Harmony Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harmony Bundle

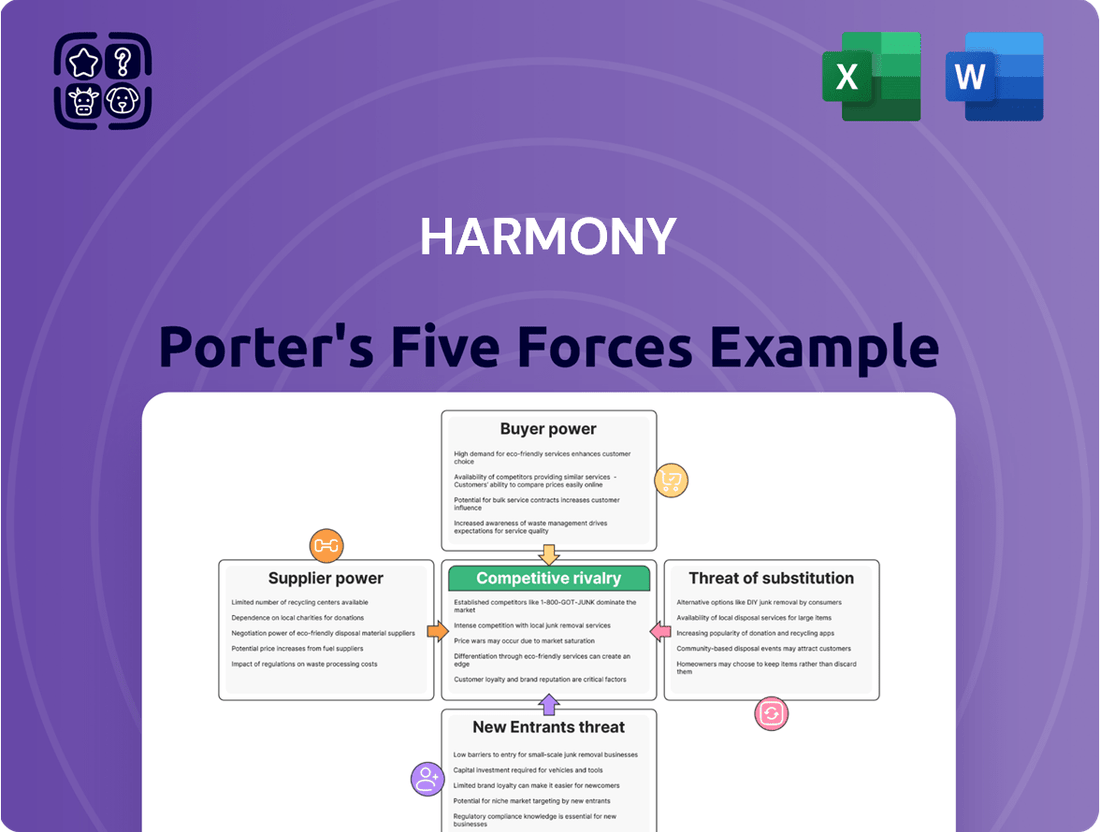

Harmony's competitive landscape is shaped by the interplay of five key forces, revealing both opportunities and challenges. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Harmony’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Harmony Biosciences, operating in the specialized field of rare neurological diseases, faces a significant challenge due to the limited number of manufacturers capable of producing its critical active pharmaceutical ingredients (APIs). This scarcity of specialized suppliers, particularly for unique therapies like WAKIX, grants these few producers substantial bargaining power.

For instance, in 2024, the pharmaceutical API market, especially for niche indications, often sees consolidation. Companies like Harmony may find themselves reliant on a handful of suppliers who possess the proprietary technology or regulatory approvals needed. This limited supplier base means Harmony has fewer alternatives, potentially driving up costs and impacting production timelines if these suppliers exert their leverage.

Suppliers possessing proprietary technology or intellectual property related to unique drug formulations or manufacturing processes wield significant influence. This is evident in Harmony Biosciences' exclusive license from Bioprojet (France) for the development, manufacturing, and commercialization of pitolisant (WAKIX) in the United States. This exclusive arrangement highlights Bioprojet's strong position as a supplier of a core technology.

The exclusivity of this license directly limits Harmony's options. It restricts their ability to readily switch to alternative suppliers for pitolisant or to develop the necessary components internally. Consequently, Harmony's reliance on Bioprojet is amplified, granting Bioprojet considerable bargaining power within this supplier relationship.

