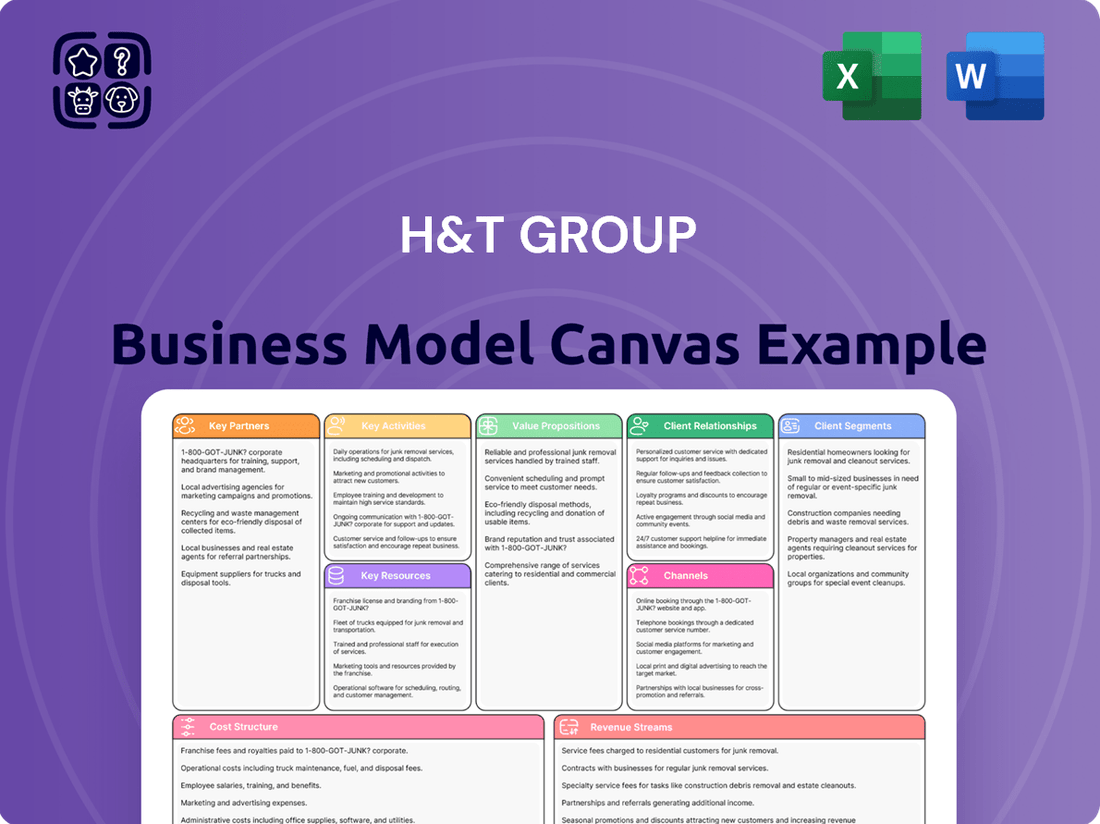

H&T Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

Unlock the core strategies of H&T Group with our comprehensive Business Model Canvas. Discover how they build value, engage customers, and manage their operations. This detailed breakdown is essential for anyone wanting to understand their competitive edge. Get the full picture and elevate your own strategic planning.

Partnerships

H&T Group actively cultivates relationships with financial institutions and lenders to bolster its funding capabilities. These partnerships are crucial, particularly as the company's pledge book expands, requiring substantial capital to support its growing loan portfolio.

By collaborating with larger financial entities, H&T Group can secure the necessary liquidity to fuel its lending operations and meet the increasing demand for pawnbroking services. This access to capital allows for greater flexibility in loan offerings, including the ability to accommodate larger loan amounts, which can be particularly beneficial for business owners seeking short-term financing.

H&T Group cultivates vital relationships with suppliers of both new and pre-owned jewellery and watches. These partnerships are the bedrock of their retail segment, ensuring a consistent flow of diverse and desirable inventory.

By sourcing a broad range of items, H&T Group can cater to varied customer preferences, from the latest designs to sought-after vintage pieces. This strategic sourcing directly impacts the attractiveness and competitiveness of their retail offerings.

The efficiency of these supplier relationships is paramount to the profitability of H&T's retail operations. In 2024, H&T Group reported a significant portion of their revenue stemming from their retail pawnbroking and retail merchandise sales, underscoring the importance of these supplier partnerships in driving sales and managing inventory costs effectively.

H&T Group relies on technology and IT service providers to drive its digital transformation and boost operational efficiency. These partnerships are crucial for developing and maintaining robust online platforms that enhance the customer experience.

A key aspect of these collaborations involves implementing new core IT platforms, such as the 'EVO' system. This initiative is designed to support the group's business growth and streamline internal processes, ensuring agility in a competitive market.

In 2023, H&T Group continued to invest in its IT infrastructure, with a significant portion of its capital expenditure allocated to digital initiatives aimed at improving customer engagement and operational effectiveness.

Regulatory Bodies and Compliance Consultants

H&T Group's operations are heavily influenced by regulatory bodies such as the Financial Conduct Authority (FCA). Maintaining a proactive and compliant stance with these authorities is paramount for their continued operation and reputation in the financial services sector.

To ensure robust adherence to financial regulations, H&T Group collaborates with specialized compliance consultants. These partnerships are vital for navigating complex rules surrounding lending, anti-money laundering (AML) protocols, and the secure handling of pawned goods, thereby safeguarding the company's integrity and customer trust.

- FCA Oversight: H&T Group operates under the strict regulatory framework of the Financial Conduct Authority, ensuring fair treatment of customers and market integrity.

