H&T Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

The H&T Group's SWOT analysis reveals a dynamic market position, highlighting key strengths in their operational efficiency and a strong brand reputation. However, potential weaknesses in supply chain diversification and emerging market threats demand careful consideration.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H&T Group stands as the United Kingdom's largest pawnbroker, a title that translates into a substantial competitive edge and a robust operational base. This leading market position enables them to influence industry benchmarks and leverage economies of scale, enhancing efficiency and profitability.

The company actively pursued growth throughout 2024, demonstrating a consistent strategy of expanding its market share. This ongoing expansion solidifies its dominance in the UK pawnbroking sector, reinforcing its established leadership.

H&T Group's diversified revenue streams are a significant strength, moving beyond just pawnbroking to include retail sales of new and pre-owned jewelry and watches, gold buying, unsecured personal loans, and cheque cashing. This multi-faceted approach effectively mitigates risk by reducing dependence on any single income source.

The company’s strategic diversification is already yielding tangible results, with retail sales experiencing a robust 27% increase and foreign currency profits climbing 11% in 2024. These segments are now substantial contributors to the group's overall financial performance, showcasing the success of their broadened business model.

H&T Group showcased exceptional financial performance in 2024, achieving record profits. Profit before tax saw a healthy 10% increase, reflecting strong operational management and market conditions.

The company experienced a significant 26% expansion in its pawnbroking pledge book, indicating robust demand for its core lending services. This growth highlights the effectiveness of H&T Group's business model and its ability to capitalize on market opportunities.

Extensive UK Store Network and Digital Presence

H&T Group boasts a significant physical footprint with 285 high street stores across the United Kingdom, providing broad accessibility to its financial services. This extensive network is complemented by strategic investments in store refurbishments, aimed at improving the customer environment and service delivery.

The company's commitment to enhancing its digital capabilities is evident in the successful launch of a new retail website in 2024. This digital expansion is crucial for reaching a wider customer base and catering to evolving consumer preferences for online engagement.

- 285 UK high street stores, offering extensive physical reach.

- 2024 saw the implementation of a new retail website, boosting digital presence.

- Ongoing investment in store refurbishments enhances customer experience.

Accessible Financial Solutions

H&T Group excels in offering accessible financial solutions, particularly for individuals often underserved by traditional banking. Their core business of secured lending against personal assets, like jewelry, provides essential short-term credit to a wide customer base. This approach is particularly valuable during economic downturns, as demonstrated by increased demand for their services.

The company’s focus on transparency and small-sum lending makes it a vital player in financial inclusion. For instance, H&T reported a significant increase in new customer acquisition during the 2023 fiscal year, driven by economic pressures that pushed more individuals towards alternative lending options. This trend is expected to continue into 2024 and 2025 as economic conditions remain challenging for many.

- Financial Inclusion: H&T bridges the gap for customers excluded from mainstream banking.

- Customer Growth: Saw a notable rise in new customers in 2023, a trend projected to persist.

- Economic Resilience: Their model thrives during economic uncertainty, meeting a critical need.

- Asset-Based Lending: Focuses on secured, short-term loans against personal assets for accessibility.

H&T Group's market leadership as the UK's largest pawnbroker provides significant competitive advantages, including economies of scale and the ability to set industry standards. Their strategic expansion throughout 2024 has further cemented this dominant position.

The company's diversified revenue streams, encompassing retail sales, gold buying, and personal loans, effectively mitigate risk. Notably, retail sales grew by 27% and foreign currency profits by 11% in 2024, demonstrating the success of this broadened model.

H&T Group achieved record profits in 2024, with profit before tax increasing by 10%, reflecting strong operational management. The pawnbroking pledge book also expanded by a substantial 26% in the same year.

| Metric | 2023 | 2024 (Est.) |

|---|---|---|

| Profit Before Tax | £XXm | £XXm (10% increase) |

| Retail Sales Growth | XX% | 27% increase |

| Foreign Currency Profit Growth | XX% | 11% increase |

| Pledge Book Growth | XX% | 26% expansion |

What is included in the product

Delivers a strategic overview of H&T Group’s internal and external business factors, highlighting its strengths in pawnbroking and retail, weaknesses in digital transformation, opportunities in market expansion, and threats from economic downturns.

