Headlam Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

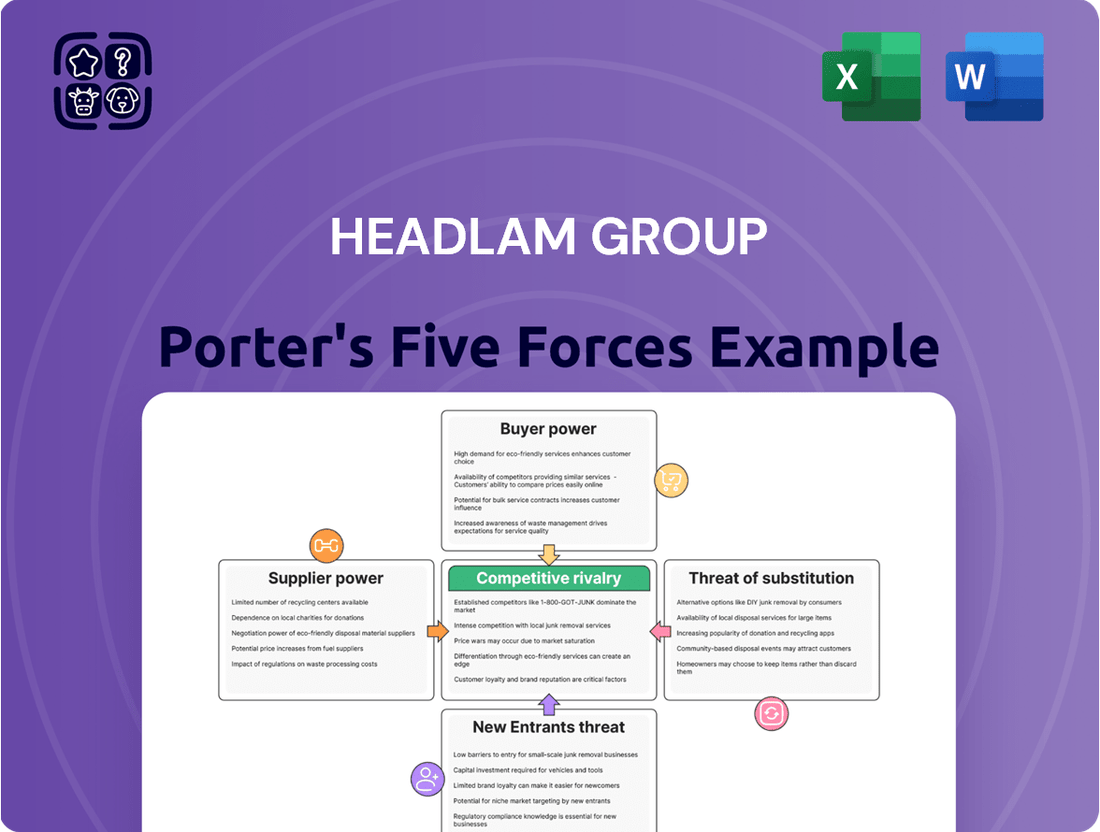

Headlam Group operates in a competitive landscape shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to grasp the company's strategic positioning.

The full Porter's Five Forces Analysis reveals the real forces shaping Headlam Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of floor covering manufacturers significantly impacts Headlam Group's supplier power. For instance, in 2024, the luxury vinyl tile market saw a notable consolidation, with several smaller players being acquired by larger entities. This trend means fewer independent suppliers for critical product lines, potentially increasing the leverage of the remaining manufacturers.

When a few dominant manufacturers control key product categories, such as high-end wood flooring or specialized carpet fibers, they can exert greater influence over Headlam. This can translate into higher input costs for Headlam or less favorable contractual terms, directly affecting the company's profitability and pricing strategies.

The uniqueness and differentiation of floor covering products from suppliers significantly impact their bargaining power with Headlam Group. If a supplier offers highly specialized, patented, or exclusive materials that are in strong demand across Headlam's customer segments, this supplier holds considerable leverage. For instance, in 2024, the flooring industry saw continued innovation in sustainable and technologically advanced materials, with some niche suppliers commanding premium pricing due to these unique offerings.

The bargaining power of suppliers for Headlam Group is significantly influenced by the substantial switching costs involved. These aren't just monetary expenses; they include the time and resources needed to build new relationships, gain product re-certifications for different markets, reconfigure intricate logistics, and manage the inherent risks of supply chain interruptions.

