Headlam Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

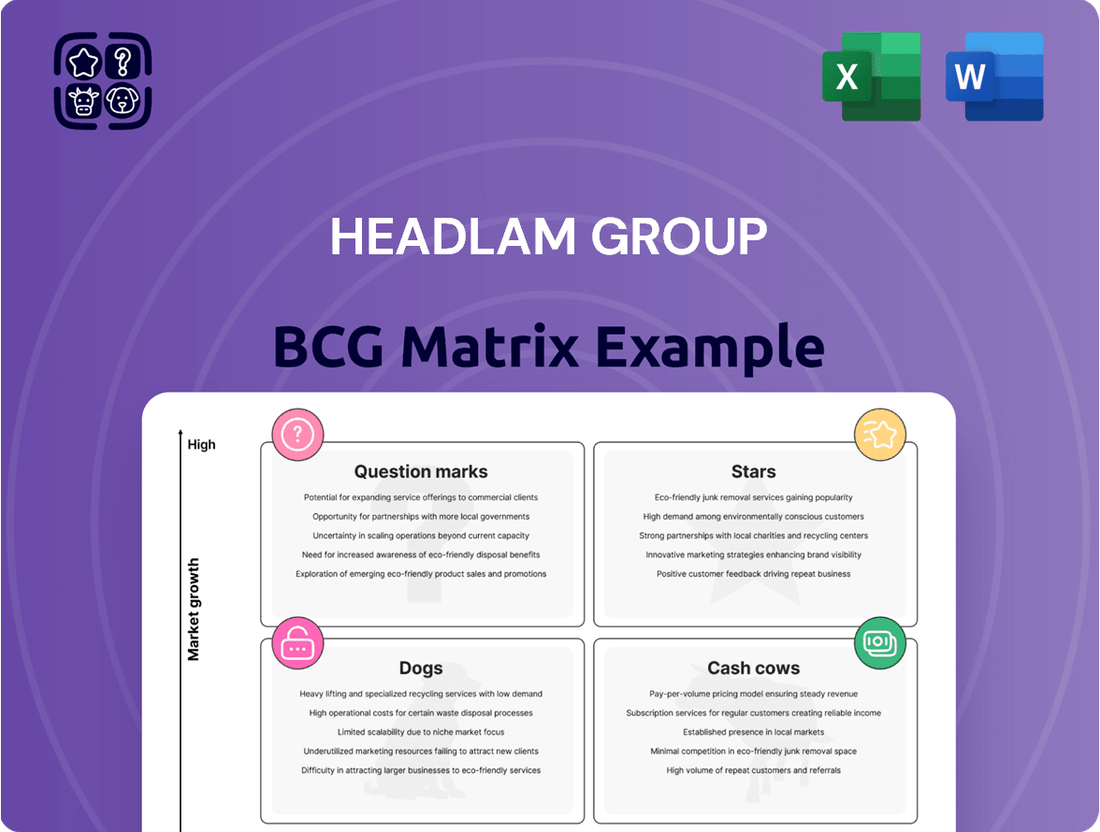

Curious about the Headlam Group's product portfolio performance? Our BCG Matrix analysis reveals their current market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the strategic clarity this provides.

Purchase the full BCG Matrix report to unlock a comprehensive breakdown of each product's position, backed by data-driven insights and actionable recommendations for optimizing your investments and product strategy.

Stars

Headlam Group's Luxury Vinyl Tile (LVT) products are a key component of their diverse offering. The European LVT market is booming, with forecasts showing a robust CAGR of 9.1% to 11.2% between 2024 and 2031/2033, indicating substantial growth potential.

As Europe's largest flooring distributor, Headlam is well-positioned to capture a significant share of this expanding LVT market. This strategic advantage means their LVT segment likely requires substantial investment to sustain its leading position and capitalize on the market's upward trajectory, fitting the profile of a 'Star' in the BCG Matrix.

