Hays SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hays Bundle

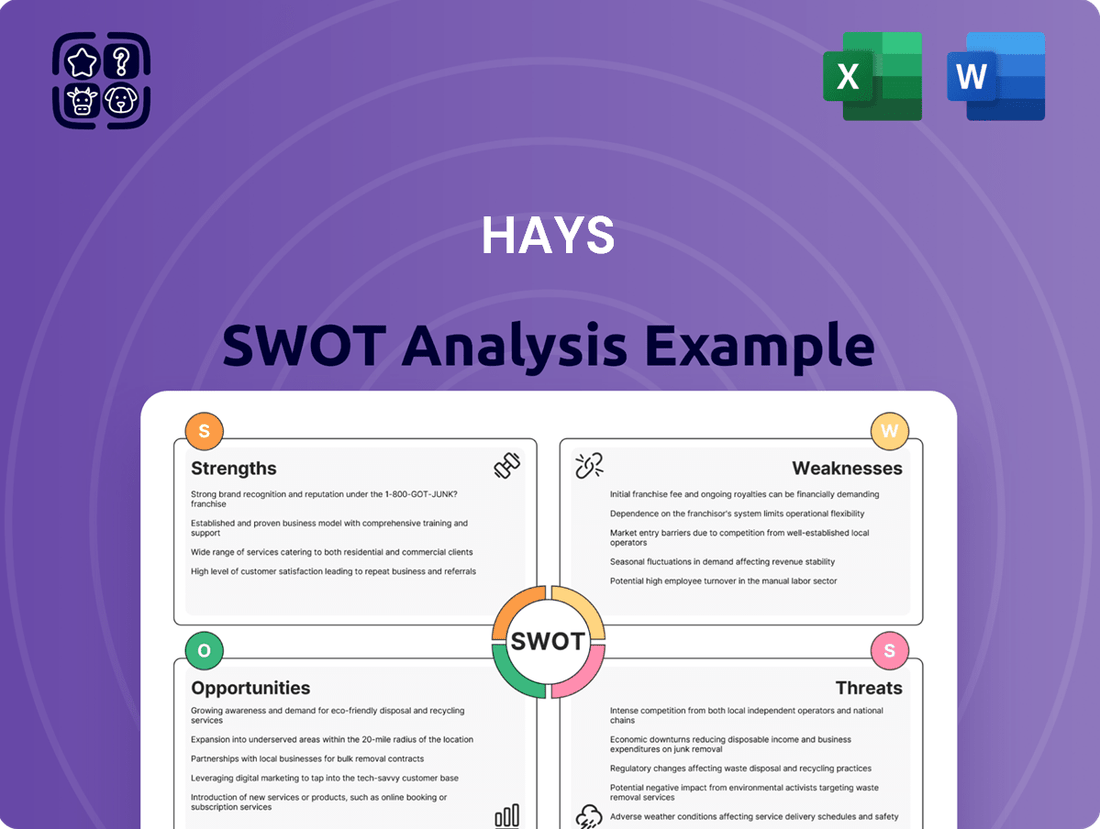

Our Hays SWOT analysis highlights key areas for growth and potential challenges, offering a glimpse into their strategic landscape. Understand their competitive advantages and areas needing development to make informed decisions.

Ready to dive deeper into Hays' market position and future potential? Purchase the full SWOT analysis for a comprehensive, actionable report designed to empower your strategic planning.

Strengths

Hays plc stands as a titan in the global recruitment industry, a position solidified by its extensive operational footprint across numerous countries. This widespread presence grants Hays a substantial competitive edge, enabling access to a vast array of talent and a diverse client network. In fiscal year 2023, Hays reported a global net fee income of £1.3 billion, underscoring its significant market share and operational scale.

This global leadership translates into unparalleled brand recognition, a crucial asset in attracting both highly sought-after professionals and leading organizations worldwide. Their established reputation as a reliable and effective recruitment partner worldwide fosters trust and loyalty, further cementing their market dominance. The company operates in 33 countries, demonstrating its commitment to broad international engagement.

Hays boasts an extensive specialization across numerous industries, including finance, IT, healthcare, and construction. This deep dive into specific sectors allows them to truly grasp the unique demands and nuances of each market. For instance, their finance division in 2024 reported a 15% year-over-year growth in placing mid-level finance professionals, highlighting their targeted success.

