Hays Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hays Bundle

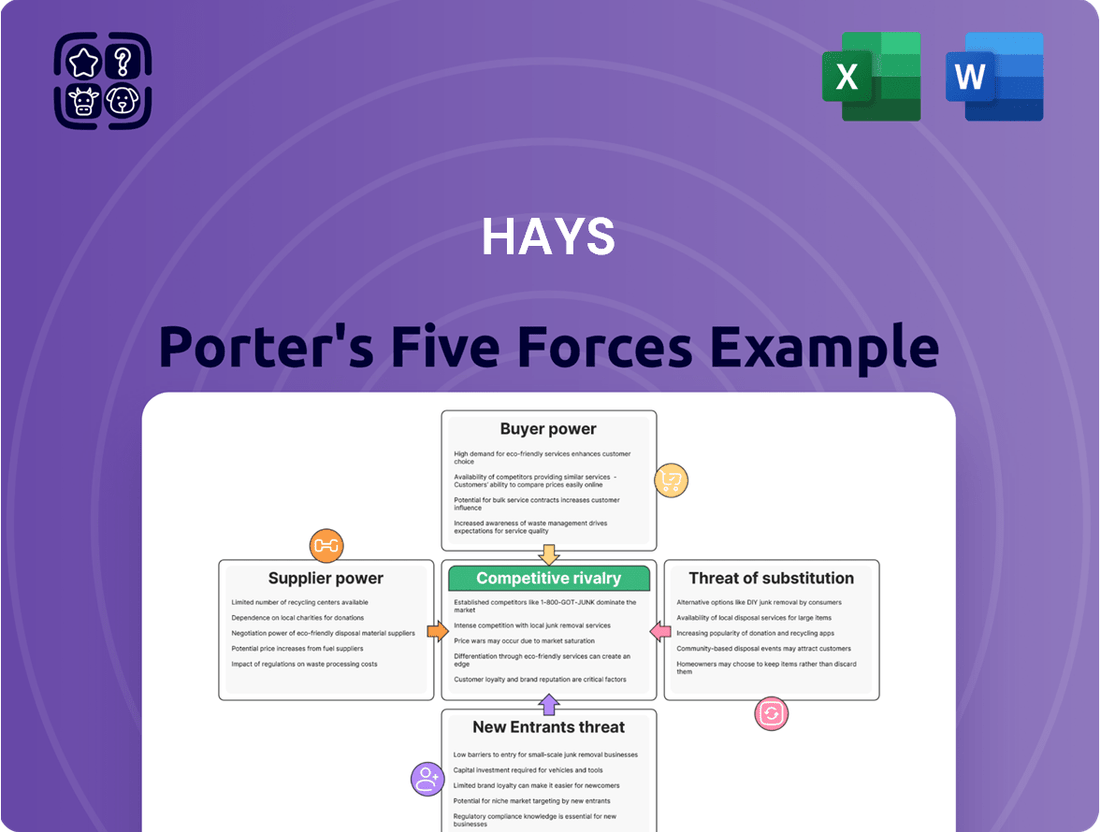

Porter's Five Forces Analysis for Hays reveals the intricate web of competitive forces shaping its market landscape. Understanding the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for navigating Hays's industry. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hays’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hays's core 'suppliers' are the skilled professionals they connect with employers. When the market experiences a shortage of talent, particularly in high-demand fields like technology, cybersecurity, and data analytics, the bargaining power of these individuals significantly increases. This means Hays must offer attractive compensation and benefits packages to secure and retain top-tier candidates, which directly influences their profitability.

Technology providers hold significant bargaining power in the recruitment sector, as companies like Hays increasingly depend on advanced software. For instance, AI-driven recruitment platforms are becoming essential for efficient candidate sourcing and management. If only a few companies offer these critical technologies, they can dictate terms and pricing, potentially increasing operational costs for Hays.

Hays relies heavily on digital channels to connect with potential employees, making platforms like LinkedIn and Indeed crucial. These major job boards wield considerable influence, and their pricing structures for job advertisements can directly affect Hays's recruitment expenses. For instance, in 2024, the average cost per click on job postings across major platforms continued to be a significant factor in recruitment marketing budgets.

