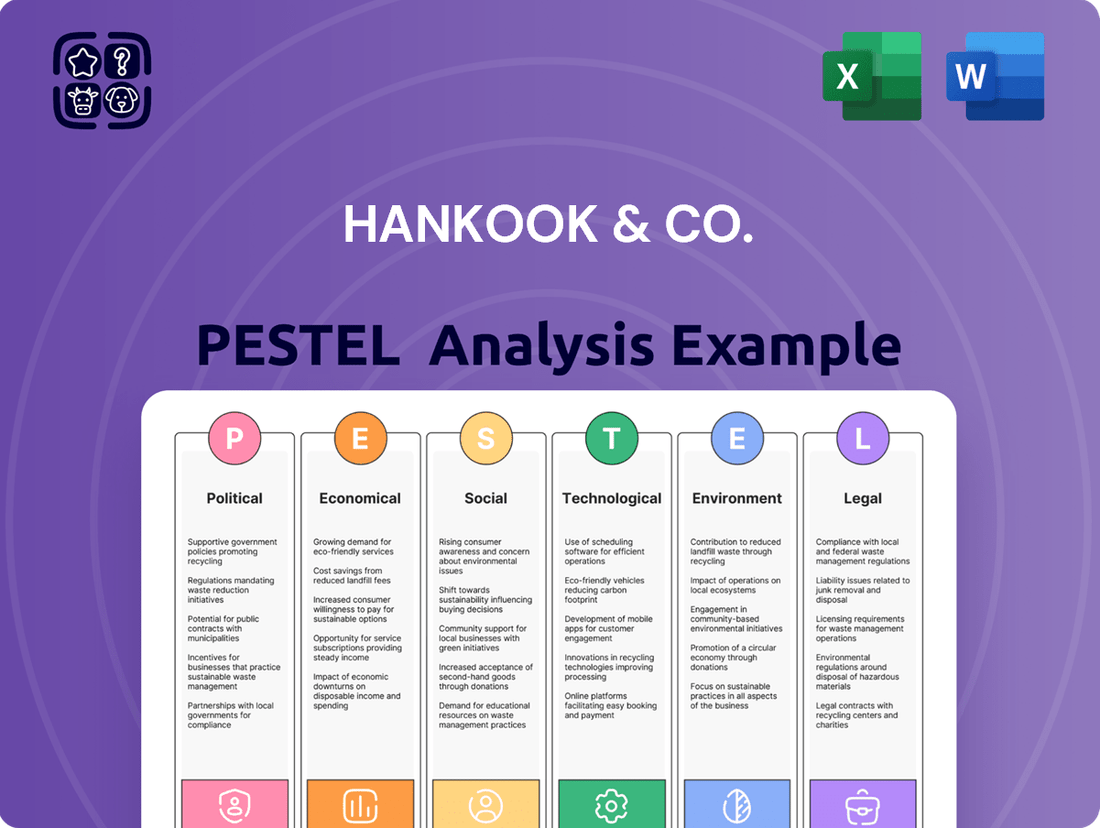

Hankook & Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hankook & Co. Bundle

Understand how political shifts, economic fluctuations, and evolving social attitudes are shaping Hankook & Co.'s trajectory. Our PESTLE analysis delves into the technological advancements and environmental regulations impacting the tire industry, offering crucial intelligence. Gain a competitive edge by uncovering the legal frameworks that influence their global operations. Download the full version now for actionable insights to refine your market strategy.

Political factors

Hankook & Co.'s extensive global manufacturing and sales network means it is particularly exposed to rising trade protectionism and tariffs. For instance, potential tariffs on automotive parts and finished vehicles by major markets like the United States, targeting countries such as South Korea, directly increase import costs. This escalation of trade barriers can significantly erode Hankook's competitive pricing advantage or necessitate price hikes, ultimately impacting sales volumes and profit margins.

In response to such protectionist policies, the South Korean government has signaled its intention to implement support measures for its vital automotive sector, aiming to mitigate the adverse effects of tariffs. Despite these governmental efforts, the inherent unpredictability and evolving nature of international trade policies continue to present a substantial operational and strategic challenge for Hankook & Co.

Government policies worldwide are a significant driver for electric vehicle (EV) adoption, directly impacting demand for EV-specific tires and batteries, key products for Hankook Tire & Technology and Hankook AtlasBX. For example, South Korea has extended its corporate discount subsidies for EVs, aiming to boost sales and encourage greener transportation, which benefits companies like Hankook.

Ongoing geopolitical tensions, such as the conflict in Eastern Europe and trade friction between major economies, continue to pose significant risks to global supply chains. These disruptions directly impact the availability and price of essential raw materials crucial for tire manufacturing, like natural rubber, and for the burgeoning electric vehicle battery sector, including lithium and cobalt. For Hankook & Co., this translates to potential production delays and increased input costs.

