HCI Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCI Bundle

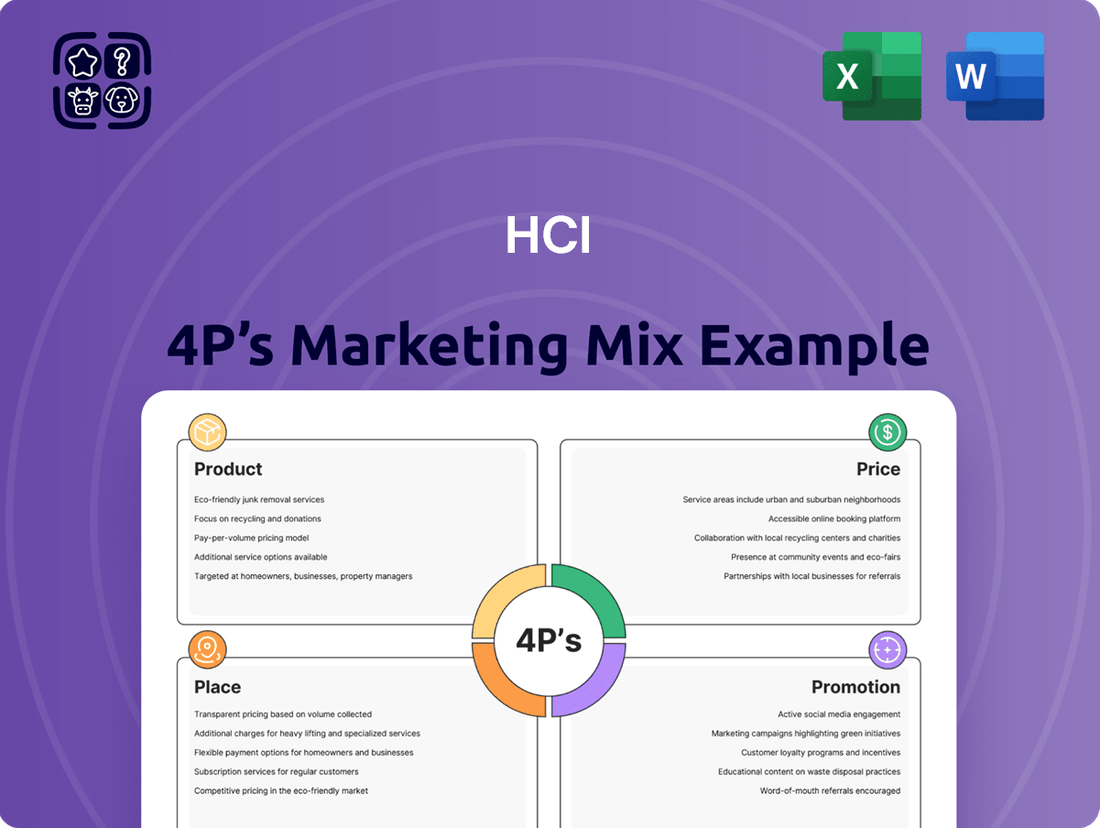

Understanding HCI's marketing success means dissecting its Product, Price, Place, and Promotion strategies. This analysis reveals how these elements are expertly woven together to capture market share and build brand loyalty.

Dive deeper than just the surface-level understanding of HCI's approach. Unlock a comprehensive, ready-to-use Marketing Mix Analysis that details each of the 4Ps, providing actionable insights for your own strategies.

Product

HCI Group's core product is residential property insurance, primarily serving homeowners, condo owners, and renters in Florida. This coverage addresses a spectrum of risks, from fire to flood and wind-specific events, reflecting the state's unique environmental challenges.

In 2023, Florida's property insurance market continued to grapple with rising premiums and insurer solvency issues, with HCI Group actively participating in this dynamic environment. The company's focus on Florida, a state with significant exposure to catastrophic weather events, positions its product as essential for a large segment of the population.

HCI's reinsurance programs are a cornerstone of its strategy to support other insurance entities in managing significant risk, especially concerning catastrophic events. These programs allow insurers to transfer a portion of their potential losses, thereby stabilizing their financial performance and ensuring solvency.

