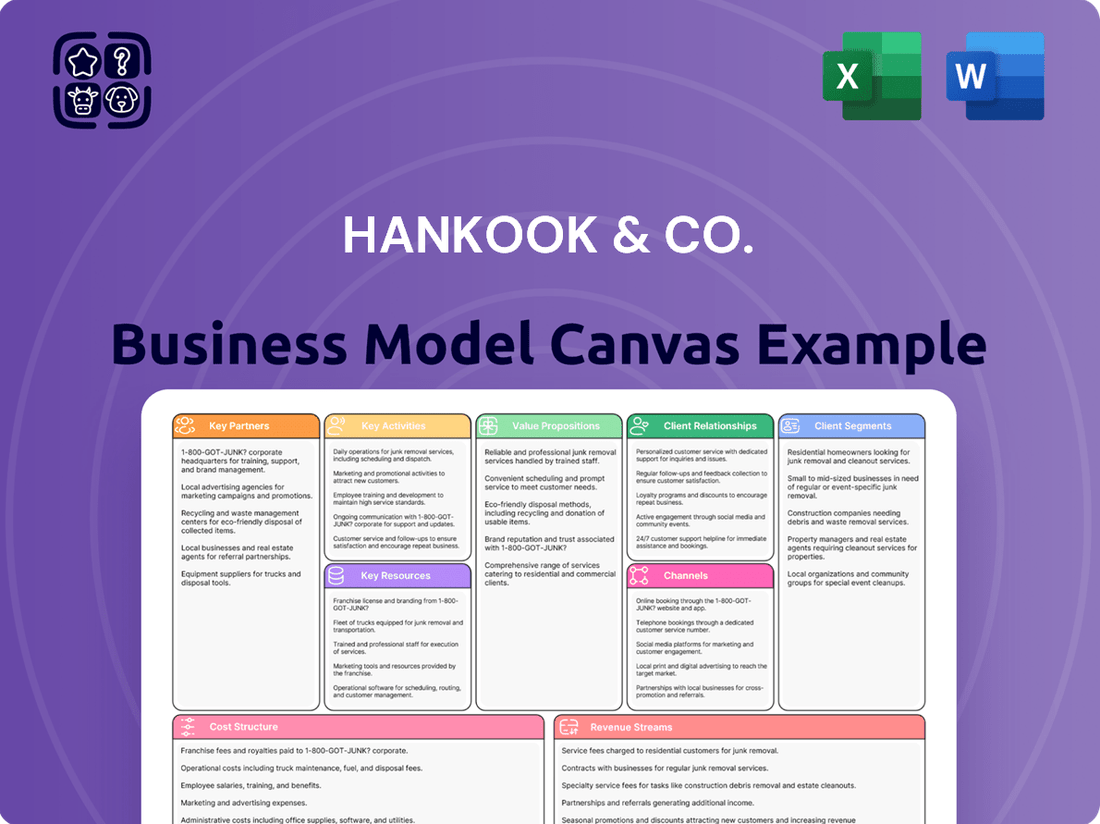

Hankook & Co. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hankook & Co. Bundle

Unlock the full strategic blueprint behind Hankook & Co.'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. It details key partners, customer relationships, and revenue streams, offering a clear view of their operational framework. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader.

Partnerships

Hankook & Co. solidifies its market presence through robust Original Equipment (OE) collaborations with prominent global automakers. These strategic alliances extend to premium brands such as Mercedes-AMG, BMW, Audi, and Porsche, underscoring Hankook's reputation for quality and performance.

The company's OE supply agreements encompass a diverse array of vehicle models, critically including high-performance and increasingly popular electric vehicles. This broad integration highlights Hankook's adaptability and commitment to meeting evolving automotive demands.

Hankook's success in securing and maintaining these OE partnerships is a testament to its unwavering dedication to meeting and exceeding the rigorous performance and quality benchmarks set by leading automotive manufacturers. This capability positions Hankook as a reliable and preferred supplier within the competitive automotive landscape.

Hankook & Co. has forged significant alliances with leading electric vehicle (EV) manufacturers, including giants like Tesla, BYD, Hyundai, Kia, and Lucid. These partnerships are instrumental in supplying specialized EV-dedicated tires, such as the iON series, for the latest EV models hitting the market.

For example, Hankook's iON tire range is specifically engineered to meet the unique demands of EVs, focusing on factors like reduced rolling resistance for extended range and enhanced durability to support higher vehicle weights and instant torque delivery. This deep integration with manufacturers ensures Hankook's tires are optimized for performance and efficiency in these cutting-edge vehicles.

These collaborations are not just about supplying tires; they are strategic moves that solidify Hankook's position as a leader in the rapidly expanding global EV market. By working closely with these automotive innovators, Hankook gains invaluable insights into future EV development, allowing them to stay ahead of the curve in tire technology and design.

The EV sector is projected for substantial growth, with global EV sales reaching an estimated 17 million units in 2024, a significant increase from previous years. Hankook's strong relationships with key players in this sector are therefore critical for capturing market share and driving future revenue growth.

Hankook Tire solidifies its position through key partnerships in motorsport, notably as the exclusive tire supplier for the ABB FIA Formula E World Championship and the FIA World Rally Championship (WRC) for the 2025-2027 seasons.

These high-profile collaborations act as crucial testing grounds, allowing Hankook to demonstrate and refine its cutting-edge tire technology in demanding competitive environments.

The association with elite racing series significantly elevates Hankook's premium brand image on a global scale, reaching a passionate and influential audience.

This strategic engagement in motorsport underscores Hankook's commitment to innovation and performance, directly impacting its brand perception and market presence.

Technology and Research Partners

Hankook & Co. actively collaborates with leading research institutions and industry organizations to foster innovation, particularly in sustainable materials and advanced manufacturing processes. These partnerships are crucial for staying at the forefront of tire technology and environmental responsibility.

A prime example of this engagement is Hankook's participation in key industry events, such as the 'Sustainability in Tires 2024' conference. Such platforms facilitate knowledge exchange and highlight the latest trends and breakthroughs in eco-friendly tire development. In 2023, Hankook announced a target to reduce its Scope 1 and 2 greenhouse gas emissions by 46.2% by 2030 compared to a 2019 baseline, aligning with the Science Based Targets initiative (SBTi). This commitment demonstrates a proactive approach to carbon reduction and a dedication to achieving tangible environmental goals.

These strategic alliances underscore Hankook's deep-seated commitment to eco-friendly advancements and the development of sustainable solutions within the automotive industry. By leveraging external expertise and participating in collaborative initiatives, Hankook aims to drive meaningful progress in areas like circular economy principles and the use of recycled materials in tire production.

- Research Collaborations Engage with universities and research centers to explore novel materials and production techniques.

- Industry Initiatives Participate in forums like 'Sustainability in Tires 2024' to share and gain insights on eco-friendly practices.

