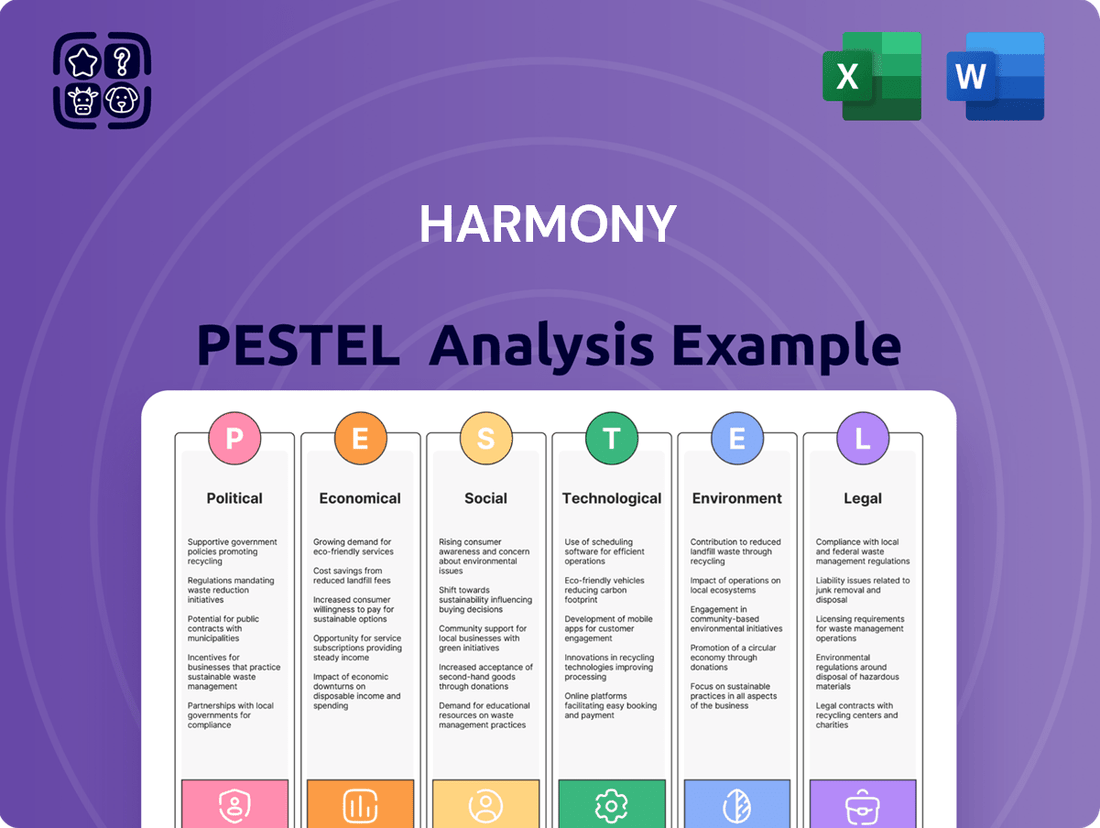

Harmony PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harmony Bundle

Unlock the strategic landscape surrounding Harmony with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its trajectory. This expertly crafted report provides actionable insights to inform your investment decisions and competitive strategy. Download the full version now and gain a critical advantage.

Political factors

Harmony Biosciences' focus on rare neurological diseases positions it to benefit from government incentives designed to encourage orphan drug development. These incentives, including tax credits for clinical trials and market exclusivity, are vital for recouping substantial R&D investments and fostering innovation in underserved therapeutic areas. For instance, the Orphan Drug Act of 1983 has historically driven significant investment in rare disease treatments.

However, potential policy shifts, such as those seen with the Inflation Reduction Act of 2022, introduce a layer of uncertainty. Provisions within this act, particularly those concerning drug price negotiation, could impact the profitability of drugs with multiple indications, potentially affecting the financial calculus for companies like Harmony Biosciences. The Congressional Budget Office projected that Medicare drug price negotiation could save the government $100 billion over a decade, illustrating the scale of potential financial shifts.

Government healthcare policies and reimbursement structures are pivotal for Harmony Biosciences. Favorable policies ensuring broad coverage and adequate reimbursement for rare disease treatments, like those for narcolepsy treated by WAKIX, are crucial for continued commercial success. For instance, the Centers for Medicare & Medicaid Services (CMS) reimbursement rates in 2024 significantly impact drug pricing and patient access.

