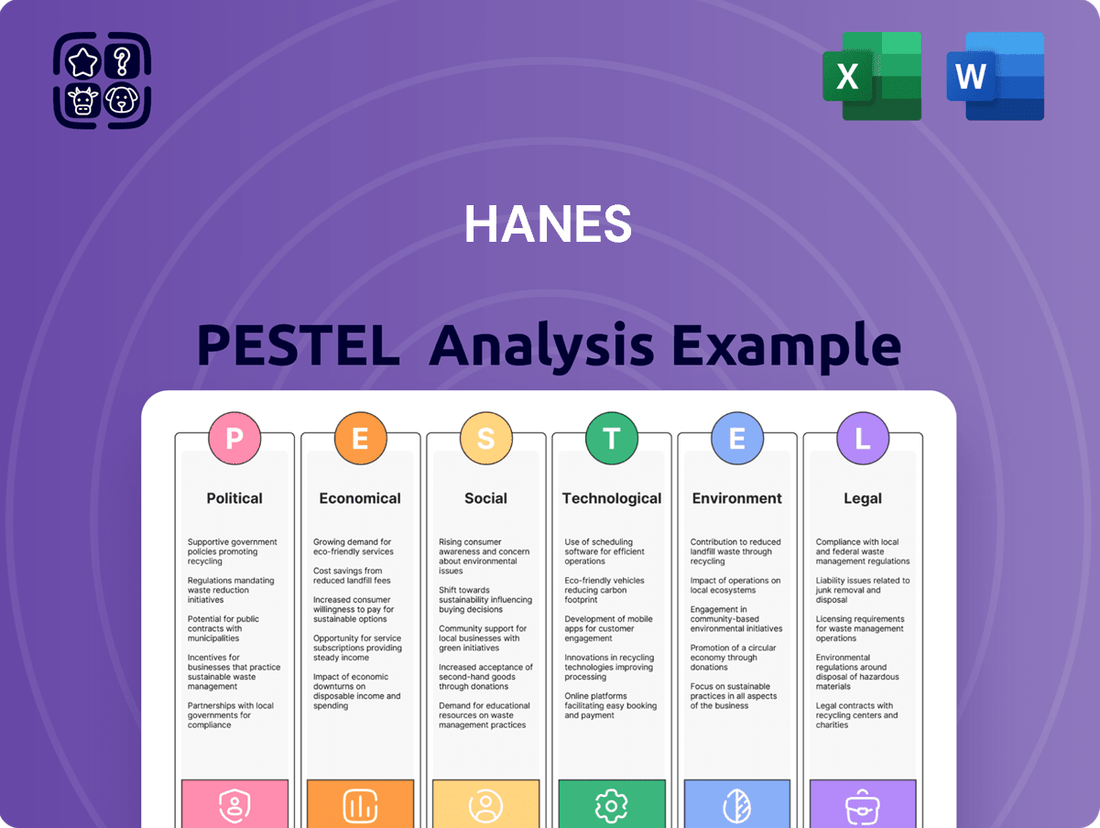

Hanes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Unlock Hanes's strategic future by understanding the political, economic, social, technological, environmental, and legal forces at play. Our expert-crafted PESTLE analysis provides the critical intelligence you need to anticipate market shifts and capitalize on opportunities. Gain a competitive edge—download the full Hanes PESTLE analysis now and make informed decisions.

Political factors

Changes in international trade policies, like tariffs and trade agreements, directly influence Hanesbrands' costs for sourcing materials and manufacturing products. As a global apparel company, Hanesbrands operates across various countries, making it susceptible to shifts in trade relations that can alter the price of raw materials and finished goods, impacting overall profitability and how they price their items.

For instance, the ongoing trade tensions between major economies in 2024 and 2025 could lead to adjustments in Hanesbrands' supply chain strategies to lessen the potential financial blow from new tariffs or trade barriers. Companies like Hanesbrands are constantly evaluating their global footprint to navigate these evolving trade landscapes efficiently.

Hanesbrands' global manufacturing footprint means navigating a complex web of international labor laws. For instance, minimum wage fluctuations in key production countries like Vietnam or El Salvador directly impact operational costs. In 2024, many nations saw adjustments to their minimum wages, with some regions experiencing increases of 5-10% to combat inflation, directly affecting Hanes' labor expenses.

Compliance with these varying regulations, covering everything from working hours to workplace safety, is non-negotiable. Failure to adhere can result in significant fines and reputational damage. For example, a 2023 report highlighted that companies with poor labor practices faced an average of a 15% drop in consumer trust.

