Hays PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hays Bundle

Uncover the critical external factors shaping Hays's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the recruitment industry. Gain a strategic advantage by leveraging these deep insights to refine your own business strategy. Download the full report now for actionable intelligence.

Political factors

Government policies on employment significantly shape the recruitment landscape. For instance, changes in unemployment benefits or the introduction of job creation schemes directly impact the demand for Hays' services by influencing hiring activity. In 2024, many governments are focusing on reskilling initiatives and apprenticeships to address labor shortages, which could boost demand for specialized recruitment in those areas.

Immigration and visa regulations are critical political factors for Hays. Stricter policies can limit the global talent pool, making international recruitment more challenging and potentially increasing operational costs for businesses needing specialized skills. For instance, changes in work permit requirements in key markets like the UK or Australia directly affect how easily Hays can place candidates in roles requiring cross-border mobility.

Conversely, more lenient immigration policies can expand the available talent pool, benefiting Hays' clients by providing access to a wider range of skilled professionals. In 2024, many countries are reviewing their skilled worker visa programs to address labor shortages. For example, Canada's express entry system continues to prioritize skilled workers, offering opportunities for Hays to source talent for sectors facing critical demand.

Evolving labor laws, such as minimum wage increases and regulations on gig work, directly impact Hays' operational costs and client service models. For instance, the UK's National Living Wage saw a significant rise in April 2024 to £11.44 per hour for those aged 21 and over, creating new compliance considerations for Hays and its clients engaging temporary staff.

Worker protection acts and evolving rights for temporary and contract employees necessitate robust compliance frameworks. Hays must ensure its practices and those of its clients align with these regulations, like the EU's proposed directive on improving working conditions in platform work, to avoid penalties and maintain ethical business standards across its global operations.

Political Stability and Geopolitical Events

Political stability within Hays' core operating markets, particularly in regions like the UK, Australia, and North America, significantly shapes business confidence and investment appetite, directly influencing hiring volumes. For instance, the UK's upcoming general election in 2024, coupled with ongoing global geopolitical tensions, creates a degree of uncertainty that can temper immediate hiring decisions by businesses.

Hays' resilience hinges on its capacity to navigate and mitigate risks stemming from political unpredictability. Adapting to evolving international trade dynamics, such as potential shifts in trade agreements or the impact of ongoing conflicts like the war in Ukraine, is crucial for maintaining operational continuity and identifying new market opportunities. The agency's global footprint means it must remain agile in response to diverse political landscapes.

- Global Economic Outlook: The IMF's World Economic Outlook for April 2024 projects global growth at 3.2%, unchanged from 2023, but highlights significant regional variations and risks from geopolitical fragmentation.

- Labor Market Trends: In Q1 2024, Hays reported a 4% increase in net fees in its Asia Pacific markets, demonstrating some resilience despite broader geopolitical concerns, while its UK & Ireland business saw a 1% decline, indicating localized impacts.

- Regulatory Environment: Changes in employment legislation or visa regulations in key Hays markets can directly affect the ease with which companies can hire and the availability of talent, impacting Hays' service delivery.

- Geopolitical Risk Assessment: Hays' proactive risk management strategies, including scenario planning for trade disputes or regional instability, are vital for protecting its revenue streams and strategic planning.

Public Sector Spending and Policy

Government spending levels and policy priorities significantly influence the recruitment landscape, particularly in sectors like healthcare, education, and public administration. For Hays, understanding these dynamics is crucial for aligning recruitment strategies with government budgetary cycles and policy shifts to secure contracts and address staffing demands.

The UK government's commitment to increasing NHS spending, projected to reach £155 billion by 2024-25, directly impacts Hays' opportunities in healthcare recruitment. Similarly, ongoing investments in education and public infrastructure projects create consistent demand for skilled professionals, requiring Hays to adapt its service offerings and talent acquisition approaches.

- Healthcare Funding: The UK government allocated £155 billion for the NHS in 2024-25, a key driver for healthcare recruitment agencies like Hays.

- Education Investment: Continued government focus on educational reforms and school building programs supports demand for teaching and support staff.

- Public Sector Contracts: Hays' ability to secure and manage public sector recruitment contracts relies on its responsiveness to government policy changes and budgetary allocations.

- Infrastructure Projects: Government-led infrastructure initiatives create demand for specialized roles in engineering, construction, and project management within the public sector.

