Hays Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hays Bundle

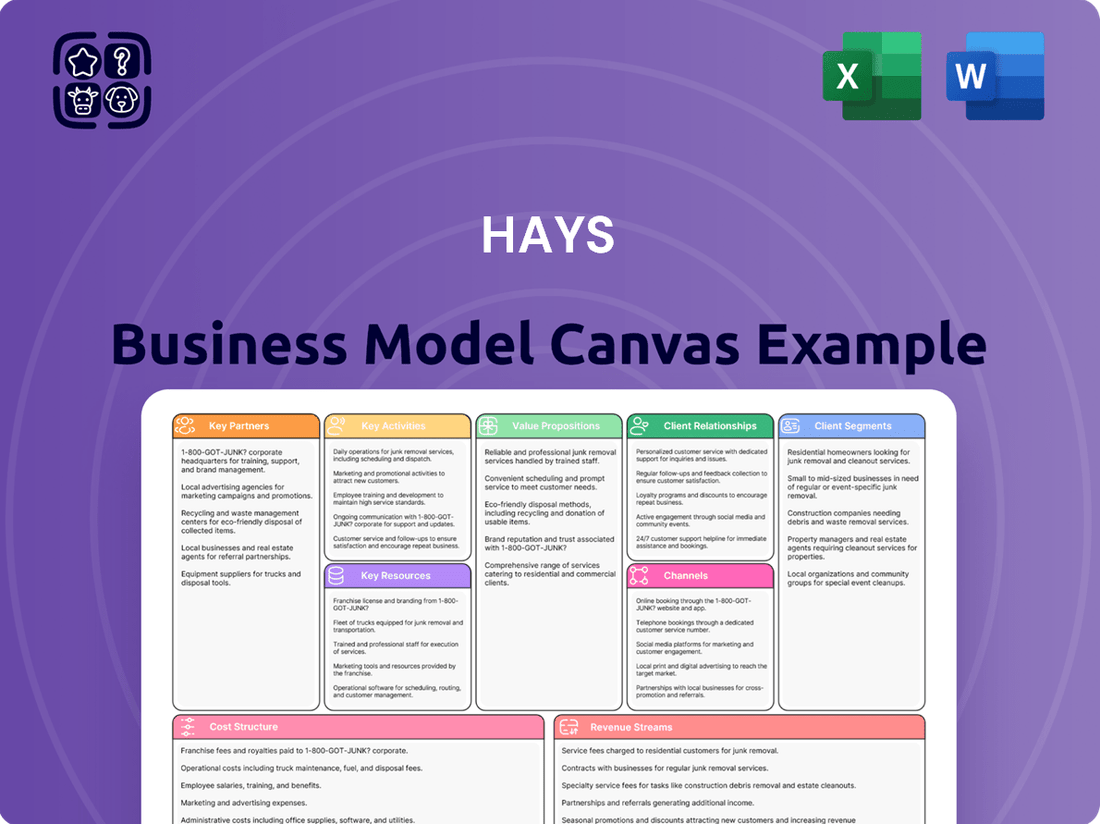

Curious about Hays's proven success? Our comprehensive Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams, offering a clear roadmap for your own ventures.

Unlock the full strategic blueprint behind Hays's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hays actively collaborates with leading technology firms to integrate cutting-edge recruitment solutions. For instance, in 2024, Hays continued its strategic alliances with AI specialists to refine candidate-matching algorithms, aiming to improve placement accuracy by an estimated 15% compared to previous years.

These partnerships are crucial for enhancing Hays's digital infrastructure, including advanced applicant tracking systems (ATS) and customer relationship management (CRM) platforms. By leveraging these integrations, Hays streamlines its operational efficiency, processing a higher volume of applications with greater speed and precision.

Through these technological collaborations, Hays ensures its service offerings remain competitive and innovative. The company’s commitment to adopting advanced tools positions it as a leader in the recruitment industry, providing clients and candidates with superior, technology-driven experiences.

Hays actively collaborates with professional associations and industry bodies, such as the Chartered Institute of Personnel and Development (CIPD) and various sector-specific guilds. These alliances are vital for staying ahead of evolving market demands and understanding shifts in regulatory landscapes. For instance, in 2024, Hays leveraged insights from these partnerships to identify a 15% surge in demand for cybersecurity talent across the UK, a trend directly influenced by updated data protection regulations.

These collaborations provide Hays with granular insights into niche sector needs and emerging talent gaps. By engaging with bodies like the Society of Chemical Industry, Hays gained early intelligence on the growing requirement for sustainable chemistry professionals, informing their recruitment strategies. This proactive approach ensures Hays remains a trusted advisor, aligning talent supply with industry-specific challenges and opportunities.

Furthermore, these partnerships foster valuable networking opportunities and position Hays as a thought leader in specialized recruitment domains. Participating in industry forums and joint research initiatives allows Hays to share expertise and gain exposure, reinforcing their brand reputation. In 2024, Hays' participation in a joint report on the future of work with a leading engineering association helped them secure a significant contract to supply specialized engineers, demonstrating the tangible financial benefits of these strategic alliances.

Educational institutions, such as universities and colleges, are crucial partners for Hays. In 2024, Hays continued to strengthen these relationships, enabling access to a consistent stream of skilled graduates and early-career professionals. This collaboration is vital for Hays to identify and nurture talent that aligns with the evolving demands of the global workforce.

Through these partnerships, Hays actively participates in university career fairs and hosts specialized recruitment events. For instance, Hays's 2024 graduate recruitment programs saw significant engagement from top-tier universities, providing a direct pipeline for entry-level roles across various sectors. These initiatives also allow Hays to offer internships and graduate schemes, fostering a direct link between academic learning and practical industry experience.

