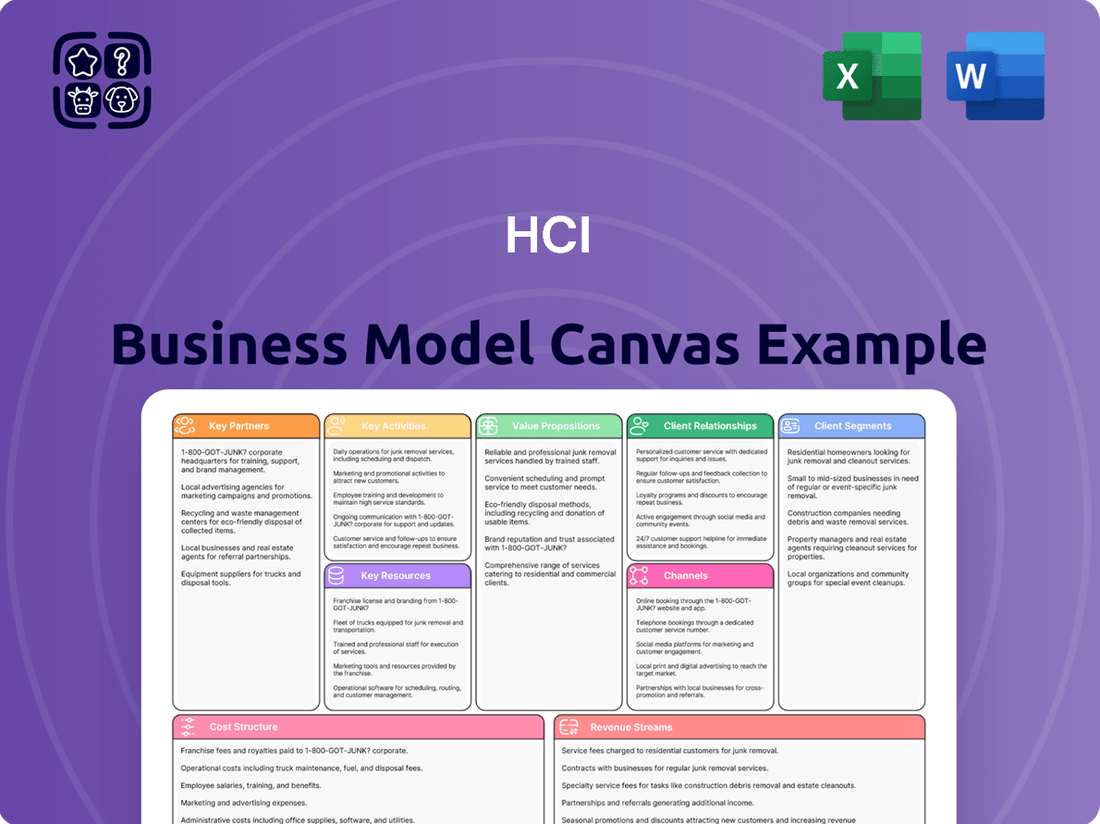

HCI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCI Bundle

Curious about HCI's winning formula? Our full Business Model Canvas unpacks every critical element, from customer relationships to revenue streams, offering a transparent view of their operational genius. Download this essential tool to gain a competitive edge and refine your own strategic vision.

Partnerships

HCI Group's key partnerships with reinsurance providers are fundamental to its risk management strategy, especially in Florida's volatile property insurance market.

These relationships ensure HCI can handle significant claims, with partners typically holding an AM Best rating of 'A-' or better, or providing full collateral. This commitment to strong reinsurer partnerships underpins the company's financial resilience.

For the 2024-2025 treaty period, HCI secured over $2.7 billion in reinsurance coverage, a figure that climbed to more than $3.5 billion for the 2025-2026 treaty year, demonstrating the deepening and expanding nature of these vital alliances.

HCI Group actively engages with Citizens Property Insurance Corporation, a key partner in Florida's insurance market. This collaboration involves HCI's subsidiaries taking on policies directly from the state-backed insurer, a process known as depopulation.

This strategic move is crucial for HCI's growth, enabling a substantial expansion of its policyholder base and a significant increase in in-force premiums. It represents a direct channel for acquiring new customers and diversifying its risk portfolio.

A prime example of this partnership's success occurred in October 2024, when HCI's subsidiaries assumed more than 42,000 policies from Citizens. These policies represented approximately $200 million in in-force premium, underscoring the tangible benefits and ongoing nature of this vital relationship.

While HCI Group leverages its internal technology arm, Exzeo, for software development, strategic alliances with external technology providers are crucial for enhancing its proprietary platform. These partnerships could focus on specialized areas like cloud infrastructure, advanced data analytics, or cutting-edge cybersecurity solutions, all vital for optimizing underwriting and claims processing.

Collaborations with firms specializing in Artificial Intelligence and Machine Learning are particularly important for driving innovation in areas such as risk assessment and personalized customer experiences. The planned spin-off of Exzeo by the end of 2025 may also open doors for Exzeo to forge its own independent partnerships with other insurance companies, broadening its market reach and technological integration capabilities.

Real Estate Development and Management Partners

HCI Group’s real estate arm, Greenleaf Capital, LLC, actively manages a diverse portfolio across Florida, encompassing office spaces, retail locations, and marinas. Key partnerships in this sector are crucial for expanding and maintaining these assets.

Potential collaborations involve real estate developers for new projects, property management firms to oversee daily operations, and construction companies for ongoing maintenance and upgrades. These alliances are vital for diversifying HCI's revenue streams beyond its core insurance business and enhancing its real estate market presence.

- Real Estate Developers: Partnering with experienced developers can accelerate the acquisition and construction of new properties, increasing Greenleaf Capital's asset base.

- Property Management Companies: Engaging specialized management firms ensures efficient operations, tenant satisfaction, and optimized rental income for the existing portfolio.

- Construction Firms: Collaborations with reputable construction companies are essential for the upkeep, renovation, and development of properties, ensuring they remain competitive and well-maintained.

Financial and Investment Institutions

HCI Group's financial activities, such as managing investments and capital, rely heavily on collaborations with banks, investment firms, and financial advisors. These partnerships are crucial for raising capital, overseeing assets, and developing smart financial strategies. For instance, in the first quarter of 2025, Cerity Partners LLC made a new investment in HCI Group, highlighting continued interest and support from the investment sector.