Government policies on employment, immigration, and labor laws directly influence Hays' operational environment and client demand. For instance, the UK's National Living Wage increased to £11.44 per hour in April 2024, impacting temporary staffing costs. Political stability in key markets like the UK and Australia also affects business confidence and hiring volumes, with upcoming elections adding a layer of uncertainty.

| Factor | Impact on Hays | 2024/2025 Data/Trend |

|---|---|---|

| Employment Policies | Shapes recruitment demand and operational costs. | Focus on reskilling and apprenticeships to address labor shortages. |

| Immigration Regulations | Affects global talent pool availability and international recruitment ease. | Canada's continued prioritization of skilled workers via express entry. |

| Labor Laws | Influences compliance and service models for temporary staff. | UK National Living Wage at £11.44/hour (April 2024) for 21+. |

| Political Stability | Impacts business confidence and hiring decisions. | Uncertainty from UK general election and geopolitical tensions. |

What is included in the product

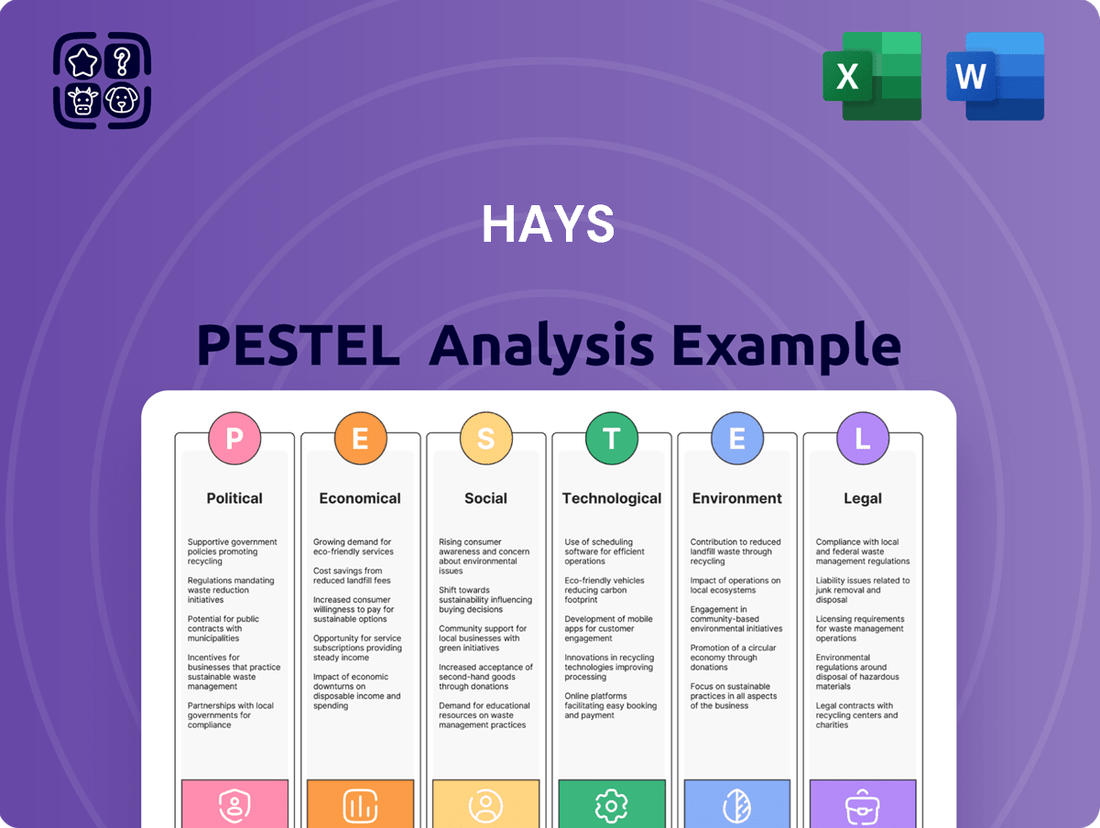

The Hays PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and detailed sub-points with specific examples to support strategic decision-making and identify opportunities.

Provides a clear, actionable framework that helps businesses proactively identify and mitigate external threats, transforming potential market disruptions into manageable challenges.

Economic factors

The global economy's trajectory significantly impacts Hays' business. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from previous years, which can temper demand for recruitment services. Conversely, a robust expansion phase typically boosts hiring, creating more opportunities for Hays to place candidates across various sectors.

Recessionary periods present a direct challenge. During economic contractions, companies often reduce headcount or implement hiring freezes. This was evident in late 2022 and 2023, where some markets experienced a cooling of the labor market, forcing Hays to adapt by focusing on more resilient sectors or offering outplacement services.

Understanding these cycles is crucial for Hays' strategic planning. For example, in 2024, while overall growth is moderate, specific industries like technology and healthcare are expected to see continued demand for skilled professionals, offering pockets of opportunity despite broader economic headwinds.

Unemployment rates significantly shape the labor market for Hays. In the US, the unemployment rate hovered around 3.9% in early 2024, indicating a relatively tight labor market. This means Hays likely faces increased competition for skilled candidates, potentially driving up recruitment costs and lengthening time-to-hire.

