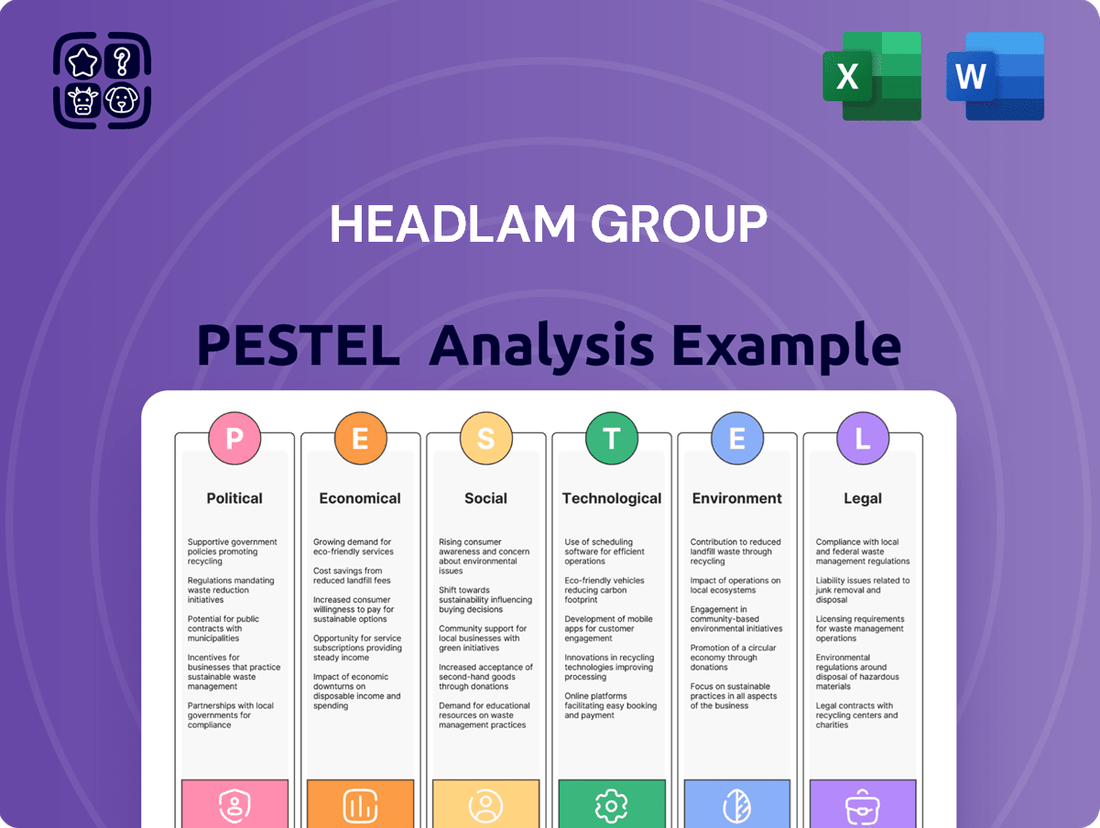

Headlam Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Headlam Group's strategic direction. Our PESTLE analysis provides a deep dive into these external forces, empowering you to anticipate market shifts and identify opportunities. Gain a competitive edge by understanding the full landscape. Download the complete PESTLE analysis now for actionable intelligence.

Political factors

Government housing policies significantly shape the demand for floor coverings. Initiatives like the UK's Stamp Duty Holiday, which concluded in September 2022, temporarily boosted property transactions and, consequently, demand for flooring. Similarly, ongoing affordable housing targets and potential future help-to-buy schemes directly influence the volume of residential flooring sales for companies like Headlam Group.

Post-Brexit trade regulations continue to shape Headlam Group's operational landscape. The UK's departure from the EU introduced new tariffs and non-tariff barriers, impacting the cost and efficiency of importing and exporting flooring products. For instance, the UK government's 2024 trade statistics indicate a notable shift in import/export volumes for certain goods, which could affect Headlam's sourcing and distribution networks.

These evolving trade policies directly influence Headlam's supply chain, potentially leading to longer lead times and increased operational expenses. Navigating these complexities is vital for maintaining competitive pricing and ensuring product availability for customers across its markets. The company's ability to adapt to these regulatory shifts is a key determinant of its ongoing financial performance.

Governments continually update building and construction regulations, influencing the types of flooring Headlam Group can offer. For instance, evolving safety standards and material specifications, such as increased fire retardancy requirements in commercial spaces, directly impact product development and compliance. Failure to meet these mandates, like those enforced by the Health and Safety Executive (HSE) in the UK, can lead to significant penalties and market exclusion.