Data and Analytics Providers

In today's recruitment market, reliable data is gold. Companies like Hays rely heavily on data providers for crucial insights into market trends, salary expectations, and talent availability. This makes these suppliers quite powerful, particularly when their data is specialized and difficult to replicate elsewhere.

The bargaining power of data and analytics providers is amplified when their offerings are unique and indispensable for a company's strategic advantage. For Hays, access to comprehensive and accurate talent intelligence, including real-time salary benchmarks, can directly influence their ability to attract and place candidates effectively, thus impacting their revenue and market share.

- Data providers offering unique, proprietary datasets hold significant leverage.

- Hays's reliance on these insights for competitive positioning strengthens supplier power.

- The cost and complexity of switching data providers can further entrench supplier influence.

Specialized Assessment Firms

For executive search and highly specialized roles, Hays may engage specialized assessment firms. These firms offer deep expertise in evaluating candidates and assessing leadership potential, a critical service for filling senior positions. Their specialized methodologies and proven success rates allow them to command premium fees.

The bargaining power of these specialized assessment firms is significant because their niche expertise is difficult for Hays to replicate internally. This reliance means these firms can influence pricing and service terms. For example, a leading assessment firm might charge upwards of $10,000 to $30,000 per assessment for C-suite executive roles, reflecting the high value and specialized nature of their services.

- Niche Expertise: Specialized assessment firms possess unique skills in psychometric testing, behavioral analysis, and leadership development, which are not readily available within general recruitment agencies like Hays.

- High Demand for Quality: Companies seeking top-tier executive talent are willing to pay for rigorous assessment processes that minimize hiring risks, thereby increasing the bargaining power of proven assessment providers.

- Limited Substitutes: The scarcity of firms with a strong, verifiable track record in high-stakes executive assessment limits Hays' ability to switch suppliers without compromising quality or incurring significant setup costs.

The bargaining power of Hays's suppliers, particularly skilled professionals and technology providers, significantly impacts its operational costs and profitability. When there's a scarcity of talent in fields like AI and cybersecurity, Hays must offer more competitive compensation to attract and retain these individuals, directly influencing their margins. Similarly, dependence on specialized software and data analytics firms means Hays is subject to their pricing and terms, especially when these solutions are unique and difficult to replace.

In 2024, the recruitment industry continued to see increased demand for specialized tech talent, driving up salary expectations and placement fees. For instance, average salaries for cybersecurity analysts saw a year-over-year increase of approximately 15% in many major markets. This upward pressure on compensation directly translates to higher costs for staffing firms like Hays, as they must pay their placed candidates more to attract them.

| Supplier Type | Impact on Hays | 2024 Trend Example |

|---|---|---|

| Skilled Professionals (Tech) | Increased recruitment costs due to higher salary demands | 15% rise in cybersecurity analyst salaries |

| Technology Providers (AI Platforms) | Higher software licensing and integration expenses | Subscription costs for advanced ATS systems up 10-12% |

| Data & Analytics Firms | Increased expenditure for market intelligence and salary benchmarks | Proprietary talent market reports costing $5,000 - $15,000 |

| Specialized Assessment Firms | Premium fees for executive candidate evaluation | C-suite assessment fees ranging from $10,000 to $30,000 |

What is included in the product

Hays' Five Forces Analysis dissects the competitive intensity within its operating environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors.

Pinpoint and alleviate competitive pressures by visualizing the intensity of each of Porter's Five Forces in a single, actionable dashboard.

Customers Bargaining Power

Large enterprise clients, by their very nature, wield substantial bargaining power in the recruitment services market. Their frequent and high-volume needs for talent mean they can command better pricing and more tailored service offerings from recruitment firms, including Hays. For instance, in 2024, major corporations continued to leverage their scale to negotiate preferred supplier agreements, often securing discounts of 10-15% on standard placement fees.

In 2024, the labor market continued to favor skilled candidates, particularly in sectors like technology and healthcare. This scarcity directly translates to increased bargaining power for job seekers. For a company like Hays, this means candidates can be more discerning about the roles they accept, often demanding higher compensation packages and more flexible work arrangements.