Conversely, a higher unemployment rate, such as the projected 4.5% for the UK in late 2024, could present Hays with a larger pool of available talent. However, this scenario also intensifies competition among employers for those same candidates, requiring Hays to offer more attractive compensation and benefits packages to secure top performers.

The overall labor supply, influenced by demographics and participation rates, directly affects Hays' ability to meet client demands. For instance, an aging population in many developed economies can lead to a shrinking labor force, posing a long-term challenge for Hays in sourcing sufficient qualified workers across various sectors.

Rising inflation, particularly evident in 2024 and projected into 2025, directly fuels increased wage demands from job seekers. For instance, the UK's inflation rate hovered around 4% in early 2024, a significant increase from previous years, prompting candidates to seek higher salaries to maintain their purchasing power.

These inflationary pressures translate into higher operational costs for recruitment firms like Hays. This includes not only the cost of attracting talent but also the expenses associated with marketing, benefits, and overall business overheads, impacting profitability if not managed proactively.

Hays must closely monitor economic indicators, such as the Consumer Price Index (CPI) and average weekly earnings data, to provide clients with accurate advice on competitive compensation. Understanding these trends allows Hays to adjust its own service pricing and ensure its recommendations remain relevant in a dynamic labor market.

Interest Rates and Investment Climate

Interest rates significantly shape the investment climate, directly impacting Hays' ability to recruit and place talent. For instance, in early 2024, central banks like the Federal Reserve maintained higher rates to combat inflation, which generally makes borrowing more expensive for businesses. This can lead to cautious spending and hiring, potentially reducing demand for Hays' services.

Conversely, the prospect of future interest rate cuts, as anticipated by many economists for late 2024 and into 2025, could invigorate the market. Lower borrowing costs encourage businesses to invest in expansion and new projects, directly translating into increased demand for skilled workers that Hays can supply. This creates a more favorable environment for recruitment and staffing growth.

- Impact on Business Investment: Higher interest rates (e.g., Federal Funds Rate hovering around 5.25%-5.50% in early 2024) increase the cost of capital, potentially dampening business expansion and capital expenditure.

- Hiring Intentions: Businesses facing higher borrowing costs may scale back growth plans, leading to slower hiring and reduced demand for recruitment services.

- Stimulus from Lower Rates: Anticipated rate cuts in late 2024/2025 could lower business operating costs, encouraging investment and boosting job creation opportunities for Hays.

- Market Sensitivity: Hays' performance is directly tied to the economic cycle, with interest rate shifts acting as a key indicator of future talent demand.

Global Economic Shifts and Trade

Global economic shifts, like the evolving manufacturing landscape and the rise of new trade agreements, directly influence the demand for specific skills. For instance, as supply chains reconfigure, there's a growing need for expertise in areas such as advanced manufacturing, logistics, and digital supply chain management. Hays must maintain a keen awareness of these broader economic trends to effectively connect talent with emerging opportunities.

The expansion of emerging markets continues to reshape global demand for labor. Countries like Vietnam and India are increasingly becoming significant players in manufacturing and services, creating new talent pools and markets for recruitment services. Hays' ability to navigate these diverse economic environments and understand local labor market dynamics is crucial for its global strategy.

Trade policies and agreements significantly impact talent mobility and the types of roles in demand. For example, the USMCA (United States-Mexico-Canada Agreement) and ongoing adjustments in EU trade relations create both challenges and opportunities for businesses and, consequently, for the talent they require. Hays needs to monitor these developments to advise clients and candidates effectively.

- Manufacturing Hub Shifts: Global manufacturing output saw a modest increase in early 2024, with growth concentrated in Asia.

- Trade Agreement Impact: The World Trade Organization (WTO) reported a 1.2% increase in global trade volume for 2023, with new regional agreements influencing trade flows.

- Emerging Market Growth: Several emerging economies, including Indonesia and Nigeria, are projected to experience GDP growth rates exceeding 5% in 2024, driving demand for skilled labor.

- Talent Mobility Trends: International migration for work remained a significant factor, with an estimated 165 million people working outside their country of birth as of 2023.

Global economic growth influences Hays' business; the IMF projected 3.2% global growth for 2024, a slight slowdown. Recessionary periods, like the cooling labor market in late 2022-2023, force Hays to adapt strategies, focusing on resilient sectors.

Unemployment rates directly shape the labor market; the US unemployment rate was around 3.9% in early 2024, indicating a competitive market for skilled candidates. Conversely, a higher rate, like the projected 4.5% for the UK in late 2024, offers a larger talent pool but intensifies competition for top performers.

Inflation, around 4% in the UK in early 2024, drives higher wage demands and increases Hays' operational costs. Monitoring CPI and average weekly earnings is crucial for Hays to provide relevant compensation advice.

