HCI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCI Bundle

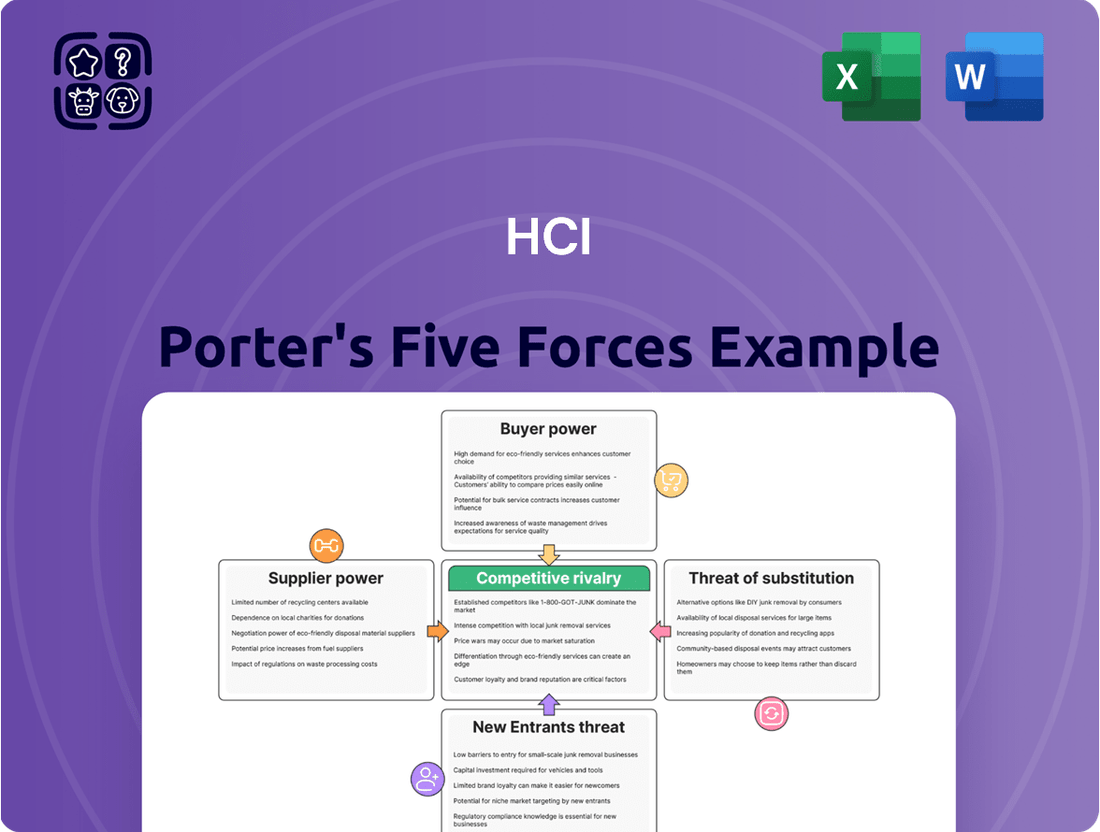

Porter's Five Forces analysis offers a powerful lens to understand the competitive landscape of HCI. By examining buyer power, supplier power, the threat of new entrants, the threat of substitutes, and industry rivalry, we can uncover the key drivers of profitability and strategic positioning. This foundational understanding is crucial for any business operating within or looking to enter the HCI market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore HCI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

HCI Group's reliance on reinsurance, especially in Florida's volatile property insurance market, makes reinsurance providers a significant force. This is demonstrated by HCI's rising reinsurance premiums, a direct consequence of policy growth and increased insured values.

Despite a global increase in reinsurance capital by 5.4% in 2024, Florida insurers continue to show a high dependence on it. For instance, ceded reinsurance leverage in Florida reached 519.4% in 2024, starkly contrasting with the US personal property average, highlighting the substantial bargaining power these providers wield.

