Hanes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

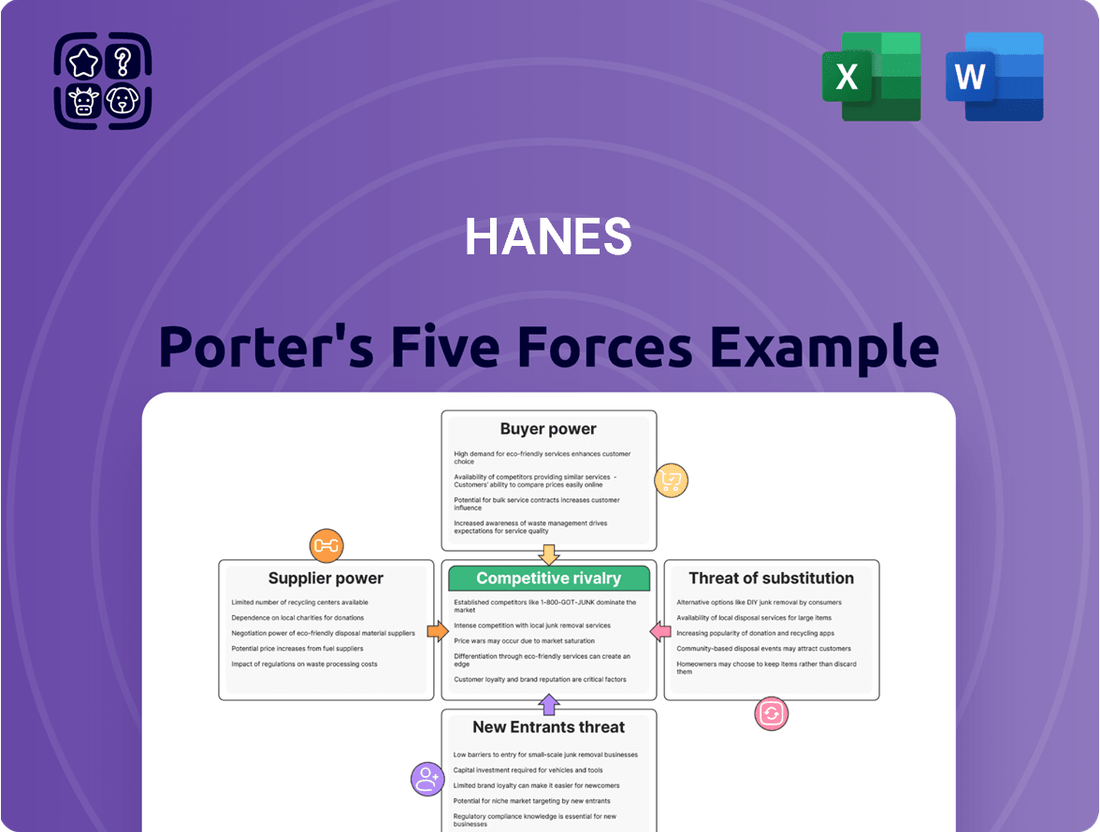

Hanes faces a complex competitive landscape shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for navigating the apparel industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hanes’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hanesbrands benefits from a diverse supplier base for its raw materials like cotton and synthetic fibers. This wide network of global suppliers means no single supplier holds significant leverage over Hanesbrands, thereby reducing their bargaining power. For example, in 2023, Hanesbrands' commitment to sourcing from multiple regions helped it navigate fluctuations in cotton prices, a key input for its apparel production.

The prices of essential raw materials like cotton, polyester staple fiber (PSF), and viscose staple fiber (VSF) are subject to significant swings. These fluctuations are driven by a mix of global economic health, disruptions in how goods are transported and delivered, and the cost of energy. For instance, cotton prices saw considerable volatility in early 2024, influenced by weather patterns in major growing regions and shifts in global demand, directly affecting Hanesbrands' input costs.

This inherent price volatility in key inputs grants suppliers a degree of bargaining power. When these material costs increase, it directly squeezes Hanesbrands' profit margins if the company cannot pass these higher costs onto consumers. The ability of suppliers to influence these prices means they can exert pressure on Hanesbrands, impacting its overall cost structure and profitability.

