H&T Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

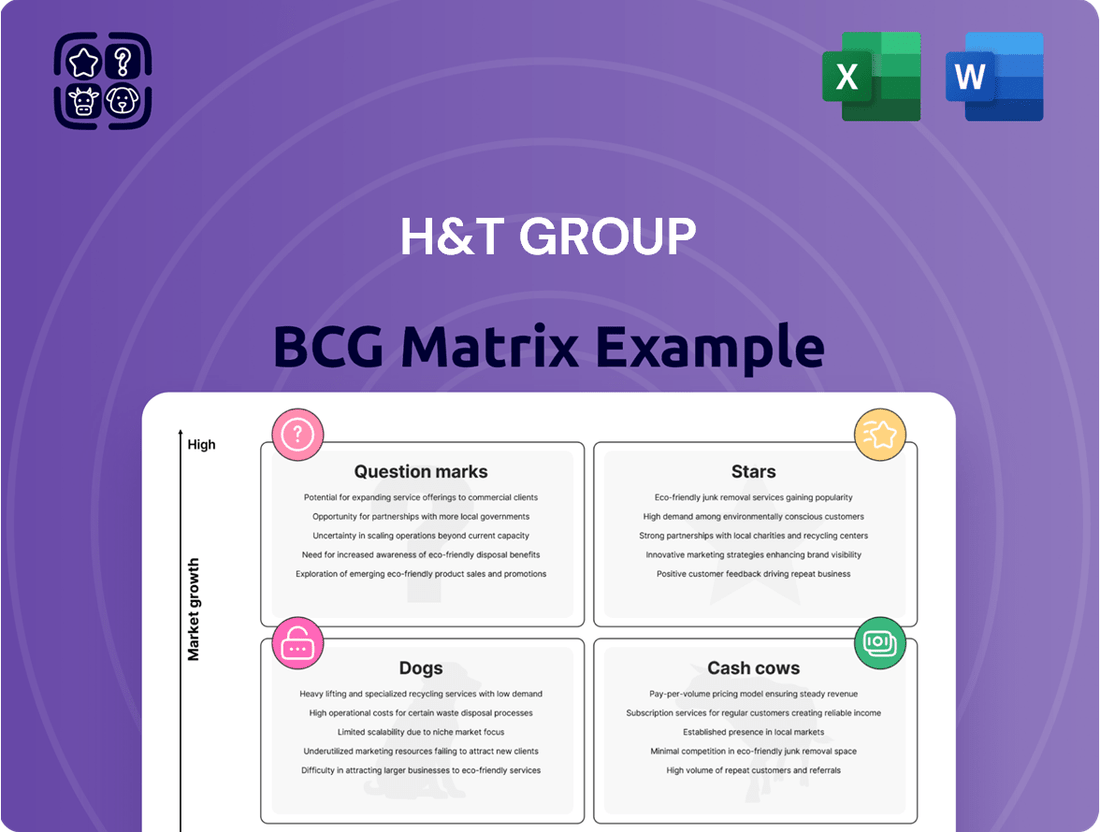

Curious about H&T Group's strategic product positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

H&T Group's core pawnbroking business is a star in its portfolio, showing impressive growth and a dominant market position. By the close of 2024, the company reported a significant 26% increase in its pledge book, reaching £127 million, and welcomed a record number of new customers.

This upward trend is fueled by a persistent demand for accessible, small-sum, short-term loans, especially as economic conditions remain challenging and regulated lending alternatives are limited. As the largest pawnbroker in the UK, H&T Group leverages its market leadership to capitalize on these opportunities, ensuring a strong base for future profitability and growth.

The retail jewellery and watch segment is a shining star for H&T Group. In 2024, sales in this area surged by an impressive 27%, reaching £61.8 million. This growth is fueled by consumers actively seeking good value and brands offering both online and in-store options.

H&T Group's strategic decision to expand its selection of new jewelry has clearly paid off. Gross profit from this segment saw a substantial 34% increase, climbing to £19.3 million. This performance highlights a strong market position within a segment that's experiencing positive consumer trends and improved profitability.

Following the Maxcroft acquisition in February 2024, H&T Group has strategically expanded its offerings to include larger pawnbroking loans, particularly for business needs. This move targets a high-growth segment of the market.

These larger secured loans, generally exceeding £5,000, are increasingly sought after by business owners for working capital and investment. By the close of 2024, this category represented 18% of H&T's total pledge book, a notable increase from 13% in 2023.

This strategic pivot allows H&T to capitalize on the growing demand for flexible, asset-backed financing, positioning the company to secure a more significant share of this specialized market.

