Hankook & Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hankook & Co. Bundle

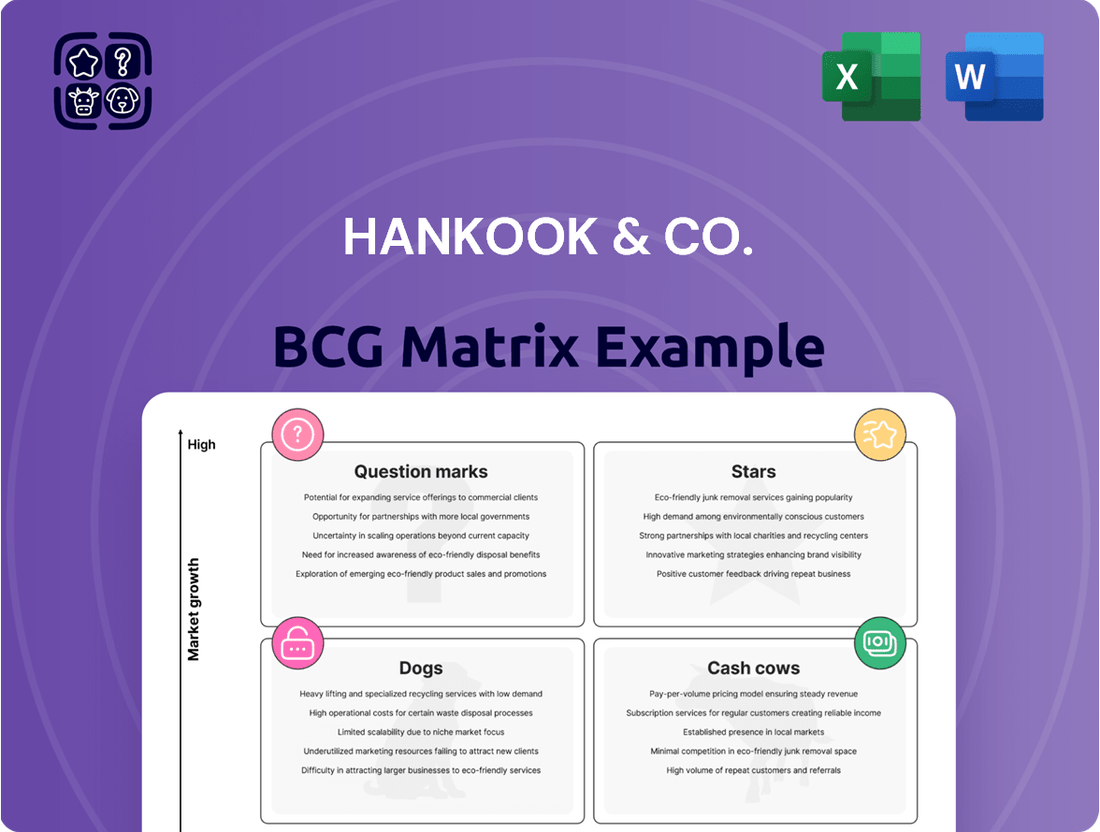

Hankook & Co.'s BCG Matrix offers a crucial lens through which to view its diverse product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is paramount for strategic resource allocation and future growth. This initial glimpse reveals the potential and challenges within Hankook's market presence.

For a comprehensive understanding of Hankook & Co.'s strategic positioning, dive into the full BCG Matrix report. It provides detailed quadrant placements and actionable insights, empowering you to make informed investment and product development decisions. Don't miss out on the opportunity to gain a competitive edge.

Stars

Hankook's iON premium EV tire lineup is a clear Star in the BCG Matrix. This brand is distinguished as the world's first comprehensive EV tire offering, tapping into a burgeoning market.

The global EV tire market is expected to surge, with a projected CAGR of 22.1% between 2025 and 2032, highlighting substantial growth potential. Hankook's strategic positioning as an Original Equipment (OE) supplier to leading premium EV makers further solidifies its Star status.

Evidence of this strength is seen in Hankook's Q1 2025 results, where EV-dedicated products constituted 23% of its OE tire sales, a significant increase of 6 percentage points compared to the previous year. This demonstrates strong momentum and market penetration in a high-growth sector.

Large-diameter (18-inch and larger) passenger car and light truck tires are a significant growth engine for Hankook & Co. In 2024, these high-value tires represented 46.5% of Hankook's sales, a clear indicator of their importance. The company aims to push this share beyond 50% by 2025, highlighting their strategic focus on premium, larger-sized tires.