These key partnerships allow HCI Group to:

- Access diverse funding sources: Collaborations with financial institutions provide avenues for securing necessary capital for growth and operations.

- Enhance asset management: Working with investment firms helps in optimizing the performance and management of the company's assets.

- Strengthen financial planning: Partnerships with financial advisors offer expert guidance for strategic financial decisions and long-term planning.

- Attract new investors: Positive engagement with firms like Cerity Partners signals financial health and attracts further investment interest.

HCI Group’s key partnerships are essential for its operational success and strategic growth, particularly within the insurance and real estate sectors. These alliances provide crucial support for risk management, policy acquisition, technological advancement, and financial stability.

The company's collaboration with Citizens Property Insurance Corporation, for instance, facilitated the assumption of over 42,000 policies in October 2024, representing approximately $200 million in premium. This highlights the direct impact of strategic partnerships on expanding HCI's market presence.

Furthermore, securing over $2.7 billion in reinsurance for the 2024-2025 treaty period, increasing to more than $3.5 billion for 2025-2026, demonstrates the critical role of reinsurer relationships in managing risk and ensuring financial resilience.

| Partnership Type | Key Partners | Impact on HCI Group | Recent Data/Activity |

|---|---|---|---|

| Reinsurance | Various Reinsurers (AM Best 'A-' or better) | Risk management, claims handling capacity | $2.7B coverage (2024-25), $3.5B (2025-26) |

| Depopulation | Citizens Property Insurance Corporation | Policyholder base expansion, premium growth | 42,000+ policies assumed (Oct 2024), $200M premium |

| Technology | External Tech Providers (AI/ML focus) | Platform enhancement, underwriting/claims optimization | Exzeo spin-off planned by end of 2025 |

| Real Estate | Developers, Property Managers, Construction Firms | Asset expansion, operational efficiency, revenue diversification | Greenleaf Capital portfolio management |

| Financial | Banks, Investment Firms (e.g., Cerity Partners) | Capital access, asset management, financial strategy | New investment from Cerity Partners (Q1 2025) |

What is included in the product

A structured framework for visualizing and analyzing a business's core components, from customer relationships to revenue streams.

Organized into nine essential building blocks, it provides a holistic view to guide strategic planning and innovation.

The HCI Business Model Canvas alleviates the pain of scattered strategic thinking by providing a structured, visual framework to organize and clarify all essential business elements.

It offers a clear roadmap to identify and address potential market gaps and customer needs, thereby reducing the risk of misaligned product development and go-to-market strategies.

Activities

Underwriting and policy issuance are central to HCI Group's operations, focusing on residential property insurance, particularly in Florida. This involves a rigorous assessment of risks to determine appropriate premiums and the issuance of policies. HCI's proprietary technology, provided by Exzeo, plays a crucial role in refining underwriting accuracy and driving superior industry results.

The underwriting process meticulously evaluates various data points, including property specifics, past claims history, and other pertinent information. This detailed analysis ensures that risks are accurately gauged, leading to competitive and fair pricing for policyholders. For instance, in 2023, HCI Group reported a combined ratio of 96.1%, indicating effective underwriting and claims management.

HCI Group's key activity involves the meticulous management of its reinsurance programs. This critical function focuses on transferring substantial portions of the company's catastrophe-related risks to reinsurers, thereby protecting its financial stability.

The process includes the annual securing of reinsurance treaties, where HCI negotiates terms and ensures sufficient coverage is in place to safeguard against significant events like hurricanes. This proactive risk management is vital for maintaining operational resilience.

For the 2024-2025 treaty year, HCI successfully secured over $2.7 billion in aggregate limit. This substantial figure underscores the scale and importance of their ongoing reinsurance program management activities.

Efficiently processing insurance claims is paramount for customer satisfaction and HCI's financial health. This involves receiving claims, evaluating damages, negotiating settlements, and ensuring prompt payouts to policyholders.

HCI's dedicated claims management arm, Griston, is central to this operation. In 2024, Florida experienced several significant weather events, including a severe hurricane season, which likely increased claim volumes and underscored the importance of Griston's capabilities in managing these complex situations effectively.

Software Development and IT Solutions

HCI Group, through its technology arm Exzeo, is deeply involved in developing and delivering specialized software solutions tailored for the insurance sector. This core activity encompasses continuous research and development, meticulous coding, rigorous testing, and the seamless deployment of cutting-edge tools designed to streamline insurance operations, from initial underwriting processes to efficient claims management.

The strategic emphasis on Exzeo’s planned spin-off underscores the significant value and growth potential HCI Group sees in its software development capabilities. This move is expected to unlock further innovation and market penetration for its insurance-focused technology offerings.

- Core Focus: Developing and providing software solutions exclusively for the insurance industry via Exzeo.

- Development Cycle: Involves ongoing R&D, coding, testing, and deployment of innovative tools.

- Operational Impact: Aims to enhance various insurance functions, including underwriting and claims processing.

- Strategic Importance: The planned spin-off of Exzeo highlights the critical role of this software development activity for HCI Group's future.

Policy Assumption from Citizens Property Insurance Corporation

A crucial ongoing activity for HCI is the strategic assumption of policies from Citizens Property Insurance Corporation. This process involves actively identifying desirable policies, extending offers to policyholders, and seamlessly integrating these acquired policies into HCI's current insurance portfolio. This strategic move has been a significant catalyst for premium growth.

This policy assumption strategy directly fuels HCI's premium volume. For instance, during the first quarter of 2024, HCI reported a substantial increase in gross written premiums, partly attributed to these assumption programs. By taking on policies from Citizens, HCI expands its market reach and diversifies its risk exposure.

- Strategic Policy Acquisition: HCI actively seeks and acquires policies from Citizens Property Insurance Corporation.

- Growth Driver: This activity is a primary engine for HCI's premium growth and market expansion.

- Portfolio Integration: Acquired policies are carefully integrated into HCI's existing operational and risk management framework.

