Hanes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

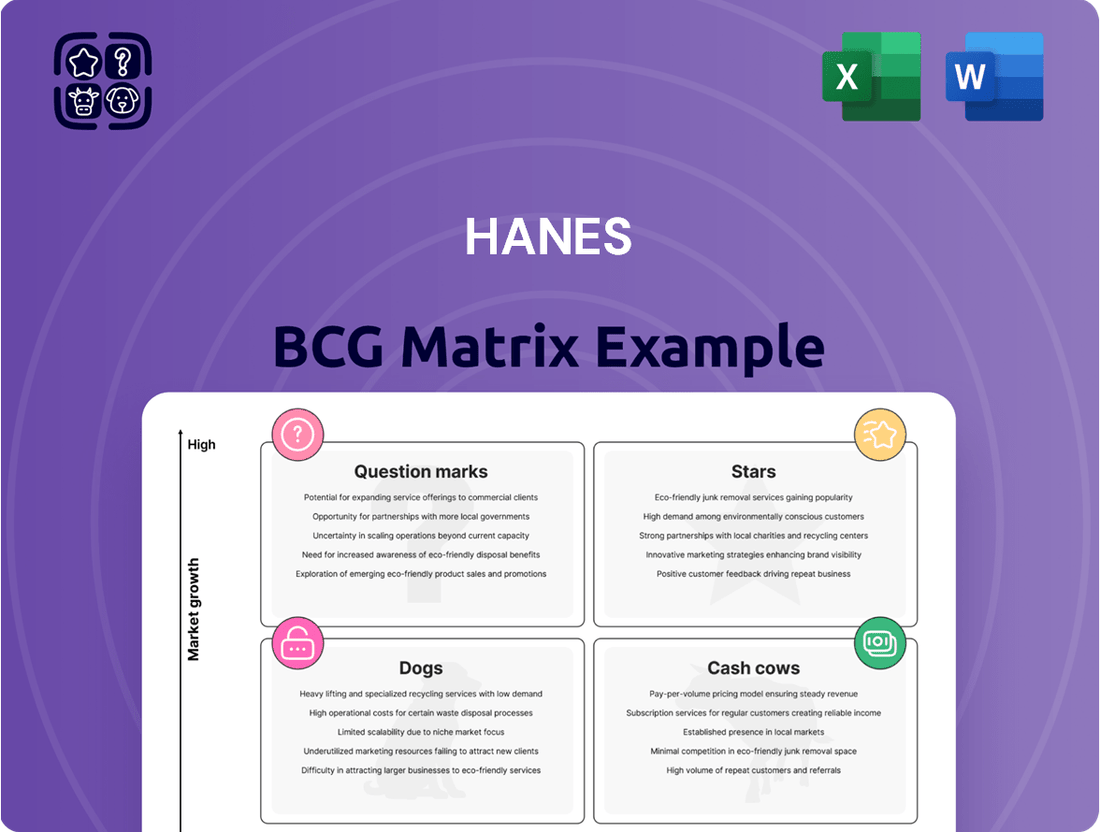

Curious about how Hanes strategically manages its diverse product portfolio? This glimpse into the BCG Matrix reveals their approach to Stars, Cash Cows, Dogs, and Question Marks. To truly understand Hanes' competitive landscape and unlock actionable insights for your own business, purchase the full BCG Matrix report for a complete quadrant-by-quadrant breakdown and strategic recommendations.

Stars

Hanes Innerwear, particularly its men's underwear segment, is a strong contender in the market. In 2024, Hanes held an estimated 30% of the US men's underwear market, a dominant position that significantly outpaces its rivals.

The company's commitment to its core innerwear brands, supported by enhanced marketing efforts and product development, has been instrumental in capturing market share, especially with younger demographics. This strategic push aligns with the innerwear market's overall growth trajectory.

The innerwear sector is seeing consistent expansion, fueled by growing fashion awareness, shifting lifestyle choices, and a greater demand for comfortable, practical undergarments. This presents a favorable, high-growth environment for Hanes' leading innerwear offerings.

Bonds stands out as a dominant force in the Australian innerwear market, having captured an impressive 23.9% market share by 2024. This leadership position is a direct result of sustained investment in brand development and e-commerce capabilities, coupled with impactful product innovations and consumer-focused marketing campaigns.

Maidenform's innovative lines, particularly the M by Maidenform collection, are performing exceptionally well. These lines have driven significant year-over-year sales increases, contributing to HanesBrands' expanding share in the innerwear market, especially with younger demographics.