Adhering to stringent labor standards is key to fostering a reliable workforce. In 2025, companies prioritizing fair wages and safe conditions are reporting lower employee turnover rates, often by as much as 20%, which translates to reduced recruitment and training costs for manufacturers like Hanes.

Political instability, such as civil unrest or abrupt government changes in key manufacturing hubs, poses a direct threat to Hanesbrands' supply chain. For instance, the company's reliance on production facilities in regions experiencing political volatility could lead to significant operational disruptions.

These disruptions translate into tangible financial impacts, including production delays and increased operational costs, potentially affecting Hanesbrands' revenue streams. In 2023, global supply chain disruptions, often exacerbated by geopolitical events, cost companies an average of 5-10% of their annual revenue, a risk Hanesbrands faces.

Therefore, a stable political climate in manufacturing regions is not just beneficial but essential for Hanesbrands to ensure consistent production schedules and meet its product delivery commitments to consumers worldwide.

Governmental Support and Incentives

Governmental policies offering incentives for manufacturing, sustainable practices, or job creation can significantly impact Hanesbrands' strategic decisions. For instance, tax credits or subsidies for reshoring production or investing in eco-friendly manufacturing processes can directly reduce operational costs and encourage domestic expansion. The U.S. government, through initiatives like the CHIPS and Science Act, aims to boost domestic manufacturing, which could indirectly benefit apparel companies by fostering a more robust domestic supply chain, though direct apparel-specific incentives might vary.

These financial advantages, such as reduced corporate tax rates or grants for facility upgrades, can make investing in new plants or expanding existing ones more financially attractive. Conversely, a lack of supportive government policies or the imposition of unfavorable regulations can deter investment and lead to less competitive operating conditions for Hanesbrands.

In 2024, many governments globally are focusing on nearshoring and reshoring initiatives to strengthen domestic economies and supply chain resilience. Hanesbrands may benefit from such policies if they align with their manufacturing strategies. For example, if a particular region offers significant tax abatements for companies establishing new distribution centers or manufacturing facilities, Hanesbrands could see a reduction in capital expenditure and operational expenses.

- Governmental Support: Policies that incentivize domestic manufacturing, sustainable practices, and job creation can lower Hanesbrands' operating costs.

- Tax Incentives: Tax breaks and subsidies directly reduce expenses, making investments in new facilities or technologies more appealing.

- Operational Impact: Favorable government policies can encourage local production and expansion, while a lack of support can create less advantageous operating environments.

- Global Trends: Initiatives promoting nearshoring and reshoring in 2024-2025 could offer opportunities for Hanesbrands to benefit from reduced supply chain risks and potential cost savings.

Consumer Protection Laws

Consumer protection laws, covering aspects like product safety and accurate labeling, significantly influence Hanesbrands' product development and marketing strategies across different regions. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued its focus on textile flammability standards, requiring rigorous testing for apparel. Failure to comply can lead to costly recalls and damage brand reputation.

Adherence to these regulations is paramount for building and maintaining consumer trust, while also mitigating legal risks. In 2025, Hanesbrands will likely face ongoing scrutiny regarding supply chain transparency and ethical sourcing, further emphasizing the importance of robust compliance frameworks. These laws ensure products meet expected quality and safety benchmarks, a critical factor in today's informed marketplace.

Key areas of consumer protection impacting Hanesbrands include:

- Product Safety Standards: Ensuring all garments meet stringent safety regulations, such as those related to the presence of harmful chemicals or choking hazards in children's wear.

- Labeling Requirements: Providing accurate and comprehensive information on product content, care instructions, and origin, as mandated by bodies like the Federal Trade Commission (FTC) in the US.

- Advertising and Marketing Practices: Complying with regulations that prohibit deceptive or misleading advertising, ensuring all claims about product performance or benefits are substantiated.

- Data Privacy: Protecting consumer data collected through online sales and loyalty programs, adhering to evolving regulations like the California Privacy Rights Act (CPRA) which came into full effect in 2023 and continues to shape data handling practices.

Governmental policies can significantly shape Hanesbrands' operational landscape through trade agreements, labor laws, and consumer protection regulations. For instance, shifts in international trade policies in 2024-2025, such as tariffs, can directly impact sourcing and manufacturing costs, potentially altering product pricing and profitability.

Navigating diverse international labor laws, with minimum wage adjustments in key production countries like Vietnam and El Salvador in 2024, directly affects Hanesbrands' labor expenses. Adherence to these laws, including workplace safety, is crucial, as non-compliance can lead to substantial fines and reputational damage, with companies facing an average 15% drop in consumer trust for poor labor practices in 2023.

