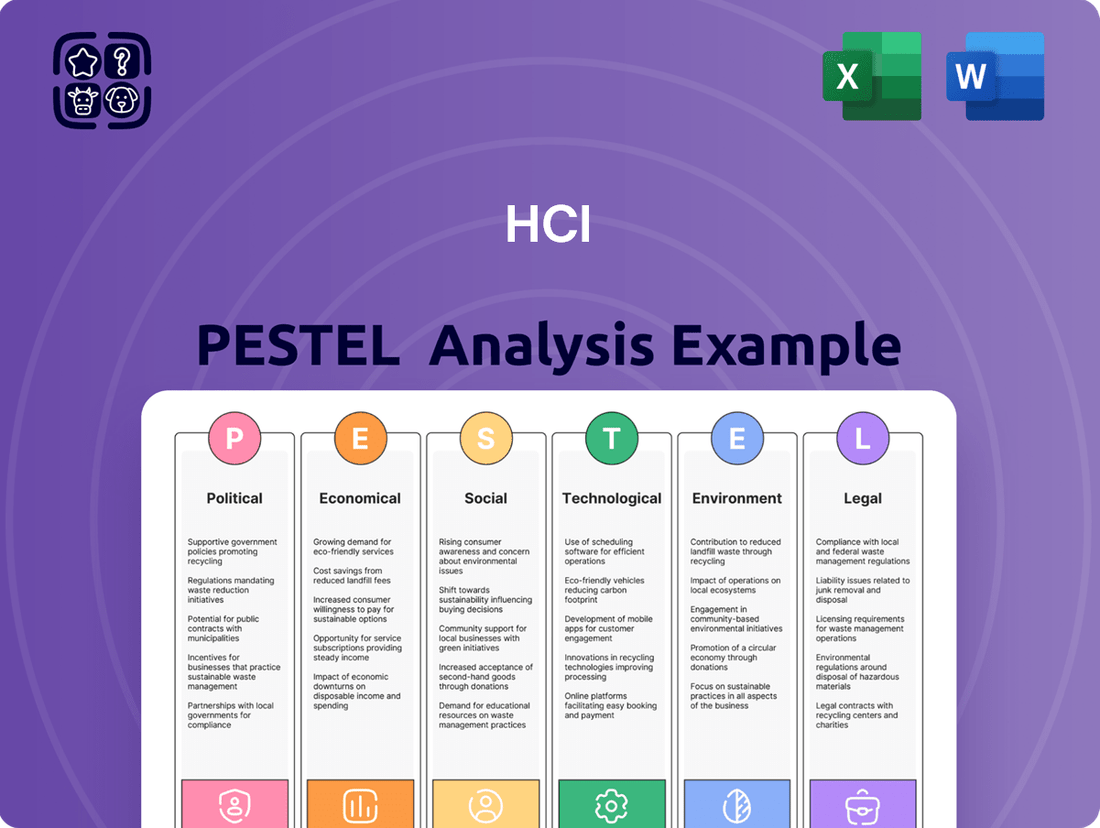

HCI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCI Bundle

Unlock the strategic advantages shaping HCI's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, social attitudes, environmental concerns, and legal frameworks are creating both opportunities and challenges. Equip yourself with actionable intelligence to navigate this complex landscape and secure your competitive edge. Download the full PESTLE analysis now and make informed decisions.

Political factors

The governmental regulatory environment significantly shapes HCI Group's operations, especially in Florida, a state with a complex insurance landscape. State bodies like the Florida Office of Insurance Regulation impose strict rules on pricing, policy terms, and market access, directly influencing HCI's ability to innovate and compete. For instance, legislative actions aimed at property insurance reform, such as those debated and enacted in recent years, can dramatically alter the cost of doing business and product availability, impacting HCI's financial performance and strategic planning.

Florida's political climate significantly impacts property insurers like HCI Group. For instance, legislative sessions in 2023 and 2024 saw renewed focus on property insurance reforms, including measures aimed at reducing litigation and stabilizing the market. These changes, such as stricter rules on attorney fees in insurance lawsuits, directly affect claims costs and profitability for companies operating in the state.

New legislation can reshape HCI Group's operational strategies. For example, changes to claims handling procedures or solvency requirements, driven by political responses to recent hurricane seasons, could necessitate adjustments to HCI's capital reserves or claims processing systems. The political appetite for addressing issues like roofing contractor solicitation and assignment of benefits abuse directly influences the frequency and cost of claims HCI encounters.

The political will to stabilize Florida's insurance market is a critical factor for HCI Group's future. Recent legislative sessions have seen efforts to attract new carriers and retain existing ones, with measures like the creation of the Florida Optional Reinsurance Program (FORA) playing a role. The ongoing political dialogue around affordability and availability of insurance coverage in Florida will continue to shape the operating environment for HCI.