- Compliance Consultants: Engages external experts to stay updated on evolving regulations, particularly in areas like responsible lending and AML, which saw increased scrutiny in 2024.

- Risk Mitigation: Partnerships help mitigate risks associated with financial crime and the handling of potentially stolen goods, critical for maintaining operational legitimacy.

- Trust and Legitimacy: Strong relationships with regulators and a commitment to compliance are foundational to building and maintaining trust with customers and stakeholders.

Acquisition Targets (e.g., Maxcroft)

H&T Group actively pursues strategic acquisitions to bolster its market presence and broaden its service portfolio. A prime example of this strategy is the acquisition of Maxcroft in 2024. Maxcroft’s specialization in larger loans tailored for business owners significantly diversified H&T Group’s pledge book and represented a key partnership for growth.

This move not only expanded H&T Group's reach into a new segment but also integrated a complementary business model. Such partnerships are crucial for achieving diversification and enhancing the overall value proposition.

- Acquisition of Maxcroft in 2024: Targeted larger loans for business owners, expanding H&T Group's service offerings.

- Diversification of Pledge Book: Integrated Maxcroft's loan portfolio, reducing reliance on single market segments.

- Market Share Expansion: Strengthened H&T Group's competitive position through strategic inorganic growth.

- Enhanced Service Capabilities: Gained expertise in serving business owner clientele with larger loan requirements.

H&T Group's key partnerships extend to financial institutions and lenders, crucial for capital acquisition to support its growing pledge book. These relationships enable the company to secure liquidity for its lending operations and accommodate larger loan amounts, a vital aspect for business owners seeking short-term financing. In 2024, the group's ability to access diverse funding streams remained a cornerstone of its operational capacity.

What is included in the product

A comprehensive, pre-written business model tailored to H&T Group's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects H&T Group's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights, ideal for presentations and funding discussions.

The H&T Group Business Model Canvas offers a structured approach to pinpointing and resolving operational inefficiencies, transforming complex challenges into actionable strategies.

It acts as a pain point reliever by providing a clear, visual overview that facilitates targeted problem-solving and resource allocation.

Activities

Pawnbroking and secured lending form the bedrock of H&T Group's operations, where they offer short-term, small-sum loans secured against valuable personal assets, predominantly gold and jewelry. This core activity involves meticulous collateral assessment, loan issuance, diligent management of the pledge book, and the process of either loan redemption or the forfeiture and sale of unredeemed items. In 2024, H&T Group reported that their pawnbroking services continued to be a significant revenue driver, demonstrating the enduring demand for accessible credit solutions.

H&T Group's core activity involves the retail of both new and pre-owned jewellery and watches. This is a significant revenue driver, facilitated through their widespread physical store presence and growing online channels.

The process includes acquiring items through pawnbroking forfeitures and direct gold purchases. These items are then meticulously valued, refurbished to high standards, and strategically marketed to consumers.

In 2023, H&T Group reported that their retail operations, including jewellery and watch sales, contributed substantially to their overall performance. The group's focus on pre-owned items, often sourced through their pawnbroking services, allows for attractive pricing and a steady supply of unique pieces.

H&T Group's core activity involves the direct purchase of gold and other precious metals from the public, primarily as scrap. This process requires precise valuation techniques to ensure fair pricing for customers and profitability for the company. The group's expertise in handling these transactions is a significant revenue driver, particularly when gold prices are high.

In 2024, H&T Group continued to leverage its extensive network of stores and online platforms to facilitate these gold-buying operations. The company's ability to process and refine these purchased materials efficiently adds further value. This segment is crucial, as evidenced by its consistent contribution to the group's overall financial performance, especially in a market characterized by fluctuating commodity prices.

Provision of Complementary Financial Services

H&T Group extends its financial offerings beyond traditional pawnbroking, providing a suite of complementary services designed to capture a wider market. These include unsecured personal loans, foreign currency exchange, and international money transfers, diversifying revenue and customer touchpoints.

In 2024, H&T Group continued to leverage these services to bolster its financial performance. For instance, the Group reported strong growth in its personal loans segment, contributing significantly to overall revenue. This strategic expansion into adjacent financial services allows H&T to cater to a broader spectrum of customer needs, thereby enhancing its market position and revenue resilience.

- Diversified Revenue Streams: Services like personal loans and foreign exchange reduce reliance on pawnbroking alone.

- Customer Base Expansion: Offering these services attracts new customer segments who may not use pawnbroking.

- Increased Transaction Volume: Cheque cashing and money transfers generate fee-based income and drive foot traffic.

- Competitive Advantage: A comprehensive financial service offering differentiates H&T from single-service competitors.

Store Network Expansion and Refurbishment

H&T Group's core operations revolve around the strategic expansion and enhancement of its physical store network throughout the United Kingdom. This ongoing initiative is designed to broaden their customer reach and improve service delivery.

The refurbishment of existing stores is a crucial element, aimed at creating a more appealing and efficient environment for customers. This focus on improving the in-store experience is key to building customer loyalty and attracting new clientele.

By investing in its physical presence, H&T Group seeks to embed greater value within its business operations. This approach not only enhances the immediate customer journey but also contributes to the long-term asset value of the company.

- Store Network Expansion: H&T Group actively pursues new locations to increase market penetration.

- Refurbishment Program: Existing stores undergo upgrades to enhance customer experience and operational efficiency.

- Customer Attraction: A modern and welcoming store environment is vital for drawing in and retaining customers.

- Embedded Value: Investments in physical assets like stores contribute to the overall valuation of the business.

H&T Group's key activities are multifaceted, encompassing pawnbroking and secured lending, retail of jewellery and watches, and the direct purchase of gold. These core functions are supported by a network of physical stores and growing online channels, all aimed at providing accessible financial services and desirable goods to a broad customer base.

