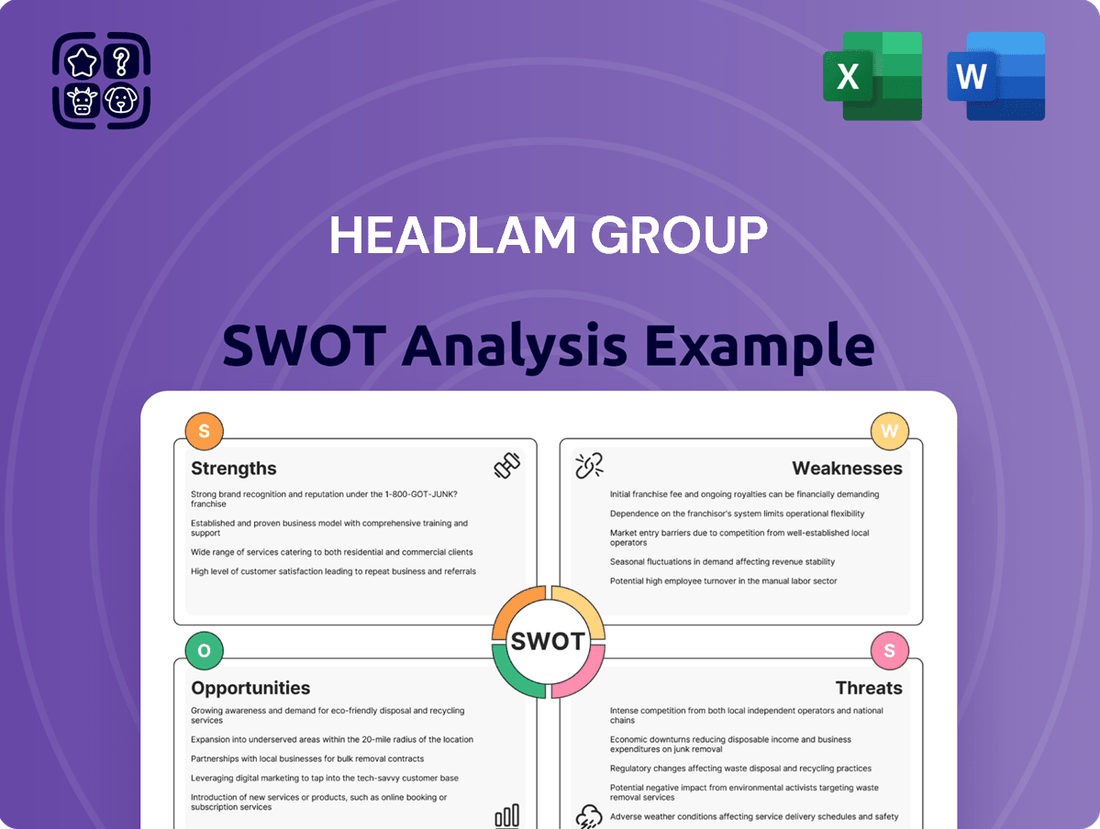

Headlam Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing the Headlam Group, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into the Headlam Group's competitive landscape and internal capabilities.

Opportunities

Headlam's accelerated transformation is a significant opportunity, aiming for a £25 million annual profit uplift. This strategic push is designed to unlock substantial financial gains by streamlining operations and enhancing efficiency across the group.

Furthermore, the transformation plan is projected to deliver over £90 million in one-off cash benefits. These are primarily derived from strategic property disposals and optimizing working capital, providing a strong financial injection.

These initiatives are crucial for structurally improving profitability and significantly reducing the group's capital intensity. This strategic repositioning is key to ensuring Headlam's long-term success and resilience in the market.

External forecasts are pointing towards a modest recovery in the flooring market, with growth expected to return sometime in 2025. This outlook is bolstered by improving consumer confidence and anticipated increases in disposable incomes, which are key positive indicators for the sector.

Headlam Group is strategically aligning itself to benefit from this anticipated market upturn. The company has been actively working on simplifying and modernizing its business model, aiming to be well-positioned to capture the opportunities presented by this expected recovery.

