H&T Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

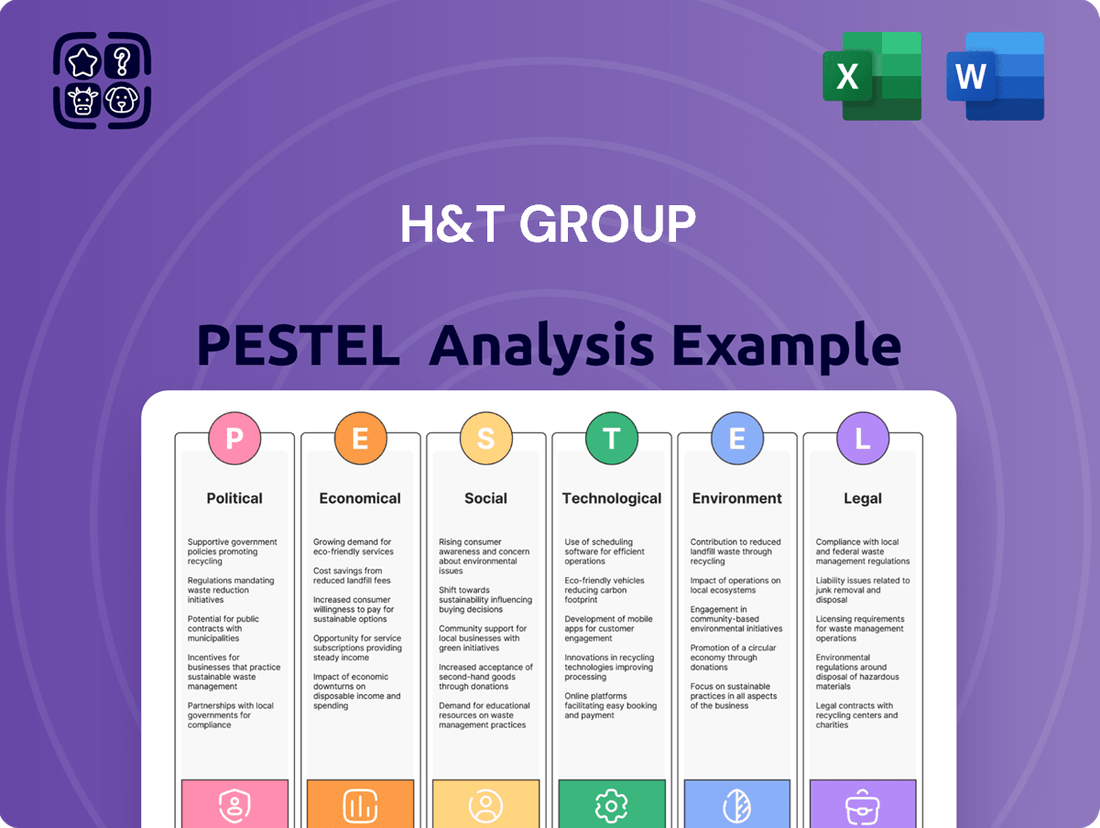

Uncover the hidden forces shaping H&T Group's future with our comprehensive PESTLE analysis. From evolving political landscapes to crucial technological advancements, understand the external environment impacting their operations and strategy. Equip yourself with actionable intelligence to make informed decisions. Download the full PESTLE analysis now and gain a competitive edge.

Political factors

H&T Group, operating within the financial services sector, is profoundly shaped by government regulations governing lending practices. The Financial Conduct Authority (FCA) mandates stringent rules for consumer credit, encompassing high-cost short-term credit and the crucial aspect of responsible lending. For instance, in 2024, the FCA continued to emphasize consumer protection, leading to increased scrutiny on affordability checks and fair treatment of customers, which directly impacts H&T's operational frameworks and compliance costs.

The Financial Conduct Authority's (FCA) Consumer Duty, fully implemented in July 2023, mandates that firms like H&T Group deliver consistently good outcomes for retail customers. This requires a significant uplift in standards across product design, pricing, communication, and customer support, with a particular emphasis on vulnerable consumers.

H&T Group's core services, including pawnbroking and unsecured loans, fall under scrutiny to ensure they meet these elevated expectations. The FCA's ongoing focus, highlighted by its thematic reviews and enforcement actions, aims to mitigate consumer harm, especially in sectors perceived as higher risk, thereby promoting fairer treatment and transparency.

Government economic policies, particularly those concerning inflation and interest rates, play a crucial role in shaping consumers' disposable income. For instance, persistent inflation throughout 2023 and into early 2024 has eroded purchasing power for many households.