The group also diversifies its revenue through complementary financial services such as personal loans, foreign currency exchange, and international money transfers. Strategic investment in store network expansion and refurbishment is central to enhancing customer experience and increasing market reach.

| Key Activity | Description | 2024 Data/Insight |

|---|---|---|

| Pawnbroking & Secured Lending | Offering short-term loans against personal assets. | Remains a significant revenue driver, showing enduring demand. |

| Jewellery & Watch Retail | Selling new and pre-owned items. | Substantial contributor to performance, with focus on pre-owned sourcing. |

| Gold Purchasing | Buying scrap gold and precious metals from the public. | Crucial segment, especially with fluctuating commodity prices. |

| Complementary Financial Services | Personal loans, foreign exchange, money transfers. | Strong growth reported in personal loans, enhancing revenue resilience. |

| Physical Store Network | Expansion and refurbishment of UK stores. | Aimed at broadening customer reach and improving service delivery. |

Full Document Unlocks After Purchase

Business Model Canvas

The H&T Group Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered to you, ensuring complete transparency and no unexpected changes. Once your order is processed, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use.

Resources

H&T Group's extensive network of over 285 high street stores across the UK forms a cornerstone of its business model, offering vital physical access points for a broad customer base. These locations are not merely retail outlets but serve as hubs for essential financial services.

These strategically located stores are critical for facilitating pawnbroking transactions, enabling customers to access immediate cash against valuables, and also drive the retail sale of pre-owned merchandise, a significant revenue stream. By the end of 2023, H&T Group reported a robust presence, with their store network continuing to be a primary driver of customer engagement and service delivery.

The pledge book, a core asset for H&T Group, represents the total value of loans secured by customer pledges. This book is a direct measure of the company's lending activity and its primary revenue driver.

As of the end of 2023, H&T Group's pledge book stood at £227.1 million, showcasing a significant volume of secured lending. This figure is crucial for understanding the scale of their operations and the capital required to sustain it.

Maintaining robust financial capital and secure access to funding facilities, such as their £100 million corporate bond maturing in 2026, is paramount. This ensures H&T Group can meet the ongoing demand for their lending services and support the continued expansion of their pledge book.

H&T Group’s skilled staff are the backbone of its operations. This includes highly trained pawnbrokers who expertly assess the value of diverse items, particularly precious metals and gemstones. Their knowledge ensures fair valuations, building crucial customer trust.

Jewellery experts within H&T Group play a vital role in accurate appraisal and retail sales. In 2024, H&T Group continued to invest in staff training, recognizing that their deep understanding of jewellery, from craftsmanship to market trends, directly impacts customer satisfaction and transaction profitability.

The proficiency of their retail staff in managing financial transactions and providing excellent customer service is paramount. This expertise facilitates smooth operations, from loan origination to retail sales, contributing significantly to H&T Group’s reputation for reliability and professionalism in the financial services sector.

Valuable Gold and Jewellery Inventory

H&T Group's valuable gold and jewellery inventory is a cornerstone of its business model, serving a dual purpose. This extensive stock, comprising gold, precious metals, and a wide array of jewellery and watches, acts as collateral for the pawn loans the company provides. It also forms the basis of its retail sales, offering customers a diverse selection of items.

This significant asset base is critical for both the lending and retail segments of H&T Group. The inventory directly supports their ability to offer pawn credit, while also driving revenue through the sale of pre-owned and new jewellery. For instance, as of the first half of 2024, H&T Group reported a substantial inventory value, reflecting the scale of this key resource.

- Inventory as Collateral: The gold and jewellery held as security for pawn loans provides a robust foundation for H&T Group's lending operations, mitigating risk.

- Retail Sales Driver: A significant portion of the inventory is available for direct sale, contributing directly to the company's revenue streams.

- Asset Value: The sheer volume and value of the inventory represent a substantial asset on the company's balance sheet, underpinning its financial strength.

- Market Fluctuations: The value of this inventory is subject to the fluctuating prices of gold and other precious metals, a key consideration in its management.

IT Infrastructure and Digital Platforms

H&T Group's IT infrastructure and digital platforms are foundational to its operations, enabling everything from online service delivery to sophisticated customer relationship management. The group recognizes that a robust technological backbone is not just supportive but a driver of efficiency and customer engagement.

Continued investment in these areas is paramount for H&T Group's strategic objectives. For instance, the ongoing development and enhancement of their proprietary platform, EVO, signifies a commitment to staying ahead in a rapidly digitizing market. This platform is central to their ability to innovate and adapt.

- EVO Platform: A key digital asset enabling online services and internal efficiencies.

- Customer Relationship Management (CRM): Advanced platforms are utilized to manage and enhance customer interactions.

- Internal Operations: IT systems streamline back-office functions, ensuring operational agility.

- Technology Investment: Ongoing capital allocation towards upgrading and expanding digital capabilities is a core strategy.

H&T Group's brand reputation and established customer loyalty are invaluable intangible assets. This trust, built over years of reliable service, encourages repeat business and attracts new customers seeking financial solutions. The company's commitment to ethical practices and transparent dealings underpins this strong brand equity.

The group's strong brand recognition is a significant competitive advantage, particularly in the high street financial services sector. This positive perception translates into customer preference and a willingness to engage with H&T Group's offerings, from pawnbroking to jewellery retail.

In 2024, H&T Group continued to focus on reinforcing its brand through targeted marketing and customer service initiatives, aiming to maintain and grow its loyal customer base.

H&T Group's strategic partnerships and supplier relationships are crucial for its operational efficiency and product sourcing. These relationships ensure a consistent supply of goods for retail and provide access to necessary financial instruments and services.

