Hanes SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Hanes boasts strong brand recognition and a vast distribution network, but faces intense competition and evolving consumer preferences. Discover the complete picture behind Hanes' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Hanesbrands commands a powerful lineup of well-known brands, including Hanes, Champion, Bonds, Maidenform, and Playtex. This diverse portfolio fosters significant consumer recognition and loyalty across various apparel categories.

These globally recognized brands hold leading positions in the everyday basic apparel market, especially within the innerwear segment in numerous international markets. For instance, Champion saw a resurgence in popularity, contributing to Hanesbrands' overall performance.

HanesBrands boasts a formidable supply chain and manufacturing infrastructure, largely concentrated in the Western Hemisphere, particularly Central America. This strategic positioning, with a significant portion of its operations in owned facilities, allows for greater control over production processes and costs.

This Western Hemisphere focus is a key advantage, especially in navigating global trade dynamics. For instance, in 2023, HanesBrands continued to leverage its nearshore manufacturing to mitigate the impact of tariffs that affect companies more heavily reliant on Asian production, contributing to a more stable cost structure.

Hanesbrands is demonstrating a strong commitment to sustainability, setting ambitious goals like achieving zero waste operations by 2025. This focus on environmental responsibility is increasingly important to consumers and investors alike, potentially enhancing brand reputation and market appeal.

The company's target of utilizing 100% renewable electricity by 2030 further underscores its dedication to eco-friendly practices. Such initiatives can lead to significant operational cost savings through reduced energy expenses and improved resource efficiency, a trend observed across the industry as companies embrace greener strategies.

Improved Financial Performance and Strategic Focus

Hanesbrands has demonstrated a notable strengthening in its financial performance. For the first quarter of 2024, the company reported net sales of $3.5 billion, with an improved gross margin of 41.3%, up from 39.6% in the prior year period. This enhanced profitability is a direct result of strategic initiatives, including the divestiture of the global Champion business, allowing Hanes to concentrate on its more lucrative innerwear operations.

The strategic refocusing is anticipated to unlock further growth potential. By shedding the less profitable Champion segment, Hanes can allocate resources more effectively towards its core brands, such as Hanes and Bali, which command higher margins. This strategic maneuver is expected to contribute to a positive trajectory in earnings per share moving forward.

- Improved Profitability: First quarter 2024 gross margin increased to 41.3%.

- Strategic Divestment: Sale of global Champion business to focus on higher-margin innerwear.

- Enhanced Focus: Sharper concentration on core brands like Hanes and Bali.

- Future Growth Driver: Innerwear segment expected to lead future earnings growth.

Market Share Gains in Key Segments

Hanesbrands has shown resilience by increasing its market share in crucial areas, even as some segments of the apparel market experienced a downturn. This is particularly evident in their U.S. innerwear business, where strategic initiatives have paid off.

The company's success in gaining share is a direct result of a strong focus on understanding consumer needs, introducing innovative products, and boosting brand visibility through marketing efforts. These actions have helped Hanesbrands stand out against competitors.

- Gaining Share in U.S. Innerwear: Hanesbrands has successfully captured a larger portion of the U.S. innerwear market, demonstrating effective strategies in a competitive landscape.

- Consumer-Centric Approach: A key driver for market share gains is Hanesbrands' commitment to aligning its products and marketing with evolving consumer preferences and demands.

- Product Innovation and Marketing: Investments in new product development and increased brand marketing have been instrumental in Hanesbrands' ability to attract and retain customers, leading to market share expansion.

Hanesbrands benefits from a robust portfolio of widely recognized brands such as Hanes, Champion, Bonds, Maidenform, and Playtex. This strong brand equity translates into significant consumer recognition and loyalty across diverse apparel segments, solidifying its market presence.

The company's strategic concentration on its innerwear business, particularly after divesting the global Champion operations, has led to improved financial health. For Q1 2024, Hanesbrands reported a gross margin of 41.3%, an increase from 39.6% in the prior year, signaling enhanced profitability and a more focused operational strategy.