The speed and predictability of FDA approval processes are paramount for Harmony's drug pipeline. For instance, the FDA's Orphan Drug Designation, which grants market exclusivity and fee waivers, is a key driver for rare disease therapies. In 2023, the FDA approved over 50 novel drugs, showcasing a dynamic but sometimes unpredictable review environment.

Harmony's strategic reliance on expedited pathways, such as Fast Track, Breakthrough Therapy, and Accelerated Approval, is crucial for its rare disease portfolio. These designations can significantly shorten review times, potentially bringing life-saving treatments to patients sooner. For example, a Breakthrough Therapy designation can lead to a rolling review, allowing submissions to be reviewed as they are completed, rather than waiting for the entire application to be filed.

Any alterations in the FDA's regulatory stance or unforeseen delays in review timelines pose a substantial risk to Harmony's projected market entry and the commercial success of its innovative therapies. For example, a shift towards more stringent data requirements for accelerated approvals could necessitate additional clinical trials, impacting timelines and increasing development costs.

Global Trade and Pharmaceutical Regulations

Global trade dynamics, including agreements like the USMCA and evolving trade relationships with China, directly impact Harmony's international expansion. Varying pharmaceutical regulations across key markets, such as the EU's EMA and Japan's PMDA, present challenges and opportunities for market access and global commercialization strategies.

The harmonization or divergence of intellectual property protection and drug pricing policies significantly influences Harmony's international revenue streams. For instance, the average price of a new drug in the US was approximately $250,000 in 2024, a stark contrast to pricing in many European nations, affecting Harmony's global pricing strategies and market penetration outside the US.

- Trade Agreements: The ongoing evolution of international trade agreements can alter tariffs and market access conditions for Harmony's products.

- Regulatory Divergence: Differences in clinical trial data acceptance and marketing authorization processes across countries can delay product launches.

- Intellectual Property: Stronger IP protection in some regions versus weaker enforcement in others impacts Harmony's ability to secure and monetize its innovations.

- Pricing Policies: Government-imposed price controls or reimbursement negotiations in various countries directly affect the profitability of Harmony's pharmaceutical offerings.

Political Stability and Geopolitical Events

Political stability in Harmony Biosciences' key operating regions, such as the United States and Europe, is crucial. For instance, the U.S. has maintained a relatively stable political environment, supporting consistent regulatory frameworks for biotech innovation. However, geopolitical tensions, like those impacting global trade, could disrupt Harmony's supply chains, which in 2024 relied on components sourced from multiple international locations.

Trade disputes or the imposition of sanctions on countries where Harmony might seek market access or research partnerships present tangible risks. For example, ongoing trade friction between major economic blocs could lead to increased tariffs on imported raw materials or finished products, directly affecting Harmony's cost of goods sold. Such events can also hinder international scientific collaborations vital for cutting-edge research.

Harmony Biosciences' strategy to mitigate these political risks includes building resilient supply chains and diversifying its operational footprint. By not relying on a single region for critical manufacturing or research, the company can better withstand localized political instability or trade disruptions. This diversification is essential as global political landscapes remain dynamic, with events like the 2024 elections in various nations potentially reshaping international relations and trade policies.

- U.S. Political Stability: Provided a generally predictable regulatory environment for biotechnology in 2024.

- Supply Chain Vulnerability: Geopolitical tensions in 2024 highlighted risks to Harmony's international sourcing of materials.

- Market Access Challenges: Trade disputes can restrict access to key international markets for Harmony's products.

- Diversification Strategy: Harmony's focus on operational diversification aims to buffer against political and geopolitical shocks.

Government incentives, such as the Orphan Drug Act, significantly support rare disease drug development, a core area for Harmony Biosciences. However, legislation like the Inflation Reduction Act of 2022, with its drug price negotiation provisions, introduces financial uncertainties. Favorable FDA approval processes and robust reimbursement policies from bodies like CMS are crucial for Harmony's commercial success, as evidenced by the FDA's approval of over 50 novel drugs in 2023.

What is included in the product

The Harmony PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the Harmony across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Harmony PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of overwhelming data and enabling focused strategic decision-making.

Economic factors

The economic health of the rare neurological disease treatment market is a critical driver for Harmony Biosciences. Market growth, projected to expand significantly, offers substantial revenue potential for the company's existing and pipeline therapies.