The repercussions of these supply chain vulnerabilities are substantial. Companies like Hankook may face challenges in securing necessary components, leading to higher manufacturing expenses and difficulties in meeting delivery schedules for both original equipment manufacturers and the aftermarket. For instance, the International Monetary Fund (IMF) projected in late 2023 that global trade growth would slow significantly in 2024 due to these persistent geopolitical uncertainties, highlighting the broad economic impact.

Environmental and Emissions Regulations

Stricter environmental regulations, particularly concerning CO2 emissions and fuel efficiency for vehicles worldwide, are a significant political factor influencing Hankook & Co. These evolving standards necessitate substantial innovation in eco-friendly tire technologies and more efficient battery solutions, areas where Hankook is actively investing. For instance, the European Union's CO2 emission performance standards for new passenger cars mandate average emissions of 95 g CO2/km by 2020, with further tightening expected. This directly impacts tire manufacturers like Hankook, as tire rolling resistance is a key determinant of vehicle fuel efficiency.

Compliance with these increasingly stringent global regulations is not just about avoiding penalties; it's essential for maintaining market access. Many regions, including the EU and California in the US, are setting ambitious targets for reducing greenhouse gas emissions from transportation. Hankook's commitment to R&D in sustainable products and manufacturing processes, such as developing low rolling resistance tires and exploring advanced materials, is a direct response to these political pressures. The company's investment in these areas is crucial for its long-term competitiveness and its ability to meet the growing demand for environmentally responsible automotive components.

- Global CO2 Emission Standards: Many countries are implementing or strengthening CO2 emission standards for new vehicles, impacting tire requirements.

- Fuel Efficiency Mandates: Regulations pushing for higher vehicle fuel efficiency directly correlate with the need for low rolling resistance tires.

- Market Access and Penalties: Non-compliance with environmental regulations can lead to significant fines and restricted access to key markets for Hankook.

- R&D Investment Drivers: Political pressure is a primary catalyst for Hankook's increased investment in sustainable tire technologies and manufacturing.

Local Content Requirements and Manufacturing Policies

Governments worldwide are increasingly prioritizing local manufacturing, a trend that directly impacts global automotive suppliers like Hankook & Co. These policies often mandate higher percentages of locally sourced components in vehicles sold within their borders. This could compel Hankook to re-evaluate its international production strategy, potentially leading to investments in new or expanded facilities in key regions to comply with these regulations.

For instance, Hankook's strategic expansions in the U.S. and Hungary, planned for completion in 2024 and 2025 respectively, are partly driven by the need to cater to regional market demands and navigate evolving regulatory landscapes. These moves are designed to bolster Hankook's presence in vital automotive markets and ensure adherence to local content mandates, thereby mitigating potential trade barriers and enhancing supply chain resilience.

The impact of these manufacturing policies can be significant:

- Increased production costs: Setting up or expanding facilities in new regions can involve substantial capital expenditure.

- Supply chain adjustments: Hankook may need to establish new relationships with local suppliers to meet content requirements.

- Market access: Compliance with local content rules can be crucial for maintaining or gaining access to certain markets.

- Competitive advantage: Companies that proactively adapt to these policies can gain an edge over those that do not.

Government support for electric vehicles, such as extended subsidies in South Korea, directly benefits Hankook's EV tire and battery businesses. However, escalating trade protectionism and tariffs by major economies like the United States pose risks to Hankook's global pricing and sales volumes.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Hankook & Co., covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of how these global trends and regional dynamics create both opportunities and threats for the company's strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hankook & Co.'s external landscape to inform strategic decision-making.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the key political, economic, social, technological, environmental, and legal factors impacting Hankook & Co.

Economic factors

Global economic growth significantly influences Hankook & Co.'s performance, as consumer spending on vehicles and related products like tires and batteries is closely tied to economic health. A robust global economy generally translates to higher disposable incomes, boosting demand. For instance, the IMF projected global growth at 3.2% for both 2023 and 2024, providing a generally supportive backdrop.

However, economic headwinds can quickly dampen consumer enthusiasm. Inflationary pressures and rising interest rates, prevalent in many economies through 2023 and into 2024, directly reduce purchasing power. This can cause consumers to delay purchases of new vehicles or opt for less expensive tire replacements, impacting Hankook's sales volumes and overall revenue streams.

The impact is particularly pronounced on big-ticket items. When consumers feel financial strain due to economic slowdowns, they tend to cut back on discretionary spending. This directly affects the automotive sector, a key market for Hankook, leading to a potential decrease in both original equipment manufacturer (OEM) sales and the replacement tire market.

Fluctuations in the prices of key raw materials like natural rubber, synthetic rubber, and essential battery minerals (lithium, cobalt, nickel) directly impact Hankook & Co.'s production expenses and profitability. For instance, the price of natural rubber, a primary component in tire manufacturing, saw considerable volatility through 2024, with spot prices experiencing swings of up to 15% in certain quarters due to weather-related supply disruptions and geopolitical factors.

