Hays Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hays Bundle

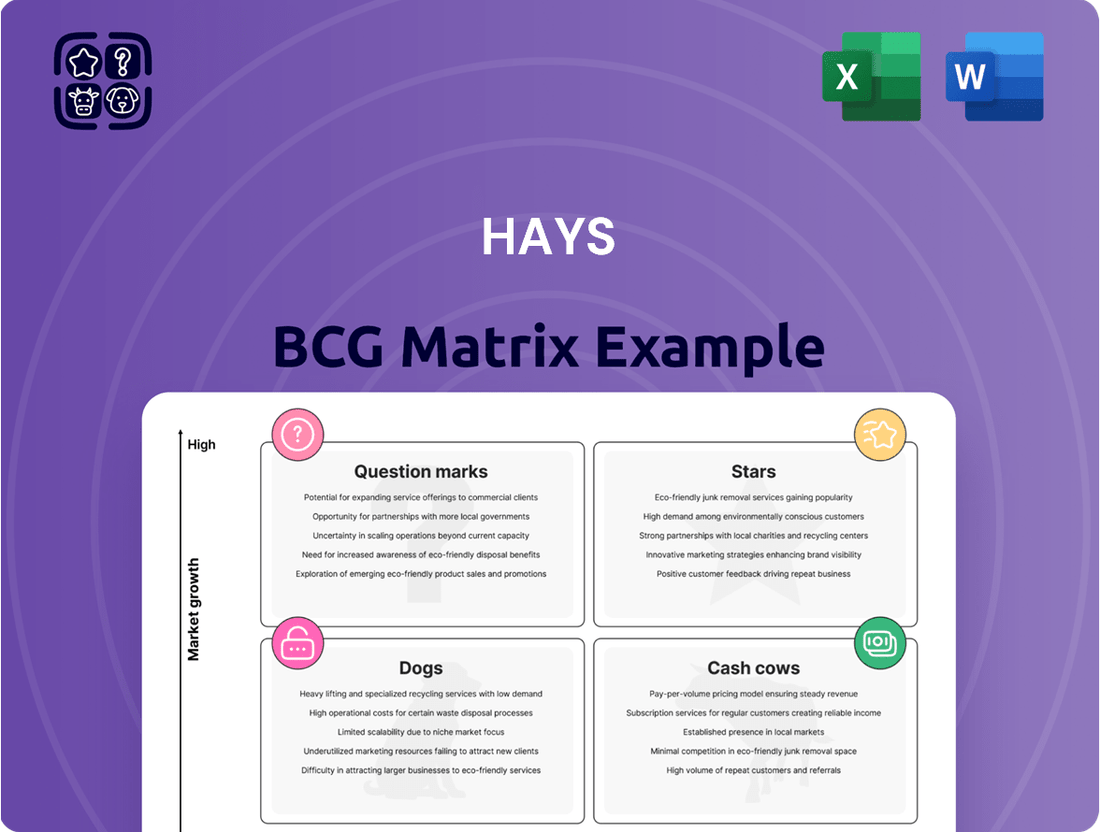

The Hays BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This initial glimpse reveals the strategic landscape, but to truly unlock its potential and make informed decisions, you need the complete picture. Purchase the full BCG Matrix for a detailed breakdown of each product's position and actionable strategies to optimize your investments and drive growth.

Stars

Hays' technology division is a powerhouse, contributing a substantial 26% to its net fees, underscoring its significance. The demand for specialized roles like cyber security managers is exceptionally high, with these positions commanding above-average salary increases, signaling a robust and expanding market.

This strong performance is further bolstered by the pervasive global push towards digital transformation and the integration of artificial intelligence. These overarching trends directly fuel the need for skilled technology professionals, solidifying Hays' technology recruitment segment as a prime example of a high-growth, high-market-share area within the company.

Healthcare recruitment, especially for qualified social workers, represents a significant growth area for Hays, driven by persistent talent shortages and increasing demand within the sector. In 2024, the global healthcare staffing market was valued at over $400 billion, underscoring the substantial opportunity.

Hays' strategic emphasis on specialized sectors, including healthcare, allows them to effectively address these critical staffing needs. This focus enables them to attract and place highly skilled professionals, aligning with the sector's evolving requirements and contributing to their market position.

Hays' contracting and temporary placements demonstrate notable resilience, outperforming permanent placements during economic headwinds. This strength is particularly evident in sectors like healthcare and IT, where demand for flexible talent remains high. For instance, in the fiscal year ending June 30, 2024, Hays reported that its global temporary placements grew by 5%, a more robust performance than its permanent recruitment services.