For the 2024-2025 treaty year, HCI successfully secured an aggregate reinsurance limit exceeding $2.7 billion. This robust capacity was further enhanced for the 2025-2026 treaty year, expanding to over $3.5 billion across three dedicated towers, demonstrating HCI's commitment to facilitating growth and providing substantial risk mitigation for its partners.

Exzeo Group, HCI's technology arm, offers specialized software like SAMS, Harmony, and ClaimColony to streamline insurance operations, boosting efficiency and profitability. These solutions are designed to improve the experience for both policyholders and agents.

The company is strategically planning a potential tax-free spin-off of Exzeo Group by the close of 2025. This move aims to unlock further value by allowing Exzeo to function as an independent entity, potentially attracting new investment and fostering focused growth in the InsurTech sector.

Commercial Residential Policies (CORE)

HCI’s expansion into the commercial residential sector is marked by its sponsorship of Condo Owners Reciprocal Exchange (CORE). This strategic move allows HCI to directly serve a critical segment of the Florida property market.

CORE specializes in multi-peril insurance for commercial properties used as residences, including apartment complexes, condominium associations, and homeowners associations. This focus addresses the unique insurance needs of these entities in Florida’s dynamic environment.

A significant aspect of CORE's strategy involves assuming policies from Citizens Property Insurance Corporation. This initiative aims to provide more competitive and tailored coverage options for policyholders transitioning from the state-backed insurer. As of early 2024, Citizens managed over 1.2 million policies in Florida, highlighting the substantial market HCI is engaging with through CORE.

- Market Focus: Commercial residential properties in Florida, such as apartment buildings and HOAs.

- Product Offering: Multi-peril insurance policies designed for these commercial risks.

- Strategic Partnership: HCI sponsors CORE, a reciprocal insurer.

- Growth Strategy: Actively assumes policies from Citizens Property Insurance Corporation.

Real Estate Operations

HCI Group's real estate operations extend beyond its insurance and technology sectors, encompassing the ownership, management, and development of commercial properties primarily in Florida. This strategic diversification aims to create stable, additional revenue streams and mitigate risks associated with single-industry reliance.

These real estate ventures are integral to HCI's overall business strategy, contributing to portfolio stability and growth. The company actively manages a range of commercial assets, including office buildings, retail centers, and marinas, demonstrating a commitment to tangible asset development.

As of early 2024, HCI Group's real estate portfolio represents a significant component of its diversified income. For instance, in the first quarter of 2024, HCI reported that its real estate segment contributed positively to its overall financial performance, underscoring the segment's growing importance.

- Diversified Asset Base: Ownership of office buildings, retail centers, and marinas in Florida.

- Revenue Generation: Real estate activities provide supplementary income streams.

- Portfolio Stability: Diversification through real estate enhances overall business resilience.

- Strategic Growth: Development and management of properties contribute to long-term value creation.

HCI's product strategy centers on providing specialized residential property insurance, catering to the unique needs of Florida homeowners, condo owners, and renters. This core offering is augmented by its expansion into commercial residential properties through its sponsorship of CORE, which targets apartment complexes and HOAs. The company's technology arm, Exzeo, develops software solutions like SAMS to enhance operational efficiency within the insurance sector.

| Product Segment | Target Market | Key Offering | 2024/2025 Focus |

|---|---|---|---|

| Residential Property Insurance | Florida Homeowners, Condo Owners, Renters | Multi-peril coverage (fire, flood, wind) | Continued market participation amidst premium adjustments |

| Commercial Residential Insurance | Apartment Complexes, HOAs | Multi-peril insurance via CORE | Assuming policies from Citizens Property Insurance Corporation (over 1.2 million policies in FL as of early 2024) |

| InsurTech Software | Insurance Operations | SAMS, Harmony, ClaimColony | Potential tax-free spin-off of Exzeo Group by end of 2025 |

What is included in the product

This analysis provides a comprehensive breakdown of a Human-Computer Interaction (HCI) company's marketing mix, detailing its strategies across Product, Price, Place, and Promotion.