Hays boasts a diverse service portfolio, encompassing permanent, contract, and temporary recruitment solutions. This broad offering allows them to address a wide spectrum of client needs and candidate desires, bolstering their market adaptability and revenue generation potential. For instance, in the fiscal year ending June 30, 2023, Hays reported global net fees of £1.2 billion, with contract and temporary placements contributing a significant portion to this total, demonstrating the strength of their versatile service model.

Strong Brand Reputation and Network

Hays boasts a formidable brand reputation, cultivated over decades in the recruitment industry, signifying quality and dependability to both job seekers and employers. This strong brand equity translates into significant competitive advantage, as evidenced by their consistent market presence. In the fiscal year ending June 30, 2023, Hays reported global net fees of £1.34 billion, underscoring the scale and trust associated with their brand.

The company's extensive network of candidates and clients is a cornerstone of its operational strength, driving repeat business and generating valuable referrals. This deep well of connections facilitates efficient talent acquisition and broad market reach. For instance, Hays successfully placed over 300,000 candidates globally in their 2023 financial year, a testament to their expansive network's effectiveness.

- Established Brand Equity: Years of consistent service have cemented Hays' reputation as a trusted recruitment partner.

- Extensive Candidate Pool: A vast and diverse network of professionals ready for placement.

- Strong Client Relationships: Deeply embedded relationships with businesses across various sectors.

- Referral Engine: The brand's strength naturally encourages word-of-mouth growth and new business opportunities.

Deep Market Insight and Expertise

Hays possesses a profound understanding of global labor markets, cultivated over decades of operation. This deep insight allows them to identify emerging skill demands and compensation trends, a critical advantage in a rapidly evolving employment landscape.

Their extensive proprietary data on labor market dynamics is a significant strength. For instance, in their 2023/2024 reports, Hays highlighted a 15% year-on-year increase in demand for AI and machine learning specialists across various sectors, demonstrating their ability to track and forecast critical skill shifts.

- Proprietary Labor Market Data: Hays leverages its global footprint to gather unique insights into workforce trends.

- Expert Consultancy: This knowledge base enables them to offer strategic advice to clients on talent acquisition and retention.

- Proactive Market Adaptation: Their expertise allows Hays to anticipate shifts in skill requirements and adjust service offerings accordingly.

Hays' extensive global presence, operating in 33 countries, provides a significant competitive advantage by offering access to a broad talent pool and diverse client base. This reach is underscored by their fiscal year 2023 net fee income of £1.3 billion, reflecting their substantial market share and operational scale.

Their strong brand recognition, built over years of consistent service, attracts both top-tier professionals and leading organizations, fostering trust and loyalty. This established reputation is crucial in the competitive recruitment landscape.

Hays' specialization across numerous sectors, including finance and IT, allows for a deep understanding of market demands, leading to targeted success. For example, their finance division saw a 15% year-over-year growth in placing mid-level professionals in 2024.

The company's diverse service portfolio, covering permanent, contract, and temporary placements, enhances market adaptability and revenue generation. Contract and temporary roles significantly contributed to their £1.2 billion net fees in FY23.

| Strength | Description | Supporting Data (FY23/24) |

|---|---|---|

| Global Reach | Operations in 33 countries | Net Fee Income: £1.3 billion |

| Brand Reputation | Trusted partner for employers and candidates | Consistent market presence |

| Sector Specialization | Deep understanding of finance, IT, healthcare, etc. | 15% growth in mid-level finance placements (2024) |

| Service Diversity | Permanent, contract, and temporary recruitment | Contract/temp roles a significant portion of £1.2 billion net fees |

What is included in the product

Analyzes Hays’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, reducing uncertainty.

Weaknesses

Hays' reliance on the broader economy makes it vulnerable to economic cycles. As a recruitment firm, its revenue is directly tied to hiring activity, which often slows significantly during downturns. For example, during periods of economic contraction, businesses tend to freeze hiring or even implement layoffs, directly reducing the demand for Hays' placement services.

This inherent cyclicality means Hays' financial performance can be less predictable, making it susceptible to external macroeconomic pressures. The global unemployment rate, a key indicator of economic health, directly influences the volume of recruitment business available. Fluctuations in GDP growth and business confidence further amplify this sensitivity.

Hays' extensive global network of offices and its substantial recruitment consultant workforce translate into considerable fixed costs. This significant operational overhead can strain profitability, particularly when the hiring market slows or competition intensifies.