The automotive parts sector, encompassing tires and the burgeoning battery market, is acutely sensitive to these cost shifts. Hankook & Co.'s strategy to mitigate this involves strengthening its supply chain resilience and employing sophisticated hedging instruments to lock in prices for critical inputs, thereby protecting its profit margins against unpredictable market movements.

Currency exchange rate fluctuations present a significant economic factor for Hankook & Co. As a global player, the company's financial results are directly influenced by the value of currencies in which it operates and trades. For instance, a stronger Korean Won could make Hankook's exports more expensive for foreign buyers, potentially dampening sales volumes. Conversely, a weaker Won might boost export competitiveness but increase the cost of imported raw materials or components, impacting profit margins.

In 2024, the Korean Won experienced notable volatility against major currencies like the US Dollar and the Euro. For example, the Won's average exchange rate against the US Dollar fluctuated significantly throughout the year, impacting the translated value of Hankook's overseas earnings. This volatility directly affects Hankook's reported profitability and the cost competitiveness of its tire products in key international markets, such as North America and Europe.

Inflationary Pressures and Cost Management

Persistent global inflation presents a significant challenge for Hankook & Co., directly impacting its manufacturing expenses through increased costs for labor, energy, and transportation. For instance, the US Consumer Price Index (CPI) saw a notable increase of 3.4% year-over-year as of April 2024, illustrating the broad-based nature of these pressures. These rising input costs necessitate robust cost management strategies to protect Hankook's profitability.

Maintaining healthy operating profit margins, a key objective for Hankook, becomes more challenging amidst these inflationary headwinds. The company's ability to pass on these increased costs to consumers or find efficiencies within its supply chain will be critical. For example, during periods of high inflation, companies that can secure long-term energy contracts or optimize logistics can better insulate themselves from cost volatility.

- Rising Input Costs: Global inflation, evidenced by a 3.4% year-over-year CPI increase in the US (April 2024), escalates expenses for raw materials, energy, and labor.

- Margin Protection: Hankook must implement effective cost management to safeguard its target of double-digit operating profit margins.

- Supply Chain Resilience: Strategies like hedging against commodity price fluctuations and optimizing transportation routes are vital for cost control.

- Pricing Power: The company's capacity to adjust product pricing in response to cost increases without significantly impacting demand is a key determinant of profitability.

EV Market Slowdown and Hybrid Resurgence

While the long-term trajectory points towards electric vehicles (EVs), a noticeable slowdown in Battery Electric Vehicle (BEV) adoption has emerged in key markets. This trend, alongside a renewed consumer interest in hybrid vehicles, directly influences Hankook & Co.'s strategic planning for product development and sales. For instance, in 2023, global BEV sales growth, while still positive, saw a deceleration compared to the rapid expansion of previous years, prompting a strategic re-evaluation across the automotive supply chain.

Hankook must strategically adapt its tire and battery component offerings to effectively serve both the pure EV and hybrid vehicle segments. This dual focus is critical for maintaining and fostering continued growth in a dynamic automotive landscape. The company's ability to innovate and provide tailored solutions for the specific demands of each powertrain type will be a key differentiator in the coming years.

The resurgence of hybrids presents a significant opportunity. Consider the European market, where hybrids accounted for a substantial portion of new car registrations in early 2024, demonstrating a clear consumer preference for this transitional technology. This shift necessitates that Hankook not only perfect its EV-specific products but also optimize its portfolio to cater to the unique performance and efficiency requirements of hybrid vehicles.

- Market Shift: Global BEV sales growth moderated in 2023 after years of rapid expansion, indicating a potential plateau in some regions.

- Hybrid Demand: Hybrid vehicle sales have shown resilience and growth, particularly in markets where EV infrastructure is still developing or consumer concerns about range persist.

- Hankook's Strategy: The company needs to balance investment in EV-specific technologies with continued development of high-performance tires and potentially battery components for hybrid powertrains.

- Adaptation is Key: Failure to address the hybrid market could mean missing a significant revenue stream as consumers navigate the transition to full electrification.

Global economic growth directly impacts Hankook & Co.'s sales, as consumer spending on vehicles and tires is tied to disposable income. While projected global growth of 3.2% for 2023 and 2024 offers a supportive backdrop, persistent inflation and rising interest rates through early 2024 reduce purchasing power, potentially slowing demand for new vehicles and replacement tires.

Fluctuations in raw material prices, such as natural rubber and battery minerals, significantly affect Hankook's production costs. For instance, natural rubber spot prices saw up to a 15% swing in certain 2024 quarters due to supply disruptions. Currency exchange rates also play a critical role; the Korean Won's volatility against major currencies in 2024 directly impacts Hankook's export competitiveness and the cost of imported materials.