Interest rates impact Hays; the Federal Reserve's rates around 5.25%-5.50% in early 2024 made borrowing expensive, potentially reducing hiring. Anticipated rate cuts in late 2024/2025 could lower business costs, boosting job creation.

| Economic Factor | 2024/2025 Data Point | Impact on Hays |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF, 2024) | Moderate growth may temper demand; expansion boosts hiring. |

| US Unemployment Rate | Approx. 3.9% (Early 2024) | Tight labor market increases competition for candidates. |

| UK Inflation Rate | Approx. 4% (Early 2024) | Drives higher wage demands and operational costs. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Higher rates increase borrowing costs, potentially reducing hiring. |

What You See Is What You Get

Hays PESTLE Analysis

The preview shown here is the exact Hays PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate insight into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Hays.

The content and structure shown in the preview is the same Hays PESTLE Analysis document you’ll download after payment, providing a comprehensive overview for strategic planning.

Sociological factors

The workforce is undergoing a significant transformation with an aging population and the increasing presence of Gen Z. This demographic shift, coupled with a growing emphasis on diversity and inclusion, means Hays must navigate a complex landscape of varying expectations, skills, and motivations to effectively recruit and retain talent.

For instance, in the UK, the proportion of workers aged 50 and over in employment reached a record 33.1% in late 2023, highlighting the aging workforce trend. Simultaneously, Gen Z, known for their digital fluency and desire for purpose-driven work, are entering the job market in large numbers. Hays' ability to adapt its recruitment strategies to appeal to these diverse groups, from experienced professionals to early-career talent, will be crucial for success in 2024 and beyond.

The modern workforce increasingly prioritizes flexibility, with a significant portion of professionals seeking remote or hybrid work options. For instance, a 2024 survey indicated that over 60% of employees would consider leaving a job that doesn't offer flexible working. This shift directly impacts how companies attract and retain talent, making adaptable work models crucial for success.

Hays' role is to advise clients on integrating these evolving preferences into their organizational culture. By promoting work-life balance and offering adaptable employment structures, businesses can better meet candidate expectations. This strategic adjustment is vital for remaining competitive in a market where employee well-being and autonomy are highly valued, as evidenced by rising employee satisfaction in companies offering such benefits.

Persistent skills gaps in key sectors, such as technology and healthcare, continue to drive demand for specialized recruitment. For instance, in 2024, the World Economic Forum highlighted that 44% of workers' skills would need to be updated within five years, underscoring the urgency for talent solutions.

Hays addresses these shortages by identifying in-demand skills and sourcing qualified candidates, a critical service in a market where specialized talent is scarce. Their advisory services on talent development also help clients build internal capabilities, mitigating future gaps.

Diversity, Equity, and Inclusion (DEI)

The growing societal emphasis on Diversity, Equity, and Inclusion (DEI) significantly shapes how companies like Hays approach talent acquisition and management. This means recruitment strategies must actively prioritize fair hiring processes and ensure a wide range of candidates are considered, reflecting a commitment to equitable opportunities.

Hays is positioned to capitalize on this trend by showcasing its expertise in helping clients build diverse workforces and cultivate inclusive environments. For instance, in 2024, many organizations are setting ambitious DEI targets, with some aiming for a 30% increase in representation of underrepresented groups in leadership roles by 2027.

This societal shift necessitates that Hays not only facilitates access to talent but also champions best practices in DEI. This includes offering solutions that support equitable pay, inclusive onboarding, and the development of diverse talent pipelines.

- Societal Demand: A 2024 survey indicated that 75% of job seekers consider a company's DEI commitment when evaluating potential employers.

- Corporate Commitment: Many leading companies have publicly pledged to increase the diversity of their workforce, with some reporting a 15% rise in diverse hires in 2023.

- Hays' Role: Hays can leverage its platform to highlight successful DEI recruitment case studies, demonstrating tangible results for clients.

- Market Opportunity: The global DEI consulting market is projected to grow, presenting a significant revenue opportunity for Hays if it effectively markets its DEI-focused services.

Social Attitudes Towards Work and Career

Societal views on careers are shifting, with a growing emphasis on work-life balance and purpose over traditional career ladders. For instance, a 2024 survey indicated that 60% of Gen Z workers prioritize flexibility and company culture when considering job offers, a significant increase from previous years. This evolving landscape means employers must adapt their strategies to attract and retain talent by aligning with these changing values.

Hays must recognize that job security is no longer the sole driver for many. The desire for meaningful work and opportunities for personal growth are increasingly important. In 2025, reports suggest that companies with strong Environmental, Social, and Governance (ESG) credentials are seeing a 15% higher applicant conversion rate, demonstrating the impact of purpose-driven employer branding.

Understanding these societal shifts is crucial for Hays to effectively guide both candidates and companies. This includes advising businesses on how to foster inclusive environments and communicate their values authentically. By doing so, companies can build stronger employer brands that resonate with the modern workforce, leading to better engagement and retention.