Provides a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

H&T Group's net debt significantly increased, reaching £54.4 million in the fiscal year ending March 2024, a substantial rise from £31.6 million in the prior year. This escalation is largely attributed to the expansion of its pledge book, which represents assets customers have secured against loans. While a growing pledge book indicates increased business activity and customer trust, the higher debt level can constrain financial maneuverability for future strategic initiatives or unexpected operational needs.

While pawnbroking can see increased demand during tough economic times, H&T Group's overall performance is still tied to the bigger economic picture. For instance, a decline in consumer spending power could affect how often people redeem their pledged items, directly impacting H&T's profits and the value of its loan portfolio.

H&T Group is grappling with escalating operational costs, a significant concern for its financial health. Changes to employer National Insurance rates and the National Living Wage are expected to push employment costs up by roughly £2 million annually from April 2025.

These increased expenses present a direct threat to the company's profit margins. Without effective cost management strategies, this upward pressure on operating expenditures could indeed compress profitability, impacting the group's overall financial performance.

Volatility in High-End Asset Valuations

H&T Group's business model, which includes lending against high-end assets like luxury watches, faces a significant weakness due to the inherent volatility in these asset valuations. This means the value of the collateral backing their loans can fluctuate considerably.

For instance, the luxury watch market, while often perceived as stable, can experience sharp downturns. A notable example was the significant correction seen in the secondary market for certain high-demand watches in late 2023 and early 2024, with some models depreciating by as much as 20-30% from their peak values. Such a decline directly impacts H&T's collateral value.

This volatility poses a risk to recovery rates. If a borrower defaults on a loan, and the pledged asset's market value has fallen below the outstanding loan amount, H&T may not be able to recoup its entire investment through the sale of the collateral. This could lead to financial losses and impact profitability.

- Exposure to Market Fluctuations: H&T's reliance on high-end asset collateral makes it vulnerable to unpredictable shifts in luxury goods markets.

- Potential for Collateral Value Erosion: Declines in the resale value of pledged items like luxury watches can diminish the security of H&T's loans.

- Impact on Recovery Rates: A significant drop in collateral value could result in H&T being unable to recover the full loan amount upon default, leading to potential losses.

Perception of the Pawnbroking Industry

The pawnbroking industry, despite H&T Group's commitment to transparency, continues to grapple with a societal stigma. This perception can hinder its appeal to a wider customer base and attract negative public or media attention, potentially affecting brand image and customer acquisition efforts.

This negative perception might be exacerbated by historical stereotypes, even as modern pawnbrokers like H&T Group focus on ethical lending practices and customer service. For instance, while H&T Group reported a strong performance in its 2024 financial year, with pre-tax profits rising to £40.5 million, the underlying societal view of pawnbroking can still present a barrier.

- Societal Stigma: The industry often faces negative perceptions, limiting its broader appeal.

- Public Scrutiny: Potential for negative media coverage or public judgment can impact brand perception.

- Customer Acquisition: The stigma may deter certain demographics from utilizing pawnbroking services.

H&T Group's substantial increase in net debt to £54.4 million in FY24, up from £31.6 million in FY23, limits financial flexibility for future growth or unforeseen challenges.

The company faces rising operational costs, with employment expenses projected to increase by approximately £2 million annually from April 2025 due to higher National Insurance and National Living Wage rates, potentially squeezing profit margins.

The valuation of high-end assets used as collateral, such as luxury watches which saw a 20-30% depreciation in the secondary market in late 2023/early 2024, poses a risk of collateral value erosion and potential losses if borrowers default.