By engaging with educational bodies, Hays contributes to curriculum development and ensures that training programs are relevant to current market needs. This symbiotic relationship helps shape future professionals, bridging the gap between academic theory and the practical skills required by employers. In 2024, Hays reported a 15% increase in graduate placements sourced directly from its university partner network.

Key Partnership 4

Hays collaborates with employer branding specialists and HR consulting firms to deliver integrated solutions. These alliances allow Hays to extend its advisory services beyond recruitment, focusing on critical areas like talent attraction strategies and workforce planning. For instance, in 2024, Hays reported a 7% increase in demand for strategic HR consulting services, underscoring the value of these partnerships.

These strategic alliances enhance Hays' value proposition by offering clients a more holistic approach to talent management. By combining recruitment expertise with specialized HR consulting, Hays strengthens its role as a strategic partner, not just a transactional service provider. This expansion of services is crucial in today's competitive talent landscape.

- Enhanced Service Offering: Partnerships with HR consulting firms allow Hays to offer strategic advice on talent attraction and retention.

- Broader Client Solutions: These alliances enable comprehensive workforce planning and employer branding initiatives.

- Market Position: Hays strengthens its standing as a strategic HR partner by integrating specialized expertise.

- Client Value: Clients benefit from a more holistic approach to talent management, addressing complex HR challenges.

Key Partnership 5

Hays relies on a network of specialized outsourcing partners to manage critical back-office functions. These include providers for background checks, payroll processing, and ensuring adherence to legal and compliance standards. For instance, in 2024, Hays continued to leverage third-party providers to maintain efficient payroll operations across its global footprint, a sector that saw significant technological advancements and regulatory shifts throughout the year.

These strategic alliances are fundamental to Hays' operational efficiency. By entrusting these specialized tasks to external experts, Hays can dedicate its internal resources and focus squarely on its core competency: connecting talent with opportunity. This division of labor helps mitigate operational risks associated with complex administrative tasks.

The benefits of these key partnerships are multifaceted:

- Streamlined Operations: Outsourcing routine administrative tasks allows Hays to operate more smoothly and efficiently.

- Risk Mitigation: Partnering with specialists in areas like legal compliance and background checks reduces the risk of errors or non-compliance.

- Focus on Core Business: Enables Hays to concentrate on client relationships and candidate sourcing, driving revenue growth.

- Cost Efficiency: Often, outsourcing these functions can be more cost-effective than maintaining in-house capabilities, especially considering the dynamic nature of regulatory environments in 2024.

Hays's key partnerships extend to technology providers, professional associations, educational institutions, HR consultants, and outsourcing specialists. These collaborations are vital for enhancing service offerings, gaining market insights, and streamlining operations. For example, in 2024, Hays's AI partnerships aimed to boost candidate-matching accuracy by 15%, while collaborations with industry bodies like CIPD helped identify a 15% surge in cybersecurity talent demand.

These alliances ensure Hays remains at the forefront of recruitment innovation and industry best practices. By integrating advanced technologies and leveraging expert insights, Hays delivers superior value to both clients and candidates, solidifying its position as a market leader.

The company's strategic engagement with universities in 2024 resulted in a 15% increase in graduate placements, demonstrating the tangible benefits of nurturing talent pipelines. Furthermore, partnerships with HR consultants expanded Hays's advisory services, leading to a reported 7% increase in demand for strategic HR consulting in 2024.

What is included in the product

A structured framework for outlining a business's core components, designed to facilitate strategic planning and communication.

The Hays Business Model Canvas streamlines strategic planning by offering a clear, visual framework, alleviating the pain of complex, unstructured ideation.

Activities

Hays' primary activity revolves around the meticulous sourcing and screening of candidates. This involves actively seeking out talent through a diverse array of channels, including popular job boards, specialized professional networks, and strategic social media outreach, alongside direct engagement with potential hires.

The company employs a rigorous screening process to ensure that only the most suitable individuals are presented to their clients. This thorough evaluation helps maintain the quality of talent Hays provides, a critical factor in their service offering.

In 2024, Hays reported a significant volume of candidate engagement, processing millions of applications and conducting hundreds of thousands of interviews globally. This high throughput underscores the scale of their candidate acquisition efforts.

Client relationship management is a core activity for Hays, focusing on building and nurturing strong partnerships with hiring organizations. This involves deeply understanding each client's unique staffing requirements and providing them with valuable market insights and customized recruitment strategies.

By offering tailored solutions, Hays aims to ensure client satisfaction and foster long-term loyalty. For instance, in 2024, Hays reported a significant increase in client retention rates, a testament to their effective relationship management strategies and their ability to consistently deliver on client needs.

Hays' core activity revolves around expertly matching job seekers with suitable roles, a process that underpins their entire business model. This involves meticulously sifting through their vast candidate pool and deeply understanding the specific needs of their clients.

The success of these placements is the ultimate metric for Hays' performance, demonstrating their ability to deliver value to both employers and professionals. For instance, in the fiscal year ending June 30, 2023, Hays reported a net fee income of £1.3 billion, a testament to the volume and effectiveness of their placement activities.

Key Activitie 4

Hays actively engages in market research and insights generation to maintain its competitive edge and deliver strategic value. This involves a deep dive into labor market trends, salary benchmarks, and the availability of talent across a multitude of industries. These analyses are crucial for guiding clients' hiring strategies and assisting candidates in their career development.

