H&T Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

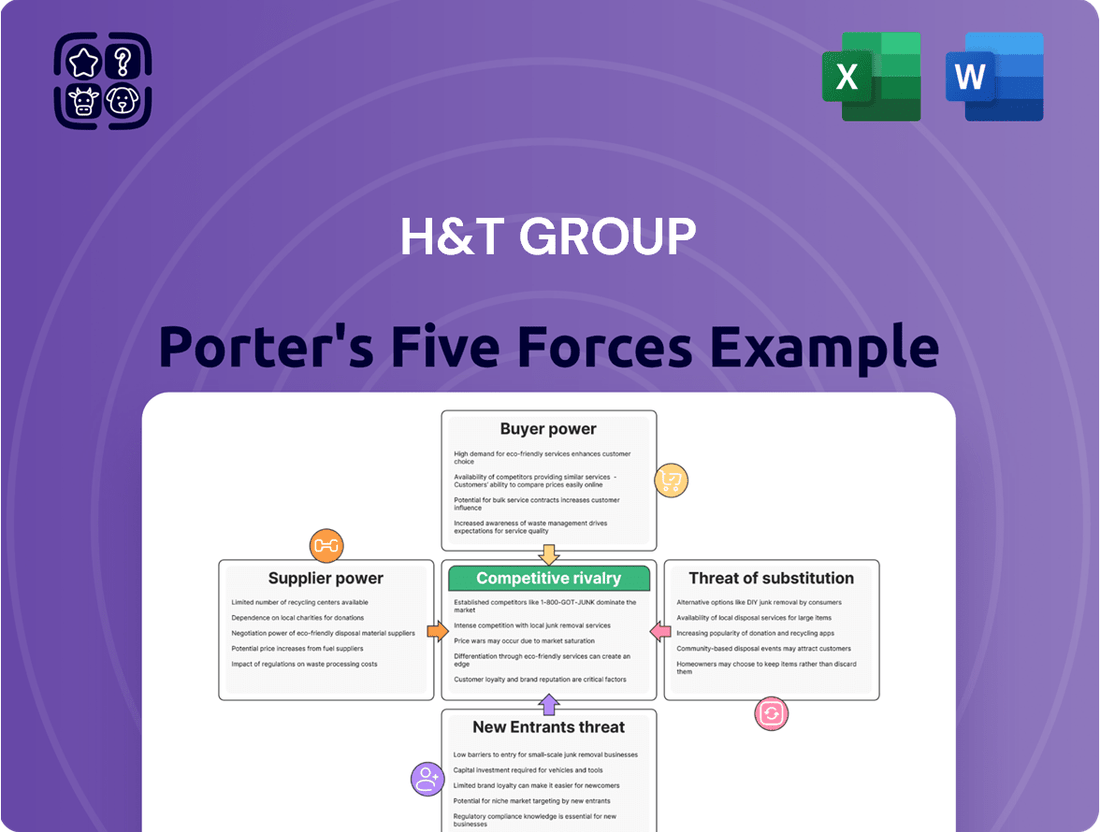

Our Porter's Five Forces analysis for H&T Group highlights the intense competition and the significant bargaining power of buyers within its market. Understanding these dynamics is crucial for navigating the industry landscape effectively.

The complete report reveals the real forces shaping H&T Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

H&T Group's primary 'suppliers' in pawnbroking are individual customers offering personal assets, primarily gold and jewelry. These individuals generally possess limited bargaining power as they often require immediate cash and their assets are illiquid for quick sales. For example, in 2023, H&T Group's pawnbroking income, which is directly linked to the value of assets pledged, remained a significant contributor to their revenue.

H&T Group's reliance on wholesale jewelry and watch suppliers for its retail operations means supplier power is a key consideration. The company sources both new and pre-owned items, suggesting a diverse supply chain. For instance, in 2024, the global jewelry market was valued at approximately $290 billion, with the pre-owned segment showing significant growth, indicating a broad base of potential suppliers for H&T to engage with.

While a diversified supplier base generally mitigates individual supplier power, the nature of specialized or high-value pre-owned watches can create pockets of stronger supplier leverage. The competitive landscape of the broader jewelry and watch market, however, allows H&T to negotiate favorable terms, balancing the influence of its wholesale partners.