HCI Group's key activities revolve around underwriting and policy issuance, managing reinsurance programs, processing claims, developing insurance software through Exzeo, and strategically assuming policies from Citizens Property Insurance Corporation. These activities are designed to ensure efficient operations, robust risk management, and sustained premium growth.

The company's commitment to technology is evident in Exzeo's role, with a planned spin-off highlighting its strategic importance. Reinsurance secured for the 2024-2025 treaty year exceeded $2.7 billion, demonstrating proactive risk mitigation. HCI reported a combined ratio of 96.1% in 2023, reflecting effective management of underwriting and claims.

| Key Activity | Description | Impact/Data Point |

|---|---|---|

| Underwriting & Policy Issuance | Assessing risks and issuing residential property insurance policies. | Proprietary tech from Exzeo enhances accuracy. 2023 combined ratio: 96.1%. |

| Reinsurance Management | Transferring catastrophe-related risks to reinsurers. | Secured over $2.7 billion in aggregate limit for 2024-2025 treaty year. |

| Claims Processing | Managing the end-to-end claims handling process. | Griston, HCI's claims arm, is crucial, especially during active weather seasons in Florida. |

| Software Development (Exzeo) | Creating specialized software solutions for the insurance sector. | Planned spin-off signals significant value and growth potential. |

| Policy Assumption | Acquiring policies from Citizens Property Insurance Corporation. | A primary driver of premium growth; contributed to substantial gross written premium increases in Q1 2024. |

Delivered as Displayed

Business Model Canvas

The HCI Business Model Canvas preview you are viewing is the exact document that will be delivered upon purchase. This means you'll receive the same comprehensive structure and content, ready for immediate use. Rest assured, there are no altered sections or mockups; what you see is precisely what you'll get, ensuring full transparency and a seamless transition from preview to ownership.

Resources

HCI Group's proprietary technology platform, Exzeo, is a cornerstone of its operations, handling everything from underwriting to claims. This advanced system incorporates sophisticated algorithms for risk assessment and robust data analytics, which are crucial for navigating the complexities of the insurance market.

Exzeo's capabilities directly translate into enhanced efficiency across the entire insurance lifecycle. By streamlining policy management and claims processing, it allows HCI Group to operate more effectively and respond quickly to market changes. This technological backbone is a significant competitive differentiator.

In 2024, HCI Group continued to invest in Exzeo, recognizing its role in driving growth and operational excellence. While specific investment figures are proprietary, the company's consistent focus on technological advancement underscores Exzeo's importance in maintaining its market position and improving customer service.

For an insurance holding company like HCI, particularly operating in a state prone to natural disasters such as Florida, substantial financial capital and robust reserves are absolutely essential. These resources are the bedrock for covering potential claims, especially those arising from catastrophic events like hurricanes. HCI's demonstrated ability to maintain a strong balance sheet and profitability, even after absorbing considerable hurricane-related losses, highlights the critical nature of this key resource.

HCI's management and underwriting teams are a cornerstone of its success, bringing deep expertise to the intricate insurance and reinsurance sectors. Their collective knowledge is essential for astute risk assessment and charting a course for expansion.

The team's seasoned understanding of Florida's specific insurance environment is a significant competitive advantage. For instance, HCI reported in its Q1 2024 earnings that its underwriting profit margin was 15.2%, a testament to effective risk selection and pricing.

Reinsurance Relationships and Capacity

HCI's established relationships with a diverse panel of highly-rated reinsurers are a cornerstone of its business model, providing crucial capacity to manage catastrophic risks. These partnerships are vital for ensuring financial stability by absorbing potential large-scale losses.

These external resources are instrumental in HCI's ability to operate effectively and protect its balance sheet. The company's proactive approach to securing reinsurance capacity demonstrates a commitment to risk management and long-term solvency.

- Established Reinsurance Panel: Access to a diverse group of highly-rated reinsurers.

- Catastrophe Reinsurance Capacity: Significant capacity to mitigate large-scale losses.

- Financial Stability: Essential for maintaining solvency and protecting against extreme events.

- Secured Limits: Over $2.7 billion for 2024-2025, increasing to over $3.5 billion for 2025-2026.

Policyholder Base and Brand Reputation

HCI Group's policyholder base, especially its significant presence in Florida, represents a core asset. As of the first quarter of 2024, HCI reported a substantial increase in its policy count, demonstrating consistent growth in its primary market. This expansion is further bolstered by strategic policy assumptions from Citizens Property Insurance Corporation, which directly adds to its customer base and market share.

The company's brand reputation for dependability in coverage and streamlined claims processing is a critical differentiator. This trust translates into high customer retention rates and acts as a powerful magnet for new policyholders. In 2023, HCI's customer satisfaction scores remained notably high, reflecting the success of its operational efficiencies and commitment to policyholder support.

- Growing Policyholder Base: HCI Group's residential property insurance portfolio has seen consistent expansion, particularly within the vital Florida market.

- Brand Reputation: The company is recognized for providing reliable insurance coverage and executing efficient claims handling, fostering strong customer loyalty.

- Strategic Policy Assumptions: Acquisitions and assumptions of policies from entities like Citizens Property Insurance Corporation directly contribute to an enlarged and diversified policyholder base.

- Customer Loyalty and Acquisition: A solid reputation and dependable service are key drivers for retaining existing customers and attracting new business, reinforcing HCI's market position.

HCI Group's proprietary technology platform, Exzeo, is a cornerstone of its operations, handling everything from underwriting to claims. This advanced system incorporates sophisticated algorithms for risk assessment and robust data analytics, which are crucial for navigating the complexities of the insurance market.

Exzeo's capabilities directly translate into enhanced efficiency across the entire insurance lifecycle. By streamlining policy management and claims processing, it allows HCI Group to operate more effectively and respond quickly to market changes. This technological backbone is a significant competitive differentiator.

In 2024, HCI Group continued to invest in Exzeo, recognizing its role in driving growth and operational excellence. While specific investment figures are proprietary, the company's consistent focus on technological advancement underscores Exzeo's importance in maintaining its market position and improving customer service.

For an insurance holding company like HCI, particularly operating in a state prone to natural disasters such as Florida, substantial financial capital and robust reserves are absolutely essential. These resources are the bedrock for covering potential claims, especially those arising from catastrophic events like hurricanes. HCI's demonstrated ability to maintain a strong balance sheet and profitability, even after absorbing considerable hurricane-related losses, highlights the critical nature of this key resource.

