Hankook & Co. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hankook & Co. Bundle

Hankook & Co. demonstrates significant strengths in its brand recognition and global distribution network, crucial for navigating the competitive tire industry. However, it faces potential threats from fluctuating raw material costs and increasing competition from emerging market players. Understanding these dynamics is key to grasping their strategic positioning.

Want the full story behind Hankook & Co.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hankook & Company's diversified automotive portfolio is a significant strength. Its core businesses, Hankook Tire & Technology and Hankook AtlasBX, provide stability through different segments of the automotive value chain, from tires to batteries.

This dual focus inherently reduces risk by not being overly dependent on a single product. For instance, strong tire sales can offset potential fluctuations in battery demand, and vice versa, contributing to overall business resilience.

The strategic acquisition of Hanon Systems in January 2025 is a prime example of this diversification, adding expertise in thermal energy management solutions. This move, completed just before the mid-2025 analysis period, positions Hankook & Company to capitalize on the growing demand for efficient thermal systems in electric vehicles.

This broadened scope within the mobility industry, encompassing tires, batteries, and thermal management, creates significant cross-selling opportunities and strengthens its competitive standing as the automotive landscape evolves.

Hankook Tire & Technology posted its strongest financial performance in 2024, with consolidated sales reaching KRW 9.6 trillion and operating profit hitting KRW 1.1 trillion. This impressive growth was propelled by their 'First Mover' strategy, sustained investment in research and development, and a strategic emphasis on enhancing premium brand value.

Looking ahead to 2025, the company is targeting continued year-over-year sales growth, projecting an increase of at least 5% from the 2024 figures. This ambition is underpinned by an aggressive expansion of high-value-added product sales, including ultra-high-performance (UHP) tires, which accounted for 45% of total sales in 2024.

Furthermore, Hankook's robust partnerships with leading global premium automakers, such as BMW and Mercedes-Benz, are expected to drive demand for their specialized tire offerings. These collaborations represent a significant advantage, providing access to a growing segment of the automotive market.

Hankook Tire stands out as a frontrunner in electric vehicle (EV) tire innovation, notably with its iON brand, the world's inaugural complete range of EV-specific tires. This leadership is underscored by securing original equipment (OE) supply deals with prestigious EV makers like Porsche, Tesla, Audi, and BYD. These partnerships highlight Hankook's advanced technology and high-quality standards within the fast-growing EV sector.

This strong foothold in the EV tire market provides Hankook with a substantial competitive edge, especially as the global automotive industry increasingly embraces electrification. By 2024, the EV market is projected to represent a significant portion of new vehicle sales, making Hankook's early and robust presence in this segment a key strength.

Commitment to Innovation and R&D

Hankook & Company places a strong emphasis on continuous innovation, backed by significant investments in research and development. This focus is crucial for driving future growth and ensuring the company remains agile in a constantly evolving market landscape. In 2024, the company continued to prioritize its digital transformation initiatives, leveraging data and artificial intelligence to sharpen its manufacturing capabilities and expedite the development of new products, aiming to solidify its competitive edge.

These innovation efforts have tangible benefits, as demonstrated by Hankook’s exclusive tire supply agreements for high-profile motorsports events. For instance, their role in the FIA World Rally Championship not only enhances brand visibility but also serves as a critical proving ground for their advanced tire technologies. Such collaborations are vital for refining product performance and showcasing technical prowess to a global audience.

The company's commitment to R&D is reflected in its strategic direction, which includes:

- Investing in advanced manufacturing technologies.

- Developing AI-powered solutions for product design and quality control.

- Securing partnerships in prestigious global motorsports.

- Focusing on sustainable material research for future tire generations.

Robust Global Manufacturing and Supply Chain

Hankook & Co. leverages a robust global manufacturing and supply chain, a significant strength. The company operates eight strategically located manufacturing facilities worldwide. These facilities are key to their profitability, driving operational efficiency and boosting regional shipment volumes.

This expansive manufacturing network, supported by an expanding distribution infrastructure, allows Hankook to navigate economic uncertainties effectively. It underpins their ability to reliably serve a wide array of global automotive brands, demonstrating resilience and reach. For instance, in 2023, Hankook Tire & Technology, a key subsidiary, reported sales of KRW 8.17 trillion, with a considerable portion stemming from its global production capabilities.

- Eight Global Manufacturing Facilities: These sites enhance operational efficiency and increase regional shipment volumes, contributing directly to profitability.