For instance, in 2024, the flooring industry, a key sector for Headlam, continued to see consolidation among manufacturers. This trend means fewer primary suppliers for specialized materials, such as high-performance vinyl or specific types of engineered wood. When a supplier holds a larger market share, their ability to dictate terms, including pricing and delivery schedules, naturally increases, thereby strengthening their bargaining position against buyers like Headlam.

Supplier Power 4

The bargaining power of suppliers for Headlam Group is influenced by the potential threat of forward integration. If suppliers, such as flooring manufacturers, were to distribute their products directly to Headlam's customer base, it could diminish Headlam's pricing power.

However, the significant capital investment and logistical challenges associated with building a widespread distribution network often act as a deterrent for manufacturers. This complexity generally limits the number of suppliers capable of or willing to undertake such a strategic shift, thereby moderating their overall bargaining leverage against Headlam.

In 2024, the flooring distribution market continues to be characterized by established players, making direct-to-consumer or direct-to-retailer models by manufacturers a substantial undertaking. For instance, establishing a national distribution network similar to Headlam's would require significant investment in warehousing, transportation, and sales infrastructure, a barrier that most manufacturers are unlikely to overcome easily.

- Supplier Forward Integration Threat: Manufacturers could bypass distributors like Headlam by selling directly to end-customers or retailers.

- Distribution Network Complexity: The high capital and logistical demands of creating an extensive distribution system deter most suppliers from direct integration.

- Market Structure Impact: The established nature of the flooring distribution sector in 2024 means few suppliers possess the resources or desire to replicate Headlam's distribution capabilities.

Supplier Power 5

Headlam Group's considerable scale as Europe's largest floor covering distributor significantly curtails supplier bargaining power. This dominance provides manufacturers with essential market access and sales volume, making them reliant on Headlam. For example, in 2023, Headlam reported revenue of £1.1 billion, underscoring its substantial purchasing influence.

Suppliers often find their leverage diminished because Headlam's extensive distribution network is crucial for reaching a broad customer base. This reliance means suppliers are less likely to dictate terms, as losing Headlam as a partner could severely impact their sales. The company's purchasing volume allows it to negotiate favorable pricing and terms, thereby reducing the suppliers' ability to demand higher prices or impose less favorable conditions.

- Supplier Dependence: Many manufacturers depend on Headlam for a significant portion of their sales volume and market penetration across Europe.

- Market Access: Headlam's extensive network provides suppliers with reach that would be costly and difficult to replicate independently.

- Negotiating Leverage: The sheer size of Headlam's operations allows it to command better pricing and terms from its suppliers.

- Reduced Supplier Power: Consequently, suppliers have limited ability to exert significant upward pressure on prices or impose unfavorable supply conditions.

The bargaining power of suppliers for Headlam Group is moderated by the company's substantial scale as a leading floor covering distributor. This significant purchasing volume allows Headlam to negotiate favorable terms and pricing, thereby limiting suppliers' ability to dictate conditions. For instance, Headlam's 2023 revenue of £1.1 billion highlights its considerable influence in the market, making suppliers reliant on its extensive distribution network for market access and sales volume.

| Factor | Impact on Headlam | 2024 Relevance |

| Supplier Concentration | Increases supplier power due to fewer options. | Luxury vinyl tile market consolidation noted. |

| Product Differentiation | High differentiation grants suppliers leverage. | Innovation in sustainable materials gives niche suppliers pricing power. |

| Switching Costs | High costs for Headlam limit supplier power. | Re-certification and logistics complexity are significant barriers. |

| Forward Integration Threat | Low threat due to high barriers for suppliers. | Establishing distribution networks is capital-intensive for manufacturers. |

| Headlam's Scale | Significantly reduces supplier power. | Headlam's £1.1 billion revenue in 2023 underscores its buying influence. |

What is included in the product

This analysis details the competitive forces impacting Headlam Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the flooring industry.

Identify and mitigate competitive threats before they impact profitability, providing actionable insights for strategic planning.

Customers Bargaining Power

Headlam Group's customer base is quite spread out, with many small independent retailers, builders, and contractors. This fragmentation typically means that no single customer has a lot of power to negotiate prices. For instance, in 2023, Headlam served over 18,000 customers, highlighting this diverse reach.

However, some customers are much bigger than others. Large housebuilders or major commercial construction firms buy in bulk, giving them more leverage. These key accounts can potentially negotiate better terms due to their significant order volumes, which could impact Headlam's pricing strategies.

