HCI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HCI Bundle

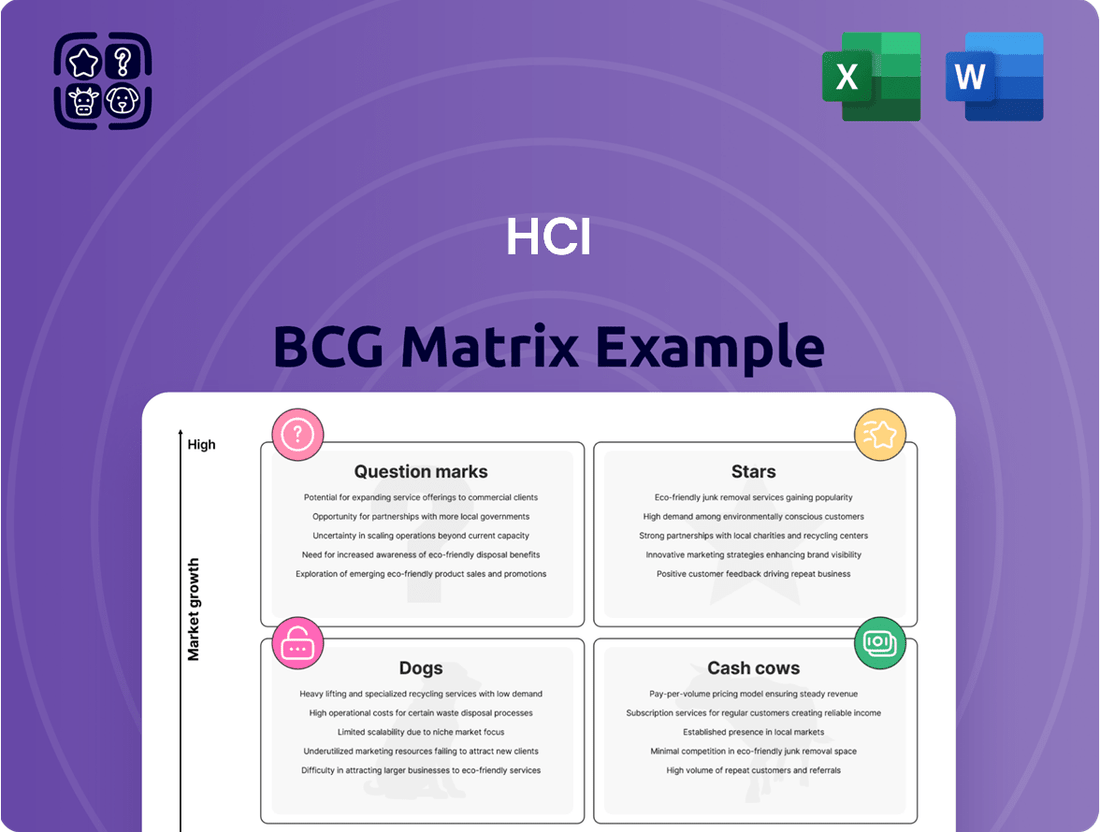

Uncover the strategic positioning of this company's product portfolio with our HCI BCG Matrix preview. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental dynamics at play. Purchase the full BCG Matrix for a comprehensive breakdown, actionable insights, and a clear roadmap to optimizing your investment and product strategy.

Stars

HCI Group's Florida property insurance segment is experiencing robust growth, significantly fueled by its strategic acquisition of policies from Citizens Property Insurance Corporation. This approach has bolstered its market presence in a sector actively undergoing stabilization and reform.

The company reported a substantial 17.0% increase in gross premiums earned in the first quarter of 2025, reaching $300.4 million compared to $256.6 million in the first quarter of 2024. Furthermore, gross premiums earned in the fourth quarter of 2024 saw an impressive 38.0% surge to $297.5 million, up from $215.2 million in the fourth quarter of 2023.

Exzeo Group, HCI's newly branded technology division, is a standout performer in the HCI BCG Matrix, classified as a Star. This segment is characterized by its high growth and substantial market opportunity, driven by its cutting-edge insurance technology solutions.