The bargaining power of suppliers is indirectly represented by the global gold price for H&T Group, impacting its core gold buying and pawnbroking operations. H&T cannot influence these prices, making them an external factor rather than a direct supplier negotiation.

A rising gold price, such as the approximate 10% increase observed in early 2024, generally benefits H&T by increasing the value of its inventory and collateral, potentially boosting retail sales and loan book value.

Conversely, a sharp decline in gold prices could negatively affect asset valuations and profit margins, highlighting the sensitivity of H&T's business model to this commodity's market fluctuations.

Funding Sources for Lending Capital

The bargaining power of suppliers for H&T Group is primarily seen in its reliance on external funding to fuel its lending operations. At the close of 2024, the group's pledge book had a capital value of £127 million, underscoring the need for robust funding sources.

H&T Group secures this capital through various funding facilities provided by banks and other capital providers. Institutions like Lloyds Bank plc, PGIM, and Allica Bank Limited act as key suppliers of this essential capital. The terms and interest rates offered by these financial institutions directly impact H&T's cost of doing business and its capacity for growth.

- Funding Dependency: H&T's pledge book reached £127 million in capital value by the end of 2024, highlighting its reliance on external capital.

- Key Capital Providers: Major financial institutions such as Lloyds Bank plc, PGIM, and Allica Bank Limited are crucial suppliers of funding.

- Cost of Capital Influence: These suppliers can dictate borrowing costs through interest rates and lending terms, affecting H&T's profitability.

- Strategic Importance: The availability and cost of this capital are critical for H&T's ability to expand its lending activities and overall business strategy.

Technology and Service Providers

The bargaining power of technology and service providers for H&T Group is a key consideration. As a company heavily reliant on digital platforms for online sales and operational efficiency, H&T engages with various IT service providers and consultants. The leverage these suppliers hold is directly tied to how unique and essential their contributions are to H&T's core functions.

For standard IT support or generic software solutions, the bargaining power of suppliers is generally low due to the availability of numerous alternative providers. However, for highly specialized software, custom development, or critical consulting services that are integral to H&T's competitive edge, supplier power can be significantly higher. H&T's ongoing investments in upgrading its technology infrastructure, as seen in its continued expansion of online capabilities, underscore a dependence on these specialized providers.

- Supplier Dependence: H&T Group's reliance on technology platforms for online sales and operations means it depends on IT and service providers.

- Uniqueness and Criticality: The bargaining power of these suppliers hinges on how unique and crucial their offerings are to H&T's business.

- Impact of Specialization: Generic IT services offer low supplier power, while specialized software or consulting can grant suppliers greater leverage.

- Investment Indicator: H&T's commitment to enhancing its technology platforms highlights its reliance on these external providers for growth and competitiveness.

H&T Group faces moderate bargaining power from its wholesale suppliers, particularly for specialized pre-owned watches, where a limited number of unique items can increase supplier leverage. However, the broad availability of gold and general jewelry items, coupled with H&T's significant purchasing volume, helps to keep overall supplier power in check. The company's ability to source from a diverse global market, valued at approximately $290 billion in 2024 for the jewelry sector, further dilutes individual supplier influence.

The bargaining power of H&T Group's capital providers is a significant factor, as the company relies on external funding, with its pledge book valued at £127 million by the end of 2024. Key suppliers like Lloyds Bank plc, PGIM, and Allica Bank Limited can influence H&T's profitability through their lending terms and interest rates, directly impacting the cost of doing business and expansion capabilities.

Supplier power is also evident in technology and service providers, especially for specialized software or consulting services crucial to H&T's competitive edge. While generic IT services offer low supplier power due to market saturation, unique or critical technology solutions can grant providers greater leverage, influencing H&T's operational efficiency and online capabilities.

| Supplier Type | Key Considerations | Impact on H&T Group | 2024 Data/Context |

|---|---|---|---|

| Individual Customers (Pawnbroking) | Need for immediate cash, asset illiquidity | Low bargaining power, favorable for H&T | Pawnbroking income a significant revenue contributor. |

| Wholesale Jewelry/Watch Suppliers | Diversified market, specialized items | Moderate power, balanced by H&T's scale and sourcing breadth | Global jewelry market ~$290 billion; pre-owned segment growing. |

| Capital Providers (Banks, Financial Institutions) | Lending terms, interest rates | Significant power, impacts cost of capital and growth | Pledge book capital value £127 million (end 2024); key providers include Lloyds, PGIM, Allica. |

| Technology & Service Providers | Uniqueness and criticality of services | Low for generic, high for specialized/critical services | H&T invests in online capabilities, dependent on specialized providers. |

What is included in the product

This analysis delves into the competitive forces shaping H&T Group's operating environment, examining the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes.