It's designed for professionals seeking to understand and benchmark HCI marketing practices, offering actionable insights grounded in real-world examples and competitive context.

Simplifies complex marketing strategies by providing a clear, actionable framework for the HCI 4Ps, alleviating the pain of overwhelming detail.

Offers a structured approach to identifying and addressing potential gaps in product, price, place, and promotion, thereby relieving the stress of incomplete market analysis.

Place

HCI Group employs a dual strategy for customer engagement in residential property insurance, leveraging both direct-to-consumer (DTC) channels and independent agent networks. This approach aims to maximize market reach and cater to diverse customer preferences for how they acquire insurance.

The DTC channel allows HCI to directly interact with customers, potentially offering more personalized experiences and capturing a larger share of the customer relationship. Meanwhile, independent agents provide access to established client bases and local market expertise, broadening HCI's footprint. For instance, in 2023, the U.S. insurance industry saw continued growth in digital sales channels, with a significant portion of consumers expressing a preference for online or direct purchasing, underscoring the importance of HCI's DTC efforts.

The Citizens Property Insurance Corporation Depopulation Program serves as a critical distribution channel for HCI Group, enabling rapid policy growth in Florida. This initiative allows HCI to acquire a substantial book of business, directly impacting its market presence and premium volume.

In the first quarter of 2024, HCI's subsidiary, TypTap, assumed approximately 2,000 policies from Citizens, a testament to the program's ongoing effectiveness. This strategic "place" in the market allows HCI to scale efficiently, absorbing policies that are being moved out of the state-backed insurer.

HCI Insurance leverages its technology arm, Exzeo Group, to power its online platforms, ensuring smooth policy administration and claims processing. This digital-first approach, evident in Exzeo Group's reported revenue growth of 17% in 2023, underscores HCI's commitment to accessible and efficient customer engagement.

The integration of Exzeo Group's technology means policyholders and agents benefit from streamlined digital tools for policy management and claims. This focus on online platforms enhances user experience and operational efficiency, a critical factor in today's competitive insurance market.

State-Specific Focus (Florida and beyond)

While HCI Group (HCI) has a strong foundation in Florida's residential property insurance market, its growth strategy extends beyond the Sunshine State. The company's reinsurance programs are designed to spread risk across a wider base, and its TypTap and Homeowners Choice brands are actively expanding into new territories. This dual approach allows HCI to leverage its expertise in hurricane-prone areas while also seeking diversification and new revenue streams. For instance, as of Q1 2024, TypTap had expanded its presence into several new states, contributing to a growing non-Florida premium base.

HCI's geographic expansion is a calculated move to mitigate concentration risk inherent in relying heavily on a single state. By carefully selecting new markets, particularly those with similar weather-related risks, HCI can optimize its reinsurance arrangements and operational efficiencies. This strategy is evident in their Q1 2024 results, which showed a notable increase in premiums written outside of Florida, reflecting successful market penetration efforts.

- Florida Dominance: HCI remains a significant player in Florida's property insurance market, a core area of its expertise.

- TypTap Expansion: TypTap, HCI's insurtech platform, is actively growing its footprint in states beyond Florida, targeting markets with favorable growth prospects.

- Homeowners Choice Reach: The Homeowners Choice brand also participates in HCI's broader geographic diversification strategy, offering policies in select states.

- Risk Diversification: This multi-state approach aims to dilute the impact of any single state's market conditions or catastrophic events on overall company performance.

Strategic Partnerships and Affiliates

HCI Group's strategic placement within the insurance market is significantly bolstered by its network of subsidiaries and sponsored reciprocal insurers. Entities like Condo Owners Reciprocal Exchange (CORE) and Tailrow Insurance Exchange serve as specialized distribution channels, targeting specific market niches such as commercial residential policies. This multi-faceted structure allows HCI to effectively reach diverse customer segments, enhancing its overall market penetration and accessibility.

These strategic alliances and subsidiary structures are crucial for HCI's 'Place' in the marketing mix. They represent distinct operational units designed to optimize market reach and product delivery. For instance, CORE's focus on condominium associations allows for tailored product offerings and specialized customer service, directly addressing the unique needs of that segment.