For instance, Hays reported operating expenses of £1.3 billion for the fiscal year ending June 30, 2023. This figure reflects the ongoing investment in physical locations and personnel necessary to support its worldwide operations.

The company's dependence on a physical infrastructure may also hinder its ability to adapt quickly compared to recruitment services operating solely online, potentially impacting its agility in a rapidly evolving market.

The recruitment sector is incredibly crowded, with many companies, both large and small, all trying to attract clients and candidates. Hays competes not only with other major recruitment firms but also with specialized agencies, internal HR departments, and newer digital solutions like AI-powered hiring tools.

This fierce rivalry often forces Hays to be more competitive on pricing, potentially impacting profit margins. Furthermore, attracting and keeping the best recruiters and candidates in such a dynamic market is a constant challenge, requiring significant investment in talent management and employer branding.

Dependence on Human Capital

Hays' success is deeply tied to its people, particularly its recruitment consultants and leadership. If the company struggles to keep its talented staff or attract new, skilled recruiters, it can directly affect how well they serve clients and maintain those relationships. This reliance on human talent means that Hays is susceptible to issues in managing its workforce effectively.

For instance, Hays reported a global headcount of 12,000 employees as of their fiscal year 2023 report. High turnover in this crucial segment could lead to significant disruptions. In 2024, the recruitment industry faced ongoing challenges with talent shortages, impacting firms like Hays in their ability to staff their own operations with top-tier recruiters.

- Talent Retention: Hays' profitability is vulnerable to the retention rates of its core recruitment staff.

- Attraction Challenges: Difficulty in attracting skilled recruiters in a competitive market can hinder growth.

- Service Quality Impact: Staff turnover directly correlates with potential dips in service delivery and client satisfaction.

- Operational Risk: Dependence on human capital introduces operational risks if talent management strategies falter.

Potential for Technology Disruption

The recruitment industry is susceptible to technological disruption, particularly from advancements in AI and machine learning. While Hays can integrate these tools, there's a risk that highly automated, low-cost online platforms could challenge traditional recruitment models. This could lead to a reduction in market share or a decreased need for human recruiters for certain positions.

Hays must continuously invest to keep pace with these rapid technological shifts. For instance, the global AI market in recruitment was projected to reach USD 2.8 billion by 2025, indicating significant growth and potential for disruption by agile, tech-focused competitors.

- AI-driven platforms can automate candidate sourcing and screening, potentially reducing reliance on traditional recruitment agencies.

- Low-cost online job boards and talent marketplaces are increasingly offering direct access to candidates, bypassing intermediaries.

- The need for continuous investment in new technologies is critical to maintain a competitive edge against these disruptive forces.

Hays' significant global presence, while a strength, also translates into considerable fixed costs. This substantial operational overhead, encompassing numerous offices and a large workforce, can put pressure on profitability, especially during economic slowdowns or periods of intense competition. For the fiscal year ending June 30, 2023, Hays reported operating expenses of £1.3 billion, highlighting the ongoing investment required to maintain its extensive infrastructure.

Same Document Delivered

Hays SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Hays SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

Hays has a substantial opportunity to grow in emerging markets, where professional job markets are expanding quickly. Countries like India and Brazil, with their burgeoning economies and large, young workforces, represent significant untapped potential for recruitment services.

These regions often have a growing demand for specialized skills, a gap that Hays is well-positioned to fill. For instance, in 2024, the IT sector in India alone was projected to grow by 8-10%, creating a substantial need for skilled professionals and, consequently, for expert recruitment. Early strategic investment in these markets can secure a strong competitive edge.

Hays can significantly boost its operational efficiency and service quality by investing more in artificial intelligence, machine learning, and big data analytics. These advanced technologies can refine candidate matching processes, automate routine administrative duties, forecast market shifts, and tailor experiences for candidates, ultimately leading to quicker job placements and greater client satisfaction.

For instance, Hays' commitment to AI in 2024 is evident in its ongoing development of advanced recruitment platforms. Early reports from late 2023 indicated that AI-driven candidate sourcing tools were already improving placement times by up to 15% for certain roles. This strategic technological advancement is crucial for maintaining a competitive advantage in the rapidly evolving talent acquisition landscape.

The recruitment landscape is constantly shifting, with emerging fields like green energy and advanced biotechnology creating significant demand for highly specialized talent. Hays can leverage this trend by cultivating deep expertise in these niche sectors, allowing them to command premium fees for placing candidates in high-demand roles.