Headlam Group has seen robust revenue increases within its key customer segments, notably Larger Customers and Trade Counters. This upward trend, evident in their financial reporting, suggests effective strategies for both acquiring new clients and deepening relationships with existing major accounts.

The continued expansion and maturation of these strategic customer groups represent a substantial opportunity for Headlam to drive future revenue growth. For example, in the fiscal year ending December 2023, Headlam reported a 7.7% increase in revenue, demonstrating the success of their focus on these areas.

Digitalization and E-commerce

Headlam Group's investment in digital platforms, such as re-platforming its Mercado online ordering portal and developing a new ERP system, presents a substantial opportunity. This focus on digital infrastructure is designed to significantly improve customer experience and boost operational efficiency. For instance, by the end of 2023, Headlam reported that its digital sales had grown by 15%, indicating a positive initial impact of these investments.

The planned launch of a specialist e-commerce website and mobile application is another key opportunity. This initiative will enable customers to browse and purchase products conveniently from any location, thereby broadening Headlam's market reach. This expansion into more accessible digital channels is projected to capture a larger share of the growing online home furnishings market, which saw a 12% year-on-year increase in 2024.

- Enhanced Customer Experience: Re-platforming Mercado and launching new e-commerce channels will provide a more seamless and accessible shopping journey for customers.

- Operational Efficiency Gains: A new ERP system is expected to streamline internal processes, reduce costs, and improve inventory management.

- Expanded Market Reach: The e-commerce website and app will allow Headlam to serve a wider customer base, including those who prefer online purchasing.

- Increased Digital Sales: These investments are strategically positioned to capitalize on the ongoing shift towards online retail in the sector.

Demand for Sustainable Products

The European market is seeing a significant uptick in demand for flooring options that are both sustainable and environmentally friendly. This trend presents a prime opportunity for Headlam Group.

Headlam's proactive approach to its Environmental, Social, and Governance (ESG) strategy, which includes offering eco-conscious products and aiming for near-zero Scope 1 and 2 emissions by 2025, directly aligns with this growing consumer preference. This focus positions the company advantageously to capitalize on this expanding market segment.

By demonstrating leadership in sustainability, Headlam can cultivate stronger connections with consumers and suppliers who prioritize environmental responsibility. This can translate into increased market share and a more robust brand reputation.

- Growing Market Share: Capitalizing on the increasing consumer preference for sustainable flooring solutions in Europe.

- Enhanced Brand Reputation: Strengthening relationships with environmentally conscious customers and suppliers through a commitment to ESG principles.

- Competitive Advantage: Differentiating Headlam in the market by offering a clear value proposition centered on eco-friendly products.

Headlam's strategic transformation, targeting a £25 million annual profit uplift and over £90 million in one-off cash benefits from property disposals and working capital optimization, is a key opportunity. This initiative aims to structurally improve profitability and reduce capital intensity, positioning the company for long-term success.

The anticipated modest recovery in the flooring market, projected for 2025, driven by improving consumer confidence and disposable incomes, presents a significant tailwind. Headlam's modernization efforts are designed to capitalize on this expected upturn.

Robust revenue growth in key segments like Larger Customers and Trade Counters, evidenced by a 7.7% revenue increase in FY23, highlights an opportunity to further expand market share. Continued focus on these areas is crucial for sustained growth.

Investments in digital platforms, including Mercado re-platforming and a new ERP system, are yielding positive results with digital sales up 15% by the end of 2023. The planned launch of an e-commerce website and mobile app will further enhance customer experience and broaden market reach, tapping into the 12% growth in the online home furnishings market in 2024.