Instantly identify and address competitive pressures with a clear, actionable breakdown of the H&T Group's market landscape.

Customers Bargaining Power

While pawnbroking customers often face urgent financial needs, which typically weakens their bargaining power, the availability of alternative short-term credit options, even if less favorable, does grant them some leverage. This is particularly true for those seeking small-sum, short-term loans where the perceived differences in interest rates and terms, however minor, can influence their decision-making process.

In 2024, the landscape of small-sum lending continues to be shaped by the accessibility of payday loans and overdraft facilities, which, despite their own drawbacks, represent alternatives for individuals needing quick cash. For H&T Group, this means that while their pawnbroking service offers a regulated and often more transparent solution compared to some informal lenders, customers still possess the power to compare and choose based on perceived value and immediate affordability.

In the retail segment for new and pre-owned jewelry and watches, customers exhibit noticeable price sensitivity. The sheer volume of competing retailers, both brick-and-mortar and online, allows consumers to readily compare prices and actively search for the best value. This competitive landscape means that H&T Group must remain attuned to market pricing to attract and retain its customer base.

H&T's strategy directly addresses this by focusing on offering competitive pricing, particularly for its pre-owned items. Furthermore, the company is expanding its selection of new jewelry, aiming to provide a broader appeal and capture customers who might otherwise shop elsewhere. This dual approach is crucial for maintaining market share in a segment where price is a significant decision-making factor for shoppers.

For financial services such as cheque cashing and foreign currency exchange, customers face minimal barriers when switching providers. This means they can readily move to a competitor offering more favorable exchange rates or a more convenient service. In 2023, the average customer in the UK spent approximately £50 on foreign currency transactions, highlighting the potential for small rate differences to influence choice.

H&T Group is actively working to lessen this customer power. By investing in improving its online platform and broadening its range of foreign currency options, the company aims to make its services more attractive and convenient, thereby encouraging customer loyalty and reducing the likelihood of them switching to rivals.

Impact of Economic Conditions on Customer Demand

Macroeconomic conditions, particularly inflation and the ongoing cost of living crisis, directly impact customer demand for H&T Group's services. As consumers face increased financial pressures and tighter access to traditional credit, there's a noticeable rise in the demand for pawnbroking loans.

This dynamic suggests that customer demand is heavily influenced by external economic factors. While these conditions can boost the volume of customers, they also imply that many individuals are in more vulnerable financial situations. This vulnerability can, within regulatory boundaries, grant H&T a degree of leverage in negotiating loan terms.

- Inflationary Pressures: Rising inflation in 2024 continues to squeeze household budgets, making essential goods and services more expensive.

- Cost of Living Crisis: Many households are experiencing reduced disposable income, leading them to seek alternative financing options.

- Credit Constraints: Traditional lenders may tighten lending criteria during economic downturns, pushing individuals towards pawn services.

- Increased Pawnbroking Demand: H&T Group reported a significant increase in pawnbroking transactions in its 2024 financial updates, directly correlating with these economic pressures.

Regulatory Protection for Consumers

The Financial Conduct Authority (FCA) in the UK oversees the pawnbroking industry, with a key objective of safeguarding consumers, particularly those who are more vulnerable. This regulatory framework can bolster customer bargaining power by mandating fair dealings, clear disclosures, and accessible avenues for resolving complaints, thereby curbing H&T Group's capacity for imposing unfavorable terms.

FCA Consumer Duty Board Reports, for instance, highlight the expectation for firms to actively track customer results and adopt strategies that prioritize positive customer outcomes. This focus on consumer welfare means that H&T Group must operate with a degree of transparency and fairness that directly influences customer leverage.

- FCA Regulation: The FCA's presence limits the potential for predatory practices, enhancing consumer trust and bargaining power.

- Consumer Duty: This initiative mandates that firms like H&T Group actively ensure good outcomes for their customers, directly impacting customer leverage.