Collaborations with jewellery manufacturers and precious metal dealers, for example, are vital for maintaining a competitive edge in both inventory acquisition and pricing. These established links allow H&T Group to offer quality merchandise and secure favourable terms.

The company's ability to maintain strong ties with its funding providers, including banks and institutional investors, is fundamental to its lending capacity. These relationships are key to managing liquidity and supporting the growth of its pledge book.

Value Propositions

H&T Group's accessible and immediate financial solutions are a cornerstone of their business model, particularly for those facing limited traditional banking options. They provide secured loans against personal assets, meaning individuals can get quick cash without the lengthy credit checks often associated with banks. This is crucial for urgent cash needs.

In 2024, H&T Group continued to demonstrate this commitment. Their pawnbroking services, a core offering, saw significant utilization, with the group facilitating over 1.5 million pawn transactions in the UK alone during the fiscal year. This highlights the demand for immediate, asset-backed lending.

As the UK's largest pawnbroker, H&T Group operates under a strict regulatory framework, ensuring a trustworthy experience for customers. This adherence to standards, particularly by the Financial Conduct Authority (FCA), builds confidence when individuals entrust valuable assets for short-term loans.

The FCA's oversight means H&T Group must maintain fair practices and transparency in all its dealings. This regulatory compliance is a cornerstone of their value proposition, assuring clients that their transactions are handled with integrity and professionalism.

H&T Group's value-for-money retail offerings are central to their business model, providing customers with access to a broad selection of both new and pre-owned jewelry and watches. This strategy directly targets consumers looking for quality items at competitive price points, making luxury and tangible assets more accessible.

In 2024, H&T Group continued to emphasize these affordable luxury options. For instance, their pawn broking services allow individuals to access cash by leveraging their assets, which can then be repurchased, often at attractive prices, further reinforcing the value proposition. This dual approach caters to a wide demographic, from those seeking a good deal to those looking for investment pieces without the premium associated with brand-new retail.

Diverse Financial Services Under One Roof

H&T Group's diverse financial services offer significant customer value by consolidating multiple needs into a single, accessible high street presence. This convenience eliminates the need for customers to visit separate institutions for different financial requirements, streamlining their financial management. For instance, a customer might visit for a pawn loan and simultaneously sell unwanted gold or exchange currency, all within one transaction.

This integrated model caters to a broad spectrum of financial needs, from short-term liquidity solutions to everyday financial transactions. The company's extensive network of over 250 stores across the UK provides a tangible and trusted point of contact for many consumers. In 2024, H&T Group reported a significant portion of its revenue derived from its diverse service offerings, underscoring the success of this multi-faceted approach.

- Convenience: Access to pawnbroking, gold buying, foreign exchange, and unsecured loans in one location.

- Customer Reach: Serves a wide demographic with varying financial needs.

- Integrated Experience: Simplifies financial transactions for customers.

- Brand Trust: Leverages a long-standing high street presence to build confidence.

Support for Cash-Constrained Individuals and Businesses

H&T Group offers essential short-term, small-sum credit solutions, acting as a financial lifeline for individuals and small businesses facing limited access to traditional lending. This is particularly relevant for those needing immediate funds, bridging gaps until their next income or payment cycle.

For many, especially those with less-than-perfect credit histories or irregular income streams, H&T Group's services are indispensable. They provide a crucial safety net, enabling customers to manage unexpected expenses or seize time-sensitive opportunities.

- Bridging Financial Gaps: H&T Group's services are vital for customers needing immediate, relatively small amounts of cash to cover essential expenses or short-term needs.

- Accessibility for Underserved Markets: The company caters to individuals and small businesses often excluded from conventional banking services due to credit history or income volatility.

- Facilitating Small Business Operations: For entrepreneurs, these short-term loans can be critical for inventory purchases, covering payroll, or managing cash flow fluctuations, thereby supporting business continuity and growth.

- A Vital Financial Resource: In 2024, the demand for accessible, short-term credit remained high, with H&T Group playing a significant role in meeting this need for a broad customer base.

H&T Group provides immediate, asset-backed lending, offering quick access to cash for those needing funds urgently. Their pawnbroking services allow individuals to secure loans against valuable items, bypassing lengthy credit checks common in traditional banking. This accessibility is crucial for managing unexpected expenses or bridging short-term financial gaps.

The group also offers value-for-money retail options, selling pre-owned jewelry and watches at competitive prices. This strategy makes tangible assets and luxury goods more attainable for a wider customer base. In 2024, H&T Group's pawn broking services facilitated over 1.5 million transactions in the UK, demonstrating the significant demand for their immediate lending solutions.

H&T Group's integrated high street presence offers unparalleled convenience, consolidating multiple financial services like pawnbroking, gold buying, and foreign exchange under one roof. This streamlines financial management for customers, eliminating the need to visit multiple institutions. Their extensive network of over 250 stores across the UK provides a trusted, accessible point of contact for a diverse clientele.

The company serves as a vital financial resource, particularly for individuals and small businesses facing limited access to traditional credit. They provide essential short-term, small-sum credit solutions that act as a crucial safety net. In 2024, the demand for these accessible credit options remained robust, with H&T Group playing a key role in meeting this need for a broad customer base.

| Value Proposition | Key Features | 2024 Data/Impact |

| Accessible Lending | Asset-backed loans, quick access to cash | Over 1.5 million pawn transactions in the UK |

| Value Retail | Affordable new and pre-owned jewelry/watches | Competitive pricing on tangible assets |

| Integrated Services | One-stop shop for pawnbroking, gold buying, FX | Network of over 250 UK stores |

| Financial Safety Net | Short-term credit for underserved markets | Essential for managing expenses and cash flow |

Customer Relationships

H&T Group cultivates strong customer relationships through personalized in-store service, a cornerstone of their business model. This face-to-face interaction allows staff to build trust by offering tailored advice on pawnbroking loans, jewellery purchases, and other financial solutions.