The bargaining power of suppliers in the IT talent and software development services sector for HCI Group is significant. The high demand for specialized skills in areas like AI and machine learning, crucial for insurance software advancements in 2025, directly empowers IT professionals and service providers. This trend is underscored by the projected global IT spending on AI, expected to reach $300 billion in 2025, indicating a robust market for these in-demand skills.

For HCI, the bargaining power of data and analytics providers is substantial. Accurate risk assessment and underwriting are paramount in the insurance industry, making suppliers of comprehensive, real-time data – including geospatial, weather analytics, and claims history databases – highly influential. These providers dictate terms due to the critical nature of their offerings for competitive pricing and effective risk management.

Catastrophe Modeling Firms

Catastrophe modeling firms wield significant bargaining power over insurers like HCI, especially given HCI's Florida focus. These firms offer crucial data and complex models to forecast disaster losses, directly impacting underwriting and reinsurance strategies. Their specialized knowledge and proprietary tools create a dependency for insurers seeking to manage hurricane-related risks.

- High Demand for Specialized Expertise: The need for accurate catastrophe modeling is paramount for insurers operating in disaster-prone regions.

- Proprietary Data and Models: Catastrophe modeling firms invest heavily in developing unique datasets and sophisticated modeling techniques, creating a barrier to entry and enhancing their value proposition.

- Concentration of Providers: A limited number of leading catastrophe modeling firms exist, concentrating market power and allowing them to command higher fees. For instance, in 2024, the top three global catastrophe modeling firms accounted for a significant majority of the market share.

Legal and Claims Adjustment Services

The bargaining power of suppliers in legal and claims adjustment services is a significant factor for HCI. Florida's insurance market has a history of high litigation, making these services essential. While recent legislative reforms aim to curb lawsuits, their influence persists.

The efficiency and cost of these legal and claims adjustment services directly affect HCI's loss adjustment expenses. For instance, despite premium growth, HCI reported a decrease in these expenses in Q1 2025. This suggests a potential positive trend in managing these supplier costs, although their inherent power remains substantial due to market dynamics.

- Historical Litigation Frequency: Florida's insurance market has long been marked by frequent and costly legal disputes.

- Impact of Reforms: Legislative efforts in 2022 and 2023 sought to mitigate litigation, but the underlying need for these services remains.

- Cost Management: HCI's Q1 2025 results showed a decrease in loss adjustment expenses, indicating improved cost control in this area.

- Supplier Influence: Despite cost improvements, the critical nature of legal and claims adjustment services grants suppliers considerable bargaining power.

The bargaining power of suppliers for HCI Group is notably strong in several key areas, primarily due to the specialized nature of their offerings and the critical role they play in HCI's operations. This power is evident in the reinsurance market, IT talent acquisition, data provision, catastrophe modeling, and legal/claims adjustment services.

| Supplier Category | Key Factor Driving Power | Impact on HCI | Relevant Data/Trend |

|---|---|---|---|

| Reinsurance Providers | High dependence of Florida insurers on reinsurance | Increased premiums, limited options | Florida ceded reinsurance leverage at 519.4% in 2024 |

| IT Talent & Software Development | High demand for specialized skills (AI, ML) | Higher labor costs, potential delays | Global AI spending projected at $300 billion in 2025 |

| Data and Analytics Providers | Critical for risk assessment and underwriting | Dictate terms for essential data | N/A (specific data provider costs not public) |

| Catastrophe Modeling Firms | Proprietary data and complex models | Essential for risk management, command high fees | Top 3 firms held significant market share in 2024 |

| Legal & Claims Adjustment Services | Historical litigation frequency in Florida | Significant impact on loss adjustment expenses | HCI saw a decrease in loss adjustment expenses in Q1 2025 |

What is included in the product

This analysis delves into the five competitive forces shaping HCI's industry, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on profitability.

Quickly identify and neutralize competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Florida policyholders have historically faced limited choices and significant rate hikes, weakening their bargaining power. However, recent legislative actions and new market entrants in late 2024 and early 2025 are fostering a more competitive landscape. With 23 private insurers filing for rate reductions or stability and several new companies entering the market, consumers are gaining more options, which could begin to shift bargaining power back to them.

