Harmony Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harmony Bundle

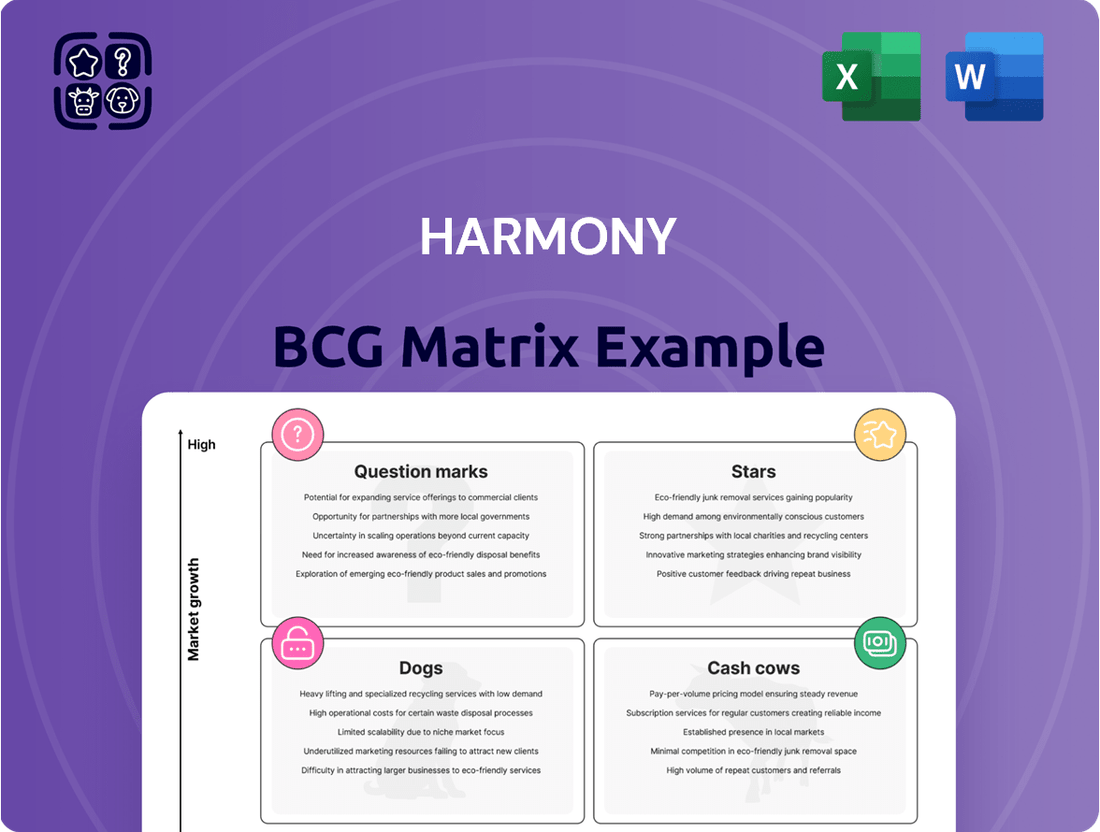

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing each product into Stars, Cash Cows, Dogs, or Question Marks based on market growth and market share. Understanding these placements is crucial for effective resource allocation and strategic decision-making.

This preview offers a glimpse into how your products might be positioned, but for a truly actionable strategy, you need the full picture. Purchase the complete BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap to optimize your product investments and drive future growth.

Stars

WAKIX, approved in June 2024 for pediatric narcolepsy, represents a significant growth opportunity for Harmony Biosciences. This expansion into a new patient demographic, with a commercial launch in July 2024, positions WAKIX for a strong market share in the pediatric EDS segment. The drug's efficacy in this younger population underscores its potential as a leading therapy.

Harmony is developing Pitolisant-HD, a next-generation high-dose formulation for narcolepsy, with Phase 3 trials slated for Q4 2025. This advanced treatment targets significant unmet needs, aiming for enhanced efficacy in both excessive daytime sleepiness and cataplexy.