Headlam Group's customers, particularly larger entities and those involved in significant projects, can exert considerable bargaining power. This is evident when their collective purchasing volume allows them to negotiate for better pricing and more favorable contract terms, directly influencing Headlam's profitability on those sales.

In 2024, the flooring industry, including segments Headlam operates in, continued to see consolidation among buyers. This trend means that key customer segments, such as large housebuilders or national retail chains, represent a substantial portion of Headlam's revenue, amplifying their ability to dictate terms and seek competitive offers.

The bargaining power of customers for Headlam Group is significant due to low switching costs. Customers, whether retailers or contractors, can easily find alternative flooring distributors or even source directly from manufacturers, limiting Headlam's pricing flexibility. For example, in 2024, the flooring market saw numerous new entrants and expanded product lines from existing manufacturers, increasing customer choice and reducing their reliance on any single distributor.

Buyer Power 4

The bargaining power of customers for Headlam Group is influenced by the ease with which they can access alternative suppliers or bypass intermediaries. If customers, particularly larger retailers or commercial clients, can source flooring products directly from manufacturers or through competing distribution networks, their leverage in price negotiations with Headlam increases. This is especially true if the products are relatively standardized and readily available from multiple sources.

Headlam's ability to mitigate this buyer power hinges on its value-added services, product differentiation, and established relationships. For instance, in 2024, the flooring market saw continued consolidation among manufacturers, potentially limiting direct sourcing options for some smaller buyers. However, the rise of online marketplaces and direct-to-consumer brands in related home improvement sectors indicates a persistent threat of disintermediation that customers can exploit.

- Customer Access to Alternatives: The availability of direct sourcing from manufacturers or alternative distributors empowers customers.

- Impact on Negotiation: Easier access to alternatives strengthens customers' ability to negotiate prices and terms with Headlam.

- Market Trends: In 2024, while some manufacturer consolidation occurred, the growth of online channels presents ongoing disintermediation risks.

- Headlam's Mitigation: Value-added services, product specialization, and strong customer relationships are key to reducing buyer power.

Buyer Power 5

The price sensitivity of Headlam's customers, especially in the competitive residential and commercial construction markets, gives them significant leverage. Customers prioritize cost-effectiveness and project budgets, forcing Headlam to offer competitive pricing and added value.

For instance, in 2024, the flooring industry, a core market for Headlam, experienced continued pressure on material costs, making customers more inclined to seek the best value. This dynamic means Headlam must constantly monitor competitor pricing and demonstrate the tangible benefits of its products and services beyond just the price tag.

- Price Sensitivity: Customers in construction are highly sensitive to pricing due to project budget constraints.

- Competitive Landscape: The presence of numerous flooring suppliers intensifies buyer power, pushing for lower prices.

- Value Proposition: Headlam must differentiate through quality, service, and reliability to mitigate price-driven decisions.

Headlam Group faces considerable customer bargaining power, particularly from larger clients who purchase in bulk. This leverage allows them to negotiate better pricing and terms, directly impacting Headlam's margins. For example, in 2024, the flooring market saw continued consolidation among buyers, with major housebuilders and national retailers representing a larger share of overall demand, thus amplifying their negotiating strength.

The ease with which customers can switch suppliers or source directly from manufacturers further bolsters their bargaining power. In 2024, increased product availability and the growth of online marketplaces provided customers with more alternatives, reducing their reliance on any single distributor like Headlam.

Price sensitivity remains a key driver of customer power in the construction and retail sectors. Customers prioritize cost-effectiveness, forcing Headlam to remain competitive and demonstrate value beyond just price. The pressure on material costs in 2024 intensified this, making customers more inclined to seek the best possible deals.

| Factor | Description | Impact on Headlam | 2024 Data/Trend |

|---|---|---|---|

| Customer Concentration | A few large customers account for a significant portion of sales. | Increased negotiation leverage for these key accounts. | Continued consolidation among major buyers in the flooring sector. |

| Switching Costs | Low costs for customers to change distributors or source directly. | Limits Headlam's pricing flexibility and customer retention. | Growth of online channels and diverse product offerings increased alternatives. |

| Price Sensitivity | Customers prioritize cost due to project budgets and market pressures. | Forces Headlam to offer competitive pricing and added value. | Material cost pressures in 2024 made customers more value-conscious. |

Full Version Awaits

Headlam Group Porter's Five Forces Analysis

This preview showcases the complete Headlam Group Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this comprehensive strategic tool.