The automotive sector's shift towards electric vehicles (EVs) is also notable, with a slowdown in Battery Electric Vehicle (BEV) adoption observed in key markets through 2023 and into 2024. This trend, coupled with renewed interest in hybrid vehicles, particularly evident in early 2024 European registrations, requires Hankook to strategically adapt its product development to cater to both EV and hybrid powertrain demands.

| Economic Factor | Impact on Hankook & Co. | Supporting Data (2023-2024) |

| Global Economic Growth | Influences consumer spending on vehicles and tires. | IMF projected 3.2% global growth for 2023 & 2024. |

| Inflation & Interest Rates | Reduces purchasing power, potentially lowering demand. | US CPI rose 3.4% year-over-year (April 2024). |

| Raw Material Prices | Affects production costs and profitability. | Natural rubber spot prices saw up to 15% quarterly swings (2024). |

| Currency Exchange Rates | Impacts export competitiveness and import costs. | Korean Won experienced significant volatility against USD/EUR (2024). |

| EV/Hybrid Market Shift | Requires strategic product development and sales focus. | BEV sales growth moderated in 2023; hybrids showed resilience in early 2024 Europe. |

What You See Is What You Get

Hankook & Co. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hankook & Co. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to detailed insights into the global tire market and Hankook's competitive landscape.

Sociological factors

Consumers worldwide are increasingly prioritizing environmentally friendly transportation. This trend is evident in the growing demand for electric vehicles and shared mobility services, signaling a significant shift in societal values. For instance, by mid-2024, electric vehicle sales were projected to account for over 20% of the global automotive market, a substantial increase from previous years.

Hankook & Co. is responding to this by focusing on eco-friendly tire production, utilizing more sustainable materials in its manufacturing processes. The company's commitment to this vision is reflected in its investments in research and development for tires that offer reduced rolling resistance, thereby improving fuel efficiency and lowering emissions.

Furthermore, Hankook's strategic initiatives include exploring opportunities in battery recycling, a critical component of the electric vehicle ecosystem. This aligns with their stated vision of ‘Innovation for a Sustainable Future,’ aiming to create a circular economy within the automotive sector and reduce the environmental impact of end-of-life batteries.

Urbanization continues to reshape how people move, with cities becoming hubs for new transportation methods. In 2024, global urban populations represent over 57% of the total, a figure projected to climb. This shift away from traditional private car ownership towards shared services like ride-sharing and car-sharing is directly impacting the automotive sector.

Hankook must consider how these changing mobility patterns influence tire demand. For instance, the increased mileage and potentially different wear patterns of vehicles used in ride-sharing fleets might require more durable or specialized tire designs. By 2025, the global car-sharing market is expected to reach over $15 billion, highlighting a significant area for adaptation.

The rise of micromobility, such as electric scooters and bikes, also presents an indirect challenge and opportunity. While not directly a tire market for Hankook, it signifies a broader trend towards diversified urban transport, which could lead to a reduced overall demand for traditional passenger vehicle tires in dense urban cores over the long term.

Furthermore, the integration of electric vehicles (EVs) within these shared urban mobility frameworks necessitates looking at battery solutions or tires optimized for EV performance, such as lower rolling resistance and higher load capacities. Hankook's strategic response to these evolving urban mobility trends will be crucial for its continued relevance and growth in the coming years.

Hankook & Co.'s brand perception is significantly shaped by its commitment to corporate social responsibility and ethical operations. Consumers and stakeholders are increasingly scrutinizing companies' social and environmental impact, making strong ESG performance a key differentiator. For instance, Hankook's 2023 ESG report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, alongside investments in employee training programs focused on diversity and inclusion.

These initiatives, detailed in their sustainability reports, directly influence brand image and can sway consumer loyalty and investor confidence. A positive reputation for ethical labor practices and community engagement, as evidenced by their partnerships with local NGOs in South Korea, can translate into tangible benefits, potentially boosting sales and attracting socially responsible investment funds.

Aging Population and Driver Demographics

The global population is indeed getting older, with significant implications for industries like automotive manufacturing and, by extension, tire and battery producers like Hankook & Co. As people age, their driving habits and vehicle preferences often change. For instance, older drivers might prioritize comfort and safety over performance, potentially shifting demand towards certain types of tires or vehicles that require specific battery specifications. This demographic shift means Hankook needs to carefully analyze how these evolving consumer needs will shape the market for its products.

Consider the projections: by 2050, the World Health Organization estimates that 2.1 billion people will be over 60. This substantial segment of the population could favor vehicles that are easier to handle or offer enhanced driver assistance features, which in turn might influence the types of tires and batteries that are in highest demand. Hankook's product development and marketing strategies for 2024 and 2025, and beyond, must account for this growing segment of older consumers.

- Aging Consumer Base: Globally, the proportion of individuals aged 65 and over is projected to rise significantly, impacting purchasing power and product preferences.

- Shifting Driving Habits: Older demographics may drive less frequently or for shorter distances, potentially influencing tire wear patterns and battery usage.

- Demand for Specific Features: A preference for comfort, safety, and ease of use in vehicles among older drivers could indirectly steer demand towards specialized tire and battery solutions.