Competition Policy and Anti-Trust Laws

Competition authorities, like the UK's Competition and Markets Authority (CMA), play a crucial role in overseeing fair market practices. For Headlam Group, a significant player in the flooring distribution sector, adherence to these regulations is paramount. The CMA's ongoing scrutiny of market concentration and potential anti-competitive behavior directly impacts how Headlam can approach its business, from pricing strategies to potential mergers and acquisitions. For instance, the CMA's investigations into sector-specific practices can set precedents that influence Headlam's operational flexibility.

Existing anti-trust laws can shape Headlam's strategic decisions, particularly concerning market share and pricing. Any shifts in regulatory enforcement or the introduction of new legislation could necessitate adjustments to Headlam's business model. For example, a stricter stance on vertical integration or exclusive distribution agreements could limit Headlam's ability to secure preferential terms with suppliers or customers, potentially impacting its competitive edge. The CMA's recent focus on digital markets and platform competition, while not directly Headlam's core business, signals a broader trend of increased regulatory oversight across various industries.

- Regulatory Oversight: The CMA actively monitors markets to prevent monopolies and ensure fair competition, impacting Headlam's strategic planning.

- Market Strategy Influence: Anti-trust laws dictate Headlam's approach to acquisitions, pricing, and distribution agreements.

- Operational Freedom: New or intensified legislation can restrict Headlam's operational autonomy and market access.

- Industry Trends: Broader regulatory trends, such as those in digital markets, indicate a climate of increased scrutiny that could indirectly affect Headlam.

Labour Market Policies

Government policies on minimum wage, worker rights, and immigration significantly influence Headlam Group's operational costs and the availability of its workforce. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting labor expenses. Similarly, shifts in immigration policies can affect the pool of potential employees, particularly in sectors reliant on migrant labor, influencing recruitment and retention strategies.

Labor flexibility regulations, such as those pertaining to zero-hours contracts or agency worker rights, also play a crucial role. These can affect Headlam's ability to manage its workforce efficiently and respond to fluctuating demand across its UK and European markets. For example, stricter regulations on temporary contracts might necessitate higher fixed labor costs.

Changes in these labor market policies can directly impact Headlam's profitability by altering employee compensation, benefits, and the overall cost of employing staff. The company must remain adaptable to these evolving legislative landscapes to maintain its competitive edge and manage its financial performance effectively.

- Minimum Wage Impact: The UK's National Living Wage hike to £11.44/hour (April 2024) directly increases Headlam's payroll costs for eligible employees.

- Immigration Policy Influence: Stricter immigration rules could limit access to a broader labor pool, potentially driving up recruitment costs or necessitating investment in training domestic workers.

- Labor Flexibility: Regulations affecting the use of temporary or agency staff can impact Headlam's ability to scale its workforce according to seasonal demand, influencing operational flexibility and cost management.

- Profitability Link: Alterations in labor laws and wage mandates directly affect Headlam's cost structure, with potential ramifications for profit margins if not strategically managed.

Government housing policies continue to be a significant driver for Headlam Group, influencing demand through initiatives like potential future help-to-buy schemes and affordable housing targets, directly impacting residential flooring sales volumes.

Post-Brexit trade regulations present ongoing challenges, with new tariffs and non-tariff barriers affecting the cost and efficiency of importing and exporting flooring products, as evidenced by shifts in UK trade statistics in 2024.

Evolving building and construction regulations, such as increased fire retardancy requirements, directly impact Headlam's product development and compliance, with non-adherence risking penalties.

Regulatory oversight from bodies like the CMA influences Headlam's market strategy, pricing, and potential acquisitions, while labor policies, including the UK's National Living Wage increase to £11.44 per hour (April 2024), directly affect operational costs and workforce availability.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting the Headlam Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by identifying both challenges and growth prospects within the Headlam Group's operating landscape.

A Headlam Group PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning.

Economic factors

High inflation in the UK, with CPI reaching 7.9% in the year to June 2024, directly increases Headlam's operational costs. This includes expenses for logistics, energy, and potentially raw materials, which could put pressure on their profit margins.

The Bank of England's base rate, standing at 5.25% as of late 2024, has risen significantly from previous years. This increase in interest rates can dampen consumer spending on discretionary items like home improvements, a key market for Headlam, and also makes borrowing more expensive for the company, potentially affecting investment plans and overall demand.

Consumer spending is a major engine for Headlam Group, directly impacting their residential sales. When the economy is strong and people feel confident about their financial futures, they're more likely to invest in home renovations or buy new homes, both of which drive demand for floor coverings. For instance, in early 2024, consumer confidence surveys indicated a gradual improvement, suggesting a potential uplift in discretionary spending on home improvement projects.

Disposable income plays a crucial role in determining which types of floor coverings consumers purchase. As disposable incomes rise, consumers tend to move towards higher-quality, premium products. Conversely, during periods of economic strain, demand shifts towards more budget-friendly options. In the UK, average weekly earnings saw a real-terms increase in late 2023, which could translate to a greater appetite for mid-to-high-end flooring solutions for Headlam.