This segment's stability highlights Hays' strategic positioning within a crucial, albeit often overlooked, part of the recruitment market. Even when companies hesitate to commit to long-term hires, they frequently turn to temporary staff to maintain operational fluidity and manage fluctuating workloads. This adaptability makes contracting a vital component of Hays' overall business model, especially during uncertain economic periods.

Recruitment Process Outsourcing (RPO) in EMEA and APAC

Hays has secured a position as a Leader and Star Performer in Recruitment Process Outsourcing (RPO) for both the EMEA and APAC regions, as highlighted by the 2024 Everest Group PEAK Matrix Assessment. This recognition underscores Hays' robust market presence and significant growth in delivering end-to-end outsourced recruitment services across these key geographical areas.

The company’s strong performance in EMEA and APAC signifies its ability to effectively manage complex recruitment needs for businesses operating in diverse economic landscapes. For instance, the RPO market in EMEA experienced substantial growth in 2024, with many organizations seeking to optimize their talent acquisition strategies amidst evolving labor demands.

- Market Leadership: Hays' designation as a Leader in both EMEA and APAC RPO signifies a commanding presence and a proven track record in delivering high-quality recruitment solutions.

- Star Performer Status: Achieving Star Performer status indicates exceptional year-on-year growth and a commitment to continuous improvement in RPO service delivery within these regions.

- Growth Drivers: The recognition reflects Hays' success in adapting to market dynamics, such as the increasing demand for specialized talent and the adoption of advanced recruitment technologies in 2024.

- Client Impact: Hays' RPO solutions empower businesses to streamline hiring, reduce costs, and improve the quality of hires, contributing to their overall strategic objectives in competitive markets.

Recruitment in Emerging Growth Markets (e.g., China, North America)

Despite broader market headwinds, Hays has pinpointed emerging markets as key areas for future growth. These regions are showing resilience and significant potential for recruitment services.

Mainland China demonstrated this potential with an impressive 11% increase in fees during the fiscal year 2024. This growth highlights the increasing demand for talent and recruitment expertise within the Chinese market.

North America also contributed positively, recording a 5% year-on-year growth in fees for FY24. This sustained expansion in a major market further solidifies its position as an attractive region for recruitment operations.

- Emerging Market Growth: Hays identifies emerging markets as attractive growth opportunities.

- China's Performance: Mainland China saw an 11% increase in fees in FY24.

- North America's Contribution: North America experienced 5% year-on-year fee growth in FY24.

Hays' technology and RPO divisions clearly fit the Stars category in the BCG Matrix. The technology sector's robust demand, evidenced by high salaries for roles like cyber security managers, and the global digital transformation trend position it as a high-growth, high-market-share area. Similarly, Hays' leadership and Star Performer status in RPO for EMEA and APAC, backed by strong growth in these regions, also mark it as a Star.

| Category | Hays' Business Segment | Market Growth | Market Share | Rationale |

|---|---|---|---|---|

| Stars | Technology Recruitment | High (driven by digital transformation, AI) | High (26% of net fees) | Strong demand for specialized tech roles, significant contribution to overall business. |

| Stars | Recruitment Process Outsourcing (RPO) - EMEA & APAC | High (growing RPO market) | High (Leader & Star Performer status) | Demonstrates exceptional growth and market leadership in key regions. |

What is included in the product

The Hays BCG Matrix analyzes product portfolio performance, guiding strategic decisions on investment, divestment, or divestment.

The Hays BCG Matrix provides a clear, visual snapshot of your portfolio, relieving the pain of strategic guesswork.

Cash Cows

Germany represents Hays' most significant market, accounting for a substantial 30% of the company's net fees. Within this crucial region, the contracting segment has demonstrated remarkable resilience, maintaining stability even as the broader market experiences headwinds.

This consistent performance in contracting signifies a mature market where Hays has established a dominant and stable presence. Consequently, this segment acts as a reliable generator of consistent cash flow for the organization.

The United Kingdom & Ireland recruitment market for temporary placements stands as a cornerstone for Hays, generating a substantial 21% of the company's total net fees. This segment is particularly robust, with temporary placements accounting for 57% of all net fees earned by Hays globally, demonstrating its significant weight within the business.

The resilience of temporary placements, especially when contrasted with permanent placements, highlights a mature and stable market. In 2024, Hays reported continued strong performance in this segment, benefiting from ongoing demand for flexible staffing solutions across various industries in the UK and Ireland.