HCI Group's reinsurance customers, other insurance entities, experience varying bargaining power influenced by the global reinsurance market's capacity and competitiveness. As of mid-2025, a notable increase in global reinsurance capital is observed, coupled with a market shift favoring buyers. This translates to greater flexibility in terms and broader coverage options for these customers, potentially enhancing their negotiating leverage.

For HCI's technology segment, Exzeo, which provides insurance industry software, the bargaining power of its customers is a significant factor. These clients can exert pressure if they have readily available alternative software providers or if they possess the internal resources to develop their own solutions.

The evolving landscape of insurance technology, marked by the growing integration of AI, machine learning, and cloud computing, further empowers these customers. They will increasingly demand sophisticated, efficient, and highly adaptable software, granting them leverage if Exzeo's solutions aren't demonstrably superior and unique.

Citizens Property Insurance Corporation Policyholders

Policyholders transitioning from Citizens Property Insurance Corporation to private insurers like HCI Group possess a degree of bargaining power. This is primarily driven by their active search for more favorable rates and comprehensive coverage, especially following rate adjustments by Citizens. In 2023, Citizens saw a significant reduction in its policy count as policyholders moved to the private market, indicating a strong desire for alternative options.

The collective action of these policyholders seeking better terms can influence pricing and service offerings from private insurers. As of early 2024, the Florida insurance market continues to see shifts, with private insurers actively competing for these customers. This competition inherently empowers the policyholders.

- Policyholder Migration: Citizens' policy count has decreased substantially as policyholders seek private market alternatives.

- Rate Sensitivity: Policyholders are motivated by Citizens' rate increases to explore and negotiate with private insurers.

- Market Competition: The influx of policyholders into the private market creates a competitive environment that benefits consumers.

Demand for Competitive Pricing and Tailored Products

Customers in Florida's property insurance market are showing a heightened sensitivity to pricing, a direct consequence of significant premium increases experienced in recent years. This environment compels insurers, including HCI, to actively seek out and present more competitive pricing structures. The demand for value is pushing insurers to innovate with product offerings that cater to individual needs, such as options for higher deductibles or discounts for implementing specific mitigation measures.

This shift directly amplifies the bargaining power of customers. For instance, in 2023, Florida homeowners faced average property insurance premium increases of around 14%, according to the Florida Office of Insurance Regulation. This trend makes consumers more inclined to switch providers for even marginal savings, forcing HCI to maintain competitive rates and flexible product designs to retain its customer base.

- Price Sensitivity: Florida homeowners experienced an average property insurance premium increase of approximately 14% in 2023, driving a stronger focus on competitive pricing.

- Product Tailoring: Insurers like HCI are offering products with higher deductibles and mitigation discounts to meet customer demand for cost-saving options.

- Increased Shopping Behavior: Consumers are actively comparing quotes and switching providers to secure better deals, thereby enhancing their bargaining power.

The bargaining power of customers is amplified when they have numerous alternatives and are price-sensitive. In Florida's property insurance market, policyholders are increasingly exercising this power due to rising premiums and a growing number of competing insurers. This trend is forcing companies like HCI Group to offer more competitive pricing and tailored products to retain business.

| Market Factor | Impact on Customer Bargaining Power | Supporting Data (2023-2024) |

|---|---|---|

| Number of Insurers | Higher competition increases customer options and leverage. | 23 private insurers filed for rate reductions or stability in Florida (late 2024/early 2025). |

| Price Sensitivity | Customers actively seek lower costs, driving down prices. | Florida homeowners faced average property insurance premium increases of ~14% in 2023. |

| Availability of Alternatives | Switching to competitors becomes easier, pressuring existing providers. | Significant policyholder migration from Citizens to private insurers indicates a strong demand for alternatives. |

Preview the Actual Deliverable

HCI Porter's Five Forces Analysis

This preview showcases the complete HCI Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the Human-Computer Interaction field. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring you get a comprehensive and ready-to-use resource without any alterations or missing sections.