- Strong Global Supply Chain: The company maintains a resilient supply chain capable of expanding distribution even during challenging economic periods.

- Diverse Customer Base: The extensive manufacturing footprint enables Hankook to effectively cater to the needs of numerous global automotive manufacturers.

- Operational Resilience: Their ability to sustain and grow their manufacturing and distribution capabilities highlights a core operational strength.

Hankook & Company's diversified business model, encompassing tires, batteries, and thermal management solutions, provides significant stability. The strategic acquisition of Hanon Systems in early 2025 further bolsters this by adding expertise in crucial EV thermal management, enhancing its resilience against market fluctuations.

Hankook Tire & Technology demonstrated impressive financial performance in 2024, achieving KRW 9.6 trillion in sales and KRW 1.1 trillion in operating profit, driven by its premium brand strategy and R&D investments. The company anticipates at least a 5% sales increase in 2025, with ultra-high-performance tires already representing 45% of 2024 sales.

The company's leadership in EV tire technology, particularly with its iON brand, is a key strength, evidenced by original equipment supply deals with major EV manufacturers like Porsche, Tesla, and BYD. This positions Hankook favorably to capitalize on the rapidly expanding electric vehicle market.

Hankook's commitment to innovation is backed by substantial R&D spending, focusing on advanced manufacturing, AI integration for product development, and participation in prestigious motorsports like the FIA World Rally Championship. These efforts solidify its technological leadership and brand visibility.

Hankook & Co. operates a robust global manufacturing network with eight facilities, enhancing operational efficiency and regional sales volumes. This extensive footprint, coupled with a resilient supply chain, allows the company to reliably serve a diverse international customer base and navigate economic uncertainties effectively.

| Metric | 2024 Data (Hankook Tire & Technology) | 2025 Target (Hankook Tire & Technology) | Key Strength |

|---|---|---|---|

| Consolidated Sales | KRW 9.6 trillion | KRW 10.08 trillion+ (5% growth) | Strong market presence and growth trajectory |

| Operating Profit | KRW 1.1 trillion | Projected increase | Profitability and operational efficiency |

| UHP Tire Sales % | 45% | Targeting increase | Focus on high-value products |

| EV Tire Market Position | Leading innovator (iON brand) | Continued expansion and OE deals | Capturing growth in the EV sector |

| Manufacturing Facilities | 8 global locations | Continued operation and optimization | Global reach and operational efficiency |

What is included in the product

Delivers a strategic overview of Hankook & Co.’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats to inform future strategic decisions.

Offers a clear, actionable roadmap by highlighting Hankook & Co.'s competitive edges and potential pitfalls.

Weaknesses

Hankook & Company's heavy reliance on the automotive sector, despite its internal diversification into tires and batteries, represents a significant weakness. This concentration leaves the company particularly exposed to the inherent cyclicality and specific risks within this industry.

For instance, a global economic slowdown that dampens new vehicle sales directly impacts demand for Hankook's core products. In 2023, the global automotive industry experienced fluctuating production levels due to ongoing supply chain issues and shifts in consumer spending, which would have directly influenced Hankook's revenue streams.

This singular industry focus means that any disruption, such as the increasing shift towards electric vehicles (EVs) which may require different tire specifications or battery technologies, poses a substantial challenge to Hankook's established business model if not proactively addressed.

Hankook operates in a fiercely competitive global tire market, facing pressure from giants like Michelin, Bridgestone, and Goodyear, alongside emerging players. This intense rivalry means Hankook must constantly innovate in areas like tire technology and sustainability to keep pace. For instance, Michelin invested over €500 million in R&D in 2023, highlighting the significant resources competitors dedicate to staying ahead.

Hankook & Company's reliance on key inputs like natural rubber, synthetic rubber, carbon black, and crucial battery minerals such as lithium and cobalt makes it highly susceptible to price swings. For instance, during the first quarter of 2025, the company reported that increased raw material costs put pressure on its profit margins, directly impacting its bottom line.

These commodity price volatilities can significantly disrupt production costs, making it challenging to maintain stable pricing for its tire and battery products. Effective management of these risks requires sophisticated supply chain strategies and financial hedging instruments to mitigate the impact of unpredictable market movements.

Challenges in the Global Battery Market

Despite Hankook AtlasBX's established position, the global battery market faces considerable headwinds. A notable challenge is the deceleration of electric vehicle (EV) sales growth in key markets during late 2024 and early 2025, impacting demand. Furthermore, the industry is grappling with widespread overcapacity in battery production, leading to intensified price competition.