This shift in power dynamics impacts Hays's operational efficiency. When candidates have numerous options, they are less likely to accept the first offer, prolonging recruitment cycles. Furthermore, the expectation for personalized candidate experiences, from initial contact to onboarding, requires Hays to invest more resources in relationship management and tailored service delivery.

According to industry reports from late 2023 and early 2024, average salary increases for in-demand tech roles often exceeded 10%, demonstrating the tangible leverage candidates held. This upward pressure on wages means Hays must effectively manage client expectations regarding recruitment costs while ensuring they can attract top talent for their placements.

Many large organizations are building out significant internal recruitment departments. This means they can handle many of their hiring needs without needing to outsource, directly impacting agencies like Hays. For example, in 2024, a growing number of Fortune 500 companies reported strengthening their internal talent acquisition teams, aiming to reduce external recruitment fees.

This internal capacity gives these companies considerable leverage. They can choose to manage the entire recruitment process themselves, which naturally limits the revenue Hays can generate from them. This trend reflects a strategic shift towards cost control and direct talent management within larger businesses.

Switching Costs for Clients

Switching costs for clients engaging with recruitment agencies like Hays are generally low. While some effort is required to onboard a new provider, such as integrating systems or building rapport with new contacts, these hurdles are typically not significant enough to deter clients from seeking better alternatives. This ease of switching directly impacts Hays's bargaining power, as clients can readily move to competitors if they find more favorable terms or service levels elsewhere.

In 2024, the recruitment industry continued to see a dynamic landscape where client retention is paramount. Factors influencing switching decisions often include perceived value, responsiveness, and the quality of candidates presented. For instance, a survey of hiring managers in early 2024 indicated that over 60% would consider switching recruitment partners if their current provider consistently failed to meet specific candidate profile requirements within agreed timelines.

- Low Integration Effort: Clients typically face minimal technical or operational hurdles when changing recruitment agencies, unlike industries with deeply embedded proprietary software.

- Relationship-Based, Not System-Based: While relationships are built, the core of the service delivery doesn't rely on proprietary client-side systems that would be costly to replace.

- Market Fluidity: The ease of finding alternative recruitment solutions means clients can readily explore options, putting pressure on existing providers to maintain competitive pricing and service quality.

Price Sensitivity and Market Transparency

Clients are becoming more attuned to pricing, particularly when the economy is tough. They can readily compare what different recruitment agencies charge and what services they offer because the market is more transparent. This increased visibility into pricing options can lead to pressure on Hays to lower its fees.

For instance, in 2024, the recruitment industry saw continued competition, with many firms highlighting their fee structures online. This transparency means clients can easily benchmark Hays against competitors, potentially driving down average placement fees. This trend directly impacts Hays's ability to maintain its current pricing power.

- Increased Price Sensitivity: Economic headwinds in 2024 heightened client focus on cost-effectiveness in recruitment services.

- Market Transparency: Online platforms and industry reports in 2024 made it simpler for clients to compare Hays's fee structures with those of rivals.

- Downward Fee Pressure: The ease of comparison in 2024 allowed clients to negotiate lower fees, impacting Hays's revenue per placement.

- Client Bargaining Power: Heightened awareness and accessibility to competitor pricing in 2024 significantly boosted client leverage in fee discussions.

Customers, especially large enterprises, possess significant bargaining power due to their volume needs and the low switching costs associated with recruitment services. In 2024, major clients continued to leverage their scale to negotiate favorable terms, often securing discounts of 10-15% on standard placement fees. This power is amplified by increased market transparency, allowing clients to easily compare pricing and service offerings, thereby exerting downward pressure on recruitment fees.