Exzeo offers advanced underwriting algorithms and data analytics, demonstrating a strong history of enhancing HCI's insurance operations. The insurtech market is booming, projected to reach $96.24 billion by 2029, underscoring Exzeo's strategic importance.

HCI intends to spin off Exzeo, likely tax-free, to shareholders by the end of 2025. This move aims to unlock further value and broaden Exzeo's reach within the expanding insurance technology landscape.

HCI Group significantly bolstered its reinsurance programs for the 2025-2026 treaty year, securing over $3.5 billion in aggregate limit. This strategic move underscores a commitment to managing risk effectively, particularly in Florida's hurricane-prone environment. The substantial increase in coverage, a 30% jump from the previous year, directly supports HCI's aggressive growth in policy count.

This enhanced reinsurance capacity is crucial for HCI's expansion, enabling prudent risk management while accommodating a growing policy base. The company’s reinsurance subsidiary, Claddaugh Casualty, also plays a role by selectively participating in the program, further solidifying HCI's comprehensive risk mitigation strategy.

Strategic Acquisitions and Policy Takeouts

HCI Group actively participates in Florida's Citizens depopulation program, strategically acquiring market share by assuming policies. This approach is a key element in its growth strategy, allowing the company to absorb a significant number of policies.

For instance, in October 2024, HCI took on more than 42,000 policies. These policies represent roughly $200 million in in-force premiums, demonstrating the scale of their strategic acquisitions. This move positions HCI to leverage its technology for profitable policy selection.

- Strategic Policy Assumption: HCI Group's engagement in Florida's Citizens depopulation program showcases its ability to grow by acquiring existing insurance policies.

- Significant Market Share Growth: The assumption of over 42,000 policies in October 2024, representing approximately $200 million in premiums, highlights a substantial increase in market presence.

- Technology-Driven Profitability: HCI utilizes technology to select profitable policies from these takeouts, aiming to convert them into stable revenue streams.

- High-Growth Asset Potential: These acquired policies are viewed as high-growth assets that can contribute to HCI's long-term financial stability and expansion.

Condo Owners Reciprocal Exchange (CORE)

Condo Owners Reciprocal Exchange (CORE) is positioned as a potential star within the HCI BCG Matrix. As a reciprocal insurance company sponsored by HCI, CORE specifically targets the condominium association and owner market in Florida. This focus allows it to address a growing niche with tailored insurance solutions.

CORE's strategy of providing custom insurance for this specific market segment suggests an opportunity for focused growth and market share capture. The overall recovery and stabilization of the Florida insurance market in 2024 further bolster the outlook for high growth potential. For instance, Florida's property insurance market saw a decrease in the number of insurers withdrawing in late 2023 and early 2024, signaling a more stable environment for new entrants and specialized providers like CORE.

- Market Focus: Specializes in the condominium association and owner market in Florida.

- Growth Potential: Benefits from a growing niche and the stabilizing Florida insurance market.

- Strategy: Offers custom insurance solutions to meet specific market needs.

- 2024 Outlook: The Florida insurance market experienced a reduction in insurer exits, indicating a more favorable environment for specialized companies.

Exzeo Group, HCI's technology arm, is a prime example of a Star in the BCG Matrix. Its high growth, driven by innovative insurtech solutions, positions it for significant market share capture. The projected growth of the insurtech market, expected to reach $96.24 billion by 2029, validates Exzeo's potential. HCI's plan to spin off Exzeo by the end of 2025 aims to further unlock its value as a high-growth asset.

Condo Owners Reciprocal Exchange (CORE) also shows Star potential. By focusing on the specialized condominium insurance market in Florida, CORE addresses a niche with tailored solutions. The stabilization of Florida's insurance market in 2024, with fewer insurers withdrawing, creates a favorable environment for CORE's focused growth strategy.

| Segment | BCG Category | Key Growth Drivers | Market Opportunity | HCI's Strategy |

|---|---|---|---|---|

| Exzeo Group | Star | Advanced underwriting algorithms, data analytics, insurtech innovation | $96.24 billion by 2029 (Insurtech market projection) | Spin-off by end of 2025 to unlock value |

| Condo Owners Reciprocal Exchange (CORE) | Potential Star | Specialized condominium insurance, custom solutions | Stabilizing Florida insurance market (reduced insurer exits in 2024) | Targeted niche market capture |

What is included in the product

Strategic guidance on allocating resources by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Visualize your portfolio's strategic positioning with the HCI BCG Matrix, simplifying complex business unit analysis.