- Carbon Reduction Targets Commit to SBTi goals, aiming for a 46.2% reduction in Scope 1 and 2 emissions by 2030 (vs. 2019 baseline).

- Sustainable Material Development Focus on R&D for bio-based and recycled materials to enhance product sustainability.

Acquired Subsidiaries and Affiliates

Hankook & Co.'s strategic acquisition of Hanon Systems in January 2025 marked a pivotal moment, significantly broadening its business scope into advanced thermal energy management. This move is designed to unlock substantial synergies by integrating resources and technologies across its core businesses, including tires, batteries, and the newly acquired thermal management systems. The goal is to solidify Hankook & Co.'s position as a holistic provider of mobility solutions.

This integration is expected to foster cross-disciplinary innovation. For example, advancements in battery thermal management from Hanon Systems can directly benefit Hankook Tire's development of tires optimized for electric vehicles, enhancing performance and range. Similarly, shared R&D efforts can accelerate the creation of integrated thermal systems for next-generation EVs.

- Hanon Systems Acquisition: Completed January 2025, adding thermal management expertise.

- Synergy Maximization: Integration of resources and technologies across tires, batteries, and thermal systems.

- Strategic Positioning: Aiming to become a comprehensive mobility solutions provider.

- Market Impact: Expected to enhance EV performance and battery efficiency through integrated solutions.

Hankook & Co. actively cultivates partnerships with leading automakers, a cornerstone of its Original Equipment (OE) strategy. This includes collaborations with premium brands like Mercedes-AMG, BMW, Audi, and Porsche, ensuring its tires are fitted as original equipment on a wide range of vehicles, especially high-performance and electric models.

Furthermore, Hankook Tire is a key player in the burgeoning electric vehicle market, supplying specialized tires like the iON series to major EV manufacturers such as Tesla, BYD, Hyundai, Kia, and Lucid. This strategic alignment with EV pioneers is crucial, given the projected global EV sales reaching an estimated 17 million units in 2024.

In motorsports, Hankook's role as the exclusive tire supplier for the ABB FIA Formula E World Championship and the FIA World Rally Championship (WRC) for the 2025-2027 seasons provides a powerful platform for technological advancement and brand elevation. These high-stakes partnerships underscore Hankook's commitment to performance and innovation.

Beyond direct automotive supply, Hankook engages with research institutions and industry bodies, exemplified by its participation in events like the 'Sustainability in Tires 2024' conference. This commitment to sustainability is further reinforced by its target to reduce Scope 1 and 2 greenhouse gas emissions by 46.2% by 2030, aligning with Science Based Targets initiative (SBTi) goals.

The strategic acquisition of Hanon Systems in January 2025 significantly expands Hankook & Co.'s capabilities into thermal energy management, aiming to create synergies across its tire, battery, and new thermal system businesses to offer comprehensive mobility solutions. This integration is poised to enhance EV performance and battery efficiency.

What is included in the product

Hankook & Co.'s Business Model Canvas outlines its strategy for tire manufacturing and distribution, focusing on diverse customer segments like automotive OEMs and replacement markets, leveraging global production facilities and sales networks to deliver high-quality, innovative tire solutions.

The Hankook & Co. Business Model Canvas acts as a pain point reliever by providing a clear, high-level view of their operations, enabling rapid identification of core strategic components.

This one-page snapshot is perfect for quickly understanding how Hankook & Co. addresses market needs, making it ideal for brainstorming and internal strategy alignment.

Activities

Hankook & Co.'s key activities center on the comprehensive process of tire manufacturing and development. This encompasses the design, engineering, and large-scale production of a wide array of tires, catering to passenger vehicles, SUVs, light trucks, commercial trucks, and even motorsports applications.

A significant emphasis is placed on developing high-performance tires and those specifically engineered for electric vehicles (EVs). This focus is supported by the utilization of cutting-edge technologies and a robust network of global manufacturing plants. For instance, in 2023, Hankook Tire announced its plan to expand its EV tire production capacity at its plant in Hungary to meet growing demand.

Continuous investment in research and development is a cornerstone of their strategy, ensuring ongoing product innovation and maintaining a competitive edge in the dynamic automotive market. This commitment to R&D allows them to introduce advanced tire technologies, such as improved fuel efficiency and enhanced durability, directly impacting their market positioning.

Hankook & Co. produces automotive batteries, primarily premium AGM (Absorbent Glass Mat) types, through its affiliate Hankook AtlasBX. This strategic focus diversifies the company's footprint within the automotive parts sector and bolsters its overall consolidated revenue.

The battery division is a crucial element of Hankook & Co.'s expanding mobility offerings. In 2023, Hankook & Co. reported a consolidated revenue of approximately 8.3 trillion KRW (roughly $6.2 billion USD), with its battery segment contributing a significant portion to this total, reflecting strong demand for advanced battery technologies in vehicles.

Hankook & Co. dedicates substantial resources to Research and Development, a cornerstone of its strategy. The company focuses on pioneering advancements in sustainable materials, environmentally conscious manufacturing techniques, and enhanced tire performance to meet evolving market demands. This commitment is evident in their development of specialized products like the iON EV-exclusive tire brand, designed for the unique requirements of electric vehicles.

Furthermore, Hankook & Co.'s R&D efforts are directly aligned with global sustainability goals, actively working to reduce greenhouse gas emissions across its operations. They are also heavily invested in creating products that cater to the future of mobility, anticipating and shaping the needs of emerging transportation technologies.

Global Sales and Distribution

Hankook & Co. manages an extensive global sales and distribution network to serve a wide array of customer segments across the world. This involves maintaining robust operations within traditional offline sales channels, which remain a cornerstone of their market reach. The company is actively broadening its horizons by venturing into emerging areas such as shared mobility services and cultivating relationships with corporate clients, demonstrating adaptability to evolving market demands.

Furthermore, Hankook & Co. is committed to strengthening its digital presence by enhancing its business-to-business (B2B) platforms. This digital expansion is key to streamlining transactions and improving accessibility for its partners. The overarching objective is to guarantee that Hankook & Co.'s products are readily available and efficiently delivered to customers wherever they are located.

- Global Reach: Hankook & Co. operates in over 180 countries, underscoring its commitment to widespread product availability.

- Channel Diversification: Expansion into shared mobility and corporate sales demonstrates a strategic move beyond traditional retail.

- Digital Enhancement: Investment in B2B platforms aims to improve customer experience and operational efficiency in digital sales.

- Logistical Strength: Maintaining a stable distribution network is paramount for timely delivery, directly impacting customer satisfaction and market share.

Sustainable Management and ESG Initiatives

Hankook & Co. prioritizes sustainable management and Environmental, Social, and Governance (ESG) initiatives. A key activity involves implementing programs like 're:move' to foster a circular economy and minimize waste. This focus extends to actively reducing their environmental footprint across all operations.