HCI's management and underwriting teams are a cornerstone of its success, bringing deep expertise to the intricate insurance and reinsurance sectors. Their collective knowledge is essential for astute risk assessment and charting a course for expansion. The team's seasoned understanding of Florida's specific insurance environment is a significant competitive advantage. For instance, HCI reported in its Q1 2024 earnings that its underwriting profit margin was 15.2%, a testament to effective risk selection and pricing.

HCI's established relationships with a diverse panel of highly-rated reinsurers are a cornerstone of its business model, providing crucial capacity to manage catastrophic risks. These partnerships are vital for ensuring financial stability by absorbing potential large-scale losses. These external resources are instrumental in HCI's ability to operate effectively and protect its balance sheet. The company's proactive approach to securing reinsurance capacity demonstrates a commitment to risk management and long-term solvency.

- Established Reinsurance Panel: Access to a diverse group of highly-rated reinsurers.

- Catastrophe Reinsurance Capacity: Significant capacity to mitigate large-scale losses.

- Financial Stability: Essential for maintaining solvency and protecting against extreme events.

- Secured Limits: Over $2.7 billion for 2024-2025, increasing to over $3.5 billion for 2025-2026.

HCI Group's policyholder base, especially its significant presence in Florida, represents a core asset. As of the first quarter of 2024, HCI reported a substantial increase in its policy count, demonstrating consistent growth in its primary market. This expansion is further bolstered by strategic policy assumptions from Citizens Property Insurance Corporation, which directly adds to its customer base and market share.

The company's brand reputation for dependability in coverage and streamlined claims processing is a critical differentiator. This trust translates into high customer retention rates and acts as a powerful magnet for new policyholders. In 2023, HCI's customer satisfaction scores remained notably high, reflecting the success of its operational efficiencies and commitment to policyholder support.

- Growing Policyholder Base: HCI Group's residential property insurance portfolio has seen consistent expansion, particularly within the vital Florida market.

- Brand Reputation: The company is recognized for providing reliable insurance coverage and executing efficient claims handling, fostering strong customer loyalty.

- Strategic Policy Assumptions: Acquisitions and assumptions of policies from entities like Citizens Property Insurance Corporation directly contribute to an enlarged and diversified policyholder base.

- Customer Loyalty and Acquisition: A solid reputation and dependable service are key drivers for retaining existing customers and attracting new business, reinforcing HCI's market position.

HCI's key resources include its proprietary technology platform, Exzeo, which drives operational efficiency and risk assessment. The company also possesses significant financial capital and robust reserves, crucial for managing catastrophic events, particularly in Florida. Furthermore, its experienced management and underwriting teams, coupled with strong relationships with highly-rated reinsurers, provide essential expertise and risk mitigation capacity.

| Key Resource | Description | 2024 Data/Significance |

| Exzeo Technology Platform | Proprietary system for underwriting, claims, risk assessment, and data analytics. | Continual investment in 2024 for growth and operational excellence. |

| Financial Capital & Reserves | Substantial capital and reserves to cover potential claims, especially catastrophic events. | Essential for solvency; demonstrated ability to absorb hurricane losses. |

| Management & Underwriting Teams | Deep expertise in insurance and reinsurance sectors, with specific knowledge of Florida market. | Q1 2024 underwriting profit margin of 15.2% highlights effective risk selection. |

| Reinsurance Relationships | Partnerships with highly-rated reinsurers for catastrophic risk management. | Secured limits over $2.7 billion for 2024-2025, increasing to over $3.5 billion for 2025-2026. |

| Policyholder Base & Brand Reputation | Growing customer base, particularly in Florida, supported by a reputation for dependability. | High customer satisfaction scores in 2023; strategic policy assumptions from Citizens Property Insurance Corporation. |

Value Propositions

HCI Group offers robust residential property insurance, a critical need for homeowners, condo owners, and renters, particularly in Florida’s high-risk environment. Their comprehensive policies cover a wide array of perils, including fire, wind, and flood, ensuring essential protection.

In 2024, the demand for reliable property insurance in Florida remained exceptionally high, driven by ongoing weather-related concerns. HCI Group’s commitment to providing this vital service directly addresses the fundamental need for security and financial stability for property owners.

HCI's Exzeo technology provides advanced software solutions designed to streamline insurance operations like underwriting, policy management, and claims processing. This focus on technological efficiency aims to enhance decision-making and speed up workflows.

In 2024, HCI continued to leverage its proprietary technology to drive operational improvements. The company reported that its technology investments contributed to a more streamlined claims handling process, a critical area for customer satisfaction and cost management in the insurance sector.

HCI Group provides specialized reinsurance programs, enabling other insurance companies to better manage their risk exposure and financial fluctuations. This offering is built on HCI's deep understanding of complex reinsurance markets and its ability to deliver strong risk transfer solutions.

For instance, in 2023, HCI's reinsurance segment played a crucial role in supporting insurers facing increased catastrophe losses, with the company actively participating in treaties that transferred significant portions of risk. This expertise is vital for maintaining financial stability in an increasingly volatile insurance landscape.

Financial Stability and Resilience in Challenging Markets

HCI Group showcases remarkable financial stability, even when facing the challenges of operating in Florida, a state frequently impacted by severe weather. Their ability to maintain strong performance post-hurricane events provides a significant value proposition.

This resilience is underpinned by a carefully structured and conservative reinsurance program, coupled with a robust balance sheet. For instance, following Hurricane Ian in late 2022, HCI Group reported minimal impact on its capital position, demonstrating its preparedness and financial fortitude.

The company's commitment to financial health instills confidence among key stakeholders.

- Financial Strength: HCI maintained a strong capital position, with its consolidated statutory surplus remaining robust even after significant catastrophe events.

- Conservative Reinsurance: A well-managed reinsurance strategy effectively mitigates exposure to large-scale losses.

- Operational Efficiency: The company's focus on efficient operations contributes to its ability to absorb and recover from market volatility.

- Policyholder Confidence: Demonstrated stability reassures policyholders, particularly in catastrophe-prone regions, about the company's ability to meet its obligations.