Hanesbrands has demonstrated success in expanding its market share within key categories, notably the U.S. innerwear market. This growth is attributed to a deliberate focus on consumer needs, product innovation, and effective marketing strategies that resonate with target demographics.

The company's commitment to sustainability, including its goal of zero-waste operations by 2025 and 100% renewable electricity by 2030, enhances its brand image and appeals to environmentally conscious consumers and investors. These initiatives also offer potential for long-term operational cost efficiencies.

What is included in the product

Delivers a strategic overview of Hanes’s internal and external business factors, highlighting its brand strength and market presence while also addressing potential supply chain and competitive challenges.

Identifies key competitive advantages and areas for improvement, easing the burden of strategic planning.

Weaknesses

Hanesbrands has historically carried a significant debt burden. While the company has been focused on reducing this debt, as of the first quarter of 2024, total debt stood at approximately $2.8 billion. This substantial leverage can constrain the company's ability to invest in new growth opportunities or respond effectively to market shifts.

Hanes has grappled with declining profitability in specific business areas, notably its activewear segment. This downturn is attributed to broader market challenges within activewear and a more conservative approach to inventory from retail partners, which has directly affected sales performance.

Hanesbrands' strong focus on reducing its debt, a key strategic priority, could inadvertently limit its ability to invest in growth initiatives. For instance, by prioritizing debt repayment, the company might allocate fewer resources towards crucial capital expenditures needed for modernizing facilities or developing innovative new product lines. This conservative financial stance, while strengthening its balance sheet, could mean passing up chances to expand its market presence or enter promising new product categories.

Supply Chain System Disparities

Hanesbrands faces challenges due to a fragmented supply chain infrastructure, a legacy of past acquisitions. This patchwork of purchasing and enterprise resource-planning systems can impede seamless data integration. For instance, as of late 2023, the company was still working on consolidating these disparate systems, which can slow down real-time insights into supplier operations and overall efficiency.

These system disparities can create blind spots, making it difficult to gain a unified view of inventory levels and supplier performance across the entire network. This lack of unified visibility hinders proactive problem-solving and can lead to inefficiencies in procurement and logistics. The ongoing integration efforts, while necessary, represent a significant undertaking that requires substantial investment and time.

- System Fragmentation: Inherited disparate purchasing and enterprise resource-planning systems from acquisitions.

- Data Integration Hurdles: Difficulty in consolidating data for real-time visibility into supplier performance.

- Operational Inefficiencies: Hindered ability to gain a unified view of inventory and supplier operations.

Competition in the Apparel Market

Hanes operates in a fiercely competitive apparel sector. Major global sportswear giants like Nike and Adidas, along with a multitude of other basic apparel manufacturers, constantly vie for consumer attention and market share. This crowded landscape puts significant pressure on pricing strategies and can erode profitability.

The intense competition means Hanes must continually innovate and differentiate its offerings to stand out. For instance, in the athletic wear segment, brands are investing heavily in new fabric technologies and sustainable materials, creating a challenging environment for established players like Hanes to maintain their market position without substantial investment. In 2024, the global apparel market is projected to reach approximately $1.7 trillion, highlighting the sheer scale of competition.

- Intense Rivalry: Faces strong competition from global powerhouses and numerous smaller brands.

- Price Sensitivity: High competition can lead to price wars, impacting profit margins.

- Market Share Erosion: Competitors' innovations and marketing efforts can threaten Hanes' existing customer base.

- Innovation Demands: Constant need to invest in new product development and marketing to stay relevant.

Hanesbrands' substantial debt, approximately $2.8 billion as of Q1 2024, can limit its ability to invest in growth. Declining profitability in areas like activewear, due to market shifts and retailer inventory management, further strains financial flexibility. The company's focus on debt reduction, while strengthening its balance sheet, might mean fewer resources for crucial capital expenditures or new product development, potentially hindering market expansion.