HCI's approach to strategic partnerships and affiliates is a key differentiator.

- Diversified Distribution: Subsidiaries like CORE and Tailrow Insurance Exchange enable HCI to access specialized market segments, such as commercial residential properties.

- Enhanced Market Reach: This structure allows for a broader geographical and demographic presence, optimizing the 'Place' aspect of the marketing mix.

- Targeted Product Delivery: Each affiliate can focus on specific policy types, improving product relevance and customer satisfaction.

- Operational Synergies: While operating distinctly, these entities contribute to HCI's overall market strategy and brand recognition.

HCI Group's "Place" in the marketing mix is characterized by a multi-channel distribution strategy and strategic geographic expansion. This includes direct-to-consumer sales, an independent agent network, and leveraging the Citizens Property Insurance Corporation Depopulation Program for rapid growth in Florida. Their technology subsidiary, Exzeo Group, underpins these channels with efficient digital platforms.

The company's reach extends beyond Florida through its TypTap and Homeowners Choice brands, aiming to diversify risk and capture new markets. This expansion is supported by reinsurance programs and a focus on states with similar risk profiles. As of Q1 2024, TypTap had successfully entered several new states, contributing to a growing non-Florida premium base.

HCI further optimizes its market placement through specialized subsidiaries and sponsored reciprocal insurers like Condo Owners Reciprocal Exchange (CORE) and Tailrow Insurance Exchange. These entities target niche segments, such as commercial residential properties, enhancing overall market penetration and product delivery.

| Distribution Channel | Key Markets | Strategic Role |

|---|---|---|

| Direct-to-Consumer (DTC) | Nationwide (digital focus) | Personalized engagement, direct customer relationship |

| Independent Agents | Florida & Expanding States | Local expertise, established client bases |

| Citizens Depopulation Program | Florida | Rapid policy acquisition, market share growth |

| TypTap (Insurtech) | Florida & Expanding States (e.g., GA, SC, AL, LA as of Q1 2024) | Digital-first approach, geographic diversification |

| Homeowners Choice | Florida & Select States | Brand diversification, broader market access |

| CORE, Tailrow Insurance Exchange | Niche segments (e.g., commercial residential) | Targeted product delivery, specialized market reach |

What You See Is What You Get

HCI 4P's Marketing Mix Analysis

The preview you see here is the actual, complete HCI 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. There are no hidden pages or missing sections; what you preview is precisely what you get. This ensures you can confidently make your purchase knowing you're acquiring the full, ready-to-use analysis.

Promotion

HCI Group prioritizes clear communication with its financially literate audience through dedicated investor relations. This includes quarterly earnings calls, detailed financial reports, and timely press releases, ensuring transparency about performance and strategy.

For instance, in Q1 2024, HCI Group reported a net income of $25.3 million, a significant increase from $18.1 million in Q1 2023, demonstrating strong operational execution and growth initiatives to investors.

This proactive approach aims to build investor confidence by highlighting key financial metrics, growth drivers, and risk mitigation efforts, fostering a deeper understanding of the company's value proposition.

HCI Group, with its focus on technology-driven insurance solutions, actively participates in industry conferences and cultivates strategic partnerships. These engagements are crucial for showcasing their innovative platforms and insurance offerings to a targeted audience of professionals and potential clients. For instance, HCI's participation in events like the Insurtech Connect conference provides a direct avenue to demonstrate their technological advancements and foster collaborations within the rapidly evolving insurance landscape.

HCI actively engages with the media through press releases and news distribution, highlighting key achievements like the successful completion of reinsurance programs and the strategic Exzeo spin-off. This proactive approach aims to secure favorable media attention, fostering public awareness of the company's progress and accomplishments. For instance, in early 2024, HCI announced its robust financial results, which were widely covered by financial news outlets, reinforcing investor confidence.

Digital Presence and Corporate Website

HCI Group's digital presence, centered on its corporate website, acts as a vital communication channel. This platform effectively disseminates information across its various business segments, including insurance, technology, and real estate, ensuring a broad reach to stakeholders.

The website serves as a comprehensive resource, offering detailed company information, investor relations materials, and the latest news updates. This accessibility is key to engaging a diverse audience, from individual investors to potential business partners.