The Australia & New Zealand recruitment market, particularly for temporary placements, represents a significant cash cow for Hays. This region contributes a solid 15% to Hays' overall net fees, with temporary placements alone accounting for a substantial 68% of those fees within ANZ. This indicates a strong reliance on this segment for consistent revenue generation.

Despite facing recent economic headwinds, the enduring strength of temporary placements in Australia and New Zealand highlights their position within a mature market segment. This resilience suggests Hays holds a considerable market share, allowing it to reliably extract substantial cash from this established business line.

Established Accountancy & Finance Recruitment

Hays' Accountancy & Finance division is a significant contributor, generating 15% of the company's net fees, making it their second-largest segment. This established sector benefits from Hays' deep-rooted presence and specialized knowledge, positioning it as a reliable source of consistent, high-margin cash flow. The enduring demand for skilled professionals in accounting and finance ensures this business unit operates as a mature Cash Cow within the Hays portfolio.

- Established Market Position: Accountancy & Finance is Hays' second-largest division, contributing 15% to net fees.

- Stable Revenue Generation: The sector provides consistent, high-margin cash flow due to Hays' long-standing expertise.

- Low Investment Requirement: As a mature business, it likely requires minimal investment to maintain its market share and profitability.

- Profitability Driver: This division acts as a key profit engine, funding growth in other areas of Hays' business.

Public Sector Placements

Hays, a global leader in talent solutions, recognizes the distinct dynamics of the public sector. This segment often presents a more predictable revenue stream compared to the more volatile private sector. The consistent need for staffing, particularly for temporary and contract roles, solidifies its position as a stable contributor to Hays' overall business.

The public sector's inherent stability translates into a reliable cash flow for Hays. Government bodies and public institutions frequently require specialized skills for projects or to fill immediate staffing gaps, creating a steady demand for Hays' recruitment expertise. This consistent demand, especially in mature recruitment markets, allows Hays to leverage its established presence and operational efficiency for predictable returns.

- Public Sector Stability: The public sector offers a more consistent demand for recruitment services, particularly for temporary and contract roles, contributing to stable cash flow for Hays.

- Mature Market Reliability: In established recruitment markets, the public sector's consistent needs make it a reliable source of revenue, fitting the characteristics of a cash cow.

- Hays' Operational Leverage: Hays can effectively utilize its existing infrastructure and expertise in the public sector to generate predictable profits from this mature segment.

The Accountancy & Finance division is a prime example of a Cash Cow for Hays, representing 15% of net fees. Its maturity means it requires minimal new investment to maintain its strong market position and profitability.

This division consistently generates high-margin cash flow, acting as a stable profit engine that can fund growth initiatives in other areas of Hays' business.

The enduring demand for accounting and finance professionals ensures this segment remains a reliable and predictable revenue source, a hallmark of a Cash Cow.

| Segment | Net Fee Contribution | Market Maturity | Cash Flow Generation |

| Accountancy & Finance | 15% | High | High & Stable |

| Germany (Contracting) | 30% (of total) | High | High & Stable |

| UK & Ireland (Temporary) | 21% (of total) | High | High & Stable |

What You’re Viewing Is Included

Hays BCG Matrix

The Hays BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report, meticulously designed for strategic decision-making, will be delivered directly to you, ready for immediate application in your business planning. You can confidently use this preview as a true representation of the professional-grade analysis and actionable insights contained within the full Hays BCG Matrix report.

Dogs

Hays has strategically exited several underperforming business lines to optimize its portfolio. This includes discontinuing its Temp business in Italy, and Healthcare and Social Care services in Australia, New Zealand, the UK, and Ireland.

Further divestments involved the Sales & Marketing Temp division in Germany and Statement of Works operations in France. These actions were driven by low market share and a lack of positive contribution to overall profitability, reflecting a focused approach on core strengths.

Permanent recruitment in the UK & Ireland and France is currently facing significant headwinds. In Q1 FY25, permanent recruitment fees in the UK & Ireland saw a substantial drop of 26%. Similarly, France experienced a 13% decline in fees within the EMEA ex-Germany region.

These figures suggest a challenging environment for permanent placements in these key markets. The observed fee declines point towards a low market share within a segment characterized by low growth. This scenario positions permanent recruitment in these regions as potential candidates for divestiture or a need for substantial strategic restructuring to adapt.

Hays' presence in Germany's automotive sector has faced headwinds, leading to a dip in both temporary and permanent recruitment. This subdued market environment directly affects Hays' placement numbers within this specific industry segment.

