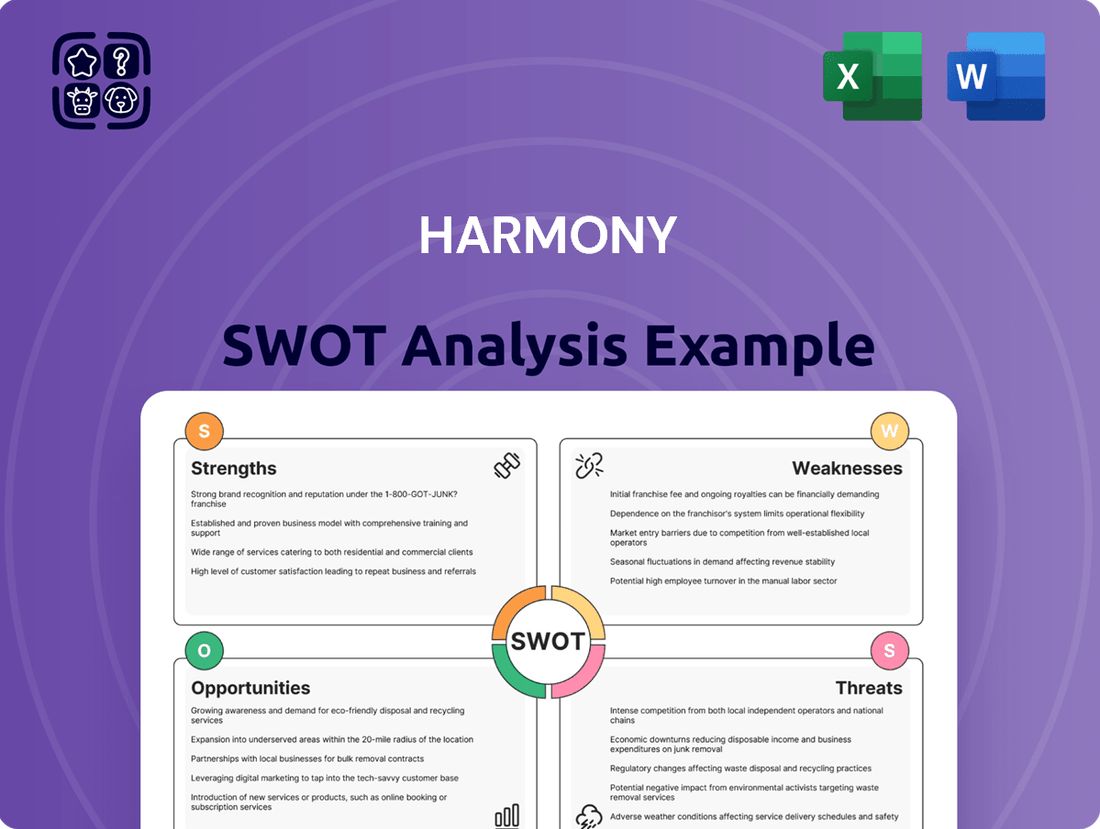

Harmony SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harmony Bundle

Harmony's current market position is defined by its unique strengths in [mention a key strength], but also faces potential threats from [mention a key threat]. Understanding these dynamics is crucial for any forward-thinking investor or strategist.

Want the full story behind Harmony's competitive edge, potential pitfalls, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Harmony Biosciences' flagship product, WAKIX, continues to show impressive commercial strength. In 2024, WAKIX achieved net revenues of $714.7 million, marking a significant 23% jump from the previous year. This growth highlights strong market penetration and demand for the narcolepsy treatment.

Looking ahead, the company anticipates WAKIX net revenues to reach between $820 million and $860 million in 2025. This trajectory suggests WAKIX is on track to capture a substantial share of the narcolepsy market, with potential to reach $1 billion in this indication alone.

The rapid success of WAKIX is further evidenced by its cumulative net revenue, which has surpassed $2 billion in under five years. This remarkable achievement underscores the product's broad market acceptance and its position as a key revenue driver for Harmony Biosciences.

Harmony Biosciences is building a strong foundation with its late-stage pipeline, which is both robust and diversified. This means they aren't putting all their eggs in one basket, which is a smart move for long-term success.