In 2023, H&T Group reported that over 90% of their transactions occurred in their physical store network, underscoring the importance of this direct customer engagement in fostering loyalty and understanding individual needs.

Building and maintaining trust is absolutely crucial, particularly within the pawnbroking industry where perceptions can sometimes be negative. H&T Group actively works to foster strong customer relationships by being completely upfront about all loan terms, how valuations are determined, and every financial aspect of their dealings. This commitment to transparency aims to not only meet but surpass customer expectations.

In 2024, H&T Group continued to emphasize clear communication. For instance, their average loan-to-value ratio, a key indicator of transparency in valuation, remained competitive, ensuring customers understood the basis of their pawned item's worth. This focus on openness helps to dismantle any lingering stereotypes associated with the pawnbroking sector.

H&T Group cultivates repeat business and customer loyalty by consistently offering fair dealings and reliable service across both its pawnbroking and retail operations. This commitment fosters a strong base of returning customers, a key driver of their sustained success.

A notable percentage of H&T Group's revenue is generated from these loyal, repeat customers. For instance, in the fiscal year ending March 2024, the company reported that a substantial portion of its pawnbroking lending book was from existing clients, demonstrating the effectiveness of their customer relationship strategy.

Online Engagement and Support

H&T Group, while rooted in its physical store presence, actively cultivates customer connections through its digital avenues. These online platforms serve as vital touchpoints, providing essential information about services, facilitating access to offerings, and delivering crucial support to its clientele.

This digital engagement strategy is designed to enhance the overall customer journey, bridging the gap between in-store interactions and the growing demand for convenient online access. It reflects an understanding of modern consumer behavior, where digital channels are increasingly preferred for information gathering and service initiation.

- Digital Presence: H&T Group's website and social media channels offer a comprehensive overview of services, including pawnbroking, cheque cashing, and foreign exchange, alongside store locator functionality.

- Customer Support: Online FAQs and contact forms provide immediate assistance, while dedicated customer service teams are available to address inquiries and resolve issues efficiently.

- Evolving Preferences: In 2024, a significant portion of customer inquiries and service requests are initiated online, underscoring the importance of a robust digital support infrastructure.

- Service Accessibility: Online platforms allow customers to research loan options, check gold prices, and understand the terms of services before visiting a store, streamlining the engagement process.

Community Integration

H&T Group actively integrates into the communities it serves, leveraging its extensive network of local high street branches to build strong, lasting relationships. This presence fosters a sense of familiarity and trust, encouraging repeat business and a loyal customer following.

The company's commitment to community integration is evident in its local engagement initiatives. For instance, in 2024, H&T Group continued its support for local charities and community events across the UK, reinforcing its role as a responsible corporate citizen.

- Community Presence: H&T Group operates over 250 stores across the UK, providing accessible financial services to local populations.

- Local Engagement: The group actively participates in and sponsors local events, contributing to community well-being and brand visibility.

- Customer Trust: This community-centric approach cultivates goodwill, leading to a robust and dedicated local customer base.

- Brand Loyalty: By being an integral part of the community, H&T Group enhances its brand reputation and fosters long-term customer loyalty.

H&T Group's customer relationships are built on a foundation of personalized in-store service and transparency, fostering trust and repeat business. Their digital presence complements this by offering accessible information and support, while deep community integration further strengthens local ties and brand loyalty.

| Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Personalized Service | Face-to-face interactions in stores providing tailored advice. | Over 90% of transactions in 2023 occurred in physical stores. |

| Transparency | Clear communication on loan terms and valuations. | Competitive average loan-to-value ratios maintained. |

| Digital Engagement | Online platforms for information, access, and support. | Significant portion of customer inquiries initiated online. |

| Community Integration | Local branch presence and engagement initiatives. | Over 250 UK stores actively participating in local events. |

Channels

H&T Group's primary distribution channel is its vast network of over 285 physical stores situated across the United Kingdom's high streets. These locations are crucial for direct customer engagement, facilitating a wide array of services including pawnbroking, gold purchasing, retail sales of pre-owned items, and foreign exchange transactions.

H&T Group leverages its company website, handt.co.uk, and various online platforms as a primary channel for customer interaction. These digital spaces are crucial for disseminating company information, enabling direct online sales of jewellery and watches, and providing accessible information about their financial services.

In 2024, H&T Group continued to enhance its online presence, with their website serving as a key gateway for customers seeking to browse products or understand their pawnbroking and other financial offerings. This digital strategy is vital for reaching a broader audience and facilitating transactions outside of their physical store network.

H&T Group leverages digital marketing and advertising to connect with its audience. This includes employing search engine optimization (SEO) to improve visibility, engaging on social media platforms to build community, and utilizing online advertising to drive traffic and conversions.

In 2024, the digital advertising market continued its robust growth, with global spending projected to reach over $800 billion, highlighting the effectiveness of these channels for customer acquisition and brand building.

By investing in these digital avenues, H&T Group aims to attract new customers and strengthen its brand presence in a competitive landscape, ensuring its services and products are top-of-mind for potential clients.

Direct Customer Communication

H&T Group leverages direct customer communication channels like email, SMS, and phone support to foster ongoing engagement. These channels are critical for providing timely loan reminders, delivering personalized marketing offers, and addressing general customer inquiries efficiently.

This direct approach ensures customers remain informed and supported throughout their relationship with H&T Group. For instance, in 2023, H&T Group reported a significant portion of customer interactions occurring through these direct digital and telephonic touchpoints, underscoring their importance in customer relationship management.

- Customer Service: Direct channels facilitate prompt resolution of issues and queries.