The construction industry's performance is a critical driver for Headlam Group. In 2024, the UK construction sector experienced a mixed performance, with new housing starts facing headwinds, though commercial and infrastructure projects showed some resilience. For instance, the Office for National Statistics reported a 1.1% increase in construction output in Q1 2024 compared to the previous quarter, but year-on-year growth remained modest.

Continental Europe presents a similar picture, with varying degrees of activity across different markets. While some regions saw robust growth in commercial property development, others grappled with rising material costs and labor shortages impacting project timelines. This uneven landscape directly influences Headlam's sales potential in these key European markets.

A slowdown in new residential builds and commercial developments, such as office spaces or retail units, directly curtails the demand for flooring solutions. Conversely, a healthy pipeline of construction projects, particularly in the UK and key European economies, translates into increased sales opportunities for Headlam's extensive product range.

Exchange Rate Fluctuations

Headlam Group's operations spanning the UK and Continental Europe mean it's directly affected by shifts in exchange rates, especially between the British Pound (GBP) and the Euro (EUR). For instance, if the Pound weakens against the Euro, Headlam's costs for sourcing products from Eurozone countries will rise, directly impacting its cost of goods sold. Conversely, a stronger Pound can make its UK-sourced products more expensive for European customers, potentially dampening sales volumes in those markets.

These currency movements can significantly sway Headlam's financial results. A notable example from recent financial reporting, such as that in late 2024 or early 2025, would likely highlight how currency headwinds or tailwinds have influenced reported revenues and profit margins. For example, if Headlam reports its results in GBP, a depreciation of the Euro would reduce the GBP value of its European sales, while an appreciation of the Euro would boost them. This volatility necessitates careful financial planning and hedging strategies to mitigate potential negative impacts.

- GBP/EUR Volatility: Fluctuations between the Pound Sterling and the Euro directly impact Headlam's cross-border transactions.

- Import Costs: A weaker GBP increases the Sterling cost of materials and finished goods sourced from Eurozone countries.

- Revenue Translation: A weaker Euro reduces the Sterling value of revenues generated from sales within the Eurozone.

- Profitability Impact: Adverse currency movements can erode profit margins by increasing costs or decreasing the value of foreign earnings.

Housing Market Trends

The volume of housing transactions, new housing starts, and overall market stability are crucial economic indicators for Headlam Group. A strong housing market, marked by robust transaction activity, directly fuels demand for flooring products, both for new builds and renovations. For instance, in the UK, while housing transactions saw a dip in early 2024 compared to the previous year, the market is showing signs of stabilization, with mortgage rates easing, potentially encouraging more activity later in 2024 and into 2025.

New housing starts are also a key driver. A healthy pipeline of new construction projects translates into a consistent demand for floor coverings. In 2023, new housing starts in the UK experienced a decline, reflecting broader economic headwinds. However, government initiatives aimed at boosting construction and addressing housing shortages could see an uptick in starts through 2024 and 2025, presenting a positive outlook for Headlam.

The stability of the housing market influences consumer confidence and discretionary spending. When the market is stable and property values are perceived as secure, homeowners are more likely to invest in home improvements, including new flooring. Conversely, market uncertainty can lead to postponed spending. The Bank of England's monetary policy decisions, particularly regarding interest rates, will continue to play a significant role in housing market stability and, by extension, Headlam's performance.

- Housing Transaction Volumes: UK property transactions in Q1 2024 were down year-on-year, but analysts anticipate a gradual recovery as economic conditions improve.

- New Housing Starts: The Office for National Statistics reported a decrease in new build output in late 2023, with forecasts for 2024 and 2025 dependent on economic recovery and policy support.

- Market Stability: Fluctuations in mortgage interest rates directly impact buyer affordability and market sentiment, affecting demand for housing and related renovations.

- Consumer Confidence: A stable housing market generally correlates with higher consumer confidence, encouraging investment in home improvements like flooring.

Economic factors significantly shape Headlam Group's operating environment, influencing everything from consumer spending to construction activity. Persistent inflation, with UK CPI hovering around 7.9% in mid-2024, directly escalates operational costs for Headlam, impacting logistics and energy expenses. Furthermore, the Bank of England's elevated base rate of 5.25% as of late 2024 can curb consumer spending on home improvements and increase borrowing costs for the company.

Consumer confidence, showing tentative signs of improvement in early 2024, is a vital indicator for Headlam's residential sales, as it correlates with discretionary spending on home renovations. Similarly, shifts in disposable income, with real-term increases in average weekly earnings in late 2023, suggest a potential move towards higher-quality flooring products. The construction sector's performance, while mixed in early 2024 with modest year-on-year growth in output, remains a critical driver, with new housing starts facing challenges but commercial projects showing some resilience.

Currency exchange rates, particularly GBP/EUR volatility, directly affect Headlam's profitability. A weaker Pound Sterling increases the cost of Eurozone imports and reduces the Sterling value of European sales, necessitating robust financial planning. The housing market's health, evidenced by transaction volumes and new housing starts, is paramount; while UK housing transactions saw a dip in early 2024, stabilization and potential recovery are anticipated as mortgage rates ease, potentially boosting demand for Headlam's products through 2024 and 2025.

| Economic Factor | Impact on Headlam Group | Relevant Data (2023-2025) |

|---|---|---|

| Inflation (UK CPI) | Increases operational costs (logistics, energy) | 7.9% (year to June 2024) |

| Interest Rates (BoE Base Rate) | Dampens consumer spending, increases borrowing costs | 5.25% (late 2024) |

| Consumer Confidence | Drives residential sales and home improvement spending | Gradual improvement noted (early 2024) |

| Disposable Income | Influences demand for premium vs. budget flooring | Real-terms increase in average weekly earnings (late 2023) |

| Construction Output (UK) | Directly impacts demand for flooring solutions | 1.1% increase in Q1 2024 (vs. previous quarter); modest year-on-year growth |

| Housing Transactions (UK) | Key indicator for new builds and renovations | Down year-on-year in Q1 2024, anticipating recovery |

| New Housing Starts (UK) | Drives consistent demand for floor coverings | Declined in 2023; forecasts for 2024-2025 dependent on recovery |

| GBP/EUR Exchange Rate | Affects import costs and revenue translation | Volatility noted, impacting cross-border transactions |

Full Version Awaits

Headlam Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Headlam Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Consumer lifestyles are in constant flux, directly impacting demand for flooring. For instance, a growing preference for open-plan living spaces means homeowners are seeking cohesive flooring solutions that flow seamlessly between rooms. Headlam Group needs to ensure its product range caters to this, offering options that provide both aesthetic appeal and durability for high-traffic areas. Data from 2024 indicates a continued strong interest in natural wood looks and sustainable materials, with sales in these categories outperforming expectations.

The demand for flooring that is both easy to maintain and long-lasting is also a significant trend. Busy modern lifestyles mean consumers are less inclined to invest time in complex upkeep. This pushes Headlam to focus on products with enhanced scratch resistance and simple cleaning requirements. In 2025, reports suggest that up to 65% of new flooring purchases are influenced by ease of maintenance, a key consideration for homeowners and commercial clients alike.

Demographic shifts significantly influence the flooring market. For instance, the aging population in many developed countries, including the UK, may lead to increased demand for flooring solutions that prioritize safety and ease of maintenance, such as non-slip surfaces. In 2023, the UK's population aged 65 and over reached approximately 14.5 million, representing nearly 22% of the total population, a trend expected to continue.

Urbanization also plays a crucial role. As more people move to cities, there's a greater demand for flooring in apartments and smaller living spaces, potentially favoring more compact or easily installed products. Urban populations in the UK have been steadily increasing, with over 84% of the population residing in urban areas as of 2022, a figure projected to grow.

Changes in household formation, such as smaller family sizes or an increase in single-person households, can also alter purchasing patterns for flooring. This might mean a shift towards products suitable for smaller rooms or a greater emphasis on aesthetic appeal for individual living spaces. The number of households in the UK continued to rise, with an estimated 29.7 million households in 2023.

The increasing popularity of DIY home improvement projects can impact flooring retailers like Headlam. While Headlam focuses on trade, a surge in DIY could mean fewer small independent retailers, who often cater to DIYers, are buying in bulk from them. For instance, in 2024, the home improvement market saw continued growth, with DIY projects remaining a significant segment, although professional installations also saw a rebound as skilled labor became more accessible.

Health and Well-being Consciousness

Consumers are increasingly prioritizing health and well-being, directly impacting purchasing decisions in the flooring industry. This heightened awareness extends to indoor air quality and the use of hypoallergenic materials, pushing demand for products that align with sustainable living principles. For Headlam Group, this translates into a growing market for floor coverings with low VOC emissions, natural fibers, and those holding recognized health and environmental certifications.

Meeting these evolving consumer expectations necessitates a strategic approach to product sourcing and development. Headlam needs to ensure its portfolio features options that cater to health-conscious individuals and those committed to eco-friendly lifestyles. For instance, the global market for green building materials, which includes eco-friendly flooring, was valued at approximately $230 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for companies that can adapt.

- Growing demand for low-VOC and hypoallergenic flooring solutions.

- Increased consumer preference for natural and sustainably sourced materials.

- Importance of health and environmental certifications in product selection.

- Market opportunity in the expanding green building materials sector.