The resilient flooring portfolio, encompassing more than just LVT, represents a significant growth engine for Headlam Group. This broader category, which includes vinyl and other advanced durable options, is experiencing robust expansion across Europe.

Market projections indicate a compound annual growth rate of 6.55% for resilient flooring through 2030, highlighting its increasing importance. Headlam's established market presence and comprehensive product offerings position it favorably to capture a substantial share of this expanding market.

Sustained investment in this segment is crucial for Headlam to leverage market opportunities and defend its competitive standing. This strategic focus ensures the company remains a leader in a dynamic and growing sector.

Headlam's Trade Counter expansion represents a significant growth engine, showing robust performance even as the broader market faces headwinds. In the first half of 2024, this segment achieved a 7% revenue increase, and for the full year 2024, it posted a 7.4% growth, outperforming the overall market.

The company is strategically investing in this area, with plans to increase its Trade Counter network to around 100 locations by mid-2025. This aggressive expansion signals a high-growth internal initiative where Headlam is actively cultivating a strong market position.

Larger Customers Channel

The Larger Customers channel is a key focus for Headlam, demonstrating resilience and growth. Revenue in this segment saw a 2% increase in the first half of 2024 and is projected to grow by 4% for the full year 2024.

Despite broader market challenges, Headlam is strategically targeting this segment to capture greater market share. This channel is identified as a Star due to its substantial potential for scaling operations and increasing profitability.

- Strategic Focus: Headlam is actively investing in enhancing its service offerings and product variety specifically for its larger clientele.

- Revenue Growth: Achieved a 2% revenue increase in H1 2024, with a full-year 2024 projection of 4% growth.

- Market Potential: This segment represents a significant opportunity for market share expansion, even amidst industry headwinds.

- Future Outlook: Continued investment positions this channel as a strong contender for sustained future growth and performance.

Innovation in Sustainable Flooring Solutions

Innovation in Sustainable Flooring Solutions is a key area for Headlam Group. The European flooring market is seeing a significant shift towards sustainable and eco-friendly materials. Resilient flooring formats, such as SPC and LVT, are gaining traction, driven by factors like material circularity and the development of bio-based alternatives.

Headlam's strategic focus on sourcing and developing innovative products that meet these evolving consumer demands positions them well. Their commitment to offering sustainable flooring solutions allows them to capture early market share in this rapidly expanding, environmentally conscious market. For instance, the global sustainable flooring market was valued at approximately USD 250 billion in 2023 and is projected to grow significantly in the coming years, with Europe being a major contributor to this growth.

- Sustainable Materials: Increasing demand for recycled content and bio-based flooring options.

- Resilient Flooring Growth: SPC and LVT formats are leading due to durability and aesthetic versatility.

- Circular Economy Focus: Emphasis on products designed for recyclability and reduced environmental impact.

- Market Expansion: The sustainable flooring segment is a high-growth area within the broader European flooring industry.

Headlam's Trade Counter expansion is a clear 'Star' within the BCG Matrix. This segment experienced a robust 7.4% revenue growth in 2024, significantly outpacing the broader market. The company's commitment to expanding its network to around 100 locations by mid-2025 underscores its aggressive investment in this high-growth area.

The Larger Customers channel also qualifies as a 'Star'. It demonstrated resilience with a 2% revenue increase in the first half of 2024 and is projected to achieve 4% growth for the full year 2024. Headlam's strategic focus on this segment aims to capture increased market share and drive profitability.

Headlam's investment in sustainable flooring solutions, particularly LVT and SPC, positions these as 'Stars'. The European market for resilient flooring is growing, with projections showing a healthy CAGR. This segment benefits from increasing consumer demand for eco-friendly materials and circular economy principles.

| Segment | 2024 H1 Growth | 2024 Full Year Projection | BCG Category |

|---|---|---|---|

| Trade Counter Expansion | 7% | 7.4% | Star |

| Larger Customers | 2% | 4% | Star |

| Sustainable Flooring (LVT/SPC) | N/A (Market Growth Driven) | N/A (Market Growth Driven) | Star |

What is included in the product

This BCG Matrix analysis categorizes Headlam Group's divisions, guiding investment and divestment strategies.