China's significant market share and aggressive pricing strategies create a substantial competitive barrier for manufacturers outside of China, including Hankook AtlasBX. This dynamic is particularly evident as Chinese battery producers often benefit from government subsidies and economies of scale, allowing them to offer lower per-unit costs.

These market conditions directly threaten Hankook AtlasBX's expansion plans and financial performance. The pressure to reduce costs while maintaining quality is immense, potentially squeezing profit margins.

- Slowing EV Sales Growth: Some major EV markets experienced a slowdown in sales growth towards the end of 2024, impacting immediate battery demand.

- Production Overcapacity: Global battery production capacity is estimated to exceed demand, leading to price wars and reduced profitability for manufacturers. For instance, by mid-2024, excess lithium-ion battery production capacity was projected to reach hundreds of gigawatt-hours globally.

- Chinese Dominance: Chinese manufacturers held over 70% of the global battery market share by production volume in 2023, often leveraging lower production costs.

- Cost Pressures: Intense competition forces battery makers to absorb rising raw material costs or pass them on, impacting margins.

Risk from Geopolitical Tensions and Trade Barriers

Geopolitical shifts and escalating trade barriers, like tariffs and subsidies, are significantly altering global automotive trade dynamics. As a company with a worldwide manufacturing and sales footprint, Hankook & Company faces considerable exposure to these political and economic forces. These pressures can lead to supply chain disruptions, higher operating expenses, and restricted access to key markets.

For instance, the ongoing trade friction between major economic blocs could directly impact Hankook’s ability to import raw materials or export finished tires, potentially increasing lead times and costs. In 2024, uncertainty surrounding international trade agreements and the imposition of new tariffs in several key regions where Hankook operates could add significant volatility to its cost structure and revenue streams.

-

Supply chain interruptions due to trade disputes could delay production and increase logistics costs.

-

Tariffs on imported components or exported tires would directly impact Hankook's pricing competitiveness and profit margins.

-

Market access restrictions in certain countries could limit Hankook's sales growth opportunities.

-

The company's global operational strategy makes it vulnerable to the ripple effects of regional political instability.

Hankook & Company's strong dependence on the automotive sector makes it vulnerable to industry downturns and shifts, such as the increasing adoption of electric vehicles. The company also faces intense competition from established global players like Michelin and Bridgestone, necessitating continuous innovation and significant R&D investment. Furthermore, Hankook's reliance on key raw materials exposes it to price volatility, impacting profit margins, as seen in early 2025 when increased costs pressured profitability.