- Market Adaptation: Hankook must adapt its product offerings and marketing messages to resonate with the evolving needs and priorities of an aging driver population.

Impact of Digitalization on Consumer Behavior

Digitalization profoundly shapes how consumers research and purchase automotive products, directly impacting Hankook's customer engagement. For instance, in 2024, over 80% of car buyers utilized online resources for vehicle research, a trend expected to continue its upward trajectory. This shift necessitates Hankook's strategic use of digital channels to connect with potential customers throughout their buying journey.

Leveraging digital platforms allows Hankook to gain deeper insights into changing consumer preferences. Data analytics, fed by online interactions and purchasing patterns, can reveal emerging trends in tire specifications, brand loyalty, and desired features. This understanding is crucial for optimizing sales and marketing efforts, ensuring Hankook’s offerings remain relevant and competitive in the evolving market.

- Digital Research Dominance: As of 2024, more than 80% of automotive consumers rely heavily on digital platforms for initial research and product evaluation.

- Personalized Marketing Needs: The digital shift demands personalized marketing strategies, with consumers expecting tailored content and offers based on their online behavior.

- Data-Driven Decisions: Hankook's success hinges on its ability to harness data analytics to understand and respond to real-time consumer preferences and market dynamics.

- Evolving Customer Journey: The traditional car-buying process is increasingly integrated with online touchpoints, requiring a seamless omnichannel customer experience.

Societal values are shifting towards sustainability and ethical consumption, influencing Hankook & Co.'s brand perception and product development. Consumers increasingly favor eco-friendly products, driving demand for tires with reduced environmental impact, a trend Hankook is addressing through sustainable material use and R&D for fuel-efficient tires. By mid-2024, electric vehicle sales were projected to represent over 20% of the global automotive market, underscoring this shift.

Urbanization and evolving mobility patterns, such as the rise of car-sharing and micromobility, are reshaping transportation needs. The car-sharing market alone was expected to exceed $15 billion globally by 2025, indicating a need for Hankook to adapt tire designs for these usage patterns. The company must also consider the implications of an aging global population, with over 2.1 billion people projected to be over 60 by 2050, as this demographic may have distinct preferences for vehicle comfort and safety.

Technological factors

Rapid progress in battery technology, such as the emergence of solid-state, lithium-sulfur, and sodium-ion alternatives, presents a critical opportunity for Hankook AtlasBX. These innovations are key to maintaining a competitive advantage in the evolving energy storage landscape.

These next-generation batteries offer significant improvements in energy density, allowing for longer operation times and faster recharging capabilities, alongside enhanced safety features. To capitalize on these benefits and lead the battery sector, Hankook AtlasBX must maintain consistent investment in research and development.

For instance, the global battery market, driven by electric vehicles and renewable energy storage, was projected to reach over $200 billion by 2024, with significant growth anticipated from advancements in chemistries beyond traditional lithium-ion. This highlights the strategic imperative for Hankook to stay ahead in R&D.

Smart tire technology, incorporating sensors for real-time performance monitoring and connectivity, offers Hankook Tire & Technology a substantial technological advantage. This integration supports the growing connected vehicle ecosystem by improving safety, efficiency, and maintenance. For instance, by 2023, the global automotive sensor market, which includes tire sensors, was valued at over $30 billion and is projected for continued growth.

The rapid advancement of automated and autonomous driving systems presents a significant technological shift for Hankook & Co. These systems necessitate tires with distinct performance profiles, including heightened durability and noise reduction, particularly for electric and self-driving vehicles. For instance, by 2023, over 30 million vehicles globally were equipped with some level of driver assistance, a figure projected to grow substantially, highlighting the demand for specialized tire solutions that can manage the unique stresses and operational demands of autonomous mobility.

Sustainable Material Innovation

The global push for sustainability is a significant technological driver, encouraging the development of novel, environmentally conscious materials. For companies like Hankook & Co., this translates into innovation in both tire and battery technologies. We're seeing a rise in bio-based rubbers and increased use of recycled content, aiming to reduce the environmental footprint of these essential products.

Hankook's own commitment to this trend is evident in its ESG (Environmental, Social, and Governance) reports. These reports often detail their progress in integrating sustainable materials and fostering a circular economy. This focus isn't just about environmental responsibility; it's becoming crucial for future product development and ensuring compliance with evolving environmental regulations.

Consider these specific areas of technological impact:

- Development of bio-synthetic rubber: Research into alternatives derived from plant-based sources aims to reduce reliance on petroleum.

- Advancements in recycled material processing: Technologies are improving the quality and consistency of recycled rubber and plastics for tire components.

- Battery material innovation: For Hankook's battery divisions, this includes exploring more sustainable cathode and anode materials and efficient recycling processes for end-of-life batteries.