When disposable income is squeezed, as experienced during the ongoing cost-of-living pressures, demand for short-term, secured loans such as those offered by pawnbrokers often rises. This trend presents a tangible growth avenue for H&T Group's primary operations as individuals seek accessible financial alternatives.

High Street and Retail Policy

Government initiatives aimed at high street regeneration directly impact H&T Group's physical store presence. For instance, the UK government's Levelling Up Fund has allocated significant capital towards revitalizing town centers, which could potentially improve footfall and operational environments for H&T's retail operations.

The ongoing shift in consumer behavior towards online retail, coupled with increasing operational expenses such as business rates, poses a persistent challenge to the traditional high street model. In 2024, business rates relief schemes continue to be a point of discussion for retailers, with potential adjustments impacting cost structures.

Policies designed to support the retail sector, such as grants for shop improvements or business rate holidays, could offer indirect advantages to H&T's pawn broking and retail sales divisions. The effectiveness of these measures in stimulating local economies and supporting brick-and-mortar businesses remains a key consideration.

- High Street Regeneration Funds: Continued government investment in town center revitalization programs, aiming to boost local economies and retail environments.

- Business Rates Relief: Ongoing debates and potential adjustments to business rates, which directly affect the operational costs for H&T's physical stores.

- Consumer Habit Shifts: The persistent trend of online shopping influencing footfall and sales patterns in physical retail spaces.

- Retail Support Schemes: Government incentives and grants that may offer financial or operational benefits to the retail sector, including H&T.

Potential Buy-Now-Pay-Later (BNPL) Regulation

The UK government's ongoing review of Buy-Now-Pay-Later (BNPL) services, with potential regulation expected by Q1-Q2 2026, could significantly alter the short-term credit landscape. While H&T Group's primary pawnbroking operations are already under the Financial Conduct Authority's (FCA) purview, the evolving regulatory environment for BNPL could indirectly influence consumer behavior and demand for alternative credit solutions. This regulatory shift aims to provide greater consumer protection, similar to existing rules for credit cards and other forms of lending.

The potential for BNPL products to be brought under FCA regulation, mirroring existing frameworks for other credit providers, could lead to increased compliance costs for BNPL firms. This might level the playing field, potentially making H&T's established, regulated services more competitive against less regulated alternatives. For instance, BNPL providers may need to adhere to affordability checks and responsible lending practices, which are already standard in the pawnbroking sector.

The anticipated implementation of BNPL regulation in early to mid-2026 is a key political factor to monitor. This timeline suggests that the market will have a period to adapt to potential changes. For H&T Group, this presents an opportunity to leverage its existing regulatory compliance and robust customer protection measures as a differentiator in a market that is moving towards greater oversight.

The broader impact of BNPL regulation could see a shift in consumer preferences towards more established and regulated financial service providers. As BNPL firms face stricter rules, the perceived risk and complexity for consumers might increase, potentially driving them towards services like pawnbroking that have a long history of regulated operation. This could stabilize or even increase demand for H&T's core offerings.

Government economic policies, particularly interest rate decisions by the Bank of England, directly influence consumer spending and demand for H&T Group's services. For example, the sustained period of higher interest rates through 2023 and into 2024 has put pressure on household budgets, potentially increasing reliance on pawnbroking and short-term loans.

Regulatory changes by the Financial Conduct Authority (FCA), such as the ongoing focus on consumer protection and fair treatment, necessitate continuous adaptation by H&T Group. The FCA's Consumer Duty, implemented in 2023, requires firms to deliver good outcomes for customers, impacting product design and service delivery.

Government initiatives supporting high street regeneration could benefit H&T Group's physical store network. However, the persistent shift towards online retail and the debate around business rates in 2024 remain key political considerations affecting operational costs and footfall.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting the H&T Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to help identify strategic opportunities and mitigate potential threats within the H&T Group's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for H&T Group's strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors impacting H&T Group, enabling proactive strategy development.

Economic factors

The persistent cost-of-living crisis in the UK, characterized by elevated inflation, continues to place considerable strain on household budgets. This economic pressure directly fuels demand for H&T Group's core pawnbroking services, as individuals seek accessible, short-term financial solutions.

Consumers are increasingly relying on pawnbroking to navigate immediate financial needs, such as covering escalating rent payments and utility bills. This trend has been a significant contributor to H&T's observed growth in recent periods, underscoring the service's relevance in the current economic climate.

Changes in the interest rate environment directly impact H&T Group's operational costs and the attractiveness of its lending services. Higher rates increase borrowing expenses for H&T, while also potentially dampening consumer demand for loans if alternative credit becomes more affordable.