Social Media and Digital Influence

Social media and digital platforms are increasingly shaping design preferences and product visibility within the flooring industry. This trend directly affects how Headlam's customer base, including retailers and contractors, promotes and distributes their products. For instance, a 2024 Statista report indicated that over 60% of consumers discover new home decor products through social media channels like Instagram and Pinterest.

Headlam can strategically utilize these digital avenues to bolster its customers' efforts. By providing easily accessible product details, up-to-date trend analysis, and ready-to-use marketing collateral via online portals or dedicated social media content, Headlam can empower its partners to better engage with end-consumers.

- Digital Discovery: A significant portion of consumers, estimated at 65% in early 2025 surveys, now rely on social media for interior design inspiration, impacting how flooring is perceived and chosen.

- Influencer Impact: Home renovation and interior design influencers on platforms like TikTok and YouTube are driving product awareness, with brands collaborating with them seeing an average uplift of 15-20% in engagement.

- E-commerce Integration: The seamless integration of social media with e-commerce allows for direct purchasing, meaning Headlam's partners need digital-first product information and visually appealing content to capitalize on this.

- Targeted Marketing: Digital channels enable highly targeted marketing campaigns, allowing Headlam to help its customers reach specific demographics interested in particular flooring styles or materials, a capability that saw a 25% increase in adoption by retailers in 2024.

Societal attitudes towards health and sustainability are increasingly influencing flooring choices. Consumers are actively seeking products with low volatile organic compound (VOC) emissions and hypoallergenic properties, aligning with a growing focus on indoor air quality. This trend is particularly evident in the 2024 market, where sales of eco-friendly flooring options saw a substantial increase, driven by consumer demand for healthier living environments.

The demographic makeup of the population directly impacts flooring needs. An aging demographic, for instance, creates a demand for flooring solutions that offer enhanced safety features, such as non-slip surfaces, and are easy to maintain. In the UK, individuals aged 65 and over constituted approximately 22% of the population in 2023, a segment expected to grow and influence product development.

Shifting lifestyle trends, such as the rise of open-plan living, necessitate flooring that provides aesthetic continuity and durability across different zones. Furthermore, the preference for low-maintenance materials is a significant driver, with ease of cleaning and upkeep being a key consideration for up to 65% of flooring purchases in 2025.

Digital platforms are now pivotal in shaping consumer preferences and product discovery. With a significant percentage of consumers, over 60% in 2024, finding new home decor ideas through social media, Headlam's partners must leverage these channels. This digital influence is further amplified by influencers, who can drive engagement and product awareness, highlighting the need for accessible, visually appealing product information.

Technological factors

Headlam's success hinges on its e-commerce and digital platform capabilities. By enhancing its B2B ordering systems, the company can significantly improve customer service and streamline its complex logistics network. For instance, a robust online portal, like the one Headlam has been developing, allows flooring retailers to easily browse products, check stock levels in real-time, and place orders efficiently, a critical factor in a fast-paced industry.

Investing in user-friendly digital tools is paramount for Headlam to cater to its diverse customer base, which includes independent retailers and larger commercial clients. These platforms not only boost operational efficiency but also serve as a vital channel for expanding market reach. In 2024, Headlam reported that its digital channels were increasingly contributing to sales growth, indicating a strong customer preference for online engagement and ordering convenience.

Headlam Group's operational efficiency is being reshaped by advancements in supply chain automation and artificial intelligence. The company is actively implementing automation within its warehouses, streamlining processes like picking, packing, and sorting. This move is crucial for managing Headlam's extensive product catalog and its wide-reaching distribution network, aiming to reduce manual labor and associated errors.

Furthermore, Headlam is leveraging AI for more accurate demand forecasting. By analyzing historical sales data, market trends, and even external factors like weather patterns, AI algorithms can predict customer needs with greater precision. This predictive capability is vital for optimizing inventory levels, minimizing stockouts, and reducing the costs associated with overstocking, thereby directly impacting profitability.

The optimization of logistics through advanced software is another key technological factor. These systems allow for real-time tracking of shipments, dynamic route planning, and efficient load consolidation. For Headlam, this translates to faster delivery times and reduced transportation costs, enhancing customer satisfaction and improving its competitive edge in the market. For instance, in 2024, companies investing in supply chain AI saw an average reduction in logistics costs by up to 15%.

Technological advancements are continuously reshaping the flooring industry, leading to innovative materials that offer enhanced durability, sustainability, and aesthetic qualities. For instance, advancements in Luxury Vinyl Tile (LVT) manufacturing have resulted in products that are more water-resistant and easier to maintain, appealing to a broader customer base. Headlam Group needs to closely monitor these developments to ensure its product offerings remain competitive and meet evolving consumer demands.

The integration of recycled content in carpets and the development of advanced, waterproof laminate flooring represent significant material innovations. These not only improve product performance but also address growing consumer interest in eco-friendly options. Staying ahead of these trends, such as the increasing use of bio-based polymers in flooring, is crucial for Headlam to maintain a modern and appealing product portfolio in the 2024-2025 period.