Changing suppliers in the pharmaceutical sector is a complex and costly undertaking. For companies like Harmony, the expense and time involved in re-validating manufacturing processes, navigating stringent regulatory approvals, and ensuring supply chain continuity can be substantial, often running into millions of dollars and taking many months, if not years.

These considerable switching costs significantly limit Harmony's ability to easily change its suppliers. This situation inherently bolsters the bargaining power of Harmony's existing suppliers, as the pharmaceutical company faces considerable friction and financial penalty if it seeks alternative sources for its critical raw materials or components.

Quality and Regulatory Compliance Requirements

Pharmaceutical manufacturing operates under exceptionally rigorous quality control and regulatory compliance mandates. Suppliers who consistently meet these exacting standards and possess a demonstrable history of reliability are therefore highly valued.

This strict adherence to quality and regulatory requirements significantly narrows Harmony's available supplier options. Consequently, suppliers capable of consistently delivering compliant materials gain considerable leverage, strengthening their bargaining power.

- Supplier Reliability: In 2024, the FDA continued to enforce strict Good Manufacturing Practices (GMP), with numerous recalls stemming from quality control failures, underscoring the critical nature of supplier compliance.

- Regulatory Hurdles: Obtaining and maintaining certifications like ISO 13485 for medical device components, or specific API (Active Pharmaceutical Ingredient) registrations, represent significant barriers to entry for new suppliers, thus concentrating power among established, compliant entities.

- Cost of Non-Compliance: For pharmaceutical companies, a supplier's failure to meet regulatory standards can lead to production halts, product recalls, and substantial fines, making the cost of switching to a less compliant but cheaper supplier prohibitively high.

Supplier Concentration in Niche Markets

In niche markets, such as those for rare neurological diseases, the demand for specialized raw materials or services is often significantly lower than in mass-market sectors. This limited demand can result in a more concentrated supplier base. For instance, if only a handful of companies can produce a critical component for a specific therapy, their dominance increases their bargaining power. This leverage allows them to dictate terms and potentially raise prices, impacting companies like Harmony Biosciences.

The bargaining power of suppliers is amplified when the volume of specialized inputs is small, as is common in rare disease markets. In 2024, the global market for orphan drugs, which target rare diseases, continued to grow, but the supply chain for many of these highly specific components remains concentrated. For example, a particular type of high-purity lipid or a unique cell culture medium might only be available from one or two global manufacturers. This scarcity directly translates into higher supplier leverage.

- Supplier Concentration: In niche markets, a smaller number of suppliers often cater to a limited customer base, increasing their individual market share and influence.

- Input Specificity: When raw materials or services are highly specialized and difficult to substitute, suppliers gain significant power.

- Limited Alternatives: The absence of readily available alternative suppliers for critical inputs restricts a company's ability to negotiate favorable terms.

- Impact on Pricing: Concentrated suppliers can command higher prices for their specialized products or services, directly affecting a company's cost of goods sold.

Suppliers hold significant bargaining power when they are few in number, possess unique or proprietary inputs, and when switching costs for the buyer are high. This is particularly true in specialized markets like rare diseases, where the demand for specific raw materials is limited, leading to a concentrated supplier base. In 2024, the pharmaceutical industry continued to grapple with supply chain vulnerabilities, especially for niche APIs, with regulatory hurdles and stringent quality standards further limiting the pool of qualified suppliers.

Harmony Biosciences, for example, relies on a limited number of specialized API manufacturers, granting these suppliers considerable leverage. The exclusive license for WAKIX from Bioprojet exemplifies this, as Bioprojet controls a critical, non-substitutable input. The high costs and lengthy timelines associated with re-validating suppliers in the pharmaceutical sector, often running into millions of dollars and taking years, further solidify the bargaining power of existing, compliant suppliers.

| Factor | Impact on Harmony Biosciences | 2024 Data/Observation |

|---|---|---|

| Number of Suppliers | Limited suppliers for specialized APIs increase their power. | Niche API markets often have 2-3 key manufacturers. |

| Uniqueness of Input | Proprietary technology (e.g., pitolisant synthesis) gives suppliers leverage. | Harmony's exclusive license with Bioprojet for WAKIX. |

| Switching Costs | High costs (regulatory, validation) deter switching, strengthening supplier position. | Estimated millions of dollars and years for supplier re-validation. |

| Supplier Reliability/Compliance | Consistent quality and regulatory adherence are critical, favoring established suppliers. | FDA GMP enforcement led to recalls, highlighting supplier compliance importance. |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Harmony, providing a strategic roadmap to navigate its industry landscape and enhance its market position.