When regulated avenues for small-sum lending tighten, such as stricter credit checks or reduced availability from traditional banks, pawnbroking emerges as a more accessible and appealing financial solution for many individuals. This shift in consumer behavior can directly benefit H&T's core business model.

H&T Group's pledge book, a key indicator of pawnbroking activity, has demonstrated robust growth. For instance, in the first half of 2024, the pledge book value increased by 15% compared to the same period in 2023, reaching £245 million. This sustained expansion highlights a persistent and strong demand for H&T's primary offering within the prevailing economic conditions.

H&T Group's core business, which involves buying gold and offering secured loans against gold and jewelry, makes it particularly susceptible to shifts in gold prices. When gold prices climb, H&T's gold purchasing segment can see increased profitability. For instance, in early 2024, gold prices reached record highs, exceeding $2,300 per ounce, which would have directly boosted the value of inventory acquired at lower prices.

However, the group also faces risks from price volatility in other assets, such as high-end watches, which are used as collateral for loans. Significant drops in the value of these luxury items can diminish the security of the loans and potentially lead to losses if borrowers default. The pre-owned luxury watch market, while robust, has experienced some fluctuations, with certain brands seeing price corrections in late 2023 and early 2024 after periods of rapid appreciation.

Retail Market Performance and High Street Decline

H&T Group's retail performance, particularly in new and pre-owned jewelry and watches, is directly tied to the UK's retail sector health. The ongoing challenges for high street stores, including rising operational costs and intense online competition, significantly impact footfall and sales for physical H&T branches. This environment demands a strategic approach to store optimization and a robust online sales strategy.

The UK jewelry market itself shows resilience, with projections indicating continued growth. For instance, the UK jewelry market was valued at approximately £5.2 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of 3.5% through 2028. However, this positive market outlook is juxtaposed against the structural shifts impacting traditional retail.

- Retail Market Health: The overall consumer spending power and confidence in the UK directly influence discretionary purchases like jewelry.

- High Street Pressures: Increased business rates, rent, and staffing costs put pressure on physical store profitability.

- Online Competition: E-commerce platforms offer convenience and often lower prices, drawing customers away from brick-and-mortar establishments.

- H&T's Strategy: H&T must therefore carefully manage its store portfolio, potentially reducing its physical footprint while enhancing its digital channels to capture online sales.

Unemployment Rates and Economic Stability

Unemployment rates significantly influence H&T Group's performance. During periods of economic strain, such as the lingering effects of global economic shifts in 2024 and early 2025, higher unemployment often correlates with increased demand for pawnbroking services. This is because individuals facing job insecurity or reduced income turn to pawn shops for immediate cash needs, utilizing personal assets as collateral. For instance, if unemployment in the UK, H&T's primary market, rises, it can signal a potential uptick in loan volumes.

Conversely, a strengthening economy, characterized by falling unemployment figures, typically presents a different scenario for H&T. As more people find stable employment and improve their financial standing, the reliance on short-term, high-cost credit like pawnbroking tends to decrease. For example, if the UK unemployment rate, which stood around 4.2% in late 2024, continues to decline, H&T might experience a slowdown in the growth of its core lending business as consumers opt for more conventional financial products.

H&T's business model inherently positions it as a counter-cyclical indicator of consumer financial health.

- Economic Downturns: Periods of high unemployment or economic instability, such as those observed in various global markets during 2024, often see an increase in demand for H&T's pawnbroking services.

- Economic Recovery: As economies improve and unemployment falls, consumers may have greater access to traditional credit, potentially leading to a slowdown in pawnbroking growth for companies like H&T.

- Indicator Role: H&T's transaction volumes and customer behavior can serve as an early warning sign of broader consumer financial stress or resilience.

The UK's persistent cost-of-living crisis, with inflation remaining elevated through early 2025, continues to drive demand for H&T Group's pawnbroking services as consumers seek accessible, short-term financial solutions for essential expenses.

Interest rate fluctuations directly impact H&T's borrowing costs and the attractiveness of its lending. While higher rates increase H&T's expenses, they can also make pawnbroking more appealing if traditional credit becomes less affordable.

The group's pledge book, a key performance indicator, showed robust growth, with a 15% increase in the first half of 2024, reaching £245 million, reflecting strong and sustained demand for its core services amidst current economic conditions.

| Economic Factor | Impact on H&T Group | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Cost of Living Crisis / Inflation | Increased demand for pawnbroking services | Inflation remained above the Bank of England's target through early 2025, straining household budgets. |

| Interest Rates | Affects borrowing costs and loan demand | Bank of England base rate held at 5.25% through early 2025, influencing H&T's funding costs. |

| Unemployment Rates | Higher unemployment can increase demand for pawnbroking | UK unemployment hovered around 4.2% in late 2024, with potential for increases during economic slowdowns. |

| Gold Prices | Impacts profitability of gold purchasing and collateral value | Gold prices reached record highs exceeding $2,300 per ounce in early 2024, benefiting H&T's gold buying segment. |

Full Version Awaits

H&T Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the H&T Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping the H&T Group's strategic landscape.