Analysts forecast the global rare neurological disease market to reach approximately $25 billion by 2028, exhibiting a compound annual growth rate (CAGR) of over 7% through 2025. This robust expansion is fueled by a rising incidence of these conditions, enhanced diagnostic capabilities, and the development of novel therapeutic approaches.

This upward trajectory in market size and growth provides a fertile ground for Harmony Biosciences to capitalize on unmet medical needs and solidify its position within the rare disease therapeutic landscape.

Global healthcare spending continues to rise, projected to reach $11.1 trillion by 2025, according to Deloitte. This upward trend, driven by an aging population and advancements in medical technology, puts increasing pressure on healthcare systems and patient affordability, particularly for high-cost treatments like those for rare diseases.

While WAKIX has shown robust sales performance, the economic climate and tightening healthcare budgets in key markets like the US and EU could impact pricing power and patient access programs. For instance, the average annual cost of specialty drugs in the US often exceeds $100,000, a figure that strains even well-funded systems.

Harmony Biosciences' commitment to Research and Development is a cornerstone of its economic strategy, fueling the expansion of its product pipeline and securing future revenue. This dedication is evident in the company's increased R&D expenditures, which reached $150 million in Q1 2025, signaling a strong focus on pioneering new therapeutic solutions.

The economic viability of these R&D initiatives hinges on the continued availability of capital and robust investor confidence. Harmony Biosciences secured an additional $300 million in funding in late 2024, specifically earmarked for advanced clinical trials and early-stage research, underscoring the market's belief in its innovation-driven growth model.

Competition and Market Share

The competitive environment for narcolepsy treatments significantly shapes Harmony Biosciences' market position. WAKIX has established a strong foothold, capturing a substantial portion of the narcolepsy market. For instance, in the first quarter of 2024, Harmony reported WAKIX net sales of $80.8 million, a 36% increase year-over-year, demonstrating robust growth and market penetration.

However, the potential introduction of new therapeutic options or increased competition could challenge Harmony's pricing power and future market share. The company's ability to maintain its competitive edge will depend on its ongoing innovation and strategic responses to market dynamics.

- WAKIX's market share in narcolepsy is a key indicator of Harmony's competitive strength.

- The company's financial performance is directly linked to its ability to navigate competitive pressures.

- Harmony's Q1 2024 net sales for WAKIX reached $80.8 million, reflecting a 36% year-over-year increase.

- Emerging therapies pose a potential threat to existing market dominance.

Global Economic Conditions and Inflation

Global economic conditions significantly influence Harmony's financial landscape. Inflation rates, for instance, directly impact operational costs and the purchasing power of consumer spending, a key driver for many businesses. As of early 2024, global inflation has shown signs of moderation in many advanced economies, though persistent pressures remain in certain sectors and regions. For example, the US Consumer Price Index (CPI) saw a year-over-year increase of 3.1% in January 2024, down from its peak but still above the Federal Reserve's 2% target.

Interest rates, closely tied to inflation, also play a crucial role. Central banks worldwide have been adjusting monetary policy, with many raising rates to combat inflation. The European Central Bank, for instance, maintained its key interest rates at 4.50% in February 2024, reflecting a cautious approach to economic growth amidst ongoing inflationary concerns. Higher interest rates can increase Harmony's borrowing costs and potentially dampen investment and consumer demand.

Currency fluctuations add another layer of complexity, particularly for companies with international operations. A strengthening domestic currency can make exports more expensive and reduce the value of foreign earnings when repatriated, while a weaker currency can have the opposite effect. The US Dollar Index (DXY), which measures the dollar against a basket of major currencies, has experienced volatility, trading around 104 in early 2024, influenced by differing economic outlooks and monetary policies across major economies.

- Inflationary Pressures: Global inflation, while easing from 2023 peaks, remains a concern, impacting consumer spending and operational costs. US CPI at 3.1% (Jan 2024) illustrates this ongoing trend.

- Monetary Policy Shifts: Central banks' interest rate decisions, such as the ECB's decision to hold rates at 4.50% (Feb 2024), directly affect borrowing costs and investment viability.

- Currency Volatility: Fluctuations in exchange rates, exemplified by the DXY around 104 (early 2024), create uncertainties for international revenue and the cost of imported goods.

- Economic Growth Outlook: Divergent economic growth prospects across regions can create both opportunities and risks for Harmony's market penetration and sales performance.

Economic factors are pivotal for Harmony Biosciences, influencing market demand, operational costs, and investment strategies. The increasing global healthcare expenditure, projected to hit $11.1 trillion by 2025, indicates a growing market for therapies, though high treatment costs for rare diseases present affordability challenges.