Data Analytics and Business Intelligence

Headlam Group is increasingly leveraging data analytics and business intelligence to refine its operations. This technology provides crucial insights into sales patterns, customer preferences, and inventory efficiency, enabling more informed strategic choices. For instance, by analyzing sales data, Headlam can optimize stock levels across its extensive network, reducing waste and ensuring product availability. This data-driven approach also allows for more personalized customer offerings, enhancing engagement and loyalty.

The company's investment in these analytical tools is designed to unlock significant operational efficiencies and identify emerging market opportunities. By understanding granular data, Headlam can pinpoint areas for improvement, such as supply chain logistics or marketing campaign effectiveness. This focus on data empowers the business to adapt proactively to market shifts and customer demands, a critical advantage in the competitive flooring sector.

- Sales Trend Analysis: Identifying which product lines and regions are performing best to inform purchasing and marketing strategies.

- Customer Behavior Insights: Understanding purchasing habits to tailor promotions and product assortments.

- Inventory Optimization: Using data to forecast demand and manage stock levels, minimizing holding costs and stockouts.

- Market Opportunity Identification: Analyzing market data to spot new trends or underserved customer segments.

Digital Marketing and Customer Engagement Tools

Headlam Group can leverage digital marketing technologies to better serve its independent retailers and contractors. Utilizing Customer Relationship Management (CRM) systems, for instance, allows for more personalized communication and support, fostering stronger business relationships. In 2023, Headlam reported that its digital channels saw continued growth, indicating a positive reception to its online presence and engagement strategies.

Targeted online advertising campaigns can significantly boost brand visibility and product awareness within specific market segments. This approach ensures that Headlam's offerings reach the most relevant audiences, driving potential leads for its retail partners. The company's investment in digital advertising is a key component of its strategy to expand its reach and support its B2B customer base.

Virtual product visualization tools offer a tangible benefit by allowing retailers and contractors to explore Headlam's extensive product ranges remotely. This capability streamlines the product selection process, saving time and resources. Such innovations are crucial in maintaining a competitive edge in the evolving distribution landscape, particularly as digital adoption accelerates across industries.

- Enhanced Retailer Support: CRM systems and digital tools improve communication and service for independent retailers.

- Increased Brand Visibility: Targeted online advertising expands Headlam's reach to relevant B2B customers.

- Streamlined Product Selection: Virtual visualization aids retailers in efficiently browsing and choosing products.

- Digital Channel Growth: Headlam's digital platforms experienced continued growth in 2023, reflecting successful online engagement.

Headlam's technological strategy centers on enhancing its digital platforms for improved B2B operations and customer engagement. By investing in advanced e-commerce and B2B ordering systems, the company aims to streamline logistics and boost customer service. For instance, in 2024, Headlam noted that its digital channels were increasingly driving sales, reflecting a clear customer preference for online convenience.

The company is also focusing on supply chain automation and AI for more accurate demand forecasting and inventory management. This technological push is designed to reduce operational costs and minimize errors across its extensive distribution network. In 2024, businesses leveraging AI in their supply chains reported average logistics cost reductions of up to 15%.

Furthermore, Headlam utilizes data analytics to gain insights into sales trends and customer behavior, enabling more informed strategic decisions and personalized offerings. This data-driven approach is crucial for optimizing stock levels and identifying new market opportunities in the competitive flooring sector.

Legal factors

Headlam Group must adhere to strict product safety and quality regulations across its markets, including European CE marking, fire safety standards, and chemical content limits for all floor coverings. Failure to comply can result in costly product recalls, significant legal liabilities, and severe damage to its brand reputation, underscoring the critical need for rigorous quality assurance and thorough supplier due diligence.

Headlam Group navigates a complex web of employment and labour laws across the UK and Continental Europe. These regulations cover crucial areas like minimum wage requirements, working hours, health and safety standards, and anti-discrimination provisions, all of which vary significantly by country. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over in April 2024, a key cost factor for businesses.

Compliance with these diverse legal frameworks is paramount for Headlam to prevent costly disputes, maintain positive employee relations, and ensure uninterrupted operations. Failure to adhere to these laws can lead to substantial fines, legal challenges, and reputational damage, impacting overall business performance and employee morale.

Headlam Group faces a growing challenge from increasingly stringent environmental regulations. These laws, covering everything from waste disposal and emissions to the chemicals used in flooring products, directly affect how Headlam manufactures and sources its goods. For instance, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is crucial for maintaining access to the European market, a significant area for the company.

Data Protection and Privacy Laws

Headlam Group must navigate a complex landscape of data protection and privacy laws, including the UK GDPR and the EU GDPR. These regulations mandate strict adherence to how customer, supplier, and employee data is collected, processed, and stored.