Hanesbrands' ownership of a substantial part of its manufacturing gives it some control, but labor costs remain a key factor. For instance, in 2024, many apparel manufacturing hubs continued to grapple with rising wages due to inflation and labor shortages, directly impacting Hanesbrands' operational expenses and potentially increasing the bargaining power of its workforce or any third-party labor providers.

The apparel industry's trend towards nearshoring and regionalized supply chains, which gained momentum in recent years and continued through 2024, is reshaping manufacturing cost structures. This shift could lead to new supplier relationships and alter the bargaining power landscape, as Hanesbrands might find itself dealing with a more diverse set of regional manufacturers, each with its own cost considerations and labor dynamics.

Sustainability and Ethical Sourcing Demands

The increasing consumer and regulatory focus on sustainability is significantly impacting the apparel sector. Suppliers capable of providing materials that meet rigorous environmental and ethical standards are finding themselves in a stronger negotiating position. This is particularly relevant for companies like Hanesbrands, which has publicly committed to ambitious goals, such as sourcing 100% sustainable cotton and utilizing recycled or degradable polyester.

This shift necessitates greater transparency and compliance throughout the supply chain, empowering suppliers who can demonstrate adherence to these evolving demands.

- Sustainable Cotton Sourcing: By 2025, Hanesbrands aims for 100% of its cotton to be sourced from more sustainable sources.

- Recycled Materials: The company is also increasing its use of recycled and degradable polyester, creating demand for these specific materials.

- Supply Chain Transparency: Brands are increasingly requiring detailed information on labor practices and environmental impact from their suppliers.

Technological Advancements in Supply Chain

Technological advancements are reshaping the bargaining power of suppliers in the textile industry. The integration of AI, machine learning, and digital transformation is becoming essential for enhancing efficiency, improving forecasting accuracy, and enabling greater customization within supply chains.

Suppliers who proactively invest in these cutting-edge technologies can offer significant value by providing real-time data and optimizing production processes. This capability can strengthen their negotiating position, as they become more indispensable partners.

This evolving landscape underscores a critical shift towards data-driven decision-making across the entire supply chain. For instance, in 2024, companies leveraging advanced analytics in their supply chains reported an average of 15% improvement in inventory turnover, highlighting the tangible benefits of technological adoption.

- AI and Machine Learning: Enabling predictive analytics for demand forecasting and inventory management.

- Digital Transformation: Facilitating real-time visibility and traceability of goods.

- Data-Driven Optimization: Allowing suppliers to offer tailored solutions and improve operational efficiency.

The bargaining power of suppliers for Hanesbrands is influenced by the concentration of suppliers and the availability of substitutes for raw materials. While Hanesbrands benefits from a broad supplier base, price volatility in key inputs like cotton and polyester, driven by global economic factors and weather patterns, grants suppliers some leverage. In early 2024, cotton prices experienced significant fluctuations, impacting input costs.

The increasing demand for sustainable and ethically sourced materials strengthens the negotiating position of suppliers who can meet these criteria. Hanesbrands' commitment to sourcing 100% sustainable cotton by 2025 and increasing recycled polyester use means suppliers aligned with these goals hold greater influence.

Technological advancements also empower suppliers. Those investing in AI and digital transformation can offer enhanced efficiency and data-driven solutions, making them more valuable partners. For example, companies utilizing advanced supply chain analytics in 2024 saw an average 15% improvement in inventory turnover.

| Factor | Impact on Hanesbrands | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Low due to diverse global base | Low |

| Raw Material Price Volatility (e.g., Cotton) | Increases input costs, squeezes margins | Moderate to High |

| Sustainability Demands | Requires compliance, favors compliant suppliers | Moderate to High |

| Technological Adoption by Suppliers | Offers efficiency and data insights | Moderate to High |

What is included in the product

This analysis dissects the competitive forces impacting Hanes, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the apparel industry.

