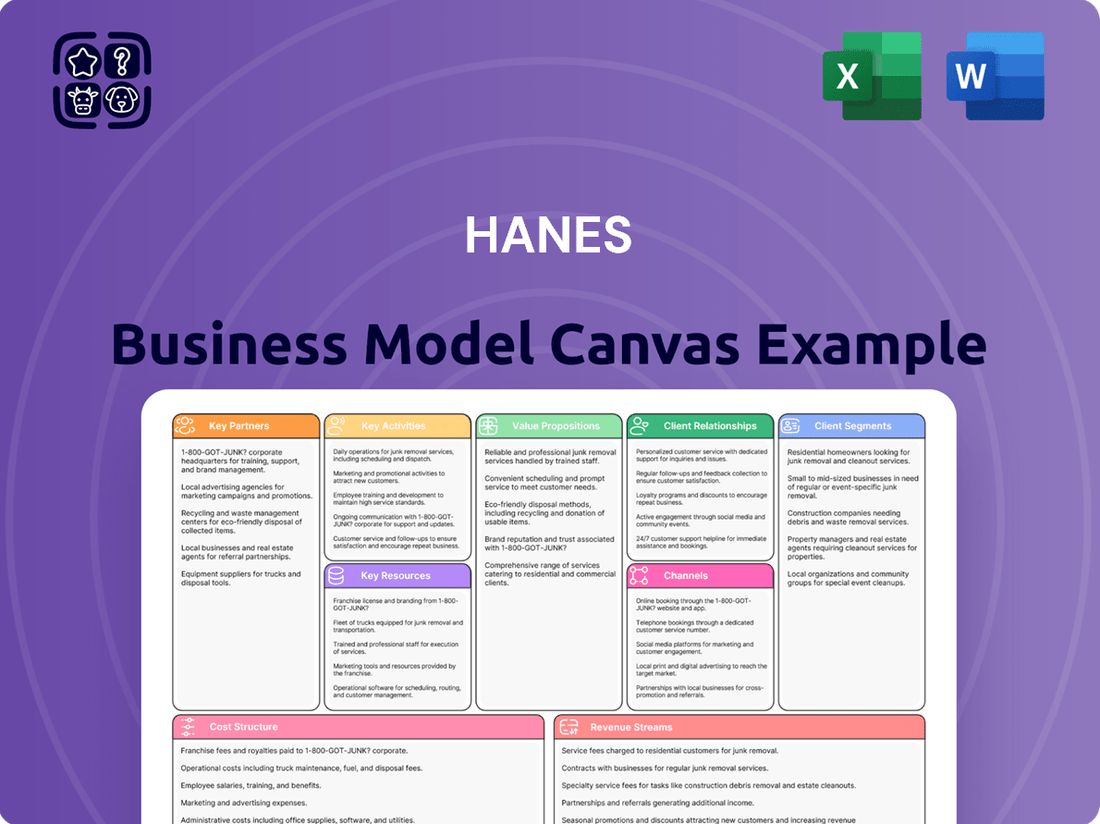

Hanes Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Unlock the full strategic blueprint behind Hanes's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hanesbrands’ extensive network of retailers, including giants like Walmart and Target, along with specialty stores, is fundamental to its market reach. In 2024, these partnerships continued to be the backbone for getting their diverse apparel lines, from basics to activewear, into consumers' hands across numerous channels.

The company also leverages online retail platforms, a critical growth area. Collaborations with e-commerce players ensure Hanesbrands products are accessible to a digitally-savvy consumer base, complementing their traditional brick-and-mortar presence. This dual approach is vital for capturing market share in an evolving retail landscape.

Furthermore, strategic alliances with distributors are essential for optimizing the supply chain. These partnerships ensure efficient inventory management and timely product delivery to thousands of sales points globally, minimizing stockouts and maximizing availability for their vast product portfolio.

Hanesbrands relies heavily on its raw material suppliers, including cotton growers and fabric manufacturers, to maintain its production capabilities. These partnerships are vital for securing a steady flow of quality materials at favorable costs, directly impacting Hanesbrands' operational efficiency and overall cost management. For instance, in 2023, cotton prices, a key input for Hanes, saw fluctuations, making strong supplier relationships crucial for price stability.

Hanesbrands relies heavily on logistics and shipping providers to manage its extensive global supply chain, ensuring raw materials reach manufacturing facilities and finished products arrive at retail stores and direct-to-consumer platforms efficiently. These partnerships are crucial for maintaining optimal inventory levels and minimizing transportation expenses.

In 2024, Hanesbrands continued its focus on supply chain optimization, a strategy that directly impacts its logistics and shipping relationships. By consolidating operations and streamlining distribution networks, the company aims to improve delivery times and reduce overall costs, enhancing its competitive edge in the apparel market.

Technology and Innovation Partners

Hanesbrands actively collaborates with technology and innovation partners to refine its product design and manufacturing. For instance, in 2024, the company continued to invest in advanced analytics to gain deeper business insights, aiming to optimize inventory and personalize customer experiences across its digital channels.

These partnerships are crucial for enhancing Hanesbrands' e-commerce platforms, ensuring a seamless online shopping journey for consumers. Furthermore, the company explores cutting-edge textile technologies, such as smart fabrics and advanced compression materials, to develop innovative apparel that offers enhanced functionality and comfort, particularly in categories like shapewear.

- Data Analytics: Leveraging AI and machine learning for predictive analytics in sales forecasting and supply chain management.

- E-commerce Enhancement: Partnering with tech firms to improve website performance, personalization, and mobile shopping experiences.

- Textile Innovation: Collaborating on research and development for new materials, including sustainable and performance-enhancing fabrics.