With preliminary intellectual property extending to 2044, Pitolisant-HD represents a strategic move to solidify long-term market leadership and growth. The company projects a PDUFA date in 2028, underscoring its potential to become a key player in the narcolepsy therapeutic landscape.

BP1.15205, an orexin-2 receptor agonist from Harmony Biosciences, is positioned as a potential Star in the Harmony BCG Matrix. Preclinical data from SLEEP 2025 showed impressive wake-promoting and cataplexy-suppressing effects in a mouse model of narcolepsy. This novel OX2R agonism mechanism targets a high-growth market segment for narcolepsy and other potential indications.

The rapid progression of BP1.15205 is underscored by a planned first-in-human study in Q3 2025. This suggests a strong market opportunity with significant growth potential, aligning with the characteristics of a Star in the BCG framework, which requires substantial investment to maintain its growth trajectory.

Expansion into Idiopathic Hypersomnia (Pitolisant-HD)

Harmony is strategically positioning its pitolisant franchise for significant growth by targeting Idiopathic Hypersomnia (IH). Despite an initial Refusal to File (RTF) for its sNDA in February 2025, the company is moving forward with a Phase 3 registrational trial for Pitolisant-HD in IH, slated to begin in Q4 2025. This expansion into another major sleep disorder market is viewed as a critical driver for future revenue.

The potential market for pitolisant in IH is substantial, offering a high-growth avenue for the company. With a projected PDUFA date in 2028 and patent protection extending well into the 2040s, this initiative represents a long-term value creation opportunity. Harmony's focus on this indication underscores its commitment to broadening the therapeutic applications of pitolisant.

- Expansion into Idiopathic Hypersomnia (IH): Harmony is pursuing a Phase 3 registrational trial for Pitolisant-HD in IH, commencing Q4 2025.

- Market Opportunity: IH represents a significant sleep disorder market, offering substantial growth potential for the pitolisant franchise.

- Timeline and Protection: The company anticipates a PDUFA date in 2028, with patent protection extending into the 2040s.

- Strategic Importance: This development is considered a key catalyst for Harmony's future revenue growth.

Strategic Pipeline Expansion

Harmony Biosciences is actively pursuing strategic pipeline expansion, aiming for at least one new product or indication approval each year through 2028. This ambitious plan includes anticipating up to six Phase 3 clinical development programs by the close of 2025.

This robust development across various neurological conditions is designed to secure sustained high growth and establish market leadership in rare neurological diseases. The company's current pipeline holds the potential to generate over $3 billion in net revenue, indicating a substantial future market share in developing therapeutic areas.

- Pipeline Growth Target: At least one new product or indication approval annually through 2028.

- Phase 3 Programs: Anticipating up to six by year-end 2025.

- Market Focus: Rare neurological diseases.

- Revenue Potential: Over $3 billion in net revenue from the current pipeline.

BP1.15205, an orexin-2 receptor agonist, is positioned as a Star due to its strong preclinical data and planned first-in-human study in Q3 2025. This drug targets a high-growth segment within the narcolepsy market, requiring significant investment to sustain its trajectory.

The pitolisant franchise's expansion into Idiopathic Hypersomnia (IH) also marks it as a Star. Despite an initial setback with an sNDA in February 2025, the Phase 3 trial for Pitolisant-HD in IH, starting Q4 2025, targets a substantial market with considerable growth potential.

Harmony's overall strategy to achieve at least one new product or indication approval annually through 2028, with up to six Phase 3 programs by the end of 2025, reinforces its focus on high-growth areas in rare neurological diseases. The pipeline's potential to generate over $3 billion in net revenue underscores these Star classifications.

| Product/Indication | BCG Classification | Key Development Milestone | Market Potential |

| BP1.15205 (OX2R Agonist) | Star | First-in-human study Q3 2025 | High-growth narcolepsy segment |

| Pitolisant-HD (IH Indication) | Star | Phase 3 trial Q4 2025 | Substantial sleep disorder market |

| WAKIX (Pediatric Narcolepsy) | Question Mark/Cash Cow (potential) | Commercial launch July 2024 | Growing pediatric EDS segment |

What is included in the product

The Harmony BCG Matrix offers a strategic overview of a company's portfolio, categorizing units by market share and growth to guide investment decisions.