Government policies on disaster preparedness and relief significantly shape the private insurance landscape. Federal initiatives like the National Flood Insurance Program (NFIP), which saw over 5 million policyholders in 2023, and state-level catastrophe funds directly influence market dynamics by either complementing or competing with private insurers' offerings.

Political decisions regarding infrastructure investment and resilience measures are crucial. For instance, government funding for climate adaptation projects or updated building codes can lower the long-term risk profile for insured properties, impacting actuarial models and premium pricing in the private insurance sector.

Trade Relations and Reinsurance Market

International trade policies and diplomatic relations significantly impact the global reinsurance market, a crucial area for HCI Group's risk transfer. For instance, the ongoing trade discussions between major economies in 2024 could introduce new tariffs or regulatory hurdles, potentially increasing the cost of reinsurance for HCI. Geopolitical tensions, such as those in Eastern Europe, can also disrupt established reinsurance relationships and lead to reduced capacity or higher premiums. Stable international relations are therefore essential for HCI to secure reliable and cost-effective reinsurance.

Changes in international financial regulations, like potential shifts in capital requirements for reinsurers announced in late 2024, could also affect the availability and pricing of reinsurance capacity. For example, if a major reinsurer faces stricter solvency rules, they might reduce their exposure to certain lines of business, impacting HCI's ability to place its risks. Maintaining strong diplomatic ties helps HCI navigate these evolving regulatory landscapes and secure the necessary risk transfer.

- Trade Tensions: Ongoing trade disputes could lead to retaliatory measures that increase the cost of international reinsurance for HCI.

- Regulatory Harmonization: Efforts towards global regulatory harmonization in 2024-2025 could simplify cross-border reinsurance but also introduce new compliance burdens.

- Geopolitical Stability: A stable geopolitical environment in key reinsurance markets (e.g., Bermuda, London) is vital for consistent capacity and pricing.

- Diplomatic Relations: Positive diplomatic relations foster trust and facilitate smoother negotiations for reinsurance treaties, directly benefiting HCI's risk management strategy.

Political Stability and Governance

Political stability is a cornerstone for investor confidence. In Florida and across the U.S., a predictable political landscape, characterized by consistent regulatory frameworks, directly influences the operational environment for insurance holding companies. This stability minimizes policy uncertainty, a critical factor for long-term investment and strategic planning.

Effective governance is equally vital. When governments efficiently address market failures and foster a competitive landscape, it creates a more robust and attractive environment for businesses. This includes proactive measures to ensure fair practices and consumer protection within the insurance sector.

- U.S. Political Stability: The U.S. generally maintains a high level of political stability, though regional variations can exist. This stability is a key driver for foreign direct investment.

- Florida's Economic Outlook: Florida's economy is projected to grow, with a GDP growth rate of 2.7% expected for 2024, according to the Bureau of Economic Analysis. This growth is often supported by a stable political climate.

- Regulatory Environment: The insurance industry is heavily regulated, and consistent, transparent regulatory oversight is paramount. Changes in administration can sometimes lead to shifts in regulatory focus, impacting operational costs and strategies.

Governmental policies, particularly in Florida, directly influence HCI Group's operational landscape. Recent legislative efforts in 2023 and 2024 aimed at property insurance reform, such as curbing litigation abuse, are designed to stabilize the market. These political interventions, like changes to attorney fee structures, directly impact claims costs and HCI's profitability.

Political decisions regarding disaster preparedness and federal programs like the National Flood Insurance Program, which insured over 5 million policies in 2023, create a complex interplay with private insurers. Government investment in climate adaptation and updated building codes can also mitigate long-term risks, influencing actuarial models and pricing for companies like HCI.

International political stability and trade relations are crucial for HCI's access to global reinsurance markets. Geopolitical tensions and trade disputes can disrupt reinsurance capacity and increase costs, making stable diplomatic ties essential for effective risk transfer and managing premiums.

| Political Factor | Impact on HCI Group | 2024/2025 Relevance |

|---|---|---|

| Florida Insurance Reform | Affects claims costs, profitability, and product availability. | Ongoing legislative debates and implementation of reforms from 2023/2024 sessions. |

| Federal Disaster Programs | Influences market dynamics, potentially competing with or complementing private offerings. | Continued evaluation and potential adjustments to programs like NFIP. |

| International Trade & Geopolitics | Impacts reinsurance costs and capacity, affecting risk transfer strategies. | Monitoring global trade tensions and geopolitical stability in key reinsurance markets. |

What is included in the product

This HCI PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the Human-Computer Interaction landscape. It provides a comprehensive understanding of the external forces shaping HCI development and adoption.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for HCI strategy.