Online Originated Sales

Online originated sales for H&T Group demonstrated robust expansion in 2024, climbing 36% to reach £13.3 million. This surge signifies a growing reliance on digital channels, with online sales now accounting for 22% of the total value, an increase from 20% in the prior year.

The launch of a new retail website in early 2024 significantly contributed to this upward trend, enhancing the customer experience and driving digital engagement. This channel is vital for H&T Group's strategy to attract a broader customer base and extend its market presence beyond traditional physical locations.

- Increased Sales Value: Online sales grew to £13.3 million in 2024, a 36% rise year-over-year.

- Growing Market Share: Online sales now constitute 22% of total sales by value, up from 20% in 2023.

- Strategic Website Launch: A new retail website, implemented in the first half of 2024, fueled this digital growth.

- Future Potential: This channel is identified as high-growth, with significant potential for further market share expansion.

Store Estate Expansion and Refurbishment

H&T Group's strategic focus on its physical store estate, including expansion and refurbishment, positions it as a strong contender in the traditional retail lending and second-hand goods market. By the close of 2024, the company aimed to operate 285 stores, having completed 48 refurbishments. This investment is crucial for maintaining and growing its market share in the brick-and-mortar sector.

This ongoing investment in its store network is not just about physical presence; it's about building long-term value and enhancing the earning capacity across H&T's diverse product and service offerings. The expanding footprint directly supports increased customer access and engagement, vital for core services like pawnbroking and retail sales.

- Store Network Growth: H&T Group's objective to reach 285 stores by the end of 2024 demonstrates a commitment to physical market penetration.

- Refurbishment Program: The completion of 48 store refurbishments in 2024 indicates an effort to modernize and improve the customer experience.

- Embedded Value Creation: Investments in the store estate are designed to build significant embedded value and underpin future profitability.

- Market Share Driver: The expanding store footprint acts as a primary engine for growth and market penetration for H&T's core pawnbroking and retail operations.

H&T Group's core pawnbroking business is a star, demonstrating robust growth with a 26% increase in its pledge book to £127 million in 2024. This segment benefits from consistent demand for accessible credit and H&T's leading market position in the UK.

The retail jewelry and watch segment also shines, with sales climbing 27% to £61.8 million in 2024, driven by consumer demand for value and omnichannel offerings. Gross profit in this area increased by 34% to £19.3 million, reflecting strong performance and improved profitability.

Larger pawnbroking loans, particularly for business needs following the Maxcroft acquisition, represent a growing star. These loans exceeded £5,000 and constituted 18% of the pledge book by the end of 2024, up from 13% in 2023.

Online originated sales are another star, surging 36% to £13.3 million in 2024, now accounting for 22% of total sales by value. The launch of a new retail website in early 2024 significantly boosted this digital channel's performance.

| Segment | 2024 Performance | Key Drivers |

|---|---|---|

| Pawnbroking | Pledge book: £127m (+26%) | Demand for accessible credit, Market leadership |

| Retail Jewelry & Watches | Sales: £61.8m (+27%) | Consumer value-seeking, Omnichannel strategy |

| Larger Pawnbroking Loans | 18% of pledge book (vs 13% in 2023) | Business demand, Maxcroft acquisition |

| Online Sales | Sales: £13.3m (+36%) | Digital channel growth, New website launch |

What is included in the product

This BCG Matrix overview for H&T Group highlights which business units to invest in, hold, or divest based on market growth and share.

H&T Group BCG Matrix: A visual guide to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The established base of returning pawnbroking customers for H&T Group acts as a solid cash cow. This segment benefits from consistent demand, ensuring a stable and predictable cash flow for the company.

In 2024, H&T Group reported that its pawnbroking segment continued to be a significant revenue driver, with customer retention rates remaining high. The accessibility of short-term credit, a core offering, fuels this ongoing demand from loyal patrons.

Gold purchasing, a key component of H&T Group's strategy, acts as a robust cash cow. This segment thrives on consistently high gold prices, translating into substantial gross profit and dependable cash flow for the company.

The infrastructure for gold purchasing, once established, operates with relatively low overhead. This allows H&T to efficiently acquire inventory for its retail operations or process gold for scrap, ensuring a continuous and stable revenue stream.

The enduring demand for gold, particularly during periods of economic instability, solidifies gold purchasing as a reliable cash generator for H&T Group. For instance, in 2023, H&T Group reported a significant increase in their pawnbroking and retail sales, with gold purchasing underpinning much of this success by providing a consistent supply of valuable inventory.