Effortlessly identify and address competitive pressures with a visual breakdown of each of Porter's Five Forces, enabling targeted strategic adjustments.

Customers Bargaining Power

Hanesbrands commands significant bargaining power from its customers due to its portfolio of deeply entrenched and trusted brands. Names like Hanes, Champion, Bonds, Maidenform, and Playtex are household staples, fostering a loyal customer base. This brand loyalty means customers are less likely to switch for minor price differences or demand extensive customization, thereby limiting their individual bargaining power.

Hanesbrands leverages diverse distribution channels, including mass merchants, e-commerce, and direct-to-consumer sales, to reach its customer base. This multi-channel approach is crucial in managing customer bargaining power.

Major retailers like Walmart, Amazon, and Target represent significant sales volumes for Hanesbrands. In 2024, these large retailers continued to exert considerable influence due to the sheer scale of their purchasing power, a trend consistent with previous years.

While these large customers hold sway, Hanesbrands' strategy of diversifying its sales channels helps to mitigate the overall bargaining power of any single customer segment. This broad reach allows the company to spread its reliance across various retail partners and direct sales.

Consumers in the mass market, particularly for basic apparel like that offered by Hanesbrands, exhibit significant price sensitivity. This means that the cost of a product is a primary driver in their buying choices. For instance, in 2024, the average consumer spent approximately $500 annually on apparel, with a substantial portion of that allocated to everyday wear where price is a major consideration.

This high price sensitivity grants customers considerable bargaining power. They can easily shift their loyalty to a competitor offering a lower price, forcing Hanesbrands to adopt aggressive pricing strategies. Promotional activities and discounts are therefore crucial for capturing and retaining these price-conscious shoppers, as seen in the industry's reliance on seasonal sales events.

Demand for Sustainable and Ethical Products

The increasing consumer demand for sustainable and ethical products significantly bolsters customer bargaining power. A growing segment of consumers is willing to pay a premium for goods that align with their environmental and social values. This trend means customers can exert pressure on Hanesbrands to meet higher ESG standards, influencing purchasing decisions beyond just cost and quality.

For instance, by 2024, a significant portion of consumers, particularly younger demographics, actively seek out brands with transparent supply chains and demonstrable commitments to reducing their environmental footprint. This conscious consumerism translates into a powerful lever for customers, allowing them to dictate terms related to sourcing, labor practices, and environmental impact.

- Consumer Preference Shift: A growing number of consumers prioritize sustainability and ethical production, impacting brand loyalty and purchasing decisions.

- Premium Willingness: Consumers are increasingly willing to pay more for products that meet higher environmental, social, and governance (ESG) standards.

- ESG Pressure: This demand allows customers to pressure companies like Hanesbrands to adopt and improve their ESG practices.

- Beyond Price and Quality: Purchasing decisions are now influenced by factors beyond traditional cost and quality metrics, giving consumers more leverage.

Evolving Consumer Preferences and Digital Engagement

Consumer buying behavior is rapidly shifting, heavily influenced by digital advancements, the demand for personalized products, and the convenience of online shopping. This evolution significantly amplifies the bargaining power of customers.

The surge in social commerce, coupled with a heightened expectation for tailored experiences, grants consumers unprecedented access to information and a wider array of choices. This empowers them to more effectively negotiate for specific product features or unique shopping experiences.

- Digital Influence: By mid-2024, over 60% of global retail sales are projected to occur online, giving consumers direct access to a vast marketplace and comparison tools, thereby increasing their leverage.

- Customization Demand: A 2023 survey indicated that 71% of consumers expect personalized interactions, pushing brands to offer more customizable options or risk losing business.

- Information Accessibility: The proliferation of online reviews and social media feedback means customers are well-informed about product quality and pricing, enabling them to bargain more effectively.

Customers wield significant power over Hanesbrands, primarily due to price sensitivity in the mass market for basic apparel. In 2024, consumers' willingness to switch for lower prices means Hanesbrands must employ competitive pricing and promotions to retain shoppers.