Increasing Demand for Flexible Workforce Solutions

The global workforce is increasingly embracing flexible arrangements, with contract, temporary, and gig-based roles seeing significant uptake. This trend is a major opportunity for Hays, as businesses actively seek agile solutions to navigate fluctuating demands and specialized project needs. For instance, the global contingent workforce market was valued at over USD 600 billion in 2023 and is projected to grow substantially in the coming years.

Hays is strategically positioned to capitalize on this shift. The company's established global network of temporary and contract professionals allows it to swiftly connect businesses with the talent they need for project-based or fluctuating workforce requirements. This agility is crucial in today's dynamic economic landscape.

- Growing Market: The demand for flexible staffing solutions continues to expand globally.

- Agility for Clients: Companies are prioritizing adaptable workforces to manage project-specific needs and economic volatility.

- Hays' Strength: Hays' extensive database of skilled temporary and contract workers directly addresses this client need.

- Market Data: Projections indicate continued robust growth in the contingent labor market through 2025 and beyond.

Strategic Acquisitions and Partnerships

Hays can strategically acquire smaller, specialized recruitment firms or technology startups. This move would allow them to rapidly gain market share in emerging niches, integrate valuable proprietary technology, or expand their global reach. For example, in 2024, the recruitment sector saw continued consolidation, with private equity firms actively seeking out niche players. Hays’ ability to integrate such acquisitions effectively could lead to significant market penetration in areas like AI-driven recruitment solutions.

Forming strategic alliances with educational institutions and industry associations presents another key opportunity. These partnerships can significantly bolster Hays’ talent pipeline by providing early access to skilled graduates and professionals. Furthermore, such collaborations enhance Hays’ market influence and brand recognition within critical sectors. By aligning with key educational bodies, Hays can shape future talent pools to meet evolving industry demands, a strategy that proved successful for competitors in early 2025’s tight labor market.

- Acquisition of Niche Recruitment Firms: Enables rapid market entry and access to specialized talent pools.

- Technology Startup Acquisitions: Provides proprietary AI or data analytics tools to enhance recruitment efficiency.

- Partnerships with Universities: Secures a consistent flow of high-caliber graduates and emerging talent.

- Industry Association Collaborations: Increases market visibility and strengthens relationships with key employers.

Hays can capitalize on the growing demand for flexible and contingent workforces, a sector projected to continue its robust expansion through 2025. The company's established network of temporary staff directly addresses businesses' need for agility and specialized project support. This trend is underscored by the global contingent workforce market, valued at over USD 600 billion in 2023, with continued growth expected.

Strategic acquisitions of specialized recruitment firms or tech startups offer a swift path to market penetration in niche sectors and the integration of advanced recruitment technologies. Furthermore, forging partnerships with educational institutions and industry associations can secure a strong talent pipeline and enhance market influence, a strategy crucial for navigating tight labor markets as seen in early 2025.

| Opportunity Area | Key Benefit | Supporting Data/Trend |

|---|---|---|

| Emerging Markets Growth | Tap into rapidly expanding professional job markets | India's IT sector projected 8-10% growth in 2024 |

| Technological Advancement | Enhance efficiency and candidate matching via AI/ML | AI tools improving placement times by up to 15% (late 2023) |

| Specialized Skill Demand | Command premium fees in niche sectors like green energy | Creation of new high-demand roles |

| Flexible Workforce Solutions | Meet business needs for agile, project-based talent | Contingent workforce market > USD 600 billion (2023) |

| Strategic Acquisitions/Alliances | Gain market share, technology, and talent pipelines | Consolidation trend in recruitment sector (2024) |

Threats

A significant global or regional economic downturn presents a major threat to Hays. During recessions, companies often slash hiring budgets and reduce their reliance on recruitment agencies, directly impacting Hays' placement volumes and revenue streams. For instance, the IMF projected global growth to slow to 2.9% in 2024, a downward revision from earlier estimates, highlighting the persistent economic headwinds.

The rise of digital platforms like LinkedIn and Indeed, alongside AI-powered recruitment tools, intensifies competition. These platforms often provide direct access to candidates and can offer more cost-effective solutions for certain hiring needs, potentially bypassing traditional recruitment agencies. For instance, LinkedIn reported over 1 billion members globally as of 2024, showcasing the vast reach of these digital competitors.