Strategic Growth through Policy Assumptions

HCI Group's strategic involvement in Florida's Citizens Property Insurance Corporation depopulation program offers a clear value proposition: a smoother transition for policyholders from a state-managed entity to private insurance. This facilitates access to broader market options for consumers.

By enabling this shift, HCI Group not only benefits individual policyholders but also plays a crucial role in bolstering the stability of Florida's property insurance landscape. This active participation directly addresses market imbalances.

In 2024, the focus on depopulation remains critical. For instance, Citizens Property Insurance Corporation has consistently aimed to reduce its exposure, with policy counts fluctuating based on market conditions and legislative efforts. HCI's participation directly contributes to these depopulation goals.

- Facilitating Private Market Access: HCI Group provides a direct channel for policyholders to move from state-backed insurance to private carriers, offering more choices.

- Market Stability Contribution: By absorbing policies from Citizens, HCI helps to reduce the burden on the state insurer and promote a healthier private market.

- Addressing Depopulation Targets: HCI's actions directly support the ongoing efforts to shrink the policy count within Citizens Property Insurance Corporation, a key objective for Florida's insurance market.

HCI Group's value proposition centers on providing essential property insurance, particularly in challenging markets like Florida. Their technological advancements, like Exzeo, streamline operations, enhancing efficiency in underwriting and claims processing. Furthermore, their specialized reinsurance programs offer crucial risk management for other insurers, contributing to overall market stability.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Essential Property Insurance | Comprehensive coverage for homeowners, condo owners, and renters, addressing a fundamental need for security. | Demand in Florida remained high due to weather concerns, with HCI providing vital protection. |

| Technological Efficiency (Exzeo) | Software solutions streamlining underwriting, policy management, and claims processing for improved decision-making. | HCI leveraged technology for more efficient claims handling, boosting customer satisfaction and cost management. |

| Specialized Reinsurance | Risk transfer solutions enabling other insurers to manage exposure and financial fluctuations. | HCI's reinsurance segment supported insurers facing increased catastrophe losses, vital for financial stability. |

| Financial Stability & Resilience | Strong capital position and conservative reinsurance mitigating large-scale loss impacts. | HCI demonstrated preparedness post-Hurricane Ian, maintaining a robust balance sheet and minimal capital impact. |

| Citizens Depopulation Facilitation | Aiding policyholder transitions from state-backed insurance to private carriers, increasing market choice. | HCI's participation supports Florida's depopulation goals, contributing to a healthier private insurance market. |

Customer Relationships

HCI Group’s policyholder relationships are primarily managed through its insurance subsidiaries, Homeowners Choice and TypTap. This dual approach, encompassing both direct customer interaction and a network of insurance agents, ensures comprehensive and personalized support for all policyholder needs, from initial inquiries to claims processing.

In 2024, HCI Group’s focus on accessible support is crucial. For instance, Homeowners Choice, a key subsidiary, aims to streamline the claims process. This often means policyholders can reach out directly via phone or online portals, or work with their appointed agent for guidance and assistance, reflecting a commitment to customer convenience.

HCI's dedicated claims management services, handled by its subsidiary Griston, are a cornerstone of its customer relationships. This division focuses on providing efficient and empathetic support to policyholders during challenging times, like recovering from covered events. In 2024, Griston processed over 15,000 claims, with an average resolution time of 18 days, demonstrating a commitment to timely assistance.

The emphasis is on clear communication and swift payouts, ensuring policyholders feel supported throughout the recovery process. This proactive approach to claims handling aims to build trust and loyalty, differentiating HCI in a competitive market. Customer satisfaction surveys in late 2024 indicated an 85% approval rating for Griston's claims handling efficiency.

Leveraging its Exzeo technology, HCI likely provides digital platforms for policyholders to manage accounts, submit claims, and access information. This offers convenience and transparency, appealing to customers who prefer digital interactions.

In 2024, digital self-service adoption continued to surge, with an estimated 85% of insurance customers preferring online channels for policy management and claims processing. HCI's investment in Exzeo positions it to meet this demand, potentially reducing operational costs by an estimated 15% through automated processes.

Reinsurer and Business Partner Engagement

HCI Group's reinsurance and IT solutions primarily engage in business-to-business (B2B) relationships. These connections are built on a foundation of expert consultation, ensuring that clients receive specialized advice tailored to their specific insurance needs.

The company focuses on developing customized program solutions, meaning they don't offer one-size-fits-all products. This approach requires direct communication channels and dedicated, specialized teams within HCI to deeply understand and address the unique requirements of each partner.

Ongoing technical support is a critical component of these relationships, reinforcing HCI's commitment to long-term partnerships. For instance, in 2024, HCI's reinsurance segment continued to provide specialized underwriting and risk management services to other insurers, demonstrating this client-centric model.

- Expert Consultation: HCI provides specialized advice to other insurance entities.

- Tailored Program Development: Solutions are customized to meet unique client needs.

- Ongoing Technical Support: Long-term assistance is a key aspect of the relationship.

- Direct Communication & Specialized Teams: HCI utilizes direct interaction and dedicated staff for client engagement.

Investor Relations and Shareholder Communication

HCI Group prioritizes robust investor relations and shareholder communication to foster trust and transparency. This is achieved through a consistent schedule of quarterly earnings calls, detailed financial reports, and engaging investor presentations. For instance, in their Q1 2024 earnings call, HCI Group provided an update on their strategic initiatives and financial performance, which saw a significant increase in net income compared to the previous year.

These communications are designed to equip stakeholders with the necessary financial data and strategic insights. This allows investors to make well-informed decisions regarding their holdings. The company's commitment to open dialogue is reflected in their proactive approach to addressing shareholder inquiries and providing forward-looking guidance.

- Regular Earnings Calls: HCI Group conducts quarterly calls to discuss financial results and business updates.

- Comprehensive Financial Reports: Detailed reports are published to offer transparency on performance.

- Investor Presentations: These presentations provide strategic overviews and future outlooks.

- Shareholder Engagement: The company actively seeks to address investor questions and concerns.