Furthermore, the growing consumer demand for ethically and sustainably produced goods amplifies customer leverage. By mid-2024, a substantial segment of consumers, particularly younger ones, actively sought brands with transparent supply chains and strong ESG commitments, influencing purchasing decisions beyond mere cost.

Digital advancements and the rise of social commerce also empower customers, providing access to vast product comparisons and personalized experiences. By 2024, over 60% of global retail sales were online, giving consumers direct access to a wider marketplace and increasing their negotiation power.

| Factor | Impact on Hanesbrands | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High power for basic apparel consumers | Average annual apparel spend ~$500; price is key for everyday wear. |

| Sustainability Demand | Leverage for ESG-focused consumers | Growing segment willing to pay premiums for ethical/eco-friendly products. |

| Digital & Social Commerce | Increased access to information and choices | >60% of global retail sales online by mid-2024; 71% expect personalized interactions. |

What You See Is What You Get

Hanes Porter's Five Forces Analysis

This preview showcases the complete Hanes Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You are viewing the final, professionally formatted report, ensuring no discrepancies or placeholder content. This means you get instant access to the exact, ready-to-use analysis without any surprises.

Rivalry Among Competitors

The global apparel market is a battlefield, with Hanesbrands facing a crowded field of competitors. This includes other well-known brands, store-specific private labels, and the ever-present fast-fashion giants. The fragmentation means Hanesbrands must constantly innovate and adapt to stay ahead.

Hanesbrands' market share reflects this intense rivalry. In the fourth quarter of 2024, their share stood at approximately 6.63%, and it slightly increased to 7.37% in the first quarter of 2025. These figures highlight that while Hanesbrands is a significant player, no single company commands overwhelming dominance, underscoring the dynamic and competitive nature of the industry.

Competitive rivalry in the apparel industry, particularly for companies like Hanesbrands, is intensely fueled by a relentless pursuit of product differentiation and innovation. Companies are constantly introducing new fabrics, updated designs, and enhanced performance features to capture consumer interest and market share.

The current market landscape sees significant emphasis on sustainability and the growing athleisure trend. Competitors are actively highlighting eco-friendly materials and versatile activewear lines, creating pressure for established players. For instance, Hanesbrands has responded by launching collections such as HanesOriginals SuperSoft and HanesMoves, aiming to align with these consumer preferences and maintain its competitive edge.

The apparel industry, especially in basic categories, is characterized by intense competition where many players aggressively pursue cost leadership. This means that keeping prices as low as possible is a major battleground.

Hanesbrands has actively worked to improve its operational efficiency and financial health through various cost-saving measures. These include optimizing its supply chain to reduce expenses and strategically reducing its debt burden, which strengthens its overall financial stability.

In 2023, Hanesbrands reported net sales of $3.9 billion, and its focus on operational efficiency is crucial for maintaining competitive pricing in this crowded market. For instance, their supply chain initiatives aim to streamline operations and reduce per-unit costs, directly impacting their ability to compete on price.

Marketing and Brand Building

Competitive rivalry in the apparel industry is significantly intensified by extensive marketing and brand-building initiatives. Hanesbrands, for instance, relies heavily on its portfolio of well-established brands to capture consumer attention and loyalty.

The company actively strengthens its retail partnerships to enhance brand visibility and ensure widespread consumer accessibility across diverse sales channels. In 2023, Hanesbrands reported approximately $6.3 billion in net sales, underscoring the scale of its operations and the importance of its brand presence.

Effective marketing is not merely a tactic but a strategic imperative for companies like Hanesbrands to differentiate themselves and gain an edge in a highly saturated marketplace. This includes significant investments in advertising and promotional activities to maintain brand relevance.

- Brand Portfolio Strength: Hanesbrands' competitive advantage is bolstered by its ownership of widely recognized brands such as Hanes, Champion, Bali, and Maidenform.

- Retail Partnerships: Strategic alliances with major retailers are crucial for product placement and consumer reach, contributing to brand visibility.

- Marketing Investment: In 2023, the apparel sector, including companies like Hanesbrands, continued to allocate substantial budgets towards advertising and digital marketing campaigns to drive sales and brand equity.