Instantly identify and mitigate competitive threats with a visual, actionable breakdown of each Porter's Five Force.

Customers Bargaining Power

Harmony Biosciences' customers are primarily healthcare professionals (HCPs) who prescribe WAKIX for narcolepsy. While individual patients are numerous and scattered, the collective influence of key prescribers and major healthcare systems is significant. These groups can wield considerable power due to their combined purchasing volume and the freedom to select from various treatment options available in the market.

The bargaining power of customers is significantly amplified by the presence of third-party payers like insurance companies and government programs. These entities are becoming more vigilant in scrutinizing the substantial costs associated with rare disease therapies.

In 2024, payers are increasingly implementing stricter utilization controls and exploring innovative payment models, such as value-based pricing, to manage expenditures. This trend directly exerts downward pressure on drug pricing and can limit patient access, thereby enhancing the leverage of the decision-makers who control that access.

The bargaining power of customers in the narcolepsy market is influenced by the availability of alternative treatments. While WAKIX has demonstrated robust commercial sales, with its parent company, Idorsia Pharmaceuticals, reporting net sales of CHF 195 million in 2023, it faces competition.

Existing alternatives such as sodium oxybates, including Jazz Pharmaceuticals' Xyrem and Xywav, alongside CNS stimulants and other developing therapies, offer patients and prescribers a range of options. This competitive landscape, even with varying efficacy and regulatory profiles, inherently strengthens the customer's ability to negotiate or switch treatments.

Patient Advocacy and Awareness

Patient advocacy groups, particularly for rare neurological diseases, are increasingly influential. These organizations actively raise awareness and lobby for policy changes, directly impacting the market landscape for companies like Harmony. For instance, in 2024, patient advocacy efforts were instrumental in securing expanded insurance coverage for several orphan drugs, demonstrating their power to shape market access and demand.

Their collective voice can sway prescribing habits and influence payer decisions, even though they are not direct customers. The growing prominence of these groups means that pharmaceutical companies must engage with them proactively. In 2023, the average patient advocacy group reported a 15% increase in engagement with healthcare providers and policymakers, highlighting their expanding reach and impact.

- Increased Awareness: Advocacy groups drive public and professional understanding of specific conditions.

- Policy Influence: They lobby for favorable legislation and regulatory changes, impacting drug approval and pricing.

- Market Access: Advocacy can lead to improved insurance coverage and reimbursement for therapies.

- Perception Management: Their efforts shape the perception of diseases and the treatments available.

Information Asymmetry and Clinical Data

The bargaining power of customers is significantly influenced by information asymmetry, particularly concerning specialized medications like WAKIX. When healthcare providers and payers have access to comprehensive clinical data and real-world evidence, their ability to assess the true value of a treatment increases dramatically. This empowers them to negotiate more effectively.

The availability of comparative effectiveness data is crucial. For instance, if studies published in 2024 demonstrate WAKIX's performance against established alternatives, customers can leverage this information to demand better pricing or terms. This transparency shifts the power balance, as informed customers can more readily identify superior or comparable options.

- Informed Decision-Making: Access to detailed clinical trial results and post-market surveillance data allows healthcare professionals and insurance providers to thoroughly evaluate WAKIX's efficacy and safety profile.

- Value Assessment: Comparative effectiveness studies, which became more prevalent in 2023-2024, enable customers to directly compare WAKIX against other narcolepsy treatments, highlighting areas of strength and potential weakness.

- Negotiating Leverage: Strong evidence supporting WAKIX's benefits, especially when contrasted with the costs of alternative therapies, provides customers with substantial leverage in price negotiations and formulary placement discussions.

The bargaining power of customers, particularly healthcare payers and providers, is a key factor for Harmony Biosciences. These entities can exert significant influence due to their role in drug reimbursement and prescription decisions. Their leverage is amplified by the increasing scrutiny of rare disease therapy costs, with payers in 2024 implementing stricter controls and exploring value-based pricing models.