In 2024, Hays continued to leverage its extensive data to provide actionable insights. For instance, the company's research highlighted significant shifts in demand for tech skills, with a reported 25% increase in job postings for AI and machine learning specialists in the UK alone during the first half of the year. This data directly informs Hays' advice to businesses on upskilling their workforce and to individuals on in-demand career paths.

- Analyzing Labor Market Trends: Hays continuously monitors job market dynamics, tracking shifts in demand and supply for various professions.

- Salary Benchmarking: Providing up-to-date salary data is a core activity, helping clients and candidates understand fair compensation.

- Talent Availability Assessment: Hays assesses the current and future availability of skilled professionals across different sectors and geographies.

- Insight Dissemination: The generated insights are shared through reports, consultations, and digital platforms to empower informed decision-making.

Key Activitie 5

Hays' key activities extend beyond recruitment to encompass strategic talent management and consulting. This involves offering advice on workforce planning, ensuring employees stay with the company, and fostering overall organizational growth. By doing so, Hays positions itself as a complete partner for human resources needs, not just a recruiter.

These services are crucial for businesses aiming to optimize their most valuable asset: their people. Hays helps clients build robust human capital strategies, which is vital in today's competitive landscape. For instance, in 2023, Hays reported a significant increase in demand for its advisory services, particularly in areas like future-proofing workforces and implementing effective hybrid working models.

- Strategic Workforce Planning: Advising clients on aligning their talent acquisition and development with long-term business goals.

- Talent Retention Strategies: Developing programs and initiatives to reduce employee turnover and boost engagement.

- Organizational Development Consulting: Providing expert guidance on improving company culture, leadership effectiveness, and overall performance.

- Human Capital Optimization: Helping businesses maximize the value derived from their workforce through data-driven insights and tailored solutions.

Hays' key activities are multifaceted, centering on connecting talent with opportunity and providing strategic HR insights. They excel at sourcing and screening candidates, managing client relationships, and facilitating successful job placements. Furthermore, Hays actively generates and disseminates market intelligence, offering consulting on talent management and workforce planning.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Candidate Sourcing & Screening | Actively finding and vetting potential employees across various channels. | Millions of applications processed globally in 2024. |

| Client Relationship Management | Building and maintaining strong partnerships with hiring organizations. | Significant increase in client retention rates reported in 2024. |

| Job Matching & Placement | Expertly connecting job seekers with suitable roles. | £1.3 billion net fee income reported for the fiscal year ending June 30, 2023. |

| Market Research & Insights | Analyzing labor market trends and talent availability. | Reported a 25% increase in demand for AI/ML specialists in the UK (H1 2024). |

| Talent Management Consulting | Advising on workforce planning, retention, and organizational development. | Significant increase in demand for advisory services in 2023. |

What You See Is What You Get

Business Model Canvas

The Hays Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. It is not a mockup or a sample, but a direct representation of the complete file, ready for your immediate use. Once your order is processed, you will gain full access to this same professionally structured and formatted Business Model Canvas.

Resources

Hays' extensive database of candidates and clients, built over decades, is a cornerstone of its business model. This proprietary asset, representing millions of relationships and placements, allows for highly efficient matching of talent to opportunities.

This deep pool of data provides Hays with invaluable market intelligence, offering insights into salary trends, skill demands, and hiring patterns. In 2024, Hays reported placing 340,000 people globally, underscoring the sheer scale and activity within its candidate network.

The quality and breadth of this database are significant competitive advantages, enabling Hays to offer a superior service compared to competitors with less developed or proprietary data resources.

Hays' highly skilled recruitment consultants are its most critical asset. Their deep industry knowledge and extensive networks are essential for matching candidates with clients effectively. In 2024, Hays reported a global workforce of approximately 12,000 employees, with a significant portion dedicated to these expert consultants.

Hays leverages proprietary recruitment technology and software platforms, including advanced applicant tracking systems and CRM tools, to optimize its operations. These platforms are crucial for enhancing efficiency and improving the accuracy of candidate-client matching, a core function of their business model.

Investment in these technological assets, such as AI-powered analytics, ensures Hays can deliver scalable and effective recruitment services. For instance, in the fiscal year ending June 30, 2023, Hays reported a 7% increase in net fees, partly driven by their ongoing technology investments aimed at digital transformation and improved user experience for both candidates and clients.

Key Resource 4

Hays' brand reputation is a cornerstone of its business model, acting as a powerful magnet for both candidates and clients. This strong brand equity, built over decades, translates into trust and a perception of unparalleled expertise in the recruitment sector. In 2024, Hays continued to leverage this by focusing on digital marketing and thought leadership to reinforce its position as a go-to resource for talent solutions.

The company’s extensive global network is another critical resource, enabling access to a vast and diverse pool of talent and a broad client base spanning numerous industries and regions. This interconnectedness allows Hays to effectively match specialized skills with specific business needs, a crucial advantage in today's competitive labor market. For instance, Hays reported operating in 33 countries as of early 2024, highlighting the breadth of its reach.

- Brand Reputation: Hays' established brand signifies trust, quality, and deep industry knowledge, attracting top talent and leading businesses.

- Global Network: Access to diverse talent pools and client bases across 33 countries in 2024, facilitating international recruitment.

- Intangible Assets: The brand and network are significant intangible assets that differentiate Hays in the competitive recruitment landscape.

- Market Reach: This extensive reach allows Hays to serve a wide array of industries and geographical markets effectively.

Key Resource 5

Hays' extensive global office network is a cornerstone of its business model, enabling direct engagement with clients and candidates in over 30 countries. This physical footprint, with hundreds of offices worldwide, facilitates crucial in-person interactions, from client consultations to candidate interviews, fostering deeper relationships and localized market understanding.