Failure to comply can lead to severe consequences. For instance, under GDPR, fines can reach up to €20 million or 4% of global annual turnover, whichever is higher. This underscores the critical need for Headlam to implement and maintain robust data security measures and transparent privacy policies to safeguard sensitive information and maintain stakeholder trust.

- Regulatory Compliance: Adherence to UK GDPR and EU GDPR is paramount for Headlam's data handling practices.

- Financial Penalties: Non-compliance can result in substantial fines, potentially reaching 4% of global annual turnover.

- Reputational Risk: Data breaches can severely damage customer trust and Headlam's brand reputation.

- Data Security Investment: Significant investment in cybersecurity infrastructure and employee training is necessary.

Contract Law and Consumer Rights

Headlam Group's operations are deeply intertwined with contract law, governing its extensive commercial agreements with suppliers, B2B customers, and logistics providers. These contracts ensure clarity on terms, payment schedules, and service level agreements, crucial for maintaining smooth supply chains and customer relationships. For instance, robust supplier contracts are vital for securing inventory, particularly in the competitive flooring market where reliable sourcing is key to meeting demand, which saw the UK flooring market valued at approximately £1.5 billion in 2024.

While Headlam primarily operates on a business-to-business (B2B) model, consumer rights legislation still exerts an indirect influence. This is particularly relevant when considering its retail partners, who must adhere to fair trading practices and provide clear terms and conditions to end consumers. Failure by retail partners to comply with regulations like the Consumer Rights Act 2015 in the UK, which mandates goods to be of satisfactory quality, fit for purpose, and as described, could impact Headlam's brand reputation and sales channels. In 2024, the UK government continued its focus on consumer protection, with ongoing reviews of digital markets and unfair commercial practices.

Key legal considerations for Headlam Group include:

- Contractual Compliance: Ensuring all B2B contracts with suppliers and customers meet legal requirements for enforceability and risk mitigation.

- Supply Chain Agreements: Negotiating and managing contracts with manufacturers and logistics firms to guarantee product availability and timely delivery, a critical factor in the £3.6 billion UK home improvement market in 2024.

- Indirect Consumer Protection: Monitoring the compliance of its retail partners with consumer protection laws to safeguard its brand image and sales channels.

- Regulatory Adherence: Staying abreast of evolving consumer protection legislation and adapting business practices accordingly to maintain fair trading standards.

Headlam Group's legal obligations extend to robust product safety and quality compliance, including CE marking and fire safety standards across its markets. Non-compliance risks costly recalls and liabilities, emphasizing the need for stringent quality control and supplier vetting.

The company must also navigate varying employment laws across Europe, covering minimum wage, working hours, and health and safety. For example, the UK's National Living Wage rose to £11.44 per hour in April 2024, impacting labor costs.

Furthermore, Headlam faces stringent environmental regulations, such as REACH, affecting manufacturing and sourcing, with non-compliance posing market access risks. Data protection laws like UK GDPR and EU GDPR also mandate strict data handling, with potential fines up to 4% of global annual turnover for breaches.

Contract law governs Headlam's B2B relationships, ensuring clarity in agreements with suppliers and customers, which is vital for supply chain stability in the £1.5 billion UK flooring market in 2024.

Environmental factors

The construction sector, a key market for Headlam Group, faces increasing calls for sustainability. This means a greater demand for products incorporating recycled content and materials that can be easily recycled at the end of their life. Headlam's sourcing and waste management strategies are directly affected by these evolving environmental standards.

Adopting circular economy principles, where materials are reused and waste is minimized throughout the supply chain, presents a significant opportunity for Headlam. By integrating these practices, the company can strengthen its market standing and better align with the growing expectations of environmentally conscious customers. For instance, in 2024, the UK government announced new targets for construction waste reduction, aiming for a 50% decrease in waste sent to landfill by 2030, which will likely influence material choices and supply chain operations.

The increasing global focus on climate change mandates a significant reduction in carbon emissions throughout the entire supply chain, from product manufacturing to final delivery. This imperative directly influences Headlam's operational decisions, impacting everything from the efficiency of its logistics network to the energy sources powering its distribution centers and offices.

Headlam's commitment to minimizing its carbon footprint is not just an environmental responsibility but also a strategic business advantage. By optimizing transportation routes and investing in energy-efficient facilities, the company can achieve tangible cost savings. For instance, in 2023, many logistics companies reported fuel cost reductions of up to 15% through route optimization software, a trend Headlam can leverage.

Furthermore, demonstrating a proactive approach to carbon reduction can significantly enhance Headlam's corporate reputation among environmentally conscious consumers and business partners. Companies with strong ESG (Environmental, Social, and Governance) credentials often see improved brand loyalty and a competitive edge, with studies showing a 10-20% increase in customer preference for sustainable brands.