The Headlam Group BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis for leadership.

Cash Cows

Headlam Group's core UK floor coverings distribution business is a classic cash cow. With a commanding market share of around 22% in the UK, this segment benefits from a well-established presence in a mature industry that serves both homes and businesses.

This strong market position translates into significant and consistent cash generation. Even amidst tougher economic climates, such as those experienced in 2024, Headlam managed to hold onto its market share, a testament to the enduring profitability and stability of this core operation.

Within Headlam Group's diverse offerings, traditional carpet and laminate flooring represent established product lines with a substantial market presence. These categories benefit from a long-standing customer base and broad appeal, contributing consistently to the company's revenue streams.

While the growth rate for traditional carpets and laminates might not match that of emerging materials like LVT, their maturity in the market, coupled with Headlam's robust distribution infrastructure, guarantees reliable cash flow. For instance, in 2024, Headlam reported that its flooring division, which heavily features these traditional products, continued to be a bedrock of its financial performance, demonstrating consistent demand.

Consequently, capital allocation for these segments primarily targets operational efficiency and the preservation of their existing market standing, rather than pursuing aggressive expansion strategies. This focus ensures these product ranges continue to act as dependable cash cows for the group.

The established residential sector is a cornerstone for Headlam Group, representing a significant 65% of its revenue in FY23. This robust contribution underscores its importance as a primary revenue driver.

Even with current softness in consumer spending on home improvements, Headlam's extensive distribution network and deep-rooted relationships with independent retailers and housebuilders ensure a steady, high-volume sales flow. This stability is a key characteristic of a cash cow.

While the residential market itself might be experiencing low growth, Headlam's commanding market share and streamlined operational efficiencies within this segment allow it to function as a consistent and reliable generator of cash for the business.

Extensive Distribution Network and Logistics

Headlam Group's extensive distribution network and logistics are a prime example of a Cash Cow within its business portfolio. This robust infrastructure, developed over three decades, facilitates nationwide next-day delivery across the UK and Continental Europe, offering a significant competitive edge.

The efficiency of this network, coupled with its sheer scale in a mature distribution market, translates directly into high profit margins and dependable cash flow. For instance, in 2024, Headlam continued to leverage this strength, ensuring efficient market access for its wide array of products.

- Network Scale: Operates numerous businesses and a sophisticated logistics system.

- Delivery Capability: Enables nationwide next-day delivery.

- Competitive Advantage: Over 30 years of infrastructure development.

- Financial Impact: Contributes to high profit margins and consistent cash flow.

Supplier Relationships and Product Breadth

Headlam Group thrives by fostering extensive collaborations with numerous global suppliers. This network allows them to present an impressive selection of over 67 distinct brands, effectively serving as a vital market entry point for manufacturers.

These deep-rooted supplier partnerships, combined with the vast product assortment, guarantee a steady flow of inventory and a diversified revenue base. This solidifies Headlam's standing as a dominant force in its sector, even in periods of subdued market expansion.

- Supplier Network: Collaborates with a wide array of global suppliers.

- Product Breadth: Offers an unparalleled choice of over 67 brands.

- Market Access: Provides an effective route to market for manufacturers.

- Revenue Stability: Ensures consistent supply and diverse revenue streams, generating reliable cash flow.

Headlam Group's core UK floor coverings distribution business is a classic cash cow. With a commanding market share of around 22% in the UK, this segment benefits from a well-established presence in a mature industry that serves both homes and businesses.

This strong market position translates into significant and consistent cash generation. Even amidst tougher economic climates, such as those experienced in 2024, Headlam managed to hold onto its market share, a testament to the enduring profitability and stability of this core operation.