The company has established ambitious targets for carbon emission reductions, demonstrating a commitment to combating climate change. Hankook & Co. also actively pursues and obtains relevant environmental certifications to validate their sustainability efforts. These actions are integral to their long-term strategy.

- Environmental Impact Reduction: Hankook & Co. is dedicated to lowering its environmental impact, aiming for significant carbon emission reductions.

- Circular Economy Promotion: The 're:move' program exemplifies their commitment to a circular economy by focusing on resource efficiency and waste reduction.

- Value Chain Responsibility: Ensuring responsible practices extends throughout their entire value chain, from sourcing to product end-of-life.

- Environmental Certifications: Obtaining recognized environmental certifications underscores their adherence to rigorous sustainability standards.

Hankook & Co.'s key activities encompass the complete lifecycle of tire manufacturing, from advanced R&D to global distribution. They focus on producing a diverse range of tires, with a notable emphasis on high-performance and EV-specific models like the iON brand.

Beyond tires, Hankook & Co. diversifies its portfolio through its affiliate, Hankook AtlasBX, which manufactures automotive batteries, particularly premium AGM types, bolstering their presence in the automotive parts sector.

A critical activity involves managing an extensive global sales and distribution network, actively expanding into emerging mobility services and strengthening digital B2B platforms to ensure product accessibility worldwide.

The company also prioritizes sustainable management and ESG initiatives, driving efforts to reduce environmental impact through programs like 're:move' and setting ambitious carbon emission reduction targets.

| Key Activity | Description | 2023 Data/Focus |

|---|---|---|

| Tire Manufacturing & Development | Design, engineering, and production of various tire types. | Expansion of EV tire capacity in Hungary. |

| Battery Production | Manufacturing of automotive batteries, especially AGM. | Contributed significantly to 2023 revenue of ~8.3 trillion KRW. |

| Global Sales & Distribution | Managing sales channels and logistics. | Operations in over 180 countries; expanding into shared mobility. |

| R&D and Sustainability | Innovation in materials, manufacturing, and ESG. | Focus on sustainable materials, EV tires, and carbon emission reduction. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hankook & Co. Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable, showcasing the comprehensive breakdown of Hankook's strategic framework. You'll gain immediate access to this fully editable and actionable Business Model Canvas, mirroring the structure and content presented here, ensuring no surprises and full value for your investment.

Resources

Hankook & Co. relies on its eight strategically located global manufacturing facilities, including its significant plant in Tennessee, USA, to drive its production capabilities. These facilities are the backbone of the company's ability to serve diverse markets efficiently and manage its extensive supply chain effectively.

The company is actively investing in expanding these manufacturing sites to keep pace with escalating global demand, especially for passenger and light truck tires. This expansion is crucial for maintaining a competitive edge and ensuring timely product delivery to customers worldwide.

Hankook & Co.'s Technoplex headquarters in South Korea, alongside other advanced research and development centers, serves as the crucible for groundbreaking tire and battery technologies. These facilities are not just buildings; they are engines of innovation, driving the company's competitive edge.

The company's investment in intellectual property is substantial. This includes a robust portfolio of patents and proprietary material compounds, particularly crucial for the development of high-performance tires and those specifically designed for electric vehicles (EVs). These intangible assets represent significant value and a barrier to entry for competitors.

This deep technological expertise directly fuels product innovation. For instance, Hankook's focus on EV tires has led to advancements in low rolling resistance and noise reduction, critical factors for the growing electric vehicle market. By 2024, the company has continued to expand its R&D capabilities, aiming to solidify its position as a leader in sustainable mobility solutions.

Hankook & Co. leverages a robust brand portfolio, featuring prominent tire brands like Hankook and Laufenn, as well as the Hankook AtlasBX battery brand. This diverse offering caters to various market segments.

The company actively cultivates a premium brand image, significantly bolstered by its involvement in motorsport sponsorships and accolades for its commitment to sustainability. This strategic positioning enhances customer appeal and loyalty.

In 2024, Hankook Tire & Technology, a key entity within Hankook & Co., continued to invest in brand building. For instance, their sponsorship of Formula E, a leading all-electric motorsport series, directly aligns with their sustainability initiatives and targets a tech-savvy audience.

This strong brand equity translates into tangible market advantages, allowing Hankook & Co. to command premium pricing and achieve higher customer retention rates compared to competitors with less established brand identities.

Financial Capital and Investment Capacity

Hankook & Co.'s robust financial health, evidenced by consolidated revenues of KRW 9.4119 trillion in 2024 and strong operating profits, underpins its significant investment capacity. This financial strength is a cornerstone of its business model, allowing for substantial allocation towards critical growth initiatives.

The company leverages this financial capital to fuel strategic investments in key areas. These include cutting-edge research and development to maintain technological leadership, expanding production capacity to meet growing global demand, and pursuing strategic acquisitions that broaden its market reach and diversify its portfolio. A prime example is the acquisition of Hanon Systems, which significantly bolstered its presence in the automotive components sector.

- Financial Strength: Consolidated revenues of KRW 9.4119 trillion in 2024 and healthy operating profits provide a solid foundation.

- R&D Investment: Capital is allocated to research and development, ensuring innovation and competitive advantage.

- Capacity Expansion: Financial resources support the scaling of production facilities to meet market needs.

- Strategic Acquisitions: Investments like the Hanon Systems acquisition enhance diversification and market position.

Human Capital and Expertise

Hankook & Co. relies heavily on its skilled human capital, encompassing engineers, researchers, and management. This expertise is fundamental to driving innovation, ensuring operational efficiency, and supporting the company's global expansion efforts. For instance, in 2023, Hankook Tire & Technology, a key subsidiary, reported significant investment in R&D, reflecting the value placed on its technical workforce.

The company actively cultivates a Proactive Culture, emphasizing employee well-being and continuous improvement. This internal environment is designed to empower employees and facilitate the effective execution of strategic initiatives. Such a focus on human capital is a cornerstone of their business model, enabling them to adapt to market changes and maintain a competitive edge.

- Skilled Workforce: Engineers, researchers, and management are vital for innovation and global reach.

- R&D Investment: Hankook Tire & Technology's commitment to research underscores the importance of its technical talent.

- Proactive Culture: Fostering employee well-being and continuous improvement enhances strategic execution.

- Talent Management: Investing in and nurturing human capital is a core strategy for sustained success.