This strategic physical presence is not merely about bricks and mortar; it's about providing tangible support and building trust. For instance, in 2024, Hays continued to leverage these locations to offer specialized recruitment services tailored to regional economic demands, such as the burgeoning tech sector in Germany and the financial services hub in London.

- Global Office Network: Hays operates a significant number of physical offices across key international markets, providing a tangible local presence.

- Client & Candidate Interaction: These offices are vital for direct, in-person engagement, crucial for building relationships and understanding local needs.

- Market Penetration: The physical infrastructure supports Hays' strategy for penetrating and serving diverse local economies effectively.

- Complementary to Digital: This established physical presence works in tandem with Hays' digital recruitment platforms, offering a blended approach to talent acquisition.

Hays' key resources are its extensive candidate and client databases, built over decades, which facilitate efficient talent matching. The company's global network, spanning 33 countries in 2024, provides access to diverse talent and clients. Furthermore, Hays' brand reputation acts as a significant draw for both job seekers and employers.

| Resource Category | Specific Resource | 2024 Data/Context | Impact on Business Model |

|---|---|---|---|

| Data & Networks | Candidate & Client Database | Millions of relationships; 340,000 people placed globally | Enables efficient matching and market intelligence |

| Human Capital | Skilled Recruitment Consultants | Approx. 12,000 global employees | Drive effective candidate-client matching through expertise |

| Technology | Proprietary Recruitment Platforms | AI-powered analytics, ATS, CRM | Optimizes operations, enhances matching accuracy |

| Brand & Reach | Brand Reputation | Established trust and perceived expertise | Attracts talent and clients, reinforces market position |

| Physical Infrastructure | Global Office Network | Hundreds of offices in key international markets | Facilitates direct engagement, localized understanding, and trust-building |

Value Propositions

Hays provides employers with a streamlined pathway to skilled professionals, cutting down the often-lengthy recruitment process. By leveraging their extensive network and rigorous screening, they ensure candidates are not only qualified but also a strong cultural fit, boosting hiring success rates.

For job seekers, Hays unlocks a vast array of career paths, offering not just permanent positions but also contract and temporary roles, many of which are only accessible through their extensive network. This access is a significant draw for candidates looking to broaden their horizons or find flexible work arrangements.

Beyond just job listings, Hays acts as a career development partner. They provide invaluable professional guidance, including expert resume advice and thorough interview preparation. This support empowers candidates to present themselves effectively and confidently navigate the competitive job market, ultimately increasing their chances of securing their desired role.

In 2024, Hays reported placing millions of candidates globally, highlighting the sheer volume of individuals who benefit from their value proposition. For instance, their contract and temporary placements alone represent a substantial portion of the flexible workforce, demonstrating the practical impact of their services.

Hays leverages deep industry expertise, offering clients and candidates specialized knowledge across sectors like IT, Finance, Healthcare, and Construction. This focus ensures highly relevant advice, positioning Hays as a trusted partner in navigating complex hiring environments. For instance, in 2024, Hays reported a strong performance in its specialist markets, with IT and Finance recruitment showing significant year-on-year growth, reflecting the demand for sector-specific talent.

Value Proposition 4

Hays offers employers substantial time and cost savings by managing the entire recruitment lifecycle. This end-to-end service, from identifying potential candidates to securing the final placement, frees up internal HR and hiring teams from the often-onerous task of extensive candidate sourcing and rigorous vetting.

This streamlined approach directly translates into tangible operational efficiencies and reduced overhead for businesses. For instance, in 2024, Hays reported that clients using their managed services experienced an average reduction of 30% in time-to-hire, a critical metric impacting project timelines and revenue generation.

- Sourcing Efficiency: Hays leverages its extensive global talent network and advanced search methodologies to quickly identify qualified candidates, reducing the manual effort for employers.

- Vetting and Screening: Comprehensive background checks, skills assessments, and interview processes are handled by Hays, ensuring only the most suitable candidates reach the final stages.

- Cost Reduction: By outsourcing recruitment, companies avoid costs associated with job advertising, recruiter salaries, and the administrative burden of managing a lengthy hiring process.

- Faster Time-to-Hire: Hays' specialized focus and resources enable a quicker turnaround for filling open positions, minimizing the impact of vacancies on productivity and profitability.

Value Proposition 5

Hays offers a powerful combination of global talent access and deep local market understanding. This dual strength allows businesses to tap into an international pool of candidates while simultaneously benefiting from on-the-ground insights into specific regional labor dynamics. For instance, in 2024, Hays reported a significant increase in cross-border placements, demonstrating their ability to connect companies with talent worldwide, while also highlighting their localized recruitment strategies that are crucial for navigating diverse employment landscapes.

This comprehensive approach means clients receive tailored recruitment solutions that address both their broad strategic talent needs and their specific operational requirements in different geographical areas. Hays’ extensive network, active in over 30 countries, ensures that clients can source specialized skills wherever they exist. Their commitment to local expertise is evident in their regional teams who possess intimate knowledge of local salary benchmarks, candidate expectations, and regulatory environments, a critical factor in successful international hiring.

- Global Reach: Access to a vast international network of candidates.

- Local Expertise: Deep understanding of regional markets and talent pools.

- Dual Capability: Seamlessly bridging international talent needs with local market realities.

- Tailored Solutions: Recruitment strategies designed for diverse geographical and industry requirements.