- Transparency Requirements: Regulations often require clear communication of fees, interest rates, and terms, enabling customers to make informed comparisons and negotiate more effectively.

Customers of H&T Group, particularly in the pawnbroking segment, possess moderate bargaining power. While urgent needs often limit their options, the availability of alternative short-term credit, like payday loans and overdrafts, allows for some price comparison. In 2024, the cost of living crisis increased demand for pawnbroking, but also highlighted customer vulnerability, which, within regulatory limits, can offer H&T some leverage.

In the retail sector, price sensitivity is high due to numerous competitors, forcing H&T to offer competitive pricing. For financial services like currency exchange, switching costs are low, making rate and convenience key decision factors. The FCA's Consumer Duty mandates fair treatment, further empowering customers by requiring transparency and good outcomes.

| Service Segment | Customer Bargaining Power Factors | H&T Group's Response/Mitigation | 2024 Data/Context |

|---|---|---|---|

| Pawnbroking | Urgency of need vs. alternative credit availability (payday loans, overdrafts) | Focus on regulated, transparent service; leverage economic pressures for volume | Increased pawnbroking transactions due to cost of living crisis; customer vulnerability can offer leverage within regulations. |

| Retail (Jewelry & Watches) | Price sensitivity, availability of numerous competing retailers (online & physical) | Competitive pricing, expanding new jewelry selection | Customers actively compare prices across a wide market. |

| Financial Services (Cheque Cashing, FX) | Low switching costs, importance of rates and convenience | Improving online platform, broadening FX options to enhance loyalty | In 2023, UK customers spent ~£50 on FX transactions, indicating sensitivity to small rate differences. |

Preview the Actual Deliverable

H&T Group Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of the H&T Group you'll receive immediately after purchase. It delves into the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain actionable insights into the strategic positioning and potential challenges facing H&T Group, all presented in a professionally formatted document ready for your use.

Rivalry Among Competitors

The UK pawnbroking market, while showing growth, is characterized by a degree of fragmentation. Despite this, H&T Group stands out as the clear leader, holding a significantly larger market share than its competitors. This dominant position naturally lessens the intensity of direct rivalry within the core pawnbroking services.

As of December 2024, H&T Group operated an extensive network of 285 stores across the UK. This substantial physical presence and established brand recognition provide a considerable advantage, effectively reducing the immediate threat from smaller, independent pawnbrokers and regional chains that still operate in the market.

H&T Group contends with a diverse array of short-term lenders, including payday loan providers, credit unions, and emerging alternative finance platforms, especially in the unsecured lending space. The Financial Conduct Authority (FCA) reported that in 2023, the UK's short-term lending market continued to see significant activity, with a notable portion of consumers turning to these options due to the ongoing scarcity of small-sum credit from traditional banking institutions.

While H&T's core pawnbroking business provides secured loans against tangible assets, the broader landscape for small, short-term credit is intensely competitive. The persistent 'continued lack of supply of small-sum credit' from mainstream lenders has, in fact, redirected a substantial segment of demand towards pawnbrokers, indicating that while direct pawnbroking rivalry might be somewhat contained, the overall short-term credit market presents a significant competitive challenge.

Competitive rivalry is a major force within the UK jewelry retail market, a sector where H&T Group actively participates. The retail sales of both new and pre-owned jewelry and watches represent a significant portion of H&T's operations, with this segment experiencing a robust 27% increase in sales during 2024, reaching an estimated £6,188 million for the overall UK market that year.

This intense competition stems from a diverse range of players, including established high-street jewelers, numerous online retailers, large department stores, and various other generalist retailers. The market's substantial size, projected for continued growth, coupled with a growing consumer comfort in purchasing jewelry online and embracing pre-owned items, fuels this fierce competitive landscape.

Geographic Concentration and Local Competition

While H&T Group operates a national network of stores, the intensity of competition often escalates at a more granular, local level. This means that in specific towns or cities, H&T may face significant rivalry from other established pawnbrokers or even independent jewelers who cater to the immediate community's needs. This localized competition can impact market share and pricing power within those particular geographic areas.

H&T Group's strategic approach to managing this localized rivalry involves substantial investment in its physical store estate. By refurbishing existing stores and ensuring a strong, appealing local presence, the company aims to differentiate itself and enhance the customer experience. This focus on improving the in-store environment and service quality is a key tactic to attract and retain customers, thereby mitigating the pressures from local competitors.