Hankook & Co.'s key resources include its extensive global manufacturing footprint, with eight strategically positioned plants, including a significant facility in Tennessee, USA. This infrastructure is complemented by its Technoplex headquarters and advanced R&D centers in South Korea, which are crucial for technological innovation. The company also possesses a substantial portfolio of intellectual property, including patents and proprietary material compounds, particularly for EV and high-performance tires.

| Key Resource | Description | Strategic Importance |

| Global Manufacturing Facilities | Eight strategically located plants worldwide, including Tennessee, USA. | Ensures efficient production, supply chain management, and market reach. |

| R&D Centers (Technoplex) | Advanced research and development facilities in South Korea. | Drives innovation in tire and battery technologies, crucial for competitive edge. |

| Intellectual Property | Patents and proprietary material compounds, especially for EV tires. | Creates barriers to entry and underpins product differentiation and performance. |

| Brand Portfolio | Recognized brands like Hankook, Laufenn (tires), and Hankook AtlasBX (batteries). | Caters to diverse market segments and supports premium brand image. |

| Financial Strength | KRW 9.4119 trillion in consolidated revenues (2024) and strong operating profits. | Enables substantial investment in R&D, capacity expansion, and strategic acquisitions. |

| Skilled Human Capital | Expertise in engineering, research, and management; emphasis on a proactive culture. | Drives innovation, operational efficiency, and strategic initiative execution. |

Value Propositions

Hankook offers a distinct competitive edge with its Ultra Ultra High Performance (UUHP) tires, delivering exceptional grip and handling. This commitment to superior performance extends to its pioneering iON brand, meticulously engineered for the unique demands of electric vehicles.

These specialized tires, like the Ventus S1 evo Z, provide EVs with enhanced stability, reduced rolling resistance for better efficiency, and the durability needed for instant torque. For instance, the iON evo tire, launched in 2023, was developed to meet the specific needs of the EV market, showcasing Hankook's forward-thinking approach.

Hankook & Co.'s commitment to sustainability is a core value, evident in their drive to cut carbon emissions and innovate with eco-friendly materials. This focus resonates with a growing market of environmentally aware consumers, bolstering the company's image and market appeal.

The company's 're:move' program exemplifies its dedication to circular economy principles, aiming to reduce waste and maximize resource utilization. Such initiatives not only demonstrate corporate responsibility but also position Hankook & Co. as a forward-thinking leader in sustainable business practices.

In 2024, Hankook Tire & Technology, a key entity within Hankook & Co., reported significant progress in its sustainability efforts, including a reduction in greenhouse gas emissions intensity by 10% compared to 2019 levels. This tangible achievement underscores their proactive approach to environmental stewardship.

Furthermore, the development of sustainable tire materials, such as those incorporating recycled plastics and bio-based compounds, is a critical component of their value proposition. These innovations cater to the increasing demand for greener products across various industries.

Hankook & Co. stands as a benchmark for reliability and technological prowess as an Original Equipment Manufacturer (OEM). The company proudly supplies its advanced tire solutions to roughly 50 prominent automotive brands worldwide, equipping over 280 distinct vehicle models.

This extensive reach underscores Hankook's capacity to meet the exacting quality and performance benchmarks set by leading global car manufacturers. Such consistent delivery fosters deep trust and guarantees a high level of product uniformity across its diverse customer base.

Comprehensive Mobility Portfolio

Hankook & Co.'s acquisition of Hanon Systems significantly expands its value proposition in the mobility sector. This move allows Hankook to offer more than just tires, now encompassing critical components like batteries and advanced thermal management systems. This integrated approach positions Hankook & Co. to provide comprehensive solutions tailored to the rapidly changing demands of the automotive industry and the emerging landscape of future mobility.

The expanded portfolio directly addresses the industry's shift towards electric vehicles (EVs) and connected technologies. By bundling diverse mobility solutions, Hankook & Co. can offer greater value and convenience to its automotive partners. This strategic diversification is crucial for staying competitive and capturing growth opportunities in a dynamic market.

- Diversified Product Offerings: Beyond tires, Hankook & Co. now includes batteries and thermal management systems, enhancing its appeal to EV manufacturers.

- Integrated Solutions Provider: The company can now offer a more complete package of components, simplifying supply chains for its clients.

- Future Mobility Focus: This expanded portfolio is designed to meet the evolving needs of the next generation of transportation.

Innovation and Future-Oriented Development

Hankook & Co. prioritizes innovation by consistently channeling significant resources into research and development. This commitment is crucial for staying ahead of evolving mobility trends, including the rapid advancements in autonomous driving and connected vehicle technologies. By proactively anticipating these shifts, the company develops next-generation products and solutions.

This forward-thinking strategy ensures Hankook & Co. is not just responding to market demands but actively shaping them. For instance, their ongoing investment in R&D aims to create advanced tire technologies that enhance safety and efficiency for electric and autonomous vehicles. In 2024, Hankook Tire & Technology, a key entity within Hankook & Co., continued its robust R&D spending, focusing on smart tire technologies and sustainable materials.

- R&D Investment: Hankook Tire & Technology's dedication to innovation is reflected in its consistent R&D expenditure, a critical component for developing technologies for autonomous and connected vehicles.

- Future Mobility Focus: The company's research actively targets the unique demands of future mobility, ensuring its product pipeline aligns with market evolution.

- Industry Leadership: By developing cutting-edge technologies, Hankook & Co. solidifies its position as an innovator within the global tire and mobility sectors.

- Smart Tire Development: Significant efforts are directed towards creating intelligent tire systems that can communicate data, enhancing vehicle performance and safety.

Hankook & Co. offers a robust value proposition through its advanced tire technology, particularly its Ultra Ultra High Performance (UUHP) tires and specialized EV tires like the iON brand, which enhance vehicle stability and efficiency. The company's commitment to sustainability, demonstrated by initiatives like the 're:move' program and a 10% reduction in greenhouse gas emissions intensity by 2024 (compared to 2019), appeals to environmentally conscious consumers.

As a leading Original Equipment Manufacturer (OEM), Hankook supplies tires to approximately 50 global automotive brands, equipping over 280 vehicle models, ensuring widespread adoption and trust. The strategic acquisition of Hanon Systems further diversifies Hankook's offerings, enabling the provision of integrated mobility solutions including batteries and thermal management systems, thereby catering to the evolving demands of the electric and future mobility sectors.

Hankook & Co.'s significant investment in research and development, with a strong focus on smart tire technologies and sustainable materials in 2024, positions it as an industry innovator. This dedication ensures its product pipeline aligns with the advancements in autonomous and connected vehicle technologies, solidifying its leadership in the global mobility market.

Customer Relationships

Hankook & Co. prioritizes enduring collaborations with major global automakers, fostering trust through joint research and development initiatives. This strategic approach ensures Hankook is consistently considered a top-tier supplier for original equipment, reflecting a commitment to mutual growth and innovation.

These OEM partnerships are characterized by ongoing dialogue and the co-creation of specialized tire solutions, meticulously designed to align with the precise specifications of each vehicle model. This dedication to tailored development solidifies Hankook's position as a vital component in the automotive supply chain.