Preview Before You Purchase

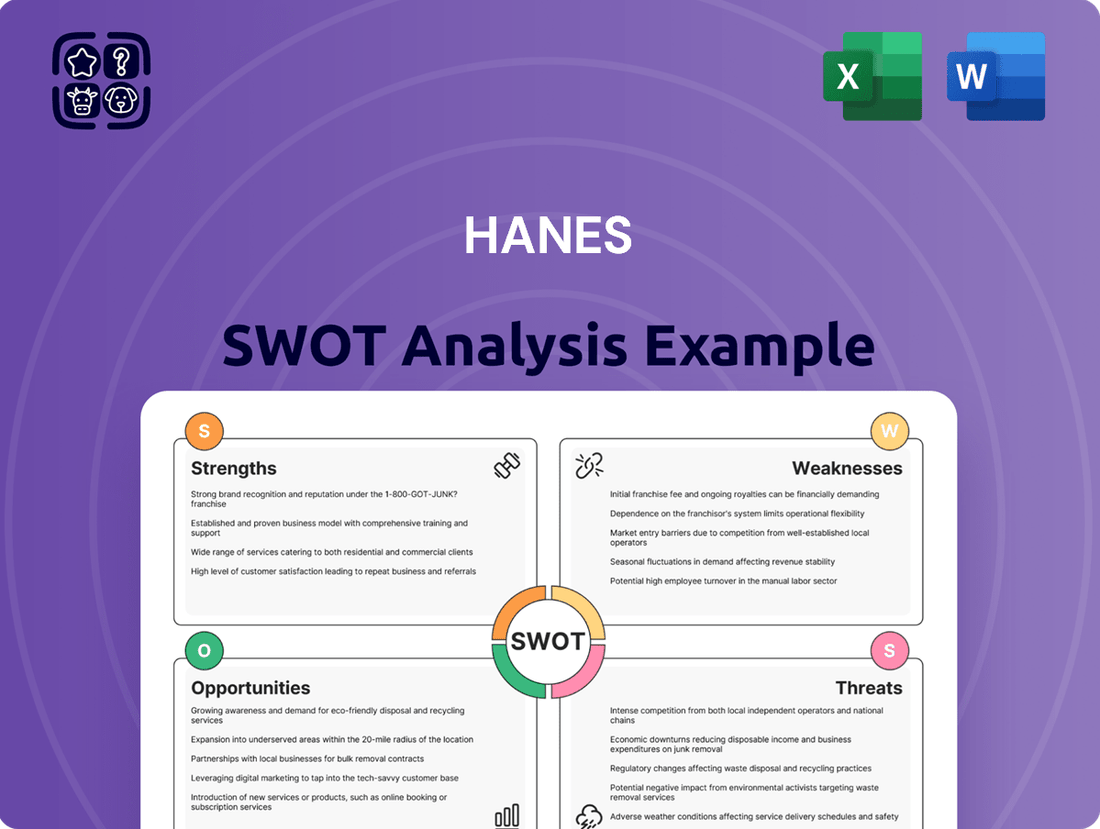

Hanes SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Hanes SWOT analysis before committing.

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of Hanes' strategic position.

Opportunities

Hanes is strategically investing in its e-commerce infrastructure and digital marketing capabilities to better connect with consumers and fuel growth. This focus is a core component of their 'Full Potential' plan, aiming to elevate the online shopping experience and cater to shifting consumer demands.

Hanesbrands' commitment to ambitious sustainability targets, such as achieving zero waste by 2025 and sourcing 100% renewable electricity by 2030, offers a significant opportunity to resonate with the growing segment of environmentally conscious consumers. This focus not only enhances brand reputation but can also translate into tangible cost savings, as demonstrated by their past reductions in energy consumption and waste disposal expenses.

Hanes can capitalize on product innovation and smart assortment management to boost sales and appeal to younger consumers. Recent new product introductions in innerwear have already shown promising performance for the company.

Strategic Focus on Core Innerwear Business

Hanesbrands' strategic pivot to prioritize its core innerwear business, following the divestiture of the Champion brand, presents a significant opportunity. This sharpened focus allows the company to allocate capital and management attention more effectively to its leading innerwear segments, which are known for higher profit margins. By concentrating on these established strengths, Hanes can aim for more predictable revenue streams and enhanced profitability.