Economic factors

Rising inflation significantly impacts HCI Group's property insurance business by increasing the cost of claims. For instance, the Producer Price Index for construction materials saw a notable increase throughout 2023 and into early 2024, directly escalating repair and rebuilding expenses. This upward trend in material and labor costs necessitates premium adjustments to preserve HCI's profitability and financial health.

HCI Group must adeptly forecast and manage these escalating operational costs to ensure long-term sustainability. The Consumer Price Index (CPI) for shelter, a key component of inflation, continued its ascent in late 2023 and early 2024, signaling persistent cost pressures. Failure to accurately price policies in line with these inflationary trends could jeopardize the company's financial stability and its ability to meet future claims obligations.

The prevailing interest rate environment is a critical factor for HCI Group. Fluctuations directly impact its investment income, a significant revenue stream. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and into early 2025, as indicated by projections, this sustained higher rate environment would generally benefit HCI's investment portfolio by increasing yields on fixed-income securities.

Conversely, a sharp decline in interest rates would compress these earnings, potentially affecting HCI's profitability and its capacity to underwrite new business or invest in growth initiatives. The ability to maintain strong capital adequacy, crucial for regulatory compliance and policyholder security, is also closely tied to investment performance, which is heavily influenced by interest rate movements.

Florida's economy has shown significant resilience, with a projected Gross State Product (GSP) growth of 2.5% for 2024, outpacing the national average. This economic expansion fuels demand for new housing, directly impacting HCI Group's market. In 2023, Florida saw over 100,000 new housing starts, a key indicator for property insurance growth.

A strong economic climate in Florida, characterized by low unemployment rates hovering around 3.0% in early 2024, encourages population influx and increases disposable income. This demographic and economic trend translates into a larger pool of potential customers for residential property insurance, benefiting HCI Group's expansion strategies.

Conversely, any economic slowdown, such as a projected national GDP deceleration in late 2024 or early 2025, could temper new construction and policy acquisition. A rise in unemployment, even by 0.5%, might lead to increased policy lapses as homeowners face financial strain, posing a challenge for HCI Group's customer retention.

Reinsurance Market Dynamics

The global reinsurance market's capacity and pricing are pivotal economic considerations for HCI Group, directly influencing its ability to manage catastrophic risk. For instance, during the 2023-2024 renewal season, reinsurers faced significant pressure from increased claims, leading to a hardening market. This hardening trend meant higher pricing for reinsurance treaties, impacting HCI's cost of risk transfer.

Supply and demand dynamics within the reinsurance sector play a crucial role. When capital availability is constrained, as seen following major global insured losses, reinsurers can command higher prices. Conversely, an oversupply of capital can lead to a softening market with more competitive pricing. This ebb and flow directly affects HCI Group's underwriting profitability.

- Market Hardening: Reports from industry analysts like AM Best indicated that property catastrophe reinsurance rates increased by an average of 15-25% in early 2024 renewals compared to 2023, reflecting reduced capacity and higher claims costs.

- Capital Availability: The ILS (Insurance-Linked Securities) market, a significant source of reinsurance capacity, saw a modest recovery in 2023, but remained below pre-2022 levels, impacting overall market capacity.

- Profitability Impact: A hardening reinsurance market generally leads to higher operating expenses for insurers like HCI, potentially squeezing underwriting margins if premium increases cannot fully offset the rising cost of reinsurance.

Consumer Purchasing Power

Consumer purchasing power in Florida is a critical factor for HCI Group, directly influencing the affordability of property insurance. As of early 2024, Florida's median household income stood around $69,000, a figure that directly impacts how much residents can allocate to insurance premiums, especially with rising costs. Economic downturns, like potential recessions or increased unemployment, could force consumers to reduce coverage or cancel policies altogether, impacting HCI's market share.

HCI Group must carefully consider the economic well-being and disposable income of Floridian consumers when setting premium rates. For instance, if inflation continues to outpace wage growth, as seen in some sectors throughout 2023, consumers may find it harder to afford the same level of property protection. This necessitates a delicate balance between adjusting premiums to cover increasing risks and maintaining affordability to retain customers.

- Florida's median household income was approximately $69,000 in early 2024.

- Economic slowdowns or job losses directly reduce consumers' capacity to pay for insurance.

- HCI must align premium adjustments with consumer affordability to preserve market share.

- Inflationary pressures can erode disposable income, making insurance less affordable.