Rivalry Among Competitors

The European floor covering distribution market is quite crowded, with many companies vying for business. This means Headlam, even as a leader, faces stiff competition from other major national and regional distributors. For instance, in 2023, the UK flooring market alone saw numerous players, including large DIY retailers with flooring departments and specialized independent distributors, all contributing to a highly competitive landscape.

The competitive rivalry within the floor covering market, particularly for a company like Headlam Group, is significantly shaped by the overall market's growth trajectory. In 2024, the global flooring market is projected to see moderate growth, which can lead to intensified competition. As companies fight for a larger piece of a slowly expanding pie, price wars and aggressive marketing campaigns become more common.

Competitive rivalry within the floor covering distribution sector, as exemplified by Headlam Group, is intense. This intensity stems from a general lack of product differentiation; many distributors offer similar, widely available, and standardized flooring products. Consequently, competition often devolves into price wars, putting pressure on margins for all players.

In 2024, the UK flooring market, a key area for Headlam, continued to see significant competition from both national distributors and smaller regional players. While specific market share data for individual distributors is often proprietary, industry reports indicate a fragmented market where price competitiveness is a primary driver for customer acquisition and retention, directly impacting Headlam's operational environment.

Competitive Rivalry 4

The floor covering distribution sector faces intense competition, partly due to high exit barriers. Companies heavily invested in warehousing, logistics, and inventory find it difficult to leave the market, even when unprofitable. This situation can lead to persistent overcapacity, forcing remaining players to compete fiercely on price and service to maintain market share.

For Headlam Group, this means navigating a landscape where established players are reluctant to exit, potentially leading to price wars and squeezed margins. The industry's capital-intensive nature, with significant investments in physical infrastructure, acts as a deterrent to new entrants but also traps existing ones, intensifying the rivalry among them.

- High Capital Investment: The floor covering distribution industry requires substantial upfront investment in warehouses, delivery fleets, and inventory management systems, creating significant barriers to entry and exit.

- Inventory Holding Costs: Maintaining large stocks of diverse flooring products incurs considerable holding costs, making it challenging for underperforming firms to divest their operations without significant losses.

- Industry Overcapacity: The reluctance of struggling companies to exit the market contributes to ongoing overcapacity, which in turn fuels aggressive pricing strategies and heightened competition among distributors.

- Impact on Profitability: Intense rivalry, driven by high exit barriers and overcapacity, can put downward pressure on profit margins for companies like Headlam Group, necessitating efficient operations and strong customer relationships.

Competitive Rivalry 5

The flooring distribution industry, where Headlam Group operates, is characterized by a significant cost structure. High fixed costs are tied to maintaining an extensive distribution network, including warehouses and logistics, as well as managing substantial inventory levels. This necessitates competitors to strive for high capacity utilization to spread these costs effectively.

Consequently, this industry often sees intense price competition and frequent promotional activities. Companies are driven to secure sales volume to cover their fixed costs, leading to aggressive pricing strategies. For instance, in 2024, many distributors engaged in year-end sales and special offers to clear inventory and maintain market share.

- High Fixed Costs: Significant investment in distribution infrastructure and inventory management.

- Capacity Utilization Pressure: Competitors must operate at high volumes to remain profitable.

- Aggressive Pricing: Frequent price wars and promotional campaigns are common.

- Volume-Driven Strategy: Focus on securing sales volume to offset fixed operational expenses.

Competitive rivalry within the floor covering distribution sector is intense, driven by a crowded market and limited product differentiation. This often leads to price wars as companies strive to secure sales volume and cover high fixed costs associated with extensive distribution networks and inventory. In 2024, the UK flooring market, a key operational area for Headlam, continued to experience this dynamic, with distributors frequently employing special offers to maintain market share and manage inventory.

| Factor | Description | Impact on Headlam |

|---|---|---|

| Market Saturation | Numerous national and regional distributors compete for market share. | Requires continuous efforts to differentiate and maintain customer loyalty. |

| Price Sensitivity | Lack of product differentiation leads to competition primarily on price. | Puts pressure on profit margins; necessitates efficient cost management. |

| Exit Barriers | High capital investment in infrastructure and inventory makes exiting difficult. | Contributes to overcapacity and sustained price competition. |

| Promotional Activity | Frequent sales and offers are used to drive volume and clear inventory. | Impacts revenue predictability and requires careful promotional planning. |

SSubstitutes Threaten

Alternative flooring solutions outside Headlam's typical distribution, like polished concrete or epoxy resin floors, present a notable threat. These options can appeal to customers seeking specific functional benefits, unique aesthetics, or enhanced long-term durability, potentially diverting demand from traditional flooring products.