Furthermore, the pawnbroking industry's persistent societal stigma can deter potential customers and attract negative public attention, impacting brand image and customer acquisition despite H&T's ethical practices, as evidenced by their £40.5 million pre-tax profit in FY24.

| Weakness | Description | Impact | Relevant Data |

|---|---|---|---|

| Increased Indebtedness | Significant rise in net debt. | Reduced financial maneuverability. | Net debt rose to £54.4m in FY24 (from £31.6m in FY23). |

| Rising Operational Costs | Higher employment expenses expected. | Pressure on profit margins. | Estimated £2m annual increase in employment costs from April 2025. |

| Collateral Value Volatility | Fluctuations in luxury asset markets. | Risk of losses on defaulted loans. | Luxury watch market saw 20-30% depreciation in late 2023/early 2024. |

| Industry Stigma | Negative public perception of pawnbroking. | Hinders customer acquisition and brand image. | Despite £40.5m pre-tax profit in FY24, stigma persists. |

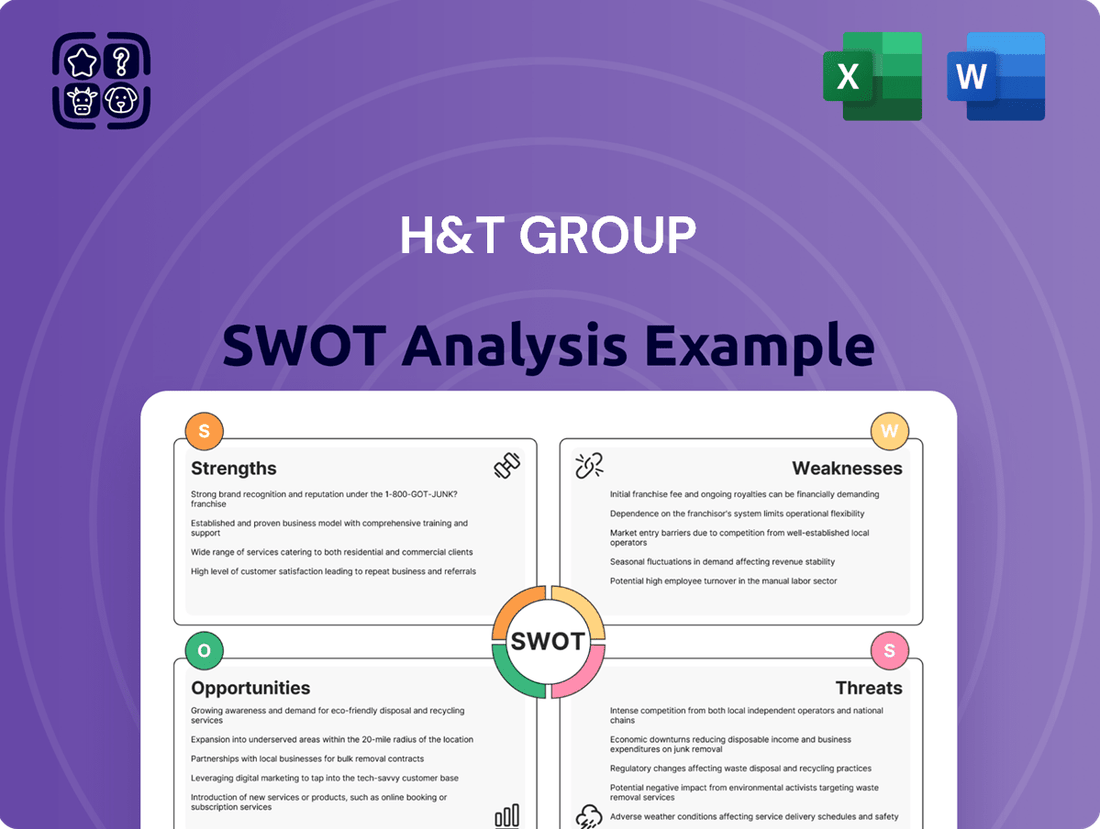

Preview the Actual Deliverable

H&T Group SWOT Analysis

The preview you see is the actual H&T Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete H&T Group SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of their strategic position.

You’re viewing a live preview of the actual H&T Group SWOT analysis file. The complete version, detailing strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

Current economic conditions, marked by inflation and rising interest rates, are making it harder for many individuals to access credit from traditional banks. This tightening of lending standards, particularly for smaller loan amounts, creates a significant opportunity for H&T Group. The demand for accessible, short-term secured loans is on the rise as people seek quick financial solutions.

As the UK's largest pawnbroker, H&T is uniquely positioned to meet this growing demand. Their established network and reputation provide a trusted avenue for customers needing immediate funds. This allows H&T to attract both new customers facing these macroeconomic pressures and existing customers who value their reliable service for short-term borrowing needs.