Rivalry Among Competitors

The Florida property insurance landscape is becoming more competitive. In 2024, at least nine new property and casualty insurers entered the market, and 23 private companies filed for rate decreases or no changes, signaling a more dynamic environment. This influx of new players, alongside HCI's own subsidiaries like Tailrow Insurance Company, is directly increasing the intensity of rivalry.

Competitive rivalry in the Florida property insurance market is intense, with HCI Group notably expanding its footprint. In 2023, HCI Group's gross premiums earned surged to $550.3 million, partly due to assuming policies from Citizens Property Insurance Corporation. This aggressive expansion, coupled with new entrants and some carriers exiting the market, highlights a fierce battle for market share.

Competitive rivalry in the insurance sector is significantly shaped by how companies differentiate their products and harness technology. Insurers are constantly innovating with diverse coverage options, from specialized cyber insurance to parametric policies, while simultaneously investing in technology for more accurate underwriting and a smoother customer journey. This technological push is crucial for gaining an edge.

HCI Group, for instance, is strategically leveraging its proprietary technology platform, Exzeo. This platform is designed to enhance underwriting accuracy through advanced algorithms and robust data analytics, aiming to provide a distinct competitive advantage. The company's decision to spin off Exzeo further underscores the perceived value and strategic importance of this technological asset in the competitive landscape.

Pricing Strategies and Profitability

Competitive rivalry in the Florida insurance market is intensifying, with a noticeable shift from sharp premium hikes to stabilization and even rate decreases from some providers. This dynamic directly impacts insurer profitability, demanding a keen focus on operational efficiency and robust risk management to maintain margins.

While HCI demonstrated strong Q1 2025 performance, including enhanced underwriting results, the evolving competitive environment necessitates continuous adaptation. The ability to offer competitive pricing while ensuring sustained profitability hinges on effective cost control and strategic risk selection.

- Florida Insurance Market Trends: Recent data indicates a move away from aggressive premium increases towards more stable or even reduced rates by some insurers.

- HCI's Performance: The company reported strong Q1 2025 results, showing improved underwriting performance, which is crucial in a competitive landscape.

- Profitability Drivers: Sustained profitability for insurers like HCI in this market relies heavily on efficient operations and sophisticated risk management strategies.

Regulatory Environment and Legislative Reforms

Florida's legislative reforms, particularly those enacted in 2022 and 2023, significantly altered the competitive rivalry landscape by aiming to stabilize the insurance market. These changes were designed to curb rampant litigation, a major drain on insurer profitability and a barrier to entry for new companies.

The reforms have demonstrably impacted the number of active insurers. For instance, following the 2022 legislative session, the number of property insurance policies in force with private insurers saw a notable shift, with some carriers exiting and others entering, indicating a dynamic response to the new regulatory framework. Insurers that successfully navigate these legislative shifts, reducing their exposure to costly litigation, are better positioned to compete and attract capital.

- Market Stabilization Efforts: Florida's legislative actions in 2022 and 2023 focused on reducing litigation abuse, a key factor in insurer solvency and market stability.

- Attracting New Entrants: Reforms aimed to create a more predictable legal environment, encouraging new insurers to enter the market, thereby increasing competition.

- Impact on Existing Insurers: Companies that adapted to the new legal and operational requirements, often by reducing their litigation-related expenses, found themselves in a stronger competitive position.

- Litigation Frequency Reduction: Data from 2023 indicated a decrease in certain types of insurance litigation, a direct outcome of the legislative changes, which benefits insurers by lowering operational costs.

The competitive rivalry within Florida's property insurance market is escalating, driven by new entrants and HCI Group's strategic policy assumptions. In 2024, nine new property and casualty insurers entered the market, while 23 existing companies sought rate decreases or no changes, indicating a more aggressive pricing environment. This heightened competition pressures insurers to focus on operational efficiency and technological innovation to maintain profitability.

HCI Group's expansion, including assuming policies from Citizens Property Insurance Corporation, contributed to its $550.3 million in gross premiums earned in 2023. This growth, alongside market stabilization efforts through legislative reforms in 2022 and 2023 aimed at curbing litigation, is reshaping the competitive dynamics. Insurers that adapt to these changes, particularly by reducing litigation-related expenses, are better positioned to thrive.