Visualize your portfolio's health with a clear, actionable BCG Matrix, simplifying complex strategic decisions.

Cash Cows

WAKIX, Harmony Biosciences' leading treatment for narcolepsy, is a prime example of a cash cow within their portfolio. Its approval for both excessive daytime sleepiness and cataplexy in adults has driven significant and steady revenue streams.

For the entirety of 2024, Harmony Biosciences reported $714.7 million in net product revenues, marking a solid 23% growth compared to the previous year. The company anticipates 2025 net revenues to range between $820 million and $860 million, indicating a clear path towards a billion-dollar market opportunity solely within narcolepsy.

This established market position, coupled with its robust cash generation capabilities, firmly places WAKIX in the cash cow category, even within a relatively mature market segment.

Harmony Biosciences exhibits exceptional financial strength, marked by four consecutive years of profitability. As of the first quarter of 2025, its cash and investments surpassed $600 million, a testament to its sound financial footing.

The company's 2024 GAAP net income reached $145.5 million, an increase from $128.9 million in 2023. Furthermore, its non-GAAP adjusted net income stood at $233.9 million, underscoring robust cash generation capabilities.

This financial resilience, primarily fueled by the strong performance of WAKIX, empowers Harmony Biosciences to independently finance its pipeline development. It clearly illustrates the company's capacity to capitalize on its established product.

Harmony's established commercial infrastructure, which reaches approximately 9,000 healthcare professionals, underscores WAKIX's broad clinical utility and consistent demand in the narcolepsy market. This extensive network requires minimal additional investment for promotion, making it a highly efficient cash generator.

The significant number of patients on WAKIX, estimated at around 7,100 by the close of 2024, highlights its strong market penetration and reliability as a steady revenue source for Harmony.

Intellectual Property Protection for WAKIX

Harmony's intellectual property protection for WAKIX is a key factor in its Cash Cow status within the BCG matrix. The company secured a favorable settlement in its initial Abbreviated New Drug Application (ANDA) litigation, which includes a generic license provision starting in January 2030, or potentially sooner under specified conditions. This strategic move effectively prolongs WAKIX's market exclusivity and its ability to generate consistent revenue.

Further bolstering WAKIX's protected market position, Harmony is actively pursuing pediatric exclusivity. If awarded, this would grant an additional six months of regulatory exclusivity, extending the period during which WAKIX can operate without direct generic competition. These combined efforts are designed to maximize the product's cash-generating potential for an extended duration.

- Intellectual Property Defense: Favorable settlement in first ANDA litigation.

- Generic License: Granted starting January 2030 or earlier under certain conditions.

- Pediatric Exclusivity: On track to obtain, potentially adding six months of regulatory exclusivity.

- Cash Flow Security: These protections extend WAKIX's product lifespan and secure its cash-generating ability.

Consistent Revenue Growth for Core Product

WAKIX, a prime example of a Cash Cow within the Harmony BCG Matrix, demonstrates exceptional and consistent revenue expansion. For the entirety of 2024, its net product revenue surged by 23% over the previous year. This robust performance continued into the first quarter of 2025, with a notable 20% growth compared to the same period in 2024.

This sustained growth, even within a well-established market, highlights WAKIX's commanding market position. Its ability to consistently generate substantial cash flow is a direct result of its enduring market acceptance and utility, fueled by ongoing organic demand.

- 23% Net product revenue growth for WAKIX in full-year 2024.

- 20% Net product revenue growth for WAKIX in Q1 2025 year-over-year.

- WAKIX maintains a dominant market share, ensuring reliable cash generation.

- Sustained organic demand confirms WAKIX's continued market relevance and value.