This segment is crucial for Hankook's qualitative growth and profitability. The market for these premium, larger tires is expanding globally, and Hankook is well-positioned to capitalize on this trend. Their strategy includes strengthening original equipment (OE) supply relationships with leading global premium automotive brands, further cementing their position in this profitable market.

Hankook has solidified its position in the Original Equipment (OE) tire market for premium automotive brands, achieving exclusive fitments for key high-performance models. For instance, they are supplying tires for the Mercedes-AMG GT Coupe and the BMW M5, underscoring their ability to meet demanding specifications.

This strategic focus places Hankook in a high-growth, high-value segment of the OE market. Their technological prowess is crucial for meeting the stringent performance and quality requirements of these luxury and performance-oriented vehicles.

In 2024, the global automotive OE tire market is projected to see steady growth, with the premium segment experiencing particularly robust expansion. Hankook's success in securing these high-profile partnerships indicates a strong market share within this lucrative niche, driven by innovation and brand reputation.

Motorsports Tire Supply (FIA WRC, Formula E)

Hankook's exclusive tire supply for the FIA World Rally Championship (WRC) starting in 2025, alongside its ongoing role in the ABB FIA Formula E World Championship, positions it strongly in these rapidly expanding motorsports arenas. This dual involvement generates substantial revenue and significantly bolsters Hankook's premium brand perception, while simultaneously driving innovations transferable to its broader product portfolio.

- Market Leadership: Hankook holds a dominant market share in the WRC and Formula E, two high-growth, high-visibility motorsports sectors.

- Revenue Generation: Direct tire sales to these championships provide a consistent revenue stream.

- Brand Enhancement: Association with prestigious racing series elevates Hankook's premium image and technological credibility.

- Technological Advancement: The demanding environments of WRC and Formula E accelerate the development of advanced tire technologies applicable to consumer products.

Global Aftermarket Premium & UHP Tires

Hankook & Co. is strategically focusing on its premium and ultra-high-performance (UHP) tire segment within the global aftermarket. This focus aims to bolster its market share by emphasizing high-value products in key regions. For instance, in 2023, Hankook's sales of UHP tires saw significant growth, contributing to an overall increase in its aftermarket revenue.

The company's commitment to research and development in this area is crucial. By continuously innovating and improving tire technology, Hankook ensures its products meet the evolving demands of performance-oriented consumers. This dedication is reflected in the robust demand for premium and seasonal tires, especially within the European market, which represents a substantial portion of Hankook's aftermarket sales.

Hankook's efforts in enhancing its premium brand positioning are directly impacting its performance in this competitive segment. The company's strong market presence in premium and UHP tires is a testament to its strategic approach.

- Market Share Growth: Hankook is actively expanding its sales of high-value premium and UHP tires in strategic global markets.

- Demand in Europe: The European region shows robust demand for high-performance and seasonal tires, a key focus for Hankook.

- R&D Investment: Continuous investment in research and development underpins Hankook's sustained leadership and growth in the UHP tire segment.

- Brand Positioning: Hankook's strategy includes enhancing its premium brand image to capture a larger share of the high-value aftermarket.

Hankook's iON premium EV tire lineup and its strong presence in large-diameter tires (18-inch and up) represent clear Stars in the BCG Matrix. These segments are characterized by high growth and strong market share for Hankook, driven by innovation and strategic partnerships. Their exclusive supply deals with premium EV manufacturers and performance vehicles, coupled with their dominance in motorsports like WRC and Formula E, solidify their Star status.

| Segment | Market Growth | Hankook's Market Share | Key Drivers |

|---|---|---|---|

| EV Tires (iON) | High (22.1% CAGR 2025-2032) | Strong (23% of OE sales in Q1 2025) | First-mover advantage, OE supply to premium EVs |

| Large Diameter Tires (18"+) | High (Aiming for >50% share by 2025) | Significant (46.5% of sales in 2024) | Focus on premium vehicles, OE supply to luxury brands |

| Motorsports (WRC/Formula E) | High Growth & Visibility | Dominant | Brand enhancement, revenue generation, tech advancement |

What is included in the product

The Hankook & Co. BCG Matrix offers strategic guidance on resource allocation across its diverse business units.

It clearly outlines which segments offer high growth potential and which require careful management or divestment.

Hankook & Co.'s BCG Matrix offers a clear, one-page overview of their business units, simplifying complex portfolio analysis.