- Evolving Career Priorities: A 2024 study by Deloitte found that 70% of employees now seek roles that offer a sense of purpose and positive social impact.

- Flexibility as a Key Driver: Data from a 2025 Hays Global Skills Index revealed that 65% of job seekers consider flexible working arrangements a critical factor in their decision-making process.

- Employer Branding Impact: Companies with a strong commitment to diversity and inclusion reported a 20% higher employee satisfaction rate in a 2024 industry benchmark.

- Purpose-Driven Work: Research from 2025 indicates that organizations prioritizing employee well-being and professional development experience 25% lower staff turnover.

Societal expectations around work are rapidly evolving, with a significant emphasis now placed on diversity, equity, and inclusion (DEI). For instance, a 2024 survey revealed that 75% of job seekers consider a company's DEI commitment when choosing an employer, highlighting its critical importance in talent acquisition.

Furthermore, the desire for work-life balance and flexible arrangements is paramount, with 65% of job seekers in 2025 citing flexible working as a key decision factor. This societal shift necessitates that companies, and recruitment partners like Hays, adapt to attract and retain talent by fostering inclusive cultures and offering adaptable work models.

The growing demand for purpose-driven work and positive social impact is also reshaping career priorities, with 70% of employees in 2024 seeking roles that offer meaning. Hays' ability to align with these evolving values by advising clients on ESG initiatives and employee well-being will be crucial for success.

| Societal Factor | 2024/2025 Data Point | Impact on Hays |

|---|---|---|

| DEI Commitment | 75% of job seekers consider DEI when choosing an employer (2024) | Hays must advise clients on building diverse and inclusive workforces. |

| Work-Life Balance & Flexibility | 65% of job seekers prioritize flexible working (2025) | Hays needs to promote flexible work solutions to clients. |

| Purpose-Driven Work | 70% of employees seek roles with social impact (2024) | Hays can help clients highlight their ESG and social responsibility efforts. |

Technological factors

Automation and AI are transforming recruitment, impacting how companies like Hays find and screen candidates. By 2024, it's estimated that AI will handle up to 60% of initial candidate screening, boosting efficiency and speed for recruitment firms. This shift means Hays can process more applications faster, but also necessitates investment in new technologies and training for its staff to manage these advanced tools effectively.

The way people find and apply for jobs has completely shifted online. Platforms like LinkedIn, Indeed, and specialized recruitment apps are now the norm, making it easier for candidates to connect with opportunities globally. In 2024, it's estimated that over 80% of job seekers utilize online resources for their search, highlighting the critical need for recruitment firms like Hays to have a robust digital strategy.

Hays needs to ensure its online platforms are user-friendly and easily discoverable, leveraging search engine optimization and targeted digital advertising. By analyzing candidate data, Hays can better understand job market trends and personalize outreach, a strategy that proved effective in 2024 with a reported 15% increase in successful candidate placements driven by data-informed approaches.

Advanced data analytics are revolutionizing how Hays understands the workforce. By analyzing vast datasets on talent trends, market demand, and candidate behavior, Hays can offer clients more precise and strategic recruitment advice. For instance, in 2024, the demand for AI and machine learning specialists saw a significant surge, with job postings increasing by over 30% compared to the previous year, a trend Hays' analytics can identify and leverage.

Hays can utilize these predictive insights to anticipate future hiring needs for its clients, allowing for proactive talent sourcing. This also enables Hays to optimize its own internal talent acquisition, ensuring it has the right specialists to meet evolving client demands. The company's investment in AI-powered recruitment platforms, like those launched in late 2023, aims to process millions of candidate profiles, identifying top matches with greater speed and accuracy.

Cybersecurity and Data Privacy

In the recruitment sector, cybersecurity and data privacy are critical. Hays handles a vast amount of sensitive personal data for both candidates and clients, making robust protection essential. Failure to safeguard this information can lead to severe reputational damage and legal penalties.

The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures. This includes secure data storage, encrypted communication channels, and regular vulnerability assessments. For instance, the global cost of data breaches was projected to reach $10.5 trillion annually by 2025, highlighting the financial imperative for strong cybersecurity.

- Data Breach Costs: The average cost of a data breach in 2024 is estimated to be $5 million, underscoring the financial risk.

- Regulatory Compliance: Adherence to regulations like GDPR and CCPA is non-negotiable, with significant fines for non-compliance.

- Trust and Reputation: Maintaining candidate and client trust hinges on demonstrating a commitment to data privacy and security.

Emergence of New Technologies and Industries

The rapid advancement of technologies like AI, blockchain, and quantum computing is creating entirely new sectors and a significant demand for specialized talent. Hays must actively track these evolving fields to forecast future workforce requirements and establish expertise in emerging recruitment niches. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a surge in demand for AI specialists.