Cash cows are established products with high market share in low-growth markets, generating more cash than they consume. WAKIX, Harmony Biosciences' narcolepsy treatment, exemplifies this. Its 2024 net product revenue reached $714.7 million, a 23% increase year-over-year, and is projected to reach $820 million to $860 million in 2025.

Harmony Biosciences reported $145.5 million in GAAP net income for 2024, up from $128.9 million in 2023, and its cash and investments exceeded $600 million as of Q1 2025. This financial strength, driven by WAKIX, allows for pipeline financing and demonstrates the product's robust cash generation.

| Product | Market Share | Revenue Growth (2024) | Cash Generation |

|---|---|---|---|

| WAKIX | Dominant | 23% | High |

Full Transparency, Always

Harmony BCG Matrix

The comprehensive Harmony BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no hidden surprises – just the complete, professionally formatted strategic analysis ready for your immediate application. You're seeing the exact final product, meticulously crafted to provide clear insights into your business portfolio for effective decision-making.

Dogs

Pitolisant for pediatric cataplexy, as represented in the Harmony BCG Matrix, currently sits in the question mark quadrant. While WAKIX received FDA approval for excessive daytime sleepiness in pediatric narcolepsy, it faced a complete response for treating cataplexy in the 6 to <18 age group. This suggests a low market share and limited growth potential for this specific indication.

The initial FDA rejection for pediatric cataplexy implies that further substantial investment in this particular application might not deliver a strong return on investment. This strategic positioning highlights the need for careful consideration regarding future development and resource allocation for this specific therapeutic use.

Harmony's pipeline analysis, particularly concerning its early-stage programs, doesn't explicitly label specific projects as 'discontinued' or 'stalled' within publicly accessible data. However, within the framework of the BCG matrix, these would represent areas consuming valuable research and development (R&D) investment without clear progress or future revenue potential. Such stalled initiatives are a common challenge in the pharmaceutical industry, where high failure rates are inherent in drug discovery.

In 2024, the pharmaceutical sector continued to see significant R&D expenditure. For instance, major pharmaceutical companies often allocate billions annually to their R&D efforts, with a substantial portion directed towards early-stage discovery. Programs that fail to demonstrate sufficient efficacy or safety, or face insurmountable regulatory hurdles, are effectively stalled or discontinued, impacting the overall efficiency of R&D spending and potentially delaying the introduction of new revenue-generating products.

Harmony Biosciences, like many biopharmaceutical companies, likely has explored or continues to explore therapies with limited market opportunities, often referred to as "dogs" in the context of the BCG matrix. These are typically internal projects that are deprioritized due to a very small patient population or limited commercial viability, not always explicitly detailed in public updates. For instance, a therapy targeting an ultra-rare genetic disorder with only a few hundred diagnosed patients globally would fall into this category, even if the unmet medical need is significant.

The company's strategic focus on rare neurological diseases, while addressing critical unmet needs, inherently carries the risk of encountering indications with very small target markets. Developing and seeking regulatory approval for any therapy is a costly endeavor, and if the potential patient base is exceedingly small, the return on investment may not justify the expenditure. Harmony's pipeline decisions would weigh these factors, likely leading to the internal shelving of projects with exceptionally narrow commercial potential.

Products Facing Generic Competition Imminently

WAKIX, despite recent patent defense successes, faces an imminent threat from generic competition. A settlement with Novugen Pharma permits a generic version to enter the market as early as January 2030. This looming competition positions WAKIX as a potential 'Dog' within Harmony's product portfolio if new, innovative products aren't strategically developed to compensate for the anticipated revenue decline.

The projected erosion of WAKIX's market share signifies a low-growth future for this particular revenue stream. For instance, if WAKIX currently represents 15% of Harmony's total revenue, and generic entry is expected to capture 50% of that market within two years, it could translate to a significant drop in overall company performance.

- WAKIX Patent Settlement: Allows generic entry from January 2030.

- Market Share Erosion: Anticipated decline due to generic competition.

- Low-Growth Prospect: WAKIX revenue stream expected to stagnate or decrease.

- Strategic Imperative: Need for new, differentiated products to offset WAKIX decline.