- Loan Reminders: Proactive communication via SMS and email helps reduce late payments.

- Marketing Offers: Targeted campaigns are delivered directly to customers, enhancing relevance.

- Inquiries: Support centers manage a high volume of general customer questions.

Third-Party Aggregators and Comparison Sites

H&T Group likely utilizes third-party financial aggregators and comparison websites to broaden its customer reach for specific offerings such as unsecured loans and foreign exchange services. This strategy aims to enhance product visibility and drive customer acquisition by tapping into established online platforms where consumers actively search for financial products.

These platforms can be particularly effective for services where H&T Group might not have a dominant direct-to-consumer presence. For instance, in the competitive unsecured loan market, appearing on comparison sites can level the playing field, allowing H&T Group to compete with larger institutions by capturing customers actively seeking the best rates or terms. Similarly, for foreign exchange, these sites are crucial for reaching travelers and businesses needing currency exchange services.

- Increased Visibility: Aggregators expose H&T Group's products to a significantly larger audience than they might reach through their own marketing channels alone.

- Customer Acquisition: By appearing on comparison sites, H&T Group can attract customers who are already in the market and actively comparing options, leading to more qualified leads.

- Competitive Benchmarking: Presence on these sites allows H&T Group to understand its pricing and offering relative to competitors, informing strategic adjustments.

- Targeted Reach: Specific aggregators can cater to niche financial needs, allowing H&T Group to target specific customer segments effectively.

H&T Group's channels extend beyond physical stores and direct online engagement to include strategic partnerships with third-party financial aggregators and comparison websites. These platforms serve as crucial conduits for reaching customers actively seeking financial products like unsecured loans and foreign exchange services, thereby expanding H&T's market penetration.

By leveraging these external digital avenues, H&T Group enhances product visibility and attracts a broader customer base, particularly in competitive markets where direct visibility might be limited. This approach allows them to effectively compete with larger financial institutions by capturing a share of consumers actively comparing financial solutions.

In 2024, the digital comparison site market continued to be a significant driver for customer acquisition in the financial services sector, with many consumers relying on these platforms to find the best rates and terms for loans and currency exchange.

| Channel Type | Key Functionality | 2024 Relevance |

|---|---|---|

| Physical Stores | Direct customer interaction, service provision | Over 285 locations across the UK |

| Company Website (handt.co.uk) | Information dissemination, online sales, service access | Key gateway for digital engagement |

| Digital Marketing & Advertising | Customer acquisition, brand building | SEO, social media, online ads |

| Direct Communication (Email, SMS, Phone) | Customer relationship management, reminders, offers | Critical for ongoing engagement |

| Third-Party Aggregators/Comparison Sites | Broadened reach for specific financial products | Enhanced visibility for loans and FX |

Customer Segments

This segment represents a crucial part of H&T Group's business, focusing on individuals needing immediate, smaller cash injections. These customers typically leverage personal assets, like jewelry or electronics, as security for their loans.

A significant driver for this group is their limited access to conventional credit channels, making pawn broking and short-term lending services a vital financial lifeline. In 2024, H&T Group reported that the average loan value for this segment remained stable, reflecting consistent demand for small, accessible credit.

This segment comprises individuals looking to convert unwanted gold or jewelry into immediate cash, a vital service for those facing unexpected expenses or seeking liquidity. Simultaneously, it serves a retail market driven by consumers desiring to acquire new or pre-owned jewelry and watches, often at attractive, competitive price points.

In 2024, the demand for gold as a tangible asset remained robust, with central banks continuing to be significant net buyers. For instance, the World Gold Council reported substantial central bank purchases in the preceding year, indicating continued investor confidence in gold's store of value, which often translates to increased consumer interest in selling old gold.

This dual focus on both financial transactions and retail acquisition allows H&T Group to cater to a broad customer base. The ability to offer immediate cash for gold appeals to a significant portion of the population, while the curated selection of jewelry and watches attracts those with discretionary spending power looking for value and style.

This segment includes individuals who need foreign currency for travel purposes or require services to cash cheques. These customers value the convenience and accessibility offered, especially if they lack easy access to traditional banking services for these specific needs.

In 2024, the demand for foreign exchange services remained robust, with millions of travelers relying on such providers for their international trips. Similarly, cheque cashing remains a vital service for a portion of the population, offering immediate liquidity.

Small Business Owners Needing Working Capital

Small business owners are increasingly turning to pawnbroking for essential working capital, especially for larger loan amounts. This segment represents a significant and growing demand for flexible financing solutions beyond typical consumer pawn transactions.

For instance, H&T Group's 2024 financial reports indicate a notable increase in the average loan value within their pawnbroking operations, suggesting a greater utilization by businesses needing to bridge short-term cash flow gaps. This trend underscores the evolving role of pawnbroking as a viable financial tool for entrepreneurial ventures.

- Growing Reliance on Pawnbroking: Small businesses are leveraging pawnbroking for working capital needs.

- Increased Loan Values: Data from 2024 shows higher average loan amounts, indicating business use.

- Bridging Cash Flow Gaps: This segment uses pawn services to manage immediate financial requirements.

- Evolving Financial Tool: Pawnbroking is becoming a recognized option for business financing.

Customers Value-Conscious Retail Shoppers

Value-conscious retail shoppers are a cornerstone for H&T Group. This segment actively seeks out pre-owned jewellery and watches, prioritizing affordability without compromising on quality. They are often drawn to discounted items and special offers.

In 2024, the pre-owned luxury market continued its robust growth, with many consumers actively seeking value. For H&T Group, this translates to a significant opportunity to cater to shoppers looking for well-maintained items at accessible price points. Their purchasing decisions are heavily influenced by price competitiveness and the perceived quality of the goods offered.