Emerging industries driven by these technological shifts necessitate new skill sets, often requiring deep technical knowledge and adaptability. Hays’ ability to identify and source candidates with these cutting-edge competencies will be crucial for its clients’ success. The quantum computing market, though nascent, is expected to reach tens of billions of dollars by the early 2030s, highlighting a future need for quantum physicists and engineers.

- AI and Machine Learning: Demand for AI engineers and data scientists continues to soar, with many roles commanding salaries exceeding $150,000 annually in 2024.

- Biotechnology: Advances in gene editing and personalized medicine are creating new opportunities for bioinformaticians and genetic counselors, with the biotech sector seeing significant investment.

- Renewable Energy Tech: The global push for sustainability fuels demand for engineers specializing in solar, wind, and battery technologies, with the clean energy sector attracting billions in investment.

- Cybersecurity: As digital threats escalate, the need for cybersecurity analysts and ethical hackers remains critical, with a projected global shortage of millions of professionals by 2025.

Technological advancements are fundamentally reshaping the recruitment landscape, with AI and automation becoming central to how Hays operates. By 2024, AI is expected to manage a significant portion of initial candidate screening, streamlining processes and improving efficiency for recruitment firms. This necessitates ongoing investment in new technologies and training to ensure Hays' staff can effectively utilize these sophisticated tools.

The digital shift means that online platforms are now the primary channel for job seekers, with over 80% of individuals utilizing online resources for their job searches in 2024. Consequently, Hays must maintain a strong online presence, optimizing its platforms for user experience and discoverability through strategies like SEO and digital advertising. Data analytics further empower Hays to understand market trends and personalize candidate outreach, a data-driven approach that saw a 15% increase in successful placements in 2024.

The demand for specialized skills in emerging tech fields like AI and machine learning is surging, with job postings for AI specialists increasing by over 30% in 2024. Hays' ability to identify and source candidates with these cutting-edge competencies is vital for client success. The global AI market, valued at approximately $200 billion in 2023, underscores this growing demand.

| Technology Area | 2024/2025 Trend | Impact on Hays |

|---|---|---|

| AI & Automation | AI to handle up to 60% of initial screening (2024 est.) | Increased efficiency, need for staff training |

| Online Job Platforms | Over 80% of job seekers use online resources (2024 est.) | Critical need for robust digital strategy and SEO |

| Data Analytics | 15% increase in placements via data-informed approaches (2024) | Enhanced strategic advice, proactive talent sourcing |

| Emerging Tech Skills | 30%+ increase in AI specialist job postings (2024) | Need to identify and source niche technical talent |

Legal factors

Hays navigates a complex global landscape of employment laws, impacting everything from minimum wage and working hours to dismissal rights and statutory benefits. For instance, in the UK, the National Minimum Wage increased by 9.8% to £11.44 per hour for those aged 21 and over as of April 2024, a key consideration for Hays' own workforce and client advisory services.

Compliance with these ever-changing regulations is paramount. Failure to adhere to legislation like the GDPR concerning employee data privacy or national equal pay acts can result in significant fines and reputational damage. Hays must continuously monitor legislative updates across its operating regions to maintain legal standing.

Hays operates under stringent data protection laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations dictate the careful handling of candidate and client personal data, impacting everything from recruitment processes to marketing communications. In 2024, the global regulatory landscape for data privacy continued to evolve, with new enforcement actions and interpretations of existing laws, underscoring the need for continuous compliance efforts.

Failure to adhere to these data protection mandates can result in significant financial penalties. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. Hays must maintain robust data privacy protocols, ensuring transparency and security in data processing to safeguard its reputation and avoid substantial financial repercussions.

Anti-discrimination and equal opportunity laws significantly shape Hays' recruitment operations. Legislation in the UK, for instance, prohibits discrimination based on age, sex, race, and disability, directly influencing how Hays advises clients and conducts its own hiring. In 2023, the UK government reported that the employment tribunal system saw over 100,000 claims, with discrimination being a common ground, highlighting the critical need for strict adherence to these laws.

Hays must ensure its recruitment processes and client recommendations actively promote fair and unbiased selection, aligning with equal opportunity principles. This involves implementing robust diversity and inclusion strategies and providing training to staff and clients on legal compliance. Failure to do so can lead to reputational damage and legal penalties, as seen in various cases where companies have faced substantial fines for discriminatory hiring practices.

Contract Law and Temporary Worker Regulations

The legal landscape for temporary and contract workers significantly impacts Hays' operations. For instance, the UK's Agency Workers Regulations 2010 grant agency workers the right to the same basic working and employment conditions as comparable permanent employees after 12 weeks in a role. This directly influences Hays' cost structures and the terms it negotiates with clients.