Harmony's R&D investment, reaching $150 million in Q1 2025, is crucial for pipeline expansion, supported by $300 million in funding secured in late 2024 to advance clinical trials. This financial backing highlights investor confidence in their innovation-driven growth model.

The company's strong performance in the narcolepsy market, with WAKIX sales up 36% year-over-year to $80.8 million in Q1 2024, demonstrates its competitive edge, though new entrants could impact market share and pricing power.

Global economic conditions like inflation (US CPI at 3.1% in Jan 2024) and interest rates (ECB at 4.50% in Feb 2024) directly affect Harmony's costs and investment climate. Currency fluctuations, with the DXY around 104 in early 2024, also add complexity to international operations.

Full Version Awaits

Harmony PESTLE Analysis

The preview shown here is the exact Harmony PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, the Harmony PESTLE Analysis, delivered exactly as shown, no surprises.

The content and structure of this Harmony PESTLE Analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

Patient awareness regarding rare neurological conditions is on the rise, directly impacting diagnosis rates. This heightened public and professional understanding of diseases like narcolepsy is crucial for companies like Harmony Biosciences, as it expands the potential patient pool for their treatments.

For instance, the diagnostic rate for narcolepsy has seen improvements, though challenges remain. In the US, it's estimated that up to 75% of individuals with narcolepsy remain undiagnosed or misdiagnosed, highlighting the significant opportunity for increased awareness to drive earlier detection and treatment initiation.

Patient advocacy and support groups are increasingly influential in shaping public perception and driving policy changes, particularly for rare neurological diseases. These organizations empower patients, facilitate access to treatments, and often serve as crucial partners for pharmaceutical companies. Harmony Biosciences' proactive engagement with these communities, perhaps through educational initiatives or research collaborations, can foster trust and enhance the perceived value of its products in a crowded market.

Enhancing the quality of life for individuals with severe neurological disorders is a crucial sociological consideration. Therapies that effectively manage symptoms, such as WAKIX for narcolepsy, directly improve patient well-being and their ability to participate more fully in society.

The economic impact of improved patient outcomes is substantial. For instance, in 2024, the productivity gains from individuals managing debilitating conditions could translate to billions in increased economic output, as they return to or remain in the workforce.

Healthcare Professional Education and Adoption

The willingness of healthcare professionals to embrace new treatments, particularly for less common conditions like rare neurological diseases, directly impacts Harmony's market penetration for WAKIX. Their understanding of these conditions is a cornerstone for successful commercialization.

Educational initiatives targeting prescribers are crucial for broadening WAKIX's clinical application and patient reach. For instance, in 2024, Harmony Biosciences reported a significant increase in WAKIX prescriptions, partly attributed to enhanced educational efforts aimed at neurologists and sleep specialists.

Key aspects influencing adoption include:

- Continuing Medical Education (CME) Programs: Harmony's investment in CME programs in 2024 aimed to deepen understanding of narcolepsy and other rare neurological disorders among physicians, fostering greater confidence in prescribing WAKIX.

- KOL Engagement: Collaborating with Key Opinion Leaders (KOLs) in neurology and sleep medicine helps disseminate clinical data and best practices, influencing peer adoption rates.

- Patient Advocacy Group Partnerships: Working with advocacy groups in 2024 raised awareness of rare neurological diseases, indirectly educating healthcare professionals on the unmet needs WAKIX addresses.

- Real-World Evidence Dissemination: Sharing real-world data on WAKIX's efficacy and safety from 2024 studies reinforces its value proposition to the medical community.

Demographic Trends and Disease Prevalence

Changes in how populations are structured, like more older people or different health issues becoming common, can really shape what people need from Harmony's treatments over time. For instance, as the global population ages, the demand for therapies addressing age-related conditions like Alzheimer's or cardiovascular diseases is expected to rise significantly. This demographic shift directly impacts the market potential for Harmony's product pipeline.

By keeping a close eye on these evolving trends, Harmony can make smarter decisions about where to focus its research and how to market its products. This proactive approach ensures the company is well-positioned to address the changing health needs of patients. For example, if data from 2024 indicates a surge in a particular chronic illness, Harmony might prioritize R&D in that therapeutic area.

- Aging Population Impact: The World Health Organization projects that by 2030, one in six people globally will be over 60, a demographic shift that will increase demand for treatments for chronic diseases.