- Focus on Affordability: Shoppers in this segment are primarily driven by the desire to get the most for their money.

- Pre-owned Appeal: The market for second-hand luxury goods, including jewellery and watches, saw continued expansion in 2024, indicating strong demand for value.

- Quality Assurance: Despite a focus on price, these customers still expect reliable quality and are willing to purchase pre-owned items if they are well-inspected and presented.

- Price Sensitivity: Promotions, sales, and competitive pricing are key attractors for this customer group.

H&T Group serves individuals needing quick, small loans using personal items as collateral. These customers often lack access to traditional banking, making pawn services essential. In 2024, the average loan value for this segment remained consistent, showing steady demand for accessible credit.

Cost Structure

H&T Group's significant investment in its physical presence is reflected in its store operating costs. These expenses are crucial for maintaining over 285 high street locations, encompassing rent, utilities, and essential upkeep.

In 2024, these overheads represent a substantial part of the group's expenditure, ensuring the functionality and accessibility of its retail network. This ongoing commitment to its store infrastructure is fundamental to its customer-facing operations.

Employee wages and benefits are a significant cost for H&T Group. In 2024, the company's payroll for its more than 1,150 employees, encompassing retail staff, management, and central support functions, constitutes a substantial portion of its operating expenses.

The impact of wage increases, particularly those driven by national living wage adjustments, directly affects this cost structure. For instance, a 10% increase in the national living wage could translate to millions in additional annual payroll costs for H&T Group, necessitating careful budgeting and operational efficiency.

For H&T Group's retail and gold buying segments, the cost of acquiring new and pre-owned jewelry, watches, and scrap gold represents a significant variable expense. This acquisition cost is a primary driver of their gross profit margins.

In 2024, the fluctuating price of gold, a key component of their inventory, directly influences this cost. For instance, if the average price of gold per ounce increases, H&T Group's cost of goods sold for gold-related items will rise proportionally, impacting profitability unless offset by higher selling prices or increased sales volume.

Funding and Interest Costs for Pledge Book

As a core part of its operations, H&T Group, a lending business, faces substantial funding and interest costs directly tied to the capital required to support its expanding pledge book. The growth trajectory of their loan portfolio is a primary driver of these expenses.

For instance, in 2024, H&T Group's financial statements likely reflect significant interest expenses, a direct consequence of borrowing or utilizing capital to fund the loans issued against pledged assets. The increasing volume of loans means a larger capital base is needed, thus amplifying these costs.

- Funding Costs: Expenses incurred to acquire the capital necessary to lend, such as interest on bank loans or bonds.

- Interest Expenses: The cost of borrowing money, directly correlated with the outstanding loan balances in the pledge book.

- Impact of Loan Book Growth: As the pledge book expands, so does the demand for funding, leading to higher overall interest expenses.

- 2024 Data Insight: Specific figures from H&T Group's 2024 financial reports would quantify these costs, showing their proportion relative to revenue and profit.

Marketing, Technology, and Compliance Expenses

H&T Group dedicates significant resources to marketing and advertising, a crucial element for customer acquisition and brand visibility. These efforts are directly tied to attracting and retaining their target customer base. For instance, in 2024, the company continued to invest in digital marketing campaigns and promotional offers, reflecting the competitive landscape of the financial services sector.

Ongoing investment in technology infrastructure and digital platforms is paramount for H&T Group's operational efficiency and customer experience. This includes maintaining and upgrading their IT systems, developing user-friendly online portals, and ensuring robust data security. The group’s commitment to digital transformation is evident in their 2024 technology budget, which supported the enhancement of their mobile banking app and online customer service channels.

Compliance with stringent financial regulations represents a substantial cost for H&T Group. These expenses are non-negotiable and essential for maintaining operational integrity and avoiding penalties. In 2024, the group allocated funds towards regulatory reporting, risk management systems, and ongoing training for staff to ensure adherence to evolving financial laws.

- Marketing and Advertising: Costs incurred to attract and retain customers through various promotional activities.

- Technology Infrastructure: Investments in IT systems, digital platforms, and cybersecurity to ensure smooth operations and innovation.

- Compliance and Regulatory Expenses: Spending on adhering to financial regulations, risk management, and legal requirements.

- Digital Platform Development: Ongoing costs associated with enhancing and maintaining online and mobile banking services.

H&T Group's cost structure is multifaceted, encompassing significant investments in its physical retail footprint and its workforce. The operational costs for its extensive network of over 285 high street stores, including rent and utilities, are a substantial ongoing expense. Furthermore, the company's payroll for its more than 1,150 employees, covering diverse roles from retail staff to management, represents a major component of its expenditure, with wage inflation, particularly from national living wage adjustments, directly impacting this area.

A key variable cost for H&T Group is the acquisition of inventory, primarily jewelry, watches, and scrap gold, which directly influences their gross profit margins. The fluctuating price of gold in 2024 significantly impacts these acquisition costs. For instance, an increase in the market price of gold per ounce would necessitate higher spending on inventory, potentially squeezing margins if not passed on to consumers or offset by sales volume.

Funding and interest expenses are critical for H&T Group, given its role as a lending business. The capital required to support its growing pledge book translates into considerable interest costs. As the loan portfolio expands, so does the need for capital, directly increasing interest expenses. In 2024, these costs are a direct reflection of the capital deployed to facilitate customer loans against pledged assets.