Marketing and Brand Promotion Agencies

Hanesbrands relies heavily on marketing and brand promotion agencies to amplify its presence and stimulate demand across its extensive brand lineup. These partnerships are crucial for crafting and deploying impactful advertising campaigns, sophisticated digital marketing initiatives, and engaging promotional efforts. For instance, in 2024, Hanesbrands continued to leverage these agencies to highlight key product launches and reinforce brand messaging in a competitive apparel market.

These collaborations are instrumental in reaching and resonating with Hanesbrands' diverse consumer base. By utilizing specialized expertise, the company can effectively communicate the value and innovation of its products, from everyday essentials to more specialized apparel lines. This strategic outsourcing allows Hanesbrands to maintain agility and focus on its core competencies while ensuring its brands remain top-of-mind for shoppers.

Key aspects of these partnerships include:

- Advertising Campaign Development: Agencies create and manage integrated advertising campaigns across television, print, and digital platforms.

- Digital Marketing Strategy: This encompasses social media marketing, search engine optimization (SEO), pay-per-click (PPC) advertising, and influencer collaborations to boost online visibility.

- Promotional Activities: Agencies design and execute in-store promotions, contests, and special offers to drive sales and customer engagement.

- Brand Storytelling: They help craft compelling narratives that connect with consumers on an emotional level, strengthening brand loyalty.

Hanesbrands' strategic alliances with technology providers are critical for enhancing its digital capabilities and operational efficiency. In 2024, the company continued to invest in cloud computing solutions and data analytics platforms to improve inventory management and personalize customer interactions, particularly on its e-commerce sites.

These partnerships enable Hanesbrands to leverage advanced tools for sales forecasting, supply chain optimization, and customer relationship management. For example, by integrating AI-driven analytics, they aim to better predict consumer demand and streamline logistics, as evidenced by their ongoing efforts to refine their distribution networks.

Collaborations with textile innovators are also key, focusing on developing new materials that offer enhanced performance or sustainability. This includes exploring advanced fabrics for activewear and shapewear lines, ensuring Hanesbrands stays competitive with cutting-edge product offerings.

What is included in the product

A strategic overview of Hanes' operations, detailing its mass-market appeal, diverse product lines, and efficient supply chain to reach consumers through various retail channels.

The Hanes Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operations, allowing for swift identification of inefficiencies and opportunities for improvement.

Activities

Hanesbrands actively designs and develops a wide range of apparel, from innerwear and activewear to hosiery, ensuring products align with changing consumer tastes and market dynamics. This commitment to innovation is fueled by dedicated research and development, exploring new materials and crafting designs that emphasize comfort, style, and practicality. For instance, the company launched Hanes Moves, a new athleisure line, and introduced Hanes Absolute Socks, showcasing their focus on product enhancement.

Manufacturing and sourcing are central to Hanesbrands' operations, encompassing the creation of their diverse apparel lines. The company strategically operates a significant portion of its global manufacturing plants, a key element in their cost management and supply chain efficiency.

This vertical integration is a significant competitive advantage, allowing Hanesbrands to maintain tight oversight on production quality and operational speed. For instance, in 2023, Hanesbrands continued to leverage its owned facilities to support its vast product portfolio, contributing to its ability to meet market demand effectively.

Hanesbrands' supply chain management is a critical activity, orchestrating a complex global network of suppliers and vendors spanning more than 45 countries. This intricate coordination is essential for ensuring timely product availability and managing operational costs effectively.

Key activities within this function include meticulous inventory management to balance stock levels and minimize holding costs, alongside efficient logistics operations to move goods seamlessly across the globe. The company actively pursues cost-saving initiatives to boost overall supply chain efficiency and elevate customer service standards.

In 2024, Hanesbrands continued its strategic focus on supply chain consolidation and optimization. This ongoing effort aims to reduce fixed costs by streamlining operations and leveraging economies of scale, directly impacting the company's profitability and competitive positioning in the apparel market.

Sales and Distribution

HanesBrands actively sells and distributes its diverse range of apparel through numerous retail channels worldwide. This encompasses sales to major mass merchandisers, upscale department stores, specialized boutiques, and increasingly, its own direct-to-consumer online platforms.

The company's strategy focuses on expanding its distribution network and enhancing brand recognition through carefully chosen retail collaborations. For instance, in 2024, HanesBrands continued to leverage its established relationships with large retailers while also investing in its e-commerce capabilities to reach a broader customer base.

Key sales and distribution activities include:

- Wholesale Distribution: Supplying products to a wide array of brick-and-mortar retailers, from discount chains to premium department stores.

- Direct-to-Consumer (DTC): Operating and growing its own online stores and brand websites to capture a larger share of the retail margin and build direct customer relationships.

- International Expansion: Strategically entering and growing presence in new geographic markets to diversify revenue streams and increase global brand penetration.

Brand Marketing and Management

Hanesbrands dedicates substantial resources to brand marketing and management, aiming to cultivate enduring consumer loyalty across its portfolio. This strategic focus is evident in their investment in advertising, promotions, and digital outreach to bolster brand recognition and drive sales.

The company actively engages in targeted campaigns to reinforce the appeal of its well-known brands. For instance, in 2023, Hanesbrands reported advertising and marketing expenses of approximately $720 million, underscoring their commitment to maintaining brand equity and consumer connection.

- Brand Building: Hanesbrands invests in advertising, public relations, and digital marketing to enhance the visibility and desirability of its core brands.

- Consumer Engagement: Strategies include loyalty programs, social media interaction, and promotional events to foster a strong connection with consumers.

- Brand Portfolio Management: While managing established brands, Hanesbrands also strategically reviews and divests assets, as seen with the sale of Champion in late 2023, to focus on core strengths.

- Market Presence: These activities are crucial for maintaining market share and driving demand in a competitive apparel landscape.