- Market Saturation: The intense competition necessitates continuous innovation in marketing strategies to cut through the noise and connect with target demographics.

Global Market Presence and Expansion

Competitors are actively expanding their global footprints, enhancing their supply chain efficiencies through strategies like nearshoring. This global push means that companies like Hanesbrands must also fortify their international presence and strategic market positioning to remain competitive on a worldwide stage.

The intensified global competition, driven by widespread expansion and optimized sourcing, creates a more aggressive rivalry across diverse geographical markets. For instance, in 2024, many apparel companies reported increased investments in emerging markets, aiming to capture new customer bases and diversify production risks.

- Global Expansion: Competitors are broadening their reach into new international territories.

- Sourcing Optimization: Strategies like nearshoring are being adopted to improve supply chain resilience and cost-effectiveness.

- Market Positioning: Companies are focusing on strengthening their brand presence and strategic advantages in key global markets.

- Intensified Rivalry: This global activity fuels heightened competition across all regions where these companies operate.

The competitive rivalry within the apparel sector is fierce, with Hanesbrands navigating a crowded marketplace. Differentiation through product innovation, such as new fabrics and designs, is key. In 2024, the company saw its market share fluctuate, indicating the constant need to adapt to consumer trends like sustainability and athleisure.

Cost leadership remains a critical battleground, pushing companies like Hanesbrands to optimize operations and supply chains. In 2023, Hanesbrands reported net sales of $3.9 billion, highlighting the scale of its operations and the importance of efficiency in maintaining competitive pricing.

Marketing and brand strength are vital differentiators. Hanesbrands leverages its well-known brands, investing in advertising to maintain visibility. In 2023, the company's net sales reached approximately $6.3 billion, underscoring the significant marketing efforts required to stand out.

Global expansion and supply chain optimization by competitors intensify rivalry. Companies are increasingly investing in emerging markets, forcing Hanesbrands to reinforce its international presence and strategic positioning to remain competitive worldwide.

| Metric | 2023 Data | 2024 Data (Q4 Est.) | 2025 Data (Q1 Est.) |

|---|---|---|---|

| Hanesbrands Net Sales | $3.9 Billion | N/A | N/A |

| Hanesbrands Market Share | N/A | 6.63% | 7.37% |

| Total Apparel Market Sales | ~$1.7 Trillion (Global Est.) | N/A | N/A |

SSubstitutes Threaten

The growing popularity of casual wear and athleisure presents a significant threat of substitution for traditional innerwear and activewear. Consumers increasingly seek comfort and versatility in their clothing, blurring the lines between different apparel categories. For instance, many are opting for stylish leggings or comfortable joggers as everyday wear, potentially reducing demand for dedicated activewear or even some forms of loungewear.

The burgeoning second-hand and rental apparel market poses a substantial threat of substitution for new basic apparel. Platforms like ThredUp and Poshmark, along with rental services, are increasingly appealing to consumers prioritizing sustainability and cost savings. For instance, the resale market in the US was projected to reach $35 billion by 2024, demonstrating a significant shift in consumer behavior away from solely purchasing new items.

The increasing consumer focus on environmental impact presents a significant threat of substitution for Hanesbrands. As awareness of sustainability grows, shoppers are actively seeking out brands that prioritize eco-friendly materials and ethical production. For instance, the global sustainable fashion market was valued at approximately $7.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating a substantial shift in consumer preference.

If Hanesbrands' offerings are not perceived as sufficiently aligned with these growing environmental values, consumers may readily switch to competitors specializing in organic cotton, recycled fabrics, or transparent supply chains. This trend means that brands with a strong sustainability narrative can capture market share from those perceived as less committed to eco-conscious practices, directly impacting Hanesbrands' customer loyalty and sales volume.

DIY and Customization Options

The growing availability of DIY and customization options presents a subtle but significant threat to traditional apparel manufacturers like Hanes. Consumers increasingly have access to platforms that enable personalized clothing creation, often leveraging AI for design assistance and on-demand production. This trend, while not directly replacing the need for everyday basics, can siphon off discretionary spending that might otherwise go to mass-produced items.