Increasing global awareness of resource scarcity, particularly for materials like timber used in hardwood flooring and petroleum derivatives for synthetic carpets, directly impacts Headlam Group's cost structure and product sustainability. For instance, the UN's Food and Agriculture Organization reported in 2024 that deforestation rates, while showing some regional improvements, continue to pose challenges for sustainable timber sourcing. This necessitates a strategic focus on diversified and ethically sourced materials to mitigate supply chain risks and meet evolving consumer demand for eco-friendly options.

Waste Management and Recycling

Headlam Group, like many in the flooring industry, is navigating increasing regulatory pressure and evolving consumer demand for sustainable end-of-life product management. This means a growing focus on how old carpets, vinyl, and wood flooring are handled after removal. The company faces the dual challenge and opportunity of implementing effective recycling solutions to divert waste from landfills.

Opportunities exist for Headlam to develop or partner in take-back schemes and establish robust recycling processes. For instance, the UK government's Extended Producer Responsibility (EPR) schemes, while still developing for textiles and construction products, signal a future where manufacturers bear more responsibility for product disposal. This could encourage innovation in material recovery and circular economy models within the flooring sector, potentially reducing landfill contributions. In 2023, the UK generated approximately 229.1 million tonnes of total waste, with construction and demolition waste being a significant component, highlighting the scale of the challenge.

- Evolving Regulations: Anticipate stricter rules on waste disposal and product lifecycle management, impacting how Headlam handles old flooring.

- Consumer Expectations: Growing demand for eco-friendly practices means customers will increasingly favor companies with clear recycling and waste reduction initiatives.

- Recycling Infrastructure: Developing or accessing effective recycling facilities for mixed materials like carpets and vinyl presents a logistical and investment hurdle.

- Circular Economy Potential: Implementing take-back schemes can create new revenue streams and enhance brand reputation by demonstrating commitment to sustainability.

Climate Change Impact and Adaptation

Climate change presents significant physical risks for Headlam Group. Extreme weather events, such as increased flooding or severe storms, could disrupt supply chain logistics, impacting the timely delivery of flooring products. For instance, the UK experienced its wettest February on record in 2024, leading to widespread disruption. These events could also directly affect Headlam's own facility operations, potentially causing damage or downtime.

Adapting to a changing climate will likely influence product development and market demand. There may be a growing need for flooring materials that are more durable and resilient to fluctuating environmental conditions, such as increased humidity or temperature variations. Consumer preferences might shift towards sustainable and eco-friendly flooring options, reflecting a broader societal awareness of climate impact.

- Physical Risks: Increased frequency and intensity of extreme weather events (e.g., floods, storms) pose a threat to Headlam's supply chain and operational facilities.

- Adaptation Needs: Potential for evolving product durability requirements to withstand changing environmental conditions.

- Market Demand Shifts: Growing consumer preference for sustainable and climate-resilient flooring solutions.

- Operational Resilience: The need to invest in infrastructure and processes that can mitigate the impact of climate-related disruptions.

Environmental factors are increasingly shaping Headlam Group's operations and strategy, driven by a global push for sustainability and climate action. Stricter regulations on waste and emissions, coupled with growing consumer demand for eco-friendly products, are key influences.

Headlam must navigate the challenges of resource scarcity, particularly for timber, and the need for robust recycling solutions for end-of-life flooring. The company's ability to adapt to climate change impacts, such as extreme weather disrupting logistics, also remains crucial.

The company's response to these environmental pressures, including investments in circular economy principles and resilient infrastructure, will be vital for its long-term success and market positioning. For example, in 2024, the UK government's commitment to reducing construction waste by 50% by 2030 highlights the regulatory landscape.

| Environmental Factor | Impact on Headlam Group | Key Data/Trend (2023-2025) |

|---|---|---|

| Sustainability Demand | Increased demand for recycled content and eco-friendly materials. | 10-20% customer preference increase for sustainable brands (general consumer trend). |

| Waste Management & Recycling | Need for effective recycling solutions; potential impact of Extended Producer Responsibility (EPR) schemes. | UK generated ~229.1 million tonnes of total waste in 2023; construction waste is a significant component. |

| Carbon Emissions | Pressure to reduce emissions across the supply chain and operations. | Logistics companies reported up to 15% fuel cost reduction via route optimization in 2023. |

| Resource Scarcity | Challenges in sourcing sustainable timber and other raw materials. | UN FAO reported continued challenges with deforestation rates impacting timber sourcing in 2024. |

| Climate Change Risks | Physical risks from extreme weather impacting logistics and operations. | UK experienced its wettest February on record in 2024, causing widespread disruption. |

PESTLE Analysis Data Sources

Our Headlam Group PESTLE Analysis is meticulously constructed using data from official government publications, reputable market research firms, and leading economic data providers like Statista and the Office for National Statistics. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the building materials sector.