What You See Is What You Get

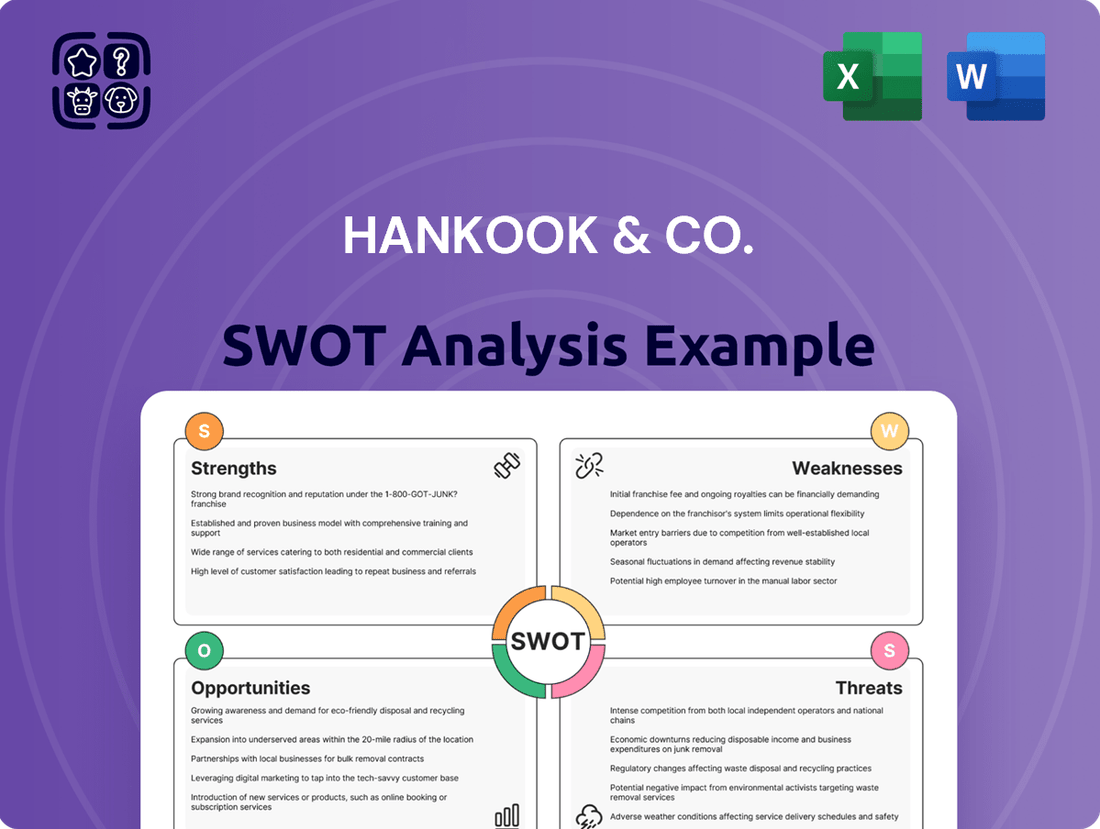

Hankook & Co. SWOT Analysis

This is the actual Hankook & Co. SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive breakdown of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed analysis is crucial for strategic planning and understanding Hankook & Co.'s competitive landscape.

Opportunities

The accelerating global adoption of electric vehicles (EVs) offers a substantial growth avenue for Hankook. The company's established strength in developing tires specifically for EVs, coupled with its expanding battery production, positions it well to capitalize on this trend. For instance, EV sales are projected to reach over 18 million units globally in 2024, a significant increase from previous years, directly translating to higher demand for specialized EV tires.

As this transition gains momentum across major markets, the demand for advanced EV batteries and high-performance EV tires will undoubtedly surge. Hankook's established expertise in these critical areas allows it to effectively meet this growing need, paving the way for increased market penetration and expanded market share in the coming years.

Hankook & Company is actively pursuing expansion into new mobility solutions and technologies, a strategic move that builds on its existing strengths in tires and batteries. This diversification is crucial as the automotive industry rapidly evolves towards electrification and advanced features.

The company's stated aim to broaden its footprint in the automotive parts sector is already seeing tangible results. For instance, Hankook & Company is investing significantly in areas like advanced driver-assistance systems (ADAS), recognizing their growing importance in modern vehicles. By 2024, ADAS components are projected to represent a substantial portion of the automotive aftermarket, offering a significant growth avenue.

Furthermore, Hankook & Company is exploring opportunities in connected car technologies and components for autonomous vehicles. This aligns with the global trend of increasing vehicle connectivity, with the connected car market expected to reach over $200 billion by 2025. This expansion into these cutting-edge areas positions Hankook & Company to capitalize on the future of mobility.

Hankook & Co.'s acquisition of Hanon Systems in January 2025 for an undisclosed sum highlights a robust strategy for portfolio enhancement and synergy realization. This move signals a clear intent to leverage M&A for growth.

The company is well-positioned to explore further strategic alliances with major global automakers, key technology providers, and complementary industry leaders. Such collaborations could open up new geographical markets and significantly bolster its technological prowess.

By forging these partnerships, Hankook & Co. can aim to integrate cutting-edge innovations and secure a more dominant standing in the competitive automotive supply chain landscape, building on its 2024 global market share in tire production.

Increasing Demand for High-Value-Added Products

Hankook's strategic push to elevate the sales contribution of larger, high-value tires, specifically those 18 inches and above for passenger cars, presents a significant avenue for growth. This focus on premium tire segments, including specialized offerings for high-performance vehicles, luxury cars, and the rapidly expanding electric vehicle (EV) market, is designed to unlock higher profit margins and bolster the company's brand image.

This opportunity is further amplified by the increasing trend of original equipment manufacturer (OEM) supply to prestigious automotive brands, indicating a growing acceptance and demand for Hankook's advanced tire technologies within the premium automotive sector. For example, in 2024, the market for ultra-high-performance (UHP) tires, a key segment for Hankook's high-value strategy, was projected to see continued robust growth, driven by consumer preference for enhanced driving dynamics and efficiency.

- Growing Market Share in 18-inch and Larger Tires: Hankook aims to expand its dominance in the premium tire segment, targeting a larger share of sales from tires with rim diameters of 18 inches and greater.

- Premiumization Strategy for EVs and High-Performance Vehicles: The company is concentrating on developing and marketing specialized tires tailored for electric vehicles and performance-oriented cars, which command higher price points and margins.