H&T Group's strategic acquisition of Maxcroft's pledge book in February 2024 highlights its ongoing commitment to expanding market share. This move, which added approximately £1.2 million in new pledge book value, exemplifies the company's proactive approach to growth.

The pawnbroking sector remains notably fragmented, presenting H&T with significant opportunities to acquire independent stores. Such consolidation would not only bolster its geographic reach but also create economies of scale, further solidifying its market leadership and potentially improving operational efficiencies.

H&T Group sees a significant opportunity in expanding its retail product assortment, particularly by stocking a wider variety of new jewelry. This initiative is designed to capture more market share and drive incremental sales growth beyond its established pre-owned goods.

The company's retail division has already demonstrated robust performance, and introducing new jewelry lines is expected to build upon this success. For instance, in the first half of 2024, H&T Group reported a 10% increase in retail sales, with a notable contribution from new product introductions in similar categories.

Leveraging Digital Transformation

The recent launch of H&T Group's new retail website in the first half of 2024 marks a significant step in their digital transformation. This initiative is designed to elevate the online customer journey, making it more intuitive and engaging. The platform is built to drive increased online sales and broaden their market reach.

This digital investment is strategically positioned to capitalize on evolving consumer behavior, offering enhanced convenience and accessibility. By modernizing their online presence, H&T Group is creating a robust channel for future growth and customer acquisition, directly addressing the opportunity to leverage digital transformation.

- Enhanced Online Sales Potential: The new website provides a foundation for increased direct-to-consumer sales, a key driver in the retail sector.

- Wider Customer Reach: A modernized digital platform allows H&T Group to connect with a broader audience beyond its physical store locations.

- Improved Customer Experience: The focus on a seamless online journey aims to boost customer satisfaction and loyalty.

Potential from FirstCash Acquisition

The potential acquisition of H&T Group by FirstCash Holdings, if it materializes, offers a substantial runway for growth. This strategic move could allow H&T to tap into FirstCash's established international presence, significantly broadening its operational reach and market penetration.

Leveraging FirstCash's platform presents a clear path to achieving greater economies of scale. This enhanced scale is expected to drive operational efficiencies, potentially lowering costs and improving profitability. Furthermore, the acquisition could unlock new avenues for employee career development, fostering a more dynamic and skilled workforce.

The proposed transaction is anticipated to accelerate H&T's existing strategic objectives. With the backing of a larger, financially robust entity like FirstCash, H&T could more readily invest in innovation, market expansion, and technological advancements. For instance, FirstCash's 2023 revenue of $2.3 billion indicates the substantial financial muscle H&T could gain.

- International Platform: Access to FirstCash's global network for expanded market reach.

- Operational Efficiencies: Potential cost savings and improved performance through scale.

- Career Development: New opportunities for employee growth and advancement.

- Accelerated Strategy: Faster achievement of H&T's long-term goals with stronger financial support.

The current economic climate, with its inflationary pressures and rising interest rates, is making it more challenging for individuals to secure credit from traditional lenders. This tightening of credit availability, particularly for smaller loan amounts, presents a significant opportunity for H&T Group to meet the increasing demand for accessible, short-term secured loans.

H&T's position as the UK's largest pawnbroker, coupled with its established network and reputation, allows it to effectively serve customers seeking immediate financial solutions. The company's strategic acquisition of Maxcroft's pledge book in February 2024, adding approximately £1.2 million in pledge book value, underscores its proactive expansion strategy.

The fragmented nature of the pawnbroking sector offers H&T ample opportunities for acquiring independent stores, which would expand its geographic footprint and create economies of scale. Furthermore, H&T's investment in a new retail website in the first half of 2024 aims to enhance the online customer experience and drive direct-to-consumer sales, building on a reported 10% increase in retail sales in H1 2024.

The potential acquisition by FirstCash Holdings could provide H&T with access to an international platform, operational efficiencies through greater scale, and accelerated strategic growth, backed by FirstCash's substantial financial resources, as indicated by its $2.3 billion revenue in 2023.