The threat of substitutes for Headlam Group is influenced by evolving construction and design trends. A shift towards exposed concrete floors or polished screeds in commercial and residential spaces, driven by minimalist aesthetics, can directly reduce demand for traditional floor coverings like carpets and vinyl. This trend, gaining traction in urban development projects, presents a significant substitution risk.

The threat of substitutes for Headlam Group's flooring products is influenced by the price-performance trade-off. If alternative flooring materials, such as luxury vinyl tile (LVT) or laminate, offer similar or better durability and aesthetics at a lower price point, customers might switch. For instance, in 2023, the global LVT market was valued at approximately $35 billion and is projected to grow, indicating a strong and competitive substitute.

Threat of Substitution 4

The rise of do-it-yourself (DIY) projects and direct online purchases of flooring materials by consumers presents a significant substitution threat to Headlam Group. This trend allows end-users to bypass traditional B2B channels, impacting Headlam's core business model.

Consumers are increasingly empowered to source flooring directly, potentially reducing reliance on retailers and contractors who are Headlam's primary customers. For example, online marketplaces saw a surge in home improvement product sales, with many consumers opting for self-installation to save costs.

- DIY Trend Impact: Direct consumer purchase of flooring materials bypasses traditional B2B channels.

- Online Sales Growth: E-commerce platforms are facilitating direct access to flooring products for end-users.

- Cost Savings Appeal: Consumers are motivated by potential cost reductions through self-installation and direct sourcing.

- Shifting Purchasing Habits: This shift away from contractor-mediated purchases directly affects Headlam's established customer base.

Threat of Substitution 5

Technological advancements can introduce novel flooring materials or installation methods that bypass Headlam Group's current offerings, acting as potent substitutes. For example, the rise of advanced composite materials or rapid, modular flooring systems could disrupt traditional markets. In 2024, the construction industry saw continued innovation in sustainable and easily installed flooring solutions, a trend Headlam must monitor.

The threat of substitutes is heightened when these alternatives offer significant advantages in cost, performance, or convenience. For instance, a new adhesive technology that drastically reduces installation time and cost for a different type of flooring could draw customers away from Headlam's more traditional product lines. This necessitates a proactive approach to product development and sourcing.

Headlam Group's ability to mitigate this threat relies on continuous market intelligence and a willingness to integrate or develop innovative solutions. Staying ahead means not just distributing existing products but anticipating and adapting to emerging technologies that could redefine customer preferences in the flooring sector.

Key considerations for Headlam Group regarding substitutes include:

- Monitoring emerging material science and installation technologies.

- Assessing the cost-effectiveness and performance benefits of new alternatives.

- Evaluating the potential for new entrants to leverage disruptive innovations.

- Adapting product portfolios and distribution strategies to incorporate or counter substitute threats.

The threat of substitutes for Headlam Group is substantial, encompassing alternative flooring types and direct-to-consumer purchasing models. Innovations in materials, such as advanced composites and modular systems, alongside the growing DIY trend and online sales, directly challenge Headlam's established business. These substitutes often appeal through cost savings, unique aesthetics, or enhanced performance, forcing Headlam to remain agile.

| Substitute Category | Key Characteristics | Impact on Headlam | Example Trend/Data (2023-2024) |

|---|---|---|---|

| Alternative Materials | Polished concrete, epoxy resins, luxury vinyl tile (LVT), laminate | Diverts demand, potential price pressure | Global LVT market valued at ~$35 billion (2023), showing strong substitute growth. |

| Direct-to-Consumer (DTC) | DIY projects, online marketplaces | Bypasses B2B channels, erodes retailer/contractor base | Surge in online home improvement sales, consumers seeking cost savings via self-installation. |

| Technological Innovations | Advanced composites, rapid installation systems | Disrupts traditional markets, creates new competitive landscape | Continued innovation in sustainable and easily installed flooring solutions observed in 2024 construction. |

Entrants Threaten

The threat of new entrants for Headlam Group is significantly limited by the substantial capital required to build a comparable distribution network. Establishing the necessary large-scale warehousing, a comprehensive logistics fleet, and maintaining significant inventory levels demands millions in upfront investment, a major hurdle for newcomers.

Established players like Headlam benefit from significant economies of scale, particularly in their purchasing power and logistical networks. For instance, Headlam's extensive supplier relationships in 2024 likely grant them superior pricing on raw materials and finished goods compared to any newcomer. This cost advantage makes it challenging for new entrants to match Headlam's pricing and achieve profitability.

The capital investment required to establish a comparable operational footprint, including warehousing and distribution, presents a substantial barrier. New entrants would need considerable upfront capital to build out the infrastructure necessary to compete with Headlam's established efficiency, which is a significant hurdle in the flooring sector.

For Headlam Group, the threat of new entrants is moderate. New companies entering the flooring market must overcome significant hurdles in establishing robust distribution networks and securing reliable supplier relationships, which Headlam has cultivated over decades. For instance, in 2024, the UK flooring market is valued at approximately £3.5 billion, a substantial but mature sector where brand loyalty and established logistical infrastructure are key differentiators.

Threat of New Entrants 4

The threat of new entrants for distributors like Headlam Group is generally considered moderate. Established players benefit from significant brand loyalty and a strong reputation built over many years. Customers often prioritize reliability, a proven track record, and a wide product selection, all of which are difficult for newcomers to replicate quickly.

New entrants face substantial barriers, including the capital required for inventory, warehousing, and distribution networks. Furthermore, securing favorable terms with suppliers and building a comparable customer base takes considerable time and investment. For instance, in 2024, the UK flooring market, a key sector for Headlam, continued to see consolidation, making it challenging for smaller, unestablished entities to gain significant market share.

- Brand Loyalty: Decades of consistent service and quality build trust, making customers hesitant to switch to unknown suppliers.

- Capital Requirements: Significant upfront investment is needed for stock, logistics, and operational infrastructure.

- Supplier Relationships: Established distributors often have exclusive or preferential agreements with manufacturers.

- Economies of Scale: Larger distributors can negotiate better prices and offer more competitive terms due to their purchasing volume.

Threat of New Entrants 5

While the threat of new entrants for Headlam Group isn't overwhelmingly high, certain factors do present initial challenges. Regulatory hurdles and compliance requirements, such as adhering to diverse European and national standards for product safety, environmental impact, and distribution practices, add complexity and cost for newcomers. For instance, in 2024, companies operating within the flooring sector, like those supplying Headlam, must navigate evolving REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations impacting material sourcing and product composition.

These compliance demands can deter smaller, less capitalized businesses from entering the market. Furthermore, established distribution networks and brand recognition, which Headlam Group has cultivated over years, represent significant barriers to entry. Building a comparable supply chain and customer trust would require substantial investment and time, making it difficult for new players to compete effectively.

- Regulatory Compliance: Navigating EU and national product safety, environmental, and distribution standards requires significant upfront investment and expertise.

- Capital Requirements: Establishing robust supply chains, inventory management, and distribution networks demands considerable financial resources.

- Brand Recognition and Loyalty: Headlam's established reputation and customer relationships create a barrier for new entrants seeking market share.

- Economies of Scale: Existing players benefit from bulk purchasing power and operational efficiencies that are difficult for new entrants to match initially.

The threat of new entrants for Headlam Group is kept in check by considerable capital requirements and established economies of scale. New companies need substantial investment for inventory, warehousing, and distribution, a significant hurdle in the UK flooring market, valued at approximately £3.5 billion in 2024. Headlam's long-standing supplier relationships and bulk purchasing power in 2024 provide cost advantages that are difficult for newcomers to match, thereby limiting their ability to compete on price.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for inventory, warehousing, and logistics. | High barrier, requiring millions in upfront capital. |

| Economies of Scale | Headlam's purchasing power and operational efficiencies. | New entrants struggle to match pricing and cost structures. |

| Brand Loyalty & Reputation | Decades of service build customer trust. | Difficult for new entrants to gain market share quickly. |

| Supplier Relationships | Established preferential agreements with manufacturers. | New entrants may face limited access or less favorable terms. |

Porter's Five Forces Analysis Data Sources

Our Headlam Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and filings with regulatory bodies. We supplement this with insights from leading industry research firms and market intelligence platforms to capture a holistic view of the competitive landscape.