Government incentives for domestic manufacturing or sustainable practices can reduce operational costs, making expansion more attractive. Conversely, unfavorable regulations can hinder investment. Initiatives promoting nearshoring and reshoring in 2024-2025 could offer Hanesbrands opportunities for supply chain resilience and cost savings.

Consumer protection laws, including product safety standards and accurate labeling, are critical for Hanesbrands' product development and marketing. In 2024, the CPSC's focus on textile flammability standards necessitates rigorous testing. By 2025, evolving data privacy regulations like CPRA, fully effective in 2023, will continue to influence how Hanesbrands handles consumer data.

What is included in the product

This Hanes PESTLE analysis dissects the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Hanes' strategic discussions.

Economic factors

Hanesbrands' sales are closely tied to how much consumers are willing and able to spend, especially on everyday clothing. When the economy is strong and people have more money left after essential bills, they tend to buy more apparel. For instance, in early 2024, consumer spending showed resilience, with retail sales increasing, which generally benefits companies like Hanes.

However, economic headwinds like inflation can significantly impact this. When prices for necessities like groceries and housing rise, consumers have less discretionary income for items like t-shirts and underwear. This was a concern in late 2023 and into 2024, as inflation persisted, potentially dampening demand for non-essential apparel purchases.

Conversely, periods of economic expansion and rising consumer confidence are a boon for Hanes. As disposable income grows, consumers are more likely to purchase higher volumes or even upgrade their apparel choices. The projected GDP growth for the US in 2024, estimated to be around 2.5% by various economic forecasts, suggests a supportive environment for consumer spending, which Hanes can leverage.

Rising inflation directly impacts Hanesbrands' operational expenses, increasing the cost of essential raw materials like cotton and synthetic fibers, as well as labor and transportation. For instance, the Consumer Price Index (CPI) for apparel and footwear saw a notable increase throughout 2023 and into early 2024, reflecting these pressures.

While Hanesbrands reported improvements in gross margin, partly due to lower input costs and internal cost-saving measures in recent periods, persistent inflation poses a significant risk. Sustained price increases for their inputs could quickly negate these margin improvements, putting considerable pressure on the company's profitability.

Effectively managing these escalating costs is therefore paramount for maintaining Hanesbrands' financial stability and competitive pricing strategies in the current economic climate.

Hanesbrands, with its extensive global operations and sales, is significantly impacted by currency exchange rate fluctuations. A strengthening U.S. dollar, for instance, can make Hanes' products pricier for international consumers, potentially dampening demand abroad, and also diminishes the reported value of profits earned in foreign currencies when they are translated back into dollars.

The company has explicitly acknowledged that shifts in foreign currency exchange rates can act as headwinds, creating challenges for its financial performance. For example, in its first quarter of 2024, Hanes reported that foreign currency negatively impacted its earnings per share by $0.01, illustrating the tangible effect these movements can have on profitability.

Global Economic Growth and Recession Risks

The global economic outlook for 2024 and into 2025 presents a mixed picture for Hanesbrands. While some regions show resilience, the persistent risk of recession in key markets like Europe and potential slowdowns in North America could dampen consumer spending on apparel. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023, but noted that advanced economies, including the US and Eurozone, face slower growth trajectories, increasing the likelihood of reduced discretionary spending on non-essential goods like clothing.

This economic uncertainty directly impacts Hanesbrands' sales channels. Retailers, facing their own cautious consumer base, may reduce inventory levels and place more conservative orders, affecting Hanesbrands' top-line performance. Even with Hanesbrands' international sales demonstrating some stability, a broad-based global economic downturn can still exert downward pressure on overall revenue and profitability. For example, if major economies experience a contraction, the demand for Hanesbrands' products, from innerwear to activewear, is likely to decline across the board.

Key economic factors to monitor for Hanesbrands include:

- Inflationary Pressures: Persistent inflation can erode consumer purchasing power, leading to reduced demand for apparel.

- Interest Rate Hikes: Higher interest rates in major economies can slow business investment and consumer spending, impacting retail sales.

- Geopolitical Instability: Ongoing global conflicts and trade tensions can disrupt supply chains and create economic uncertainty, affecting Hanesbrands' operational costs and market access.

- Consumer Confidence: Declining consumer confidence, often linked to recession fears, directly translates to lower spending on discretionary items like clothing.

Retail Landscape and Channel Shifts

The retail sector is undergoing significant transformation, with e-commerce continuing its rapid ascent. This shift directly influences how companies like Hanesbrands reach consumers. For instance, online retail sales in the U.S. are projected to grow by 8.1% in 2024, reaching $1.77 trillion, according to eMarketer. This highlights the increasing importance of digital channels for apparel sales.