The established residential sector is a cornerstone for Headlam Group, representing a significant 65% of its revenue in FY23. Even with current softness in consumer spending on home improvements, Headlam's extensive distribution network and deep-rooted relationships with independent retailers and housebuilders ensure a steady, high-volume sales flow, a key characteristic of a cash cow.

Headlam Group's extensive distribution network and logistics are a prime example of a Cash Cow. This robust infrastructure, developed over three decades, facilitates nationwide next-day delivery across the UK and Continental Europe, offering a significant competitive edge and contributing to high profit margins.

| Segment | Market Share (UK) | Revenue Contribution (FY23) | Cash Flow Generation |

|---|---|---|---|

| Core UK Floor Coverings Distribution | ~22% | Significant driver | High and consistent |

| Residential Sector Distribution | Dominant | 65% | Steady, high-volume sales |

| Logistics and Distribution Network | Leading | Enabling factor | High profit margins |

What You’re Viewing Is Included

Headlam Group BCG Matrix

The Headlam Group BCG Matrix preview you see is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing information—just the complete strategic analysis ready for your immediate use. You are viewing the exact document that will be delivered, ensuring transparency and confidence in your acquisition for informed business decisions.

Dogs

Headlam's Regional Distribution segment in the UK faced considerable headwinds, with revenue falling 19% in the first half of 2024 and 16% for the entirety of 2024. This sharp decline suggests that these operations, possibly tied to older distribution methods, are not capturing sufficient market share, especially in a less robust market environment.

The company's strategic response, which includes consolidating 32 trading businesses into the unified Mercado entity and shutting down underperforming locations, clearly points towards a strategy of divesting or significantly restructuring these weaker regional units. This move aims to streamline operations and focus resources on more promising areas of the business.

Within Headlam Group's diverse offerings, certain older or less popular flooring product lines could be classified as dogs. These might reside in sub-segments of the market experiencing stagnation or decline, leading to a low market share for these specific items.

Such products likely contribute minimally to revenue and profit, while simultaneously consuming valuable inventory space and tying up operational resources. For instance, if a particular vinyl flooring range, popular a decade ago, now sees reduced consumer interest, it would fit this category.

Headlam's 2024 annual report might detail specific product category performance, where a segment showing declining sales volume and profitability would highlight these dog products. Identifying and strategically managing these underperforming lines, perhaps through discontinuation or targeted clearance, is crucial for optimizing capital allocation towards growth areas.

The Headlam Group's strategic consolidation of 32 trading businesses into a unified entity, 'Mercado,' strongly indicates that many of these legacy operations were likely underperforming. Prior to this significant restructuring, these individual businesses may have struggled with low efficiency and a diminished market presence within their respective sectors.

These legacy operations, burdened by higher operational costs or a restricted market reach, would naturally fall into the 'Dog' category of the BCG Matrix. They consumed valuable resources and capital without generating substantial returns or contributing meaningfully to the group's overall growth trajectory.

For instance, if some of these acquired businesses had operating margins below the industry average of, say, 5-7% in the flooring distribution sector, they would represent classic 'Dogs.' Headlam's consolidation efforts are specifically designed to address and eliminate these inherent inefficiencies, thereby improving the group's overall financial health and competitive positioning.

Segments Heavily Reliant on Deeply Depressed Housing Transactions

Headlam's business is closely tied to the health of residential housing transactions and the associated repair, maintenance, and improvement (RMI) spending. Both of these areas have experienced significant suppression, impacting revenue streams.

While the broader residential sector might be considered a Cash Cow, certain niche segments within it are particularly vulnerable to a depressed housing market. These are the areas where Headlam's market share might be less dominant, and where revenue generation is sluggish in a prolonged low-growth economic climate.

- Impact of Housing Market Downturn: Headlam's reliance on the residential sector means that a slowdown in property transactions directly affects demand for its products. For instance, a significant drop in new home sales or a prolonged period of low transaction volumes can lead to reduced orders for flooring and related materials.