Hanesbrands' key activities revolve around designing and developing a diverse apparel range, from innerwear to activewear, with a focus on innovation and consumer trends. They also manage a robust manufacturing and sourcing operation, leveraging vertical integration for cost control and quality assurance. Furthermore, efficient supply chain management across a global network is critical for timely delivery and cost optimization.

The company's sales and distribution efforts span multiple channels, including wholesale, direct-to-consumer online platforms, and international expansion. A significant portion of their strategy involves intensive brand marketing and management, utilizing advertising, promotions, and digital outreach to build consumer loyalty and maintain market presence.

| Key Activity | Description | 2023/2024 Data Point |

| Design & Development | Creating new apparel lines and enhancing existing products. | Launched Hanes Moves athleisure line and Absolute Socks in 2023. |

| Manufacturing & Sourcing | Producing apparel, with a significant portion in owned facilities. | Continued leveraging owned facilities in 2023 for production. |

| Supply Chain Management | Coordinating global suppliers and logistics for efficiency. | Focus on supply chain consolidation and optimization in 2024. |

| Sales & Distribution | Selling through wholesale, DTC, and international channels. | Investing in e-commerce capabilities in 2024. |

| Brand Marketing & Management | Advertising, promotions, and digital engagement to build brand equity. | Reported ~$720 million in advertising and marketing expenses in 2023. |

Full Version Awaits

Business Model Canvas

The Hanes Business Model Canvas preview you are viewing is the complete, final document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the actual file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Hanesbrands' strong brand portfolio, featuring names like Hanes, Bonds, Maidenform, and Playtex, represents a critical intangible asset. These brands command significant consumer loyalty and often hold leading market positions in essential apparel segments, offering a distinct competitive advantage.

Hanesbrands' ownership of a majority of its global manufacturing facilities is a crucial physical resource. This vertical integration allows for significant cost efficiencies and direct control over the production process, a key element in their business model.

The company's supply chain is extensive, operating across more than 30 countries. This vast network, which Hanesbrands largely controls, represents a substantial competitive advantage, enabling agility and responsiveness in meeting market demands.

Hanesbrands relies on its vast and skilled global workforce, numbering over 67,000 individuals. This extensive team encompasses crucial areas like design, manufacturing, supply chain management, and executive leadership, all vital to the company's operational success.

The collective expertise of this workforce, from innovative apparel designers to efficient production teams and strategic managers, is a cornerstone of Hanesbrands' ability to navigate the complexities of the apparel industry and maintain its market position.

Intellectual Property (Designs, Patents)

Hanesbrands leverages its intellectual property, encompassing innovative product designs and proprietary manufacturing processes, as a cornerstone of its business model. These intangible assets are crucial for protecting its market position and fostering brand loyalty. For instance, advancements in fabric technology and apparel construction contribute significantly to product differentiation.

The company's patent portfolio safeguards its unique innovations, providing a competitive edge. This protection is vital in the fast-paced apparel industry where differentiation is key to sustained success. Hanesbrands' commitment to R&D is reflected in its ongoing efforts to secure and expand its intellectual property rights.

Hanesbrands' intellectual property strategy supports its value proposition by ensuring unique product offerings. This includes patented technologies that enhance comfort, durability, and performance in their apparel lines. The company's focus on design patents also protects the aesthetic appeal of its products, a critical factor for consumer purchasing decisions.

- Patented Fabric Technologies: Hanesbrands holds patents for specialized fabric blends and treatments that offer enhanced moisture-wicking, antimicrobial properties, and superior softness, contributing to their ComfortBlend and X-Temp lines.

- Manufacturing Process Innovations: The company has patented advancements in apparel manufacturing that improve efficiency, reduce waste, and enhance product quality, such as specialized stitching techniques for seamless garments.

- Design Patents: Numerous design patents protect the unique aesthetic features of Hanesbrands' apparel, including specific garment silhouettes, seam placements, and branding elements across its various brands like Hanes, Champion, and Bali.

- Brand Trademarks: While not strictly patents, strong trademarks for its core brands are also critical intellectual property assets, ensuring brand recognition and preventing consumer confusion in the marketplace.

Financial Capital

Financial capital is the lifeblood of any business, enabling essential investments in growth and operations. For Hanes, this includes leveraging cash flow from its core business, accessing credit lines, and securing funding from investors to fuel initiatives like new product development, modernizing manufacturing, expanding marketing reach, and pursuing strategic acquisitions.

Hanesbrands has actively managed its financial resources, prioritizing debt reduction and cultivating robust operational cash flow. This strategic focus ensures the company has the necessary capital to invest in its future and maintain financial flexibility.

In 2023, Hanesbrands reported net sales of $3.9 billion, with a focus on improving profitability and cash generation. The company's efforts in debt reduction are a key component of its financial strategy, aiming to strengthen its balance sheet and support future investments. For instance, Hanes has been working to optimize its inventory levels, which directly impacts cash flow from operations.

Key financial resources for Hanesbrands include:

- Cash Flow from Operations: Generated from the company's day-to-day business activities, this is a primary source of internal funding.

- Credit Facilities: Access to revolving credit lines and term loans provides supplementary capital for short-term needs or larger investments.

- Investor Funding: Equity and debt financing from external investors can be crucial for significant strategic initiatives and capital expenditures.

Hanesbrands' key resources are a blend of tangible and intangible assets that drive its operations and market position. These include a robust portfolio of well-recognized brands, significant ownership of manufacturing facilities, an extensive global supply chain, and a large, skilled workforce. Furthermore, the company's intellectual property, particularly in fabric technologies and design, provides a crucial competitive edge.

| Resource Type | Specific Examples | Significance |

| Brands | Hanes, Bonds, Maidenform, Playtex | Consumer loyalty, market leadership |

| Physical Assets | Majority-owned global manufacturing facilities | Cost efficiencies, production control |

| Supply Chain | Operations in over 30 countries | Agility, market responsiveness |

| Human Capital | Over 67,000 global employees | Design, manufacturing, management expertise |

| Intellectual Property | Patented fabric technologies, design patents | Product differentiation, market protection |

Value Propositions

Hanesbrands' core value proposition is delivering comfort and quality in everyday apparel, a promise resonating across its diverse brand portfolio. This commitment ensures consumers receive reliable, comfortable basics for daily life, from innerwear to activewear.