Investments in Unsuccessful Acquisitions

Investments in unsuccessful acquisitions, often referred to as 'Dogs' in a BCG-like framework, represent areas where Harmony Biosciences may have deployed capital into companies or assets that failed to deliver anticipated returns. These could stem from pipeline candidates faltering in clinical trials or the acquired entity not integrating effectively, tying up resources with minimal to no positive outcome.

Such underperforming assets would necessitate strategic decisions, potentially including divestiture or write-offs, to reallocate capital towards more promising ventures. While specific instances of Harmony Biosciences' unsuccessful acquisitions are not detailed in the provided information, this category highlights a general risk inherent in the biotech sector's pursuit of growth through M&A.

- Pipeline Failures: Acquired companies whose lead drug candidates fail in Phase 2 or Phase 3 trials, as seen in the broader biotech industry where approximately 90% of drugs entering clinical trials do not reach market approval.

- Integration Challenges: Acquisitions that struggle with operational or cultural integration, leading to reduced synergies and failure to meet projected financial targets.

- Market Misjudgment: Investing in companies whose underlying technology or market niche proves less viable than initially assessed, resulting in diminished asset value.

Dogs in the Harmony BCG Matrix represent products or ventures with low market share and low growth potential. These often consume resources without generating significant returns, requiring careful management or divestment. For Harmony Biosciences, potential 'dogs' could include early-stage pipeline projects with limited commercial viability or legacy products facing intense competition.

The strategic implication of 'dogs' is the need to minimize investment and potentially exit these areas to reallocate capital to more promising opportunities. Identifying and managing these 'dogs' is crucial for optimizing the overall portfolio and ensuring sustainable growth.

Harmony's WAKIX, while currently a strong performer, faces future challenges from generic competition starting in 2030. This looming patent cliff, allowing generic entry as early as January 2030, positions WAKIX as a potential 'dog' if its revenue stream significantly declines without new product contributions.

Investing in acquisitions that fail to deliver expected returns also falls into the 'dog' category. These underperforming assets tie up capital and require strategic decisions, such as divestiture, to free up resources for more impactful ventures.

| Category | Description | Harmony Biosciences Example | Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low growth potential | Potential future WAKIX (post-generic entry), unsuccessful acquisitions | Minimize investment, divest, or manage for cash flow |

| WAKIX Future | Market share erosion post-2030 | Expected decline due to generic competition | Need for new products to offset revenue loss |

| Acquisition Risk | Underperforming assets | Acquired companies failing in trials or integration | Capital reallocation, potential write-offs |

Question Marks

ZYN002, a cannabidiol gel, is currently in a pivotal Phase 3 trial for Fragile X Syndrome (FXS), with results anticipated in Q3 2025. This positions it as a potential first-ever treatment for FXS, a condition impacting approximately 80,000 individuals in the United States.

Given the absence of any approved therapies for FXS, this represents a significant, high-growth market opportunity. However, Harmony currently holds a minimal market share in this unmet need, classifying ZYN002 as a classic question mark within the BCG Matrix framework.

EPX-100, a novel serotonin agonist, is currently undergoing pivotal trials for rare and severe epilepsy conditions, Dravet Syndrome (DS) and Lennox-Gastaut Syndrome (LGS). The ARGUS trial for DS is a registrational study with topline data anticipated in 2026. For LGS, a Phase 3 trial commenced in the fourth quarter of 2024.

These indications represent significant growth opportunities due to high unmet medical needs, positioning EPX-100 as a potential high-reward asset. However, Harmony currently holds no market share in these specialized epilepsy markets, making these development programs inherently high-risk, high-reward ventures demanding substantial investment.

Harmony's TEMPO study, launched in April 2024, positions pitolisant for Prader-Willi Syndrome (PWS) as a significant 'Question Mark' in the BCG matrix. This Phase 3 trial is crucial for demonstrating efficacy in addressing excessive daytime sleepiness (EDS) and behavioral issues common in PWS.