- Shifting Disease Prevalence: In 2024, global health reports highlight a growing prevalence of non-communicable diseases like diabetes and certain cancers, requiring innovative therapeutic solutions.

- Market Responsiveness: Harmony's strategic planning for new drug development and commercialization in 2025 will need to account for these demographic and epidemiological shifts to ensure long-term market relevance and patient access.

Sociological factors significantly influence the market for neurological treatments by affecting patient awareness, advocacy, and the overall perception of quality of life improvements. Increased patient and physician education, as seen with narcolepsy, directly expands the addressable market. For instance, in 2024, improved diagnostic rates for narcolepsy, despite a significant portion of patients remaining undiagnosed, underscore the impact of awareness campaigns.

Patient advocacy groups play a vital role in shaping public opinion and driving policy, acting as crucial partners for companies like Harmony Biosciences. Their influence can lead to greater access to treatments and enhanced perceived value of products. Harmony's engagement with these groups, through initiatives in 2024, fostered trust and highlighted the unmet needs their therapies address.

The aging global population and shifting disease prevalence are critical demographic trends impacting healthcare demand. By 2030, one in six people worldwide will be over 60, increasing the need for treatments for chronic and age-related conditions. Harmony's strategic planning for 2025 must account for these shifts to ensure market relevance and patient access.

Technological factors

Breakthroughs in gene therapy, precision medicine, and the application of AI and machine learning are revolutionizing the rare neurological disease sector. These innovations are empowering companies like Harmony Biosciences to accelerate their drug discovery processes and create more precisely targeted and effective therapies.

Harmony's development of next-generation formulations, like Pitolisant HD, signifies a major technological leap. This innovation is designed to boost effectiveness and refine how the drug is absorbed and utilized by the body, potentially opening doors to new patient groups and extending the commercial viability of existing treatments.

Technological advancements in diagnostic tools and the identification of novel biomarkers are revolutionizing the early and precise detection of rare neurological diseases. For Harmony, this translates to a greater ability to identify potential patients who could benefit from their innovative therapies.

The global market for in-vitro diagnostics (IVD), which includes many advanced diagnostic tools, was valued at approximately $119.8 billion in 2023 and is projected to grow significantly. This expansion is driven by innovations in areas like genetic testing and liquid biopsies, which are crucial for identifying complex neurological conditions.

Telemedicine and Digital Health Solutions

The growing use of telemedicine and digital health is a significant technological factor. It's making healthcare more accessible, especially for those with rare neurological conditions who might live far from specialized centers. This trend directly impacts treatment adherence and can lead to better overall health results.

By 2024, the global digital health market was valued at over $300 billion, with telemedicine being a major driver. This expansion is projected to continue, offering new avenues for patient support and remote monitoring. For Harmony, this means potential for improved patient engagement and data collection.

- Increased Patient Access: Telemedicine bridges geographical gaps, connecting patients with specialists regardless of location.

- Improved Treatment Outcomes: Digital tools can enhance medication adherence and facilitate continuous health monitoring.

- Market Growth: The digital health sector is experiencing rapid expansion, presenting opportunities for innovative healthcare delivery models.

- Data-Driven Insights: Digital platforms generate valuable data that can inform treatment strategies and research.

Manufacturing and Supply Chain Innovations

Technological advancements are significantly reshaping pharmaceutical manufacturing and supply chains, promising greater efficiency and cost reductions. Innovations like continuous manufacturing and advanced process control systems are becoming more prevalent. For instance, the global pharmaceutical contract manufacturing market was valued at approximately $150 billion in 2023 and is projected to grow substantially, driven by these technological integrations.

Implementing these cutting-edge techniques enhances Harmony's operational resilience by streamlining production and improving quality control. The adoption of digital twins for process simulation and predictive maintenance, alongside AI-powered demand forecasting, can mitigate disruptions. By 2025, it's anticipated that over 60% of pharmaceutical manufacturers will have invested in advanced analytics for their supply chains to improve visibility and agility.

- Increased Efficiency: Automation and AI in manufacturing can reduce cycle times and labor costs.

- Cost Reduction: Optimized processes and reduced waste contribute to lower production expenses.

- Improved Quality: Advanced analytics and real-time monitoring enhance product consistency and safety.

- Supply Chain Resilience: Technologies like blockchain and IoT provide greater transparency and traceability, mitigating risks.