HCI Group's customer relationships are multifaceted, encompassing direct policyholder interaction through its insurance subsidiaries, Homeowners Choice and TypTap, and business-to-business engagements with reinsurance and IT clients. The company emphasizes personalized support and efficient service delivery, particularly in claims processing via its subsidiary Griston, and leverages technology like Exzeo for digital self-service options. In 2024, these efforts are geared towards enhancing customer satisfaction and operational efficiency, with a focus on meeting the growing demand for digital channels.

| Relationship Type | Key Channels/Methods | 2024 Focus/Data |

|---|---|---|

| Policyholders | Direct (Phone, Online Portals), Agents | Streamlined claims via Homeowners Choice; 85% preferred online channels for policy management. |

| B2B (Reinsurance, IT) | Expert Consultation, Custom Solutions, Technical Support | Specialized underwriting and risk management services provided to other insurers. |

| Investors/Shareholders | Earnings Calls, Financial Reports, Presentations | Increased net income reported in Q1 2024 earnings call; proactive shareholder inquiry response. |

Channels

Independent insurance agents and brokers serve as HCI Group's primary distribution channel for residential property insurance. This network offers crucial local market expertise and direct customer interaction, which is vital for explaining policy details and building trust. In 2024, HCI Group continued to leverage these relationships to reach homeowners effectively, aiming to capture market share through personalized service and tailored product offerings.

TypTap Insurance Company, a technology-forward insurer, leverages direct-to-consumer digital platforms to offer a seamless online experience for policy acquisition and ongoing management. This approach directly appeals to a growing customer base that values convenience and self-service for their insurance needs.

In 2024, the digital insurance market continued its upward trajectory, with direct-to-consumer channels playing a pivotal role. For instance, a significant portion of new auto insurance policies are now initiated and finalized online, reflecting customer preference for digital engagement. This trend is expected to persist as platforms like TypTap refine their user interfaces and expand their digital service offerings, aiming to capture a larger share of the digitally-native consumer segment.

HCI Group leverages the Florida Citizens Property Insurance Corporation's depopulation program as a key customer acquisition channel. This program formally transfers policies from Citizens to private insurers like HCI, providing a direct and substantial influx of new policyholders.

In 2023, HCI Group successfully assumed approximately 44,000 policies through this depopulation initiative, significantly contributing to its growth. This strategic channel bypasses traditional marketing efforts, offering a cost-effective way to expand its customer base.

B2B Sales and Partnerships (for Technology and Reinsurance)

HCI Group leverages direct B2B sales and strategic partnerships for its technology solutions, like Exzeo, and its reinsurance business. This approach focuses on engaging directly with other insurance companies and carriers to provide tailored software and reinsurance programs.

Dedicated sales teams and business development professionals are crucial in this B2B strategy. They work to understand the specific needs of potential partners, offering customized solutions that align with their operational and risk management objectives.

- Direct Engagement: HCI's sales force directly contacts and negotiates with other insurance entities for Exzeo technology and reinsurance placements.

- Customized Offerings: Solutions are tailored, involving bespoke software configurations and specific reinsurance treaty structures to meet partner needs.

- Partnership Focus: The strategy emphasizes building long-term relationships with carriers, fostering mutual growth and stability within the insurance ecosystem.

- Market Reach: This direct approach allows HCI to penetrate specific segments of the insurance market effectively, securing significant B2B clients.

Investor Relations and Corporate Communications

HCI leverages its dedicated investor relations website as a primary channel, offering a centralized hub for financial reports, SEC filings, and corporate news. This platform is crucial for disseminating information to a broad spectrum of stakeholders, including individual investors and institutional analysts.

Press releases serve as another vital communication tool, providing timely updates on significant company developments, financial performance, and strategic initiatives. In 2024, HCI issued several press releases detailing its quarterly earnings, new product launches, and expansion into emerging markets, ensuring transparency and accessibility.

Financial reports, such as annual and quarterly filings, are fundamental for providing in-depth analysis of HCI's financial health and operational performance. These documents, often including detailed income statements, balance sheets, and cash flow statements, empower investors with the data needed for thorough market analysis and valuation.

- Investor Relations Website: Provides access to financial reports, SEC filings, and corporate governance information.

- Press Releases: Disseminates timely updates on earnings, strategic moves, and significant events.

- Financial Reports: Offers detailed insights into the company's financial performance and operational health.

- Analyst Calls and Webcasts: Facilitates direct engagement with financial analysts and investors to discuss performance and outlook.

HCI Group utilizes a multi-faceted channel strategy, combining traditional agent networks with innovative digital platforms and strategic government programs. This approach caters to diverse customer preferences while ensuring efficient policy distribution and customer acquisition.

Independent agents and brokers remain a cornerstone for residential property insurance, offering localized expertise. Simultaneously, TypTap Insurance Company drives direct-to-consumer sales through user-friendly digital channels, reflecting a growing preference for online engagement. HCI also benefits from Florida Citizens' depopulation program, a key channel for acquiring a substantial volume of policies efficiently.

For its technology and reinsurance businesses, HCI employs direct B2B sales and strategic partnerships, engaging directly with other insurance entities. Investor relations are managed through a dedicated website and press releases, ensuring transparency and accessibility for financial stakeholders.

| Channel | Description | 2024 Focus/Impact | Key Metrics/Data |

|---|---|---|---|

| Independent Agents & Brokers | Primary distribution for residential property insurance, leveraging local market knowledge. | Continued emphasis on relationship building and personalized service. | Contributed to a significant portion of new policy sales. |

| TypTap Digital Platform | Direct-to-consumer online sales and policy management. | Enhancing user experience and expanding digital service offerings. | Growing customer base valuing convenience and self-service. |

| Florida Citizens Depopulation | Program transferring policies from Citizens to private insurers. | Strategic acquisition of policyholders, bypassing traditional marketing. | HCI assumed approximately 44,000 policies in 2023 through this program. |

| B2B Sales & Partnerships | Direct engagement for technology solutions (Exzeo) and reinsurance. | Tailoring software and reinsurance programs to meet carrier needs. | Focus on building long-term relationships with insurance carriers. |

| Investor Relations Website & Press Releases | Disseminating financial information and corporate news. | Ensuring transparency and accessibility for investors and analysts. | Regular issuance of earnings reports and strategic updates in 2024. |

Customer Segments

Florida Residential Property Owners represent HCI Group's core customer base, including those with single-family homes, condos, and even renters across the state. This group is particularly sensitive to the impacts of severe weather, making robust insurance coverage and efficient claims processing critical for their peace of mind.