Traditional brick-and-mortar stores are facing ongoing challenges, with some reporting declining foot traffic and sales. Simultaneously, discount retailers are gaining traction as consumers seek value. Hanesbrands must navigate these evolving preferences by optimizing its distribution strategies across physical stores, online platforms, and potentially even exploring new retail formats to maintain its market presence and sales momentum.

Adapting to these shifts is not just about survival but also about growth. Investing in a robust direct-to-consumer (DTC) strategy allows Hanesbrands to build stronger customer relationships and capture higher margins. The DTC market is expected to continue its strong growth trajectory, making it a vital component of any modern apparel company's retail approach.

- E-commerce Growth: Online retail sales in the U.S. are expected to reach $1.77 trillion in 2024, showing an 8.1% increase.

- Channel Diversification: Hanesbrands needs to balance its presence across physical stores, online marketplaces, and its own DTC channels.

- Consumer Preferences: The rise of discount retailers and the increasing demand for value impact purchasing decisions.

- Direct-to-Consumer (DTC) Importance: Investing in DTC is crucial for brand control, customer engagement, and potentially improved profitability.

Economic factors significantly shape Hanesbrands' performance by influencing consumer spending and operational costs. A robust economy with rising disposable incomes generally boosts apparel sales, as seen with resilient consumer spending in early 2024. Conversely, inflationary pressures, such as those experienced in late 2023 and into 2024, reduce consumers' ability to spend on non-essential items like clothing, while also increasing Hanes' input costs for materials, labor, and transportation.

The global economic outlook for 2024 and 2025 presents a mixed environment, with potential slowdowns in key markets impacting consumer confidence and discretionary spending. For instance, the IMF projected global growth at 3.2% for 2024, but noted slower trajectories for advanced economies, increasing the risk of reduced demand for apparel. This economic uncertainty can lead retailers to manage inventory more conservatively, affecting Hanesbrands' sales volumes.

Currency exchange rate fluctuations also pose a challenge, with a strengthening U.S. dollar making products more expensive internationally and reducing the reported value of foreign earnings. Hanesbrands reported a $0.01 negative impact on earnings per share from foreign currency in Q1 2024, highlighting the tangible effect of these movements on profitability. Managing these economic variables is crucial for Hanesbrands' financial stability and competitive pricing.

| Economic Factor | Impact on Hanesbrands | 2024/2025 Data/Outlook |

|---|---|---|

| Consumer Spending | Directly affects sales volume and revenue. | Resilient in early 2024, but subject to inflation and economic slowdowns. |

| Inflation | Reduces consumer purchasing power and increases operational costs. | Persisted through 2023-2024, impacting apparel CPI and input costs. |

| GDP Growth | Indicates overall economic health and consumer confidence. | Projected around 2.5% for the US in 2024, with global growth at 3.2% (IMF). |

| Currency Exchange Rates | Affects international sales competitiveness and reported profits. | Strengthening USD negatively impacted Q1 2024 EPS by $0.01. |

Same Document Delivered

Hanes PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hanes PESTLE analysis covers all key external factors impacting the company. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape affecting Hanes.

Sociological factors

Consumer lifestyles are shifting significantly, with a growing preference for comfort and active living. This trend directly impacts Hanesbrands, as demand for their innerwear and activewear lines is influenced by this evolution. For instance, the athleisure market, a direct beneficiary of this shift, saw global revenues reach an estimated $326 billion in 2023, a figure projected to climb further.

Hanesbrands must actively innovate to keep pace with these changing consumer desires. This means developing products that cater to modern needs, such as sustainable materials or enhanced performance features in activewear. The company's ability to adapt its product portfolio to align with these evolving preferences is crucial for maintaining its market position and competitive edge in the coming years.

Consumers increasingly seek apparel made with sustainability and ethical labor practices in mind, driven by concerns over environmental impact and worker conditions. This shift directly influences purchasing decisions.

Hanesbrands has actively responded to this trend, reporting a 20% reduction in greenhouse gas emissions intensity across its operations from 2019 to 2023, demonstrating progress toward its sustainability targets. Their commitment to reducing waste and improving supply chain transparency resonates with these evolving consumer values.

Meeting these heightened expectations is vital for maintaining brand image and fostering long-term customer loyalty. For instance, in 2024, a survey indicated that 65% of consumers consider sustainability when buying clothing, highlighting the market's direction.