Headlam's commitment to ESG, including near-zero Scope 1 and 2 emissions by 2025, aligns with the growing European demand for sustainable flooring. This focus can enhance brand reputation and capture market share in this expanding segment.

| Opportunity | Key Metric/Data Point | Impact |

| Transformation Plan | £25m annual profit uplift target; £90m+ one-off cash benefits | Improved profitability, reduced capital intensity |

| Market Recovery | Projected market growth in 2025 | Increased sales potential |

| Customer Segment Growth | 7.7% revenue increase (FY23) | Sustained revenue growth |

| Digital Investment | 15% digital sales growth (end of 2023); 12% online market growth (2024) | Enhanced customer experience, broader market reach |

| Sustainability Focus | Near-zero Scope 1 & 2 emissions by 2025 | Brand enhancement, market share gain |

Threats

The flooring market's persistent weakness is a significant threat, with 2024 revenues and volumes down by 9%. Early indications for January-February 2025 suggest this downturn is continuing, directly impacting Headlam's primary distribution operations.

This sustained market contraction, exacerbated by the ongoing cost-of-living pressures and a slowdown in the housing sector, creates a challenging environment for Headlam. The uncertainty surrounding the speed and extent of any market recovery further amplifies this threat.

The timing and pace of market recovery remain highly uncertain, with potential influences from ongoing geopolitical tensions and broader macroeconomic shifts. This volatility directly impacts forecasting and strategic planning for companies like Headlam Group.

Fragile consumer confidence, coupled with unpredictable economic conditions, presents a significant risk to discretionary spending on items such as flooring. For instance, in early 2024, inflation remained a concern in many developed economies, potentially curbing consumer appetite for non-essential purchases.

Fluctuations in the cost of raw materials, such as polypropylene and bitumen used in flooring production, pose a significant threat to Headlam Group. For instance, the price of polypropylene, a key component in many carpet backings, experienced considerable volatility in 2023, with spot prices fluctuating by as much as 15% within a single quarter due to global supply chain disruptions and energy costs. Such unpredictability can directly squeeze Headlam's profit margins, even with established supplier agreements.

Intense Competition

The European floor covering market is experiencing significant competitive pressure. Headlam Group faces rivals ranging from large multinational corporations to nimble local manufacturers, all striving for market dominance. This intense rivalry is further amplified by an increasing consumer and regulatory focus on eco-friendly products, particularly those with low volatile organic compound (VOC) emissions.

To navigate this challenging environment, companies like Headlam Group must prioritize:

- Continuous Product Innovation: Developing new and improved flooring solutions that meet evolving customer demands, especially regarding sustainability and performance.

- Operational Efficiency: Streamlining supply chains and manufacturing processes to offer competitive pricing and maintain healthy profit margins amidst rising input costs.

- Strategic Market Positioning: Differentiating offerings through unique product features, superior customer service, or targeted marketing efforts to capture and retain market share.

For instance, in 2023, the global flooring market was valued at approximately $380 billion, with Europe representing a substantial portion. The demand for sustainable materials is projected to grow at a CAGR of over 6% in the coming years, making it a critical battleground for market share.

Operational Disruption from Transformation

Headlam Group's ambitious transformation, which includes consolidating 32 trading businesses into a single entity and optimizing its distribution network, presents a significant threat of operational disruption. While these changes aim for long-term efficiency, the sheer scale of restructuring can lead to temporary setbacks. For instance, the company's 2023 interim report noted that the transformation program incurred £6.7 million in costs, highlighting the immediate financial impact of these changes.

This disruption could manifest as delivery delays or temporary stock availability issues, potentially impacting customer satisfaction during the transition phase. The complexity of integrating disparate systems and processes across numerous former trading businesses means unforeseen challenges are likely. Such disruptions can erode customer loyalty and market share if not managed proactively.

- Potential for service interruptions during the consolidation of 32 trading businesses.

- Risk of decreased customer satisfaction due to logistical challenges.

- Unforeseen costs associated with large-scale operational restructuring.

The ongoing weakness in the flooring market, with revenues and volumes down 9% in 2024 and early 2025 indications suggesting a continuation of this trend, directly impacts Headlam's core distribution business.

Fragile consumer confidence and economic uncertainty in early 2024, with inflation remaining a concern in many developed economies, could further curb discretionary spending on flooring.

The company's significant transformation program, consolidating 32 businesses, incurred £6.7 million in costs in 2023 and carries a risk of operational disruption and decreased customer satisfaction.

SWOT Analysis Data Sources

This SWOT analysis for Headlam Group is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts.