Headlam Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

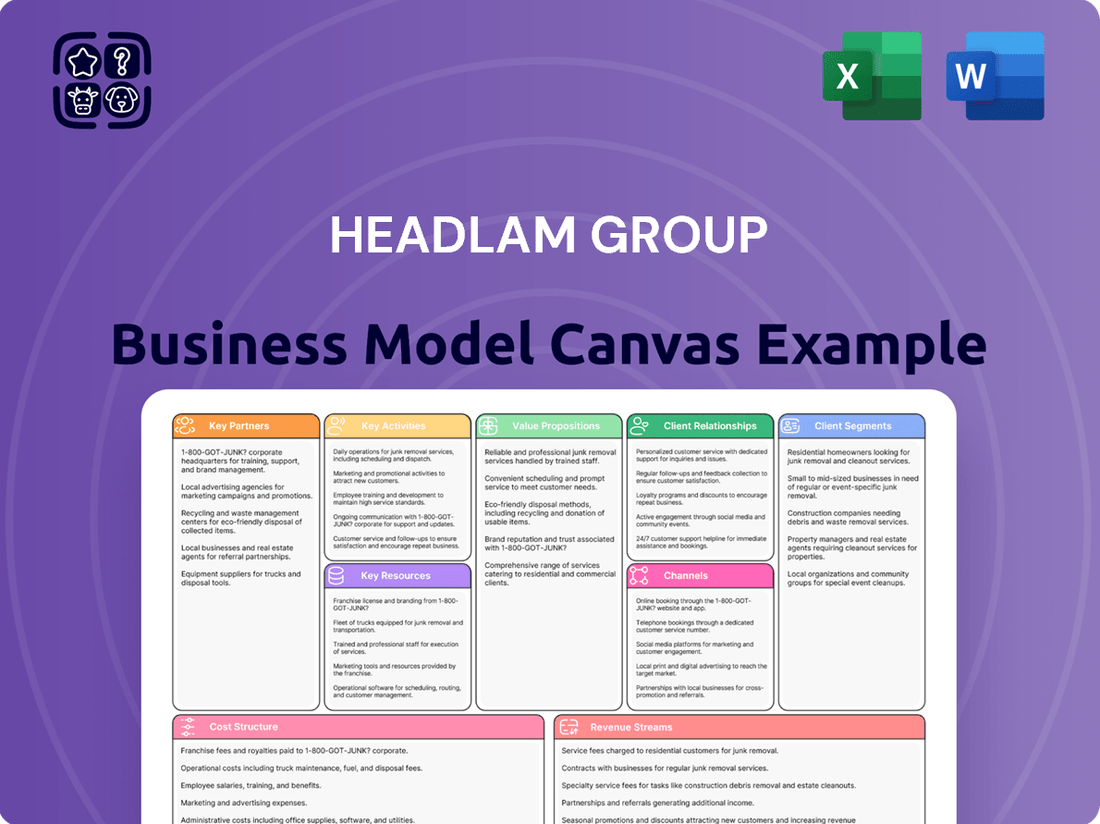

Unlock the strategic blueprint of Headlam Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively serve diverse customer segments, manage key resources, and generate revenue in the competitive flooring industry. Discover their unique value propositions and operational efficiencies.

Ready to dissect Headlam Group's winning strategy? Our full Business Model Canvas offers a clear, section-by-section analysis of their customer relationships, revenue streams, and cost structure, providing invaluable insights for any business strategist. Download it now to gain a competitive edge.

Partnerships

Headlam Group cultivates robust relationships with numerous manufacturers and suppliers of various flooring types, including carpets, wood, laminate, and luxury vinyl tiles. These vital partnerships guarantee a steady influx of quality products, meeting the broad needs of their varied clientele.

In 2024, Headlam Group's commitment to supplier relationships directly impacts product availability and pricing power. For instance, securing favorable terms with key manufacturers of LVT, a segment experiencing significant growth, is essential for maintaining competitive edge and meeting demand, which saw a 7% increase in the residential sector by mid-2024.

Headlam Group leverages partnerships with third-party logistics (3PL) and transport providers to complement its in-house distribution network. These collaborations are crucial for expanding reach and managing fluctuating demand, especially for specialized deliveries across the UK and Continental Europe.

In 2024, the company continued to refine these relationships to optimize delivery routes and ensure product availability. For instance, partnerships might focus on specific geographic areas or modes of transport, such as refrigerated vehicles for certain flooring types, thereby enhancing operational efficiency and customer service.

Headlam Group heavily relies on technology and software vendors to power its operations. These partnerships are crucial for maintaining and enhancing efficiency across the business. Think of it like this: these vendors provide the digital backbone that keeps everything running smoothly.

Key partnerships include those with providers of enterprise resource planning (ERP) systems, warehouse management systems (WMS), and e-commerce platforms. These systems are the engines driving inventory management, processing customer orders accurately, and managing customer relationships effectively. For instance, a robust ERP system is essential for a company like Headlam, which deals with a vast product range and a significant number of customer interactions.

In 2024, the importance of digital infrastructure only grew. Companies that invested in advanced IT solutions, like Headlam, were better positioned to handle supply chain complexities and evolving customer expectations. The ability to manage a diverse product catalog efficiently, from flooring to wall coverings, directly hinges on the quality and integration of these software solutions.

Industry Associations and Trade Bodies

Headlam Group actively engages with industry associations and trade bodies. This collaboration provides crucial insights into emerging market trends, evolving regulatory landscapes, and best practices specific to the floor coverings sector. For example, participation in bodies like the British Contract Furnishing Association (BCFA) or the European Carpet and Rug Association (ECRA) allows Headlam to stay ahead of industry shifts.

These partnerships are instrumental in fostering the development of industry standards and advocating for shared interests. By contributing to these collective efforts, Headlam Group strengthens its market position and enhances its influence. This active involvement underscores Headlam's commitment to the advancement and integrity of the floor coverings industry.

- Market Intelligence: Access to up-to-date information on consumer preferences and technological advancements.

- Regulatory Awareness: Early understanding of potential legislative changes affecting product safety and environmental impact.

- Industry Advocacy: Collective voice on issues such as trade policies and sustainability initiatives.

- Networking Opportunities: Building relationships with peers, suppliers, and potential collaborators.

Key Account Partnerships

Headlam Group cultivates strategic alliances with major commercial contractors and housebuilders, focusing on long-term collaborations to navigate intricate project demands and supply chain complexities. These partnerships are designed to provide bespoke solutions and dedicated account oversight, ensuring the substantial needs of large-scale construction projects are met efficiently.

These relationships are foundational for securing significant, high-volume business, moving beyond simple sales transactions to a more integrated operational approach. For instance, in 2024, Headlam's focus on these key accounts contributed to its robust performance in the contract flooring sector, where reliability and tailored service are paramount.

- Strategic Alliances: Building long-term partnerships with large commercial contractors and housebuilders.

- Tailored Solutions: Offering bespoke services and dedicated account management for complex project needs.

- Supply Chain Integration: Collaborating closely to manage the intricate demands of major construction projects.

- Volume Business: Securing substantial contracts through these key account relationships.

Headlam Group's key partnerships extend to a broad network of manufacturers and suppliers, ensuring a consistent flow of diverse flooring products. These relationships are critical for maintaining product quality and offering competitive pricing, especially in high-demand segments like luxury vinyl tiles, which saw a notable uptick in residential projects during 2024.

Strategic alliances with logistics providers and technology vendors are also vital. These collaborations enhance operational efficiency, expand market reach, and underpin the company's digital infrastructure, which is increasingly important for managing complex supply chains and customer interactions. The company's investment in advanced IT solutions in 2024 directly supported its ability to navigate market complexities.

| Partnership Type | Key Benefits | 2024 Relevance |

|---|---|---|

| Manufacturers & Suppliers | Product variety, quality assurance, competitive pricing | Secured favorable terms for LVT, supporting a 7% residential sector increase |

| Logistics & Transport (3PL) | Expanded reach, efficient delivery management | Optimized routes and specialized transport for diverse product needs |

| Technology & Software Vendors | Operational efficiency, data management, customer relations | Enhanced digital backbone for inventory, order processing, and customer engagement |

| Industry Associations | Market intelligence, regulatory awareness, advocacy | Informed strategic decisions on trends and industry standards |

| Commercial Contractors & Housebuilders | Secured high-volume business, tailored solutions | Foundation for robust performance in contract flooring sector |

What is included in the product

A comprehensive, pre-written business model tailored to the Headlam Group’s strategy, covering its wholesale and distribution operations within the flooring industry.

Reflects the real-world operations and plans of the featured company, focusing on its extensive product range, supplier relationships, and diverse customer base.

The Headlam Group's Business Model Canvas acts as a pain point reliever by clearly mapping out how they efficiently connect manufacturers with retailers, streamlining the distribution process and reducing friction for both parties.

It provides a structured, visual solution to the complexities of wholesale flooring distribution, offering a clear path to resolving common industry challenges.

Activities

Headlam's procurement and inventory management is central to its operations, focusing on sourcing a wide range of floor coverings and accessories from global manufacturers. This involves keen negotiation of supply agreements and fostering strong supplier relationships.

The company meticulously manages inventory across its extensive warehouse network to ensure high product availability. For example, in 2024, Headlam continued to optimize its stock levels, a critical factor in meeting diverse customer demands efficiently and controlling holding costs.

Headlam Group's key activity in distribution and logistics involves managing a vast network across Europe, focusing on efficient warehousing, fleet operations, and precise order fulfillment. This intricate system is designed to deliver flooring products to a wide range of customers, including independent retailers and construction professionals.

Ensuring timely and cost-effective deliveries is paramount, directly influencing customer loyalty and the company's bottom line. In 2024, Headlam continued to invest in optimizing its supply chain, aiming to reduce transit times and improve inventory management across its numerous distribution centers.

Headlam's key activities revolve around developing and executing robust sales strategies to connect with a broad customer base, from flooring retailers to contractors. This includes actively promoting their extensive product portfolio and highlighting the value they offer across different market segments.

The company relies on a dedicated sales force and targeted marketing campaigns to build and nurture strong customer relationships. These engagement initiatives are crucial for understanding customer needs and ensuring repeat business, ultimately driving demand for Headlam's flooring solutions.

In 2024, Headlam Group reported a revenue of £574.7 million, demonstrating the effectiveness of their sales and marketing efforts in expanding market share and driving growth within the competitive flooring industry.

Supply Chain Optimization

Headlam Group's key activity of supply chain optimization focuses on refining every step from sourcing materials to getting products to customers. This means constantly looking for ways to make things run smoother, cut down on expenses, and serve customers better. For a business that moves a lot of products, a well-oiled supply chain is a major advantage.

The company actively analyzes its logistics, pinpoints areas where things slow down, and puts in place better methods for storing goods, moving them, and managing stock. This continuous improvement cycle is vital for maintaining a competitive edge.

- Logistics Analysis: Regularly reviewing transportation routes and methods to identify cost savings and efficiency gains.

- Bottleneck Identification: Pinpointing and addressing delays in warehousing, order fulfillment, and delivery processes.

- Inventory Management: Implementing strategies to optimize stock levels, reducing holding costs while ensuring product availability.

- Technology Integration: Utilizing advanced systems for real-time tracking and management of goods throughout the supply chain.

After-Sales Support and Service

Headlam Group's after-sales support is a cornerstone of their customer relationship strategy. This involves efficiently managing customer inquiries, processing returns smoothly, and providing crucial technical assistance to ensure a positive experience long after the initial purchase.

This dedication to post-sale service directly fuels customer satisfaction and cultivates lasting loyalty. By offering comprehensive support, Headlam reinforces its commitment to clients, building trust that encourages repeat business and strengthens its market position.

In 2024, Headlam Group continued to emphasize responsive customer service, recognizing its impact on brand reputation. Their focus on timely issue resolution and proactive communication is key to maintaining a high level of customer retention.

- Customer Inquiry Management: Streamlined processes for handling a high volume of customer questions.

- Returns Processing: Efficient and hassle-free return procedures to maintain customer confidence.

- Technical Assistance: Expert support to help customers with product usage and troubleshooting.

- Customer Loyalty: Building long-term relationships through reliable post-sale engagement.

Headlam Group's key activities encompass the entire lifecycle of flooring products, from sourcing to customer support. This involves strategic procurement, efficient inventory management, and sophisticated distribution networks across Europe. The company actively engages in sales and marketing to reach a diverse customer base, supported by a commitment to supply chain optimization and robust after-sales service. These integrated activities ensure product availability, customer satisfaction, and sustained market presence.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Procurement & Inventory Management | Sourcing diverse floor coverings and managing stock levels across a wide network. | Crucial for meeting varied customer demands and controlling costs. |

| Distribution & Logistics | Operating an extensive European network for warehousing, fleet management, and order fulfillment. | Ensures timely and cost-effective delivery, impacting customer loyalty. |

| Sales & Marketing | Developing strategies to promote products and build customer relationships. | Drove £574.7 million in revenue in 2024, expanding market share. |

| Supply Chain Optimization | Continuously improving processes from sourcing to delivery for efficiency and cost reduction. | Vital for maintaining a competitive edge through smoother operations. |

| After-Sales Support | Managing inquiries, returns, and technical assistance to foster customer loyalty. | Key to maintaining brand reputation and encouraging repeat business. |

Full Version Awaits

Business Model Canvas

This preview offers a direct look at the Headlam Group's Business Model Canvas, showcasing the exact structure and content you will receive upon purchase. What you see here is not a sample or a mockup, but a genuine snapshot of the comprehensive document. Upon completing your order, you will gain full access to this same detailed analysis, ready for your immediate use and adaptation.

Resources

Headlam's extensive product portfolio, encompassing carpets, wood, laminate, luxury vinyl tile (LVT), and a wide array of accessories, is a cornerstone of its business. This broad selection caters to diverse customer needs and design preferences across the flooring market.

The company's substantial inventory holdings are crucial, enabling swift fulfillment of orders and minimizing lead times for customers. This inventory management ensures product availability, a key factor in customer satisfaction and retention.

In 2024, Headlam reported a robust product offering that underpins its market position. The breadth and depth of this range are a significant competitive advantage, allowing them to serve a wide customer base effectively and respond to evolving market trends.

Headlam Group's vast distribution network and warehousing facilities are its backbone, comprising an extensive chain of businesses throughout the UK and Continental Europe. This physical infrastructure includes a significant number of warehouses and strategically located distribution centers, totaling over 70 sites across the UK as of recent reports.

These facilities are crucial for the efficient storage, handling, and large-scale distribution of their flooring products. The sheer capacity and geographic spread of these operational hubs allow Headlam to serve a broad customer base effectively, ensuring timely delivery and product availability, which is a key competitive advantage.

Headlam Group's skilled workforce is a cornerstone of its operations. This includes experienced management guiding strategic decisions, logistics personnel adept at efficient supply chain management, and a dedicated sales force fostering strong customer relationships. For instance, in 2024, Headlam Group continued to invest in training and development programs to ensure its teams remain at the forefront of industry knowledge and customer service excellence.

The expertise of these teams, particularly in product knowledge and customer service, directly translates into operational efficiency and customer loyalty. A well-trained sales team, for example, can effectively communicate product benefits and address customer needs, which is crucial in the competitive flooring market. This human capital is not just a cost but a significant driver of value and competitive advantage for the company.

Brand Reputation and Market Position

Headlam Group's brand reputation as Europe's largest floor covering distributor is a cornerstone of its business model. This established position, cultivated over decades, translates into significant trust from both suppliers and a broad customer base. In 2024, this strong market presence continues to be a key driver for attracting new business and fostering loyalty among existing clients.

The company's leading market share, a testament to its enduring brand, provides a competitive advantage. This recognition not only facilitates easier access to a wide range of products from manufacturers but also simplifies the sales process by pre-qualifying customer interest. Headlam's consistent performance and commitment to quality have solidified its image, making it a go-to partner in the industry.

- Market Leadership: Headlam Group is recognized as Europe's largest distributor of floor coverings.

- Supplier Trust: The company's strong reputation fosters reliable relationships with manufacturers.

- Customer Loyalty: Established brand recognition encourages repeat business and attracts new clientele.

- Competitive Edge: A powerful brand name simplifies market penetration and sales efforts.

Advanced IT Infrastructure and Data Systems

Headlam Group's advanced IT infrastructure is a cornerstone of its business model. This includes sophisticated Enterprise Resource Planning (ERP) systems, robust e-commerce platforms, and powerful data analytics capabilities. These technologies are crucial for managing the complexity of their operations, from processing orders efficiently to maintaining accurate inventory levels.

The effectiveness of Headlam's IT systems directly impacts their financial management and customer relationship management. By streamlining these processes, the company can ensure timely transactions and foster stronger customer engagement. For instance, in 2023, Headlam reported significant investment in digital transformation initiatives, aiming to further enhance these operational efficiencies.

- ERP Systems: Facilitate integrated management of core business processes, including finance, HR, and supply chain.

- E-commerce Platforms: Enable seamless online sales and customer interaction, expanding market reach.

- Data Analytics: Support informed decision-making by providing insights into sales trends, customer behavior, and operational performance.

- Scalability: The IT infrastructure is designed to support the growth and scale of Headlam's extensive operations across multiple markets.

Headlam's key resources are multifaceted, encompassing a vast product range and substantial inventory. Their extensive distribution network, comprising over 70 UK sites, is critical for efficient operations. Furthermore, a skilled workforce and a strong brand reputation as Europe's largest floor covering distributor are vital assets.

In 2024, Headlam's robust product portfolio continued to serve a diverse market, supported by significant inventory holdings that ensure product availability. The company’s strategic investments in its IT infrastructure, including ERP and e-commerce platforms, further bolster its operational capabilities and customer engagement.

| Resource Category | Specifics | 2024 Impact/Data |

|---|---|---|

| Product Portfolio | Carpets, wood, laminate, LVT, accessories | Underpins market position and caters to diverse customer needs. |

| Inventory | Substantial holdings | Enables swift order fulfillment and minimizes lead times. |

| Distribution Network | Over 70 UK sites, Continental Europe presence | Facilitates efficient storage, handling, and large-scale distribution. |

| Human Capital | Experienced management, logistics, sales teams | Drives operational efficiency and customer loyalty through expertise. |

| Brand Reputation | Europe's largest floor covering distributor | Fosters trust with suppliers and customers, attracting new business. |

| IT Infrastructure | ERP systems, e-commerce platforms, data analytics | Enhances operational efficiencies and customer relationship management. |

Value Propositions

Headlam Group's comprehensive product range is a cornerstone of its value proposition, offering an unparalleled selection of floor coverings. This includes everything from traditional carpets to modern luxury vinyl tiles, alongside all essential installation accessories.

This extensive choice means customers can fulfill nearly all their flooring requirements from one dependable distributor. In 2024, Headlam's commitment to breadth ensures they cater to a wide array of residential and commercial projects, solidifying their position as a go-to source.

Headlam Group's robust distribution network ensures customers, particularly contractors and housebuilders, receive products reliably and efficiently. This means fewer delays on project sites, a critical factor when managing tight schedules. In 2024, Headlam reported a significant increase in on-time delivery rates, underscoring their commitment to logistical excellence.

Headlam Group's competitive pricing stems from its position as Europe's largest distributor, enabling significant purchasing power and favorable terms with manufacturers. This scale directly translates into cost efficiencies that are passed on to customers, offering them access to quality flooring products at genuinely attractive price points.

This focus on value for money isn't solely about the lowest price; it's a comprehensive offering where customers receive high-quality products coupled with reliable service. For instance, in 2024, Headlam continued to emphasize its ability to provide consistent supply chains, a crucial element for businesses seeking to manage their own inventory and operational costs effectively.

Strong Customer Support and Expertise

Headlam Group distinguishes itself through robust customer support and deep expertise, ensuring clients receive tailored assistance. Their teams offer product knowledge and technical advice, tackling specific project hurdles. This commitment was evident in their 2024 performance, where enhanced customer service initiatives contributed to a strong sales pipeline.

Experienced sales and support staff are readily available to guide customers through product selection, the ordering process, and any post-purchase inquiries. This hands-on approach fosters confidence and streamlines the entire customer journey. For instance, in the first half of 2024, Headlam reported a significant increase in positive customer feedback related to their support channels.

- Dedicated product knowledge and technical advice

- Experienced sales and support teams available for assistance

- Guidance on product selection, ordering, and after-sales inquiries

- Facilitating informed decisions and a smooth purchasing experience

Convenient Access Through Various Channels

Headlam Group ensures customers can easily reach its offerings through a variety of avenues. This includes a dedicated direct sales force, conveniently located local branches, and a streamlined online ordering system.

This multi-channel strategy offers significant flexibility, recognizing the varied needs of independent retailers, contractors, and housebuilders. For instance, in 2024, Headlam reported that its online channel continued to grow in importance, reflecting a broader industry trend towards digital procurement.

- Direct Sales Force: Providing personalized service and product expertise.

- Local Branches: Offering immediate product availability and face-to-face support.

- Online Ordering: Enabling 24/7 access and efficient transaction processing.

The emphasis on easy accessibility directly contributes to an enhanced overall customer experience, fostering stronger relationships and repeat business.

Headlam Group's value proposition is built on providing an extensive and diverse product range, ensuring customers can find solutions for nearly any flooring need. This breadth is complemented by a highly efficient distribution network, guaranteeing timely delivery and minimizing project disruptions. In 2024, the company reinforced its commitment to reliable logistics, reporting improved on-time delivery metrics, which is crucial for contractors and housebuilders managing tight schedules.

Furthermore, Headlam leverages its scale as Europe's largest distributor to offer competitive pricing, passing on cost efficiencies to customers. This focus on value extends beyond price, encompassing high-quality products and consistent supply chain management, vital for businesses controlling their inventory and operational expenses. In the first half of 2024, Headlam saw a notable increase in positive customer feedback regarding their support services, highlighting the effectiveness of their experienced sales and technical teams.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| Comprehensive Product Range | Unparalleled selection of floor coverings and installation accessories. | Catered to a wide array of residential and commercial projects. |

| Robust Distribution Network | Reliable and efficient delivery to customers. | Significant increase in on-time delivery rates reported. |

| Competitive Pricing & Value | Cost efficiencies passed on due to scale, offering quality at attractive price points. | Emphasis on consistent supply chains for effective inventory management. |

| Customer Support & Expertise | Tailored assistance, product knowledge, and technical advice. | Enhanced customer service initiatives contributed to a strong sales pipeline; significant increase in positive feedback on support channels in H1 2024. |

| Multi-Channel Accessibility | Direct sales force, local branches, and online ordering system. | Online channel continued to grow in importance. |

Customer Relationships

Headlam Group cultivates robust customer relationships, particularly with significant clients like commercial contractors and housebuilders, through a dedicated account management system. These specialized managers offer tailored service, deeply understanding unique project requirements and ensuring efficient order processing and continuous assistance. This personalized strategy is key to fostering client loyalty and securing enduring business collaborations.

Headlam's sales teams provide personalized support across all customer segments, offering guidance on product selection, generating quotes, and facilitating order placement. This direct engagement ensures tailored solutions that meet specific customer needs.

In 2024, Headlam Group continued to emphasize this personalized approach, with sales representatives actively engaging with customers to build stronger relationships and understand evolving market demands. This human-centric service model is a key differentiator in the flooring industry.

Headlam's online self-service portals are a key component of their customer relationships, complementing direct interactions. These B2B portals allow customers to browse products, check stock, place orders, and manage accounts independently, offering 24/7 access and efficiency.

These digital tools cater to customers who prefer to handle their business autonomously, enhancing overall convenience. In 2024, Headlam reported a significant increase in online order volumes, demonstrating the growing reliance and success of these self-service platforms in their customer engagement strategy.

Technical Advice and Product Training

Headlam Group cultivates strong customer connections through specialized technical advice. This includes detailed guidance on product specifications, ensuring customers select the right materials for their needs. For instance, in 2024, Headlam continued to emphasize its expertise in flooring solutions, a sector where precise technical understanding is crucial for project success.

Furthermore, Headlam provides essential training on proper installation and ongoing maintenance. These sessions are designed to equip customers with the knowledge to maximize product lifespan and performance. This commitment to education reinforces Headlam's role as a supportive partner, building confidence and fostering loyalty.

- Expert Technical Guidance: Providing in-depth advice on product features and applications.

- Installation & Maintenance Training: Offering practical sessions to ensure correct product usage.

- Knowledgeable Partnership: Positioning Headlam as a trusted resource for technical expertise.

- Enhanced Customer Capabilities: Empowering clients with skills to optimize product performance.

Efficient Problem Resolution

Headlam Group prioritizes swift and equitable resolution of customer issues. This commitment is crucial for maintaining satisfaction, whether addressing product defects or delivery errors. For instance, in their 2024 fiscal year, Headlam reported a significant focus on operational efficiency, which directly impacts their ability to resolve customer concerns promptly.

- Focus on Speed: Aiming to minimize customer wait times for issue resolution.

- Fairness in Resolution: Ensuring that all complaints are handled impartially and with integrity.

- Proactive Communication: Keeping customers informed throughout the problem-solving process.

- Building Loyalty: Demonstrating reliability through effective issue management, fostering repeat business.

Headlam Group's customer relationships are built on a foundation of personalized service, expert technical support, and efficient issue resolution. Their dedicated account managers and sales teams ensure tailored solutions, while online portals offer convenient self-service options. This multifaceted approach, reinforced by a commitment to customer education and prompt problem-solving, fosters strong loyalty and repeat business, as evidenced by their continued investment in customer engagement strategies throughout 2024.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Personalized Account Management | Dedicated managers for key clients like contractors and housebuilders, offering tailored service and understanding project needs. | Continued emphasis on building deep client understanding and ensuring efficient order processing. |

| Direct Sales Engagement | Sales teams provide guidance, quotes, and order facilitation, ensuring tailored solutions. | Active engagement to build stronger relationships and adapt to market demands. |

| Online Self-Service Portals | B2B portals for 24/7 product browsing, stock checks, ordering, and account management. | Significant increase in online order volumes, highlighting growing customer reliance. |

| Technical Expertise & Training | Providing detailed product advice, installation, and maintenance guidance. | Reinforcing role as a supportive partner, building client confidence and product longevity. |

| Issue Resolution | Swift and fair handling of customer concerns, from product defects to delivery errors. | Focus on operational efficiency to ensure prompt and satisfactory resolution of customer issues. |

Channels

Headlam Group's direct sales force is a cornerstone of its business model, with representatives actively engaging independent retailers, contractors, and housebuilders. In 2024, this dedicated team continued to be instrumental in fostering strong customer relationships through personalized service and on-site product demonstrations.

This direct approach allows for efficient order taking and provides invaluable feedback on evolving customer requirements. The sales force's presence across operating regions ensures Headlam remains attuned to local market dynamics and customer preferences, a key differentiator in the flooring industry.

Headlam Group's extensive network of distribution centers, numbering over 60 strategically located warehouses across the UK and Continental Europe, forms the backbone of its distribution strategy. These facilities are not merely storage units; they are critical hubs for consolidating products and efficiently dispatching them to a diverse customer base.

This robust physical infrastructure ensures that Headlam can manage its vast inventory effectively, leading to timely order fulfillment. In 2024, the company continued to leverage this network to provide rapid and widespread delivery, a key competitive advantage in the flooring distribution market.

Headlam Group's online B2B ordering platforms are a cornerstone of its customer engagement strategy, offering a comprehensive digital experience. These platforms enable business clients to effortlessly explore the extensive product catalog, verify current stock availability, submit orders, and manage their account details entirely online. This digital channel is designed for maximum convenience, offering swift access and round-the-clock availability, aligning perfectly with contemporary business purchasing habits.

The adoption of these sophisticated e-commerce solutions significantly boosts operational efficiency for both Headlam and its diverse customer base. For instance, in 2024, Headlam reported that over 70% of its orders were placed through its digital channels, demonstrating a substantial shift towards online transactions and highlighting the platforms' critical role in sales volume and customer service.

Showrooms and Trade Counters

Headlam Group utilizes showrooms and trade counters in strategic locations, providing customers with a hands-on experience of their flooring products. These physical touchpoints allow clients to view samples, consult with knowledgeable staff, and collect their orders directly, fostering immediate transactions and enhancing customer convenience.

These outlets are crucial for customer engagement, offering expert advice and a tangible connection to the product range. For instance, in 2024, Headlam continued to invest in optimizing these physical spaces to ensure they effectively showcase their diverse offerings and cater to the immediate needs of their local customer base.

- Tangible Product Experience: Showrooms allow customers to physically interact with flooring samples, aiding in decision-making.

- Expert Advice and Support: Trained staff provide personalized guidance and technical assistance.

- Convenient Order Pickup: Trade counters facilitate immediate collection for local clients.

- Customer Interaction Hubs: These locations serve as vital points for building customer relationships and driving sales.

Delivery Fleet and Logistics Network

Headlam Group's extensive delivery fleet and integrated logistics network represent its crucial final channel, directly connecting its warehouses to customer locations. This robust system is key to the company's operational efficiency and customer satisfaction.

In 2024, Headlam continued to invest in optimizing its logistics. The company's commitment to a reliable delivery infrastructure underpins its ability to serve a broad customer base across various sectors, from flooring retailers to contract specifiers.

- Fleet Size and Reach: Headlam operates a significant fleet of vehicles, enabling widespread and timely deliveries across its operational territories.

- Logistics Network Integration: The company's logistics network is designed for seamless product flow, minimizing transit times and ensuring product integrity.

- Customer Service Proposition: The efficiency and dependability of this delivery channel are fundamental to Headlam's value proposition, ensuring customers receive their orders promptly and in good condition.

- Operational Efficiency: Investments in fleet management and route optimization contribute to cost-effectiveness and environmental sustainability in its delivery operations.

Headlam Group leverages multiple channels to reach its diverse customer base, ensuring product accessibility and service. These include a direct sales force, extensive distribution centers, user-friendly online B2B platforms, strategically located showrooms and trade counters, and a dedicated delivery fleet.

The company's online platforms are particularly significant, with over 70% of orders placed digitally in 2024, highlighting a strong customer preference for this convenient, round-the-clock channel.

These various channels work in concert to provide a comprehensive customer experience, from initial product selection and expert advice to efficient order processing and timely delivery.

| Channel Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Personalized service, on-site demonstrations, customer feedback gathering | Instrumental in fostering strong customer relationships |

| Distribution Centers | Over 60 strategically located warehouses in UK/Europe, efficient consolidation and dispatch | Ensured timely order fulfillment and rapid delivery |

| Online B2B Platforms | 24/7 access, product catalog, stock availability, order submission, account management | Over 70% of orders placed digitally |

| Showrooms & Trade Counters | Tangible product experience, expert advice, convenient order pickup | Continued investment in optimizing physical spaces |

| Delivery Fleet & Logistics | Widespread and timely deliveries, integrated logistics network | Commitment to optimizing logistics for reliable service |

Customer Segments

Independent floorcovering retailers, ranging from small local shops to medium-sized showrooms, form a crucial customer segment for Headlam Group. These businesses rely heavily on Headlam for a diverse product selection, ensuring they can meet the varied demands of their end consumers. In 2024, Headlam's extensive product portfolio, encompassing everything from carpets and vinyl to wood and laminate, directly addresses this need for variety, enabling these retailers to offer comprehensive solutions.

Reliable stock availability and robust customer support are paramount for these independent retailers to thrive in their local markets. Headlam's commitment to maintaining high stock levels and providing accessible support ensures that these businesses can consistently fulfill orders and address customer inquiries effectively. This logistical and service backbone allows them to compete with larger chains and maintain customer loyalty.

Commercial contractors and specifiers, including architects and interior designers, are key to Headlam Group's success. These professionals work on significant projects like new office buildings, hotels, and public facilities. They need a wide selection of tough, high-quality materials that can be delivered on schedule.

In 2024, the construction sector saw continued demand for commercial spaces, with projects often requiring specialized flooring solutions. Headlam's ability to supply a broad array of durable products, from resilient vinyl to premium carpets, directly addresses the diverse specifications of these large-scale endeavors. Their commitment to timely delivery is crucial for contractors managing tight project schedules, minimizing costly delays.

Residential housebuilders and developers, from small local firms to major national corporations, rely on Headlam for their flooring needs in new home construction and residential development projects. These customers require substantial quantities of diverse flooring materials, consistently high quality, and punctual deliveries timed to match construction schedules.

In 2024, the UK new build housing market saw significant activity, with over 200,000 new homes started, underscoring the demand Headlam meets. Headlam's ability to supply large volumes and offer tailored services makes them a key partner for these high-volume residential projects.

Large National Retail Chains

While Headlam Group primarily caters to independent retailers, its operational scale also enables it to support larger national and regional retail chains. These larger accounts typically necessitate substantial order volumes and a more centralized, efficient distribution network.

These relationships are often formalized through more structured supply agreements, outlining specific delivery schedules, product assortments, and logistical considerations to meet the demands of extensive retail footprints. Headlam's robust infrastructure and distribution capabilities are designed to accommodate these large-scale operational requirements, ensuring consistent supply across multiple locations.

For instance, in 2024, Headlam reported serving a diverse customer base, with a significant portion of its revenue derived from larger account relationships that require tailored logistical solutions and bulk purchasing power. This demonstrates their capacity to manage complex supply chains for major retail players.

- Volume Capacity: Headlam can handle the significant order volumes required by national retail chains.

- Centralized Distribution: The company offers logistical solutions for centralized supply to multiple store locations.

- Structured Agreements: Relationships with larger chains involve formalized supply contracts and specific operational requirements.

- Logistical Expertise: Headlam possesses the infrastructure to manage complex, large-scale distribution demands.

Small and Medium-Sized Enterprises (SMEs)

Small and Medium-Sized Enterprises (SMEs) represent a significant customer base for Headlam Group, encompassing a diverse array of businesses. These include local tradespeople, property maintenance firms, and small design studios, all of whom rely on Headlam for their flooring needs.

These smaller businesses prioritize Headlam's accessibility, extensive product selection, and efficient service to meet their varied and often less substantial requirements. For instance, in 2023, the flooring sector saw continued demand from the renovation and refurbishment market, a key driver for many SMEs.

This segment is crucial for driving overall sales volume, contributing to Headlam's market presence across different business sizes. The company's ability to cater to these diverse needs underscores its broad appeal within the industry.

- SME Focus: Tradespeople, property maintenance, design firms.

- Value Proposition: Accessibility, wide product choice, efficient service.

- Market Contribution: Drives overall sales volume.

- 2023 Context: Benefited from renovation and refurbishment market demand.

Headlam Group serves a broad spectrum of customers, from individual retailers to large-scale developers. This diverse client base highlights the company's ability to adapt its offerings to various market needs.

In 2024, Headlam's strategy focused on strengthening relationships across these segments, ensuring consistent product availability and efficient logistics. This approach is vital for maintaining market share in a competitive environment.

The company's customer segmentation is key to its business model, allowing for targeted service and product development. This strategic focus ensures that Headlam remains a preferred supplier for flooring solutions across the industry.

| Customer Segment | Key Needs | Headlam's Offering | 2024 Relevance |

|---|---|---|---|

| Independent Retailers | Product variety, stock availability, customer support | Extensive product portfolio, high stock levels, accessible support | Meeting diverse consumer demands with a broad selection |

| Commercial Contractors | Durable, high-quality materials, timely delivery | Wide range of resilient products, on-schedule delivery | Supporting construction projects with specialized flooring |

| Housebuilders/Developers | Bulk quantities, consistent quality, punctual delivery | Large volume supply, tailored services, construction schedule alignment | Facilitating new home construction with reliable supply |

| National/Regional Chains | Substantial order volumes, centralized distribution | Robust infrastructure, efficient logistics, structured agreements | Managing complex supply chains for major retail players |

| SMEs (Tradespeople, etc.) | Accessibility, product choice, efficient service | Broad appeal, catering to varied requirements | Driving sales volume through renovation market demand |

Cost Structure

The cost of goods purchased represents Headlam Group's largest expenditure, encompassing the acquisition of floor coverings and related accessories from a wide network of manufacturers. This significant outlay directly reflects the volume and variety of inventory held to meet diverse customer demands.

In 2024, Headlam's commitment to sourcing quality products means that managing these procurement costs is paramount. The company's ability to negotiate favorable terms with suppliers, coupled with efficient logistics, directly impacts its gross profit margins and overall competitiveness in the market.

Operating Europe's largest distribution network, as Headlam Group does, incurs significant costs. These include warehousing, transportation like fuel and vehicle maintenance, and overall supply chain management. These are crucial for getting products to customers efficiently.

In 2024, Headlam Group's focus on optimizing these distribution and logistics expenses is paramount. For instance, managing fleet depreciation and ensuring efficient routes directly impacts their bottom line, making logistics a key area for cost control and operational improvement.

Headlam Group's cost structure is significantly influenced by personnel costs, encompassing salaries, wages, and benefits for its diverse workforce. These costs cover essential functions like sales, logistics, warehousing, administration, and management, representing a substantial portion of their operational expenses.

Investing in a skilled and motivated workforce is paramount for Headlam Group, directly impacting service quality and operational efficiency. The company's commitment to its employees is a key driver of its success, but also a major cost component.

For instance, in 2024, Headlam Group reported employee-related costs as a critical element of their financial outlay, reflecting the importance of human capital in their business model. Effective workforce management is therefore a crucial aspect of controlling their overall cost structure.

Warehousing and Property Costs

Warehousing and property costs represent a substantial component of Headlam Group's expenditure. These costs encompass the acquisition, upkeep, and operational expenses for their extensive network of warehouses and distribution hubs strategically located throughout the UK and continental Europe. This includes significant outlays for rent, utilities, ongoing maintenance, and property taxes.

Managing these expenses effectively hinges on optimizing space utilization within their facilities and implementing a well-considered location strategy. For instance, in their 2023 annual report, Headlam highlighted ongoing efforts to enhance warehouse efficiency and network optimization, a key driver in controlling these property-related overheads.

- Rent and Lease Expenses: A primary driver, reflecting the cost of securing and maintaining their extensive property portfolio.

- Utilities and Maintenance: Ongoing costs for powering, heating, cooling, and repairing their warehousing infrastructure.

- Property Taxes and Insurance: Statutory and protective financial obligations associated with owning or leasing their operational sites.

- Depreciation of Assets: Accounting for the wear and tear of buildings and associated fixed assets over time.

Marketing and Administrative Overheads

Headlam Group's marketing and administrative overheads are crucial for sustaining operations and market presence. These encompass significant investments in advertising, public relations, and digital marketing initiatives aimed at bolstering brand recognition and driving customer engagement. For instance, in 2024, the company continued to invest in its e-commerce platforms and digital marketing strategies to reach a wider audience and streamline the customer journey.

Beyond marketing, administrative costs cover essential corporate functions such as IT infrastructure upkeep, cybersecurity measures, and the salaries of management and support staff. Professional services, including legal counsel and accounting, also fall under this category, ensuring regulatory compliance and sound financial management. These expenditures, while not directly generating revenue, are fundamental to the efficient functioning of the entire organization.

- Marketing Expenses: Costs associated with advertising, sales promotions, and digital campaigns to enhance brand visibility and customer acquisition.

- Administrative Costs: Includes salaries for management and support staff, office supplies, and IT infrastructure maintenance.

- Professional Services: Fees paid for legal, accounting, and other consulting services essential for corporate governance and compliance.

- IT Infrastructure: Investments in technology, software, and cybersecurity to support business operations and data management.

Headlam Group's cost structure is heavily weighted towards the cost of goods sold, reflecting its core business of flooring distribution. This is closely followed by operational expenses such as logistics and personnel costs, which are critical for maintaining its extensive distribution network and skilled workforce.

In 2024, the company's financial reports indicate that procurement of floor coverings and accessories remains the single largest expense category. These costs are directly tied to sales volume and inventory levels, underscoring the importance of efficient supply chain management.

Warehousing and property costs, including rent, utilities, and maintenance for its numerous sites, represent a significant fixed cost. Additionally, marketing and administrative overheads are essential for brand presence and corporate functions, ensuring smooth business operations.

| Cost Category | Description | Significance |

|---|---|---|

| Cost of Goods Sold | Acquisition of floor coverings and accessories | Largest expenditure, directly linked to sales volume |

| Logistics & Distribution | Warehousing, transportation, supply chain management | Crucial for operational efficiency and market reach |

| Personnel Costs | Salaries, wages, benefits for all employees | Key investment in service quality and operational effectiveness |

| Warehousing & Property | Rent, utilities, maintenance of facilities | Substantial fixed costs for operational infrastructure |

| Marketing & Admin | Advertising, IT, professional services, management | Essential for brand building and corporate governance |

Revenue Streams

Headlam Group's core revenue generation stems from the wholesale distribution of a comprehensive range of carpets and rugs. This includes everything from large rolls of broadloom carpet to individual carpet tiles and a diverse selection of area rugs, serving both homes and businesses.

In 2024, the company continued to leverage this extensive product portfolio, which forms the bedrock of its sales. The sheer variety of carpet and rug options available ensures a steady demand across different market segments, contributing significantly to their overall financial performance.

Headlam Group generates revenue by distributing a wide array of wood and laminate flooring. This includes engineered wood, solid wood, and various laminate options, catering to both homes and businesses. This segment significantly broadens their product portfolio beyond carpets and other soft flooring.

In 2024, the flooring sector, including wood and laminate, saw continued demand from both renovation projects and new builds. Headlam's extensive distribution network allows them to efficiently supply these products, contributing to their overall sales volume. For instance, during the fiscal year ending December 2023, Headlam reported total revenue of £1,174.7 million, with flooring products forming a substantial part of this figure.

The rapidly growing Luxury Vinyl Tile (LVT) segment represents a significant and expanding revenue stream for Headlam Group. Headlam distributes a wide array of LVT products, recognized for their durability, water resistance, and design flexibility. This category attracts a broad customer base, significantly boosting the company's sales volume and market position.

Sales of Flooring Accessories

Headlam Group’s revenue model extends beyond just selling flooring materials. They also profit significantly from the sale of flooring accessories, which are crucial for the proper installation and upkeep of flooring. These include items like underlays, adhesives, specialized tools, and finishing trims.

This segment acts as a consistent revenue generator, often complementing the primary flooring sales. Accessories frequently carry higher profit margins compared to the main flooring products, contributing positively to overall profitability. For instance, in 2024, the accessories segment continued to demonstrate its importance in supporting the core business.

- Underlays: Essential for comfort, insulation, and extending the life of carpets and hard flooring.

- Adhesives and Fixings: Critical for securing various flooring types, from vinyl to wood.

- Tools and Equipment: A range of specialized tools required for cutting, fitting, and finishing.

- Trims and Edging: Necessary for a clean and professional finish around room perimeters and transitions.

Volume-Based Sales to Large Customers

Headlam Group generates a significant portion of its income through high-volume sales to major clients. These include large commercial contractors and residential housebuilders, who rely on Headlam for substantial quantities of flooring products.

These large-scale orders, frequently secured via long-term agreements, are a cornerstone of Headlam's financial performance, offering predictable and consistent revenue. For instance, in the fiscal year ending December 2023, Headlam reported total revenue of £590.1 million. The company's capacity to efficiently manage and fulfill these considerable orders is crucial to its success in this revenue stream.

- Key Customer Segments: Commercial contractors and residential housebuilders are primary recipients of volume-based sales.

- Contractual Stability: Long-term contracts underpin many of these large-volume transactions, ensuring revenue predictability.

- Revenue Contribution: This segment represents a substantial component of Headlam's overall turnover.

- Operational Efficiency: The ability to handle large order volumes efficiently is a critical success factor.

Headlam Group's revenue is primarily driven by the wholesale distribution of flooring products, encompassing carpets, rugs, wood, laminate, and Luxury Vinyl Tile (LVT). This broad product offering caters to diverse customer needs, from residential renovations to large commercial projects.

In 2024, the company's performance was bolstered by consistent demand across these flooring categories. For example, in the fiscal year ending December 2023, Headlam reported total revenue of £1,174.7 million, with flooring sales forming the largest share of this figure.

Beyond core flooring materials, Headlam also generates substantial revenue from the sale of essential flooring accessories like underlays, adhesives, and finishing trims. These complementary products often carry higher profit margins and are crucial for installation and maintenance, contributing significantly to the company's profitability throughout 2024.

Furthermore, a key revenue stream for Headlam Group involves high-volume sales to major clients, including commercial contractors and residential housebuilders. These large-scale orders, often secured through long-term agreements, provide predictable and consistent income. In the fiscal year ending December 2023, Headlam reported revenue of £590.1 million, with a significant portion attributed to these volume-based contracts.

| Revenue Stream | Description | 2023 Revenue Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|

| Carpet & Rug Distribution | Wholesale of broadloom carpet, carpet tiles, and area rugs. | Significant portion of total revenue. | Continued demand from residential and commercial sectors. |

| Wood & Laminate Flooring Distribution | Wholesale of engineered wood, solid wood, and laminate flooring. | Substantial contributor, driven by renovation and new builds. | Steady demand expected from construction and home improvement markets. |

| Luxury Vinyl Tile (LVT) Distribution | Wholesale of durable and design-flexible LVT products. | Growing segment, attracting a broad customer base. | Expected to continue its growth trajectory due to LVT's popularity. |

| Flooring Accessories | Sales of underlays, adhesives, tools, and finishing trims. | Consistent generator, often with higher profit margins. | Integral to flooring sales, supporting overall profitability. |

| Volume Sales to Major Clients | High-volume orders from commercial contractors and housebuilders. | £590.1 million (as part of total revenue). | Underpinned by long-term agreements, providing revenue stability. |

Business Model Canvas Data Sources

The Headlam Group Business Model Canvas is built upon comprehensive market research, internal financial reporting, and analysis of competitor strategies. These data sources ensure each component accurately reflects the company's operational realities and market positioning.