- RMI Spending Sensitivity: The repair, maintenance, and improvement segment is also highly sensitive to economic conditions. When household budgets are strained due to factors like inflation or interest rate hikes, discretionary spending on home improvements often takes a backseat, impacting Headlam's RMI-focused customer base.

- Sub-segment Vulnerability: Within the residential sector, specific sub-segments that are heavily dependent on high transaction volumes, such as builders focused on new developments or retailers catering to first-time homebuyers, are likely experiencing the most acute pressures.

- Revenue Challenges: In a persistently low-growth environment for housing transactions, these highly sensitive sub-segments struggle to generate consistent revenue. This can be exacerbated if Headlam has a lower penetration rate in these particular niches compared to its stronger market positions.

Certain Continental Europe Business Units

Certain Continental Europe Business Units within Headlam Group are positioned as Dogs in the BCG Matrix. This classification is driven by their performance in 2024, where revenue from these operations saw a decline of 14.9% to 15.9%. The Netherlands, in particular, experienced notable weakness within these European segments.

These specific business units or product categories within Continental Europe are likely exhibiting low market share within their local markets. Despite the potential for growth in the broader European market, their individual performance places them in a challenging position. Such units often require significant re-evaluation, as they can become cash traps, demanding substantial investment without commensurate returns.

- Low Market Share: Units in Continental Europe struggle to capture significant market share in their local territories.

- Revenue Decline: Experienced a revenue drop of 14.9% to 15.9% in 2024, indicating shrinking sales.

- Geographic Weakness: The Netherlands is specifically cited as an area of particular weakness for these business units.

- Potential Cash Traps: These segments may require extensive capital injection without a clear path to profitability, necessitating strategic review or divestment.

Dogs represent business units or product lines with low market share and low growth potential. For Headlam Group, these could be older flooring product lines or specific regional operations that are not performing well.

These underperforming segments consume resources without generating significant returns, potentially acting as cash traps. Headlam's strategic consolidation into Mercado and closure of underperforming sites suggests a clear effort to divest or restructure these 'dog' assets.

For instance, if a particular vinyl flooring range, popular a decade ago, now sees reduced consumer interest, it would fit this category, similar to how some Continental European units experienced revenue declines of 14.9% to 15.9% in 2024.

Identifying and managing these 'dogs' is crucial for optimizing capital allocation towards more promising growth areas within the group.

| BCG Category | Characteristics | Headlam Example (Illustrative) | 2024 Performance Indication |

| Dogs | Low Market Share, Low Growth | Underperforming Regional Distribution Units (UK), Certain Legacy Product Lines | UK Regional Distribution Revenue fell 16% in 2024. Continental Europe revenue declined 14.9% to 15.9%. |

Question Marks

Headlam's Continental Europe operations faced a significant revenue decline in 2024, dropping between 14.9% and 15.9%. This performance suggests a relatively low market share in these specific territories, even as the broader European flooring market demonstrates overall growth potential.

Regions like France and the Netherlands within Continental Europe are currently categorized as question marks. They are consuming cash without delivering substantial returns, reflecting Headlam's current struggles to gain traction.

However, these markets hold promise for future growth. If Headlam can successfully increase its market share through focused investment and strategic adjustments, these question marks could potentially transition into stars.

Headlam Group's investment in advanced digital ordering, particularly the re-platforming of its Mercado portal and development of a new ERP system, positions it to capitalize on the growing e-commerce trend in floor coverings, projected at a 7.75% CAGR from 2025 to 2030. This strategic move aims to streamline operations and customer interactions, a crucial step for any business looking to enhance its digital presence.

While the potential is high, the current market share in the online space for Headlam is likely nascent due to the newness of its unified digital platform. This initiative represents a significant capital outlay, but if successful in driving market adoption and achieving operational efficiencies, it could elevate the digital offering from a question mark to a star performer within the BCG matrix.