Technological advancement is a key differentiator. HCI's proprietary platform, Exzeo, enhances underwriting accuracy through advanced algorithms and data analytics, providing a competitive edge. This focus on technology, coupled with diverse product offerings and efficient operations, is crucial for insurers navigating the increasingly competitive Florida market, especially as some carriers exit and new ones enter.

| Metric | 2023 Value | 2024 Trend | Key Driver |

|---|---|---|---|

| New Insurer Entrants (Florida) | N/A | 9 | Market stabilization reforms |

| Insurers Filing Rate Decreases/No Change (Florida) | N/A | 23 | Increased competition, efficiency focus |

| HCI Group Gross Premiums Earned | $550.3 million | Continued growth expected | Policy assumptions, market expansion |

| Litigation Frequency (Florida Insurance) | Decreasing | Continued decrease anticipated | Legislative reforms (2022-2023) |

SSubstitutes Threaten

Self-insurance, including catastrophe savings accounts, presents a potential threat of substitutes for traditional homeowners insurance. For individuals with substantial assets or in regions with lower perceived risk, setting aside funds to cover potential damages can seem like a viable alternative to paying insurance premiums. This is particularly true if insurance costs escalate significantly, making self-funding appear more cost-effective over the long term.

Government-backed insurance programs, such as Florida's Citizens Property Insurance Corporation, represent a significant threat of substitutes for private insurers like HCI Group. Citizens acts as an insurer of last resort, stepping in when private market coverage is scarce or too costly, offering an alternative for homeowners. For example, as of the first quarter of 2024, Citizens reported over 1.3 million policies in force, highlighting its substantial market presence.

While legislative actions are in place to reduce Citizens' policy count, its continued existence provides a readily available substitute. HCI Group's strategy of acquiring policies directly from Citizens demonstrates an acknowledgment of this competitive dynamic. This direct assumption of policies from a state-backed entity underscores how government programs can directly impact the market share and growth potential of private insurers.

For companies like HCI that offer reinsurance, alternative risk transfer mechanisms pose a significant threat. These alternatives, such as catastrophe bonds and other insurance-linked securities (ILS), provide capital to absorb risks, directly competing with traditional reinsurance providers. The increasing popularity of ILS means that insurers have more options for managing their risk exposure beyond relying solely on reinsurers.

The market for these alternatives is robust and growing. For instance, the first half of 2025 witnessed record issuance in the catastrophe bond market, demonstrating a strong investor demand for these instruments. This trend suggests that more capital is available through these substitute channels, potentially reducing the reliance on and the pricing power of traditional reinsurers like HCI's reinsurance segment.

Non-Traditional Insurance Models (e.g., Reciprocal Exchanges)

The rise of non-traditional insurance models, like reciprocal exchanges, presents a potential substitute for conventional insurance providers. In these structures, policyholders also act as insurers, which can attract customers looking for alternative governance and risk-sharing arrangements. For instance, Tailrow Reciprocal Exchange, a subsidiary of HCI Group, exemplifies this shift.

These alternative models can exert pressure on established insurers by offering different value propositions. They might appeal to policyholders who prefer direct participation in underwriting profits and losses, or who are seeking more specialized coverage. This segment of the market could divert business from traditional insurers if these models prove more efficient or customer-centric.

As of early 2024, the insurance industry continues to see innovation in distribution and structure. While specific market share data for reciprocal exchanges versus traditional insurers is still developing, the trend towards customer empowerment and alternative risk transfer mechanisms is evident. This suggests a growing threat of substitution for companies that do not adapt to evolving customer preferences.

- Market Diversification: Non-traditional models like reciprocal exchanges offer policyholders a stake in the insurer, appealing to those seeking direct participation in profits and losses.

- Customer Preference Shift: A growing segment of consumers may favor alternative governance and risk-sharing structures over traditional stock or mutual company models.