- Localized Rivalry: H&T faces competition from other pawnbrokers and jewelers in specific geographic areas.

- Store Estate Investment: The company invests in refurbishing stores to strengthen its local presence.

- Customer Experience Focus: Enhancing the in-store experience is a strategy to combat localized competition.

Regulatory Environment and Compliance Costs

The Financial Conduct Authority's (FCA) stringent oversight of the pawnbroking sector significantly shapes competitive rivalry. This regulatory landscape, including rules on lending practices and consumer protection, can deter new entrants and increase operational complexity.

Compliance with these regulations incurs substantial costs. For instance, in 2024, firms must navigate evolving guidelines on responsible lending and data security, which require ongoing investment in systems and training. These costs can disproportionately impact smaller, independent pawnbrokers, potentially leading to market consolidation favoring larger entities like H&T Group, which possess greater resources to absorb these expenses.

- FCA Oversight: The FCA's regulatory framework acts as a significant barrier to entry and a key determinant of competitive intensity within the pawnbroking industry.

- Compliance Burden: Adherence to regulations, including those concerning fair treatment of customers and operational integrity, necessitates considerable financial and administrative resources.

- Market Consolidation: The high cost of compliance can disadvantage smaller competitors, potentially driving market consolidation and strengthening the position of larger, well-resourced firms like H&T Group.

- Reduced Competition: The regulatory and compliance burden indirectly limits the number of active participants in the market, thereby influencing the level of competitive rivalry.

The competitive rivalry for H&T Group is multifaceted, stemming from both direct pawnbroking competitors and the broader short-term lending market, as well as the highly contested jewelry retail sector. While H&T's substantial UK presence of 285 stores as of December 2024 provides a buffer against smaller rivals, the overall short-term credit landscape, fueled by a continuing lack of small-sum credit from traditional banks, presents a significant challenge. The UK jewelry retail market, which saw a 27% sales increase to £6,188 million in 2024, is intensely competitive with numerous online and high-street players.

| Competitor Type | Key Characteristics | Impact on H&T Group |

|---|---|---|

| Direct Pawnbrokers | Smaller independent and regional chains | Limited direct impact due to H&T's market leadership and store network. |

| Short-Term Lenders | Payday lenders, credit unions, alternative finance platforms | Significant indirect competition for unsecured lending; demand shifts due to credit scarcity. |

| Jewelry Retailers | High-street jewelers, online retailers, department stores | Intense competition in H&T's retail segment, driven by market growth and online purchasing trends. |

SSubstitutes Threaten

The most significant substitutes for pawnbroking loans are unsecured personal loans and payday loans. While H&T Group does offer some unsecured personal loans, the broader market includes numerous traditional banks, agile online lenders, and other providers of high-cost, short-term credit.

The core appeal of pawnbroking stems from its secured nature, which typically grants access to funds for individuals who might be excluded from mainstream financial services. However, the increasing prevalence and accessibility of unsecured lending present a clear challenge.

The unsecured personal loan market saw substantial growth, expanding by nearly 25% in 2024 alone, underscoring its strength as a viable and increasingly popular alternative to secured pawnbroking services.

Individuals increasingly opt to sell personal assets directly rather than pawn them, bypassing loan obligations and interest. This trend is fueled by greater awareness of the resale value of items like gold, jewelry, and luxury watches, offering a direct route to liquidity. For instance, the global pre-owned luxury watch market was valued at approximately $20 billion in 2023 and is projected to grow significantly, indicating a substantial pool of assets available for direct sale.

Credit cards and bank overdrafts represent potential substitutes for H&T Group's services, especially for individuals with established credit histories. These traditional financial products offer short-term liquidity, often with interest rates that can be competitive with pawnbroking, particularly for those with good credit standing.

However, the accessibility of these substitutes is a key differentiator. H&T Group's primary customer demographic often faces challenges accessing mainstream banking facilities due to credit limitations or other financial circumstances. For instance, in 2023, around 15% of UK adults were considered to be in financial difficulty, a segment less likely to qualify for favourable credit card terms or overdrafts.

Borrowing from Friends and Family

The threat of substitutes for H&T Group's services is notably influenced by informal lending from friends and family. This alternative, while often lacking formal structure and interest charges, presents a compelling substitute for individuals needing quick cash. Its attractiveness is amplified by the absence of credit checks or lengthy application processes, making it a readily accessible option for many.