Headlam Group actively sources and develops innovative flooring solutions, identifying emerging product categories as a key growth driver. These specialized materials, perhaps advanced eco-friendly composites or smart flooring technologies, represent new entrants to the market. While these niche innovations are positioned in high-growth sectors, Headlam's initial market share would likely be modest, necessitating significant investment in marketing and distribution to establish a strong foothold.

Penetration into New Customer Segments (e.g., specific commercial niches)

Headlam Group is actively seeking to expand its reach into new customer segments, moving beyond its established base of independent retailers. The company recognizes the potential in specific commercial niches that offer robust market growth but currently see low penetration from Headlam. This strategic push aims to diversify revenue streams and capture new market share.

While the larger customer channel has demonstrated some growth, the focus is now sharpening on untapped commercial areas. These might include sectors like specialized healthcare facilities, the hospitality industry, or even large-scale infrastructure projects, all of which represent significant opportunities for expansion. Capturing these markets will likely necessitate dedicated strategic investments to build brand awareness and establish a strong operational presence.

- Targeting Untapped Niches: Headlam is identifying specific commercial sectors with high growth potential and low current penetration, such as healthcare and hospitality.

- Strategic Investment Required: Significant investment will be needed to effectively penetrate these new customer segments and secure a competitive position.

- Diversification Goal: The aim is to broaden the customer base beyond traditional independent retailers, reducing reliance on a single channel.

- Market Growth Potential: These new segments are chosen for their robust growth prospects, offering substantial opportunities for Headlam's future development.

Strategic Acquisitions in High-Growth Sub-markets

Headlam Group's strategy includes acquiring businesses in rapidly expanding niche markets within the flooring sector. For instance, the acquisition of Melrose in 2023 aimed to bolster growth.

Identifying and integrating companies in high-growth sub-markets, even with a small initial market share, is key. These moves are designed to capitalize on emerging trends and future potential.

- Acquisition Strategy: Targeting sub-markets with high growth potential, even if Headlam's initial presence is minimal.

- Example: The Melrose acquisition in 2023 demonstrates this approach to expanding market reach.

- Integration Focus: Subsequent investment and integration are crucial to unlock the full value of these acquired entities.

- Transformation Goal: The ultimate aim is to transform these acquisitions into 'Stars' within the BCG matrix through strategic development.

Question marks represent areas where Headlam Group is investing in markets with high growth potential but currently holds a low market share. These ventures consume significant capital, and their future success hinges on Headlam's ability to increase market penetration and achieve profitability. The key challenge is to transform these nascent operations into strong market players.

The company’s digital transformation efforts and expansion into new commercial niches exemplify these question mark strategies. For instance, the projected 7.75% CAGR for e-commerce in floor coverings from 2025 to 2030 highlights the growth potential Headlam aims to capture through its new unified digital platform, despite its current limited online market share.

Similarly, targeting untapped commercial sectors like healthcare and hospitality, which exhibit robust market growth, requires substantial investment to build brand awareness and operational capacity. These initiatives are critical for diversifying revenue streams and reducing reliance on traditional channels.

Headlam's acquisition strategy, as seen with Melrose in 2023, also falls into the question mark category. While these acquisitions bolster growth in expanding niche markets, they require further investment and integration to transition from low-share entities into potential star performers.

| BCG Category | Market Growth | Market Share | Headlam's Position | Strategic Focus |

|---|---|---|---|---|

| Question Mark | High | Low | Emerging digital platforms, new commercial customer segments, acquired niche businesses | Increase market share, achieve operational efficiencies, strategic investment |

| Example: E-commerce | 7.75% CAGR (2025-2030) | Nascent | Developing unified digital platform and ERP system | Streamline operations, enhance customer interaction, drive adoption |

| Example: New Niches | Robust | Low penetration | Healthcare, hospitality sectors | Build brand awareness, establish operational presence, diversify revenue |

BCG Matrix Data Sources

Our Headlam Group BCG Matrix is built on a foundation of comprehensive market data, including internal sales figures, competitor analysis, and industry growth projections.