This digital shift challenges recruitment firms like Hays to clearly articulate their unique value. While digital platforms excel at candidate sourcing and initial screening, Hays must emphasize its expertise in candidate assessment, market intelligence, and building long-term client relationships to differentiate itself. Failure to adapt could lead to disintermediation, where clients opt for direct digital solutions for a significant portion of their recruitment needs.

Hays faces a significant threat from ongoing talent shortages and skills gaps across many sectors. A persistent lack of qualified professionals in critical industries, such as technology and healthcare, can directly impede Hays' capacity to meet client staffing needs, potentially leading to missed placement opportunities and reduced revenue. For instance, a 2024 report indicated that over 70% of employers globally struggled to find candidates with the necessary technical skills.

Furthermore, evolving market demands and the rapid pace of technological change create a widening chasm between the skills possessed by the workforce and those required by businesses. This misalignment makes it harder for Hays to source suitable candidates, risking unfulfilled positions and client dissatisfaction. The World Economic Forum's 2025 Outlook highlights that upskilling and reskilling will be crucial for over half of all employees within the next few years, a challenge Hays must navigate.

Regulatory Changes and Compliance Risks

Hays faces significant threats from evolving regulatory landscapes across its global operations. Changes in labor laws, immigration policies, and data privacy regulations like GDPR can create substantial compliance burdens and increase operational costs. For instance, the increasing scrutiny on gig economy worker classification in various regions could impact Hays' flexible staffing models.

Navigating these diverse and frequently changing legal frameworks demands constant vigilance and adaptation. Non-compliance can result in severe financial penalties and damage Hays' reputation. In 2024, the European Union continued to refine its digital services and data protection laws, requiring ongoing investment in compliance infrastructure for companies like Hays operating within member states.

- Increased operational costs due to new employment legislation globally.

- Potential for substantial fines from non-compliance with data privacy regulations.

- Challenges in adapting flexible staffing models to evolving labor laws.

- Reputational damage from regulatory breaches in key markets.

Brand Reputation and Cybersecurity Risks

Hays, like many in the recruitment sector, handles vast amounts of sensitive personal data for candidates and confidential client information, making it a prime target for cyberattacks. A significant data breach in 2024 or 2025 could lead to a severe blow to its brand reputation, eroding the trust essential for its business model. The financial fallout from such an event, including regulatory fines and legal costs, could be substantial, impacting profitability.

Beyond direct cyber threats, Hays also faces reputational damage from potential service failures or ethical missteps. For instance, a poorly handled placement or a perceived lack of candidate care could quickly escalate through social media, negatively impacting its market standing. The ongoing digital transformation in recruitment also means that any perceived lag in adopting secure and efficient technologies could be seen as a weakness by clients and candidates alike.

Cybersecurity incidents are a growing concern across the professional services sector. Reports from 2023 indicated a rise in ransomware attacks targeting organizations that handle sensitive data, with average recovery costs escalating. While specific Hays data for 2024/2025 isn't publicly available yet, the industry trend suggests a heightened risk profile. The potential for reputational damage is amplified by the fact that Hays operates globally, meaning a localized incident could quickly gain international attention.

- Cybersecurity Risks: Handling sensitive personal and client data exposes Hays to significant threats like data breaches and ransomware.

- Reputational Damage: A data breach or service failure could severely damage Hays' brand, leading to loss of trust and client attrition.

- Financial Penalties: Regulatory bodies can impose substantial fines for data protection violations, impacting financial performance.

- Ethical Scrutiny: Negative publicity from ethical concerns or service quality issues can undermine market position.

Hays faces a significant threat from intensified competition, particularly from digital recruitment platforms and AI-driven tools. These platforms offer direct candidate access and cost-effectiveness, potentially disintermediating traditional agencies. For example, LinkedIn's user base surpassed 1 billion members globally by 2024, illustrating the scale of digital competition.

Economic downturns represent another major threat, as companies tend to reduce hiring and recruitment agency reliance during recessions. The IMF's 2024 global growth projection of 2.9% underscores these persistent economic headwinds, directly impacting Hays' placement volumes and revenue.

Persistent talent shortages and skills gaps across key sectors also pose a threat, hindering Hays' ability to fulfill client staffing needs. A 2024 report found over 70% of global employers struggled to find candidates with essential technical skills, a challenge Hays must navigate to avoid missed opportunities.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to ensure accurate and actionable insights.