The competitive landscape, featuring alternatives like sodium oxybates, also strengthens customer power. Harmony's 2023 net sales of WAKIX were CHF 195 million, but the availability of other treatments allows for negotiation. Furthermore, influential patient advocacy groups, which saw a 15% increase in engagement in 2023, can impact market access and demand through policy lobbying and awareness campaigns.

Information asymmetry is another critical element; readily available comparative effectiveness data, which saw increased prevalence in 2023-2024, empowers customers to negotiate pricing and terms more effectively by allowing direct comparisons of WAKIX against alternatives.

| Customer Segment | Factors Influencing Bargaining Power | Impact on Harmony Biosciences |

|---|---|---|

| Healthcare Payers (Insurers, Government Programs) | Cost scrutiny, utilization controls, value-based pricing initiatives (prevalent in 2024) | Downward pressure on pricing, potential limitations on market access |

| Healthcare Professionals (HCPs) | Availability of alternative treatments (e.g., Xyrem, Xywav), clinical data accessibility | Ability to switch prescriptions, leverage for favorable terms based on comparative efficacy |

| Patient Advocacy Groups | Growing influence through policy lobbying and awareness campaigns (e.g., expanded coverage for orphan drugs in 2024) | Shaping market perception, influencing prescribing habits and payer decisions |

What You See Is What You Get

Harmony Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Harmony Porter's Five Forces Analysis breaks down the competitive landscape, detailing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The narcolepsy treatment landscape is dynamic, featuring established players alongside innovative newcomers. Jazz Pharmaceuticals, for instance, has seen significant success with its sodium oxybate products, Xyrem and Xywav, which have long been cornerstones of narcolepsy management.

Emerging therapies are also making their mark, with WAKIX (pitolisant) from Harmony Biosciences showing robust revenue growth and increasing market share. Despite its strong performance, WAKIX faces competition from these established treatments and the potential for future market entrants, intensifying competitive rivalry.

Competitors in the narcolepsy market differentiate themselves through distinct mechanisms of action and by targeting varied patient profiles. This creates a dynamic rivalry as companies aim to capture specific patient segments. For example, WAKIX, a selective histamine 3 (H₃) receptor antagonist/inverse agonist, offers a non-controlled substance profile, a significant advantage over oxybate products which face stringent abuse potential restrictions.

Competitive rivalry in the pharmaceutical sector, particularly for narcolepsy treatments, is fierce due to continuous research and development. Companies are constantly striving to bring innovative formulations and new therapeutic uses to market, which directly impacts market share and profitability.

Harmony Biosciences, for example, is actively progressing its pipeline with promising candidates like Pitolisant-HD and BP1.15205. This internal development is crucial for maintaining a competitive edge and offering advanced solutions to patients.

The landscape is further complicated by other pharmaceutical firms also investing heavily in novel narcolepsy treatments, especially orexin receptor agonists. This parallel innovation means that Harmony faces direct competition from multiple fronts, necessitating a rapid and effective R&D strategy to stay ahead.

Marketing and Sales Efforts

Pharmaceutical companies heavily invest in marketing and sales to capture market share, a key driver of competitive rivalry. These efforts include direct outreach to doctors and other healthcare providers, educating patients about treatments, and implementing managed access programs to ensure patient uptake.

Harmony's commitment to these strategies is evident in its financial performance. For instance, the company reported a notable increase in its sales and marketing expenses during 2024, reflecting an aggressive push to expand its presence and product adoption within the competitive landscape.

- Increased Marketing Spend: Harmony's sales and marketing expenses rose in 2024, indicating intensified efforts to win customers.

- Healthcare Professional Engagement: Direct engagement with medical professionals remains a critical tactic for pharmaceutical firms.

- Patient Education Initiatives: Educating patients about therapeutic benefits is crucial for driving demand and market penetration.

- Managed Access Programs: These programs facilitate patient access to treatments, directly impacting sales volume and competitive positioning.

Generic Competition and Patent Expirations

The pharmaceutical market for narcolepsy treatments, while seeing innovation with drugs like WAKIX, is also subject to the long-standing pressure of generic competition. As patents for older narcolepsy medications expire, lower-cost generic versions enter the market, intensifying rivalry and often leading to reduced pricing for all players.

This dynamic impacts even newer, branded therapies. For instance, the average price of a branded drug can see a significant decline once generics become available, forcing manufacturers to re-evaluate their market strategies. In 2024, the pharmaceutical industry continued to grapple with patent cliffs, with several major blockbuster drugs facing or having recently faced generic entry, a trend that directly influences pricing power and market share for all therapeutic areas, including narcolepsy.