This shift towards personalization is gaining momentum. For instance, in 2024, the global custom t-shirt printing market was valued at approximately $3.5 billion, with projections indicating continued growth. This highlights a segment of consumers actively seeking unique apparel over standardized offerings.

- Growing Consumer Demand for Personalization: Consumers are increasingly seeking unique and tailored clothing, moving away from purely mass-produced items.

- AI-Enabled Customization: Advancements in AI are making it easier and more accessible for consumers to design and order personalized apparel.

- Diversion of Spending: While not a direct replacement for all apparel needs, customization options can divert a portion of consumer budgets from traditional purchases.

- Market Growth in Custom Apparel: The custom apparel market is experiencing significant growth, indicating a tangible shift in consumer preferences and spending patterns.

Durability and Longevity of Apparel

The durability and longevity of apparel, while a positive attribute for consumers and a potential strength for brands like Hanesbrands focusing on quality, can inadvertently bolster the threat of substitutes. When clothing items are well-made and last longer, consumers naturally reduce their purchase frequency for replacements. This extended product life cycle means fewer sales opportunities for the company and the broader apparel market.

Consider the impact on sales: if a t-shirt, for example, lasts for five years instead of two, a consumer might only need to buy one-third as many over a given period. This directly affects the volume of goods sold. In 2024, the global apparel market experienced steady growth, but the underlying trend of consumers seeking value and longevity in their purchases means that brands must innovate to maintain demand.

This dynamic presents a challenge because it increases the perceived value of existing garments, making consumers less susceptible to frequent trend-driven purchases. The threat is amplified when considering the rise of sustainable fashion and the circular economy, which further encourage the reuse and repair of clothing.

- Reduced Purchase Frequency: Longer-lasting apparel means consumers buy new items less often.

- Value Perception: Consumers increasingly prioritize quality and durability, seeing it as better value.

- Sustainability Influence: Growing interest in sustainable practices encourages garment longevity and reuse.

- Market Impact: This trend can dampen overall sales volume in the apparel industry, even for quality-focused brands.

The rise of athleisure and casual wear directly substitutes for traditional innerwear and activewear as consumers prioritize comfort and versatility. This blurring of lines means stylish leggings or joggers can replace dedicated activewear, impacting sales for brands like Hanes. The global athleisure market was valued at over $320 billion in 2023 and is projected to grow significantly.

Entrants Threaten

The apparel manufacturing sector, particularly for established players like Hanesbrands with extensive owned production capabilities, demands a considerable upfront capital outlay. This investment covers advanced machinery, cutting-edge technology, and robust infrastructure, creating a formidable financial hurdle for newcomers.

New entrants face the challenge of achieving the economies of scale crucial for competitive pricing in the mass-market apparel segment. For instance, in 2024, the global apparel market was valued at approximately $1.7 trillion, with a significant portion driven by basic and mid-range items where cost efficiency is paramount. Newcomers must overcome the established cost advantages that larger, existing firms enjoy due to their production volume.

Hanesbrands possesses a powerful advantage through its portfolio of well-known brands, like Hanes and Champion, which have achieved significant household recognition and consumer trust over many years. This deep-seated loyalty is a formidable barrier.

For newcomers, replicating this level of brand equity is a massive undertaking, demanding substantial marketing expenditure and a considerable amount of time to cultivate similar consumer affinity. This makes it challenging for new entrants to quickly gain traction and capture meaningful market share against such established players.

Hanesbrands benefits from extensive distribution networks, including strong relationships with major mass retailers like Walmart and Target, and a significant e-commerce presence. For instance, in 2023, Hanesbrands reported that its direct-to-consumer channel, which includes its own websites and Amazon, accounted for a substantial portion of its sales, demonstrating its reach.

New entrants would struggle to replicate this broad accessibility, facing significant hurdles in securing prime shelf space in brick-and-mortar stores and building efficient, cost-effective supply chains to match Hanesbrands' established logistics. This makes market penetration a considerable challenge for any aspiring competitor.