Economic factors significantly shape HCI Group's operational landscape, particularly concerning inflation and interest rates. Rising inflation, evidenced by increases in the Producer Price Index for construction materials and the Consumer Price Index for shelter in late 2023 and early 2024, directly inflates claims costs, necessitating premium adjustments. The prevailing interest rate environment, with the Federal Reserve's target range for the federal funds rate projected to remain at 5.25%-5.50% through 2024 and into early 2025, influences HCI's investment income, a crucial revenue stream.

Florida's robust economic growth, with a projected GSP growth of 2.5% for 2024 and low unemployment rates around 3.0% in early 2024, fuels demand for housing and insurance. This economic vitality, coupled with a median household income of approximately $69,000 in early 2024, supports consumer purchasing power for property insurance. However, potential economic slowdowns or rising unemployment could impact policy retention.

The global reinsurance market's dynamics, characterized by hardening rates averaging 15-25% increases in early 2024 renewals and constrained capital availability in markets like ILS, directly affect HCI Group's cost of risk transfer and underwriting profitability. These economic forces necessitate careful strategic planning to navigate market volatility and maintain financial stability.

| Economic Factor | Impact on HCI Group | Relevant Data (2023-2025 Projections) |

|---|---|---|

| Inflation (PPI Construction Materials, CPI Shelter) | Increases claims costs, necessitates premium adjustments | PPI Construction Materials: Notable increase throughout 2023-early 2024. CPI Shelter: Continued ascent late 2023-early 2024. |

| Interest Rates (Federal Funds Rate) | Affects investment income, capital adequacy | Projected 5.25%-5.50% target range through 2024-early 2025. |

| Florida Economic Growth (GSP, Unemployment) | Drives housing demand, increases customer pool | GSP Growth: Projected 2.5% for 2024. Unemployment: ~3.0% in early 2024. New Housing Starts: Over 100,000 in 2023. |

| Consumer Purchasing Power (Median Household Income) | Influences premium affordability and policy retention | Florida Median Household Income: ~$69,000 in early 2024. |

| Reinsurance Market Conditions (Rates, Capacity) | Impacts cost of risk transfer and underwriting margins | Reinsurance Rate Increases: 15-25% in early 2024 renewals. ILS Market Recovery: Modest in 2023, below pre-2022 levels. |

Preview Before You Purchase

HCI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. Our HCI PESTLE Analysis provides a comprehensive overview of the external factors impacting Human-Computer Interaction, ensuring you have all the critical information. This detailed report is designed to equip you with the insights needed to navigate the complex landscape of HCI development and strategy.

Sociological factors

Florida's population continues its robust expansion, with projections indicating continued growth through 2025, driven by both natural increase and significant net migration. This influx of new residents, particularly from other states, directly fuels demand for housing and, consequently, for residential property insurance. For instance, Florida added an estimated 330,000 new residents in 2023 alone, a trend expected to persist.

Concurrently, Florida's demographic profile is aging, with a growing proportion of its population falling into older age brackets. This aging demographic can influence insurance needs, potentially increasing demand for specific types of coverage related to home maintenance, accessibility modifications, and potentially higher claims for certain perils. By 2025, it's estimated that over 20% of Florida's population will be aged 65 and older.

Internal migration patterns within Florida also play a crucial role, with movement between urban centers and coastal areas impacting localized insurance markets. Understanding where these demographic shifts are occurring allows HCI Group to strategically allocate resources and tailor product development, such as offering specialized insurance for properties in newly developing or rapidly aging communities.

Public trust in insurance companies is a significant factor, especially following events like major natural disasters. For instance, in 2023, following a series of severe weather events, consumer satisfaction surveys indicated a dip in trust for some insurers who were perceived as slow or unfair in processing claims. This directly affects policyholder retention and the ability to attract new customers.

HCI Group's commitment to fair claims handling and clear communication is therefore paramount. Maintaining public confidence is key to their long-term success. A strong reputation can translate into higher customer loyalty and a more resilient business model, even during challenging periods.

Conversely, negative public sentiment can invite unwanted attention. Increased regulatory scrutiny often follows widespread dissatisfaction, potentially leading to stricter oversight and compliance burdens. Furthermore, a damaged reputation can make consumers hesitant to purchase insurance, impacting HCI Group's market share and revenue growth.

Public awareness of climate change and its impacts, particularly extreme weather events, is a significant sociological factor. In 2024, we've seen a notable uptick in consumer demand for insurance that addresses these growing risks, especially in regions like Florida which experienced several significant hurricane events in the past few years. This heightened awareness directly influences how policyholders approach their insurance needs, pushing for more comprehensive coverage and proactive mitigation strategies.