Cash Cows

Homeowners Choice Property & Casualty Insurance Company, HCI's largest subsidiary, is a significant cash cow. Its established presence and substantial market share in the mature Florida residential property insurance market provide a consistent and stable cash flow. This stability is crucial for the overall financial health of the HCI Group.

Despite facing market headwinds, Homeowners Choice demonstrates a strong focus on underwriting profitability and efficient claims management. This dedication is reflected in its improved gross loss ratio, which stood at 68.8% in Q1 2025, a testament to its operational effectiveness and ability to generate reliable cash even in challenging conditions.

TypTap Insurance Company's established policies represent a significant cash cow within the HCI portfolio. This segment benefits from a large, mature customer base, generating consistent premium income. In 2024, TypTap reported a robust combined ratio, indicating strong profitability from its existing book of business, a testament to its efficient operations.

HCI's proprietary technology plays a crucial role in maintaining TypTap's cash cow status by optimizing risk management and underwriting processes. This technological advantage allows for more accurate pricing and reduced claims costs, thereby enhancing profitability. This efficiency is vital in the competitive insurance landscape, ensuring steady returns.

The mature policy portfolio requires less capital for growth compared to newer initiatives, freeing up resources for investment elsewhere in HCI. This consistent cash generation from TypTap's established business underpins its role as a reliable contributor to the company's overall financial health and strategic flexibility.

Greenleaf Capital, HCI Group's real estate arm, operates in established markets, characterized by low growth but significant market share. This division, encompassing office/retail leasing, restaurants, and marinas, functions as a classic Cash Cow within the BCG framework.

The stable income generated from these mature assets provides a consistent and reliable source of cash flow for HCI Group. For instance, in 2024, the real estate sector, despite moderate growth projections, continued to be a bedrock of rental income and operational profits, contributing substantially to the company's overall financial health.

Claddaugh Casualty Insurance Company (Captive Reinsurer)

Claddaugh Casualty Insurance Company, HCI's captive reinsurer based in Bermuda, is a significant contributor to the group's financial strength. By managing a portion of HCI's reinsurance needs internally, Claddaugh Casualty captures premiums that would typically be paid to external reinsurers.

This internal retention of premiums directly boosts HCI's profitability and strengthens its financial resilience. In 2024, for example, captive insurance arrangements like Claddaugh Casualty have become increasingly vital for companies seeking to control costs and retain underwriting profits. The Bermuda market, where Claddaugh operates, remains a key hub for such operations, facilitating efficient capital management.

- Captive Reinsurer Role: Claddaugh Casualty handles a portion of HCI's reinsurance, keeping premiums within the group.

- Profit Retention: This strategy allows HCI to capture profits that would otherwise go to external reinsurers.

- Financial Resilience: The internal reinsurance mechanism enhances HCI's overall financial stability and profitability.

- Market Context: Bermuda-based captives, like Claddaugh, are integral to managing risk and retaining capital in the global insurance market, a trend reinforced in 2024.

Net Investment Income

HCI Group's net investment income, derived from its cash, cash equivalents, and available-for-sale fixed maturity securities, functions as a classic Cash Cow within the BCG framework. This income, while susceptible to market shifts, offers a consistent cash flow with minimal active management needs, contrasting with the demands of its core operations.

The company reported a notable increase in net investment income for 2024, underscoring its stability and contribution to HCI's overall financial health. This performance reinforces its position as a reliable generator of surplus cash.

- HCI Group's Net Investment Income: A steady stream from financial assets.

- Low Investment Requirement: Minimal ongoing capital needed for management.

- 2024 Performance: An increase in net investment income demonstrates growth in this stable segment.

- Cash Cow Status: Provides essential cash flow to fund other business areas.

Cash Cows in HCI's portfolio, like Homeowners Choice and TypTap Insurance, represent established businesses with significant market share and consistent cash generation. These entities require minimal investment for growth, allowing HCI to allocate resources to other strategic areas. Their stable performance, even amidst market challenges, underscores their value as reliable income generators.