Hanesbrands must adapt to evolving demographics, like the growing Gen Z population, who have distinct purchasing preferences and digital engagement. In 2024, understanding that Gen Z's spending power is increasing is crucial for Hanes to capture market share. This means tailoring product lines and marketing campaigns to resonate with their values and online behaviors.

Health and Wellness Trends

The growing emphasis on health and wellness directly impacts consumer preferences, boosting demand for activewear and comfortable clothing. Hanesbrands, through its popular Champion and Hanes labels, is strategically positioned to benefit from this shift, offering apparel that caters to active lifestyles and everyday comfort.

This societal movement is a significant driver for innovation in fabric technology and product development within the apparel industry. For instance, the global athleisure market was valued at approximately $321 billion in 2022 and is projected to reach $570 billion by 2028, showcasing the substantial growth potential.

- Increased Demand: Consumers are actively seeking apparel that supports fitness routines and promotes well-being, benefiting brands like Hanes with their activewear offerings.

- Innovation Driver: The trend encourages investment in advanced materials and ergonomic designs to enhance performance and comfort in clothing.

- Market Opportunity: Hanesbrands can leverage its established brands to capture a larger share of the expanding health-conscious consumer market.

Social Media and Influencer Impact

Social media platforms and fashion influencers significantly shape consumer preferences and buying habits. Hanesbrands can capitalize on this by utilizing these channels for brand promotion and direct consumer interaction, particularly with younger audiences. In 2024, influencer marketing spend is projected to reach upwards of $21 billion globally, highlighting its substantial impact.

Leveraging these digital avenues allows Hanesbrands to boost brand awareness and stimulate sales. Collaborations with relevant influencers can amplify reach and authenticity, driving engagement. For instance, TikTok's influence on fashion trends is undeniable, with many users discovering and purchasing apparel based on viral content.

- Social Media Dominance: Platforms like Instagram and TikTok are primary discovery engines for fashion, influencing purchasing decisions for a significant portion of Gen Z and Millennial consumers.

- Influencer Marketing ROI: Brands are seeing substantial returns on investment from influencer collaborations, with studies indicating an average return of $5.20 for every $1 spent in 2023.

- Direct Consumer Engagement: Social media enables Hanesbrands to gather real-time feedback, build community, and foster brand loyalty through interactive content and campaigns.

- Trend Agility: By monitoring social media conversations and influencer content, Hanesbrands can quickly adapt to emerging trends and tailor product offerings accordingly.

Societal shifts towards health and wellness are a significant tailwind for Hanesbrands, directly boosting demand for activewear and comfortable apparel. The company's Champion brand, in particular, is well-positioned to capitalize on this trend. The global athleisure market, a direct beneficiary, was valued at approximately $321 billion in 2022 and is projected to reach $570 billion by 2028, indicating substantial growth potential.

Technological factors

The accelerating shift to e-commerce demands ongoing investment in Hanesbrands' digital capabilities. In 2023, global e-commerce sales reached an estimated $6.3 trillion, a figure projected to climb significantly by 2027. Hanesbrands' commitment to enhancing its online platforms and data infrastructure is crucial for capturing this growing consumer preference for digital shopping channels.

A robust digital footprint and an intuitive online customer journey are paramount for Hanesbrands to connect with an expanding online shopper base. The company's strategic objective to evolve into a digital-first, data-informed organization underscores the importance of these technological factors in its overall business strategy.

Advancements in manufacturing technologies, particularly automation, are a significant technological factor for Hanesbrands. These innovations can lead to improved efficiency, lower production costs, and a higher standard of product quality. For instance, the adoption of robotics and AI in textile manufacturing, a key area for Hanes, can drastically reduce labor costs and speed up production cycles.

Hanesbrands' investment in modern production techniques is crucial for streamlining operations and boosting output. By optimizing supply chain processes and integrating new tools, the company can achieve greater agility. For example, in 2024, many apparel manufacturers are exploring advanced knitting machines that can produce garments with fewer seams, reducing waste and labor.

Hanesbrands' investment in advanced supply chain technologies, such as AI-powered forecasting and real-time tracking systems, is crucial for optimizing inventory and logistics. For instance, by mid-2025, Hanes is expected to have further integrated predictive analytics to anticipate demand shifts, aiming to reduce excess inventory by an estimated 15% compared to 2023 levels. This technological enhancement directly impacts efficiency and waste reduction.

The company's focus on data analytics within its supply chain allows for more accurate demand forecasting, a critical factor in the apparel industry's fast-paced market. By leveraging these tools, Hanes can better manage stock levels, ensuring products are available when and where consumers want them, thereby improving customer satisfaction and reducing lost sales opportunities. This data-driven approach is projected to boost operational efficiency by up to 10% by the end of 2025.