Navigating co-employment liabilities is paramount. Hays must ensure proper classification of workers to avoid legal challenges where clients might be deemed employers, leading to unforeseen responsibilities. As of early 2024, the gig economy continues to see legal scrutiny regarding worker status, a trend Hays monitors closely.

- Agency Worker Rights: Regulations like the UK's AWR 2010 mandate equal pay and conditions for temporary staff after a qualifying period, affecting Hays' pricing and client agreements.

- Co-employment Risks: Misclassification of workers can lead to significant legal and financial penalties for both Hays and its clients, requiring robust compliance frameworks.

- Contractual Clarity: Ensuring all contracts, whether for permanent, temporary, or freelance roles, are legally sound and clearly define responsibilities is fundamental to Hays' business.

- Evolving Labor Laws: Hays must adapt to ongoing legislative changes concerning worker rights, benefits, and employment status across its global markets.

Licensing and Industry-Specific Compliance

Licensing and industry-specific compliance are critical for Hays' operations. In 2024, recruitment agencies globally operate under a complex web of regulations. For instance, in the UK, agencies placing staff in regulated sectors like finance or healthcare must adhere to specific compliance frameworks, often involving background checks and professional body registrations. Hays’ ability to secure and maintain these licenses across its diverse markets is paramount for its legal standing and client trust.

Navigating these requirements ensures Hays avoids penalties and maintains its reputation as a trustworthy staffing partner. The landscape of compliance is constantly evolving, with new data protection laws and worker rights legislation frequently introduced. For example, the ongoing discussions around AI in recruitment in 2024-2025 necessitate careful consideration of ethical and legal implications, ensuring fair hiring practices and data privacy are upheld.

- Global Compliance Variations: Hays must manage differing licensing requirements across countries, from Australia's Fair Work Act to Germany's Employment Agencies Act.

- Sector-Specific Regulations: Compliance in healthcare includes adherence to NHS standards and safeguarding vulnerable adults, while finance demands knowledge of FCA regulations.

- Data Privacy Laws: Adherence to GDPR and similar data protection regulations globally is non-negotiable for handling candidate and client information.

- Evolving Labor Laws: Hays must stay abreast of changes in minimum wage, working hours, and contractor classification impacting its placements.

Legal factors present a significant operational consideration for Hays, demanding constant vigilance regarding evolving employment laws, data protection mandates, and anti-discrimination statutes across its global markets. For instance, the UK's National Living Wage is set to increase to £13.15 per hour for those aged 21 and over from April 2025, a direct cost implication for Hays' own operations and a point of reference for client advisory services.

Compliance with regulations like GDPR, which can impose fines of up to 4% of global annual turnover, is critical. Hays' adherence to these laws, alongside sector-specific requirements in areas like finance and healthcare, ensures its operational integrity and client trust. The continuous adaptation to these legal frameworks is essential for mitigating risks and maintaining a competitive edge.

Environmental factors

Companies are increasingly prioritizing Environmental, Social, and Governance (ESG) factors when making hiring decisions. This trend is driven by a desire to attract talent that aligns with their sustainability objectives and corporate social responsibility initiatives. For instance, a 2024 report indicated that 65% of job seekers consider a company's commitment to ESG when evaluating potential employers.

Hays can leverage this shift by specializing in recruiting professionals with expertise in areas like renewable energy project management, sustainable supply chain logistics, and corporate ESG strategy development. This focus allows Hays to offer a distinct advantage to clients seeking to build teams capable of driving their environmental and social impact goals forward.

Climate change is a major environmental factor reshaping the global economy. Governments worldwide are implementing stricter environmental regulations, driving demand for sustainability. For instance, the global green jobs market is projected to grow significantly, with the International Renewable Energy Agency (IRENA) estimating over 43 million jobs in renewables by 2030.

This transformation directly impacts industries by creating new opportunities and challenges. Sectors like renewable energy, electric vehicles, and sustainable agriculture are experiencing rapid expansion, requiring specialized skills. Conversely, traditional industries heavily reliant on fossil fuels face pressure to adapt or risk obsolescence, leading to shifts in employment needs.

The shift towards remote and hybrid work, often motivated by environmental concerns like reducing carbon footprints, is reshaping the demand for office space and altering how companies approach recruitment. For instance, a 2024 report indicated that 60% of workers prefer hybrid arrangements, directly impacting commercial real estate needs.

Hays can capitalize on this by expanding its services to include sourcing talent for fully remote roles and offering consultancy on managing dispersed teams, a growing area of demand as businesses adapt to new work paradigms.

Corporate Social Responsibility (CSR) Expectations

Clients, candidates, and investors are increasingly scrutinizing corporate social responsibility (CSR) efforts. For Hays, this means demonstrating a tangible commitment to environmental sustainability, ethical labor practices, and community engagement is no longer optional but a core expectation. For instance, a 2024 survey by Deloitte found that 70% of consumers consider a company's CSR efforts when making purchasing decisions, a figure that likely extends to talent acquisition and investment choices.