Cash Cows

Hankook's standard replacement passenger car tires are a classic cash cow. They dominate mature markets thanks to Hankook's strong brand name and extensive distribution networks. This means they bring in a steady stream of money without needing a huge marketing budget, unlike newer, faster-growing products.

These tires are the bedrock of Hankook's financial stability, providing the reliable income needed to fund other ventures. In 2024, the replacement tire market for passenger cars remained robust, with Hankook maintaining a significant presence, especially in North America and Europe. The company's continuous focus on quality and value in this segment ensures sustained demand and profitability.

Hankook AtlasBX's Maintenance-Free (MF) lead-acid batteries are a solid cash cow. These batteries are built for standard passenger cars and commercial vehicles, a market that’s mature but still very dependable. This segment boasts a significant market share, which translates into consistent cash flow thanks to well-honed production methods.

The company's extensive experience and broad product range in MF lead-acid batteries, which dates back decades, guarantees ongoing profitability. For instance, the automotive battery market, a key sector for these products, saw global sales exceeding 300 million units in 2023, with lead-acid batteries still holding a dominant position.

Enhanced Flooded Batteries (EFB) are a significant cash cow for Hankook AtlasBX, particularly due to their integral role in modern start-stop vehicle systems. This technology, optimized for frequent engine restarts, has become a standard feature, solidifying Hankook's strong market position.

The widespread adoption of EFB batteries translates into substantial profit margins for Hankook. Because the technology is well-established, the need for heavy promotional spending is reduced, allowing for consistent, high returns. For instance, the global automotive battery market, which includes a substantial segment of EFB batteries, was valued at over $50 billion in 2023 and is projected to see steady growth.

Original Equipment (OE) Tires for Volume Segment ICE Vehicles

Hankook's original equipment (OE) tire supply to high-volume internal combustion engine (ICE) vehicles represents a significant cash cow. This segment benefits from broad adoption across numerous global automotive manufacturers, providing a stable and predictable revenue stream. The sheer volume of these vehicles ensures consistent demand, even as the ICE market matures.

These long-term contracts with major automakers solidify Hankook's market position and guarantee substantial sales. While the growth rate for ICE vehicles may be slowing, the established infrastructure and ongoing production of these models mean a continued, reliable demand for OE tires. This stability is a hallmark of a healthy cash cow business unit.

Key aspects of this cash cow include:

- Consistent Revenue: High-volume production and long-term contracts provide predictable income.

- Market Share Stability: Established relationships with global automakers secure a significant share of the OE market.

- Low Growth, High Volume: While the ICE market isn't expanding rapidly, the sheer number of vehicles produced ensures substantial sales volume.

- Brand Recognition: OE fitments enhance brand visibility and trust across a wide consumer base.

Truck and Bus Radial (TBR) Tires in Established Markets

Hankook's Truck and Bus Radial (TBR) tire segment in established markets, such as Europe and North America, represents a significant cash cow. This is due to their long-standing market presence and substantial market share, which translates into consistent revenue streams. The demand for these durable tires from commercial fleets is steady, even if growth is modest.

These products benefit from strong brand loyalty and operational efficiencies that Hankook has cultivated over years of serving these mature markets. This allows for predictable cash generation, essential for funding other areas of the business. For instance, in 2024, the global TBR tire market is projected to reach approximately USD 30 billion, with established regions accounting for a significant portion of this value.

- Established Market Dominance: Hankook holds a considerable share in mature TBR markets, ensuring a stable customer base.

- Consistent Revenue Generation: The steady demand from commercial transportation provides a reliable income source.

- Operational Efficiency: Years of experience have led to optimized production and distribution, enhancing profitability.

- Brand Loyalty: Trusted for durability and performance, Hankook TBR tires benefit from repeat business.

Hankook's standard replacement passenger car tires continue to be a cornerstone cash cow, leveraging a strong brand and extensive distribution in mature markets. This segment generates consistent, reliable income, minimizing the need for substantial marketing investment. For 2024, this sector remains a key contributor to Hankook's profitability, especially in North America and Europe, where quality and value drive sustained demand.

Hankook AtlasBX's Maintenance-Free (MF) lead-acid batteries also function as a reliable cash cow, serving the mature but dependable passenger car and commercial vehicle markets. Decades of experience and a broad product range ensure ongoing profitability, with the lead-acid segment still holding a dominant position in the global automotive battery market, which saw over 300 million units sold in 2023.