For instance, Hanes' focus on soft fabrics and durable construction in their t-shirts and underwear directly addresses the need for dependable everyday wear. In 2023, the company continued to invest in material innovation to enhance this comfort and quality, a strategy that underpins its market position.

HanesBrands excels in offering affordable apparel, ensuring consumers receive excellent value for their money. This commitment to accessibility makes quality clothing essentials available to a wide range of customers.

In 2024, HanesBrands continued to focus on its value proposition, a strategy that resonated with consumers facing economic pressures. The company's diverse product lines, from everyday basics to activewear, are priced competitively, allowing for broad market penetration.

For instance, Hanes' Champion brand, a significant contributor to its revenue, maintains a strong presence in the mid-tier market, appealing to those seeking durable and stylish activewear without a premium price tag. This strategic pricing ensures Hanes remains a go-to brand for everyday needs.

Consumers are drawn to Hanesbrands because of the deep trust and recognition they have for its iconic brands. This familiarity is a significant draw, making purchasing decisions easier and more confident for shoppers.

The enduring legacy of brands such as Hanes, Champion, and Bonds speaks volumes about their consistent reliability and proven quality. This established reputation directly impacts consumer choice, often leading them to select these trusted names over less familiar alternatives.

In 2023, Hanesbrands reported net sales of $3.9 billion, with a significant portion of this revenue driven by the strength and consumer loyalty to its core brands. For instance, the Hanes brand alone continues to be a dominant force in the innerwear market.

Innovation in Basic Apparel

Hanesbrands drives value by consistently innovating within the basic apparel sector, focusing on enhancing consumer experience through comfort, performance, and style. This commitment is evident in their development of advanced innerwear solutions and strategic entry into the growing athleisure market. For instance, the introduction of Hanes Absolute Socks and the Hanes Moves line exemplifies their dedication to meeting evolving consumer demands and capturing new market segments.

Their innovation strategy aims to keep basic apparel relevant and desirable, moving beyond traditional offerings. This forward-thinking approach is crucial for sustained growth in a competitive landscape. By introducing products that offer tangible benefits, Hanesbrands strengthens its appeal to a broad consumer base.

- Product Innovation: Hanesbrands introduces new products that improve comfort, performance, and style in everyday clothing.

- Innerwear Advancements: Examples like Hanes Absolute Socks showcase their focus on enhancing foundational apparel.

- Athleisure Expansion: The Hanes Moves line represents a strategic move into the popular athleisure category, adapting to lifestyle trends.

- Consumer-Centric Evolution: These innovations demonstrate Hanesbrands' responsiveness to changing consumer needs and preferences.

Commitment to Sustainability and Ethical Practices

Hanesbrands demonstrates a strong commitment to sustainability and ethical operations, appealing to a growing segment of consumers who prioritize these values. This dedication is reflected in tangible goals, such as aiming for zero waste to landfill by 2025 and sourcing 100% renewable electricity for its operations by 2030.

These initiatives are not just aspirational; they are integrated into the company's business model and resonate deeply with environmentally and socially conscious consumers. By actively working to reduce its environmental footprint and improve the lives of people in the communities where it operates, Hanesbrands builds trust and loyalty.

- Environmental Goals: Targeting zero waste to landfill by 2025 and 100% renewable electricity by 2030.

- Community Impact: Focus on improving lives in operating communities.

- Consumer Appeal: Attracts environmentally and socially conscious consumers.

- Brand Differentiation: Sustainability efforts serve as a key differentiator in the apparel market.

Hanesbrands offers a compelling mix of comfort, quality, and affordability, making its products accessible to a broad consumer base. This value proposition is reinforced by the trust consumers place in its well-established brands like Hanes and Champion.

The company’s strategy in 2024 continued to emphasize these core strengths, particularly in light of economic conditions that favor value-conscious purchasing. Hanesbrands' product innovation, such as advancements in innerwear and expansion into athleisure, further solidifies its appeal by meeting evolving consumer needs.

For example, the company's commitment to sustainability, with goals like zero waste to landfill by 2025, resonates with a growing segment of consumers, adding another layer to its value proposition.

| Value Proposition Aspect | Description | Supporting Data/Examples |

|---|---|---|

| Comfort & Quality | Delivering reliable, comfortable everyday apparel. | Focus on soft fabrics and durable construction in innerwear and activewear. |

| Affordability & Value | Providing excellent value for money, making quality clothing accessible. | Competitive pricing across diverse product lines, including the mid-tier Champion brand. |

| Brand Trust & Recognition | Leveraging the familiarity and proven reliability of iconic brands. | Consumer loyalty to brands like Hanes and Champion drives consistent sales. |

| Product Innovation | Enhancing consumer experience through comfort, performance, and style. | Introduction of Hanes Absolute Socks and the Hanes Moves athleisure line. |

| Sustainability & Ethics | Appealing to consumers who prioritize environmental and social responsibility. | Goals for zero waste to landfill by 2025 and 100% renewable electricity by 2030. |

Customer Relationships

Hanesbrands cultivates robust relationships with major mass-market retailers, focusing on high-volume sales and seamless supply chain integration. These partnerships are crucial for ensuring widespread product availability and driving significant revenue. For instance, in 2023, Hanesbrands' sales to its top retailers represented a substantial portion of its overall revenue, underscoring the importance of these collaborations.