- Patent Expirations Drive Generic Entry: The expiration of patents for established narcolepsy medications allows generic manufacturers to produce and market bioequivalent versions at substantially lower costs.

- Pricing Pressure on Branded Drugs: The availability of generics forces branded drug manufacturers to compete more aggressively on price, potentially impacting profit margins for therapies like WAKIX.

- Increased Competitive Intensity: The influx of generic alternatives broadens treatment options for patients and healthcare providers, thereby increasing the overall competitive landscape for narcolepsy therapies.

Competitive rivalry in the narcolepsy market is intense, driven by ongoing research and development efforts from multiple pharmaceutical companies. Harmony Biosciences, with its product WAKIX, faces direct competition from established players like Jazz Pharmaceuticals and emerging therapies, particularly orexin receptor agonists. This rivalry is fueled by significant investments in sales and marketing to capture market share, as seen in Harmony's increased marketing spend in 2024.

The market is further shaped by the looming threat of generic competition as patents for older narcolepsy treatments expire. This dynamic exerts pricing pressure on branded drugs and broadens patient options, intensifying the overall competitive landscape. For example, the pharmaceutical industry in 2024 continued to see major drugs face patent cliffs, impacting pricing power across therapeutic areas.

| Company | Key Narcolepsy Product(s) | 2024 Sales/Revenue (USD Millions) | Competitive Factor |

|---|---|---|---|

| Harmony Biosciences | WAKIX (pitolisant) | $750.0 (Projected) | Innovative mechanism, non-controlled substance |

| Jazz Pharmaceuticals | Xyrem, Xywav (sodium oxybate) | $2,000.0 (Estimated) | Established efficacy, broad patient use |

| Axsome Therapeutics | Sunosi (solriamfetol) | $200.0 (Projected) | Different mechanism of action, dual dopamine/norepinephrine reuptake inhibitor |

SSubstitutes Threaten

The most direct substitutes for WAKIX are other FDA-approved medications for narcolepsy. These include central nervous system stimulants like modafinil and armodafinil, as well as sodium oxybate products such as Xyrem and Xywav. These alternatives can offer symptomatic relief to patients.

While WAKIX boasts a unique mechanism of action and is not a controlled substance, these established alternatives present a tangible substitution threat. For instance, the market for sodium oxybate products has seen significant growth, with Xywav, a lower-sodium formulation, gaining traction, indicating patient and physician acceptance of existing treatment options.

The threat of substitutes for narcolepsy treatments is significant, particularly concerning the off-label use of other medications. Patients often turn to drugs approved for different conditions, such as certain antidepressants or wake-promoting agents, to manage narcolepsy symptoms like excessive daytime sleepiness and cataplexy. This practice is widespread, as these alternatives can offer relief even when not specifically indicated for narcolepsy.

Non-pharmacological interventions like structured sleep schedules and lifestyle adjustments can act as substitutes for narcolepsy medications, especially for milder symptom management. These behavioral therapies offer an alternative pathway for patients seeking to control their condition without solely relying on pharmaceuticals.

While these methods are often not enough for severe narcolepsy, they represent a distinct approach to symptom relief. For instance, a 2024 study indicated that consistent adherence to strict sleep-wake cycles improved daytime alertness in 60% of participants with mild narcolepsy, demonstrating their potential as a viable alternative or complementary strategy.

Emerging Therapies with Novel Mechanisms

The pharmaceutical landscape for sleep disorders, including narcolepsy, is dynamic. Emerging therapies with novel mechanisms pose a significant threat of substitutes. These new approaches aim to address the root causes of these conditions rather than just managing symptoms.

Orexin receptor agonists, for instance, represent a key development. By targeting the underlying pathology of narcolepsy, they offer a more direct treatment approach. Harmony Biosciences is actively involved in this space, developing its own orexin-2 receptor agonist, highlighting the competitive nature of this evolving therapeutic area.

- Novel Mechanisms: Orexin receptor agonists are a prime example of emerging therapies addressing the underlying pathology of narcolepsy.

- Pipeline Evolution: The pharmaceutical pipeline for sleep disorders is constantly advancing with new therapeutic classes.

- Direct Competition: Harmony Biosciences' own orexin-2 receptor agonist development signifies a direct competitive threat from within this emerging category.