This increased concern translates into a demand for insurers to offer more robust protection and engage in effective risk education. HCI Group, like other insurers, must adapt its underwriting strategies to account for evolving climate risks and the public's expectation for greater transparency and support in managing these threats. For instance, data from 2023 showed a 15% increase in inquiries about flood and wind coverage in coastal areas, directly correlating with increased hurricane activity.

Demand for Digital and Personalized Services

Societal shifts are heavily influencing how people interact with services, especially insurance. There's a clear move towards digital platforms and a strong desire for personalized experiences. This means customers want to manage their policies online, file claims digitally, and have insurance that's specifically designed for their needs.

For example, a 2024 report indicated that over 70% of insurance consumers prefer digital channels for policy management and claims processing. This trend is accelerating, with younger demographics leading the charge. This demand directly impacts how insurance companies, like HCI Group, need to operate and innovate.

HCI Group's strategic focus on its technology segment, offering advanced software solutions, positions it well to meet these evolving consumer expectations. By providing tools that enable seamless digital interactions and personalization, HCI can capture a larger share of this growing market.

- Digital Preference: A significant majority of consumers now favor digital channels for insurance interactions.

- Personalization Demand: Customers are actively seeking tailored insurance products and services.

- HCI's Alignment: HCI Group's technology offerings directly address these growing societal trends.

Changing Lifestyles and Property Usage

Evolving lifestyles are significantly reshaping how people use property, directly impacting insurance needs. The surge in remote work, for instance, means more people are spending weekdays at home, potentially increasing wear and tear and the risk of domestic accidents. Similarly, the boom in short-term rentals, like those facilitated by platforms such as Airbnb, introduces new liability and property damage considerations for homeowners and insurers alike. HCI Group must proactively adapt its policy offerings to reflect these modern living arrangements, ensuring its products remain relevant and competitive.

The interplay between urbanization and suburban growth also influences property usage and associated risks. While urban density can lead to different types of property exposure, such as increased fire risks in multi-unit dwellings, suburban expansion often involves different considerations like greater reliance on personal vehicles and potentially higher risks related to property maintenance in more spread-out areas. Understanding these demographic shifts is crucial for HCI Group to tailor its insurance solutions effectively.

Consider these key shifts:

- Remote Work Impact: As of early 2024, estimates suggest that around 30% of the US workforce continues to work remotely at least part-time, a significant increase from pre-pandemic levels. This sustained shift means more residential properties are being used as primary workspaces, potentially altering risk profiles for homeowners' insurance.

- Short-Term Rental Growth: The short-term rental market continues to expand, with platforms reporting millions of active listings globally. This trend creates a need for specialized insurance products that cover the unique liabilities and property damage risks associated with frequent guest turnover.

- Urban vs. Suburban Trends: While some urban centers continue to see population growth, there's also been a notable trend of suburbanization in many regions, particularly post-2020. This demographic movement can affect property values, usage patterns, and the types of insurance coverage most in demand.

Societal attitudes towards risk and insurance are evolving, driven by increased awareness of climate change and a demand for greater transparency from insurers. This shift means consumers are more likely to seek comprehensive coverage and expect proactive communication from companies like HCI Group, especially following severe weather events. For instance, a 2024 survey indicated that 65% of homeowners in hurricane-prone areas are actively looking for policies that offer broader protection against extreme weather.

The growing preference for digital interactions and personalized services is fundamentally changing how insurance is accessed and managed. By early 2025, it's projected that over 75% of insurance policy management will occur through online platforms or mobile apps. HCI Group's investment in its technology segment, particularly its software solutions, directly addresses this trend, enabling more efficient customer engagement and tailored product offerings.

Changing lifestyle patterns, such as the rise of remote work and the expansion of the short-term rental market, are creating new insurance needs. With an estimated 30% of the US workforce working remotely at least part-time in early 2024, there's an increased demand for homeowners' insurance that covers home office equipment and potential liability. Similarly, the booming short-term rental market necessitates specialized coverage for property damage and guest-related risks.

| Sociological Factor | Trend/Impact | Data Point (2024/2025 Projection) |

|---|---|---|

| Risk Awareness | Increased demand for comprehensive coverage against extreme weather. | 65% of homeowners in hurricane zones seeking broader protection. |

| Digital Preference | Shift towards online platforms for policy management and claims. | Projected 75% of policy management via digital channels by early 2025. |

| Lifestyle Changes | Emergence of new insurance needs due to remote work and short-term rentals. | 30% US workforce working remotely part-time (early 2024). |

Technological factors

The rapid growth of Insurtech is fundamentally reshaping the insurance industry, introducing novel approaches to risk assessment, claims processing, and customer engagement. For HCI Group, its technology segment can capitalize on these advancements to streamline property and casualty operations, ultimately boosting efficiency and elevating the customer experience.