The scarcity of skilled talent in 2024, particularly in tech and healthcare, further bolstered candidate bargaining power, which indirectly impacts client negotiations. Clients are increasingly building internal recruitment functions, reducing their reliance on external agencies like Hays. For example, a significant number of Fortune 500 companies enhanced their in-house talent acquisition teams in 2024 to control costs and manage talent directly.

| Factor | Impact on Hays | 2024 Data/Trend |

|---|---|---|

| Client Volume & Scale | Negotiating Power for Lower Fees | Discounts of 10-15% common for large enterprises. |

| Switching Costs | Low; clients can easily change providers. | Clients would switch if providers consistently missed candidate profiles (60%+ sentiment in early 2024 surveys). |

| Market Transparency | Downward pressure on pricing. | Increased online fee disclosures by competitors in 2024. |

| Internal Recruitment Growth | Reduced demand for external services. | More Fortune 500 companies strengthening internal talent acquisition in 2024. |

Preview Before You Purchase

Hays Porter's Five Forces Analysis

This preview shows the exact, professionally written Hays Porter's Five Forces Analysis you'll receive immediately after purchase. You're looking at the complete, ready-to-use document, which details the competitive landscape of an industry by examining threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors. No surprises, no placeholders—just the fully formatted analysis ready for your strategic planning needs.

Rivalry Among Competitors

The recruitment sector is incredibly crowded, featuring a wide array of companies. Hays contends with more than 24,000 active competitors, a mix of global giants and specialized local firms.

This intense fragmentation means Hays must constantly innovate and differentiate itself to stand out. The sheer volume of players, from large, well-established recruitment brands to agile startups, creates a dynamic and challenging competitive landscape.

Hays operates in a highly competitive landscape, with a presence in 33 countries. This global reach means they encounter rivals ranging from large international staffing firms to smaller, niche local players in each market. The intensity of this competition isn't uniform; it shifts significantly depending on the specific country and the industry sector Hays is targeting.

While Hays holds strong, often market-leading positions in many of its operational areas and specialisms, this doesn't eliminate competitive pressure. For instance, in the UK, a key market, Hays faces robust competition from firms like Adecco and ManpowerGroup, alongside numerous specialized recruitment agencies. In 2023, the global recruitment market was valued at over $600 billion, highlighting the sheer scale and the number of entities vying for market share.

Hays differentiates itself by offering more than just candidate placement. They focus on the quality of their talent pool, the speed at which they can fill roles, and deep industry-specific knowledge. For instance, Hays reported a strong performance in its fiscal year 2023, with global fees reaching £2.5 billion, indicating their ability to attract and retain both clients and candidates through these differentiated services.

Beyond core recruitment, Hays provides value-added services such as talent consulting and broader workforce solutions. This strategic focus on comprehensive client partnerships, rather than transactional placements, allows them to build stronger, more enduring relationships. Their commitment to these integrated offerings is a key factor in maintaining a competitive edge in the recruitment landscape.

Market Conditions and Economic Cycles

The recruitment industry is inherently cyclical, with its performance closely tied to broader economic trends. During economic downturns, businesses often scale back hiring, leading to a contraction in the available job market. This directly impacts recruitment firms, intensifying competition for a shrinking pool of opportunities.

In challenging market conditions, such as those experienced in late 2023 and early 2024, recruitment agencies face heightened rivalry. This pressure often translates into downward pressure on fees as firms compete aggressively for mandates, impacting overall profitability. For instance, global recruitment spending saw a slowdown in 2023, with some sectors experiencing significant contractions.

- Economic Sensitivity: Recruitment demand fluctuates with GDP growth and business investment.

- Fee Compression: Reduced hiring volumes force agencies to lower their service fees to secure business.

- Profitability Squeeze: Lower fees combined with a need to maintain operational capacity can significantly reduce profit margins.

- Candidate Market Dynamics: In a downturn, candidates may be more willing to accept lower offers, further enabling fee pressure from clients.

Technological Advancements and AI Adoption

The recruitment industry is seeing intense competition fueled by rapid technological advancements, particularly in AI and digital transformation. Companies that effectively integrate AI for tasks like candidate sourcing, matching, and onboarding are gaining a significant advantage, forcing competitors, including Hays, to constantly innovate to keep pace.

This AI-driven shift means that recruitment firms are increasingly judged on their ability to offer efficient, data-backed solutions. For instance, AI-powered platforms can analyze vast datasets to identify top talent much faster than traditional methods. By mid-2024, many leading recruitment firms reported a substantial increase in the efficiency of their candidate screening processes, with some seeing improvements of up to 40% due to AI implementation.