Enhanced Flooded Batteries (EFB) are a significant cash cow for Hankook AtlasBX, vital for modern start-stop vehicle systems. Their widespread adoption fuels substantial profit margins due to established technology and reduced promotional spending needs. The global automotive battery market, including EFBs, was valued at over $50 billion in 2023, indicating strong and consistent revenue for this product line.

Hankook's original equipment (OE) tire supply to high-volume internal combustion engine (ICE) vehicles remains a strong cash cow. Long-term contracts with major automakers ensure a stable revenue stream from the continued production of these vehicles. Despite the ICE market's maturity, the sheer volume guarantees ongoing demand for OE tires, reinforcing brand visibility and trust.

The Truck and Bus Radial (TBR) tire segment in established markets like Europe and North America represents another key cash cow for Hankook. Strong brand loyalty, operational efficiencies, and a substantial market share in these mature regions translate into consistent revenue. The global TBR tire market is projected to reach approximately USD 30 billion in 2024, with established regions forming a significant part of this value.

| Product Segment | BCG Classification | Key Characteristics | 2023/2024 Market Context |

| Standard Replacement Passenger Car Tires | Cash Cow | Mature market, strong brand, extensive distribution, low marketing needs, consistent revenue. | Robust market, significant presence in North America/Europe, sustained demand. |

| MF Lead-Acid Batteries (Hankook AtlasBX) | Cash Cow | Mature market, dependable, broad product range, operational efficiency, consistent cash flow. | Lead-acid still dominant in global automotive battery market (300M+ units in 2023). |

| Enhanced Flooded Batteries (EFB) (Hankook AtlasBX) | Cash Cow | Integral to start-stop systems, high profit margins, reduced promotional needs, established technology. | Global automotive battery market valued over $50B in 2023, steady growth. |

| OE Tires for ICE Vehicles | Cash Cow | High-volume production, long-term contracts, stable revenue, market share stability, brand visibility. | Continued production of ICE vehicles ensures ongoing demand for OE fitments. |

| Truck and Bus Radial (TBR) Tires (Established Markets) | Cash Cow | Long-standing presence, substantial market share, brand loyalty, operational efficiency, predictable cash generation. | Global TBR market projected ~USD 30B in 2024, mature regions significant. |

Delivered as Shown

Hankook & Co. BCG Matrix

The Hankook & Co. BCG Matrix preview you are viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis is designed for strategic clarity and professional application, containing no watermarks or demo content. You can be confident that the data and insights presented here are what you will leverage for your business planning and competitive strategy. This is the final, ready-to-use document, offering immediate value without any need for further revisions.

Dogs

Certain older tire models, especially those in smaller sizes or with less advanced technology within highly competitive markets, often find themselves in the Dogs quadrant. These are typically products that have been around for a while and are now facing significant pressure from newer, more efficient alternatives.

In 2024, the passenger car tire segment, a prime example of commoditization, continued to see intense price wars. For instance, some legacy tire manufacturers reported that their older, basic tread designs saw profit margins shrink to as low as 2-3% due to this intense competition, making reinvestment in these product lines less attractive.

These products, like certain older, smaller diameter tires, are likely experiencing very slow or even negative market share growth. They consume valuable resources in production and marketing without generating substantial returns, hindering the company's ability to invest in more promising, high-growth areas of its portfolio.

The challenge with these Dogs is that they can tie up capital and management attention. For a company like Hankook, strategically managing these legacy products, perhaps through phased discontinuation or niche marketing, is crucial to optimize resource allocation and focus on innovation.

Certain regional distribution networks, especially within North America, have experienced a downturn in consumer tire revenue. This dip is attributed to increased market competition and deliberate sales adjustments. For instance, Hankook & Co. might observe a decline in their non-strategic product sales in these regions.

These underperforming networks, if not actively supporting high-value strategic products, can be categorized as Dogs in the BCG Matrix. They exhibit sluggish market share growth and represent a drain on resources due to ongoing competitive pressures. In 2024, the global tire market faced significant cost inflation, impacting profitability for many distributors.

Niche or obsolete lead-acid battery applications for Hankook AtlasBX, while not explicitly detailed in public 2024 reports, would fall into the Dogs quadrant of the BCG Matrix. These are segments where demand is shrinking due to technological advancements, such as the rise of lithium-ion batteries in automotive and energy storage.

Such applications might include specialized industrial equipment or older vehicle models that are no longer in mass production. Their market share is likely minimal, and growth prospects are negligible, offering very low returns on any further investment.