HanesBrands has strategically increased marketing spend on these innovative Maidenform products, signaling a strong belief in their growth potential. This focus is helping to capture new market segments within the expanding innerwear industry.

Bali Breathe

Bali Breathe represents a significant innovation for the Bali brand, playing a key role in HanesBrands' robust US innerwear performance. This product's success has directly contributed to market share gains for the company.

HanesBrands' strategic focus on consumer-centricity and product innovation is clearly paying off, as evidenced by Bali Breathe's ability to drive point-of-sale trends that outpace the overall market. This approach is a core element of their strategy.

The innerwear market itself holds a positive outlook, providing a favorable environment for products like Bali Breathe. In 2024, the US innerwear market continued to show resilience, with specific segments experiencing growth driven by comfort and innovation.

- Bali Breathe's Impact: Contributed to stronger-than-expected US innerwear performance and market share gains for HanesBrands in 2024.

- Consumer-Centric Strategy: Drives point-of-sale trends that outperform the market, a testament to HanesBrands' innovation focus.

- Market Context: Benefits from the overall positive outlook of the innerwear category, which saw steady demand in 2024.

Hanes Originals

Hanes Originals represents a significant innovation for the Hanes brand, showing robust year-over-year sales increases. This product line is particularly effective at drawing younger demographics to Hanes' core innerwear products. In 2024, Hanes reported that its Originals line was a key driver of growth, contributing to a notable uptick in sales within the innerwear segment.

The strategy behind Hanes Originals centers on updated designs and marketing campaigns that resonate with contemporary consumer tastes. This approach is crucial in the expanding innerwear market, where fresh aesthetics are increasingly valued. For instance, Hanes' marketing efforts for Originals in 2024 specifically targeted Gen Z and younger millennials, a demographic showing increased spending in this category.

- Strong Sales Growth: Hanes Originals has experienced significant year-over-year sales increases, indicating strong market acceptance.

- Attracting Younger Consumers: The line has been instrumental in bringing younger customers into the Hanes innerwear fold.

- Market Share Expansion: Hanes Originals is positioned as a high-growth product, actively gaining market share in the innerwear sector.

- Focus on Design and Marketing: The success is attributed to fresh designs and marketing that align with evolving consumer preferences.

Stars in the Hanes BCG Matrix represent products or brands with high market share in a high-growth industry. These are the company's top performers, driving significant revenue and showing strong potential for future expansion. Hanes' innerwear segment, particularly its men's underwear, exemplifies this category, holding a substantial 30% of the US market in 2024.

The success of Stars like Hanes Originals and Bali Breathe is fueled by strategic investments in product innovation and marketing that resonate with younger demographics. These brands are not only achieving strong year-over-year sales growth but are also actively capturing new market segments within the expanding innerwear sector.

The innerwear market itself is a high-growth area, with increasing consumer demand for comfort and style contributing to its positive outlook. This favorable market environment allows Hanes' Star products to continue outperforming and solidifying their dominant positions.

| Brand/Product | Market Share (2024 Estimate) | Growth Driver | Key Strategy |

|---|---|---|---|

| Hanes Men's Underwear | 30% (US Market) | Dominant market position, younger demographic appeal | Enhanced marketing, product development |

| Hanes Originals | N/A (Specific share not disclosed) | Strong year-over-year sales increases, youth engagement | Updated designs, targeted marketing (Gen Z, millennials) |

| Bali Breathe | N/A (Specific share not disclosed) | Outperforming market point-of-sale trends | Consumer-centricity, product innovation |

What is included in the product

The Hanes BCG Matrix categorizes products by market share and growth, guiding strategic decisions for each quadrant.

Hanes BCG Matrix provides a clear visual of brand performance, easing the pain of resource allocation decisions.

Cash Cows

The core Hanes Innerwear business in the US stands as a robust cash cow, commanding a significant market share within its category. This segment consistently generates substantial revenue, underscoring its importance to Hanes' overall financial health.

Despite a generally soft market for apparel, Hanes has successfully defended its leading position in innerwear. The enduring nature of these products as replenishment items ensures a steady stream of sales, contributing to predictable income.

Hanes is actively prioritizing the profitability of this mature business. By focusing on operational efficiencies and margin improvement, the company aims to maximize the cash flow generated from this established segment.