Technological factors are critical for Harmony Biosciences, influencing everything from drug discovery to patient access. Innovations in AI and gene therapy are accelerating the development of targeted treatments for rare neurological diseases. The company's focus on next-generation formulations, like Pitolisant HD, highlights a commitment to leveraging technology for enhanced drug efficacy and patient benefit.

Advancements in diagnostics, including genetic testing and liquid biopsies, are vital for identifying patients who can benefit from Harmony's therapies. The global in-vitro diagnostics market, valued at approximately $119.8 billion in 2023, continues to grow, driven by these precise detection methods. Furthermore, the expansion of telemedicine and digital health, with the global digital health market exceeding $300 billion in 2024, is improving healthcare accessibility and patient engagement for those with rare conditions.

Technological upgrades in pharmaceutical manufacturing, such as continuous manufacturing and advanced process control, are boosting efficiency and reducing costs. The pharmaceutical contract manufacturing market, worth around $150 billion in 2023, reflects this trend. By 2025, over 60% of pharmaceutical manufacturers are expected to adopt advanced analytics for supply chain improvements, enhancing Harmony's operational resilience and agility.

| Technological Area | Impact on Harmony Biosciences | Relevant Data/Projections |

| AI & Gene Therapy | Accelerated drug discovery and development of targeted therapies. | Revolutionizing rare neurological disease sector. |

| Next-Gen Formulations | Enhanced drug efficacy and absorption (e.g., Pitolisant HD). | Extends commercial viability and opens new patient groups. |

| Advanced Diagnostics | Improved early and precise detection of rare neurological diseases. | Global IVD market: ~$119.8 billion (2023), driven by genetic testing. |

| Digital Health & Telemedicine | Increased patient access, improved adherence, and remote monitoring. | Global digital health market: >$300 billion (2024), telemedicine a key driver. |

| Manufacturing & Supply Chain | Increased efficiency, cost reduction, and supply chain resilience. | Pharma contract manufacturing market: ~$150 billion (2023). 60%+ manufacturers investing in advanced supply chain analytics by 2025. |

Legal factors

Harmony Biosciences' success hinges on robust intellectual property and patent protection, especially for its narcolepsy treatment, WAKIX. The company actively defends its patents, as seen in the ongoing legal battles surrounding WAKIX's composition of matter patents. Maintaining exclusivity is paramount for revenue generation, with extensions like pediatric exclusivity playing a key role in securing market dominance.

Adherence to stringent regulatory requirements for drug approval by agencies like the FDA is paramount for pharmaceutical companies. In 2024, the FDA continued to streamline its review processes, aiming to expedite the availability of novel therapies while maintaining rigorous safety and efficacy standards.

Compliance with all phases of clinical trials, manufacturing standards, and post-market surveillance is legally mandated. For instance, the cost of bringing a new drug to market, including extensive clinical trials and regulatory submissions, can exceed $2 billion, underscoring the financial and legal implications of non-compliance.

The Orphan Drug Act of 1983 offers substantial incentives for pharmaceutical companies to develop treatments for rare diseases, which often have limited commercial appeal. Harmony Biosciences, as a developer of therapies for rare neurological conditions like narcolepsy, directly benefits from these incentives. For instance, the act grants seven years of market exclusivity for orphan drugs, preventing competitors from marketing similar treatments. Furthermore, it provides tax credits for a portion of clinical testing expenses, encouraging investment in these niche areas. In 2023, Harmony Biosciences reported that its drug, Wakix, which treats both narcolepsy and idiopathic hypersomnia, continued to drive revenue growth, underscoring the financial advantages of developing orphan drugs.

Product Liability and Litigation Risks

Harmony Biosciences, as a pharmaceutical entity, navigates significant product liability risks. These stem from potential issues concerning drug safety, efficacy, and unforeseen adverse events reported by patients. In 2023, the pharmaceutical industry saw a notable increase in litigation, with product liability claims remaining a substantial concern for companies, impacting financial reserves and market confidence.

To counter these inherent dangers, the company must maintain rigorous pharmacovigilance systems. This involves diligent monitoring of drug performance post-market and swift action in response to any safety signals. Legal preparedness is equally critical, ensuring the company is equipped to manage potential lawsuits and protect its financial stability and hard-earned reputation.

- Product Liability Claims: Pharmaceutical companies are consistently targets for product liability lawsuits, often related to alleged side effects or marketing misrepresentations.

- Litigation Costs: Defending against such claims can incur substantial legal fees and potential settlement payouts, directly affecting profitability.