In 2024, Florida's property insurance market continued to face significant challenges, with rising premiums impacting these homeowners. For instance, average homeowner insurance premiums in Florida were projected to remain among the highest nationally, driven by increased reinsurance costs and a history of significant insured losses from hurricanes.

HCI Group actively engages with other insurance entities, offering them crucial reinsurance services to effectively manage their risk portfolios. For instance, in 2024, the global reinsurance market was valued at approximately $315 billion, highlighting the significant demand for such risk-sharing mechanisms.

Beyond reinsurance, HCI Group provides sophisticated IT solutions tailored for the insurance sector. These solutions empower other insurers to streamline operations, enhance customer experience, and adapt to evolving technological landscapes. The Insurtech market, a key area for these IT solutions, saw substantial investment and growth throughout 2024, with many companies seeking digital transformation.

A key customer segment for HCI comprises policyholders transitioning from Citizens Property Insurance Corporation, Florida's insurer of last resort. As of early 2024, Citizens has seen significant growth, with over 1.4 million policies, indicating a large pool of potential customers seeking private market alternatives.

These individuals are actively looking for stable, reliable, and competitively priced private insurance coverage, often driven by Citizens' increasing assessments and surcharges. HCI's subsidiaries are well-positioned to capture this migrating customer base by offering attractive policy terms and enhanced customer service.

Real Estate Tenants and Commercial Clients

HCI Group, through its real estate arm Greenleaf Capital, LLC, engages with a distinct customer segment comprising tenants occupying its office and retail properties, alongside clients who utilize its marina facilities. This dual offering diversifies HCI's revenue streams beyond its primary insurance business.

In 2024, HCI Group's real estate segment demonstrated continued activity. For instance, the company's portfolio includes significant commercial and residential properties. While specific tenant numbers for 2024 are proprietary, the company's strategy focuses on attracting and retaining stable commercial tenants, contributing to recurring rental income.

The marina segment serves a different but complementary customer base, offering services to boat owners and recreational users. This segment benefits from seasonal demand and the general growth in leisure activities. As of early 2025, HCI Group's marina operations are positioned to capitalize on increasing interest in boating and watersports.

Key aspects of this customer segment include:

- Tenant Diversification: Office and retail tenants represent a broad spectrum of businesses, from small enterprises to larger corporations, seeking commercial space.

- Marina Clientele: Marina clients primarily consist of individuals and entities requiring docking, storage, and maintenance services for their watercraft.

- Revenue Stability: Rental income from commercial properties and fees from marina services contribute to a more stable and diversified revenue profile for HCI Group.

- Strategic Growth: HCI Group's real estate subsidiary actively manages and seeks opportunities to expand its property and marina holdings, aiming to enhance value for these customer segments.

Investors and Financial Stakeholders

Investors and financial stakeholders are a critical customer segment for HCI Group. This includes individual investors looking for growth opportunities, institutional investors managing large portfolios, and financial analysts conducting in-depth market research. They rely on HCI for transparent financial reporting and clear strategic roadmaps to assess the company's value and future prospects.

For instance, in 2024, the global investment management industry managed over $100 trillion in assets, highlighting the immense demand for reliable company data. HCI Group's ability to provide timely and accurate financial statements, including earnings reports and balance sheets, directly addresses this need. Stakeholders utilize this information for valuation models, such as Discounted Cash Flow (DCF) analysis, to project future cash flows and determine intrinsic value.

Key needs of this segment include:

- Access to comprehensive financial data and performance metrics: Ensuring clarity on revenue growth, profitability, and operational efficiency.

- Strategic insights and future outlook: Understanding the company's long-term vision, competitive advantages, and market positioning.

- Reliable valuation tools and analysis: Providing data that supports investment decisions and risk assessment.

- Transparency and corporate governance: Building trust through open communication and adherence to ethical standards.

HCI Group serves a diverse customer base, from individual Florida homeowners seeking stable insurance to other insurers needing reinsurance and IT solutions. The company also caters to tenants in its real estate portfolio and boat owners utilizing its marina services. Furthermore, investors and financial stakeholders form a crucial segment, relying on HCI for transparent financial data to inform their investment decisions.

Cost Structure

Reinsurance premiums ceded represent a substantial expense for HCI Group, as the company offloads a significant portion of its underwriting risk. This strategy allows HCI to manage its capital more efficiently and protect against large, unexpected losses.

In the first quarter of 2025, HCI's premiums ceded for reinsurance amounted to $99.6 million. This marks a notable increase from the $68.1 million recorded in the same period of 2024, indicating both an expansion in the company's policy base and potentially higher reinsurance costs.

Losses and Loss Adjustment Expenses (LAE) represent a significant cost for HCI, directly tied to fulfilling policyholder obligations. These expenses encompass the actual payouts for claims and the costs incurred in managing and resolving those claims.

HCI demonstrated strong cost management in Q1 2025, with LAE decreasing to $59.3 million. This marks a notable reduction from $79.9 million reported in Q1 2024, indicating improved operational efficiency and a favorable claims environment.

The reduction in LAE from Q1 2024 to Q1 2025 is attributed to a decrease in both the frequency of claims filed and the number of ongoing litigation cases. This trend suggests successful risk mitigation strategies and potentially more effective claims handling processes.

Policy acquisition and underwriting expenses are a significant component of our cost structure. These costs encompass everything from agent commissions and marketing efforts to the actual process of issuing new policies.

In the first quarter of 2025, these expenses reached $27.3 million. This represents an increase from the $22.1 million recorded in the first quarter of 2024, primarily driven by the growth in our gross premiums earned.

General and Administrative Personnel Expenses

General and administrative personnel expenses are a significant component of operational overheads within the HCI business model. These costs encompass salaries, benefits, and other administrative expenses for employees across all business segments, including insurance, technology, and real estate.

These expenses saw a notable increase, rising to $20.5 million in the first quarter of 2025 from $16.3 million in the first quarter of 2024. This escalation was largely driven by several key factors.