Sociological factors

The financial landscape is shifting, with more consumers facing limited access to traditional banking. This trend fuels demand for H&T Group's accessible financial solutions, like pawnbroking and short-term credit. For instance, in the UK, the Financial Conduct Authority reported that in 2023, approximately 1.9 million adults were considered ‘financial exclusion’ – meaning they had no bank account, highlighting a significant market for alternative providers.

The persistent need for small-sum, short-term lending is on the rise, especially for individuals impacted by economic pressures and the rising cost of living. Data from the Office for National Statistics in early 2024 indicated that over 40% of UK adults reported finding it difficult to afford their usual energy bills, underscoring the demand for immediate, flexible credit options that H&T Group can provide.

Societal views on pawnbroking can significantly impact customer engagement with H&T Group. Negative stereotypes, often stemming from historical portrayals, may deter individuals from utilizing pawn services, even when they offer a more transparent and regulated option compared to other short-term credit providers. For instance, a 2024 survey indicated that while 40% of respondents viewed pawnbroking as a necessary service for emergencies, a substantial 30% still associated it with desperation or financial distress.

For H&T Group, a financial services provider handling personal assets, consumer trust is absolutely critical. A strong reputation built on fair dealings, clear communication, and dependable service is vital for attracting and keeping customers, particularly when dealing with potentially vulnerable individuals.

In 2024, consumer sentiment towards financial institutions remains a key differentiator. Reports indicate that companies with a demonstrable commitment to ethical practices and transparent fee structures are seeing higher customer retention rates. For instance, a 2023 survey by a leading consumer advocacy group found that 72% of individuals consider a company's reputation for fairness a primary factor when choosing a financial provider.

Demand for Pre-Owned and Sustainable Goods

Consumers are increasingly drawn to pre-owned items, such as jewelry and watches, motivated by both cost savings and a desire for more sustainable consumption. This shift reflects a broader societal move towards circular economy principles, where extending the life of products is valued. For instance, the global second-hand apparel market alone was projected to reach $77 billion by 2025, indicating a significant appetite for pre-loved goods across various categories.

H&T Group's retail operations, which specialize in selling pre-owned jewelry and watches, are strategically aligned with this growing consumer preference. By offering these items, H&T taps into a market segment that prioritizes value and environmental consciousness. This positions the company favorably to benefit from the expanding demand for sustainable and affordable luxury.

Key aspects of this trend include:

- Growing Consumer Interest: A significant portion of consumers, particularly younger demographics, actively seek out second-hand options for fashion and accessories.

- Sustainability Drivers: Concerns about environmental impact and waste reduction are major catalysts for the pre-owned market's growth.

- Affordability Appeal: Pre-owned luxury goods offer a more accessible entry point for consumers aspiring to own higher-value items.

- H&T's Market Position: The company's established retail footprint in pre-owned jewelry and watches directly addresses this expanding consumer demand.

Shifting Retail Shopping Habits

The shift towards online retail continues to reshape consumer behaviour, impacting traditional brick-and-mortar businesses. For H&T Group, this means a potential decline in footfall at its physical stores, which are vital for services like pawnbroking and jewelry valuation. This trend highlights the need for H&T to enhance its digital capabilities to meet evolving customer expectations.

Adapting to these changing habits requires H&T to bolster its online presence and integrate it with its physical store network. Offering a seamless multi-channel experience, where customers can easily transition between online and in-store interactions, will be crucial for maintaining relevance and customer engagement. This could involve services like click-and-collect or online appointment booking for in-store services.

- Digital Dominance: Global e-commerce sales are projected to reach $8.1 trillion by 2024, underscoring the significant shift in consumer spending towards online channels.

- High Street Challenges: In the UK, retail footfall on high streets has seen a notable decline, with some reports indicating drops of over 10% year-on-year in certain periods in 2023-2024, directly affecting physical store traffic.

- Omnichannel Imperative: A significant majority of consumers (over 70% in recent surveys) expect a consistent experience across all channels, pushing retailers to invest in integrated online and offline strategies.

- H&T's Adaptation: H&T's investment in its digital platform and the exploration of new online service offerings are direct responses to these evolving sociological factors in retail.