The global Insurtech market was valued at approximately $11.4 billion in 2023 and is projected to reach over $40 billion by 2028, demonstrating substantial investment and adoption. Staying ahead in this dynamic environment necessitates the continuous integration of pioneering technologies to maintain a competitive edge.

Advanced data analytics and AI are transforming risk assessment, enabling more accurate underwriting and policy pricing. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting its growing impact on business operations.

HCI Group can leverage AI for sophisticated predictive modeling of natural disasters, improving preparedness and response. AI's ability to detect fraudulent claims, which cost the insurance industry billions annually, is also a significant advantage. Furthermore, AI provides personalized customer insights, enhancing engagement and service delivery.

These technological advancements directly boost the accuracy of risk profiles and streamline operational efficiencies. By analyzing vast datasets, AI can identify subtle patterns indicative of future risks, leading to better capital allocation and reduced losses.

As an information technology provider and an insurance company, HCI Group faces escalating cybersecurity threats. In 2024, the global average cost of a data breach reached $4.45 million, a significant increase from previous years, highlighting the substantial financial risks involved. Protecting sensitive customer data is paramount not only for maintaining client trust but also for adhering to stringent data privacy regulations like GDPR and CCPA.

A single data breach could result in severe financial penalties, legal liabilities, and irreparable damage to HCI Group's reputation. For instance, the Equifax breach in 2017, which exposed the personal data of 147 million people, ultimately cost the company over $700 million in settlements and remediation. Therefore, investing in advanced cybersecurity measures, including encryption, regular security audits, and employee training, is a critical technological factor for HCI Group's operational integrity and long-term viability.

Automation in Claims Processing

Technological advancements are significantly boosting automation in claims processing, streamlining everything from the initial report to the final payout. This means faster and more efficient service for policyholders. For instance, AI-powered tools can now analyze claim documents and detect fraud with remarkable speed, a crucial capability for insurers like HCI Group, especially following major events that generate a high volume of claims.

HCI Group can leverage these automated systems to refine its claims operations. By reducing manual tasks, the company can expect a notable decrease in administrative costs. Furthermore, quicker claim resolutions directly translate to improved policyholder satisfaction, a key differentiator in the competitive insurance market. In 2024, the insurance industry saw a growing adoption of AI in claims, with some reports indicating potential cost savings of up to 30% through automation.

- AI-driven document analysis: Speeds up claims assessment and reduces manual data entry.

- Automated fraud detection: Enhances accuracy and minimizes financial losses.

- Streamlined communication: Improves policyholder experience through faster updates and resolutions.

- Reduced operational costs: Achieved through the elimination of repetitive manual tasks.

Cloud Computing and Scalable IT Infrastructure

The increasing adoption of cloud computing offers HCI Group a significant advantage by providing a scalable and flexible IT infrastructure. This is vital for both their insurance and technology businesses, allowing them to adapt quickly to changing demands.

Cloud solutions are instrumental in speeding up software development and deployment cycles. They also ensure efficient data storage and robust disaster recovery capabilities, which are absolutely critical for handling the vast amounts of data generated in the insurance sector and for supporting enterprise-level applications.

By leveraging cloud infrastructure, HCI Group can enhance operational efficiency and reduce the burden of managing on-premises hardware. This strategic move supports their ability to innovate and deliver services more effectively.

Recent industry trends underscore the importance of cloud adoption. For example, a significant portion of businesses are migrating their core operations to the cloud, with global public cloud spending projected to reach over $600 billion in 2024, highlighting its critical role in modern IT strategy.

- Scalability: Cloud platforms allow HCI Group to scale IT resources up or down based on business needs, ensuring cost-effectiveness and performance.

- Agility: Faster deployment of new products and services, enabling quicker responses to market changes and customer demands.

- Data Management: Enhanced capabilities for storing, processing, and analyzing large datasets, crucial for actuarial science and risk assessment in insurance.

- Resilience: Improved disaster recovery and business continuity planning, safeguarding critical data and operations.

Technological factors are profoundly influencing the insurance landscape, with Insurtech driving innovation in risk assessment and customer interaction. HCI Group's technology segment can leverage AI for predictive modeling, enhancing preparedness for events like natural disasters and improving fraud detection, which cost the industry billions annually.

Legal factors

HCI Group navigates Florida's complex insurance regulatory landscape, a critical factor impacting its operations. This includes adherence to strict rules on policy forms, pricing, market conduct, and financial solvency. Staying compliant is paramount to prevent penalties, license issues, and business interruptions.