In 2023, Hankook Tire & Technology reported that approximately 37% of its total sales were derived from the original equipment (OE) sector, underscoring the critical importance of these long-standing relationships with car manufacturers.

For the replacement tire market, Hankook & Co. prioritizes direct engagement and exceptional customer service to foster loyalty. This includes offering satisfaction guarantees, a crucial element in building trust and encouraging repeat business.

Through its extensive distribution network, Hankook actively engages with customers, ensuring their needs are met and providing a positive post-purchase experience. This direct interaction is key to understanding market demands and refining their offerings.

In 2024, Hankook Tire & Technology reported a significant portion of its revenue coming from the replacement market, underscoring the importance of these customer relationship strategies in driving sales and brand advocacy.

Hankook & Co. cultivates strong customer relationships by leveraging high-profile motorsport sponsorships. Events like Formula E and the World Rally Championship (WRC) serve as dynamic platforms to demonstrate tire performance and technological advancements to a worldwide audience. These sponsorships are crucial for building brand prestige and trust among enthusiasts and the general public alike.

Beyond the racetrack, Hankook engages in culture marketing to expand its reach and connect with diverse consumer groups. By integrating mobility with elements of art, fashion, and music, the company creates unique experiences that resonate with younger demographics and broaden brand appeal. For instance, in 2024, Hankook continued its partnership with Formula E, a series committed to sustainability, aligning its brand with forward-thinking cultural movements.

Digital Platforms and Networking

Hankook & Co. actively cultivates its distribution network through digital channels. Their B2B platform, 'Hantai e Jia,' operating in China, serves as a key digital hub. This platform is designed to foster stronger connections and collaboration among their business partners and end-users, thereby improving overall network efficiency.

The company's digital engagement strategy aims to create a more streamlined and accessible experience for all stakeholders. By facilitating seamless online interactions, Hankook & Co. can better manage its supply chain and customer relationships. This digital approach directly supports the efficient flow of information and transactions within their extended network.

Leveraging platforms like 'Hantai e Jia' allows Hankook & Co. to gather valuable data on network activity and partner engagement. In 2023, for instance, digital B2B platforms saw a significant surge in adoption across various industries, with many reporting double-digit percentage increases in transaction volumes. This trend highlights the growing importance of digital networking for companies like Hankook & Co. to maintain competitive advantage.

- Digital Networking Hub: 'Hantai e Jia' in China connects distributors and end-users.

- Enhanced Efficiency: Streamlines interactions and processes across the distribution network.

- Improved Accessibility: Facilitates seamless communication and transactions for business partners.

- Data-Driven Insights: Enables better understanding of network activity and partner engagement.

Community and Social Contributions

Hankook & Co. actively nurtures community relationships through dedicated social contribution programs. These efforts go beyond mere corporate responsibility, aiming to create tangible positive impacts and build lasting goodwill.

Key initiatives include child traffic safety education, which has reached thousands of children, and environmental conservation projects like 'Our Forest.' In 2023 alone, Hankook invested over ₩5 billion in various social welfare and environmental protection activities.

- Child Traffic Safety Education: Hankook's programs aim to reduce childhood accidents, fostering a safer environment for young citizens.

- Environmental Conservation: Projects like 'Our Forest' focus on reforestation and sustainable land management, contributing to ecological well-being.

- Brand Image Enhancement: These activities cultivate a positive perception of Hankook & Co. within local communities, strengthening brand loyalty.

- Shared Value Creation: By investing in social good, Hankook demonstrates a commitment to creating value that extends beyond its financial performance.

Hankook & Co. maintains strong relationships with major automakers through joint R&D, ensuring it's a top OEM supplier. For the replacement market, it focuses on direct engagement, satisfaction guarantees, and an extensive distribution network to build loyalty and encourage repeat business. In 2023, the OE sector accounted for approximately 37% of Hankook Tire & Technology's sales, highlighting the significance of these manufacturer partnerships.

The company also leverages high-profile motorsport sponsorships, such as Formula E and WRC, to showcase tire performance and build brand prestige globally. Additionally, Hankook engages in culture marketing and digital platforms like 'Hantai e Jia' in China to connect with diverse consumer groups and streamline network efficiency. In 2024, Hankook continued its Formula E partnership, aligning with sustainability initiatives.

Community engagement through social contribution programs, including child traffic safety education and environmental conservation, further enhances Hankook's brand image and fosters goodwill. In 2023, the company invested over ₩5 billion in social welfare and environmental activities, demonstrating a commitment to shared value creation beyond financial performance.

Channels

Hankook's Original Equipment (OE) supply chain is a critical channel, directly providing tires and thermal management systems to automotive manufacturers for new vehicle production. This segment requires intricate global logistics and deep, collaborative relationships with carmakers to ensure seamless integration of Hankook products into their assembly lines. For instance, in 2023, Hankook was selected as an OE supplier for several major global automakers, contributing to a significant portion of their new vehicle tire fitments.

This channel is characterized by high-volume, just-in-time deliveries, demanding precision and reliability from Hankook's manufacturing and distribution networks. The company's ability to meet stringent quality standards and adapt to evolving vehicle specifications is paramount to maintaining these partnerships. In 2024, Hankook reported an increase in its OE sales volume, reflecting successful expansions of its supply agreements with leading electric vehicle manufacturers.

Hankook & Co. leverages an extensive global distribution network comprising wholesalers, distributors, and independent tire dealers to reach end-consumers in the replacement market. This multi-tiered approach ensures broad market penetration and accessibility for their aftermarket tire sales.

The aftermarket segment is a critical revenue driver for Hankook & Co., necessitating continuous optimization of their distribution channels to enhance efficiency and capture greater market share. Their strategy focuses on strengthening relationships with existing partners and expanding their reach into new territories.

In 2024, Hankook Tire & Technology, a key entity within Hankook & Co., reported significant growth in its replacement tire business, driven by strategic distribution enhancements in key markets like North America and Europe. The company continues to invest in logistics and inventory management to ensure timely product availability.

This robust distribution infrastructure is vital for maintaining competitive pricing and customer satisfaction in the dynamic global tire market, contributing substantially to Hankook & Co.'s overall financial performance.

Hankook & Co. leverages its retail and service centers as crucial channels for direct customer engagement and specialized product delivery. These include partnerships with numerous auto repair chains and its own premium auto repair shop, SONIC Dogok, facilitating sales and installation services.

These physical locations are vital for offering hands-on customer interaction, allowing for expert advice and specialized vehicle maintenance. In 2023, Hankook Tire & Technology saw continued investment in its retail network, with a focus on enhancing customer experience and service quality at these touchpoints.

Digital Sales and B2B Platforms

Hankook & Co. leverages digital sales and B2B platforms, such as its proprietary 'Hantai e Jia' system, to streamline operations. This platform allows business partners to place orders, manage inventory, and communicate seamlessly, significantly boosting efficiency across the distribution network.