While difficult to quantify precisely, this informal lending channel represents a significant competitive pressure. For instance, a 2023 survey indicated that a considerable portion of individuals facing short-term financial needs turn to personal networks before considering formal financial institutions. This highlights a behavioral shift that directly impacts the demand for pawn broking and short-term lending services.

- Informal Lending: Friends and family offer interest-free or low-interest loans, bypassing formal financial channels.

- Accessibility: This substitute is often quicker and requires less documentation than traditional loans.

- Limitations: The availability and amount of funds are dependent on personal relationships and the lender's capacity.

Other Financial Services and Welfare Support

Other financial services like budgeting loans, credit union offerings, and government welfare support present a significant threat of substitutes for H&T Group. These alternatives provide individuals, especially those facing financial difficulties, with different ways to access necessary funds. For instance, in 2024, the UK government's continued focus on welfare support aims to cushion vulnerable populations, directly competing with the short-term lending H&T Group provides.

The increasing demand for accessible financial solutions, fueled by economic pressures such as the cost-of-living crisis and persistent inflation, means individuals have more options than ever. This broadens the competitive landscape considerably.

- Budgeting Loans: Offered by the government, these can provide interest-free support for essential items.

- Credit Union Loans: These often provide more flexible repayment terms and community-focused lending.

- Government Welfare Support: Direct financial aid and benefits act as a fundamental substitute for immediate cash needs.

- Alternative Lenders: A growing market of online lenders and peer-to-peer platforms also offer various short-term credit options.

The threat of substitutes for H&T Group's pawnbroking services is substantial, encompassing a range of financial products and informal arrangements. Unsecured personal loans and payday loans are primary competitors, with the unsecured loan market growing by nearly 25% in 2024. Furthermore, individuals increasingly opt to sell assets directly, bypassing loan obligations, as seen in the growing pre-owned luxury watch market, valued at approximately $20 billion in 2023. Credit cards and overdrafts also serve as substitutes for those with good credit, though H&T's core demographic often lacks access to these mainstream options, with around 15% of UK adults facing financial difficulty in 2023.

| Substitute Type | Key Features | Target Customer Segment | 2024 Market Data/Trend | Impact on H&T Group |

|---|---|---|---|---|

| Unsecured Personal Loans | No collateral required, varying interest rates | Individuals with moderate credit history | Market grew by ~25% in 2024 | Direct competitor for cash needs |

| Direct Asset Sales | Liquidity from selling owned items | Individuals with valuable possessions | Global pre-owned luxury watch market ~ $20bn (2023) | Bypasses pawn loan need |

| Credit Cards/Overdrafts | Short-term credit, often linked to bank accounts | Individuals with established credit | Widely accessible for creditworthy individuals | Alternative for those with good credit standing |

| Informal Lending (Friends/Family) | Interest-free or low-interest, quick access | Individuals with strong personal networks | Significant, though hard to quantify, competitive pressure | Undermines formal lending demand |

| Government/Credit Union Loans | Supportive, often interest-free or flexible terms | Vulnerable populations, those in financial difficulty | Government welfare support continues to cushion vulnerable populations | Provides alternative sources of funds |

Entrants Threaten

The pawnbroking industry in the UK is overseen by the Financial Conduct Authority (FCA), which mandates substantial compliance measures. New entrants must contend with a labyrinthine regulatory landscape, encompassing the acquisition of licenses, adherence to conduct of business regulations, and ongoing reporting obligations. For instance, as of 2024, the FCA's Consumer Credit sourcebook (CONC) outlines stringent rules for firms offering credit, including pawnbroking, which require significant investment in compliance infrastructure and expertise.

Establishing a pawnbroking business demands significant upfront capital, primarily to build a substantial pledge book, which represents the loans extended against customer assets. The National Pawnbrokers Association suggests that new ventures need between £50,000 and £100,000 in loan capital for their initial year.

For established players like H&T Group, with a pledge book capital value reaching £127 million in 2024, the scale of investment required creates a considerable barrier to entry for potential new competitors seeking to operate at a similar level. This high capital threshold naturally limits the number of new entrants.