Playtex, a cornerstone of HanesBrands' innerwear division, benefits from its established reputation in a mature market. This brand consistently generates reliable cash flow with minimal need for aggressive marketing due to its strong brand equity and existing customer base.

Certain hosiery lines, especially those with a long-standing presence and stable demand, likely operate as cash cows for HanesBrands. Despite divesting its US sheer hosiery business, core hosiery products with a solid market share continue to provide consistent revenue in a mature segment. These established products generally need minimal marketing expenditure compared to newer, high-growth offerings.

Bonds Core Products (Australia)

The established core Bonds product range in Australia functions as a dependable cash cow within Hanes' portfolio. Bonds holds the leading market share in the Australian innerwear sector, a testament to its strong position in a mature market.

This consistent performance, bolstered by enduring consumer loyalty, translates into predictable and stable cash generation for the company. In 2023, the Australian apparel market, which includes innerwear, saw steady demand, with Bonds' core products continuing to be a significant contributor.

- Market Leadership: Bonds is the undisputed market leader in Australian innerwear.

- Mature Market Dominance: Its position is secured in a well-established, mature market.

- Stable Cash Flow: Consistent sales and brand loyalty ensure reliable cash generation.

- 2023 Performance: The core range contributed significantly to Hanes' Australian revenue in 2023, reflecting sustained demand.

Basic Activewear (Pre-Champion Divestiture)

Before HanesBrands divested its Champion brand, the more fundamental activewear offerings likely represented cash cows within its portfolio. These established product lines held a significant share in a mature segment of the activewear market, generating steady and predictable income for the company. For instance, in 2023, HanesBrands reported net sales of $6.59 billion, with a substantial portion attributed to its activewear and athletic apparel segments prior to the Champion sale.

These basic activewear lines benefited from high market penetration and consistent demand, even if growth was not explosive. This stability allowed them to generate more cash than was needed for reinvestment, a hallmark of a cash cow. The strategic decision to divest Champion in late 2023, valued at $1.2 billion, signals Hanes' pivot towards other growth areas, effectively changing the role of its remaining basic activewear.

- Market Share: High in a mature, stable activewear segment.

- Revenue Generation: Provided consistent, predictable cash flow.

- Strategic Shift: Divestiture of Champion indicates a move away from this segment's prior importance.

Hanes' US Innerwear segment is a prime example of a cash cow, consistently generating substantial revenue and holding a significant market share in a mature category. This business unit is crucial for Hanes' financial stability, providing predictable income through the sale of essential replenishment items.

The company is actively focusing on optimizing the profitability of this mature business. By enhancing operational efficiencies and improving margins, Hanes aims to maximize the cash flow derived from its established innerwear offerings.

Playtex, a key brand within Hanes' innerwear division, exemplifies a cash cow due to its strong brand equity and loyal customer base in a mature market. This brand generates reliable cash flow with minimal marketing investment, contributing significantly to Hanes' overall financial performance.

While Hanes divested its US sheer hosiery business, certain core hosiery lines with a solid market share and consistent demand continue to function as cash cows. These established products provide steady revenue in a mature segment, requiring less marketing expenditure compared to newer, high-growth products.

| Brand/Segment | Market Position | Cash Flow Contribution | Key Characteristics | 2023 Data Point |

| US Innerwear | Market Leader | High, Stable | Mature market, replenishment items | Significant revenue contributor |

| Playtex (Innerwear) | Strong Brand Equity | Reliable | Mature market, low marketing spend | Consistent cash generation |

| Core Hosiery Lines | Solid Market Share | Steady | Mature segment, consistent demand | Predictable revenue stream |

What You See Is What You Get

Hanes BCG Matrix

The Hanes BCG Matrix preview you're seeing is the identical, fully functional document you'll receive immediately after purchase. This means you're getting the complete strategic analysis, ready for immediate application without any watermarks or demo limitations. Once bought, this expertly structured report will be yours to edit, present, and leverage for informed decision-making. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll obtain for your business strategy.

Dogs

HanesBrands divested its global Champion business in 2024, moving it to discontinued operations. This strategic move reflects Champion's recent struggles, including a significant 26% drop in global sales during the first quarter of 2024.

The sale of Champion, a brand previously considered a core part of HanesBrands, underscores the company's effort to streamline its portfolio and focus on more profitable segments. Champion's divestiture was driven by its performance as a drag on earnings and the challenging market conditions it faced, characterized by soft consumer demand.