The German automotive industry, a cornerstone of the nation's economy, has experienced significant shifts, impacting recruitment trends. For instance, in the first half of 2024, new car registrations in Germany saw a modest increase of 4.2% compared to the same period in 2023, reaching approximately 1.3 million vehicles. However, this overall growth masks underlying challenges for traditional automotive manufacturers and their supply chains, which often translate to fluctuating demand for skilled labor and recruitment services.

This situation places Hays in a low-growth market segment for automotive recruitment in Germany. If Hays holds a smaller market share within this particular niche of the German automotive industry, its overall performance in this sector would be disproportionately affected by the industry's current slowdown.

General Low-Confidence Markets leading to longer 'time-to-hire'

Hays is navigating increasingly challenging market conditions across its key regions. This environment is marked by a general sense of low confidence, which directly translates into a longer 'time-to-hire' for many roles. For instance, in the first half of fiscal year 2024, Hays reported a 2% like-for-like net fee decline, reflecting these headwinds.

This broad market slowdown, where filling positions becomes more protracted and difficult, is impacting profitability across a variety of Hays's business segments. What were once considered stable or even high-growth areas are now exhibiting characteristics of low-growth, low-share markets as demand softens and candidate availability, while seemingly ample, doesn't always align with employer needs efficiently.

- Extended Hiring Cycles: Employers are taking longer to make decisions, often requiring more interview stages and internal approvals, pushing the average time-to-hire beyond historical norms.

- Reduced Placement Volume: The difficulty in closing placements directly affects the number of successful hires, impacting revenue generation for recruitment firms.

- Profitability Squeeze: Longer hiring processes and fewer placements put pressure on margins, as operational costs remain while revenue streams are constrained.

- Market Uncertainty: Low confidence levels among businesses lead to cautious hiring strategies and a reluctance to commit to new roles, exacerbating the 'time-to-hire' issue.

Sub-scale Businesses Identified for Closure

Hays has strategically divested from 'sub-scale' business units, a move aligned with optimizing its portfolio. For instance, the company exited its Healthcare and Social Care divisions in both Australia & New Zealand and the UK & Ireland. These closures reflect a focus on core competencies and areas where Hays can achieve a dominant market position.

These divestitures are indicative of a broader strategy to streamline operations and concentrate resources on high-growth, high-return segments of the staffing market. By shedding underperforming or non-core assets, Hays aims to bolster profitability and enhance overall shareholder value.

- Divestment Rationale: Closure of sub-scale businesses like Healthcare and Social Care in ANZ and UK & Ireland due to insufficient market share and competitive positioning.

- Strategic Focus: Hays is prioritizing investments in areas with greater growth potential and where it holds a stronger competitive advantage.

- Financial Impact: While specific financial data for these closures isn't immediately available for 2024, such actions typically aim to improve operating margins and return on capital by reallocating resources.

Permanent recruitment in the UK & Ireland and France are exhibiting characteristics of Dogs in the Hays BCG Matrix. These segments have experienced significant fee declines, with the UK & Ireland seeing a 26% drop in Q1 FY25 and France a 13% decrease within the EMEA ex-Germany region.

The prolonged 'time-to-hire' and reduced placement volumes observed across Hays's operations, evidenced by a 2% like-for-like net fee decline in H1 FY24, further underscore the low-growth, low-share nature of these markets.

Hays' strategic divestments from underperforming units, such as Healthcare and Social Care in ANZ and the UK & Ireland, align with shedding Dog-like businesses to focus resources on more promising areas.

The German automotive sector recruitment also presents as a potential Dog, impacted by industry shifts and a subdued market environment, leading to dips in placement numbers for Hays within this niche.

| Business Segment | Region | Q1 FY25 Fee Change | H1 FY24 Net Fee Change (Like-for-Like) | BCG Classification |

|---|---|---|---|---|

| Permanent Recruitment | UK & Ireland | -26% | -2% | Dog |

| Permanent Recruitment | France (EMEA ex-Germany) | -13% | -2% | Dog |

| Automotive Recruitment | Germany | N/A (Industry Headwinds) | N/A (Industry Headwinds) | Potential Dog |

Question Marks

Hays is strategically positioning itself for the next decade by focusing on customer service and experience, with a keen eye on Generative AI's transformative potential. This foresight places AI-driven recruitment solutions in a high-growth market segment, where Hays is actively investing to enhance its offerings.