This strategic realignment is expected to yield tangible financial benefits. For instance, in the first quarter of 2024, Hanes reported a 3% increase in sales for its Innerwear segment, reaching $741 million. This segment's operating margin also saw an improvement, contributing to the company's overall financial health. The divestiture of Champion, completed in late 2023, is projected to save Hanes approximately $100 million in the first year, freeing up resources for reinvestment in its core operations.

- Enhanced Profitability: Directing resources towards higher-margin innerwear products can boost overall company profitability.

- Market Leadership: Leveraging its dominant position in the innerwear market allows for greater market share capture and pricing power.

- Operational Efficiency: Streamlining operations by shedding non-core assets can lead to cost savings and improved efficiency.

- Investor Confidence: A clear strategic direction focused on core strengths can instill greater confidence in investors, potentially leading to a higher valuation.

Potential for Market Share Gains from Competitors

Hanesbrands' strategic positioning, with limited reliance on China and its own manufacturing in Central America, offers a distinct advantage in navigating global trade dynamics. This allows for greater cost predictability and potentially lower landed costs compared to competitors heavily dependent on Chinese production, especially in light of ongoing tariff discussions and potential shifts in global trade policies.

This operational structure could translate into tangible market share gains. For instance, if competitors face increased costs due to tariffs on goods manufactured in China, Hanesbrands can maintain more competitive pricing or absorb some of these costs, making its products more attractive to consumers and retailers. This is particularly relevant as global supply chains continue to be recalibrated in response to geopolitical events and economic pressures.

Key advantages for Hanesbrands include:

- Reduced Tariff Exposure: Less reliance on China minimizes the impact of potential import duties.

- Owned Manufacturing: Control over production facilities in Central America provides greater supply chain stability and cost management.

- Competitive Pricing Potential: The ability to offer more stable or lower pricing can attract price-sensitive customers.

- Supply Chain Agility: Greater flexibility to adapt to changing trade landscapes compared to more exposed competitors.

Hanes can leverage its expanding e-commerce presence and digital marketing to drive sales and reach a wider customer base. The company's investment in these areas is a key part of its strategy to adapt to evolving consumer behavior and capture online market share. This focus is crucial for future growth, especially as online retail continues its upward trajectory.

The company's commitment to sustainability presents a significant opportunity to attract environmentally conscious consumers and enhance brand image. By meeting ambitious targets, Hanes can differentiate itself in the market and potentially achieve cost savings through efficient resource management. This aligns with a growing consumer preference for ethical and sustainable brands.

Product innovation and strategic assortment management, particularly in the innerwear category, offer avenues for increased sales and appeal to younger demographics. Early positive results from recent innerwear product launches indicate strong consumer reception and potential for continued success in this core segment.

Hanes' strategic decision to concentrate on its core innerwear business following the Champion divestiture allows for more focused capital allocation and management attention on high-margin segments. This sharpened focus is expected to lead to more stable revenues and improved profitability by leveraging established market strengths.

| Opportunity Area | Description | Potential Impact | Supporting Data/Fact |

|---|---|---|---|

| E-commerce & Digital Growth | Expanding online infrastructure and digital marketing. | Increased sales, wider customer reach, enhanced brand connection. | Hanes is investing in its 'Full Potential' plan to elevate online experience. |

| Sustainability Initiatives | Meeting ambitious environmental targets. | Attracting eco-conscious consumers, improved brand reputation, cost savings. | Targeting zero waste by 2025 and 100% renewable electricity by 2030. |

| Product Innovation | Introducing new products and managing assortments effectively. | Boosting sales, appealing to younger consumers, strengthening core segments. | Recent new product introductions in innerwear have shown promising performance. |

| Core Business Focus | Divesting non-core brands to concentrate on innerwear. | Enhanced profitability, operational efficiency, investor confidence. | Divestiture of Champion completed late 2023, projected to save $100M annually. Q1 2024 Innerwear sales increased 3% to $741M. |

| Supply Chain Diversification | Reduced reliance on China, utilizing Central American manufacturing. | Reduced tariff exposure, supply chain stability, competitive pricing. | Minimizes impact of trade policy shifts and offers greater cost predictability. |

Threats

Potential economic downturns and fluctuations in consumer discretionary spending present a significant threat to HanesBrands. A slowdown in the global economy, particularly in key markets like the United States and Europe, could lead to reduced consumer confidence and a pullback in spending on apparel, even on everyday basics which Hanes specializes in. For example, if inflation remains elevated through 2024 and into 2025, consumers may prioritize essential goods over clothing purchases, directly impacting Hanes' sales volumes and profitability.