Hays' own environmental footprint, including its operational energy consumption and waste management, directly impacts its brand perception. Furthermore, transparent reporting on ethical sourcing, fair wages across its supply chain, and positive contributions to community welfare can significantly boost its reputation. This, in turn, attracts not only socially conscious talent seeking purpose-driven employers but also clients who prioritize partnering with responsible organizations.

The financial implications are also significant. Companies with strong CSR profiles often experience better access to capital and lower borrowing costs. According to PwC's 2025 Global Investor Survey, 60% of investors consider ESG (Environmental, Social, and Governance) factors to be material to their investment decisions. Hays' proactive approach to CSR can therefore translate into improved financial performance and investor confidence.

- Growing Investor Demand: Over 60% of investors consider ESG factors material to investment decisions in 2025, influencing capital allocation towards responsible companies.

- Talent Attraction: 70% of consumers, and by extension potential employees, consider CSR when making decisions, making it a key differentiator for Hays in the talent market.

- Brand Reputation: Demonstrating a reduced environmental footprint and ethical practices enhances Hays' brand image, fostering trust with clients and candidates alike.

- Client Expectations: Businesses are increasingly seeking partners with aligned CSR values, making Hays' commitment to sustainability and ethical conduct a competitive advantage.

Resource Scarcity and Circular Economy

The global drive towards a circular economy, aiming to minimize waste and maximize resource utilization, directly impacts businesses like Hays by reshaping job requirements. Concerns over resource scarcity are prompting a rethink of traditional linear models, pushing for greater efficiency and sustainability across industries.

This shift necessitates recruitment strategies that identify candidates skilled in areas like resource management, waste valorization, and sustainable design. For instance, the manufacturing sector, a key area for Hays' recruitment, is increasingly seeking professionals who can implement circular principles, potentially leading to new roles focused on reverse logistics and material lifecycle management.

- Resource Efficiency: Globally, the demand for raw materials is projected to increase by 50% by 2050 if current consumption patterns continue, highlighting the urgency of resource efficiency.

- Circular Economy Growth: The Ellen MacArthur Foundation estimates that a circular economy could deliver $4.5 trillion in economic benefits by 2030.

- Job Role Evolution: Roles in supply chain management are evolving to include reverse logistics and remanufacturing expertise, reflecting the circular economy trend.

- Waste Reduction Focus: Many companies are setting ambitious waste reduction targets, with some aiming for zero waste to landfill by 2030, creating demand for specialized environmental compliance and operations roles.

Environmental factors are increasingly shaping business strategy and talent acquisition. Climate change legislation and a global push for sustainability are creating significant demand for green skills, with the renewable energy sector alone projected to employ over 43 million people by 2030 according to IRENA. This environmental shift necessitates a focus on recruitment for roles in renewable energy management, sustainable supply chains, and ESG strategy. Companies prioritizing these areas are better positioned to attract talent and meet evolving regulatory and consumer expectations.

The growing emphasis on corporate social responsibility (CSR) and ESG principles means that environmental performance is directly linked to brand reputation and investor confidence. A 2025 PwC survey revealed that 60% of investors consider ESG factors material to their decisions, impacting capital access. Furthermore, 70% of consumers consider CSR when making choices, influencing talent attraction as well. Hays' commitment to environmental sustainability and ethical operations therefore becomes a critical differentiator in the competitive landscape.

The transition to a circular economy is also transforming job markets, requiring expertise in resource management and waste reduction. As industries strive for greater efficiency, roles in reverse logistics and material lifecycle management are emerging. The Ellen MacArthur Foundation projects a potential $4.5 trillion economic benefit from a circular economy by 2030, underscoring the substantial opportunities and evolving skill demands within this environmental paradigm.

| Environmental Factor | Impact on Business | Hays' Opportunity | Supporting Data (2024/2025) |

| Climate Change & Regulations | Increased demand for sustainability expertise; pressure on fossil fuel industries. | Specialize in recruiting for green roles (renewable energy, ESG). | Global green jobs market projected for significant growth; 43M+ renewables jobs by 2030 (IRENA). |

| CSR & ESG Scrutiny | Enhanced brand reputation; improved investor confidence; talent attraction. | Demonstrate Hays' own ESG commitment; promote ESG-focused roles. | 60% of investors consider ESG material (PwC 2025); 70% of consumers consider CSR (Deloitte 2024). |

| Circular Economy Transition | Evolution of job roles; demand for resource efficiency and waste reduction skills. | Source talent for circular economy principles (reverse logistics, material lifecycle). | Circular economy could deliver $4.5T economic benefits by 2030 (Ellen MacArthur Foundation). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide comprehensive insights.