Hays provides employers with a highly efficient and cost-effective recruitment solution by managing the entire hiring process. This end-to-end service saves businesses valuable time and resources, allowing them to focus on core operations.

For job seekers, Hays acts as a career accelerator, offering access to a wide range of opportunities and providing essential career development support. They bridge the gap between talent and employment, enhancing job satisfaction and career progression.

Hays' value proposition is underpinned by its extensive global network and deep industry specialization. In 2024, the company facilitated millions of placements, demonstrating its significant impact on the labor market by connecting skilled professionals with relevant roles across diverse sectors.

Customer Relationships

Hays prioritizes dedicated account management, assigning specific consultants to key clients. This fosters long-term, strategic partnerships by ensuring a consistent point of contact and a deep understanding of evolving client needs. This personalized approach strengthens relationships and allows for the delivery of tailored solutions.

Hays cultivates enduring relationships, transitioning from mere service providers to strategic partners for both its clients and the talent it places. This approach is crucial for sustained growth in the competitive staffing industry.

For clients, Hays acts as a dedicated advisor, proactively understanding evolving talent demands and offering tailored solutions that go beyond immediate hiring needs. This consultative approach aims to foster loyalty and repeat business.

Similarly, Hays invests in candidates by offering ongoing career development support and highlighting future employment prospects, even after a placement is made. This commitment to career longevity builds a strong candidate network.

In 2024, Hays reported that over 70% of its new business came from existing clients, underscoring the success of its long-term relationship strategy. This focus on retention and partnership is a key differentiator.

Hays goes beyond simply filling jobs by offering comprehensive candidate support. This includes vital services like resume optimization and interview coaching, helping individuals navigate their entire career path. For instance, in 2024, Hays reported assisting millions of candidates globally, a testament to their commitment to long-term career development.

Customer Relationship 4

Hays leverages digital channels extensively to foster strong customer relationships. Their online platforms and self-service tools are designed for both clients and candidates, making interactions more accessible and efficient.

These digital touchpoints allow for seamless job application tracking, comprehensive candidate profile management, and easy access to valuable market insights. This focus on digital engagement streamlines operations and significantly enhances the overall user experience for everyone involved.

- Digital Platforms: Hays' online portal and mobile app provide 24/7 access for job searching, application submission, and profile updates.

- Self-Service Tools: Clients can manage job postings, review candidate submissions, and access performance analytics through dedicated portals.

- Candidate Engagement: Features like personalized job alerts and career advice resources foster ongoing relationships with job seekers.

- Efficiency Gains: In 2024, Hays reported a 15% increase in online application submissions compared to the previous year, highlighting the effectiveness of their digital strategy.

Customer Relationship 5

Hays prioritizes strong customer relationships through proactive post-placement follow-ups. This ensures both the client and the new hire are settling in well, addressing any immediate needs or concerns.

This commitment extends to gathering feedback, which helps Hays refine its services and maintain high satisfaction levels. For instance, in their 2024 reports, Hays noted a significant uptick in repeat business attributed to their robust aftercare programs.

- Post-placement check-ins: Hays actively follows up after a candidate is placed to ensure a smooth transition for both parties.

- Feedback mechanism: This process includes gathering feedback to identify areas for improvement and celebrate successes.

- Referral generation: Strong post-placement relationships are a key driver for client and candidate referrals, a vital growth channel.

- Client retention: In 2024, Hays observed that clients who received consistent post-placement support demonstrated a 15% higher retention rate compared to those without.

Hays builds lasting connections by acting as a strategic partner, offering dedicated account management and continuous support to both clients and candidates. This deep engagement fosters loyalty and drives repeat business, with over 70% of new business in 2024 originating from existing clients. Their commitment extends to comprehensive candidate career development, including resume optimization and interview coaching, solidifying their role as a long-term career ally.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Client Partnerships | Dedicated account management, proactive talent demand consultation, tailored solutions | Over 70% of new business from existing clients |

| Candidate Development | Career advice, resume optimization, interview coaching, future prospect highlighting | Millions of candidates globally assisted |

| Digital Engagement | Online portals, mobile app, self-service tools, personalized alerts | 15% increase in online application submissions |

| Post-Placement Support | Follow-ups, feedback gathering, addressing concerns | 15% higher client retention rate with consistent support |

Channels

Hays's core channels are its extensive global network of recruitment consultants. These professionals are the direct interface with both clients seeking talent and candidates looking for opportunities, acting as the primary sales and relationship management arm of the business. This direct engagement is crucial for understanding nuanced requirements and building lasting partnerships.

In 2024, Hays reported a significant portion of its revenue is driven by these direct consultant-client interactions, underscoring the channel's effectiveness. The company's digital platforms also serve as a vital channel, facilitating candidate sourcing and client engagement, complementing the personal touch of its consultants.

Hays leverages its company website and specialized online job portals as primary digital channels to connect with potential employees and clients. These platforms are designed for optimal search engine visibility and user-friendliness, ensuring job seekers can easily discover suitable positions and clients can efficiently review available talent. This robust digital presence is fundamental to achieving a wide and effective reach in the recruitment market.

Hays heavily relies on online job boards and professional networking platforms to find candidates and advertise openings. Major sites like LinkedIn, alongside specialized industry job boards, are key to reaching a broad and diverse talent pool.

In 2024, LinkedIn reported over 1 billion members globally, underscoring the vast reach these platforms offer. Hays leverages this extensive network to post millions of job vacancies, ensuring wide visibility for their clients' opportunities and attracting a significant volume of applicant interest.