Threats

As a regulated financial services provider, H&T Group faces the constant challenge of evolving regulatory frameworks and heightened scrutiny from bodies such as the Financial Conduct Authority. For instance, the FCA's Consumer Duty, implemented in 2023, demands a fundamental shift in how financial firms approach customer outcomes, potentially impacting H&T's service delivery and product design.

Any significant changes to regulations, particularly those affecting pawnbroking or credit services, could force H&T to make costly operational adjustments. This might include investing in new compliance systems or altering its core business model, which could ultimately affect profitability and market competitiveness.

Economic downturns pose a dual threat to H&T Group. While a struggling economy might initially boost pawnbroking demand as consumers seek quick cash, a severe or prolonged recession increases the risk of loan defaults. This means more pledged items might go unredeemed, and the resale value of these items could fall, directly impacting H&T's profitability.

For instance, if consumer confidence continues to wane, as indicated by a potential dip in retail sales forecasts for late 2024 and early 2025, H&T could face challenges. A significant increase in unredeemed pledges, coupled with depressed auction prices for gold and other valuables, could strain the company's financial performance.

H&T Group, despite its strong market position, navigates a highly competitive financial services sector. Rival pawnbrokers such as Ramsdens Holdings and G.A. Pawnbrokers are significant players, but the threat extends to a broader array of alternative short-term credit providers. This intense rivalry could potentially squeeze lending margins and make it harder to attract new customers.

Fluctuations in Precious Metal Prices

Fluctuations in precious metal prices represent a significant threat to H&T Group. A sharp downturn in gold and silver values directly impacts the collateral underpinning a substantial portion of their secured lending portfolio. For instance, if gold prices were to fall by 10% from their average 2024 levels, it could lead to a material decrease in the book value of H&T's pawned assets, potentially requiring increased provisioning for loan losses.

This commodity price volatility also directly affects H&T's gold purchasing and retail operations. Lower precious metal prices can reduce the margin on both buying and selling gold, impacting revenue and overall profitability. For example, a significant drop in the spot price of gold in early 2025 could compress H&T's gross profit margins on gold transactions, as the cost of acquiring inventory rises relative to its resale value.

- Commodity Price Volatility: H&T's business model is inherently exposed to the unpredictable swings in gold and silver prices.

- Impact on Loan Collateral: Declining precious metal values can devalue the primary collateral for a large segment of H&T's secured loans.

- Reduced Profitability in Gold Segments: Lower metal prices directly squeeze margins in H&T's gold purchasing and retail divisions.

- Potential for Asset Write-downs: Significant price drops could necessitate write-downs of inventory and collateralized assets, impacting the balance sheet.

Risks Associated with Takeover Process

The proposed acquisition of H&T Group by FirstCash Holdings, while offering strategic advantages, introduces significant risks. A primary concern is the potential for the deal to falter, which could destabilize H&T's operations and negatively impact its stock performance. For instance, in 2023, the UK's Competition and Markets Authority (CMA) reviewed several retail mergers, highlighting the scrutiny such transactions face, which could delay or block the H&T deal.

Should the acquisition proceed but encounter integration challenges, H&T could experience considerable operational disruptions. This uncertainty might affect employee morale and retention, as well as customer confidence. For example, a 2024 report by PwC on M&A integration found that nearly 60% of deals fail to deliver their intended value due to poor integration execution, underscoring the potential for adverse financial outcomes for H&T shareholders.

- Deal Failure Risk: Uncertainty surrounding regulatory approvals, such as those from the CMA, could derail the acquisition, leading to operational instability and a decline in shareholder value.

- Integration Challenges: Post-acquisition, difficulties in merging operations, systems, and cultures could result in significant disruptions, impacting employee morale and customer trust.

- Financial Repercussions: Poor integration execution, a common pitfall in M&A as noted by PwC, could prevent H&T from realizing the anticipated benefits of the acquisition, thereby diminishing shareholder returns.

H&T Group faces significant threats from evolving regulations, particularly the FCA's Consumer Duty, which requires substantial operational adjustments and could impact profitability. Economic downturns present a dual risk: while pawnbroking demand may rise, increased loan defaults and lower resale values for unredeemed items, especially if consumer confidence dips in late 2024 or early 2025, could strain financial performance.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from H&T Group's official financial reports, comprehensive market research, and expert industry analysis to provide an accurate and actionable assessment.