- Strengthened OEM Partnerships with Luxury Brands: Hankook is leveraging its relationships with leading luxury automotive manufacturers, securing increased supply contracts for their new vehicle models, thereby enhancing brand visibility and sales volume in the premium original equipment market.

- Increased Profitability through High-Value Product Mix: By shifting its product mix towards these high-value-added tires, Hankook is positioned to achieve improved overall profitability and a stronger competitive standing in the global tire industry.

Advancements in Sustainable Materials and Circular Economy Initiatives

The global push towards sustainability presents a significant opportunity for Hankook & Co. The growing emphasis on eco-friendly materials, effective tire recycling, and robust circular economy principles allows the company to carve out a distinct market position. This is reinforced by the automotive industry's increasing demand for sustainable components, with projections indicating the global market for sustainable automotive materials could reach over $100 billion by 2030.

Hankook’s established initiatives, such as its 're:move' waste tire recycling program, directly address these market trends. Furthermore, the company's stated goal to reduce greenhouse gas emissions by 50% by 2030 compared to 2018 levels positions it favorably to attract environmentally aware consumers and comply with evolving environmental regulations. These efforts not only enhance brand image but also create potential for cost savings through resource efficiency.

Key opportunities stemming from this trend include:

- Developing and commercializing advanced eco-friendly tire materials, potentially incorporating recycled content.

- Expanding the scale and scope of tire recycling programs to capture greater market share in the circular economy.

- Leveraging sustainability credentials to secure partnerships and preferred supplier status with eco-conscious automakers.

- Meeting and exceeding emerging global regulations on tire end-of-life management and material sourcing.

Hankook's strategic acquisition of Hanon Systems in early 2025 for an undisclosed sum significantly bolsters its product portfolio and creates opportunities for synergy. This move underscores a commitment to growth through mergers and acquisitions, enhancing its competitive edge. The company is also actively seeking collaborations with major automakers and technology firms, aiming to expand into new markets and advance its technological capabilities.

The company is strategically increasing its focus on high-value tires, specifically targeting rim diameters of 18 inches and larger. This premiumization strategy is designed to improve profit margins and brand perception, particularly in the burgeoning EV and high-performance vehicle sectors. Hankook's success in securing OEM contracts with luxury brands in 2024 and its strong performance in the ultra-high-performance tire market, which saw robust growth in the same year, highlight the potential of this approach.

Hankook is capitalizing on the global drive towards sustainability by investing in eco-friendly materials and tire recycling initiatives. Its 're:move' program and ambitious 2030 greenhouse gas reduction targets align with increasing market demand for sustainable automotive components. By embracing circular economy principles and meeting stringent environmental regulations, Hankook aims to strengthen its brand image and secure preferred supplier status with environmentally conscious manufacturers.

Threats

The global automotive industry is experiencing a significant slowdown, with stagnating sales volumes and increasing challenges reported throughout 2024, especially in Europe. This trend directly impacts Hankook & Co. by reducing demand for its products.

A prolonged downturn in vehicle sales and production, driven by economic instability, elevated interest rates, and persistent inflation, poses a substantial threat to Hankook's financial performance. This slowdown can directly affect revenue and profitability across both its tire and battery divisions.

For instance, in the first quarter of 2024, the European automotive market saw a notable cooling in demand, with some key countries reporting year-on-year sales declines. This directly translates to fewer new vehicles being manufactured, and consequently, a reduced need for Hankook's original equipment tires and batteries.

Furthermore, the aftermarket segment, which relies on the existing vehicle parc, also faces headwinds as consumers may defer vehicle maintenance or replacement due to economic pressures, further impacting Hankook's sales volumes.

The tire and battery industries are facing fierce price competition, with the battery market particularly grappling with significant overcapacity. This situation creates substantial downward pressure on prices, especially from competitors in China who often operate with lower production costs. For Hankook & Co., this intensifies the challenge of protecting its profit margins and its position in these key markets.

This intense competition means Hankook must navigate a landscape where maintaining pricing power and market share requires constant strategic adjustment. The overcapacity in batteries, for instance, can lead to a scenario where supply outstrips demand, further exacerbating price wars. For example, in 2024, the global automotive battery market saw significant price fluctuations due to oversupply concerns.