The pawnbroking industry, including H&T Group, inherently requires customers to trust the business with their valuable personal possessions. Establishing a strong reputation for honesty, fairness, and security is paramount for any new entrant aiming to compete. This trust is not easily replicated, and it takes considerable time and consistent ethical practice to cultivate.

H&T Group, being the largest pawnbroker in the UK with a vast high street presence, already possesses significant brand recognition and a long-standing customer base built on years of dependable service. For a new competitor, overcoming this established trust and demonstrating a similar level of reliability would be a substantial hurdle, likely requiring extensive marketing and a proven track record to even begin gaining traction.

Extensive Store Network and Operational Infrastructure

The H&T Group boasts an impressive footprint with 285 high street stores across the UK, augmented by a robust online presence. This extensive physical network represents a substantial barrier to entry for potential competitors. The capital investment required to establish a comparable network of retail locations, including real estate acquisition, staffing, and logistical infrastructure, is immense. This established accessibility and broad customer reach offer H&T a significant competitive advantage, making it challenging for newcomers to quickly match their market penetration.

Consider the sheer scale: replicating 285 physical locations and the associated operational backbone would demand hundreds of millions in investment. For instance, setting up a single new store can cost upwards of £100,000 to £250,000, depending on location and size. This capital requirement, coupled with the time needed to secure prime locations and build brand recognition, effectively deters many new entrants from challenging H&T's established market position.

- Extensive Store Network: 285 high street locations across the UK.

- Online Presence: Complemented by a digital platform to broaden reach.

- Capital Investment Barrier: Significant upfront costs for real estate, staffing, and infrastructure.

- Competitive Advantage: Enhanced accessibility and customer reach due to established network.

Expertise in Valuations and Risk Management

The pawnbroking industry, including H&T Group, demands significant expertise in valuing diverse personal assets like gold, jewelry, and watches, alongside robust risk management capabilities. This specialized knowledge is a substantial barrier for potential new entrants. H&T's extensive operational history, dating back to 1897, has allowed it to cultivate a deep understanding of asset valuation, market dynamics, and risk mitigation strategies, which are not easily replicated.

- Specialized Valuation Skills: Pawnbrokers must accurately assess the value of items like precious metals and gemstones, a skill honed over years of practice.

- Risk Management Acumen: Effectively managing the risks associated with holding collateral, such as fluctuating market prices and potential theft, is crucial.

- Regulatory Compliance: Navigating the complex regulatory landscape governing financial services and pawnbroking requires dedicated resources and expertise.

- Brand Reputation and Trust: Building customer trust in handling valuable personal items is a long-term endeavor that new entrants would need to establish.

The threat of new entrants for H&T Group is relatively low, primarily due to the substantial capital requirements and stringent regulatory environment in the UK pawnbroking sector. New businesses must navigate FCA compliance, which involves significant investment in infrastructure and expertise, as highlighted by CONC regulations in 2024. Furthermore, establishing a substantial pledge book, estimated to require £50,000 to £100,000 in initial loan capital, presents a significant financial hurdle.

H&T Group's extensive network of 285 high street stores, coupled with its established brand recognition and customer trust, creates a formidable barrier. Replicating this physical footprint alone can cost hundreds of thousands per store, making it exceptionally difficult for newcomers to achieve comparable market penetration and accessibility. This scale of investment and established presence deters many potential competitors.

| Barrier Type | Description | Implication for New Entrants | H&T Group's Position |

| Regulatory Compliance | FCA oversight, licensing, conduct rules (e.g., CONC 2024) | High compliance costs and expertise needed. | Established infrastructure and knowledge. |

| Capital Investment | Building pledge book (£50k-£100k initial loan capital) | Significant upfront funding required. | Pledge book capital value £127 million (2024). |

| Brand Reputation & Trust | Building customer confidence with valuables. | Long-term effort to establish credibility. | Years of dependable service and high street presence. |

| Physical Network Scale | 285 stores, high setup costs (£100k-£250k per store) | Immense investment to match accessibility. | Dominant high street presence, broad reach. |

Porter's Five Forces Analysis Data Sources

Our H&T Group Porter's Five Forces analysis leverages a robust mix of data sources, including company annual reports, industry-specific market research from firms like IBISWorld, and financial data from platforms such as S&P Capital IQ. This comprehensive approach ensures a thorough understanding of the competitive landscape.