- Increased Accrued Discretionary Bonus: Higher bonus accruals for administrative staff contributed to the rise.

- Elevated Stock-Based Compensation: The value of stock options and awards granted to personnel increased.

- Higher Employee Health Benefits: Costs associated with employee health insurance and wellness programs went up.

Technology Development and Maintenance Costs

HCI's cost structure is heavily influenced by the significant investment required for technology development and maintenance. This includes ongoing expenses for software engineering, cloud infrastructure, and robust cybersecurity measures to protect its proprietary Exzeo platform. In 2024, companies in the insurtech sector, similar to HCI, saw technology spending increase by an average of 15% year-over-year, reflecting the critical need for advanced digital capabilities.

- Software Development: Costs associated with coding, testing, and deploying new features for the Exzeo platform.

- IT Infrastructure: Expenses for servers, cloud hosting, data storage, and network management.

- Cybersecurity: Investments in security software, personnel, and protocols to safeguard sensitive data and systems.

HCI's cost structure is dominated by reinsurance premiums ceded, which increased to $99.6 million in Q1 2025 from $68.1 million in Q1 2024. Losses and Loss Adjustment Expenses (LAE) decreased to $59.3 million in Q1 2025, down from $79.9 million in Q1 2024, indicating improved claims handling. Policy acquisition and underwriting expenses rose to $27.3 million in Q1 2025, up from $22.1 million in Q1 2024, reflecting business growth.

| Cost Category | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Reinsurance Premiums Ceded | $68.1 million | $99.6 million | +46.3% |

| Losses and Loss Adjustment Expenses (LAE) | $79.9 million | $59.3 million | -25.8% |

| Policy Acquisition and Underwriting Expenses | $22.1 million | $27.3 million | +23.5% |

| General and Administrative Personnel Expenses | $16.3 million | $20.5 million | +25.8% |

Revenue Streams

HCI Group's primary revenue source is the gross premiums collected from its property and casualty insurance policies, predominantly in Florida. This core income stream fuels the company's operations and growth initiatives.

In the first quarter of 2025, HCI Group reported a significant increase in consolidated gross premiums earned, reaching $300.4 million. This represents a robust 17.0% jump from the $256.6 million earned in the same period of 2024. A key driver behind this growth was the successful assumption of policies from Citizens Property Insurance Corporation, demonstrating HCI's strategic expansion within the Florida market.

HCI Group generates revenue by providing reinsurance programs to other insurance companies. This service allows these entities to transfer a portion of their risk, thereby strengthening their financial stability and capacity. While specific external revenue figures for reinsurance premiums aren't always broken out in their primary financial reports, the operation of their wholly-owned reinsurer, Claddaugh Casualty Insurance Company Ltd., confirms this as a key business activity.

Net investment income represents a crucial revenue stream derived from the strategic deployment of premiums and capital reserves. This income is generated through various investment vehicles, contributing to the overall financial health of the organization.

In the first quarter of 2025, net investment income reached $13.8 million. This figure shows a modest dip from the $14.1 million recorded in the first quarter of 2024. The primary driver for this slight decrease was a reduction in earnings from limited partnership investments, though it continues to be a reliable source of revenue.

Technology Licensing and Services (from Exzeo)

With Exzeo’s planned spin-off, HCI Group is poised to unlock a substantial new revenue stream by licensing its proprietary insurance technology solutions and associated services to external insurance carriers. This strategic move allows HCI to monetize its advanced platform, which has been instrumental in its own operational success, by making it available to a broader market.

This technology licensing and services segment is expected to tap into the growing demand for digital transformation within the insurance industry. For instance, in 2024, the global InsurTech market was valued at approximately $10.5 billion and is projected to grow significantly, indicating a strong appetite for the kind of solutions Exzeo offers.

- Technology Licensing: HCI Group will generate revenue by granting licenses for its insurance-specific software and platforms to other insurance companies, enabling them to enhance their operations.

- Professional Services: Beyond software access, HCI will offer implementation, customization, training, and ongoing support services to clients utilizing Exzeo’s technology.

- Revenue Diversification: This new stream diversifies HCI’s income sources, reducing reliance on its core insurance underwriting business and leveraging its technological investments.

- Market Expansion: By offering its technology externally, HCI can achieve greater economies of scale and market penetration than through internal use alone.

Real Estate Rental Income and Property Sales

HCI Group's real estate operations, managed through Greenleaf Capital, LLC, bring in money from renting out office and retail spaces. This provides a steady income flow for the company.

Beyond rental income, Greenleaf Capital also has the potential to generate revenue through the sale of its properties. This adds another layer to its financial strategy.

- Rental Income: Generates recurring revenue from leased office and retail spaces.

- Property Sales: Offers potential for lump-sum revenue through the disposition of real estate assets.

- Diversification: These dual revenue streams contribute to HCI Group's overall financial stability and growth.

HCI Group's revenue streams are diverse, stemming from core insurance operations, investments, and a growing technology licensing segment. The company's strategic expansion and focus on technological innovation are key drivers for its financial performance.

The planned spin-off of Exzeo is set to create a significant new revenue stream through technology licensing and professional services, capitalizing on the increasing demand for InsurTech solutions. This move is expected to enhance HCI's market reach and diversify its income beyond traditional insurance underwriting.

Real estate operations further contribute to HCI's revenue through rental income and potential property sales, managed by Greenleaf Capital, LLC. This segment adds a stable, recurring income source and opportunities for capital appreciation.

| Revenue Stream | Description | Q1 2025 (Millions) | Q1 2024 (Millions) |

|---|---|---|---|

| Gross Premiums Earned | Primary income from property and casualty insurance policies. | $300.4 | $256.6 |

| Net Investment Income | Earnings from strategic deployment of premiums and capital reserves. | $13.8 | $14.1 |

| Technology Licensing & Services (Projected) | Revenue from licensing Exzeo's insurance technology. | N/A (Planned) | N/A |

| Real Estate Operations | Income from property rentals and potential sales. | N/A (Managed by Greenleaf Capital) | N/A |

Business Model Canvas Data Sources

The HCI Business Model Canvas is built upon a foundation of user research, market analysis, and internal operational data. These sources ensure each component, from customer segments to key activities, is informed by empirical evidence and strategic understanding.