Florida's Office of Insurance Regulation (OIR) actively updates its guidelines. For instance, in 2024, the OIR continued its focus on insurer financial stability and consumer protection, with legislative sessions in 2024 and 2025 likely to introduce further changes affecting insurance business models and premium adjustments.

HCI Group, operating in insurance and IT, must navigate a complex web of data privacy and cybersecurity laws. This includes adhering to state-specific regulations and federal standards like HIPAA, crucial for safeguarding customer information and preventing legal penalties. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers significant control over their personal data, setting a high bar for compliance across industries.

HCI Group's litigation exposure in Florida remains a significant concern, with a notable increase in claims disputes and Assignment of Benefits (AOB) abuses. For instance, in 2023, Florida saw a substantial rise in property insurance litigation, with some reports indicating a significant percentage of all homeowner claims involving litigation, impacting insurers like HCI. This trend directly affects HCI's operational costs and necessitates robust legal defense strategies.

The ongoing legislative landscape concerning tort reform in Florida is crucial for HCI's future. Recent legislative sessions have seen attempts to curb frivolous lawsuits and regulate AOB practices, aiming to stabilize the insurance market. For example, Florida Statute 627.70151, enacted to address some of these issues, has begun to shape how claims are handled and litigated, potentially reducing HCI's legal expenses and improving its loss ratios.

Reinsurance Contract Law

HCI Group's reinsurance contracts are subject to intricate contract law, frequently spanning multiple international jurisdictions and incorporating arbitration clauses. Navigating these legal frameworks is paramount for successful risk transfer and efficient dispute resolution with reinsurance partners. For instance, in 2024, the global reinsurance market saw significant activity, with major players like Munich Re and Swiss Re reporting robust financial results, underscoring the importance of well-defined legal agreements in managing vast risk portfolios.

Changes in international legal standards and regulatory frameworks can significantly impact reinsurance arrangements. These shifts might necessitate adjustments to contract terms, capital requirements, or dispute resolution mechanisms. The ongoing evolution of insurance and reinsurance regulations, particularly concerning solvency and consumer protection, as observed in recent discussions at the International Association of Insurance Supervisors (IAIS) meetings in late 2024, highlights the dynamic legal landscape that HCI Group must continually monitor and adapt to.

- Jurisdictional Complexity: Reinsurance contracts often involve cross-border elements, requiring adherence to diverse legal systems and potentially leading to complex jurisdictional disputes.

- Arbitration Clauses: The inclusion of arbitration clauses is common, providing a structured mechanism for resolving disagreements outside of traditional court systems, often favored for its speed and neutrality in international dealings.

- Regulatory Evolution: Staying abreast of evolving international legal standards, such as those related to data privacy or financial conduct, is critical for maintaining compliance and the validity of reinsurance agreements.

Intellectual Property Rights

For HCI Group, with its focus on software solutions for the insurance sector, safeguarding intellectual property is absolutely critical. This means understanding and utilizing patent, copyright, and trademark laws to protect its unique software and technological advancements.

Legal actions to prevent infringement are essential for HCI Group to maintain its advantage in the market. For instance, in 2023, the software industry saw significant investment in IP protection, with companies allocating substantial resources to patent filings and litigation to defend their innovations.

- Patent Protection: Securing patents for novel software algorithms and processes is key to preventing competitors from replicating HCI Group's core technologies.

- Copyright Safeguards: Copyright laws protect the literal expression of HCI Group's software code, preventing unauthorized copying and distribution.

- Trademark Enforcement: Protecting brand names and logos through trademarks is vital for maintaining customer trust and preventing brand dilution.

- Litigation Costs: In 2024, the average cost of patent litigation in the technology sector can range from hundreds of thousands to millions of dollars, highlighting the financial commitment required for IP defense.

HCI Group must navigate Florida's evolving insurance regulations, with legislative sessions in 2024 and 2025 likely to introduce further changes impacting business models and pricing. Compliance with data privacy laws, such as the CCPA/CPRA, is crucial for safeguarding customer information and avoiding legal penalties.

The company faces significant litigation exposure due to increased claims disputes and Assignment of Benefits abuses in Florida, with a notable rise in property insurance litigation observed in 2023. Recent tort reform efforts, like Florida Statute 627.70151, aim to reduce frivolous lawsuits and stabilize the market, potentially lowering HCI's legal expenses.

Intellectual property protection through patents, copyrights, and trademarks is vital for HCI's software innovations, with technology sector patent litigation costs averaging substantial figures in 2024. International legal standards for reinsurance, as discussed at IAIS meetings in late 2024, also require continuous monitoring and adaptation.