HCI's real estate division, Greenleaf Capital, and its captive reinsurer, Claddaugh Casualty, also function as cash cows. Greenleaf Capital benefits from stable rental income in mature markets, while Claddaugh Casualty retains premiums internally, enhancing HCI's profitability. The company's net investment income further contributes to this category, providing a steady cash flow with low management demands.

| Business Segment | BCG Category | Key Characteristics | 2024/Q1 2025 Data Point |

|---|---|---|---|

| Homeowners Choice | Cash Cow | Mature market, stable cash flow, strong underwriting focus | Gross loss ratio of 68.8% in Q1 2025 |

| TypTap Insurance | Cash Cow | Established policies, large customer base, proprietary technology | Robust combined ratio in 2024 |

| Greenleaf Capital (Real Estate) | Cash Cow | Established markets, significant market share, stable income | Bedrock of rental income and operational profits in 2024 |

| Claddaugh Casualty (Captive Reinsurer) | Cash Cow | Internal reinsurance, profit retention, financial resilience | Integral to managing risk and retaining capital in 2024 |

| Net Investment Income | Cash Cow | Steady stream from financial assets, low investment requirement | Notable increase in net investment income for 2024 |

Delivered as Shown

HCI BCG Matrix

The HCI BCG Matrix preview you're examining is the identical, fully unlocked document you'll receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises – just a comprehensive, ready-to-deploy strategic tool for your business. You'll gain access to the complete analysis and formatting, enabling you to seamlessly integrate it into your planning and decision-making processes. This is the exact, professionally crafted report designed to provide actionable insights into your product portfolio's market position.

Dogs

Policies issued before Florida's 2022-2023 legislative reforms, designed to tackle litigation and fraud, often fall into the Dogs category of the HCI BCG Matrix. These older policies might exhibit higher loss ratios and increased claim frequency, making them less profitable.

While the reforms are gradually stabilizing the market, some legacy policies continue to incur disproportionately high costs. For instance, reports from the Florida Office of Insurance Regulation indicated a significant rise in litigation costs prior to the reforms, impacting insurers' bottom lines.

These underperforming policies can become cash traps, draining resources through claims payouts and administrative expenses that exceed the premiums collected. This situation can hinder an insurer's ability to invest in more profitable ventures or newer, more efficient products.

Non-strategic or divested real estate assets represent properties that are not contributing to HCI's core business objectives or growth. These could include older buildings with declining rental income, assets with consistently low occupancy rates, or properties requiring substantial investment for minimal expected return. For instance, if a commercial property in a declining urban area has an occupancy rate dipping below 70% and demands a $5 million renovation with a projected ROI of only 3%, it would likely fall into this category.

These assets are essentially capital drains, tying up valuable resources that could be better allocated to more promising ventures within HCI's portfolio. In 2024, the average national office vacancy rate hovered around 18.5%, a figure that could easily encompass non-strategic assets if they consistently underperform this benchmark. Divesting such properties allows HCI to free up capital and focus on its strategic real estate holdings.

Before the full development and rebranding to Exzeo, HCI Group's insurance operations likely relied on legacy IT systems. These systems, considered inefficient or outdated, would have presented significant challenges such as high maintenance expenses, limited ability to scale, and a general drag on operational efficiency. In 2023, the average IT maintenance cost for businesses can range from 50% to 80% of the initial IT investment, highlighting the potential financial burden of such systems.

Certain Regional Market Exposures with High Litigation

Certain regional market exposures within Florida, despite statewide reforms aimed at curbing litigation, continue to exhibit exceptionally high litigation rates or disproportionately severe weather events. This persistent localized challenge can significantly impact insurance policies in those specific areas, pushing them into the 'Dog' quadrant of the HCI BCG Matrix.

These challenging locales can lead to substantially higher claims costs and consequently, diminished profitability. For instance, some South Florida counties have historically reported claims frequency rates that are 20-30% higher than the state average, particularly following hurricane events, making it difficult to achieve positive returns on policies underwritten there.

- Persistent Litigation Hotspots: Areas like Miami-Dade and Broward counties in Florida have consistently shown higher rates of insurance-related lawsuits compared to other regions, even after legislative changes.