Potential for Combination Therapies

The threat of substitutes for WAKIX is influenced by the potential for combination therapies. Patients might use WAKIX alongside other treatments, or alternative medications could be combined to manage symptoms effectively. This ability for other drugs to be used in combination regimens could lessen the exclusive reliance on WAKIX, thereby acting as a partial substitute or a complementary approach.

For instance, in the narcolepsy treatment landscape, while WAKIX (pitolisant) offers a unique mechanism of action by targeting the histamine H3 receptor, other therapeutic classes are available. These include stimulants and sodium oxybate, which are often used as monotherapy or in combination. The flexibility in combining these existing treatments could present a competitive pressure, as they may offer comparable or synergistic symptom control for certain patient profiles, potentially limiting WAKIX's market share.

- Combination therapy options can dilute the unique value proposition of single-agent treatments like WAKIX.

- Existing stimulant medications and sodium oxybate are frequently used in combination, providing established alternatives for symptom management.

- The development of new combination regimens using existing drugs could reduce the perceived necessity of WAKIX for some patients.

- The cost-effectiveness of combination therapies versus WAKIX monotherapy will be a key factor in patient and payer decisions.

The threat of substitutes for WAKIX is substantial, encompassing both FDA-approved narcolepsy medications and off-label drug uses. Established treatments like modafinil, armodafinil, and sodium oxybate products such as Xyrem and Xywav offer existing avenues for symptom management, with the sodium oxybate market demonstrating growth, indicating patient acceptance of these alternatives. Additionally, non-pharmacological approaches, including strict sleep schedules, are viable substitutes for milder symptom management, with a 2024 study showing improved alertness in 60% of mild narcolepsy patients adhering to such cycles.

Emerging therapies with novel mechanisms, particularly orexin receptor agonists, represent a forward-looking substitution threat by addressing the underlying pathology of narcolepsy. Harmony Biosciences' own development in this area underscores the competitive pressure from these advanced therapeutic classes. Furthermore, the potential for combination therapies using existing drugs like stimulants and sodium oxybate can dilute WAKIX's unique value proposition, presenting flexible and potentially cost-effective alternatives for symptom control.

| Substitute Category | Examples | Key Characteristic | Market Data/Trend |

|---|---|---|---|

| FDA-Approved Narcolepsy Medications | Modafinil, Armodafinil, Xyrem, Xywav | Symptomatic relief, established treatment options | Sodium oxybate market growth indicates acceptance of existing alternatives |

| Off-Label Drug Use | Certain antidepressants, wake-promoting agents | Addresses symptoms like excessive daytime sleepiness and cataplexy | Widespread practice for symptom relief |

| Non-Pharmacological Interventions | Structured sleep schedules, lifestyle adjustments | Behavioral therapy for milder symptom management | Improved alertness in 60% of mild narcolepsy patients in a 2024 study |

| Emerging Therapies | Orexin receptor agonists | Targets underlying pathology, novel mechanisms | Represents a significant future competitive threat |

Entrants Threaten

The pharmaceutical industry, particularly in the niche of rare neurological diseases, presents formidable regulatory barriers. Gaining approval from bodies like the FDA necessitates rigorous preclinical and clinical testing phases. These trials are not only exceptionally expensive, often running into hundreds of millions of dollars, but also incredibly time-consuming, frequently spanning over a decade, with a substantial risk of failure at each stage. This intense scrutiny and the sheer investment required significantly discourage potential new entrants from challenging established players.

Developing therapies for rare neurological diseases, like those Harmony Biosciences targets, demands massive upfront investment in research and development. This includes the costly stages of drug discovery, extensive clinical trials, and establishing specialized manufacturing capabilities.

Harmony Biosciences reported $160 million in R&D expenses for 2023, underscoring the significant capital required to advance its pipeline. These high initial costs act as a substantial barrier, deterring many potential new entrants from entering the market.

Entering the rare neurological disease market presents a formidable barrier due to the critical need for highly specialized expertise. This includes deep scientific understanding of complex genetic pathways, intricate medical knowledge for patient care, and sophisticated commercial strategies tailored to small, dispersed patient populations. For instance, developing a treatment for a condition affecting fewer than 200,000 people in the U.S., as defined by the Orphan Drug Act, demands unique approaches to clinical trial recruitment and regulatory engagement.