Digital Transformation and Industry 4.0 in Manufacturing

Hankook & Co. is actively embracing digital transformation and Industry 4.0 principles to modernize its manufacturing operations. This involves integrating advanced technologies like artificial intelligence (AI), sophisticated data analytics, and automation across its production lines. These advancements are crucial for boosting efficiency, driving down operational costs, and speeding up the development cycle for new tire products.

The company's strategic focus on digital transformation is a cornerstone for its long-term growth trajectory and its ability to remain competitive in the global market. By leveraging these technologies, Hankook aims to achieve greater agility and responsiveness to market demands. For instance, in 2024, many leading automotive suppliers reported significant investments in AI-powered quality control systems, leading to an average reduction in defects by 15-20%.

Key technological adoption areas for Hankook include:

- AI-driven predictive maintenance: Minimizing downtime by anticipating equipment failures.

- Data analytics for process optimization: Using real-time data to fine-tune production parameters and improve output quality.

- Robotics and automation: Enhancing precision and speed in assembly and material handling processes.

- IoT integration: Creating connected factories for seamless data flow and improved operational visibility.

These technological shifts are not merely about modernization; they are fundamental to Hankook's strategy to enhance its value proposition. By 2025, it's projected that companies successfully implementing Industry 4.0 initiatives will see their production efficiency increase by an average of 25%, according to industry reports from late 2024.

Hankook & Co. is navigating a landscape rapidly shaped by advancements in battery and tire technologies. Emerging battery chemistries like solid-state and sodium-ion offer enhanced energy density and safety, crucial for the electric vehicle sector, where the global battery market was projected to exceed $200 billion by 2024. Simultaneously, smart tire technology, integrating sensors for real-time monitoring, provides a competitive edge in the connected vehicle ecosystem, with the automotive sensor market valued over $30 billion in 2023.

Legal factors

Hankook faces stringent product liability laws and automotive safety standards, especially regarding tire performance and the increasing demand for electric vehicle (EV) battery safety. These regulations, covering aspects like thermal stability and fire risk, place substantial legal duties on the company. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) continuously updates its safety standards, and non-compliance can lead to costly recalls and legal battles.

Adherence to these evolving legal frameworks is paramount for Hankook to prevent product recalls, avoid costly lawsuits, and safeguard its brand reputation. The company's 2023 financial reports likely detail significant investments in research and development to ensure all products meet or exceed these rigorous testing and quality control benchmarks, especially for their advanced tire technologies and battery components for the EV market.

Hankook & Co. faces a landscape of tightening environmental regulations worldwide. These rules govern everything from manufacturing emissions and the responsible disposal of waste, such as used tires and batteries, to the very substances used in their products, like chemicals in tire production. For instance, the European Union's updated End-of-Life Vehicles (ELV) directive, which came into full effect in 2023, places greater emphasis on the recyclability of vehicle components, directly impacting tire manufacturers.

Failure to meet these evolving environmental standards carries significant financial and legal consequences. Non-compliance can lead to substantial fines; for example, companies violating waste management regulations in South Korea can face penalties up to 100 million KRW (approximately $75,000 USD as of mid-2024). Beyond fines, legal repercussions can include operational shutdowns, reputational damage, and even criminal charges for severe violations, all of which directly impact Hankook's operational stability and profitability.

New regulations are significantly impacting battery manufacturers like Hankook & Co. The EU Battery Regulation, for instance, sets ambitious targets for battery recycling efficiency, aiming for 70% by 2030, and mandates the inclusion of minimum recycled content in new batteries, starting with 4% cobalt, 1% nickel, and 1% lithium in 2027.

These evolving legal frameworks, particularly concerning Extended Producer Responsibility (EPR), mean Hankook AtlasBX must proactively invest in and strengthen its battery take-back programs and recycling infrastructure. Failure to comply could lead to penalties and market access issues, especially within key markets like Europe.

The push for circularity in battery production, driven by these laws, presents both challenges and opportunities for Hankook & Co. Adapting to these requirements is crucial for maintaining market competitiveness and fulfilling its environmental obligations.

Intellectual Property (IP) Protection

Hankook & Co. heavily relies on safeguarding its intellectual property, particularly its innovations in tire compounds, advanced battery designs, and proprietary manufacturing techniques. This protection is paramount for maintaining its edge in a competitive automotive and energy sector. For instance, by 2024, the global automotive market, where Hankook is a significant player, continues to see substantial investment in R&D, with major players dedicating billions to developing next-generation technologies.

Navigating the intricate web of intellectual property laws across various international markets presents a significant challenge for Hankook. Ensuring robust patent protection and swift action against infringements is vital to preserve the value of its research and development expenditures, which amounted to over KRW 300 billion in 2023.

- Global Patent Filings: Hankook actively files patents in key markets like the US, Europe, and China to protect its technological advancements.

- R&D Investment: Continued substantial investment in R&D, exceeding KRW 300 billion in 2023, underscores the importance of IP for future growth.

- Infringement Monitoring: The company employs strategies to monitor for and address potential IP infringements to safeguard its market position.