The integration of 'Hantai e Jia' enhances accessibility, providing partners with 24/7 access to crucial business functions. This digital transformation is a key component in maintaining strong relationships and facilitating smoother transactions within Hankook & Co.'s B2B ecosystem.

- Digital Platform Adoption: In 2024, Hankook & Co. reported that over 85% of its B2B partners actively utilize the 'Hantai e Jia' platform for daily transactions.

- Efficiency Gains: The platform has contributed to a 20% reduction in order processing times since its full implementation.

- Inventory Management: Real-time inventory updates through the platform have improved stock accuracy by 95%, minimizing stockouts for partners.

- Partner Communication: Direct communication features within 'Hantai e Jia' have led to a 30% increase in partner engagement and feedback.

New Mobility Service Providers

Hankook & Co. is actively engaging with new mobility service providers, recognizing the shift away from traditional car ownership. This strategic move involves forging partnerships with shared mobility platforms and catering to corporate clients seeking flexible transportation solutions.

These new channels are crucial for adapting to evolving transportation trends and extending Hankook's market reach. By embracing these evolving models, the company aims to capture a segment of the market that prioritizes accessibility and service over outright ownership.

- Partnerships with Shared Mobility Services: Collaborating with companies like Uber, Lyft, and regional ride-sharing operators to integrate Hankook tires into their fleets.

- Corporate Fleet Solutions: Offering tailored tire management and maintenance programs for businesses utilizing car-sharing or leasing services.

- Data Analytics for Fleet Optimization: Leveraging data from shared and corporate fleets to improve tire performance and predict maintenance needs.

- Expansion into Electric Vehicle (EV) Mobility: Focusing on providing specialized tires for the growing EV fleet market, which demands specific performance characteristics.

Hankook & Co. utilizes several key channels to reach its diverse customer base. These include direct supply to automotive manufacturers for Original Equipment (OE), a broad aftermarket distribution network, direct-to-consumer retail and service centers, and increasingly, digital B2B platforms and partnerships with new mobility service providers.

The OE channel is critical for high-volume business with carmakers, while the aftermarket ensures widespread consumer access. Digital platforms streamline B2B transactions, and engagement with mobility services positions Hankook for future market shifts.

In 2024, Hankook reported that its OE sales continued to grow, particularly with electric vehicle manufacturers. Their aftermarket business also saw strong performance, bolstered by enhanced distribution in Europe and North America.

Digital adoption is high, with over 85% of B2B partners actively using the 'Hantai e Jia' platform in 2024, leading to a 20% reduction in order processing times.

| Channel | Key Characteristics | 2024 Highlights/Data |

|---|---|---|

| Original Equipment (OE) | Direct supply to automotive manufacturers for new vehicles. High-volume, just-in-time delivery. | Increased OE sales volume, especially with EV manufacturers. |

| Aftermarket Distribution | Global network of wholesalers, distributors, and dealers for replacement tires. | Significant growth driven by strategic enhancements in North America and Europe. |

| Retail & Service Centers | Direct customer engagement, sales, and installation services. Includes partnerships with repair chains and own service shops. | Continued investment in network to enhance customer experience and service quality. |

| Digital B2B Platforms | Streamlined operations and communication for business partners (e.g., 'Hantai e Jia'). | Over 85% B2B partner utilization; 20% reduction in order processing time. |

| New Mobility Services | Partnerships with shared mobility platforms and corporate clients. | Focus on catering to evolving transportation trends and providing solutions for EV fleets. |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent a critical customer segment for Hankook & Co. This encompasses major players like Mercedes-Benz, BMW, Audi, Nissan, Volkswagen, and Toyota, all of whom require tires and thermal management solutions for their new vehicle production. Hankook is strategically focusing on premium and fast-growing electric vehicle (EV) manufacturers within this broad category.

In 2024, the automotive industry continued its shift towards electrification, with EV sales projected to reach approximately 17 million units globally, up from around 14 million in 2023. This trend directly benefits Hankook as it prioritizes supplying to EV manufacturers, who often demand specialized tires with lower rolling resistance and enhanced durability. The premium segment, where Hankook has a strong presence, typically sees higher profit margins and a greater emphasis on performance and innovation.

Individual vehicle owners needing tire replacements represent a significant customer base for Hankook & Co., encompassing drivers of passenger cars, SUVs, and light trucks. This segment seeks a diverse selection of tires, including all-season, performance, and specialized EV tires, with a strong emphasis on safety, longevity, and a comfortable ride.

In 2024, the global automotive aftermarket, which includes tire replacements, continued to show resilience. For instance, the tire replacement market specifically is projected to grow, with estimates suggesting it will reach over 290 million units annually in the coming years, driven by an aging vehicle fleet and increasing vehicle miles traveled.

Consumers in this segment are increasingly informed, often researching tire performance, treadwear ratings, and fuel efficiency before making a purchase. This trend means Hankook must offer a broad portfolio that addresses various driving conditions and vehicle types, catering to both budget-conscious buyers and those prioritizing premium features.

Commercial vehicle fleets, encompassing trucking companies and bus operators, are a cornerstone customer segment for Hankook & Co.'s tire and battery divisions. These businesses are intensely focused on maximizing operational uptime and minimizing total cost of ownership.

For these fleet operators, Hankook's commercial tires are valued for their robust construction, designed to withstand heavy loads and long-haul mileage, directly impacting fuel efficiency and reducing downtime. In 2023, the global commercial vehicle tire market was valued at approximately $75 billion, with Hankook holding a significant share by focusing on these performance metrics.

Similarly, Hankook's battery solutions for commercial vehicles are chosen for their reliability and longevity, crucial for ensuring consistent vehicle performance and preventing costly service interruptions. Fleet managers actively seek products that offer a strong return on investment through extended service life and reduced maintenance requirements.

Motorsport Teams and Enthusiasts

Professional motorsport teams, particularly those in high-profile series such as Formula E and the World Rally Championship (WRC), represent a crucial customer segment for advanced tire manufacturers. These teams demand tires engineered for extreme performance, durability, and specific grip characteristics tailored to diverse racing conditions. For instance, in 2024, the Formula E championship continued to push the boundaries of electric racing, with teams investing heavily in technology, including tire development, to gain a competitive edge.

Motorsport enthusiasts, while an indirect segment, significantly influence brand perception and demand. Their engagement with events creates brand visibility and aspirational value, often translating into purchasing decisions for consumer tires that reflect the technology used in professional racing. The global motorsport viewership, with events like the 2024 WRC season drawing millions of viewers, underscores the marketing power of this segment for tire companies.

- Targeted High-Performance Needs: Motorsport teams require tires with specific compounds and construction for optimal speed, handling, and longevity in competitive environments.