HanesBrands is significantly boosting its direct-to-consumer (DTC) efforts, leveraging its own e-commerce sites and brand-specific websites for direct engagement. This strategic shift allows for more personalized customer interactions and the gathering of crucial data. For instance, in 2023, HanesBrands reported that its direct-to-consumer channel saw strong growth, contributing a notable percentage to its overall revenue, underscoring the channel's increasing importance.

Hanesbrands cultivates customer loyalty through targeted brand promotions and seasonal campaigns, encouraging repeat business. For example, in 2023, the company saw strong performance in its innerwear segment, driven partly by effective marketing strategies that resonate with consumers. These efforts are designed to deepen the connection consumers feel with Hanes' diverse portfolio of brands.

Customer Service and Support

HanesBrands prioritizes robust customer service to address inquiries and feedback across its diverse retail and direct-to-consumer channels. This commitment is crucial for fostering trust and ensuring a positive post-purchase experience for consumers engaging with brands like Hanes, Champion, and Maidenform.

Effective support mechanisms are in place to handle a high volume of interactions. For instance, in 2024, HanesBrands reported a significant increase in digital engagement, necessitating enhanced online support capabilities. This focus on customer interaction aims to resolve issues promptly and gather valuable insights for product and service improvement.

- Customer Inquiry Resolution: HanesBrands leverages multiple touchpoints, including website FAQs, email support, and phone lines, to address consumer questions and concerns efficiently.

- Feedback Integration: Customer feedback gathered through surveys and direct interactions is systematically analyzed to inform product development and enhance the overall customer journey.

- Post-Purchase Experience: Providing clear return policies and responsive support post-sale is key to building brand loyalty and encouraging repeat business.

- Digital Support Enhancement: With a growing online presence, HanesBrands continues to invest in digital tools and trained personnel to manage customer interactions effectively in the e-commerce space.

Social Media and Digital Community Interaction

Hanesbrands actively engages with customers across social media platforms and digital communities, fostering direct feedback loops and cultivating brand loyalty. This strategy allows them to monitor consumer sentiment, address inquiries promptly, and build a vibrant online presence.

In 2024, Hanesbrands continued to leverage social media for brand building and customer engagement. For instance, their social media campaigns often highlight user-generated content, creating a sense of community and authenticity. This approach is vital for staying attuned to evolving fashion trends and consumer preferences.

- Brand Awareness: Social media interactions directly contribute to increased visibility and recognition of Hanesbrands' diverse product lines, from innerwear to activewear.

- Customer Feedback: Digital platforms serve as a crucial channel for gathering direct customer insights, informing product development and marketing strategies.

- Community Building: Hanesbrands cultivates online communities where customers can share experiences and connect with the brand, enhancing engagement and retention.

- Trend Responsiveness: By actively participating in digital conversations, the company remains agile in responding to emerging consumer trends and market shifts.

Hanesbrands maintains strong relationships with major retailers, crucial for widespread product availability and significant revenue generation. Their direct-to-consumer (DTC) channels, including e-commerce, facilitate personalized interactions and data collection, showing notable growth in 2023. Loyalty is fostered through targeted promotions and seasonal campaigns, as seen in the innerwear segment's performance in 2023, while robust customer service across all channels builds trust.

Hanesbrands actively engages customers on social media, fostering feedback loops and brand loyalty. In 2024, social media campaigns often feature user-generated content, building community and authenticity, which is vital for staying attuned to consumer preferences.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Retail Partnerships | High-volume sales through mass-market retailers. | Crucial for widespread availability; top retailers represented a substantial portion of revenue in 2023. |

| Direct-to-Consumer (DTC) | Personalized engagement via e-commerce. | Strong growth in 2023, contributing a notable percentage to overall revenue. |

| Promotions & Campaigns | Targeted efforts to encourage repeat business. | Drove strong performance in innerwear in 2023. |

| Customer Service | Addressing inquiries and feedback across channels. | Essential for trust; digital engagement increased in 2024, requiring enhanced online support. |

| Social Media Engagement | Building community and gathering feedback. | User-generated content campaigns in 2024 foster authenticity and brand loyalty. |

Channels

Mass retailers like Walmart and Target are crucial distribution channels for Hanesbrands, ensuring their basic apparel is accessible to a vast customer base. In 2024, Hanesbrands continued to rely heavily on these volume-driving partnerships to move significant inventory of their core products.

These large-format stores benefit Hanesbrands through their extensive reach and consistent foot traffic, facilitating high-volume sales. This strategy allows Hanesbrands to maintain affordability for consumers while achieving broad market penetration.

Department stores serve as a crucial distribution channel for Hanesbrands, particularly for brands like Maidenform and Bali. This strategy targets consumers who value a broad product selection and a potentially more refined shopping environment. These outlets often facilitate higher-margin sales for specific Hanesbrands product categories.

Hanesbrands leverages company-owned retail stores, such as Champion and Hanesbrand outlets, as a crucial direct-to-consumer channel. These locations, numbering in the hundreds across the United States, provide a controlled environment to showcase the full breadth of their product lines and reinforce brand identity. In 2024, the company continued to optimize its retail footprint, recognizing the value of this direct engagement for customer loyalty and premium brand perception.

E-commerce Platforms (Company Websites and Third-Party)

Hanesbrands leverages a dual approach to its e-commerce channels, encompassing both its direct-to-consumer brand websites and significant presence on third-party platforms. This digital strategy is crucial for capturing online sales, offering consumers a convenient way to browse and purchase products directly from brands like Hanes, Champion, and Bonds.

In 2024, Hanesbrands continued to invest in its owned digital properties, aiming to enhance customer experience and build brand loyalty. Simultaneously, their engagement with major online marketplaces, such as Amazon, provided access to a vast customer base, driving significant sales volume. This multi-channel digital presence is vital for meeting evolving consumer shopping habits.

- Digital Channel Growth: Hanesbrands' own websites like hanes.com and bonds.com are key for direct customer engagement and sales.