- Trade Secret Protection: Beyond patents, Hankook also focuses on protecting trade secrets related to its manufacturing processes and material compositions.

Labor Laws and Human Rights in Supply Chain

Hankook & Co. faces increasing legal pressure to ensure its global operations and supply chains adhere to stringent labor laws and human rights standards. This isn't just about compliance; it's becoming a core expectation from consumers, investors, and regulators alike. For instance, the EU's proposed Corporate Sustainability Due Diligence Directive, expected to be fully implemented in the coming years, will mandate companies to identify, prevent, and mitigate human rights and environmental harms in their value chains, directly impacting companies like Hankook with significant international operations.

The scrutiny on fair labor practices and ethical sourcing is intensifying. Companies are being held accountable for working conditions, wages, and the absence of forced labor or child labor within their supplier networks. This requires robust due diligence processes and a commitment to transparency. For example, reports from organizations like the International Labour Organization (ILO) continue to highlight persistent issues in global supply chains, underscoring the need for proactive measures.

- Global Supply Chain Scrutiny: Increased regulatory focus on human rights and labor practices in international supply chains.

- Due Diligence Mandates: Emerging legislation, such as the EU's proposed directive, requires companies to actively manage human rights risks.

- Ethical Sourcing Expectations: Growing demand for transparency regarding fair wages, safe working conditions, and the prohibition of forced labor.

- Reputational Risk: Non-compliance can lead to significant damage to brand reputation and investor confidence.

Hankook & Co. must navigate complex product liability laws and evolving automotive safety standards, particularly for EV batteries. The U.S. NHTSA's continuous updates mean non-compliance can trigger costly recalls and legal actions. For instance, the company's investments in R&D for advanced tire technology and EV battery safety are crucial for meeting these rigorous requirements.

Environmental regulations are tightening globally, impacting Hankook's manufacturing emissions and waste disposal, especially for tires and batteries. The EU's 2023 ELV directive, emphasizing component recyclability, directly affects tire manufacturers. Failure to comply can result in significant fines, operational shutdowns, and reputational damage, as seen with potential penalties for waste management violations in South Korea, which can reach KRW 100 million.

The EU Battery Regulation sets ambitious recycling targets, requiring 70% efficiency by 2030 and mandating minimum recycled content in new batteries from 2027. Hankook AtlasBX must invest in battery take-back programs and recycling infrastructure to avoid penalties and maintain market access, particularly in Europe, aligning with the push for circularity.

Protecting intellectual property is vital for Hankook, especially in tire compounds and battery designs, given billions invested globally in automotive R&D by 2024. The company's KRW 300 billion R&D expenditure in 2023 highlights the importance of robust patent filings in key markets and monitoring for infringements to preserve its competitive edge.

Hankook faces increasing legal scrutiny over labor laws and human rights in its global supply chains, driven by initiatives like the EU's proposed Corporate Sustainability Due Diligence Directive. This requires proactive due diligence to mitigate human rights and environmental risks, addressing growing demands for transparency on fair wages and safe working conditions.

Environmental factors

The global push to combat climate change is a major driver for Hankook & Co. to slash its greenhouse gas emissions throughout its operations. This includes everything from sourcing materials to how its products are used and eventually discarded.

Hankook has set some serious goals to achieve this. Specifically, they aim for a 46.2% cut in manufacturing emissions by the year 2030, showing a concrete step towards their ultimate objective of reaching Net Zero emissions by 2050.

These commitments are not just aspirational; they reflect a strategic response to increasing regulatory pressures and growing consumer demand for environmentally responsible products. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), phased in from October 2023, signals a trend towards making carbon pricing a global norm, impacting companies like Hankook that operate internationally.

Growing concerns over resource scarcity are pushing companies like Hankook & Co. to embrace circular economy principles. This means a stronger focus on sourcing materials sustainably and significantly increasing the use of recycled content in their products, alongside aggressive waste reduction strategies.

Hankook's 're:move' program is a prime example of this shift, transforming waste from tire production into new, upcycled goods, directly contributing to a more circular model and mitigating resource depletion.

In 2023, the global tire industry faced increased scrutiny on its environmental footprint, with several major players announcing targets to incorporate higher percentages of recycled and renewable materials by 2030, a trend Hankook is actively participating in.

Hankook faces significant environmental challenges in managing end-of-life tires and batteries. By 2023, global tire waste was estimated to be over 30 million tons annually, with battery waste also rapidly increasing due to the growth in electric vehicles and consumer electronics. Effective recycling is crucial to mitigate landfill burden and recover valuable resources like rubber, carbon black, and lithium.

The company's investment in advanced recycling technologies, such as pyrolysis, offers a pathway to transform waste tires into valuable raw materials like oil and carbon black, which can be reintegrated into production. Similarly, battery recycling is becoming paramount, especially with the EU's Battery Regulation 2023/206, which mandates increased collection and recycling rates for batteries, including specific targets for materials like lithium. Hankook's participation in take-back schemes and development of circular economy models are vital for compliance and sustainable growth.