- AI-powered candidate matching: Firms leveraging AI can achieve significantly higher accuracy and speed in identifying suitable candidates, reducing time-to-hire.

- Digital transformation in recruitment: The adoption of digital tools streamlines operations, enhances candidate experience, and provides data-driven insights for strategic decision-making.

- Competitive pressure to innovate: Recruitment agencies must invest in and adapt to new technologies to remain competitive, as those that lag risk losing market share.

- Efficiency gains: AI and digital solutions are enabling recruitment firms to handle larger volumes of applications and placements with greater efficiency, impacting profitability.

The recruitment market is intensely competitive, with Hays facing over 24,000 rivals globally, ranging from major international players to niche local firms. This crowded field necessitates continuous innovation and differentiation. For example, in 2023, the global recruitment market was valued at over $600 billion, underscoring the vast number of entities vying for market share and the high stakes involved.

Hays differentiates itself through superior talent quality, rapid placement speed, and deep industry expertise, as evidenced by its fiscal year 2023 global fees of £2.5 billion. This focus on value-added services, including talent consulting, helps build enduring client relationships and maintain a competitive edge. The intensity of competition varies by country and sector, demanding tailored strategies for each market.

| Competitor Type | Example | Impact on Hays |

|---|---|---|

| Global Giants | Adecco, ManpowerGroup | Significant market share competition, pressure on fees and service innovation. |

| Specialized/Niche Firms | Local agencies focusing on specific industries (e.g., IT, healthcare) | Competition for specialized talent and client mandates, requiring deep sector knowledge. |

| Technology-Driven Platforms | AI-powered recruitment software providers | Drives need for digital transformation and AI integration to maintain efficiency and candidate sourcing capabilities. |

SSubstitutes Threaten

Companies increasingly rely on their internal human resources departments and dedicated talent acquisition teams to manage recruitment. This internal capability acts as a potent substitute for external recruitment agencies, particularly for roles that are frequently filled or when a company wishes to maintain absolute control over its candidate sourcing and selection processes. In 2024, a significant number of organizations continued to invest in strengthening their in-house recruitment functions, aiming to reduce reliance on third-party providers and build deeper internal talent pipelines.

The burgeoning freelance platforms and the broader gig economy present a significant threat of substitutes for traditional recruitment agencies like Hays. These digital marketplaces empower companies to bypass intermediaries and directly source talent for specific projects, thereby diminishing the perceived necessity of agency-facilitated placements. For instance, in 2024, the global freelance platform market was valued at over $3.7 billion, indicating a substantial shift towards direct talent acquisition.

Professional networking platforms, most notably LinkedIn, present a significant threat of substitution for traditional recruitment agencies. These platforms enable companies to directly source and engage with potential hires, effectively bypassing the need for intermediary services.

LinkedIn's vast database of over 1 billion users as of early 2024 and its sophisticated search and direct messaging tools allow businesses to identify and connect with candidates independently. This direct access reduces reliance on agencies for talent acquisition, particularly for roles where specific skill sets are readily identifiable online.

The cost-effectiveness and speed of direct recruitment through these platforms further enhance their substitutive power. Companies can save on agency fees, which can range from 15-30% of the candidate's first-year salary, making online sourcing an attractive alternative for many organizations.

Automation and AI-driven Matching Tools

The rise of advanced AI and automation tools presents a significant threat of substitution for traditional recruitment services. These technologies are becoming increasingly adept at performing core recruiting functions, from sifting through resumes to conducting initial candidate screenings and even matching candidates to roles. For instance, by mid-2024, many AI-powered applicant tracking systems (ATS) were capable of automating over 70% of the initial resume review process, a task previously handled by human recruiters.

While Hays itself leverages AI, the growing accessibility and sophistication of these tools mean clients might perceive less unique value in agency offerings if they can implement similar capabilities internally or through readily available software. This could lead to a shift where clients opt for direct sourcing or AI-driven platforms, bypassing traditional agency fees. The global AI in recruitment market was projected to reach over $3.5 billion by 2024, indicating substantial investment and development in this area, further fueling this substitution threat.