- Weather Event Impact: Regions prone to frequent or severe weather, such as the Panhandle or coastal areas, can experience concentrated claims, driving up costs and reducing the viability of certain policy types.

- Profitability Challenges: The combination of increased litigation and weather-related claims in these specific regions can create a negative feedback loop, making it difficult for insurers to maintain profitability and grow market share.

Small, Non-Core Business Ventures

Small, non-core business ventures, often minor investments outside of HCI's main insurance, reinsurance, and technology operations, would fall into the Dogs category. These are ventures characterized by both low market share and limited growth potential. For example, if HCI held a small stake in a niche manufacturing firm that wasn't strategically aligned and showed no signs of expanding its market presence, it would be a prime candidate for a Dog. In 2024, such ventures might represent less than 1% of a large conglomerate's total revenue but could still tie up valuable management bandwidth.

These ventures typically drain resources and management attention without offering substantial returns or contributing to the company's overarching strategic goals. Consider a situation where HCI was involved in a small, legacy software project that had been superseded by newer technologies and had a dwindling user base. This project, despite its historical significance, would likely exhibit the characteristics of a Dog, consuming maintenance costs and developer time without offering a clear path to future profitability or strategic advantage.

- Low Market Share: Ventures with a negligible presence in their respective markets.

- Minimal Growth Prospects: Little to no anticipated expansion or increased demand.

- Resource Drain: Consume management time and financial capital without significant ROI.

- Strategic Disconnect: Do not align with the core business strategy or future vision.

Policies issued before Florida's 2022-2023 legislative reforms, designed to tackle litigation and fraud, often fall into the Dogs category of the HCI BCG Matrix. These older policies might exhibit higher loss ratios and increased claim frequency, making them less profitable. While the reforms are gradually stabilizing the market, some legacy policies continue to incur disproportionately high costs. For instance, reports from the Florida Office of Insurance Regulation indicated a significant rise in litigation costs prior to the reforms, impacting insurers' bottom lines.

Non-strategic or divested real estate assets, such as commercial properties with occupancy rates below 70% and requiring substantial investment for minimal return, also fit into the Dogs category. In 2024, the average national office vacancy rate hovered around 18.5%, a figure that could easily encompass non-strategic assets if they consistently underperform this benchmark. Divesting such properties allows HCI to free up capital and focus on its strategic real estate holdings.

Legacy IT systems, characterized by high maintenance expenses and limited scalability, represent another 'Dog' within the HCI BCG Matrix. In 2023, average IT maintenance costs for businesses could range from 50% to 80% of the initial IT investment, highlighting the potential financial burden of such systems.

Certain regional market exposures within Florida, particularly those with exceptionally high litigation rates or severe weather events, can lead to substantially higher claims costs and diminished profitability. For example, some South Florida counties have historically reported claims frequency rates that are 20-30% higher than the state average, making it difficult to achieve positive returns on policies underwritten there.

Small, non-core business ventures, such as a minor investment in a niche manufacturing firm not strategically aligned with HCI's core operations, also fall into the Dogs category. These ventures typically consume management attention and financial capital without offering substantial returns or contributing to the company's overarching strategic goals.

| Category | Characteristics | Examples | Financial Impact | Strategic Implication |

| Dogs | Low market share, low growth potential, high costs, low profitability | Pre-reform Florida insurance policies, non-strategic real estate, legacy IT systems, underperforming regional exposures, non-core ventures | Resource drain, capital tie-up, negative ROI | Hindered investment in growth areas, distraction from core business |

Question Marks

TypTap Insurance's move into states beyond Florida places it in the 'Question Mark' category of the BCG Matrix. This expansion demands substantial capital for new state licensing, building distribution networks, and targeted marketing campaigns to establish brand awareness against entrenched competitors. For instance, in 2024, TypTap announced plans to enter Texas and Georgia, markets where gaining significant market share will require overcoming established players and understanding unique regulatory environments.

New technology solutions within Exzeo Group, such as advanced AI-driven claims processing or novel customer engagement platforms, would be classified as Question Marks in the HCI BCG Matrix. These innovations, while promising within the dynamic insurtech landscape, are currently in their nascent stages of market penetration and revenue generation. For instance, Exzeo's recent investment in a blockchain-based policy management system, launched in late 2023, represents a significant R&D expenditure with unproven market acceptance.