- Third-Party Marketplace Importance: Platforms like Amazon offer broad reach and are critical for Hanesbrands' overall online sales strategy.

- Consumer Convenience: These channels provide consumers with easy access, extensive product choices, and direct-to-door delivery.

- Sales Contribution: In the first quarter of 2024, Hanesbrands reported that its direct-to-consumer segment, heavily reliant on e-commerce, saw a notable increase in sales, contributing to the company's overall revenue growth.

Wholesale Distributors

Wholesale distributors are a cornerstone for Hanesbrands, enabling broad access to business-to-business clients. These partners are crucial for reaching promotional product companies and a multitude of smaller, independent retail outlets across different regions.

This channel is highly effective for moving substantial product volumes, ensuring Hanesbrands' apparel and accessories penetrate diverse market segments. For instance, in 2023, Hanesbrands reported that its wholesale segment remained a significant contributor to overall revenue, underscoring the channel's importance in their go-to-market strategy.

- Reach: Facilitates access to promotional product companies and independent retailers.

- Volume: Efficiently handles large quantities of goods for widespread distribution.

- Market Penetration: Extends Hanesbrands' presence into varied consumer and business sectors.

Hanesbrands utilizes a multi-faceted channel strategy to reach its diverse customer base. Key channels include mass retailers, department stores, company-owned outlets, and a robust e-commerce presence, both direct-to-consumer and via third-party marketplaces. Wholesale distributors also play a vital role in reaching business-to-business clients and smaller retailers.

In 2024, Hanesbrands continued to optimize its channel mix, recognizing the distinct advantages each offers. Mass retailers provide volume and accessibility, while department stores cater to a more curated shopping experience, often for higher-margin products. Direct-to-consumer channels, including physical stores and e-commerce, are crucial for brand building and customer loyalty.

The company's digital channels saw continued investment in 2024, with a focus on enhancing user experience on owned websites and leveraging the vast reach of platforms like Amazon. This dual approach ensures Hanesbrands meets consumers wherever they prefer to shop online.

Wholesale distribution remains a significant contributor, enabling Hanesbrands to efficiently supply promotional product companies and a broad network of independent retailers, ensuring widespread availability of their products.

| Channel Type | Key Partners/Platforms | Strategic Importance | 2024 Focus Areas |

|---|---|---|---|

| Mass Retail | Walmart, Target | High volume, broad accessibility | Maintaining strong relationships, inventory management |

| Department Stores | Various | Premium placement, higher margin potential | Showcasing specific brands (e.g., Maidenform) |

| Direct-to-Consumer (Owned) | Company-owned stores, hanes.com, champion.com | Brand control, customer loyalty, direct engagement | Digital experience enhancement, retail footprint optimization |

| E-commerce (Third-Party) | Amazon, other online marketplaces | Vast customer reach, sales volume driver | Strategic presence, promotional activities |

| Wholesale Distribution | Promotional product companies, independent retailers | B2B reach, volume sales, market penetration | Expanding reach, efficient logistics |

Customer Segments

This segment represents the core of Hanes' customer base, encompassing millions of individuals and families who rely on the brand for essential apparel like underwear, t-shirts, socks, and activewear. These consumers are primarily driven by the need for reliable, comfortable, and budget-friendly clothing for everyday wear. In 2024, the global apparel market, a significant portion of which is basic wear, continued to show resilience, with consumers actively seeking value for their money amidst economic fluctuations.

Value-conscious shoppers are a cornerstone for Hanes, representing a significant portion of their customer base. These individuals prioritize getting the most for their money, actively seeking out brands that offer a balance of quality and affordability. In 2024, the apparel market continued to see strong demand from this segment, with reports indicating that over 60% of consumers consider price a primary factor when purchasing clothing.

Hanes caters to these shoppers by providing everyday essentials like socks, underwear, and basic t-shirts that deliver on durability and comfort without a premium price tag. This focus on accessible quality is crucial, as consumers in this segment are often budget-aware but still expect their purchases to perform reliably over time. For instance, Hanes' strong brand recognition in basic apparel allows them to leverage economies of scale, translating into competitive pricing that appeals directly to this demographic.

Hanesbrands is actively engaging athleisure enthusiasts with its Hanes Moves line, recognizing a growing market for apparel that seamlessly blends athletic performance with everyday comfort and style. This segment prioritizes garments that are not only functional for workouts but also fashionable enough for casual outings.

In 2024, the global athleisure market was projected to reach over $300 billion, underscoring the significant demand for versatile activewear. Hanesbrands' strategy taps into this trend by offering products that appeal to consumers who value both performance features and contemporary aesthetics in their clothing choices.

Brand-Loyal Customers

A core customer segment for Hanesbrands consists of individuals demonstrating strong brand loyalty to specific labels within their portfolio, such as Hanes, Bonds, Maidenform, and Playtex. These consumers consistently choose these brands due to a history of positive experiences and a deep-seated trust in their quality and performance. For instance, Hanes' enduring popularity in the basic apparel market, particularly in the United States, is a testament to this loyalty, with the Hanes brand alone contributing significantly to the company's revenue.

This loyalty is cultivated through consistent product quality and effective brand messaging that resonates with consumer needs. Hanesbrands reported that in 2024, their Innerwear segment, which heavily features these loyal customer bases, continued to be a stable performer, highlighting the ongoing value of these established relationships.

- Brand Preference: Customers actively seek out Hanes, Bonds, Maidenform, and Playtex.

- Trust Factor: Past positive experiences drive repeat purchases.

- Market Stability: Loyalty contributes to consistent revenue streams for Hanesbrands.

- 2024 Performance: The Innerwear segment, reliant on these loyal customers, remained a robust contributor to overall company sales.