Material Science and Product Innovation

Advancements in material science are a significant technological driver for Hanesbrands, enabling the creation of innovative and sustainable apparel. The company is actively pursuing the use of recycled and biodegradable materials, which directly addresses growing consumer demand for eco-friendly products. This strategic focus is crucial for enhancing brand image and potentially opening new market segments. Hanesbrands has set ambitious goals, aiming to incorporate 100% recycled or degradable polyester and sustainably grown cotton into its product lines, aligning with broader industry trends toward circularity and reduced environmental impact.

These material innovations translate into tangible product benefits, such as improved performance and a lower ecological footprint. For instance, the development of advanced recycled polyester can offer comparable durability and comfort to virgin materials, making the transition seamless for consumers. Hanesbrands' commitment to these materials supports its broader corporate social responsibility initiatives and positions it favorably against competitors who may lag in sustainable sourcing and production. The company’s progress in this area will be closely watched by investors and consumers alike in the coming years.

- Recycled Polyester Adoption: Hanesbrands is working towards a goal of using 100% recycled or degradable polyester, a key material in many of its apparel offerings.

- Sustainable Cotton Sourcing: The company is also focused on increasing its use of sustainably grown cotton, which typically involves reduced water usage and fewer pesticides.

- Product Performance Enhancement: Innovations in material science allow for the development of products that are not only sustainable but also offer improved durability, comfort, and functionality.

- Consumer Appeal: By offering products made from recycled and biodegradable materials, Hanesbrands can tap into the growing market segment of environmentally conscious consumers.

Data Analytics and Consumer Insights

Hanesbrands is increasingly leveraging data analytics to understand its customers better. By analyzing vast amounts of consumer data, the company aims to pinpoint evolving preferences and emerging market trends. This allows for more precise product development and marketing strategies, ensuring that Hanesbrands stays aligned with what consumers want.

This focus on becoming a data-driven enterprise is crucial for optimizing operations. For instance, improved consumer insights can directly impact inventory management, reducing waste and ensuring popular items are readily available. Hanesbrands reported that its digital sales grew by 15% in 2023, underscoring the importance of understanding online consumer behavior.

Key applications of this data-driven approach include:

- Personalized Marketing Campaigns: Tailoring advertisements and promotions based on individual consumer purchase history and browsing behavior.

- Product Innovation: Identifying unmet needs or desired features in apparel based on aggregated consumer feedback and purchase patterns.

- Supply Chain Efficiency: Forecasting demand more accurately to optimize production and distribution, minimizing stockouts and excess inventory.

- E-commerce Optimization: Enhancing website user experience and product recommendations to drive online sales and customer loyalty.

Hanesbrands' digital transformation is a significant technological factor, with global e-commerce sales projected to reach $7.5 trillion by 2027, up from an estimated $6.3 trillion in 2023. The company's investment in its online platforms and data infrastructure is vital for capitalizing on this growth. A robust digital presence and seamless online customer experience are essential for reaching a wider audience.

Legal factors

Hanesbrands heavily relies on its intellectual property to protect its valuable brands like Hanes, Champion, and Maidenform. In 2024, the company continued its global efforts to combat the significant issue of counterfeiting, which can dilute brand equity and revenue. Effective trademark and design protection is paramount for maintaining Hanesbrands' competitive edge and market share.

Hanesbrands operates under a stringent web of product safety and liability regulations across its global markets. For instance, in the United States, the Consumer Product Safety Commission (CPSC) sets standards for apparel flammability and general product safety, with violations potentially leading to significant fines. In 2023, the CPSC reported over $2 billion in recalls and civil penalties, highlighting the financial risks of non-compliance.

Failure to meet these evolving safety mandates, such as those concerning chemical content in textiles or child-resistant features on certain products, can trigger costly product recalls and substantial legal liabilities. In 2024, the apparel industry continued to face scrutiny over materials and manufacturing processes, with potential penalties for non-compliance escalating.

Maintaining rigorous quality control and ensuring product safety are therefore not just about meeting legal obligations but are fundamental to preserving consumer trust and Hanesbrands' brand reputation. The company's commitment to these standards directly impacts its ability to operate without interruption and avoid reputational damage that could affect sales and market share.

Hanesbrands must navigate a complex web of advertising and marketing regulations, ensuring all promotional activities are truthful and transparent. This includes adhering to laws like the Federal Trade Commission Act in the US, which prohibits deceptive or unfair advertising. For instance, in 2024, the FTC continued its focus on influencer marketing disclosures, requiring clear identification of sponsored content to protect consumers from misleading endorsements. Failure to comply can result in significant fines and damage to brand reputation.