- Increased Automation in Screening: AI can now screen thousands of resumes in minutes, identifying keywords and qualifications with high accuracy.

- AI-powered Candidate Matching: Algorithms can analyze candidate profiles against job requirements more efficiently than manual methods.

- Virtual Interviewing Tools: AI chatbots and platforms can conduct initial interviews, assessing soft skills and basic qualifications.

- Client Adoption of AI Solutions: Companies investing in their own AI recruitment tools may reduce reliance on external agencies.

Employer Branding and Direct Sourcing

The threat of substitutes in the context of employer branding and direct sourcing is significant. Companies that cultivate strong employer brands can bypass traditional recruitment channels. For instance, in 2024, LinkedIn reported that 75% of job seekers consider employer brand when looking for a job, highlighting its power in attracting talent directly.

Direct sourcing allows organizations to build their own talent pipelines through career pages, social media, and employee referrals. This reduces reliance on external recruitment agencies, which represent a substitute for internal talent acquisition efforts. Companies like Google, known for its robust employer brand, consistently attract top talent through its own platforms, often at a lower cost per hire than agency-dependent firms.

- Reduced Agency Fees: Direct sourcing bypasses recruitment agencies, potentially saving companies millions in fees. For example, a large tech firm might spend upwards of $5 million annually on agency fees, a cost that direct sourcing can significantly mitigate.

- Enhanced Candidate Experience: A strong employer brand offers a more controlled and consistent candidate experience, directly communicating company culture and values, unlike the often filtered communication through third-party recruiters.

- Access to Passive Candidates: Direct sourcing strategies, when executed effectively, can tap into a broader pool of passive candidates who may not be actively seeking new roles but are attracted by a compelling employer brand.

- Data Control and Insights: Companies managing direct sourcing retain full ownership of candidate data, enabling better analytics and insights into recruitment effectiveness, which is often fragmented when relying on external agencies.

The threat of substitutes for recruitment agencies like Hays is multifaceted, encompassing direct sourcing channels, technological advancements, and the rise of the gig economy. Companies are increasingly leveraging professional networking platforms, AI-powered tools, and their own employer branding to find talent directly, thereby bypassing traditional agency services. This shift is driven by a desire for cost savings and greater control over the recruitment process.

| Substitute Channel | Key Features | Impact on Agencies | 2024 Data/Trend |

|---|---|---|---|

| In-house Recruitment | Internal control, talent pipeline development | Reduced reliance on external providers | Continued investment in internal HR/TA teams |

| Freelance Platforms/Gig Economy | Direct sourcing for projects, cost-effectiveness | Bypassing intermediaries for specific roles | Global freelance market exceeding $3.7 billion |

| Professional Networking Platforms (e.g., LinkedIn) | Direct candidate engagement, vast user base | Reduced need for agency-facilitated placements | Over 1 billion users; saving 15-30% on agency fees |

| AI & Automation Tools | Automated screening, matching, and initial interviews | Clients may perceive less unique agency value | AI in recruitment market projected over $3.5 billion; 70%+ automation in resume review |

| Employer Branding & Direct Sourcing | Attracting talent directly, building own pipelines | Diminished need for agency support for known brands | 75% of job seekers consider employer brand; potential savings of millions in agency fees |

Entrants Threaten

The digital transformation of recruitment, fueled by accessible Applicant Tracking Systems (ATS) and AI sourcing tools, significantly reduces the initial capital needed to launch a recruitment agency. This ease of entry allows new competitors to establish a professional online presence quickly.

In 2024, the global recruitment process outsourcing (RPO) market was valued at approximately $11.6 billion, indicating a robust and growing sector, but also one where digital tools lower the barrier to entry for new, specialized digital recruitment firms.

New entrants can strategically target underserved niche markets, such as specialized IT staffing or renewable energy recruitment, where established giants like Hays may have less concentrated expertise. This approach allows them to build a strong presence without immediate, head-on competition. For instance, in 2024, the global contingent workforce market continued its expansion, with niche segments showing particularly robust growth, offering fertile ground for focused new entrants.