Beyond their established narcolepsy treatments, Harmony has multiple promising drug candidates in late-stage clinical trials. These are aimed at treating rare neurological conditions, offering hope to many patients. By the close of 2025, the company expects to have as many as six Phase 3 clinical programs actively running.

Specifically, Harmony is advancing candidates for conditions like Fragile X syndrome, Dravet syndrome, and Lennox-Gastaut syndrome. This strategic expansion of their development pipeline is designed to ensure continued growth and lessen dependence on any single therapy.

Harmony Biosciences demonstrates robust financial health, underscored by a GAAP net income of $145.5 million in 2024. This profitability, coupled with a significant cash, cash equivalents, and investments balance of $610.2 million as of March 31, 2025, positions the company as a self-funding entity. This financial stability is crucial, enabling sustained investment in research and development and supporting strategic growth opportunities.

Specialized Focus on Unmet Medical Needs

Harmony Biosciences' strategic dedication to developing therapies for rare neurological diseases allows them to target significant unmet medical needs. This focus can lead to orphan drug designations, offering extended market exclusivity and stronger pricing power in a less competitive landscape. Their commitment to overlooked patient populations fosters a distinct market niche, potentially driving future therapeutic innovation.

This specialization is crucial in a pharmaceutical market where addressing rare conditions often garners regulatory advantages and dedicated patient advocacy. For instance, as of early 2024, the U.S. Food and Drug Administration (FDA) continues to prioritize novel treatments for rare diseases, a trend expected to persist through 2025. This regulatory environment directly benefits companies like Harmony that concentrate on these specific therapeutic areas.

- Targeting Unmet Needs: Harmony's core strategy centers on rare neurological disorders, a segment with substantial unmet medical demand.

- Orphan Drug Designation: This focus frequently results in orphan drug status, providing extended market exclusivity and potential for premium pricing.

- Market Niche: By concentrating on overlooked patient groups, Harmony cultivates a strong and defensible market position.

- Regulatory Tailwinds: The ongoing emphasis by regulatory bodies on rare disease treatments provides a favorable environment for Harmony's development pipeline.

Strong Intellectual Property Protection

Harmony's robust intellectual property (IP) strategy significantly bolsters its market position, particularly for WAKIX. A key achievement is the favorable settlement in the initial Abbreviated New Drug Application (ANDA) litigation, which effectively pushes potential generic competition for WAKIX back to at least January 2030. This provides a substantial period of market exclusivity.

Further strengthening WAKIX's IP portfolio, Harmony is actively pursuing pediatric exclusivity. If successful, this would grant an additional six months of regulatory exclusivity, extending the period before generic versions can enter the market. This proactive approach safeguards future revenue streams.

Beyond current protections, Harmony is investing in future innovation by filing provisional IP for next-generation pitolisant formulations. This forward-looking strategy aims to extend patent protection well into the future, potentially safeguarding exclusivity until 2044 and ensuring long-term market advantage.

- WAKIX exclusivity extended to at least January 2030 due to favorable ANDA litigation settlement.

- Potential for an additional six months of regulatory exclusivity through ongoing pediatric exclusivity application.

- Provisional IP filed for next-generation pitolisant formulations, targeting patent protection until 2044.

Harmony Biosciences benefits from a strong commercial foundation driven by WAKIX, which achieved $714.7 million in net revenues in 2024, a 23% increase year-over-year. The company projects WAKIX net revenues to reach $820 million to $860 million in 2025, indicating sustained growth and market leadership in narcolepsy treatment.

The company's robust pipeline, with six Phase 3 clinical programs expected by the end of 2025, diversifies its future revenue streams and targets significant unmet needs in rare neurological diseases. This strategic focus on niche markets, coupled with favorable regulatory environments for rare disease treatments, positions Harmony for continued innovation and market penetration.

Harmony's financial health is robust, with $610.2 million in cash, cash equivalents, and investments as of March 31, 2025, and a GAAP net income of $145.5 million in 2024, enabling self-funded growth and R&D investment.