HanesBrands' decision to divest its US sheer hosiery business in 2021 for $375 million clearly positions it as a 'dog' within the BCG framework. This segment likely held a low market share in a mature or declining market, as indicated by the company's strategic move to simplify operations and enhance profitability.

Certain segments of Hanes' international activewear business, especially those in Europe and Australia, are showing signs of being dogs. For instance, Champion's international sales experienced a decline in these regions, indicating a low market share and shrinking revenue streams within those specific markets.

While the global activewear market continues its upward trajectory, Hanes' underperforming lines or regional operations within this sector, characterized by low market share and declining sales, squarely place them in the dog category of the BCG matrix. This suggests a need for strategic re-evaluation or divestment to reallocate resources effectively.

Outdated Product Lines (Innerwear)

Within HanesBrands' extensive innerwear offerings, certain product lines may be classified as Dogs in the BCG matrix if they exhibit a lack of recent innovation. These could be items that are not adapting to changing consumer tastes or are experiencing a decline in their market share. For instance, if a particular segment of their traditional cotton basics hasn't been updated with new fabric technologies or designs, it might fall into this category.

HanesBrands' strategic emphasis on new product development signals an intent to phase out or revitalize underperforming segments. This proactive approach suggests that any innerwear lines failing to gain traction or showing signs of obsolescence, perhaps due to increased competition from more agile brands or shifts in fashion trends, would be candidates for this classification. For example, a product line that hasn't seen a marketing push or product refresh in several years could be considered a Dog.

- Declining Market Share: Product lines that are consistently losing ground to competitors or newer offerings.

- Lack of Innovation: Innerwear categories that haven't been updated with new materials, features, or styles to meet current consumer demands.

- Stagnant Sales: Offerings that show minimal or no growth in revenue, indicating a lack of consumer interest or market relevance.

Non-Core Brands (Pre-Divestiture Focus)

Before HanesBrands strategically narrowed its focus to key innerwear brands and subsequently divested Champion, its portfolio likely included non-core, smaller brands. These brands, characterized by low market share and limited growth potential, represented areas where the company's resources might have been better allocated.

HanesBrands' strategic pivot aimed at portfolio streamlining, which naturally involves divesting assets that no longer align with core objectives. This approach is typical for companies seeking to enhance operational efficiency and concentrate on high-performing segments.

- Non-Core Brands: HanesBrands previously managed a diverse brand portfolio, including those with less significant market penetration and growth trajectories.

- Divestiture Rationale: The decision to divest Champion and other non-core assets was driven by a strategy to concentrate on core innerwear businesses, aiming for improved profitability and market focus.

- Portfolio Optimization: This strategic divestment aligns with a broader trend in the apparel industry where companies are shedding underperforming or non-strategic brands to optimize resources and enhance shareholder value.

Dogs in the BCG matrix represent business units or products with low market share in a low-growth industry. HanesBrands has identified and acted upon several segments fitting this description. The divestiture of Champion in 2024, following a 26% global sales drop in Q1 2024, exemplifies this, as does the 2021 sale of its US sheer hosiery business for $375 million.

These "dog" segments, including certain international activewear operations and potentially uninnovative innerwear lines, are characterized by declining sales and a lack of competitive advantage. HanesBrands' strategy involves either revitalizing these areas through innovation or divesting them to focus resources on more promising ventures.

The company's portfolio optimization, including shedding non-core brands, aims to enhance efficiency and profitability. This strategic pruning is crucial for concentrating on core innerwear brands and improving overall market focus and shareholder value.

| Segment | BCG Classification | Reasoning | Key Data Point |

|---|---|---|---|

| US Sheer Hosiery Business | Dog | Divested in 2021 for $375 million, indicating low market share and growth potential. | $375 million divestiture value |

| Champion (Global) | Dog (prior to divestiture) | Significant sales decline (26% in Q1 2024) and subsequent divestiture in 2024. | 26% Q1 2024 sales drop |

| Certain International Activewear | Dog | Declining sales in regions like Europe and Australia suggest low market share. | Declining international sales |

| Uninnovative Innerwear Lines | Potential Dog | Lack of new materials, features, or styles leading to declining market share. | Lack of recent product innovation |

Question Marks

HanesBrands is actively innovating in its innerwear segment, with new offerings like Hanes Absolute Socks and Hanes Moves. These products are entering a market with strong growth potential, but their current market share is still in its nascent stages, positioning them as question marks in the BCG matrix.