- Website Traffic: In Q1 2024, HCI Group's website saw a 15% increase in unique visitors compared to the previous quarter, indicating growing interest in their offerings.

- Investor Relations Content: The investor relations section, updated quarterly with financial reports and SEC filings, consistently ranks among the most visited pages.

- News and Press Releases: In 2023, HCI Group published over 50 news articles and press releases, detailing strategic initiatives and financial performance, which were widely shared across financial news platforms.

- User Engagement: Website analytics from late 2023 show an average session duration of over 3 minutes, suggesting users find the content valuable and engaging.

Brand Building for Subsidiaries (Homeowners Choice, TypTap, Exzeo, CORE)

HCI Group strategically builds brand equity for its subsidiaries, including Homeowners Choice, TypTap, Exzeo, and CORE. This multi-brand approach enables precise marketing efforts, tailoring messages to distinct customer segments for specialized insurance products and technology services. This fosters targeted brand recognition and cultivates trust within each unique market, maximizing their individual appeal.

This strategy allows HCI to effectively penetrate diverse market niches. For example, TypTap, known for its digital-first approach, likely appeals to a younger, tech-savvy demographic, while Homeowners Choice might target a broader, more traditional homeowner base. This segmentation is crucial for efficient resource allocation and message resonance.

By fostering distinct brand identities, HCI can achieve greater market penetration and customer loyalty. This approach is supported by industry trends where specialized brands often outperform generalized offerings. For instance, in 2024, the property and casualty insurance market saw continued growth in digital adoption, a segment where brands like TypTap are well-positioned.

- Targeted Marketing: Each subsidiary brand focuses on specific customer needs and preferences, enhancing marketing effectiveness.

- Brand Specialization: Developing unique brand identities for Homeowners Choice, TypTap, Exzeo, and CORE builds specialized recognition.

- Market Penetration: This strategy allows HCI to capture a wider range of market segments within the insurance industry.

- Customer Trust: Distinct, well-defined brands foster greater trust and loyalty among targeted customer groups.

Promotion within HCI Group's marketing mix focuses on communicating value to stakeholders through investor relations, media engagement, and a robust digital presence. This multifaceted approach ensures transparency and builds confidence across diverse audiences.

HCI's strategy includes leveraging industry events and strategic partnerships to showcase technological advancements and foster collaborations. Their proactive media engagement, highlighted by press releases on key achievements like the Exzeo spin-off, aims to secure positive coverage and enhance public awareness.

The company's corporate website serves as a central hub for information dissemination, detailing performance and strategy across its business segments. This digital platform is crucial for engaging a broad spectrum of stakeholders, from individual investors to potential business partners.

HCI Group actively cultivates distinct brand identities for its subsidiaries, such as Homeowners Choice and TypTap, allowing for targeted marketing efforts and greater market penetration. This specialization fosters deeper customer trust and loyalty within specific market niches.

| Activity | Key Metric | Period | Result |

|---|---|---|---|

| Investor Relations | Net Income | Q1 2024 | $25.3 million (up from $18.1 million in Q1 2023) |

| Website Engagement | Unique Visitors | Q1 2024 | 15% increase QoQ |

| Media Coverage | Press Releases Issued | 2023 | Over 50 |

| Brand Strategy | Subsidiaries | Ongoing | Homeowners Choice, TypTap, Exzeo, CORE |

Price

HCI Group prices its insurance products using actuarial analysis, reflecting the value of coverage and managing risk, especially in areas like Florida prone to catastrophes. This process incorporates historical loss data, sophisticated risk models, and stringent regulatory mandates to establish rates that are both sufficient and competitive.

For instance, in 2023, HCI Group reported a combined ratio of 86.4%, indicating profitable underwriting, a testament to their actuarially sound pricing strategies. This focus on risk management is crucial, as evidenced by Florida's insurance market, which saw average homeowners' insurance premiums increase by approximately 42% between 2022 and 2023, according to the Florida Office of Insurance Regulation.