Furthermore, Harmony's intellectual property strategy is a significant strength, with WAKIX exclusivity secured until at least January 2030 due to a favorable ANDA litigation settlement, and potential patent protection for next-generation formulations extending to 2044.

| Metric | 2024 Data | 2025 Projection |

| WAKIX Net Revenues | $714.7 million | $820 - $860 million |

| Phase 3 Programs (by end of 2025) | N/A | 6 |

| Cash, Cash Equivalents, Investments (as of March 31, 2025) | N/A | $610.2 million |

| GAAP Net Income | $145.5 million | N/A |

| WAKIX Exclusivity (minimum) | Until Jan 2030 | Until Jan 2030 |

What is included in the product

Analyzes Harmony’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights, reducing the burden of analysis and fostering clarity.

Weaknesses

Harmony Biosciences' significant revenue dependency on WAKIX presents a notable weakness. In the first quarter of 2024, WAKIX accounted for approximately 99% of Harmony's total net revenue, highlighting extreme product concentration.

This heavy reliance on a single product, WAKIX, exposes Harmony to substantial concentration risk. Any adverse events impacting WAKIX, such as increased competition or regulatory challenges, could severely affect the company's overall financial health and stock performance.

Harmony Biosciences faced a significant hurdle in February 2025 when the U.S. Food and Drug Administration (FDA) issued a Refusal to File (RTF) letter for its supplemental New Drug Application (sNDA) concerning pitolisant for idiopathic hypersomnia (IH). This regulatory setback, while not immediately altering the company's 2025 net revenue projections, signals potential delays in broadening WAKIX's approved uses.

The RTF letter implies that the sNDA lacked sufficient information or clarity for the FDA to initiate a formal review, necessitating further submissions or data from Harmony. This could push back the timeline for market diversification, a key growth strategy for the company as it aims to expand WAKIX's reach beyond its current indications.

Harmony's operating expenses have seen a notable increase, climbing 29% in Q1 2025 compared to Q1 2024.

This surge is largely driven by substantial investments in research and development, alongside upfront licensing fees and acquisition-related costs.

While these expenditures are crucial for future growth, they pose a risk to profit margins if revenue doesn't keep pace.

Inherent Risks of Drug Development

The pharmaceutical industry inherently faces significant risks, particularly with extensive drug development pipelines. Harmony's commitment to numerous clinical trials means these projects are susceptible to the inherent uncertainties of this process. For instance, the success of late-stage trials, such as Phase 3 for ZYN002 targeting Fragile X syndrome and EPX-100 for rare epilepsies, is not guaranteed.

Failure in these crucial studies could result in substantial financial setbacks and prolonged timelines for market entry. In 2024, the industry saw an average Phase 3 trial failure rate of around 30%, highlighting the challenges. Harmony's substantial investment in its pipeline, which includes these key candidates, is therefore exposed to these high-stakes outcomes.

- Clinical Trial Uncertainty: Harmony's extensive pipeline, including ZYN002 and EPX-100, faces the inherent risk of clinical trial failure.

- Regulatory Approval Risk: Positive trial results do not guarantee regulatory approval, adding another layer of uncertainty.

- Financial Impact: Trial failures can lead to significant financial write-offs, impacting Harmony's profitability and future development.

- Industry Benchmarks: The pharmaceutical sector's average Phase 3 trial failure rate underscores the substantial risk Harmony undertakes.

Limited Commercial Portfolio Beyond Core Indication

Harmony Biosciences' commercial success is currently concentrated, with WAKIX being its primary revenue driver. This reliance on a single product presents a significant weakness, as future growth and financial stability are heavily dependent on the successful development and market introduction of its pipeline candidates. For example, as of Q1 2024, WAKIX sales reached $70.2 million, underscoring its critical role.

The company's ability to diversify its revenue streams hinges on bringing new therapies to market, a process fraught with regulatory hurdles and market adoption challenges. While Harmony has a promising pipeline, the path to significant new revenue generation beyond narcolepsy treatments is not guaranteed and requires substantial investment and successful execution.

- Revenue Concentration: Harmony's commercial portfolio is heavily reliant on WAKIX, limiting immediate revenue diversification.