- Competitive Pressure: The emergence of these substitutes can force traditional insurers to re-evaluate their offerings, pricing, and customer engagement strategies to remain competitive.

- Innovation in Risk Transfer: These models represent a broader trend in financial services towards more innovative and potentially more efficient ways of managing and transferring risk.

Property Mitigation and Resilience Investments

Investments in property mitigation and resilience act as a threat of substitutes to traditional insurance. For example, in 2024, homeowners in coastal regions are increasingly adopting advanced floodproofing techniques and storm-resistant building materials. These proactive measures can significantly lower the likelihood and severity of damage, thereby reducing the perceived need for comprehensive insurance policies or leading to more favorable premium rates.

This shift empowers individuals to self-insure against certain perils. Consider the growing adoption of impact-resistant windows and doors, which can reduce insurance claims related to wind damage. By investing in these physical safeguards, property owners can effectively substitute a portion of their insurance coverage with tangible resilience, potentially leading to a decrease in demand for certain insurance products.

The economic impact is notable. As of mid-2024, data suggests that properties with enhanced resilience features are seeing an average reduction of 10-15% in insurance premiums. This financial incentive encourages further investment in mitigation, creating a feedback loop that strengthens the substitute threat.

- Homeowners are investing in mitigation strategies like storm shutters and reinforced roofing.

- These investments can lead to lower insurance premiums, reducing the need for extensive coverage.

- By reducing damage potential, resilience measures act as a direct substitute for insurance protection against specific risks.

- The trend of self-insuring through property upgrades is expected to continue growing through 2024 and beyond.

The threat of substitutes for traditional insurance products is multifaceted, encompassing government programs, alternative risk transfer, and even property mitigation efforts. These substitutes offer consumers different ways to manage risk, potentially reducing demand for conventional insurance. For instance, the substantial market presence of government-backed entities like Florida's Citizens Property Insurance Corporation, which had over 1.3 million policies in force by Q1 2024, directly competes with private insurers.

Alternative risk transfer mechanisms, such as catastrophe bonds, are also gaining traction. The first half of 2025 saw record issuance in this market, indicating a growing availability of capital outside traditional reinsurance. Similarly, non-traditional insurance models like reciprocal exchanges, where policyholders are also insurers, present a different value proposition that may appeal to a segment of the market seeking direct participation in underwriting. Furthermore, proactive property mitigation, such as the adoption of impact-resistant materials, can reduce the perceived need for insurance, with properties featuring such upgrades seeing 10-15% lower premiums as of mid-2024.

Entrants Threaten

Florida's property insurance landscape, once daunting, has seen shifts due to legislative reforms designed to stabilize the market. These changes, including a requirement for new carriers to maintain a minimum of $35 million in extra reserves, aim to bolster solvency and predictability.

The improved profitability observed in 2024 has acted as a catalyst, signaling a more attractive environment for new ventures. This positive trend is reflected in the recent influx of at least nine new property and casualty insurers into the Florida market, demonstrating renewed confidence among potential entrants.

New companies entering the Florida property insurance market face a significant hurdle in securing adequate reinsurance. This is crucial for managing the substantial catastrophic risks inherent in the region.

While the reinsurance market has shown signs of increased capital and a more favorable environment for buyers as of mid-2025, obtaining sufficient and cost-effective reinsurance remains a challenge. This barrier is particularly pronounced for smaller or less established new entrants who may struggle to demonstrate their financial stability and risk management capabilities to reinsurers.

Established players like HCI Group have cultivated significant brand recognition and customer trust, a formidable barrier for newcomers. In 2024, for instance, HCI Group continued to leverage its established reputation, a key factor in retaining its customer base amidst market fluctuations.

New entrants must overcome the hurdle of building this trust, especially in Florida's insurance market, which has seen its share of insurer exits, making consumers naturally cautious. This inherent wariness means new companies need to invest heavily in marketing and demonstrating reliability to attract customers away from familiar names.

However, the persistent consumer drive for better insurance rates in Florida presents an opportunity. In 2024, reports indicated that many Floridians were actively seeking more affordable homeowner's insurance policies, a trend that could allow well-priced and transparent offerings from new entrants to gain traction more quickly than in less price-sensitive markets.