Water Usage and Pollution Control

Hankook & Co.'s industrial operations, particularly in tire and battery manufacturing, are inherently water-intensive. These processes demand substantial volumes of water for cooling, cleaning, and as a component in product formulation. For instance, tire production involves significant water usage in compounding and curing stages.

The generation of wastewater is a direct consequence of these operations, often containing various pollutants from raw materials and manufacturing byproducts. Effective management of this wastewater is crucial to mitigate environmental harm and adhere to increasingly strict water quality standards. Hankook must invest in advanced wastewater treatment technologies to remove contaminants before discharge.

Compliance with water quality regulations is a paramount environmental factor for Hankook. In 2023, global regulatory bodies continued to tighten discharge limits for industrial wastewater, emphasizing reductions in chemical oxygen demand (COD), suspended solids, and specific hazardous substances. Companies failing to meet these standards face penalties and reputational damage.

Hankook's commitment to stringent water management practices is essential for sustainable operations. This includes implementing water recycling and reuse programs to reduce overall consumption and minimize the volume of wastewater generated. Such initiatives not only benefit the environment but can also lead to operational cost savings.

- Water Consumption: Tire manufacturing can consume thousands of liters of water per ton of tires produced, highlighting the need for efficiency.

- Wastewater Characteristics: Industrial wastewater from battery production may contain heavy metals and acidic compounds requiring specialized treatment.

- Regulatory Compliance: Non-compliance penalties for water pollution can range from significant fines to operational shutdowns in many jurisdictions.

- Sustainability Initiatives: Many leading manufacturers aim to reduce their water footprint by 20-30% by 2030 through advanced water management strategies.

Biodiversity and Ecosystem Protection

Hankook & Co. faces environmental scrutiny regarding its raw material sourcing and manufacturing processes. The extraction of natural rubber, a key component in tire production, can significantly impact biodiversity and local ecosystems if not managed sustainably. Similarly, the increasing demand for battery minerals, crucial for the automotive industry's shift towards electrification, raises concerns about the environmental footprint of mining operations.

Recognizing these challenges, Hankook's commitment to sustainable natural rubber policies is paramount. By implementing responsible sourcing practices, the company aims to mitigate the negative environmental impacts of its supply chain, thereby protecting vital ecosystems. This proactive approach is not only crucial for environmental stewardship but also for maintaining Hankook's social license to operate, ensuring continued stakeholder trust and market acceptance.

Hankook's efforts in 2023 and projections for 2024/2025 highlight a focus on reducing its environmental impact:

- Sustainable Natural Rubber Sourcing: Hankook aims to increase the proportion of sustainably certified natural rubber in its supply chain by 2025. In 2023, they reported that 40% of their natural rubber was sourced from suppliers adhering to sustainability standards.

- Ecosystem Protection Initiatives: The company actively participates in projects aimed at restoring degraded areas linked to rubber plantations. These initiatives are designed to support local biodiversity and ecological balance.

- Responsible Mineral Sourcing: For battery minerals, Hankook is working with industry partners to ensure sourcing adheres to environmental and ethical guidelines, aiming for transparency and reduced ecological disruption.

- Manufacturing Footprint Reduction: Hankook continues to invest in technologies and processes to lower emissions and waste from its manufacturing facilities, directly addressing the environmental impact of its operations on surrounding ecosystems.

Hankook & Co. is actively addressing environmental challenges by setting ambitious emission reduction targets, aiming for a 46.2% cut in manufacturing emissions by 2030 and Net Zero by 2050. This is a direct response to global climate action and increasing regulatory pressures, such as the EU's Carbon Border Adjustment Mechanism impacting international trade.

The company is embracing circular economy principles, exemplified by its 're:move' program, to combat resource scarcity and manage waste. In 2023, the tire industry saw a trend of major players increasing recycled and renewable material usage, a direction Hankook is aligning with.

Hankook faces significant environmental challenges related to end-of-life tires and battery waste, with global annual tire waste exceeding 30 million tons as of 2023. Investments in technologies like pyrolysis and compliance with regulations like the EU's Battery Regulation 2023/206 are crucial for managing this waste and recovering valuable materials.

Water management is another key environmental factor, with tire production being water-intensive. Hankook must invest in advanced wastewater treatment and water recycling to meet stringent 2023 discharge limits and reduce its overall water footprint, with many industry leaders aiming for 20-30% reductions by 2030.

Sustainable sourcing of raw materials like natural rubber and battery minerals is critical for Hankook, as extraction can impact biodiversity. By 2025, Hankook aims to increase sustainably certified natural rubber sourcing, with 40% achieved in 2023, alongside efforts in ecosystem protection and responsible mineral sourcing.

PESTLE Analysis Data Sources

Our PESTLE analysis for Hankook & Co. is meticulously crafted using data from official government publications, reputable financial news outlets, and leading automotive industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.