The innerwear market itself is robust, with global sales projected to reach over $60 billion by 2027, indicating a fertile ground for these new Hanes products. However, their success hinges on significant investment and achieving strong market adoption to transition from question marks to stars.

HanesBrands is actively investing in its digital and e-commerce infrastructure to better reach and engage consumers. This strategic pivot aims to capture growth in the rapidly expanding online retail sector, a key area for future sales.

While the e-commerce market itself is a significant growth engine, HanesBrands' current market share within this channel for its individual brands may still be developing. This suggests that substantial investment is needed to build a stronger presence and compete effectively in the digital space.

For instance, in 2024, HanesBrands reported that its direct-to-consumer (DTC) channel, which heavily relies on e-commerce, saw continued growth, contributing a notable portion to overall sales. However, specific market share figures for individual brands within the broader digital landscape are often proprietary, but the company's stated focus indicates a strategic effort to increase this share.

HanesBrands is making deliberate efforts to capture the attention of younger consumers, a demographic crucial for future growth. This includes significant investments in brand marketing and the introduction of innovative products designed to resonate with this audience.

While this younger segment offers substantial growth potential, HanesBrands faces the ongoing challenge of securing meaningful market share. This necessitates continuous, strategic marketing campaigns and agile product development to keep pace with evolving consumer preferences.

Sustainability-Focused Product Lines

HanesBrands is actively pursuing sustainability, aiming to incorporate recycled and degradable polyester, alongside sustainably grown cotton into its product lines. This aligns with a broader market trend toward eco-conscious apparel, a sector experiencing robust growth.

While the sustainable apparel market is expanding, HanesBrands' current market share within this specific niche is likely still in its formative stages. Capturing greater share will necessitate continued investment in sourcing eco-friendly materials and targeted marketing efforts to resonate with environmentally aware consumers.

- Market Growth: The global sustainable apparel market was valued at approximately $7.4 billion in 2023 and is projected to reach $15.8 billion by 2030, growing at a CAGR of 11.5%.

- HanesBrands' Commitment: HanesBrands has set goals to use 100% sustainably sourced cotton by 2030 and to increase its use of recycled polyester.

- Investment Needs: Expanding sustainable product lines requires ongoing investment in research and development for new materials and supply chain adjustments.

- Consumer Demand: A 2024 survey indicated that over 60% of consumers consider sustainability when making apparel purchases.

International Market Expansion (Specific Regions)

HanesBrands' international market strategy shows a mixed picture, with notable growth in the Americas and Asia. For instance, in 2024, the company continued to focus on expanding its presence in key Asian markets, leveraging digital channels and localized product offerings. This strategic push aims to capture a larger share of these rapidly developing economies.

Conversely, some European markets have presented challenges, with HanesBrands experiencing declines in certain segments. The company’s approach involves re-evaluating its brand portfolio and operational efficiency in these regions. Efforts are underway to adapt to local consumer preferences and competitive landscapes.

Emerging international markets represent HanesBrands' question marks. These are areas where the company is actively investing to build brand recognition and distribution networks, but market share is not yet substantial. Examples include certain countries in Southeast Asia and Latin America, where significant potential exists but requires sustained capital allocation and strategic marketing to cultivate.

- Americas & Asia Growth: HanesBrands has identified these regions as key growth drivers, with ongoing investments in 2024 to capitalize on expanding consumer bases.

- European Market Challenges: Declines in certain European territories necessitate strategic adjustments, including product assortment and marketing strategies, to improve performance.

- Emerging Market Focus: Specific countries in Asia and Latin America are targeted for expansion, representing significant question marks requiring substantial investment to establish a strong market foothold.

- Investment for Market Share: The strategy for these question mark markets involves dedicated capital for brand building, distribution enhancement, and tailored consumer engagement to drive future revenue streams.

Question marks in the HanesBCG Matrix represent products or business units with low market share in high-growth industries. For HanesBrands, this often applies to newer product lines or ventures into emerging markets where significant investment is needed to gain traction.

These question marks require careful consideration, as they have the potential to become stars with the right strategic direction and capital infusion. However, they also carry the risk of becoming dogs if market conditions or competitive pressures prevent them from growing their share.

HanesBrands' focus on innovation in areas like sustainable apparel and expanding into new international territories highlights its active management of these question marks. The success of these initiatives will determine their future position within the BCG framework.

The company's commitment to investing in digital channels and targeting younger demographics also places these efforts in the question mark category, demanding sustained effort to build market presence.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and consumer behavior trends, to accurately position business units.