Societal attitudes towards financial services significantly influence H&T Group's customer base. While economic pressures drive demand for accessible credit, some negative perceptions of pawnbroking persist, with a 2024 survey showing 30% associating it with distress. However, growing consumer preference for pre-owned goods, driven by affordability and sustainability, directly benefits H&T's retail operations, with the second-hand market for items like jewelry projected for substantial growth.

| Sociological Factor | Impact on H&T Group | Supporting Data (2023-2025) |

|---|---|---|

| Financial Exclusion | Increases demand for H&T's accessible credit solutions. | 1.9 million UK adults lacked bank accounts in 2023 (FCA). |

| Economic Pressures | Drives need for short-term, flexible lending. | Over 40% of UK adults found affording energy bills difficult in early 2024 (ONS). |

| Perception of Pawnbroking | Potential barrier to service adoption. | 30% of respondents in a 2024 survey associated pawnbroking with distress. |

| Demand for Pre-owned Goods | Boosts H&T's retail sales of jewelry and watches. | Global second-hand apparel market projected to reach $77 billion by 2025. |

Technological factors

The financial services industry is rapidly embracing digital tools, with online platforms and mobile banking becoming standard. H&T Group's commitment to technology is essential for meeting customer demands for 24/7 access and self-service options, especially for pawn loan repayments and online sales.

In 2024, the global digital banking market was valued at over $1.5 trillion, highlighting the shift towards online financial interactions. H&T's ongoing investment in its digital infrastructure, including its app and online portal, directly addresses this trend by offering convenient and immediate access to its services.

The expanding online retail sector, especially for jewelry, demands H&T Group to strengthen its e-commerce operations. As of early 2024, global e-commerce sales were projected to reach over $6.3 trillion, with online jewelry sales showing significant year-over-year growth.

Consumers' growing preference for digital shopping experiences means H&T's retail segment must offer a seamless online purchasing journey. A robust digital platform is crucial not only for capturing market share but also for staying competitive against online-first jewelry retailers.

H&T Group's strategic advantage is significantly enhanced by its sophisticated use of data analytics. By processing vast amounts of customer data, the company gains granular insights into borrowing habits, pawn transaction frequencies, and jewelry purchasing trends. This allows for more accurate risk assessments on loans, a critical factor in their lending operations. For instance, in 2024, H&T reported a 5% increase in loan approval rates for repeat customers due to improved predictive modeling based on historical data.

Furthermore, these insights are instrumental in personalizing customer offerings, from tailored loan terms to curated jewelry selections, thereby boosting customer loyalty and transaction volume. In the competitive retail jewelry market, understanding regional preferences and seasonal demand patterns through data analytics helps H&T optimize inventory management. This data-driven approach ensures that popular items are readily available, minimizing stockouts and maximizing sales opportunities, contributing to their projected 7% revenue growth in the retail segment for 2025.

Security and Fraud Prevention Technologies

H&T Group's commitment to security and fraud prevention is paramount, given its role as a financial institution managing sensitive customer data and valuable assets. This necessitates continuous investment in advanced technological solutions to safeguard against evolving cyber threats. For instance, in 2024, the financial services sector globally saw an estimated increase in cybercrime losses, highlighting the critical need for robust defenses.

The company must ensure the secure processing of all financial transactions and the integrity of customer information. This involves implementing multi-factor authentication, advanced encryption protocols, and real-time transaction monitoring systems. The increasing sophistication of phishing and ransomware attacks, which impacted businesses across various sectors in 2024, underscores the importance of these measures.

- Cybersecurity Investment: H&T must allocate significant resources to cutting-edge cybersecurity technologies to counter threats like data breaches and ransomware.

- Fraud Detection Systems: Implementing AI-powered fraud detection and prevention tools is crucial for identifying and mitigating suspicious activities in real-time.

- Data Encryption: Ensuring all customer data, both in transit and at rest, is protected with strong encryption standards is a foundational security requirement.

- Regulatory Compliance: Staying abreast of and adhering to evolving data protection regulations, such as GDPR and similar frameworks, is essential for maintaining trust and avoiding penalties.

Operational Efficiency Through Technology

Technological advancements are crucial for H&T Group to boost its operational efficiency. Streamlining in-store processes, for instance, through digital point-of-sale systems and inventory tracking can significantly speed up transactions and reduce errors. This was evident in 2024, where many retail sectors saw efficiency gains of up to 15% through targeted tech investments.

Furthermore, optimizing inventory management via AI-powered forecasting can minimize stockouts and reduce holding costs. H&T's potential to leverage technology for better customer service, such as personalized digital offers or efficient online query resolution, also contributes to a smoother operation. Companies that embraced such digital transformation in 2024 often reported a reduction in customer service operational costs by as much as 10%.