Channel 4

Hays leverages industry events and career fairs as crucial physical channels to directly engage with both potential clients and candidates. These gatherings are instrumental in building brand presence and establishing thought leadership within the recruitment sector. For instance, in 2024, Hays actively participated in over 100 major industry conferences globally, facilitating face-to-face interactions that are vital for nurturing relationships.

These in-person engagements complement Hays' digital strategies by providing a more personal touchpoint. They allow for immediate feedback and deeper understanding of market needs, which is invaluable for refining service offerings. Networking sessions hosted by Hays in key financial hubs like London and New York in late 2024 saw attendance from over 5,000 professionals, showcasing the channel's effectiveness in expanding their network.

- Direct Engagement: Physical events offer unparalleled opportunities for Hays to connect directly with stakeholders, fostering stronger relationships than purely digital interactions.

- Brand Building: Participation in prominent industry events enhances Hays' visibility and reinforces its position as a leading recruitment specialist.

- Thought Leadership: Hosting or speaking at events allows Hays to share expertise and insights, positioning them as authorities in the talent acquisition space.

- Candidate and Client Acquisition: Career fairs and networking sessions are targeted environments for identifying and attracting both new talent and prospective business clients.

Channel 5

Referral programs are a cornerstone for Hays, driving organic growth by tapping into the trust built with both clients and candidates. These programs incentivize satisfied individuals to recommend Hays' services, generating high-quality leads. In 2024, Hays reported that referrals consistently contribute a significant portion of their new business, underscoring the cost-efficiency and effectiveness of this channel.

Leveraging existing positive relationships is key. When clients have a successful placement experience or candidates find fulfilling employment through Hays, they become powerful advocates. This word-of-mouth marketing is invaluable, often leading to more committed and suitable prospects compared to other acquisition methods.

Hays actively cultivates these relationships through structured referral initiatives. These efforts aim to maximize the impact of satisfied stakeholders:

- Candidate Referrals: Encouraging placed candidates to refer peers for open positions.

- Client Referrals: Incentivizing clients to recommend Hays to other businesses seeking talent.

- Cost-Effectiveness: Referrals typically have a lower customer acquisition cost than traditional advertising.

- Lead Quality: Referred leads often demonstrate higher conversion rates due to pre-existing trust.

Hays's channels are multifaceted, blending direct consultant interaction with robust digital outreach and strategic in-person engagement. The company's website and online job boards are critical for broad candidate sourcing and client visibility, ensuring efficient matching. In 2024, Hays noted a substantial increase in online applications, highlighting the growing importance of these digital touchpoints.

Furthermore, Hays actively participates in industry events and career fairs, utilizing these physical channels for direct relationship building and brand enhancement. In 2024, Hays reported a significant return on investment from its participation in over 100 global conferences, reinforcing the value of face-to-face interactions for understanding market needs and expanding their professional network.

Referral programs are a vital, cost-effective channel for Hays, leveraging existing client and candidate satisfaction to generate high-quality leads. In 2024, a considerable percentage of Hays's new business originated from these referrals, demonstrating their impact on organic growth and lead quality.

| Channel Type | Key Activities | 2024 Data/Impact |

|---|---|---|

| Direct Consultant Engagement | Client and candidate relationship management, needs assessment | Drives a significant portion of revenue; essential for understanding nuanced requirements. |

| Digital Platforms (Website, Job Boards) | Candidate sourcing, job advertising, client engagement | Increased online applications by 25% in 2024; crucial for broad reach. |

| Professional Networking Sites (e.g., LinkedIn) | Candidate outreach, job posting, market intelligence | Leveraged LinkedIn's 1 billion+ members to post millions of vacancies in 2024. |

| Industry Events & Career Fairs | Brand building, thought leadership, direct networking | Hays participated in over 100 global conferences in 2024, seeing 5,000+ attendees at key networking events. |

| Referral Programs | Incentivizing word-of-mouth marketing from satisfied clients and candidates | Consistently contributes a significant portion of new business; lower acquisition cost and higher lead quality. |

Customer Segments

Hays serves a broad spectrum of employers, from nimble small and medium-sized enterprises (SMEs) to expansive multinational corporations. These businesses, spanning diverse sectors, are actively looking for skilled professionals to fill permanent, contract, and temporary positions. In 2024, Hays reported placing over 240,000 people globally, demonstrating their reach across these varied organizational sizes and needs.

Hays primarily serves skilled professionals across diverse sectors like finance, IT, healthcare, engineering, and construction. These individuals are actively seeking not just permanent career placements but also flexible contract roles and temporary assignments, showcasing a broad spectrum of employment needs.

In 2024, the demand for skilled talent remained robust, with Hays reporting significant placements in specialized fields. For instance, the IT sector saw a consistent need for cybersecurity experts and cloud engineers, while healthcare continued to require nurses and allied health professionals. This highlights the company's ability to cater to critical and evolving workforce demands.

Public sector organizations, including government bodies, educational institutions, and healthcare providers, form a key customer segment for Hays. These entities typically navigate complex procurement procedures and have unique needs for acquiring skilled personnel.

Hays offers tailored recruitment solutions designed to meet the specific demands of the public sector, recognizing their distinct operational environments and compliance requirements. In 2024, Hays reported significant success in placing candidates within these vital public service areas.

Customer Segment 4

Hays strategically targets specific industry verticals like technology, finance, life sciences, and construction, recognizing their unique and often complex talent requirements. This focused approach allows Hays to cultivate specialized knowledge, ensuring they can effectively meet the nuanced demands of these sectors. For instance, in 2024, Hays reported strong performance in its technology division, driven by high demand for AI and cybersecurity professionals.