Legacy R&D Projects with Limited Commercial Viability

Hankook & Co. has historically invested in various research and development endeavors. Some of these past initiatives, while perhaps innovative at the time, have not materialized into commercially successful products or have been made obsolete by advancements in technology. These legacy projects represent a drain on resources, consuming capital and personnel without generating current revenue or contributing to future market positioning. For instance, a focus on developing early-stage battery technologies for electric vehicles that were later surpassed by more efficient solid-state battery research would fall into this category.

These types of projects are often categorized as Dogs in the BCG Matrix because they require significant investment but offer little to no return. They are typically characterized by low market share and low market growth potential. Hankook & Co.'s strategic reallocation of R&D funds towards more promising areas, such as advanced tire materials and sustainable manufacturing processes, underscores a move away from these less fruitful ventures.

- Legacy R&D Projects: Past innovations that failed to gain market traction or were superseded.

- Resource Consumption: These projects tie up capital and human resources without generating returns.

- Limited Growth Potential: They contribute neither to current market share nor future growth prospects.

- Strategic Reallocation: Hankook & Co. is shifting R&D focus to more viable and future-oriented technologies.

Outdated Manufacturing Processes and Infrastructure

Outdated manufacturing processes and infrastructure represent a significant challenge for companies like Hankook & Co. These older systems, often characterized by lower efficiency and higher maintenance costs, can hinder overall productivity and competitiveness. For instance, a significant portion of older industrial infrastructure globally requires substantial investment for modernization, with some estimates suggesting billions are needed annually to keep pace with technological advancements.

These less efficient assets can tie up valuable capital and operational expenses without contributing to the production of high-value or high-growth products. This situation is particularly relevant in the context of digital transformation, where companies are increasingly focusing on adopting advanced technologies. The financial burden of maintaining legacy systems can divert resources that could otherwise be invested in innovation and growth initiatives, directly impacting a company's ability to adapt and thrive in a rapidly evolving market.

- Legacy Equipment Costs: Older machinery may incur higher repair and energy consumption costs compared to modern, energy-efficient alternatives.

- Reduced Throughput: Inefficient processes can lead to lower production volumes and longer lead times, impacting market responsiveness.

- Capital Immobilization: Funds are tied up in assets that do not generate commensurate returns or support strategic growth objectives.

- Digitalization Lag: Failure to upgrade infrastructure can create a gap in adopting new digital technologies, essential for future competitiveness.

Products in the Dogs quadrant, like older tire models with shrinking profit margins in the competitive 2024 passenger car segment, represent a significant challenge. These items, often with minimal market share and negligible growth, consume resources without yielding substantial returns.

For Hankook & Co., strategically managing these underperforming assets is crucial. This might involve phased discontinuation or niche marketing to free up capital and management focus for more promising growth areas.

The BCG Matrix highlights that these Dogs, such as legacy R&D projects that failed to gain traction, are characterized by low market share and low growth potential, requiring careful consideration for resource reallocation.

Outdated manufacturing processes, a common issue globally, also fall into this category, immobilizing capital and hindering competitiveness due to lower efficiency and higher maintenance costs.

| Hankook & Co. BCG Matrix: Dogs Examples (Illustrative) | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Passenger Car Tires (Basic Tread) | Low | Low/Declining | Very Low (2-3% margins in 2024) | Consider divestment or niche focus |

| Obsolete Lead-Acid Battery Applications | Negligible | Shrinking | Low | Phased exit |

| Underperforming Regional Distribution Networks | Low | Stagnant | Low | Restructure or exit |

| Superseded R&D Projects | None | None | Negative (resource drain) | Write-off and reallocate R&D |

| Outdated Manufacturing Equipment | N/A | N/A | Low (high maintenance) | Modernize or replace |

Question Marks

Hanon Systems, now part of Hankook & Co. following its January 2025 acquisition, operates within the burgeoning thermal management solutions sector, a field crucial for the advancement of electric vehicles. This strategic move places Hankook & Co. in a market poised for substantial expansion.

The thermal management market for EVs is projected to reach approximately $25 billion globally by 2027, demonstrating its significant growth trajectory. Hanon Systems' integration positions Hankook & Co. to capitalize on this trend.

However, given the recent integration, Hankook & Co.'s market share in this specialized area is still developing. It requires considerable investment to establish a strong foothold and fully leverage Hanon Systems' capabilities, suggesting it's a developing asset within the BCG matrix.