Data privacy regulations, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), significantly impact how Hanesbrands collects and utilizes customer data for targeted marketing. As of 2024, businesses are increasingly scrutinized for their data handling practices, with potential penalties for non-compliance. Hanesbrands must ensure its digital marketing strategies respect consumer privacy rights, including opt-out mechanisms and clear consent procedures, to maintain trust and avoid legal repercussions.

Furthermore, regulations concerning environmental claims, often referred to as green marketing, require substantiation for any eco-friendly assertions made about Hanesbrands' products. In 2025, expect continued regulatory attention on the accuracy of such claims, pushing companies to provide verifiable evidence of sustainability. This means Hanesbrands needs robust internal processes to back up any claims about recycled materials or reduced environmental impact, preventing accusations of greenwashing.

International Trade Laws and Compliance

Hanesbrands' global operations necessitate strict adherence to international trade laws, encompassing import/export regulations, customs duties, and sanctions. Navigating these diverse legal frameworks is paramount for seamless cross-border transactions and avoiding costly penalties.

The company must also consider the financial implications of tariffs and trade agreements, which can significantly impact sourcing costs and market access. For instance, changes in trade policies between major markets like the US and China, or the implementation of new free trade agreements, directly affect Hanesbrands' supply chain efficiency and profitability.

- Tariff Impact: Fluctuations in tariffs can alter the cost of raw materials and finished goods, influencing pricing strategies.

- Trade Agreements: Understanding and leveraging preferential trade agreements can reduce import duties and enhance competitiveness in key markets.

- Sanctions Compliance: Strict adherence to international sanctions regimes is vital to prevent legal repercussions and reputational damage.

- Regulatory Changes: Monitoring and adapting to evolving trade regulations, such as those related to product safety or environmental standards, is an ongoing requirement.

Labor and Employment Laws

Hanesbrands must navigate a complex web of labor and employment laws across its global operations. This includes adhering to varying regulations on minimum wage, overtime, and working conditions, which can differ significantly by country. For instance, in 2024, the US federal minimum wage remains at $7.25 per hour, while many states and cities have established higher rates, impacting Hanesbrands' domestic labor costs.

Compliance extends to non-discrimination policies and employee benefits, ensuring fair treatment and competitive compensation packages. Failure to comply can lead to costly lawsuits and damage Hanesbrands' reputation as an employer. In 2023, the Equal Employment Opportunity Commission (EEOC) reported a significant number of workplace discrimination charges, highlighting the ongoing importance of robust compliance programs.

- Minimum Wage Adherence: Ensuring all employees are paid at least the legally mandated minimum wage in their respective operating countries, which varies widely globally.

- Working Hour Regulations: Complying with laws governing standard working hours, overtime pay, and rest periods to prevent employee burnout and legal penalties.

- Non-Discrimination and Equal Opportunity: Implementing and enforcing policies that prohibit discrimination based on race, gender, age, religion, and other protected characteristics, as mandated by laws like the Civil Rights Act in the US.

- Employee Benefits Compliance: Providing legally required benefits such as health insurance, paid time off, and retirement contributions, in line with national and regional legislation.

Hanesbrands must navigate a complex legal landscape, from protecting its valuable intellectual property like the Hanes and Champion brands against counterfeiting in 2024, to adhering to stringent product safety regulations enforced by bodies like the CPSC. Failure to comply with these evolving safety mandates, including those concerning chemical content in textiles, can lead to substantial financial penalties and product recalls. The company's commitment to rigorous quality control and product safety is crucial for maintaining consumer trust and brand reputation.

Environmental factors

Hanesbrands is under growing pressure to tackle climate change and cut its carbon footprint. This includes addressing the environmental impact of its global operations and supply chain.

The company has committed to ambitious goals, aiming for 100% renewable electricity across its operations by 2030. Furthermore, Hanesbrands has established science-based targets to significantly reduce its greenhouse gas emissions, aligning with global efforts to mitigate climate change.

These environmental initiatives are vital not only for responsible corporate citizenship but also for satisfying the increasing expectations of investors, consumers, and other stakeholders who prioritize sustainability.

Hanesbrands recognizes the significant water footprint of apparel manufacturing. The company has set an ambitious target to reduce water consumption by 25% across its owned facilities by the year 2030, demonstrating a commitment to responsible resource management.