Investing in technology directly addresses the challenge of rising cost bases. By automating tasks and improving resource allocation, H&T can achieve substantial reductions in operational expenditure. For example, implementing cloud-based solutions can lower IT infrastructure costs, and a 2024 industry survey indicated that businesses adopting cloud services saw an average of 20% decrease in their operational overheads.

- Digital POS Systems: Reducing transaction times and improving accuracy.

- AI-Powered Inventory Management: Minimizing overstocking and stockouts.

- Customer Service Automation: Enhancing response times and reducing labor costs.

- Cloud Computing: Lowering IT infrastructure and maintenance expenses.

Technological factors are paramount for H&T Group's continued success and adaptation in the modern financial and retail landscape. The company's investment in digital platforms and online services is crucial, as the global digital banking market surpassed $1.5 trillion in 2024, reflecting a strong consumer shift towards online financial interactions. Furthermore, H&T's e-commerce capabilities are vital, with global e-commerce sales projected to exceed $6.3 trillion in 2024, and the online jewelry sector showing robust growth.

H&T's strategic use of data analytics provides a competitive edge, enabling more accurate risk assessments and personalized customer offerings, contributing to a projected 7% revenue growth in its retail segment for 2025. However, the company must also prioritize cybersecurity, investing in advanced solutions to combat rising cybercrime losses, which impacted businesses significantly in 2024. These technological investments are key to enhancing operational efficiency and reducing costs, with businesses adopting cloud services in 2024 reporting an average 20% decrease in operational overheads.

| Technology Area | 2024/2025 Impact/Trend | H&T Group Relevance |

|---|---|---|

| Digital Banking & Online Platforms | Global digital banking market > $1.5 trillion (2024) | Essential for 24/7 access, self-service, and meeting customer expectations. |

| E-commerce Growth | Global e-commerce sales > $6.3 trillion (2024 projection) | Drives need for enhanced online jewelry sales and seamless customer purchasing journeys. |

| Data Analytics & AI | Improved loan approval rates (5% increase for repeat customers in 2024) | Enables better risk assessment, personalized offers, and optimized inventory management. |

| Cybersecurity Threats | Increased cybercrime losses in financial services (2024) | Necessitates continuous investment in advanced security to protect data and transactions. |

| Operational Efficiency Tech | Retail efficiency gains up to 15% via tech (2024) | Streamlining processes with digital POS and AI inventory management reduces costs and improves service. |

Legal factors

H&T Group's pawnbroking operations are strictly overseen by the Financial Conduct Authority (FCA), ensuring compliance with consumer credit, responsible lending, and vulnerable customer protection regulations. The FCA's 2024/25 business plan signals a heightened focus on supervision and enforcement, particularly in sectors identified as high-risk, which directly impacts H&T Group's operational landscape.

The Consumer Credit Act 1974 is a cornerstone of H&T Group's legal obligations, dictating how they manage lending and credit agreements. Ensuring strict adherence to its stipulations regarding interest rate caps, transparent agreement terms, and consumer protection is paramount for H&T's continued operation and reputation.

Changes or new legal interpretations of the Consumer Credit Act 1974 can significantly alter H&T's business model and compliance costs. For instance, the Financial Conduct Authority (FCA), which oversees consumer credit, regularly updates its guidance, impacting how firms like H&T must disclose fees and manage customer interactions, a process that continued throughout 2024.

H&T Group, as a financial services entity, is bound by stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to combat financial crime, including money laundering and terrorist financing.

Compliance necessitates thorough customer identification and ongoing monitoring of transactions. For H&T, this is particularly vital given the cash-intensive nature of its pawnbroking and gold buying operations, which can attract illicit activities if not properly managed.

In the UK, the Financial Conduct Authority (FCA) oversees AML/KYC compliance. For instance, in 2023, the FCA reported a significant increase in suspicious activity reports (SARs) filed by regulated firms, highlighting the continuous challenge of detecting and preventing financial crime.

Data Protection and GDPR Compliance

H&T Group, operating within the UK, must meticulously comply with data protection laws, notably the General Data Protection Regulation (GDPR). This is crucial given the significant volume of personal customer data handled by the company.

Failure to ensure the secure collection, storage, and processing of this sensitive information can lead to substantial legal penalties and damage customer trust. For instance, the Information Commissioner's Office (ICO) can impose fines of up to £17.5 million or 4% of global annual turnover for serious GDPR breaches.

- GDPR Fines: Potential penalties can reach 4% of global annual turnover or £17.5 million.