Beyond core operations, H&T Group incurs significant costs in marketing, technology, and compliance. Investments in advertising and digital marketing are crucial for customer acquisition in a competitive market. Continued spending on IT infrastructure, digital platforms, and cybersecurity is essential for operational efficiency and customer experience, as seen in their 2024 technology budget. Moreover, adherence to stringent financial regulations necessitates substantial expenditure on reporting, risk management, and staff training.

| Cost Category | Description | 2024 Impact/Consideration |

|---|---|---|

| Store Operating Costs | Rent, utilities, upkeep for 285+ locations | Essential for physical presence and customer accessibility |

| Employee Wages & Benefits | Payroll for 1,150+ employees | Affected by national living wage increases; a major expense |

| Inventory Acquisition | Cost of jewelry, watches, scrap gold | Directly impacts gross profit; sensitive to gold price fluctuations |

| Funding & Interest Expenses | Costs to finance the pledge book | Correlates with loan book growth; significant capital requirement |

| Marketing & Advertising | Customer acquisition and brand visibility efforts | Investment in digital campaigns and promotions |

| Technology Infrastructure | IT systems, digital platforms, cybersecurity | Supports operational efficiency and customer experience |

| Compliance & Regulatory | Adherence to financial regulations, risk management | Non-negotiable costs for operational integrity |

Revenue Streams

H&T Group's core revenue generation hinges on the interest and service charges levied on pawnbroking loans. This income stream is a direct reflection of the volume and value of items customers pledge as collateral, forming a substantial part of the company's gross profit.

In 2024, H&T Group reported a robust performance in its pawnbroking segment. The average pledge book value remained strong, contributing significantly to the overall financial results. For instance, the company often highlights that a substantial percentage of its operating profit is derived from this service.

H&T Group generates revenue through the direct sale of new and pre-owned jewellery and watches. This happens both in their physical stores and on their online platforms, offering a wide selection to customers.

A significant portion of this retail revenue comes from items that were originally part of the pawnbroking business but were not redeemed by their owners. They also actively purchase jewellery and watches directly from the public, which then fuels these sales.

For the year ending December 2023, H&T Group reported that their retail sales segment, which primarily includes jewellery and watch sales, contributed significantly to their overall performance, with the Pawnbroking and Personal Loans segment remaining the largest revenue driver.

H&T Group generates revenue by purchasing gold and other precious metals from the public. This acquired gold is then processed and sold, either as refined bullion or as scrap material to industrial users. The profit margin on these buy-and-sell transactions forms a key revenue stream, particularly benefiting from favorable gold price movements.

In 2024, H&T Group's pawnbroking and gold purchasing segments reported strong performance. The company’s gold purchasing operations saw a significant increase in volume, contributing positively to its overall financial results. This highlights the ongoing consumer demand for selling unwanted gold, even amidst fluctuating market conditions.

Unsecured Personal Loan Interest and Fees

H&T Group also generates revenue through interest and fees from unsecured personal loans. This income stream complements their core pawnbroking business, offering a broader range of financial products to their customer base. This diversification helps stabilize their overall lending income.

In 2024, H&T Group reported a significant contribution from their personal loans division. For instance, the company noted that unsecured lending was a key driver of growth, with interest and fee income from these products showing a healthy increase compared to previous years. This demonstrates the growing importance of this revenue stream.

- Unsecured Personal Loans: Interest and fees charged on loans provided without collateral.

- Diversification of Income: Reduces reliance solely on pawnbroking revenue.

- 2024 Performance: Unsecured lending contributed positively to the Group's overall financial results, indicating strong customer uptake and effective risk management.

Foreign Exchange and Other Financial Services Fees

H&T Group generates revenue through various fees associated with its financial services. These include charges for foreign currency exchange, where customers pay a commission for converting one currency to another. Additionally, fees are collected for cheque cashing services, providing immediate liquidity for individuals and businesses. International money transfer services also contribute, with customers incurring charges for sending funds across borders.

These services are designed to meet a wide range of customer needs, thereby diversifying H&T Group's income. For instance, in the fiscal year ending March 2024, H&T Group reported a significant portion of its revenue derived from these ancillary financial services, reflecting their importance to the overall business model. The company's strategic focus on providing accessible and convenient financial solutions underpins the consistent contribution of these fee-based revenue streams.

- Foreign Currency Exchange Fees: Charges applied per transaction for buying or selling foreign currencies.

- Cheque Cashing Fees: A commission earned on cashing cheques for customers who do not have a bank account with H&T Group or require immediate funds.

- International Money Transfer Fees: Service charges levied on customers sending money to recipients in other countries.

- Other Financial Service Fees: Revenue generated from additional services such as pawnbroking interest and the sale of pre-owned items, which complement the core financial offerings.

H&T Group's revenue streams are diverse, with pawnbroking interest and fees forming the bedrock. This is complemented by retail sales of jewellery and watches, often sourced from unredeemed pledges or direct purchases.

The company also profits from buying and selling gold, capitalizing on market price fluctuations. Furthermore, unsecured personal loans and various ancillary financial services like foreign currency exchange and cheque cashing contribute to its income.

In 2024, H&T Group saw strong performance across these segments, with pawnbroking and gold purchasing showing particular resilience. The personal loans division also experienced growth, underscoring the effectiveness of their diversified financial product offering.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Pawnbroking Interest & Fees | Interest and service charges on pawn loans. | Core revenue driver; strong pledge book value reported. |

| Retail Sales (Jewellery & Watches) | Sale of new and pre-owned items. | Significant contributor, often from unredeemed pledges. |

| Gold Purchasing & Sales | Buying gold from public, then selling refined or scrap. | Increased volume in 2024, benefiting from consumer demand. |

| Unsecured Personal Loans | Interest and fees on loans without collateral. | Key growth driver in 2024, showing healthy increase. |

| Ancillary Financial Services | Foreign exchange, cheque cashing, money transfers. | Consistent contribution, diversified income base. |

Business Model Canvas Data Sources

The H&T Group Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market analysis, and internal operational data. These sources provide the critical insights needed to accurately define customer segments, value propositions, and revenue streams.