Technological Capabilities and Innovation

The insurance sector's reliance on technology, particularly AI, machine learning, and data analytics for underwriting, claims, and customer service, presents a significant barrier. However, new entrants armed with advanced InsurTech capabilities or strategic partnerships can bypass these traditional hurdles.

These agile players can disrupt the market by offering streamlined operations, highly personalized insurance products, and a demonstrably better customer journey. For instance, by mid-2024, InsurTech funding continued to show robust activity, with significant investments directed towards companies leveraging AI for risk assessment and personalized policy creation. This technological edge allows them to operate with lower overheads and a more responsive business model.

- InsurTech Funding Trends: Investments in AI-driven insurance solutions are expected to grow substantially through 2025, indicating a strong focus on technological innovation.

- Operational Efficiency: New entrants can achieve up to 20% lower operational costs compared to legacy insurers through automation and advanced analytics.

- Customer Personalization: Data analytics enable tailored product offerings, potentially increasing customer acquisition by 15% for InsurTechs compared to traditional insurers.

Distribution Channels and Market Access

New entrants face a significant hurdle in establishing robust distribution channels to reach their target audience. This often requires substantial investment in building relationships with agents, developing direct-to-consumer platforms, or forging strategic partnerships. For example, in 2024, many insurtech startups are investing heavily in digital marketing and user experience to bypass traditional broker networks, but gaining widespread adoption remains a challenge.

Existing insurers benefit from deeply entrenched distribution networks and long-standing relationships with intermediaries. This established market access can be a formidable barrier for newcomers, making it difficult to secure visibility and customer acquisition at scale. By 2023, traditional insurance channels still accounted for over 60% of new business premiums in many developed markets, highlighting the persistent advantage of incumbent players.

- Distribution Channel Investment: New entrants must allocate significant capital to build or acquire effective distribution networks.

- Established Relationships: Incumbents leverage existing agent and broker relationships, creating a barrier to market entry.

- Market Access Challenges: Gaining visibility and customer reach is difficult for new players without pre-existing channels.

- Digital vs. Traditional: While digital channels offer new avenues, traditional networks still hold considerable sway in customer acquisition.

The threat of new entrants in Florida's property insurance market is moderate, influenced by regulatory reforms and market dynamics. While legislative changes in 2024, such as reserve requirements, aim to stabilize the market, they also create capital barriers. The influx of at least nine new insurers in 2024 indicates growing attractiveness, yet significant hurdles like securing reinsurance and building customer trust persist.

Newcomers face challenges in overcoming established brand loyalty and distribution networks. However, the demand for lower premiums in 2024 offers an opening for well-priced, transparent offerings. The technological advancements in InsurTech, supported by robust mid-2024 funding for AI-driven solutions, provide a pathway for agile entrants to differentiate themselves and potentially achieve lower operational costs.

| Factor | Barrier Level | Supporting Data/Observation (2024-2025) |

|---|---|---|

| Capital Requirements (Reserves) | Moderate to High | Minimum $35 million in extra reserves required for new carriers. |

| Reinsurance Availability & Cost | High | Crucial for catastrophic risk, though mid-2025 shows increased capital, it remains a challenge for new entrants. |

| Brand Recognition & Customer Trust | High | Established players like HCI Group leveraged reputation in 2024; consumer caution due to past exits. |

| Technological Sophistication (InsurTech) | Low to Moderate (for InsurTech) | Mid-2024 saw robust InsurTech funding for AI; potential for lower operational costs (up to 20%). |

| Distribution Channels | High | Established networks are entrenched; digital channels are growing but require significant investment. |

| Price Sensitivity | Moderate to High | Consumer drive for better rates in 2024 creates an opportunity for competitive new entrants. |

Porter's Five Forces Analysis Data Sources

Our HCI Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, technology trend analyses, and user behavior studies. We also incorporate insights from academic publications and expert interviews to capture the nuances of human-computer interaction's competitive landscape.