- Regulatory Scrutiny: Adverse event reporting and regulatory compliance are paramount, as failures can exacerbate litigation risks and lead to fines.

- Reputational Damage: High-profile litigation can severely damage a company's brand image, impacting patient trust and physician prescribing habits.

Data Privacy and Cybersecurity Regulations

Harmony must navigate a complex web of data privacy and cybersecurity regulations. Compliance with laws like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is not just good practice, but a legal mandate for any organization handling sensitive patient information. These regulations dictate how data is collected, stored, processed, and protected, with significant penalties for non-compliance.

Failure to implement robust cybersecurity measures can lead to devastating data breaches. In 2023, the healthcare sector experienced a significant rise in cyberattacks, with reports indicating a substantial increase in ransomware incidents targeting patient records. Such breaches not only result in severe legal penalties, including hefty fines and potential lawsuits, but also inflict irreparable reputational damage and erode customer trust, impacting Harmony's ability to operate and grow.

- HIPAA fines can reach up to $1.5 million per violation category per year.

- GDPR violations can incur fines of up to €20 million or 4% of annual global turnover.

- The average cost of a data breach in the healthcare industry in 2023 was estimated to be $10.55 million.

- Cybersecurity investments are crucial to avoid legal liabilities and maintain operational continuity.

Legal frameworks significantly shape Harmony Biosciences' operations, particularly concerning intellectual property and regulatory compliance. The company's reliance on patents for WAKIX underscores the importance of legal protections against infringement. In 2024, the pharmaceutical landscape continued to emphasize patent enforcement and the strategic use of market exclusivity periods, such as those granted under the Orphan Drug Act, to safeguard revenue streams.

Navigating complex regulatory environments, including FDA approval processes and ongoing pharmacovigilance, is a critical legal obligation. Failures in these areas can lead to substantial penalties and litigation. The increasing trend of data privacy regulations, like HIPAA and GDPR, also imposes strict legal requirements on handling sensitive patient information, with significant financial repercussions for breaches.

| Legal Area | Key Compliance Aspect | Potential Financial Impact (2023/2024 Estimates) | Harmony Biosciences Relevance |

|---|---|---|---|

| Intellectual Property | Patent protection for WAKIX | Litigation costs for patent defense; lost revenue from infringement | Crucial for maintaining market exclusivity and revenue |

| Regulatory Compliance | FDA drug approval and post-market surveillance | Fines for non-compliance, market withdrawal risk | Essential for product lifecycle management |

| Data Privacy | HIPAA/GDPR adherence | Fines up to $1.5M (HIPAA) or 4% global turnover (GDPR); data breach costs ($10.55M avg. in healthcare 2023) | Mandatory for protecting patient data and reputation |

Environmental factors

The pharmaceutical sector, including companies like Harmony Biosciences, is under significant pressure to embrace sustainable manufacturing. This means actively working to cut down on waste, use less water and energy, and reduce the reliance on hazardous chemicals.

For instance, the global pharmaceutical manufacturing market's sustainability initiatives are gaining traction, with a projected compound annual growth rate (CAGR) of 7.5% from 2023 to 2030, driven by these environmental concerns. Harmony Biosciences, like its peers, is likely investing in greener technologies and processes to meet evolving regulatory standards and consumer expectations.

Pharmaceutical companies face increasing pressure regarding waste management and pollution control. In 2024, the global pharmaceutical waste market was valued at approximately $15.8 billion, with projections indicating continued growth due to stringent environmental regulations and rising awareness.

Effective waste management, including the safe disposal of hazardous materials and expired medications, is paramount for compliance and public trust. For instance, the U.S. Environmental Protection Agency (EPA) enforces strict guidelines on pharmaceutical waste disposal, with non-compliance potentially leading to significant fines and reputational damage.

Minimizing emissions from manufacturing processes is also critical. Many pharmaceutical firms are investing in advanced filtration systems and cleaner production technologies to reduce their environmental footprint. By 2025, many companies are expected to have met or exceeded targets for reducing greenhouse gas emissions by 20-30% compared to 2020 levels, driven by sustainability initiatives and regulatory mandates.

Assessing and mitigating the environmental footprint throughout the entire supply chain, from sourcing raw materials to final product delivery, is a growing environmental imperative. This includes evaluating energy consumption, waste generation, and emissions at each stage. For instance, in 2024, the global logistics sector, a key component of supply chains, accounted for an estimated 10% of global greenhouse gas emissions, highlighting the significant impact of distribution.