Environmental factors

Florida's vulnerability to hurricanes and tropical storms significantly affects HCI Group's property insurance operations. The increasing frequency and severity of these weather events directly translate to higher claim payouts and a greater need for reinsurance coverage.

For instance, the 2022 Atlantic hurricane season, while not directly impacting HCI's primary market as severely as some previous years, saw significant insured losses across the industry, underscoring the ongoing risk. This trend necessitates sophisticated catastrophe modeling to accurately price risk and manage potential exposure.

HCI Group's strategic response involves continuous investment in risk management and reinsurance strategies to mitigate the financial impact of these environmental factors. Effective catastrophe modeling, as demonstrated by industry-wide efforts, is crucial for maintaining solvency and ensuring the company's ability to meet its obligations following major weather events.

Rising sea levels and coastal erosion present a substantial long-term environmental risk for HCI Group, particularly concerning its insured properties in Florida. These ongoing geological shifts can directly translate to increased property damage claims and a devaluation of insured assets, forcing HCI to re-evaluate its underwriting strategies and coastal exposure.

For instance, Florida's average sea level is projected to rise by 10 to 12 inches by 2030 compared to 2000 levels, according to the Florida Climate Institute. This trend exacerbates coastal erosion, directly impacting the insurable value of properties HCI covers. By 2070, projections suggest an additional 2 to 7 feet of sea level rise, which would dramatically increase the frequency and severity of storm surge damage.

Governmental environmental regulations, particularly stricter building codes designed to bolster resilience against natural disasters, directly impact the construction and repair expenses for insured properties. These evolving standards, such as updated seismic or flood zone requirements, can lead to higher upfront costs for repairs, influencing how companies like HCI Group manage claims and set premiums.

For instance, in 2024, many regions are seeing increased scrutiny on building materials and energy efficiency, adding an estimated 5-15% to renovation costs depending on the specific upgrades required. While these measures aim to reduce long-term risk and potential future payouts, they necessitate careful financial modeling by insurers to ensure premium rates adequately reflect these enhanced construction expenses.

Climate Change Impact on Reinsurance Markets

Climate change is significantly reshaping global weather patterns, directly impacting the availability and cost of reinsurance, a critical component for HCI Group. As extreme weather events become more frequent and severe, reinsurers are experiencing a surge in catastrophe-related claims worldwide.

This escalating risk landscape is driving up the price of reinsurance capacity. For instance, global insured losses from natural catastrophes were estimated to be around $110 billion in 2023, a notable increase from previous years, according to Swiss Re. This trend directly affects HCI Group's expense structure and its capacity to secure the necessary coverage to underwrite its risks effectively.

The increasing cost of reinsurance can lead to:

- Higher premiums for HCI Group's insurance products.

- Reduced availability of certain types of coverage.

- Increased retention of risk by HCI Group itself.

- Potential impact on HCI Group's profitability and financial stability.

Public and Investor Pressure for ESG Practices

The increasing emphasis on Environmental, Social, and Governance (ESG) principles by both the public and investors is significantly shaping corporate behavior. HCI Group, like many companies, is likely to experience heightened scrutiny regarding its sustainability initiatives. This includes expectations to showcase how it encourages policyholder participation in environmental mitigation and how it incorporates climate-related risks into its investment portfolios.

This growing ESG focus directly affects HCI Group's standing and its ability to secure funding. For instance, a significant portion of global assets under management are now guided by ESG criteria. In 2024, it's estimated that over $37 trillion in assets globally are managed with ESG considerations, a figure projected to rise substantially by 2025. Companies demonstrating strong ESG performance often find it easier to attract capital and maintain a positive brand image.

HCI Group's responsiveness to these demands can be seen through several potential actions:

- Enhanced Reporting: Publishing detailed reports on carbon emissions reduction and waste management.

- Sustainable Investment Policies: Allocating a greater percentage of its investment capital to companies with strong ESG ratings.

- Policyholder Engagement: Developing programs that incentivize policyholders to adopt eco-friendly practices, potentially through premium discounts.

- Climate Risk Integration: Incorporating climate change scenarios into actuarial models and risk management frameworks.

Environmental factors, particularly climate change, pose significant risks to HCI Group's operations. Increased frequency and severity of natural disasters like hurricanes directly lead to higher claim payouts and a greater need for costly reinsurance. For example, global insured losses from natural catastrophes were around $110 billion in 2023, impacting reinsurance costs for insurers like HCI.

PESTLE Analysis Data Sources

Our HCI PESTLE analysis is built on a robust foundation of data from reputable sources, including academic research databases, industry-specific publications, and government reports on technology adoption and societal trends. This ensures a comprehensive understanding of the macro-environment impacting human-computer interaction.