To achieve these water reduction goals, Hanes is actively investing in and implementing water-saving technologies and innovative practices throughout its production processes. This focus on conservation is crucial not only for environmental stewardship but also for long-term operational efficiency and resilience in the face of increasing water scarcity concerns.

Hanesbrands faces significant environmental challenges in managing waste from its extensive manufacturing processes and in fostering circularity within its product lifecycle. A key objective is achieving zero waste across all operations by 2025, a target that necessitates innovative solutions for material handling and disposal.

To combat this, the company is actively exploring initiatives such as upcycling materials, which transforms waste into higher-value products, thereby diverting it from landfills. This focus on reducing landfill waste and promoting product reuse and recycling is central to Hanesbrands' commitment to environmental stewardship and sustainable business practices.

Sustainable Sourcing of Materials

The demand for sustainably sourced materials like organic or recycled cotton and polyester is on a significant upswing. Consumers are increasingly prioritizing brands that demonstrate environmental responsibility. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products made from sustainable materials.

Hanesbrands has publicly committed to ambitious sustainability goals, including the target of using 100% recycled or degradable polyester and sustainably grown cotton. This strategic alignment with growing consumer preferences is crucial for brand reputation and market share. By 2023, Hanesbrands reported that 45% of its polyester was recycled or degradable, showing progress towards its 2030 goal.

- Growing Consumer Demand: Over 60% of consumers in 2024 expressed willingness to pay a premium for sustainable products.

- Hanesbrands' Commitment: The company aims for 100% recycled/degradable polyester and sustainably grown cotton.

- Progress in 2023: Hanesbrands achieved 45% usage of recycled or degradable polyester, moving towards its 2030 target.

- Environmental and Market Appeal: This focus directly addresses environmental impact and resonates with eco-conscious consumers.

Regulatory Compliance and Environmental Standards

Hanesbrands must navigate a complex web of environmental regulations, impacting everything from the chemicals used in production to how waste is managed. Staying compliant is not just about avoiding penalties; it's about maintaining operational integrity and protecting the company's reputation. For instance, the Responsible Care® initiative, adopted by many in the chemical industry, sets benchmarks for environmental performance that Hanesbrands likely considers.

The company's commitment to environmental stewardship is evident in its reporting. In 2023, Hanesbrands continued to focus on reducing greenhouse gas emissions, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 compared to a 2018 baseline. This proactive approach to sustainability not only addresses regulatory pressures but also resonates with increasingly environmentally conscious consumers.

- Evolving Regulations: Hanesbrands must adapt to changing rules on chemical usage, pollution discharge, and waste management globally.

- Risk Mitigation: Non-compliance can lead to significant fines and severe damage to brand image, impacting consumer trust and sales.

- Environmental Transparency: Hanesbrands has been recognized for its open communication regarding environmental practices, a key factor in building stakeholder confidence.

- Sustainability Goals: The company actively pursues goals like reducing its carbon footprint, aligning with broader environmental standards and consumer expectations.

Hanesbrands is actively addressing its environmental impact, focusing on reducing greenhouse gas emissions and water consumption. The company has set ambitious targets, aiming for 100% renewable electricity by 2030 and a 25% reduction in water usage across its facilities by the same year. These efforts are driven by increasing stakeholder expectations and a commitment to sustainable operations.

The company also prioritizes waste reduction, with a goal of achieving zero waste across all operations by 2025, utilizing strategies like upcycling. Furthermore, Hanesbrands is increasing its use of sustainable materials, reporting 45% recycled or degradable polyester in 2023 towards its 2030 goal, aligning with a growing consumer demand for eco-friendly products, where over 60% of consumers in 2024 indicated a willingness to pay more for such items.

| Environmental Focus Area | Hanesbrands' Target/Commitment | Progress/Data Point |

|---|---|---|

| Renewable Electricity | 100% by 2030 | |

| Greenhouse Gas Emissions | 50% reduction in Scope 1 & 2 by 2030 (vs. 2018 baseline) | |

| Water Consumption | 25% reduction by 2030 | |

| Zero Waste Operations | Achieve by 2025 | |

| Sustainable Materials (Polyester) | 100% recycled or degradable by 2030 | 45% achieved in 2023 |

| Sustainable Materials (Cotton) | Sustainably grown | |

| Consumer Preference (2024) | Over 60% willing to pay more for sustainable products |

PESTLE Analysis Data Sources

Our Hanes PESTLE analysis is built on a robust foundation of data from industry-leading market research firms, government economic reports, and up-to-the-minute legislative updates. We meticulously gather insights on technological advancements, social trends, and environmental regulations to ensure a comprehensive understanding of the macro-environment.