- Pipeline Dependency: Future revenue growth is contingent on the successful launch of pipeline assets, facing inherent development and regulatory risks.

- Market Access Challenges: New therapies must navigate complex regulatory pathways and achieve market acceptance to generate substantial new revenue streams.

Harmony Biosciences' significant revenue concentration on WAKIX is a primary weakness. In Q1 2024, WAKIX generated approximately 99% of the company's total net revenue, highlighting an extreme dependence on a single product. This concentration exposes Harmony to substantial risk; any negative development impacting WAKIX could severely affect its financial health.

The company's operating expenses saw a notable increase of 29% in Q1 2025 compared to the prior year, driven by R&D investments and acquisition costs. This rise in expenditures could pressure profit margins if revenue growth does not keep pace.

Harmony's pipeline faces inherent clinical trial uncertainties, with an industry average Phase 3 trial failure rate around 30% in 2024. Failures in key trials, such as for ZYN002 or EPX-100, could lead to significant financial setbacks and delayed market entry.

| Weakness | Description | Impact | Supporting Data |

| Revenue Concentration | Heavy reliance on WAKIX for revenue generation. | High risk from product-specific challenges. | WAKIX accounted for ~99% of Q1 2024 net revenue. |

| Increasing Operating Expenses | Significant rise in R&D and acquisition-related costs. | Potential pressure on profit margins. | Operating expenses up 29% in Q1 2025 vs. Q1 2024. |

| Pipeline Development Risk | Susceptibility of clinical trials to failure. | Financial setbacks and delayed market entry. | Industry average Phase 3 trial failure rate ~30% (2024). |

Full Version Awaits

Harmony SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at Harmony's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It's designed to provide actionable insights for Harmony's growth.

Opportunities

Harmony Biosciences is well-positioned to explore new therapeutic avenues with its promising pipeline. Advancing programs like ZYN002 for Fragile X syndrome and EPX-100 for rare epilepsies such as Dravet and Lennox-Gastaut syndromes presents a significant opportunity to address unmet medical needs and tap into new markets. These potential first-in-class treatments could significantly expand Harmony's revenue base and patient impact.

Harmony is strategically expanding its WAKIX franchise by targeting new indications like idiopathic hypersomnia. This move is crucial for broadening the drug's reach and addressing a wider patient population within the sleep-wake disorder market.

The development of next-generation formulations, including Pitolisant HD and a gastro-resistant (GR) version, is also a key opportunity. These advancements are designed to improve patient convenience and potentially enhance efficacy, further solidifying WAKIX's market position.

These expansion efforts are projected to extend the pitolisant franchise's market exclusivity and patent protection well into the 2040s. This long-term vision underscores Harmony's commitment to maximizing the value of its core assets and ensuring sustained revenue streams.

Harmony's development of BP1.15205, an orexin-2 receptor agonist, represents a significant opportunity. This novel approach targets narcolepsy and other sleep disorders by mimicking the natural wakefulness-promoting effects of orexin. The preclinical data showcasing high potency and selectivity suggest it could become a leading treatment in its class.

Successful advancement of BP1.15205 through clinical trials and regulatory approval could unlock substantial market potential. The global narcolepsy market was valued at approximately $2.5 billion in 2023 and is projected to grow, offering a lucrative avenue for Harmony. A best-in-class therapy would provide a strong competitive edge and a new, significant revenue stream.

Strategic Acquisitions and Partnerships

Harmony's proactive approach to strategic acquisitions, exemplified by its 2021 purchase of Zynerba Pharmaceuticals for approximately $1.1 billion and the earlier acquisition of Epygenix Therapeutics, significantly bolsters its pipeline. This strategy allows for swift integration of innovative compounds, particularly in the rare neurological disease space.

By continuing to pursue and successfully integrate promising assets, whether through outright acquisition or strategic partnerships, Harmony can accelerate its growth trajectory. This diversification of its asset base not only strengthens its market position but also effectively mitigates inherent risks within the biopharmaceutical sector.

- Accelerated Pipeline Expansion: Acquisitions like Zynerba Pharmaceuticals (completed 2021) brought in novel cannabinoid receptor agonists, enhancing Harmony's rare neurological disease portfolio.