Hanes faces a highly competitive landscape in the apparel and underwear sectors, with numerous established brands and agile new entrants vying for consumer attention. This intense rivalry, particularly in the fast-growing activewear market, often forces pricing adjustments and complicates efforts to expand or even retain market share. For instance, in 2023, the global activewear market reached an estimated $330 billion, projected to grow further, highlighting the battleground Hanes operates within.

Hanesbrands faces ongoing threats from global supply chain disruptions, which can impact product availability and delivery timelines. The company's reliance on key commodities like cotton and oil-related materials exposes it to significant input cost volatility, a concern that persisted through early 2024 with fluctuating energy prices affecting manufacturing and transportation expenses.

These cost fluctuations, alongside unpredictable utility and freight charges, directly impact Hanesbrands' profit margins. For instance, while specific 2024 data is still emerging, the company has historically managed these pressures through strategic sourcing and operational efficiencies, though the global economic climate in late 2023 and early 2024 presented persistent challenges in managing these variable costs.

Changing Retail Landscape

The retail sector is undergoing a significant transformation, with the ongoing migration of consumers to online platforms and dynamic shifts in how retailers operate. This evolving landscape necessitates that Hanesbrands consistently re-evaluate and adjust its distribution networks and strategic alliances to maintain its market position.

For instance, in 2023, global e-commerce sales were projected to reach over $6 trillion, underscoring the immense growth of online retail. Hanesbrands must therefore ensure its digital presence and direct-to-consumer strategies are robust and adaptable to capture this growing segment of the market.

- Evolving Consumer Preferences: A growing demand for personalized shopping experiences and sustainable products challenges traditional retail models.

- Digital Dominance: The increasing reliance on online channels requires significant investment in e-commerce infrastructure and digital marketing.

- Retailer Consolidation: Mergers and acquisitions among retailers can alter Hanesbrands' key partnership opportunities and bargaining power.

Lingering Investor Skepticism

Despite HanesBrands' reported financial progress, including a reported 2% increase in net sales for the first quarter of 2024, a degree of investor skepticism persists. This caution stems from historical underperformance and past management challenges that have impacted the company's stock. For instance, while the stock saw an uptick in early 2024, it still traded significantly below its 2019 highs, reflecting this lingering doubt.

This persistent skepticism can directly affect HanesBrands' market valuation, making it more challenging to attract new capital or achieve premium pricing for its shares. Investors may require a longer track record of consistent growth and stability before fully regaining confidence. This could limit the company's financial flexibility when pursuing strategic initiatives or acquisitions.

The threat of lingering investor skepticism can manifest in several ways:

- Lower Price-to-Earnings (P/E) Ratio: HanesBrands may trade at a lower P/E multiple compared to competitors with similar growth prospects, indicating investors are less willing to pay a premium for its earnings. As of mid-2024, its P/E ratio remained below the apparel industry average.

- Increased Cost of Capital: A lack of investor confidence can lead to higher borrowing costs for the company, as lenders may perceive greater risk.

- Difficulty in Equity Financing: Raising capital through stock offerings might be less attractive or more dilutive if investor sentiment remains cautious.

HanesBrands faces significant threats from evolving consumer preferences, particularly the growing demand for personalized shopping experiences and sustainable products, which challenges traditional retail models. The increasing reliance on online channels also necessitates substantial investment in e-commerce infrastructure and digital marketing to keep pace with digital dominance. Furthermore, retailer consolidation presents a risk by potentially altering Hanesbrands' key partnership opportunities and bargaining power within the industry.

SWOT Analysis Data Sources

This Hanes SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.