- Customer Trust: Secure data handling is paramount for maintaining customer confidence and brand reputation.

- Data Breach Impact: Incidents can result in significant financial costs beyond fines, including legal fees and remediation efforts.

Retail and Consumer Protection Laws

H&T Group's retail arm, primarily dealing in jewelry and watches, operates under a stringent framework of consumer protection laws. These regulations govern everything from the accuracy of product descriptions and the quality of goods sold to the fairness of return policies. For instance, in the UK, the Consumer Rights Act 2015 mandates that goods must be of satisfactory quality, fit for purpose, and as described. Non-compliance can lead to significant penalties and damage to brand reputation.

Maintaining customer trust is paramount, and adherence to these legal requirements directly impacts H&T's ability to foster repeat business and positive word-of-mouth. The Financial Conduct Authority (FCA) also oversees aspects of consumer credit and financing offered at the point of sale, ensuring transparency and preventing predatory practices. In 2024, the FCA continued to emphasize fair treatment of customers, with ongoing scrutiny of firms' sales practices.

- Product Quality and Description: Laws like the Consumer Rights Act 2015 in the UK require goods to be as described and of satisfactory quality, directly impacting H&T's jewelry and watch sales.

- Returns and Refunds: Consumer protection legislation dictates the conditions under which customers are entitled to returns and refunds, a critical aspect of retail operations.

- Fair Trading Practices: Regulations enforced by bodies such as the FCA aim to ensure transparency in pricing, financing, and overall sales conduct to protect consumers.

H&T Group's operations are heavily shaped by financial services regulations, particularly those from the Financial Conduct Authority (FCA). The FCA's 2024/25 plan highlights increased supervision in high-risk sectors, directly affecting H&T's compliance burden.

Key legislation like the Consumer Credit Act 1974 governs H&T's lending practices, necessitating strict adherence to rules on interest rates and transparent agreements, with ongoing FCA guidance impacting disclosures and customer interactions throughout 2024.

The company must also comply with robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, critical for its cash-intensive pawnbroking and gold buying activities, especially given the FCA's 2023 report showing a rise in suspicious activity reports.

Data protection laws, including GDPR, are paramount, with potential fines from the Information Commissioner's Office (ICO) reaching up to 4% of global annual turnover or £17.5 million for breaches, underscoring the need for secure data handling to maintain customer trust.

| Regulation Area | Key Legislation/Body | Impact on H&T Group | 2024/2025 Relevance |

|---|---|---|---|

| Financial Services Oversight | Financial Conduct Authority (FCA) | Supervision of pawnbroking, consumer credit, responsible lending | Heightened focus on supervision and enforcement in high-risk sectors |

| Consumer Credit | Consumer Credit Act 1974 | Governs lending, interest rates, transparent agreements | Ongoing updates to guidance impacting disclosures and customer interactions |

| Financial Crime Prevention | AML/KYC Regulations | Mandates customer identification and transaction monitoring | Crucial for cash-intensive operations; FCA noted increased SARs in 2023 |

| Data Protection | GDPR / Information Commissioner's Office (ICO) | Requires secure data handling, potential fines for breaches | Fines up to 4% global turnover or £17.5 million; vital for customer trust |

Environmental factors

The jewelry sector is under growing pressure to ensure precious metals and gemstones are sourced ethically. For H&T Group, a retailer dealing in both new and pre-owned pieces, this translates to a direct influence from consumers who increasingly demand supply chain transparency, fair labor conditions, and reduced environmental footprints. This growing preference for sustainable jewelry directly shapes how H&T approaches its sourcing strategies.

The environmental toll of traditional gold mining, often involving significant land disturbance and chemical use, is increasingly scrutinized. This makes the sustainability of sourcing practices a key concern for businesses like H&T Group.

H&T Group's focus on gold buying and selling presents a direct opportunity to champion the circular economy. By actively promoting the recycling and reuse of gold, the company can mitigate the environmental burden associated with new extraction.

Embracing recycled gold aligns with global sustainability objectives and appeals to a growing segment of environmentally conscious consumers and investors. For instance, the World Gold Council reported in 2023 that recycled gold accounted for approximately 12% of the total global gold supply, highlighting the market's potential.

H&T Group's extensive network of over 250 high street stores presents a significant environmental consideration regarding energy consumption and carbon footprint. The operation of these physical locations, including lighting, heating, and cooling, directly contributes to their environmental impact.

In 2023, H&T Group reported a commitment to reducing its environmental impact, though specific figures for store energy consumption and carbon footprint were not detailed in their public sustainability reports. However, the company is exploring initiatives such as LED lighting upgrades and improved insulation to enhance energy efficiency across its retail footprint.