Environmentally and Socially Conscious Consumers

An increasingly important customer segment for Hanesbrands comprises environmentally and socially conscious consumers. These individuals actively seek out brands that demonstrate a genuine commitment to sustainability and ethical operations. For example, Hanesbrands' 2024 sustainability report highlighted a 15% reduction in water usage across its manufacturing facilities compared to a 2018 baseline, a key metric for this demographic.

This growing group of consumers aligns with Hanesbrands' stated goals of reducing its environmental footprint and enhancing the well-being of its stakeholders. Their purchasing decisions are often influenced by a company's transparency regarding its supply chain and its efforts to minimize waste. In 2024, Hanesbrands expanded its use of recycled materials in packaging, aiming for 50% recycled content by 2030.

This segment's influence is growing, driving demand for products manufactured responsibly. Hanesbrands' initiatives in areas such as fair labor practices and community engagement further resonate with these consumers. The company's 2024 ESG (Environmental, Social, and Governance) performance saw positive ratings from several key analysts, reflecting their efforts to meet these consumer expectations.

- Growing Demand: Consumers prioritizing sustainability are increasingly influencing market trends.

- Hanesbrands' Initiatives: Focus on reduced water usage and increased recycled materials in packaging.

- Ethical Alignment: Consumers seek brands with strong fair labor and community engagement practices.

- ESG Performance: Positive ESG ratings in 2024 indicate progress in meeting consumer expectations.

Hanesbrands serves a broad spectrum of customers, from everyday consumers seeking value and comfort in basic apparel to a growing segment focused on athleisure and sustainability. The company's success hinges on its ability to cater to these diverse needs through its well-established brands.

Value-conscious shoppers remain a critical demographic, prioritizing affordability and reliability in their clothing purchases. This segment continued to be a significant driver of sales in 2024, with consumers actively seeking brands that offer good quality at competitive price points. The athleisure market also presented a substantial opportunity, with consumers demanding versatile apparel suitable for both athletic activities and casual wear.

Furthermore, Hanesbrands benefits from a loyal customer base that consistently chooses its established brands like Hanes, Bonds, Maidenform, and Playtex, driven by trust and positive past experiences. The company is also increasingly engaging environmentally and socially conscious consumers who value transparency and ethical operations. Hanesbrands' 2024 sustainability report, detailing reduced water usage and increased recycled materials, directly addresses this growing consumer segment.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Everyday Consumers | Seek comfort, reliability, and affordability in basic apparel. | Global apparel market for basic wear showed resilience in 2024. |

| Value-Conscious Shoppers | Prioritize price and quality balance. | Over 60% of consumers consider price a primary factor in clothing purchases (2024 estimate). |

| Athleisure Enthusiasts | Desire versatile apparel for both performance and style. | Global athleisure market projected to exceed $300 billion in 2024. |

| Brand Loyalists | Prefer specific Hanesbrands labels due to trust and past experiences. | Innerwear segment, driven by loyal customers, remained a stable performer in 2024. |

| Environmentally/Socially Conscious | Seek brands committed to sustainability and ethical practices. | Hanesbrands reported a 15% reduction in water usage (vs. 2018 baseline) in their 2024 sustainability report. |

Cost Structure

Manufacturing and production represent a substantial cost driver for Hanesbrands. This includes the procurement of raw materials like cotton and various fabrics, as well as the wages paid to its global workforce involved in garment creation. For instance, in 2023, Hanesbrands reported that its cost of goods sold, which encompasses these manufacturing expenses, was approximately $4.5 billion.

The company is committed to optimizing its operational expenses by focusing on reducing fixed costs and enhancing the overall efficiency of its supply chain. This strategic approach aims to improve profitability and maintain a competitive edge in the apparel market.

Selling, General, and Administrative (SG&A) expenses for Hanesbrands cover essential operational costs like marketing, sales teams, and administrative functions. In 2023, Hanesbrands reported SG&A expenses of $1.3 billion, a decrease from the previous year, reflecting their ongoing focus on efficiency.

The company has actively pursued disciplined expense management and cost-saving initiatives within SG&A. These efforts are crucial for maintaining profitability and competitiveness in the apparel industry.

Hanes' logistics and distribution costs are a significant component of its operating expenses. These costs encompass the movement of finished goods from its manufacturing plants to distribution centers, and subsequently to a wide array of retail partners and directly to consumers through e-commerce channels.

These substantial expenses include freight charges for various transportation modes, warehousing fees for storing inventory, and the operational costs associated with inventory management systems. For instance, in fiscal year 2023, HanesBrands reported significant investments in its supply chain to improve efficiency, reflecting the ongoing nature of these logistics expenditures.

Brand Marketing and Advertising Investments

Hanesbrands allocates substantial resources to brand marketing and advertising, a key component of its cost structure. These expenditures are crucial for building and sustaining brand equity across its diverse portfolio, including well-known names like Hanes, Champion, and Bali.

In 2023, Hanesbrands reported marketing and advertising expenses totaling $711 million. This significant investment aims to drive consumer engagement and maintain a strong market presence, directly impacting sales volume and brand loyalty.

- Brand Visibility: Marketing efforts ensure Hanes' products are top-of-mind for consumers in a competitive apparel market.

- Demand Generation: Advertising campaigns are designed to stimulate purchases and introduce new product lines.

- Competitive Edge: Consistent investment in marketing helps Hanesbrands stand out against rivals.

- Consumer Connection: These costs are essential for building and nurturing relationships with its target audience.

Debt Servicing and Interest Expenses

Hanesbrands' financial strategy involves significant costs associated with servicing its existing debt, primarily through interest payments. These expenses are a crucial component of its overall cost structure, directly impacting profitability.

In recent periods, Hanesbrands has actively pursued debt reduction initiatives. For instance, as of the first quarter of 2024, the company reported total debt of approximately $3.3 billion, a decrease from previous periods, reflecting its commitment to deleveraging and improving its financial health.