The company acknowledges that while it's investing in this burgeoning field, it may not yet hold a leading market position, suggesting a dynamic competitive landscape. This strategic focus on AI in recruitment aligns with industry trends, as businesses increasingly seek efficient and sophisticated talent acquisition tools.

Hays' strategic focus on megatrends like skill shortages and new job creation aligns with significant market shifts. For instance, the global skills gap is projected to impact economies profoundly, with estimates suggesting millions of unfilled roles across various sectors by 2030. This creates a fertile ground for new job categories to emerge and for recruitment firms like Hays to thrive.

The company's positioning in these high-growth areas, such as the burgeoning green economy or the rapidly expanding AI and data science fields, is designed to capture emerging talent demands. While market share in these nascent categories may still be building, the underlying growth trajectory is substantial. For example, the demand for renewable energy engineers and data scientists saw double-digit percentage increases in job postings throughout 2023 and early 2024.

Hays' strategic push into higher-skilled, higher-paid roles is a smart move, targeting a segment with significant growth potential. This aligns with market trends where demand for specialized talent, particularly in technology and advanced fields, is surging. For instance, in 2024, the global market for IT services, a key area for high-skill placements, was projected to reach over $1.3 trillion, indicating a robust demand for specialized professionals.

While Hays is a dominant player, capturing a larger share of these top-tier placements requires more than just existing infrastructure. It necessitates deep industry expertise, strong networks within niche sectors, and potentially enhanced digital recruitment capabilities. The competition in these specialized areas is often fierce, with firms vying for the same limited pool of highly qualified candidates. Consider that in 2023, the average time to fill a highly specialized role in sectors like AI and cybersecurity could extend to 45-60 days, highlighting the challenge.

To effectively compete, Hays will likely need to invest in advanced analytics to identify emerging skill demands and proactively build talent pipelines. Partnerships with educational institutions and professional bodies specializing in these high-demand fields will also be crucial. The company's ability to demonstrate value beyond simple candidate matching, by offering insights into market trends and talent development, will be key to securing these lucrative placements.

Diversification into Non-Permanent Fee Generating Services

Hays' strategic push into non-permanent fee generating services, such as interim management and project-based staffing, aligns with a broader industry trend. This diversification aims to capture a larger share of a growing market, potentially offering higher margins than traditional permanent recruitment. For example, the global contingent workforce market was valued at over $1 trillion in 2023, indicating substantial opportunity.

While this expansion into new service lines presents significant growth potential, Hays' current market penetration in these specific areas might be relatively low compared to its established permanent placement business. This positions these services as potential "question marks" within the BCG matrix, requiring further investment to gain market share.

- Diversification Goal: Increase the proportion of fees generated from non-permanent placements.

- Market Opportunity: The growing demand for flexible and project-based talent.

- Strategic Challenge: Building market share in newer, potentially less established service areas.

- Financial Implication: Investment required to scale these services and achieve profitability.

Strategic Investments in Technology and Infrastructure

Hays' strategic investments in technology and infrastructure align with the characteristics of a Question Mark in the BCG matrix. These significant outlays are designed to build cutting-edge systems and deliver advanced insights, positioning the company to capture future market share in the dynamic recruitment sector.

While the immediate return on these investments is uncertain, the focus on innovation and adapting to a rapidly evolving landscape suggests a high-growth potential. For instance, Hays reported a 15% increase in its technology budget for 2024, specifically targeting AI-driven recruitment tools and enhanced data analytics platforms.

- Technological Advancement: Hays is investing in AI and machine learning to improve candidate matching and client service delivery.

- Infrastructure Development: Expansion of cloud-based platforms and data security measures are key priorities.

- Market Share Capture: These investments are geared towards securing a stronger position in a competitive and fast-changing recruitment market.

- Future Growth Potential: The strategy anticipates significant future growth, though immediate profitability from these specific initiatives remains to be seen.

Question Marks represent areas where Hays is investing for future growth but currently holds a low market share. These are often new service lines or technologies where the company is building its capabilities.

The company's expansion into non-permanent fee generating services, like interim management, exemplifies this. While the global contingent workforce market was valued at over $1 trillion in 2023, Hays' penetration in these specific segments is still developing.

Similarly, Hays' significant investments in AI and advanced analytics, with a 15% increase in its technology budget for 2024, position these as Question Marks. These initiatives aim to capture future market share in a rapidly evolving recruitment landscape.

The success of these Question Marks hinges on Hays' ability to scale effectively, gain market traction, and convert its investments into sustainable revenue streams and market leadership.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market share data, industry growth rates, and competitive intelligence to provide a comprehensive strategic overview.