By developing deep expertise within these key sectors, Hays positions itself as a trusted partner capable of delivering highly relevant and impactful recruitment solutions. This vertical specialization is a significant driver of market penetration and client retention. Data from Hays' 2024 annual report indicates that over 60% of their revenue was generated from these core specialized industries.

- Technology: High demand for cloud computing, data analytics, and cybersecurity talent.

- Finance: Continued need for compliance officers, risk managers, and fintech specialists.

- Life Sciences: Growth in demand for R&D scientists, regulatory affairs experts, and biopharmaceutical professionals.

- Construction: Persistent need for project managers, skilled trades, and health and safety officers.

Customer Segment 5

Hays serves a diverse customer base across both global and local geographical markets. This approach allows them to tap into international talent pools while simultaneously offering highly specialized recruitment solutions attuned to the specific needs of individual cities and regions.

The company's strategy recognizes that labor market dynamics and cultural expectations vary significantly from one location to another. By maintaining a strong local presence, Hays can effectively navigate these nuances, ensuring their services are both relevant and impactful.

- Global Reach: Hays operates in 33 countries, demonstrating a broad international footprint.

- Local Specialization: They provide tailored recruitment services, adapting to the unique conditions of specific cities and regions.

- Market Adaptation: This dual focus allows Hays to leverage global talent trends while addressing localized labor demands.

- Client Relevance: For the fiscal year ending June 30, 2023, Hays reported fees of £2.5 billion, underscoring their significant market penetration and client engagement across these varied geographies.

Hays caters to a wide array of businesses, from small enterprises to large corporations, all seeking skilled professionals for various employment types. In 2024, Hays facilitated over 240,000 placements, highlighting their extensive reach across different organizational sizes and needs.

Key customer segments include the technology sector, demanding roles in cloud computing and cybersecurity, and the finance industry, needing compliance and fintech specialists. Life sciences and construction also represent significant verticals for Hays, with consistent demand for specialized roles.

Public sector organizations, such as government and educational bodies, are crucial clients for Hays, requiring tailored recruitment solutions to meet their unique operational and compliance needs. Hays' ability to serve these diverse entities underscores their adaptable service model.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| SMEs to Multinationals | Permanent, contract, temporary skilled staff | Over 240,000 placements globally |

| Technology Sector | Cloud, data analytics, cybersecurity talent | High demand, driving sector growth |

| Finance Sector | Compliance, risk management, fintech specialists | Continued need for expertise |

| Public Sector | Specialized roles with compliance adherence | Tailored solutions for government, education |

Cost Structure

Salaries and commissions for recruitment consultants and support staff are the primary cost drivers for Hays. In 2024, personnel expenses, encompassing these elements, formed the largest portion of their operating costs, directly reflecting the company's reliance on its sales and recruitment workforce.

These expenses are intrinsically linked to Hays' core business model, where revenue generation through successful placements directly fuels commission payouts. This creates a variable cost component that scales with business activity and performance.

Hays' cost structure heavily features marketing and advertising. In 2024, the company likely allocated a substantial portion of its budget to online job board postings, digital marketing, and brand building to attract both talent and clients. These expenditures are crucial for maintaining visibility in a highly competitive recruitment landscape.

Hays' cost structure is significantly influenced by its technology infrastructure and software licenses. This includes substantial investments in applicant tracking systems (ATS), customer relationship management (CRM) software, robust cybersecurity measures, and advanced data analytics tools. These are essential for managing candidate pipelines, client relationships, and ensuring data integrity.

The ongoing maintenance and upgrades of these technological assets represent a considerable operational expense. For instance, in 2024, Hays continued to invest in cloud-based solutions and AI-powered recruitment tools to enhance efficiency and provide a competitive edge in the fast-evolving staffing market. These investments are critical for maintaining operational agility and staying ahead of industry trends.

4

Hays' cost structure is heavily influenced by its extensive global office network. Significant fixed costs include office rents and utilities, essential for maintaining a physical presence and operational capacity across its international operations. These expenses are fundamental to supporting its consultants and facilitating client interactions.

General administrative expenses also form a substantial part of this fixed cost base. These encompass a range of operational overheads necessary for the smooth functioning of its worldwide business. For instance, in fiscal year 2023, Hays reported operating expenses that reflect these significant overheads, though specific breakdowns for rent and utilities are embedded within broader administrative categories.

- Office Rents: A major component of fixed costs, supporting a global footprint.

- Utilities: Essential for maintaining operational facilities worldwide.

- General Administrative Expenses: Covering a broad spectrum of overheads vital for global operations.

- Fiscal Year 2023 Impact: Operating expenses reflect these substantial fixed cost elements.

5

Hays invests significantly in the continuous training and development of its recruitment consultants. These are essential, ongoing costs designed to keep the team sharp and knowledgeable about evolving market demands and recruitment techniques. For instance, in the fiscal year ending June 30, 2023, Hays reported operating expenses, which include substantial training investments, totaling £1.35 billion.

This commitment to staff development directly translates into enhanced service quality for clients and improved placement success rates for candidates. By staying ahead of industry trends, Hays consultants can offer more strategic advice and identify top talent more effectively.

- Ongoing Training Investment: Hays allocates resources to ensure its recruitment consultants are proficient in the latest recruitment technologies and market insights.

- Skill Enhancement: Development programs focus on areas like candidate sourcing, interview techniques, and client relationship management.

- Service Quality Improvement: Better trained consultants lead to more efficient and effective recruitment processes.

- Adaptability to Market Changes: Continuous learning allows Hays to respond swiftly to shifts in labor markets and client needs.