- Access to Innovation: The Epygenix Therapeutics acquisition provided access to novel gene therapies, diversifying Harmony's therapeutic modalities.

- Market Position Enhancement: Strategic M&A activity strengthens Harmony's competitive standing and market share in its target therapeutic areas.

Addressing Large Unmet Patient Populations

Harmony Biosciences is strategically positioned to address significant unmet patient needs, particularly in rare disease areas. For instance, narcolepsy affects an estimated 80,000 individuals in the U.S., and Fragile X syndrome impacts a similar number.

By developing and commercializing therapies for these underserved groups, Harmony has a substantial market opportunity. The company's focus on conditions with limited existing treatment options allows for a significant positive impact on patient lives.

- Narcolepsy Patient Population (U.S.): Approximately 80,000 diagnosed individuals.

- Fragile X Syndrome Patient Population: Estimated at 80,000 individuals.

- Market Opportunity: High potential due to limited existing treatment alternatives.

- Patient Impact: Significant opportunity to improve quality of life for affected individuals.

Harmony's pipeline expansion through strategic acquisitions, such as the 2021 purchase of Zynerba Pharmaceuticals for approximately $1.1 billion, provides access to innovative therapies for rare neurological disorders.

The company is also focused on developing next-generation formulations of WAKIX, like Pitolisant HD and a gastro-resistant version, to enhance patient convenience and market position.

Harmony's development of BP1.15205, an orexin-2 receptor agonist, targets the narcolepsy market, estimated at $2.5 billion in 2023, offering a significant growth opportunity.

By addressing underserved patient populations, like those with narcolepsy (approx. 80,000 in the U.S.) and Fragile X syndrome (approx. 80,000), Harmony can make a substantial impact and capture market share.

| Opportunity Area | Key Initiative | Market Potential/Data Point | Strategic Benefit |

|---|---|---|---|

| Pipeline Expansion | Acquisition of Zynerba Pharmaceuticals | Access to novel cannabinoid receptor agonists. | Enhances rare neurological disease portfolio. |

| WAKIX Franchise Growth | Next-generation formulations (Pitolisant HD, GR version) | Improved patient convenience and potential efficacy. | Solidifies market position and extends exclusivity into the 2040s. |

| New Product Development | BP1.15205 (Orexin-2 receptor agonist) | Narcolepsy market valued at ~$2.5 billion (2023). | Potential best-in-class therapy, new revenue stream. |

| Market Penetration | Addressing underserved rare diseases | Narcolepsy: ~80,000 U.S. patients; Fragile X: ~80,000 U.S. patients. | Significant unmet need, positive patient impact. |

Threats

The narcolepsy drug market already features established players offering sodium oxybate and central nervous system stimulants, creating a competitive landscape for Harmony. This existing competition means new entrants must overcome established brand loyalty and distribution channels.

The potential for new competitors to enter the market, or for existing rivals to develop superior treatments, poses a significant threat. For instance, if a competitor develops a therapy with a more convenient dosing schedule or fewer side effects than WAKIX, it could shift patient and physician preferences, potentially impacting WAKIX's market share.

Harmony faces a significant long-term threat with the market entry of generic WAKIX versions starting January 2030, despite robust patent protections. A recent settlement agreement has paved the way for this competition, directly impacting Harmony's main revenue stream.

The company's strategic imperative is to successfully transition patients to newer formulations or introduce novel products before the loss of WAKIX exclusivity. This proactive approach is crucial for mitigating potential revenue decline and maintaining market position.

The pharmaceutical industry faces significant risks from regulatory delays and approval uncertainties. Harmony, like its peers, must navigate complex and evolving regulatory landscapes, where New Drug Applications (NDAs) or Supplemental NDAs (sNDAs) can encounter unexpected setbacks. These hurdles can push back timelines and inflate development expenses.

A clear example of this threat is the recent Refusal to File for pitolisant in idiopathic hypersomnia. This event highlights the inherent unpredictability in the drug approval process, potentially impacting Harmony's ability to bring promising pipeline candidates to market efficiently and on schedule, thereby affecting revenue projections and investor confidence.