New entrants can tap into a wealth of digital resources, from online job boards and professional networking sites to specialized talent databases, significantly reducing the traditional barriers to entry in talent acquisition. In 2024, the global HR tech market was valued at over $30 billion, demonstrating the widespread availability and adoption of these tools.

While Hays Porter benefits from established relationships and brand recognition, emerging competitors can utilize advanced analytics and AI-powered sourcing platforms to identify and engage potential candidates efficiently. This technological accessibility means that a startup with a strong digital strategy can compete for talent without the extensive physical infrastructure or long-standing recruitment networks of incumbents.

Brand Recognition and Trust

Building a strong brand in recruitment is a marathon, not a sprint, demanding substantial resources and consistent effort. Hays, with its decades of operation, has cultivated a deep reservoir of trust and recognition among both candidates and employers globally. This established reputation acts as a formidable barrier, making it exceptionally difficult for newcomers to quickly gain traction and compete effectively.

For instance, in 2024, Hays reported a revenue of approximately £13.1 billion, underscoring its significant market presence. New entrants would need to invest heavily in marketing and service delivery to even approach this level of established credibility.

- Established Reputation: Hays' long-standing presence has fostered significant brand equity.

- Client Relationships: Decades of successful placements have built strong, loyal client partnerships.

- Investment Barrier: New entrants face substantial costs to build comparable brand awareness and trust.

- Market Share: Hays' significant market share (e.g., operating in over 30 countries) presents a challenging competitive landscape.

Regulatory and Compliance Knowledge

New entrants in the recruitment sector face significant hurdles due to the intricate web of regulatory and compliance knowledge required. Navigating complex labor laws, compliance requirements, and industry-specific regulations across various geographies can be a daunting task for newcomers. For instance, understanding and adhering to GDPR in Europe, alongside local employment acts in each operating country, demands substantial legal and administrative resources. The global recruitment market, valued at over $500 billion in 2024, is heavily influenced by these varying legal landscapes.

Hays, with its extensive global presence and decades of experience, possesses a distinct advantage in this area. Their established infrastructure and deep understanding of diverse regulatory frameworks allow them to operate efficiently and compliantly in multiple markets. This expertise is crucial for maintaining client trust and avoiding costly penalties, which can easily deter new players.

- Regulatory Complexity: New entrants must master varying labor laws, data privacy regulations (like GDPR), and industry-specific compliance standards in each target market.

- Geographic Variations: The sheer diversity of regulations across countries, from employment contracts to background check requirements, creates significant barriers.

- Hays's Advantage: Hays's global operational experience and dedicated compliance teams mitigate these risks, providing a smoother entry and ongoing operation.

- Cost of Non-Compliance: Failure to comply can result in substantial fines, reputational damage, and operational shutdowns, making regulatory knowledge a critical success factor.

The threat of new entrants into the recruitment market is moderate, largely due to the decreasing capital requirements driven by digital tools. However, significant barriers persist in building brand trust and navigating complex regulations.

While new firms can leverage HR tech, valued at over $30 billion in 2024, to source talent efficiently, Hays' established reputation and global presence, with revenues around £13.1 billion in 2024, present a substantial hurdle for newcomers seeking to gain market share.

The intricate regulatory landscape across different countries, a critical factor in the global recruitment market exceeding $500 billion in 2024, demands significant legal and administrative resources that new entrants may struggle to acquire.

| Factor | Impact on New Entrants | Hays's Position |

|---|---|---|

| Digitalization & Low Capital Needs | Lowered barrier to entry for digital-first firms. | Leverages digital tools alongside established infrastructure. |

| Brand Reputation & Trust | Significant challenge to build comparable credibility. | Decades of operation foster deep client and candidate trust. |

| Regulatory & Compliance Expertise | High complexity and cost to navigate diverse global laws. | Established infrastructure and compliance teams mitigate risks. |

| Market Size & Niche Opportunities | Opportunities exist in specialized, underserved markets. | Broad market coverage, but can be outmaneuvered in hyper-niche areas. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, financial statements from key players, and publicly available company filings.

We leverage insights from trade association data, economic indicators, and expert interviews to provide a comprehensive understanding of the competitive landscape.