- Brand Advocacy and Influence: Enthusiast viewership and engagement foster brand loyalty and create a halo effect, driving consumer interest in related products.

- Technological Showcase: Racing series serve as a proving ground for new tire technologies, which can then be adapted for road vehicles, appealing to both professional teams and enthusiast consumers.

- Market Data: The global market for motorsport tires is a niche but high-value segment, with significant R&D investment from manufacturers seeking to demonstrate technological superiority.

Aftermarket Service Providers and Dealers

Aftermarket service providers and dealers represent a vital customer segment for Hankook & Co. This includes independent tire dealers, dedicated auto repair shops, and expansive retail chains that procure Hankook tires for both resale and direct installation services. These B2B partners are indispensable for Hankook's penetration into the vast replacement tire market.

These channels are crucial for extending Hankook's reach, ensuring their products are readily available to a wide consumer base. Their expertise in installation and customer service also contributes to the overall brand experience. For instance, in 2023, the global automotive aftermarket industry was valued at approximately $480 billion, with tire sales forming a significant portion of this figure.

- Independent Tire Dealers: These smaller, often specialized businesses rely on Hankook for a consistent supply of quality tires to serve their local clientele.

- Auto Repair Shops: Beyond tire sales, these establishments utilize Hankook products as part of broader vehicle maintenance and repair services, recommending them to customers.

- Large Retail Chains: These major players offer significant volume purchasing power and broad geographic coverage, acting as key distributors for Hankook's passenger and light truck tire lines.

Hankook & Co. serves a diverse array of customer segments, from major global automotive manufacturers to individual vehicle owners and commercial fleet operators. Their strategy involves catering to both the original equipment (OE) market, supplying directly to car makers, and the aftermarket, where replacement tires are sold. This dual approach ensures broad market penetration and revenue diversification.

In 2024, Hankook continued to strengthen its relationships with premium and electric vehicle (EV) manufacturers, recognizing the growth potential in these areas. Simultaneously, the company maintained its focus on the replacement tire market, which remains a significant revenue driver. The company's battery division also targets commercial fleets, emphasizing reliability and cost-effectiveness.

| Customer Segment | Key Needs | Hankook's Value Proposition |

|---|---|---|

| Global Automotive OEMs | High-quality tires, thermal management solutions for new vehicles, EV-specific tires | OE supplier to premium brands, innovation in EV tire technology, reliable thermal solutions |

| Individual Vehicle Owners | Replacement tires (all-season, performance, EV), safety, longevity, comfort | Wide product range, strong brand reputation, accessible distribution network |

| Commercial Vehicle Fleets | Durable tires for heavy loads, fuel efficiency, battery reliability, low total cost of ownership | Robust commercial tire designs, long-lasting batteries, focus on uptime and reduced maintenance |

| Motorsport Teams & Enthusiasts | Extreme performance tires, technological advancement, brand visibility | Cutting-edge tire technology developed for racing, motorsport sponsorship creating brand aspirational value |

| Aftermarket Service Providers & Dealers | Consistent supply of quality tires, competitive pricing, strong distribution support | Extensive dealer network, reliable product availability, brand marketing support for retailers |

Cost Structure

Hankook & Co. dedicates significant resources to Research and Development, focusing on groundbreaking tire technologies, eco-friendly materials, and innovative solutions for future mobility, particularly electric vehicles. These investments are fundamental to staying ahead in a dynamic and competitive automotive sector.

In 2023, Hankook Tire & Technology reported R&D expenses amounting to 355.8 billion Korean Won (approximately $260 million USD), underscoring their commitment to technological advancement and product innovation. This substantial outlay fuels the development of next-generation tires and sustainable materials, essential for maintaining market leadership.

Manufacturing and production costs are a substantial part of Hankook & Co.'s operations. These costs encompass the essential raw materials like natural and synthetic rubber, various chemicals, the energy needed to power their manufacturing plants, wages for their workforce, and the ongoing upkeep of their facilities. In 2023, the global price of natural rubber saw some volatility, impacting input costs for tire manufacturers like Hankook.

The company's profitability is particularly sensitive to changes in raw material pricing and ocean freight rates. For instance, an increase in crude oil prices directly affects the cost of synthetic rubber and transportation expenses. Hankook & Co. likely manages these risks through strategic sourcing and hedging practices to mitigate the impact of these fluctuating market conditions on their bottom line.

Hankook & Co. invests heavily in its global sales networks, encompassing significant expenses for advertising campaigns and brand building initiatives. These efforts are crucial for maintaining and expanding market share. For instance, in 2023, the company continued its robust marketing activities, including strategic motorsport sponsorships, which are a key component of their brand visibility. Optimizing these distribution and marketing expenditures remains a primary focus for enhancing customer reach and competitive positioning.

Capital Expenditures (CapEx) for Plant Expansion

Hankook & Co. is making substantial investments in its manufacturing infrastructure to meet growing market demand. A prime example is the significant capital expenditure planned for its Tennessee plant. This expansion project, valued at $1.6 billion, is specifically designed to boost the production capacity for passenger, light truck, and truck and bus radial (TBR) tires. Such large-scale capital outlays are fundamental to achieving future growth objectives and realizing the benefits of economies of scale in its operations.

These capital expenditures are not merely about increasing output; they represent a strategic commitment to enhancing Hankook's competitive position. By expanding its facilities, the company aims to improve production efficiency and reduce per-unit costs as volumes increase. This proactive investment in plant expansion is crucial for capturing a larger market share and ensuring long-term profitability in the highly competitive tire industry.

- Investment in Tennessee Plant Expansion: $1.6 billion to increase production capacity.

- Product Focus: Passenger, light truck, and TBR tires.

- Strategic Importance: Vital for future growth and achieving economies of scale.

Administrative and Overhead Costs

Hankook & Co.'s cost structure includes significant administrative and overhead expenses. These encompass general administrative costs for managing the overall business, alongside expenses related to corporate governance, which are crucial for a publicly traded entity.

Operational overhead for the holding company and its various subsidiaries forms a substantial part of these costs. Managing a global enterprise with diverse business units inherently requires a robust administrative framework, contributing to the overall expenditure.

- General Administrative Expenses: This covers salaries for administrative staff, office rent, utilities, and other day-to-day operational costs not directly tied to production.

- Corporate Governance Costs: Expenses related to board meetings, legal compliance, shareholder relations, and auditing fall under this category.

- Operational Overhead: This includes costs for maintaining the holding company's structure and supporting the various subsidiaries' operations, such as IT infrastructure and shared services.

For instance, in 2024, many large conglomerates reported increased administrative costs due to inflation and investments in digital transformation initiatives aimed at improving efficiency across their global operations.

Hankook & Co.'s cost structure is heavily influenced by its substantial investment in research and development, manufacturing, and its global sales and marketing efforts.