Clinical Trial Failures and Unfavorable Data

Harmony's extensive pipeline, particularly its reliance on Phase 3 trials for key assets like its Alzheimer's drug candidates, presents a significant threat. A failure in these pivotal studies, or the emergence of adverse safety or efficacy data, could derail its growth trajectory.

Such clinical trial setbacks can result in substantial write-offs of R&D expenditures. For instance, if a late-stage trial for a drug with projected peak sales of over $1 billion fails, the sunk costs could be hundreds of millions of dollars. This directly impacts profitability and diverts resources from other promising projects.

- Clinical Trial Risk: Failure in Phase 3 trials for key pipeline assets, such as those targeting Alzheimer's or other neurological conditions, poses a direct threat to Harmony's future revenue streams.

- Financial Impact of Failure: A single pivotal trial failure could lead to the discontinuation of a program, resulting in the loss of significant R&D investments, potentially hundreds of millions of dollars, impacting overall financial health.

- Investor Confidence: Unfavorable clinical data or trial failures can erode investor confidence, leading to a decline in Harmony's stock price and making it more challenging to secure future funding for development.

Evolving Competitive Landscape and New Therapeutic Modalities

The biopharmaceutical sector is constantly evolving, with new therapeutic approaches emerging regularly. Competitors could develop more effective orexin agonists or other treatments with faster timelines, potentially impacting Harmony's market position. For instance, as of early 2024, the global sleep disorder market, where orexin agonists play a role, was projected to reach over $20 billion, indicating significant growth and potential for new entrants.

This dynamic environment means that while Harmony may hold a strong position, the threat of disruptive innovation is ever-present. Companies might introduce treatments with improved efficacy, safety profiles, or more convenient administration methods, directly challenging existing therapies. The pace of research and development in areas like gene therapy and personalized medicine could also introduce entirely new competitive dynamics.

- Emergence of Superior Orexin Agonists: Competitors could develop next-generation orexin agonists with enhanced potency or better patient tolerability, potentially displacing Harmony's current offerings.

- Advancements in Alternative Sleep Therapies: Breakthroughs in non-pharmacological or novel pharmacological treatments for sleep disorders could reduce the reliance on orexin receptor modulators.

- Accelerated Development Timelines: Rivals with more efficient R&D processes might bring competing therapies to market significantly faster than Harmony, capturing market share before Harmony can fully establish its presence.

Harmony faces the significant threat of generic competition for WAKIX starting in January 2030, a direct consequence of patent expirations and recent settlement agreements. This looming generic entry directly targets Harmony's primary revenue source, necessitating a strategic pivot to new products or formulations before exclusivity ends. Furthermore, the biopharmaceutical landscape is characterized by rapid innovation; competitors could introduce superior orexin agonists or alternative sleep disorder treatments, potentially eroding WAKIX's market share. The company's reliance on late-stage clinical trials, particularly for its Alzheimer's pipeline, also presents a substantial risk, as trial failures could lead to significant R&D write-offs and damage investor confidence.

| Threat Category | Specific Risk | Potential Impact | Timeline/Context |

|---|---|---|---|

| Competition | Generic WAKIX entry | Significant revenue decline for WAKIX | Starting January 2030 |

| Competition | Development of superior orexin agonists or alternative therapies | Loss of market share and reduced demand for WAKIX | Ongoing, with market growth projected to exceed $20 billion by early 2024 |

| Regulatory | Delays or failures in New Drug Applications (NDAs) or Supplemental NDAs (sNDAs) | Delayed market entry, increased development costs, and potential pipeline abandonment | Ongoing, exemplified by the Refusal to File for pitolisant in idiopathic hypersomnia |

| Clinical Development | Failure in late-stage (Phase 3) clinical trials for key pipeline assets (e.g., Alzheimer's drugs) | Substantial R&D write-offs (potentially hundreds of millions of dollars), erosion of investor confidence, and stalled growth | Ongoing, particularly relevant for assets in Phase 3 trials |

SWOT Analysis Data Sources

This Harmony SWOT analysis is built upon a robust foundation of data, incorporating verified financial reports, comprehensive market intelligence, and insightful expert commentary to ensure accuracy and strategic relevance.