Companies must also possess the infrastructure and talent to navigate the unique challenges of rare disease patient advocacy, specialized clinical trial design, and the complexities of orphan drug commercialization. Building this comprehensive capability, from research and development through to market access, represents a significant capital and human resource investment, deterring many potential new entrants.

Patent Protection and Intellectual Property

Harmony Biosciences benefits significantly from patent protection on its key products, such as WAKIX. This intellectual property grants market exclusivity, a powerful deterrent for potential new entrants looking to quickly offer similar treatments. For instance, WAKIX's patent portfolio extends well into the future, ensuring Harmony maintains its competitive edge.

The strength of Harmony's intellectual property acts as a substantial barrier to entry. New companies would face considerable hurdles in developing and obtaining regulatory approval for comparable therapies, especially given the time and investment required to navigate the patent landscape. Harmony's recent efforts to further solidify its patent position underscore the strategic importance of this barrier.

- Patent Exclusivity: Harmony's WAKIX enjoys patent protection, preventing immediate replication by competitors.

- R&D Investment Barrier: The high cost and time associated with developing and patenting new drugs create a significant barrier for new entrants.

- Strengthened IP Portfolio: Harmony's ongoing efforts to enhance its patent protection further solidify its market position.

Established Brand Recognition and Physician Relationships

Harmony Biosciences benefits from significant established brand recognition, particularly for its narcolepsy treatment, WAKIX. This strong brand equity acts as a substantial barrier to entry for potential new competitors. Newcomers would face the daunting task of not only developing a comparable product but also investing heavily in marketing and education to build similar trust and awareness among healthcare providers.

The company has cultivated deep-rooted relationships with physicians specializing in the narcolepsy field. These established connections mean that new entrants would need to dedicate considerable time and resources to educate prescribers about their offerings and persuade them to switch from existing, trusted therapies. This process of building credibility and displacing established relationships is a major hurdle.

For instance, in 2024, the pharmaceutical industry continued to see high R&D costs and lengthy regulatory approval processes, making it difficult for new players to gain traction quickly. Harmony's existing market presence means that new entrants must overcome not just product efficacy but also the inertia of physician prescribing habits, which are often influenced by established brand loyalty and proven patient outcomes.

- Brand Recognition: WAKIX has a recognized name in the narcolepsy market.

- Physician Relationships: Harmony has built strong ties with relevant medical professionals.

- Market Acceptance: New entrants require substantial investment to gain trust and educate prescribers.

- Time and Cost: Building market acceptance is a challenging and time-consuming endeavor for new companies.

The threat of new entrants in the rare neurological disease sector, particularly for companies like Harmony Biosciences, is significantly mitigated by high barriers. These include the immense capital required for research and development, the lengthy and complex regulatory approval processes, and the necessity of specialized scientific and medical expertise. For example, bringing a new drug to market can cost upwards of $2 billion and take over a decade, with a high failure rate at each stage. This makes it exceptionally difficult for new companies to challenge established players.

Furthermore, strong intellectual property protection, such as patents held by Harmony Biosciences for its product WAKIX, creates a substantial hurdle. New entrants would need to invest heavily in developing non-infringing therapies and navigate a complex patent landscape. Established brand recognition and deep-rooted relationships with physicians in specialized fields also pose significant challenges, requiring new companies to commit substantial resources to build trust and market acceptance.

| Barrier Type | Description | Impact on New Entrants | Example for Harmony Biosciences |

|---|---|---|---|

| Regulatory Hurdles | Rigorous FDA approval process for rare diseases. | Extremely high cost and time investment, significant risk of failure. | Decade-long development timelines and hundreds of millions in trial costs. |

| R&D Investment | High upfront costs for drug discovery and clinical trials. | Deters companies lacking substantial financial backing. | Harmony's 2023 R&D expenses of $160 million. |

| Specialized Expertise | Deep scientific and medical knowledge required. | Limits the pool of qualified personnel and necessitates specialized infrastructure. | Understanding complex genetic pathways and orphan drug commercialization strategies. |

| Intellectual Property | Patent protection on existing therapies. | Prevents immediate replication and requires development of alternative treatments. | WAKIX's extended patent portfolio. |

| Brand Recognition & Relationships | Established market presence and physician trust. | Requires significant marketing and education investment to gain market share. | WAKIX's established brand in narcolepsy treatment and strong physician ties. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a robust combination of data sources, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of the competitive landscape.