The company's commitment to innovation is reflected in its R&D spending, while manufacturing costs are driven by raw materials, energy, and labor, with significant capital expenditures planned for facility expansions like the $1.6 billion Tennessee plant. These investments aim to boost production capacity and achieve economies of scale.

Administrative and overhead expenses, including general administration and corporate governance, also form a notable portion of its cost base, essential for managing a global enterprise.

| Cost Category | Description | 2023 Data/Example |

|---|---|---|

| Research & Development | Investment in new tire technologies and eco-friendly materials | 355.8 billion KRW (approx. $260 million USD) in R&D expenses for Hankook Tire & Technology |

| Manufacturing & Production | Raw materials (rubber, chemicals), energy, labor, facility upkeep | Volatility in natural rubber prices in 2023 impacted input costs. |

| Capital Expenditures | Investment in expanding production facilities | $1.6 billion planned for the Tennessee plant expansion. |

| Sales & Marketing | Advertising, brand building, sponsorships | Continued robust marketing activities including motorsport sponsorships in 2023. |

| Administrative & Overhead | General administration, corporate governance, operational overhead for holding company and subsidiaries | Increased administrative costs reported by conglomerates in 2024 due to inflation and digital transformation initiatives. |

Revenue Streams

Original Equipment (OE) tire sales represent a core revenue stream for Hankook & Co., where tires are supplied directly to car makers for installation on brand-new vehicles. This segment is crucial as it establishes brand presence from the initial purchase and often involves supplying tires for a significant portion of a vehicle's production run.

Hankook’s OE business is particularly focused on high-value-added products, especially for premium and electric vehicle (EV) models. These specialized tires often incorporate advanced technologies for performance, efficiency, and noise reduction, commanding higher prices and contributing substantially to the company's sales growth. For instance, in 2023, Hankook secured OE supply contracts for over 60 new vehicle models globally, a testament to its expanding reach in this lucrative market segment.

Hankook & Co. generates significant revenue from selling replacement tires. This occurs through an extensive global distribution network that includes wholesalers, retailers, and independent dealerships. These sales are a cornerstone of their financial performance.

A notable trend is the increasing contribution from larger diameter tires and those specifically designed for electric vehicles (EVs). This shift reflects evolving automotive market demands and highlights Hankook's adaptation to new technologies and consumer preferences.

In 2024, the demand for replacement tires remained robust, driven by an aging vehicle fleet in many regions and a continued focus on vehicle maintenance. Hankook's strategic expansion in key markets further bolstered these sales figures.

Hankook & Co. generates significant revenue through its Battery Sales division, primarily under the Hankook AtlasBX brand. This segment focuses on the production and sale of automotive batteries, with a particular emphasis on premium Absorbent Glass Mat (AGM) batteries, which are crucial for modern vehicles with start-stop technology and higher electrical demands.

This battery segment is a key contributor to the company's diversified income streams, solidifying its presence and reach within the broader automotive parts and components sector. For instance, in 2023, the automotive battery market was valued at approximately $31.9 billion globally, and Hankook AtlasBX aims to capture a substantial share of this growing market, especially in the premium segment.

The sales performance of Hankook AtlasBX is directly tied to global automotive production and replacement markets. The company's strategy involves leveraging technological advancements in battery performance and reliability to drive sales, especially as electric vehicle adoption continues to rise, indirectly increasing demand for advanced battery technologies in hybrid and traditional vehicles alike.

Thermal Management System Sales (Hanon Systems)

Following Hankook & Co.'s acquisition of Hanon Systems in early 2025, the sale of thermal management systems for automobiles represents a substantial new revenue stream. This strategic move allows Hankook & Co. to tap into the rapidly growing market for electric vehicle thermal solutions, a segment projected for significant expansion in the coming years.

This diversification is expected to bolster Hankook & Co.'s overall financial performance by adding a high-growth, technology-driven business. The demand for advanced thermal management is critical for EV battery performance and longevity, positioning Hanon Systems as a key player.

- New Revenue Source: Thermal management systems for electric and traditional vehicles.

- Market Growth: Leverages the expanding EV market.

- Strategic Acquisition: Hanon Systems acquisition in early 2025 is key.

- Financial Impact: Enhances overall financial performance and diversification.

High-Value-Added Product Sales

Hankook & Co. is strategically shifting its focus towards selling more high-value-added products. This means they're prioritizing the sale of larger passenger car tires, specifically those 18 inches and up, along with tires designed specifically for electric vehicles (EVs). These premium tires generally bring in more profit per unit, which is crucial for the company's growth and overall financial health.

In 2024, Hankook reported a notable increase in the sales contribution from these larger and EV-specific tires. This segment is becoming increasingly important for their revenue mix. For instance, the company has seen significant demand in the replacement tire market for larger sizes, driven by evolving vehicle trends and consumer preferences.

- Focus on 18-inch and larger passenger car tires.

- Emphasis on EV-dedicated tire sales.

- Higher profit margins from premium product sales.

- Driving qualitative growth and profitability.

Hankook & Co. generates revenue from both original equipment (OE) tire sales to car manufacturers and the replacement tire market through a vast distribution network. The company is increasingly focusing on higher-margin products, such as large-diameter (18-inch and above) tires and those specifically designed for electric vehicles (EVs), reflecting evolving automotive trends.

The Battery Sales division, operating under the Hankook AtlasBX brand, is another key revenue stream, providing automotive batteries, particularly premium AGM batteries for vehicles with advanced electrical systems. The acquisition of Hanon Systems in early 2025 will add thermal management systems for automobiles as a significant new revenue source, tapping into the growing EV market.

| Revenue Stream | Description | Key Focus/Trend | 2023/2024 Data Point |

|---|---|---|---|

| OE Tire Sales | Supplying tires directly to car makers for new vehicles. | Premium and EV models, high-value-added products. | Secured OE supply for over 60 new vehicle models globally in 2023. |

| Replacement Tire Sales | Selling tires through wholesalers, retailers, and dealerships. | Large-diameter tires (18-inch+) and EV-specific tires. | Robust demand in 2024 driven by aging vehicle fleet and maintenance focus. |

| Battery Sales (Hankook AtlasBX) | Production and sale of automotive batteries, especially AGM. | Premium batteries for start-stop technology and higher electrical demands. | Aims to capture share in the global automotive battery market, valued at ~$31.9 billion in 2023. |

| Thermal Management Systems | Sale of systems for electric and traditional vehicles (post-2025 acquisition). | EV thermal solutions for battery performance and longevity. | New revenue stream following the acquisition of Hanon Systems in early 2025. |

Business Model Canvas Data Sources

The Hankook & Co. Business Model Canvas is informed by a blend of proprietary market research, financial performance data, and internal operational reports. These diverse sources provide a comprehensive view of customer needs, competitive landscapes, and internal capabilities.