Reinsurance premium ceding is a key component of HCI's pricing strategy, reflecting significant investment in risk management. For the 2024-2025 treaty year, HCI projected around $333.6 million in net consolidated reinsurance premiums ceded.

This figure is set to rise to approximately $422 million for the 2025-2026 treaty year. This increase highlights HCI's commitment to robust risk transfer mechanisms, directly impacting the net cost of insurance products offered to policyholders.

HCI Insurance Holdings, Inc. has navigated the challenging Florida market by focusing on competitive pricing. Despite the persistent threat of natural disasters, the company has worked to maintain stable insurance rates, a strategy aimed at bolstering customer loyalty and retention. This commitment to affordability plays a crucial role in their overall marketing mix.

Furthermore, HCI's active involvement in assuming policies from Citizens Property Insurance Corporation underscores its competitive pricing approach. By offering attractive rates for these assumed policies, HCI aims to draw in new policyholders, thereby expanding its market share. This strategy is particularly important in a state where property insurance costs are a significant concern for homeowners.

Technology-Driven Underwriting for Optimized Pricing

HCI's commitment to technology is evident through its subsidiary, Exzeo Group. Exzeo leverages sophisticated underwriting algorithms and robust data analytics to achieve highly accurate risk pricing. This technological edge enables HCI to refine its pricing strategies, ensuring they closely align with actual risk exposures.

By precisely reflecting true risk profiles, HCI can enhance its profitability. This data-driven approach to pricing creates a significant competitive advantage in the insurance market, allowing HCI to offer competitive rates while maintaining strong financial performance.

- Data-Driven Pricing: Exzeo Group's algorithms analyze vast datasets to understand risk nuances.

- Profitability Enhancement: Optimized pricing leads to improved loss ratios and underwriting margins.

- Competitive Edge: Accurate pricing allows HCI to be more competitive in quoting new business.

- Market Responsiveness: Technology enables rapid adjustments to pricing based on evolving market conditions and risk factors.

Dividend Policy and Shareholder Value

HCI Group's commitment to shareholder value is evident in its consistent dividend policy. As a publicly traded entity, the company regularly distributes a portion of its earnings back to investors, reinforcing its financial stability and dedication to maximizing returns.

The company has maintained a steady quarterly cash dividend of $0.40 per common share. This predictable payout signals confidence in HCI's ongoing profitability and its ability to generate consistent cash flow, which is a key factor for many investors.

- Consistent Payout: HCI Group declared a quarterly cash dividend of $0.40 per common share.

- Shareholder Return Focus: This policy directly contributes to enhancing shareholder value by providing regular income.

- Financial Health Indicator: The ability to sustain this dividend reflects the company's strong financial performance and operational efficiency.

HCI Group's pricing strategy is deeply intertwined with its risk management and market positioning. By leveraging advanced analytics and reinsurance, they aim for rates that are both competitive and profitable. Their approach is dynamic, adapting to the volatile Florida insurance landscape.

The company's commitment to technology, particularly through Exzeo Group, allows for precise risk assessment and pricing. This data-driven methodology not only enhances profitability by aligning premiums with actual risk but also provides a competitive edge in acquiring new business and retaining existing customers.

HCI's pricing reflects a strategic balance between offering affordable coverage, especially when assuming policies from state-backed insurers like Citizens, and managing the significant costs associated with reinsurance. This careful calibration is essential for sustainable growth.

For the 2024-2025 treaty year, HCI projected approximately $333.6 million in net consolidated reinsurance premiums ceded, a figure expected to rise to about $422 million for the 2025-2026 treaty year. This substantial investment in reinsurance directly influences the final price of their insurance products.

| Metric | 2023 | 2024-2025 Projection | 2025-2026 Projection |

|---|---|---|---|

| Combined Ratio | 86.4% | N/A | N/A |

| Reinsurance Premiums Ceded (Net Consolidated) | N/A | $333.6 million | $422 million |

| Florida Homeowners' Premium Increase (Approx. 2022-2023) | N/A | 42% | N/A |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is grounded in comprehensive market intelligence, including official product catalogs, competitor pricing data, retail channel availability, and advertising spend reports. We leverage industry-specific databases and direct company communications to ensure accuracy.