Supply Chain Complexity and Expertise

The intricate global supply chain for apparel, spanning raw material sourcing, manufacturing, and distribution, presents a significant barrier to entry. Newcomers must develop sophisticated and agile supply chain operations, which can be a daunting task given the complexities of securing materials and managing logistics. For instance, in 2024, the apparel industry continued to grapple with disruptions, with lead times for certain raw materials extending by up to 15% compared to pre-pandemic levels, according to industry reports.

Building the necessary expertise and infrastructure to navigate these complexities is a substantial hurdle for potential new entrants. This includes establishing reliable sourcing networks, optimizing manufacturing processes, and ensuring efficient global distribution. Companies that have successfully managed these challenges for years, like Hanesbrands, have invested heavily in technology and relationships, creating a high bar for any aspiring competitor.

- Supply Chain Expertise: Managing a global apparel supply chain requires specialized knowledge in areas like textile sourcing, production management, and international logistics.

- Procurement Challenges: New entrants face difficulties in securing consistent access to quality raw materials and negotiating favorable terms with suppliers.

- Logistics Hurdles: Establishing efficient and cost-effective transportation, warehousing, and distribution networks across multiple countries is a significant undertaking.

- Investment Requirements: Significant capital investment is needed to build or acquire the necessary supply chain infrastructure and technology.

Regulatory and Sustainability Compliance

The apparel industry faces significant hurdles for new entrants due to stringent regulatory and evolving sustainability compliance requirements. Navigating complex labor laws, environmental standards, and international trade policies demands substantial upfront investment and expertise. For instance, the growing emphasis on supply chain transparency and ethical sourcing, highlighted by initiatives like the Fashion Revolution movement, requires new brands to invest in robust auditing and certification processes, adding to their initial cost burden.

Meeting increasing consumer and regulatory demands for sustainability is a major barrier. This includes adhering to standards for materials, manufacturing processes, and waste reduction. A 2024 report indicated that 73% of consumers consider sustainability when making purchasing decisions, pushing new companies to adopt eco-friendly practices from the outset. This often translates to higher production costs for organic materials or recycled fabrics, making it difficult for newcomers to compete on price with established players who may have amortized these investments over time.

- Regulatory Complexity: New entrants must comply with a patchwork of global and local regulations concerning labor rights, chemical usage, and import/export tariffs, which can be costly to understand and implement.

- Sustainability Investment: Achieving certifications for sustainable materials (e.g., GOTS, OCS) or ethical manufacturing (e.g., Fair Trade) requires significant financial commitment and operational changes.

- Consumer Demand for Ethics: The rising consumer awareness of environmental and social impact means new brands must demonstrate genuine commitment to sustainability, often necessitating investment in traceable supply chains and transparent reporting.

- Cost of Compliance: The combined costs of regulatory adherence and sustainable practices can create a substantial barrier to entry, potentially exceeding the capital available to many aspiring apparel businesses.

The threat of new entrants for Hanesbrands is moderate, largely due to the substantial capital required for manufacturing and brand building. Significant upfront investment in machinery, technology, and infrastructure creates a high financial barrier. Furthermore, achieving economies of scale is critical for competitive pricing in the mass market, a feat difficult for newcomers aiming to match the cost efficiencies of established giants.

Established brand loyalty and extensive distribution networks pose further challenges. Replicating the brand equity of names like Hanes and Champion requires immense marketing investment and time. Similarly, securing prime retail shelf space and building efficient supply chains to rival Hanesbrands' established logistics is a considerable hurdle for market penetration.

Navigating complex global supply chains and meeting stringent sustainability regulations also act as significant deterrents. New entrants must invest in expertise and infrastructure for sourcing, manufacturing, and distribution, while also adhering to evolving environmental and ethical standards, which can increase initial costs substantially.

Porter's Five Forces Analysis Data Sources

Our Hanes Porter's Five Forces analysis leverages a robust combination of data sources. These include Hanes' own annual reports and investor presentations, alongside industry-specific market research reports from firms like Euromonitor and Statista, to provide a comprehensive view of the competitive landscape.