Hankook & Company's recent venture into corporate venture capital, marked by the establishment of its $11 million fund, Hankook & Company Ventures, in May 2025, signals a strategic pivot towards fostering innovation in deep tech. This fund specifically targets nascent companies in robotics, artificial intelligence, quantum computing, and aerospace, sectors characterized by rapid advancement and significant future potential.

While Hankook & Company currently holds a minimal direct market presence in these cutting-edge domains, this investment strategy is designed to cultivate future leadership. By backing deep tech startups, the company aims to gain exposure and build foundational capabilities in technologies poised to redefine industries.

These investments are inherently speculative, demanding substantial capital outlay with a high degree of uncertainty regarding their financial returns. However, the objective is clear: to strategically position Hankook & Company for long-term growth and market relevance in emerging technological landscapes.

Hankook & Co.'s ambition to build out new mobility platforms and services firmly places these ventures in the Question Mark quadrant of the BCG matrix. These are markets brimming with potential, projected to see significant growth, but Hankook's presence is still nascent.

The company is actively investing in research and development for these future mobility solutions, aiming to establish a foothold in a sector that demands continuous innovation and adaptation. For instance, the global mobility-as-a-service (MaaS) market was valued at approximately $71.4 billion in 2023 and is anticipated to expand considerably in the coming years.

Currently, Hankook's market share in these emerging mobility sectors is likely minimal, reflecting the early stage of their engagement. Significant capital infusion and strategic marketing efforts will be crucial to capture market share and transition these initiatives from Question Marks to future Stars.

Model Solution's Augmented Reality (AR) and Robotics Products

Model Solution, an affiliate of Hankook & Co., is actively presenting augmented reality and robotics products, signaling a strategic move into dynamic, high-growth technology arenas. These sectors, however, are known for intense competition. As a relatively new entrant within Hankook & Co.'s broader, diversified business interests, Model Solution likely currently commands a modest market share in these advanced technology fields.

Developing and scaling these AR and robotics offerings to achieve a significant market presence will necessitate substantial capital investment. For instance, the global augmented reality market was projected to reach $30.7 billion in 2024, with the robotics market also experiencing robust expansion, driven by automation trends across industries.

- High Growth Potential: Model Solution's AR and robotics align with rapidly expanding technology markets.

- Low Current Market Share: As part of a diversified group, its share in these niche, competitive sectors is likely small.

- Investment Needs: Significant R&D and market penetration efforts require substantial funding.

- Strategic Positioning: These ventures represent a forward-looking strategy for Hankook & Co. in emerging technologies.

Development of Next-Generation Battery Technologies (Beyond Lead-Acid)

While Hankook AtlasBX holds a strong position in the lead-acid battery market, aiming to be a smart energy provider, the global battery landscape is shifting dramatically. The market is increasingly focused on advanced technologies such as lithium-ion and the emerging all-solid-state batteries, which offer higher energy density and faster charging capabilities crucial for electric vehicles (EVs) and portable electronics.

Hankook's current market share and specific developments in these next-generation battery technologies beyond auxiliary lead-acid applications appear to be limited. This necessitates significant investment in research and development to compete effectively in these high-growth segments.

- Market Shift: The global battery market is projected to reach approximately $250 billion by 2025, with lithium-ion batteries dominating, indicating a clear trend away from traditional lead-acid technologies.

- R&D Imperative: Companies like Hankook must invest heavily in R&D to develop and commercialize advanced battery chemistries to maintain relevance and capture future market share.

- Competitive Landscape: Major players are already making substantial investments in solid-state battery technology, with some expecting commercialization by the late 2020s, highlighting the urgency for Hankook to accelerate its efforts.

- Strategic Focus: To transition from a lead-acid leader to a comprehensive energy solution provider, Hankook needs to strategically allocate resources towards next-generation battery innovation.

Hankook & Company's ventures into new mobility platforms and services clearly place them in the Question Mark category of the BCG matrix. These are markets with immense growth potential, but Hankook's current involvement is still in its early stages.

The company is channeling resources into research and development for these emerging mobility solutions, aiming to establish a foothold in a sector that thrives on constant innovation. For context, the global mobility-as-a-service market was valued at approximately $71.4 billion in 2023 and is expected to see substantial growth in the coming years.

Given this early stage, Hankook's market share in these nascent mobility sectors is likely minimal. Significant capital investment and strategic marketing will be essential to gain traction and evolve these initiatives from Question Marks into future Stars.

BCG Matrix Data Sources

Our Hankook & Co. BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.