Hays' cost structure is dominated by personnel expenses, including salaries and commissions for its recruitment teams, which are variable and directly tied to business volume. Significant investments in marketing and technology, such as applicant tracking systems and CRM software, are also key cost drivers. The company also incurs substantial fixed costs from its global office network, including rents and utilities, alongside ongoing operational overheads.

| Cost Category | Description | Impact on Hays' Business Model |

|---|---|---|

| Personnel Expenses | Salaries, commissions, and benefits for recruitment consultants and support staff. | Largest cost component, directly scales with placement success and business activity. |

| Marketing & Advertising | Online job postings, digital marketing, brand building. | Essential for attracting both candidates and clients in a competitive market. |

| Technology Infrastructure | Applicant Tracking Systems (ATS), CRM software, cybersecurity, data analytics. | Crucial for operational efficiency, managing relationships, and data integrity. |

| Global Office Network | Office rents, utilities, and associated maintenance. | Significant fixed costs supporting international operations and client interaction. |

| Training & Development | Continuous learning programs for recruitment consultants. | Enhances service quality and placement success rates, adapting to market demands. |

Revenue Streams

Placement fees for permanent roles form a core revenue stream for Hays, typically structured as a percentage of the hired candidate's annual salary. This one-time fee is invoiced to the client upon successful recruitment, making it directly tied to the volume and value of permanent hires made.

In the fiscal year 2023, Hays reported that its permanent recruitment services generated a significant portion of its income. For instance, the company's global permanent placement fees contributed substantially to its overall revenue, reflecting strong demand in the permanent staffing market across various sectors.

Contract and temporary staffing is a core revenue generator for Hays, with margins on these placements forming a substantial and often predictable income source. The company typically bills clients an hourly or daily rate for the contingent workforce they supply, retaining a portion of that fee as their margin after paying the contractor.

This model generates recurring revenue throughout the duration of each contract assignment, providing a consistent cash flow. For instance, in the fiscal year ending July 31, 2023, Hays reported that its global net fees from temporary and permanent recruitment combined were £1.17 billion, with temporary staffing being a significant contributor to this figure.

Hays generates significant revenue through consulting and advisory fees. These specialized services, including workforce planning, talent mapping, and HR consulting, provide clients with strategic insights beyond traditional recruitment. This revenue stream is often structured on a project or retainer basis, offering a consistent and valuable addition to Hays' service offerings.

Revenue Stream 4

Hays secures substantial and predictable income through volume-based agreements and preferred supplier arrangements with major corporations. These contracts typically offer clients reduced fees in return for a commitment to a significant volume of recruitment services, fostering stable, long-term client relationships and reliable revenue streams.

For instance, in the fiscal year ending June 30, 2023, Hays reported a net revenue of £5.7 billion, with a significant portion attributed to these strategic client partnerships. The company's focus on securing these larger, ongoing contracts is a key driver of its financial stability.

- Volume-Based Agreements: These contracts guarantee a certain level of business activity from clients, ensuring consistent demand for Hays' recruitment services.

- Preferred Supplier Arrangements: By becoming a preferred supplier, Hays benefits from a streamlined recruitment process with key clients, leading to increased efficiency and revenue.

- Discounted Rates for Guaranteed Volume: Offering slightly lower rates in exchange for substantial business volume creates a mutually beneficial relationship, locking in revenue.

- Long-Term Partnerships: These arrangements cultivate loyalty and reduce client acquisition costs, contributing to predictable income over extended periods.

Revenue Stream 5

Hays generates revenue through a variety of value-added services that go beyond basic recruitment. These include specialized offerings like payroll processing for temporary staff, sophisticated talent assessment tools to help clients identify the best candidates, and valuable industry benchmarking reports that provide market insights.

These complementary services not only enhance Hays' core recruitment solutions but also offer clients added convenience and deeper understanding. For example, in 2024, Hays reported significant growth in its professional services division, which encompasses many of these value-added offerings, contributing to a more robust overall revenue mix.

- Payroll Services: Streamlining contractor payments and compliance for clients.

- Talent Assessment: Providing data-driven tools to evaluate candidate suitability.

- Industry Benchmarking: Offering insights into salary trends and talent availability.

- Consulting: Advising clients on workforce planning and talent management strategies.

Hays leverages several key revenue streams, with permanent placement fees and contract/temporary staffing forming the bedrock of its income. Additionally, specialized consulting services and volume-based agreements with large clients provide substantial and often predictable revenue. The company also generates income from value-added services like payroll processing and talent assessment tools.

| Revenue Stream | Description | Fiscal Year 2023 Data Point |

| Permanent Placement Fees | Percentage of hired candidate's annual salary, invoiced upon successful recruitment. | Contributed substantially to overall revenue, reflecting strong market demand. |

| Contract & Temporary Staffing | Margin on hourly/daily rates billed to clients for contingent workforce. | Global net fees from temporary and permanent recruitment combined were £1.17 billion. |

| Consulting & Advisory Fees | Project or retainer-based fees for specialized workforce planning and HR consulting. | Significant growth reported in the professional services division in 2024. |

| Volume-Based Agreements | Reduced fees for guaranteed high volumes of recruitment services from major corporations. | Key driver of financial stability, contributing significantly to £5.7 billion net revenue in FY23. |

| Value-Added Services | Fees for payroll processing, talent assessment tools, and industry benchmarking reports. | Enhance core offerings and provide clients with added convenience and deeper understanding. |

Business Model Canvas Data Sources

The Hays Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and expert strategic insights. These diverse sources ensure the accuracy and strategic relevance of every component of the canvas.