The PWS market, affecting an estimated 15,000-20,000 individuals in the U.S., currently lacks any FDA-approved treatments for EDS. This unmet medical need highlights a high-growth, underserved market, making pitolisant's development a strategic investment decision.

Pitolisant Gastro-Resistant (GR) Formulation

Harmony is positioning its pitolisant gastro-resistant (GR) formulation as a Question Mark within the BCG Matrix. This strategic move acknowledges its potential for significant market growth, contingent on successful development and market penetration. The company initiated a pivotal bioequivalence study in Q1 2025, with results expected in Q3 2025, which will be crucial in determining its future trajectory.

The pitolisant GR formulation is designed to extend the lifecycle of the existing pitolisant franchise, potentially securing patent protection until 2044 and targeting a PDUFA date in 2026. This innovation aims to capture new market share by offering an improved drug delivery profile, differentiating it from current offerings.

- High Growth Potential: The GR formulation aims to capture new market share by offering an improved delivery profile.

- Strategic Importance: It's intended to extend the pitolisant franchise, leveraging existing knowledge.

- Development Milestones: A pivotal bioequivalence study began in Q1 2025, with results due in Q3 2025.

- Market Outlook: Potential PDUFA date in 2026 and patent protection until 2044 indicate long-term market value.

New Indications for Pitolisant Beyond Narcolepsy/IH

Harmony Biosciences is actively investigating pitolisant for new uses beyond its current approvals for narcolepsy and idiopathic hypersomnia. This strategic move aligns with their objective to capture new market segments with significant unmet needs.

A key area of exploration is Myotonic Dystrophy Type 1 (DM1) with excessive daytime sleepiness (EDS). A Phase 2 signal detection study for this indication was anticipated to yield its full dataset in early 2024. This program, like others in their pipeline, represents a high-growth potential opportunity.

- New Indications: Harmony Biosciences is researching pitolisant for conditions beyond narcolepsy and IH.

- DM1 with EDS: A Phase 2 study in Myotonic Dystrophy Type 1 with EDS was expected to release its full data in early 2024.

- High-Growth Potential: These exploratory programs target areas with substantial unmet medical needs, offering significant growth prospects.

- BCG Matrix Classification: Due to the inherent uncertainties in success and market penetration, these new indications are categorized as 'question marks' requiring continued investment and thorough evaluation.

Question Marks in Harmony's portfolio represent potential high-growth opportunities with currently low market share. These assets demand significant investment to move towards market leadership. Successful development and commercialization could lead to substantial returns, but the inherent risks mean they could also fail to gain traction.

Harmony's pipeline features several Question Marks, including ZYN002 for Fragile X Syndrome and EPX-100 for rare epilepsies. Pitolisant's expansion into Prader-Willi Syndrome and Myotonic Dystrophy Type 1, along with the pitolisant GR formulation, also fall into this category. These programs are in crucial development stages, with upcoming data readouts expected to clarify their market potential.

The company's strategy involves carefully nurturing these Question Marks, providing the necessary resources for clinical trials and regulatory approvals. The goal is to transform these nascent assets into future stars, capitalizing on unmet medical needs and limited competition in their respective therapeutic areas. The success of these ventures is critical for Harmony's long-term growth trajectory.

| Asset | Indication | Stage | Estimated Market Size (US) | Harmony Market Share | BCG Category |

| ZYN002 | Fragile X Syndrome | Phase 3 | ~80,000 individuals | Minimal | Question Mark |

| EPX-100 | Dravet Syndrome / LGS | Pivotal Trials | Rare, severe epilepsy | None | Question Mark |

| Pitolisant | Prader-Willi Syndrome | Phase 3 | 15,000-20,000 individuals | None | Question Mark |

| Pitolisant GR | Lifecycle Extension | Pivotal Bioequivalence Study | Expansion of existing franchise | None | Question Mark |

| Pitolisant | Myotonic Dystrophy Type 1 (EDS) | Phase 2 | Unspecified | None | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, integrating financial performance, industry analysis, and competitive intelligence to provide actionable strategic insights.