Companies face increasing pressure to ensure their suppliers also meet rigorous environmental standards, fostering a more sustainable ecosystem. Many businesses are now implementing supplier environmental audits and requiring adherence to codes of conduct, with a notable trend in the automotive industry in 2024-2025 towards mandating recycled content in components, aiming to reduce reliance on virgin materials.

Climate Change and Resource Scarcity

Climate change presents significant operational risks for companies like Harmony Biosciences. Extreme weather events, such as intensified storms or prolonged droughts, can severely disrupt global supply chains for raw materials and finished products. For instance, the agricultural sector, a key supplier for many biotechnologies, faced an estimated 10% decline in global crop yields by 2023 due to climate-related impacts, according to the UN Food and Agriculture Organization.

Resource scarcity, directly linked to climate change, poses another challenge. Water shortages, for example, can impact manufacturing processes and agricultural inputs essential for biopharmaceutical production. In 2024, several regions, including parts of California and the Mediterranean, experienced severe water stress, leading to increased operational costs for water-intensive industries.

Consequently, businesses are increasingly integrating climate risk assessments into their strategic planning. This includes understanding vulnerabilities in their supply chains and exploring more resilient sourcing options. By 2025, it's projected that over 70% of large corporations will have formal climate risk management frameworks in place, reflecting a growing awareness of these environmental factors.

- Supply Chain Vulnerability: Increased frequency of extreme weather events threatens the stability of raw material sourcing and distribution networks.

- Resource Availability: Climate-driven scarcity of water and other essential resources can elevate operational expenditures and limit production capacity.

- Strategic Adaptation: Companies are enhancing their business strategies to include robust climate risk assessments and mitigation plans.

- Regulatory Pressure: Growing investor and governmental focus on environmental, social, and governance (ESG) factors compels proactive climate management.

Environmental, Social, and Governance (ESG) Reporting

Investor and stakeholder pressure for clear Environmental, Social, and Governance (ESG) reporting is significantly shaping pharmaceutical operations. Harmony Biosciences' focus on environmental responsibility within its ESG framework can bolster its image and appeal to ethically-minded investors.

The global sustainable investment market is expanding rapidly. For instance, assets in sustainable funds reached an estimated $3.9 trillion in the US by the end of 2023, demonstrating a clear trend towards prioritizing ESG factors in investment decisions.

- Growing Investor Demand: A significant majority of investors, over 80% according to a 2024 survey by PwC, now consider ESG factors when making investment choices.

- Reputational Enhancement: Strong ESG reporting can differentiate Harmony Biosciences, attracting capital from a growing pool of ESG-focused funds.

- Regulatory Tailwinds: Anticipated stricter regulations on corporate environmental impact reporting, particularly in regions like the EU, will further elevate the importance of transparent ESG disclosures.

Environmental factors are increasingly critical for companies like Harmony Biosciences, impacting everything from supply chains to operational costs. The push for sustainability means reducing waste and emissions, with the global pharmaceutical waste market valued at approximately $15.8 billion in 2024, highlighting the scale of this challenge.

Climate change itself poses direct risks, such as supply chain disruptions from extreme weather, which affected global crop yields by an estimated 10% by 2023. Water scarcity, a growing concern in regions like California and the Mediterranean in 2024, can also increase operational expenses for water-intensive industries.

Consequently, businesses are integrating climate risk assessments, with over 70% of large corporations expected to have formal climate risk management frameworks by 2025. This proactive approach is also driven by investor demand, as over 80% of investors consider ESG factors in their decisions, as noted in a 2024 PwC survey.

| Environmental Factor | Impact on Pharmaceutical Sector | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Waste Management & Pollution | Compliance costs, reputational risk, need for greener processes | Global pharmaceutical waste market ~$15.8 billion (2024); EPA regulations in the US |

| Emissions Reduction | Investment in cleaner tech, meeting regulatory targets | 20-30% GHG emission reduction targets by 2025 compared to 2020 |

| Climate Change Risks | Supply chain disruption, resource scarcity (water) | 10% decline in global crop yields by 2023; Water stress in key regions (2024) |

| Investor ESG Focus | Access to capital, corporate reputation | >80% of investors consider ESG (2024 PwC); Sustainable fund assets ~$3.9 trillion (US, end of 2023) |

PESTLE Analysis Data Sources

Our Harmony PESTLE Analysis is meticulously constructed using a blend of official government statistics, reputable international organizations, and leading industry publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.