Tailrow Insurance Exchange, a reciprocal insurer backed by HCI, is a newer entrant in Florida's insurance landscape. As a challenger, it fits the question mark category in the BCG Matrix, aiming to grow its market share in a promising market.

To transition from a low market share, Tailrow needs aggressive growth strategies. For instance, in 2023, HCI Group (HCI) reported that Tailrow's gross written premiums increased significantly, indicating early traction, though specific market share figures are still developing.

Emerging Real Estate Development Projects

Emerging real estate development projects by Greenleaf Capital, currently in their nascent stages, would be classified as Question Marks within the HCI BCG Matrix. These ventures demand significant upfront capital before yielding substantial returns, making their future profitability uncertain. For instance, Greenleaf's proposed mixed-use development in downtown Austin, projected to cost $150 million, represents such a Question Mark. Its success hinges on factors like projected rental income growth in the Austin market, which saw a 5.2% increase in average rents in 2024, and managing construction cost fluctuations, which experienced a 3.8% rise year-over-year for materials in the region.

These early-stage projects carry inherent risks tied to market reception, construction cost management, and adherence to development timelines. Greenleaf's commitment to thorough due diligence is crucial for these Question Marks. For example, a recent analysis indicated that 20% of large-scale urban development projects nationwide experienced cost overruns exceeding 15% in 2024, highlighting the importance of robust financial planning for Greenleaf's emerging portfolio.

- Projected Capital Outlay: Greenleaf's new developments require substantial initial investment, often in the tens to hundreds of millions of dollars.

- Market Dependency: Success is heavily reliant on current and future market demand, economic conditions, and consumer spending power.

- Risk Factors: Construction cost volatility, regulatory hurdles, and potential delays can significantly impact profitability and timelines.

- Strategic Evaluation: Careful assessment of potential ROI, competitive landscape, and risk mitigation strategies is paramount for these ventures to transition from Question Marks to Stars or Cash Cows.

Strategic Partnerships or Joint Ventures

Strategic partnerships or joint ventures for HCI Group would initially be classified as Question Marks within the BCG Matrix. These collaborations, whether in insurance or technology, involve shared risks and rewards, with success dependent on integration, synergy, and market acceptance. For instance, a 2024 initiative could involve a joint venture with a fintech firm to develop a new AI-driven underwriting platform, aiming to reduce claims processing time by an estimated 20%.

Such ventures offer significant growth potential but also present inherent uncertainties, requiring careful management and strategic alignment. The financial commitment for such a partnership in 2024 could range from $5 million to $20 million, depending on the scope and technological integration required. HCI's ability to secure favorable terms and manage operational complexities will be crucial.

- Potential for rapid market penetration through partner's existing customer base.

- Shared development costs for new technologies or products.

- Risk of misalignment in strategic goals or operational execution.

- Dependence on partner's financial stability and market reputation.

Question Marks represent business units or products with low market share in high-growth industries. They require significant investment to increase market share, but their future success is uncertain. For instance, a new insurance product with limited adoption but operating in a rapidly expanding market segment would be a Question Mark. In 2024, many insurtech startups focused on niche markets are in this category, seeking capital to scale.

These ventures have the potential to become Stars if their market share grows, but they also risk becoming Dogs if they fail to gain traction and the industry growth slows. Careful strategic decisions regarding investment and market positioning are critical for Question Marks. For example, a new digital health platform targeting a growing but competitive demographic might be a Question Mark, needing substantial marketing spend to gain visibility.

The key challenge for Question Marks is converting their potential into market dominance. This often involves aggressive marketing, product development, and strategic acquisitions. In 2023, the venture capital funding for early-stage tech companies, many of which start as Question Marks, saw a notable increase in specific sectors like AI and cybersecurity, indicating investor appetite for high-risk, high-reward opportunities.

Without a clear strategy, Question Marks can drain resources and fail to deliver returns. Companies must rigorously evaluate the market potential and their competitive advantages before committing significant capital. For example, a company might decide to divest a Question Mark if market analysis in 2024 suggests a low probability of achieving market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer surveys, and competitive analysis, to accurately position products within their respective markets.