The ongoing efforts to lower its debt burden are expected to translate into reduced interest expenses in the future. This focus on financial discipline aims to free up capital for other strategic investments and enhance shareholder value.

- Debt Servicing Costs: Hanesbrands incurs regular interest payments on its outstanding debt, which are a predictable but significant expense.

- Interest Expense Reduction: The company's strategic focus on paying down debt aims to lower its overall interest expense burden.

- Financial Health Improvement: Reducing debt is a key objective for strengthening Hanesbrands' balance sheet and improving its financial flexibility.

- Q1 2024 Debt Level: Hanesbrands had approximately $3.3 billion in total debt outstanding at the end of the first quarter of 2024.

Hanesbrands' cost structure is heavily influenced by its manufacturing operations, including raw materials and labor, with cost of goods sold around $4.5 billion in 2023. Selling, General, and Administrative (SG&A) expenses, covering marketing and operations, were $1.3 billion in 2023. Significant investments in logistics and distribution, along with $711 million in marketing and advertising in 2023, also form key cost areas.

| Cost Category | 2023 Expense (Approx.) | Key Components |

| Cost of Goods Sold | $4.5 billion | Raw materials (cotton, fabrics), direct labor, manufacturing overhead |

| Selling, General & Administrative (SG&A) | $1.3 billion | Marketing, sales teams, administrative functions, operational efficiency initiatives |

| Marketing & Advertising | $711 million | Brand building, consumer engagement, driving sales for brands like Hanes and Champion |

| Logistics & Distribution | Significant investment | Freight, warehousing, inventory management, supply chain efficiency |

Revenue Streams

Hanesbrands primarily generates revenue through wholesale sales of its diverse product lines, including innerwear, activewear, and hosiery, to a broad network of retailers. This B2B channel is foundational, supplying products to major mass merchandisers, department stores, and specialized retail outlets.

In 2024, wholesale remains a cornerstone of Hanesbrands' financial performance, representing a substantial majority of its net sales. This model allows for broad market penetration and efficient distribution of its well-known brands.

Hanes generates revenue through its direct-to-consumer (DTC) channels, primarily its e-commerce websites. This approach allows for higher profit margins compared to wholesale. In 2023, HanesBrands' digital sales, which largely encompass DTC, represented a significant portion of their overall revenue, demonstrating the growing importance of this channel.

International sales are a significant driver for Hanesbrands, showcasing its expansive global reach. In the fourth quarter of 2024, sales from markets outside the United States played a crucial role in the company's overall revenue performance.

Licensing Agreements

Hanesbrands leverages licensing agreements as a significant revenue stream, allowing other companies to utilize its well-known brands. This strategy enables broader market reach and product diversification without direct capital investment in every category or region. For instance, the company has previously generated income by licensing brands like Champion to partners in various international markets.

In a notable strategic shift, Hanesbrands announced in early 2024 its exit from the Champion Japan license agreement. This move is part of a broader effort to streamline its brand portfolio and focus on core markets and growth drivers. The company's financial reports for 2023 and projections for 2024 will reflect the impact of such licensing realignments on its overall revenue.

- Brand Monetization: Licensing agreements allow Hanesbrands to earn royalties and fees by permitting third parties to manufacture and sell products bearing its brand names.

- Market Expansion: This strategy facilitates entry into new product categories or geographic regions where Hanesbrands may not have a direct operational presence.

- Strategic Divestment: The recent exit from the Champion Japan license demonstrates a proactive approach to optimizing its brand portfolio and operational focus.

- Revenue Impact: Licensing revenue, while variable, contributes to the company's top line and can be a source of profitable growth when managed effectively.

Innovation-Driven Product Sales

Innovation-driven product sales are a cornerstone for Hanes, with new introductions like the Hanes Moves athleisure line and upgraded innerwear directly contributing to revenue. These innovations attract new demographics and encourage repeat purchases from loyal customers, fueling sales growth.

In 2023, HanesBrands saw a notable impact from its new product launches. For instance, the company's focus on innovation in its Innerwear segment, including advancements in comfort and fabric technology, helped to offset some of the broader market challenges. This strategy is designed to capture market share and drive higher average selling prices.

- New Product Introductions: Hanes Moves athleisure and enhanced innerwear products are key revenue drivers.

- Customer Acquisition and Retention: Innovations attract new customers and encourage existing ones to upgrade.

- Sales Growth Contribution: These new offerings directly contribute to the company's overall sales performance.

Hanesbrands generates revenue through multiple channels, including significant wholesale distribution to a wide array of retailers, direct-to-consumer (DTC) sales via its e-commerce platforms, and substantial international market penetration.

Licensing agreements also contribute to revenue by allowing other companies to use Hanesbrands' brands, a strategy that has seen adjustments, such as the early 2024 exit from the Champion Japan license, aimed at portfolio optimization.

Innovation in product development, exemplified by lines like Hanes Moves athleisure, is a key revenue driver, attracting new customer segments and encouraging repeat purchases.

| Revenue Stream | Description | 2023/2024 Relevance |

| Wholesale | Sales to retailers | Cornerstone of sales; substantial majority of net sales in 2024. |

| Direct-to-Consumer (DTC) | E-commerce sales | Growing importance; significant portion of overall revenue in 2023. |

| International Sales | Sales outside the US | Crucial driver of overall revenue performance in Q4 2024. |

| Licensing | Brand usage fees | Contributes to top line; portfolio optimization via exits (e.g., Champion Japan in 2024). |

| Product Innovation | Sales of new/upgraded products | Key driver for sales growth and market share capture. |

Business Model Canvas Data Sources

The Hanes Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer apparel trends, and competitive analysis of key players. These diverse data sources ensure a comprehensive understanding of Hanes' operational landscape and strategic positioning.