The automotive sector, and by extension Hankook & Co., continues to face significant risks from global supply chain disruptions. The lingering effects of semiconductor shortages, which impacted vehicle production throughout 2023 and into early 2024, highlight this vulnerability. Logistical bottlenecks and geopolitical events can further exacerbate these issues, potentially delaying the delivery of critical raw materials like natural rubber or synthetic materials needed for tire manufacturing.

Any interruption in the flow of these essential components or in the transportation networks could directly impede Hankook's production capacity. This could lead to increased manufacturing costs due to expedited shipping or the need to source from more expensive suppliers. Ultimately, these disruptions translate into longer lead times for customers and a potential hit to Hankook's reputation for reliability.

Rapid Technological Shifts and New Entrants

The automotive industry is experiencing a seismic shift, with advancements in autonomous driving and electric vehicles demanding significant adaptation. Hankook & Co. faces the threat of being outpaced by these rapid technological evolutions. For instance, the global market for electric vehicle batteries alone was projected to reach over $150 billion by 2025, a segment where tire manufacturers are increasingly involved in providing specialized solutions.

New, agile competitors, unburdened by legacy systems, are also emerging with innovative approaches to mobility. If Hankook cannot swiftly integrate new battery chemistries or develop advanced tire technologies for autonomous systems, its market position could be significantly weakened. The company's ability to adapt to these disruptive forces will be critical for maintaining its competitive edge in the coming years.

- Technological Obsolescence: Failure to invest in and integrate next-generation tire technologies for EVs and autonomous vehicles could render current product lines less competitive.

- New Entrant Disruption: Agile startups focusing on niche, high-tech mobility solutions may capture market share by offering specialized, advanced tire products.

- Supply Chain Vulnerability: Reliance on older manufacturing processes or materials could become a disadvantage as the industry shifts towards advanced, sustainable components.

Stringent Environmental Regulations and Compliance Costs

Globally, environmental regulations are tightening, especially concerning emissions, waste, and tire recycling, presenting a significant challenge for Hankook & Co. While the company is actively investing in sustainable practices, keeping pace with these evolving standards and the necessary research into eco-friendly materials and manufacturing processes can incur substantial compliance expenses and introduce operational complexities.

These growing regulatory demands necessitate ongoing investment in advanced manufacturing technologies and waste reduction strategies. For instance, the European Union's push for a circular economy, with targets for recycled content in tires, requires significant adaptation. Hankook's commitment to sustainability, as evidenced by its investments in eco-friendly R&D, is crucial but also represents a continuous cost factor that could impact profitability if not managed efficiently.

Key threats include:

- Rising Compliance Costs: Meeting stricter emission standards and waste disposal regulations globally can lead to increased operational expenditures.

- R&D Investment Burden: The need to develop and implement new eco-friendly materials and production methods requires substantial and ongoing research and development funding.

- Operational Complexity: Adapting production processes to comply with diverse and evolving environmental mandates across different operating regions can create significant management challenges.

- Potential Fines and Penalties: Non-compliance with environmental regulations could result in significant financial penalties, impacting Hankook's financial performance.

Intensifying global competition, particularly from Chinese manufacturers with lower cost structures, poses a significant threat to Hankook & Co.'s market share and profitability, especially in the battery segment which faced overcapacity issues in 2024. Furthermore, disruptions in global supply chains, evidenced by lingering semiconductor shortages in early 2024, can impede production and increase costs for raw materials essential for tire manufacturing.

The rapid technological shift towards electric and autonomous vehicles presents a risk of obsolescence for Hankook's current product lines if it fails to adapt quickly to new battery chemistries and advanced tire technologies. Stricter environmental regulations worldwide also necessitate substantial and ongoing investment in eco-friendly materials and manufacturing processes, increasing compliance costs and operational complexity.

| Threat Category | Specific Challenge | Impact on Hankook & Co. | 2024 Data/Trend |

| Competition | Price wars, especially from Chinese battery makers | Eroding profit margins, market share pressure | Battery market overcapacity reported globally |

| Supply Chain | Raw material shortages, logistical bottlenecks | Production delays, increased manufacturing costs | Semiconductor shortages continued to affect automotive sector |

| Technological Disruption | EV/AV advancements, agile new entrants | Risk of product obsolescence, weakened market position | Projected global EV battery market growth into hundreds of billions |

| Regulatory Environment | Stricter environmental standards (emissions, recycling) | Higher compliance costs, R&D investment burden | EU push for circular economy impacting tire industry |

SWOT Analysis Data Sources

This SWOT analysis for Hankook & Co. is built upon a robust foundation of data, including their latest financial statements, comprehensive market research reports, and insights from industry experts.