Adopting renewable energy sources for its stores and implementing robust waste reduction programs are key strategies H&T is considering to improve its sustainability profile. Such measures not only align with growing environmental awareness but also offer potential long-term cost savings for the business.

Waste Management and Recycling Practices

H&T Group's waste management, especially from pawnbroking and retail, presents an environmental consideration. This includes handling precious metals and other discarded items responsibly.

Effective recycling programs and waste minimization efforts are crucial for showcasing H&T's commitment to environmental stewardship. For instance, in 2023, the UK generated approximately 227.1 million tonnes of total waste, highlighting the broader context of waste reduction efforts companies are expected to engage in.

H&T Group's approach to managing waste, particularly hazardous materials like those potentially found in electronic items or batteries from retail, requires adherence to strict environmental regulations. The company's operational footprint necessitates robust waste segregation and disposal protocols.

- Waste Stream Management: H&T must manage diverse waste streams from retail, including packaging and unsold goods, alongside specialized waste from pawnbroking, such as precious metal scrap.

- Recycling Initiatives: Implementing and expanding recycling programs for materials like paper, plastics, and metals is key to reducing landfill contributions and demonstrating corporate responsibility.

- Regulatory Compliance: Adherence to evolving waste disposal and recycling regulations, such as those outlined by the Environment Agency in the UK, is paramount to avoid penalties and maintain operational integrity.

- Circular Economy Principles: Exploring opportunities to incorporate circular economy principles, such as refurbishing or reselling certain items, can further minimize waste and create value.

Consumer Demand for Sustainable Products and Practices

A significant and growing segment of consumers is actively seeking businesses that demonstrate genuine environmental responsibility in their operations and product sourcing. This trend is particularly pronounced in sectors like retail, where purchasing decisions are increasingly influenced by ethical considerations.

H&T Group's existing commitment to sustainable practices, especially within its jewelry retail and gold buying operations, can significantly enhance its brand image. By highlighting these efforts, the company can better appeal to environmentally conscious customers, fostering brand loyalty and contributing to long-term business resilience in a market increasingly prioritizing sustainability.

- Growing Consumer Preference: Surveys in late 2024 indicated that over 60% of consumers consider sustainability when making purchasing decisions for apparel and accessories.

- Brand Differentiation: Companies with demonstrable eco-friendly initiatives, such as responsible sourcing of precious metals, often see a competitive advantage.

- Impact on Sales: A strong sustainability profile can translate into increased sales, with some studies showing a 10-15% uplift for brands perceived as environmentally friendly.

The environmental impact of sourcing precious metals and the operational footprint of H&T Group's extensive store network are key environmental considerations. The company is actively exploring initiatives like LED lighting upgrades and improved insulation to enhance energy efficiency across its retail locations, aiming to reduce its carbon footprint.

H&T Group's commitment to the circular economy through gold recycling is a significant environmental strategy. This approach directly addresses the environmental toll of traditional gold mining, which often involves substantial land disturbance and chemical use, aligning with growing consumer demand for sustainable practices.

Effective waste management, particularly concerning precious metal scrap and items from pawnbroking, is crucial. H&T Group must adhere to strict environmental regulations for waste disposal, including hazardous materials, and is exploring robust waste segregation and disposal protocols to enhance its sustainability profile.

Consumer demand for ethically and sustainably sourced products is a major environmental driver. By emphasizing its efforts in recycled gold and responsible sourcing, H&T Group can enhance its brand image and appeal to the growing segment of environmentally conscious consumers, a trend supported by data showing over 60% of consumers consider sustainability in purchasing decisions as of late 2024.

| Environmental Factor | H&T Group Relevance | Data/Trend (2023-2025) | Action/Opportunity |

|---|---|---|---|

| Precious Metal Sourcing | Ethical sourcing pressure | Recycled gold accounted for ~12% of global supply (2023). | Promote recycled gold, enhance supply chain transparency. |

| Operational Energy Use | 250+ high street stores | Commitment to reducing impact (2023), exploring LED upgrades. | Invest in energy efficiency, explore renewable energy. |

| Waste Management | Retail and pawnbroking waste streams | UK generated 227.1 million tonnes total waste (2023). | Strengthen recycling, waste minimization, and regulatory compliance. |

| Consumer Environmental Awareness | Growing demand for sustainable brands | >60% consumers consider sustainability in purchases (late 2024). | Leverage sustainability efforts for brand differentiation and sales uplift. |

PESTLE Analysis Data Sources

Our H&T Group PESTLE Analysis is meticulously constructed using data from reputable sources such as government economic reports, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental influences.