Foreign currency exchange stands as a robust cash cow for H&T Group. In 2024, this segment saw profits climb by 11% to £7.0 million, fueled by a solid 10% rise in transaction volumes.

Operating within a mature market, the service leverages H&T's significant market share, a direct result of its widespread store presence and deeply ingrained customer trust.

The low investment needed for marketing and strategic placement within its stores translates into exceptionally high profit margins, solidifying its position as a reliable profit generator for the group.

Pawnbroking Scrap Sales

Pawnbroking scrap sales represent a significant revenue driver for H&T Group, functioning as a strong cash cow. In 2024, these sales generated a substantial gross profit of £9.5 million, achieving a healthy gross margin of 27%.

This consistent profitability is directly linked to the growth and maturation of the group's pledge book. As more pledged items remain unredeemed, they naturally become available for sale as scrap, ensuring a steady and high-margin income stream. This revenue is a direct, low-investment byproduct of the core pawnbroking operations.

- 2024 Gross Profit: £9.5 million

- 2024 Gross Margin: 27%

- Revenue Source: Unredeemed pledged items

- Growth Driver: Increasing pledge book size and maturity

Pre-owned Jewellery and Watch Sales (Physical Stores)

The sale of pre-owned jewellery and watches through H&T Group's physical stores acts as a dependable cash cow. This segment capitalizes on inventory sourced from their pawnbroking and gold purchasing activities, providing customers with attractive, value-driven options.

H&T Group's extensive store network and steady footfall contribute to consistent sales and cash flow in this segment. For instance, in the financial year 2024, H&T Group reported a significant contribution from their retail sales, which includes pre-owned items, demonstrating the segment's maturity and stability.

- Stable Revenue Stream: The pre-owned jewellery and watch sales consistently generate revenue, supported by existing customer traffic and a well-established retail presence.

- Inventory Leverage: This segment effectively utilizes inventory acquired through core pawnbroking and gold buying operations, minimizing acquisition costs and enhancing profitability.

- Value Proposition: H&T offers competitively priced pre-owned items, appealing to a broad customer base seeking quality and affordability.

- Operational Efficiency: The mature nature of this business allows for efficient operations, requiring less investment in market expansion compared to high-growth segments.

The established base of returning pawnbroking customers for H&T Group acts as a solid cash cow, benefiting from consistent demand and ensuring stable, predictable cash flow. In 2024, this segment remained a significant revenue driver, with high customer retention rates and ongoing demand fueled by the accessibility of short-term credit.

Gold purchasing is another robust cash cow, thriving on consistently high gold prices to generate substantial gross profit and dependable cash flow. The 2023 financial year saw a significant increase in pawnbroking and retail sales, with gold purchasing providing a consistent supply of valuable inventory.

Foreign currency exchange is a strong cash cow, with profits climbing 11% to £7.0 million in 2024, driven by a 10% rise in transaction volumes. This mature market segment leverages H&T's significant market share and customer trust, requiring minimal marketing investment for high profit margins.

Pawnbroking scrap sales generated a substantial gross profit of £9.5 million in 2024, with a healthy 27% gross margin, representing a strong cash cow. This profitability is directly linked to the growth of the pledge book, where unredeemed items become a steady, high-margin income stream.

| Segment | 2024 Performance Highlight | Role in BCG Matrix |

|---|---|---|

| Pawnbroking Customers | High retention, stable demand | Cash Cow |

| Gold Purchasing | Significant gross profit, dependable cash flow | Cash Cow |

| Foreign Currency Exchange | 11% profit growth, 10% transaction volume increase | Cash Cow |

| Pawnbroking Scrap Sales | £9.5m gross profit, 27% gross margin | Cash Cow |

What You’re Viewing Is Included

H&T Group BCG Matrix

The H&T Group BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report immediately. You can confidently download this document knowing it's the final version, perfect for immediate integration into your business planning and presentations.

Dogs

Cheque cashing services within H&T Group likely represent a Dogs category in the BCG matrix. This segment faces a declining market due to the rise of digital payments and direct deposits, indicating low market growth.

The demand for physical cheque cashing is diminishing, leading to a low market share for H&T in this specific area. As of 2024, the shift towards electronic transactions continues to accelerate, making traditional cheque cashing a less relevant service.

This business line may struggle to generate significant profits, potentially breaking even or requiring substantial investment to maintain operations in a market with limited expansion potential.

Legacy Unsecured Personal Loans in H&T Group's portfolio are classified as a 'dog' under the BCG matrix. These lending activities ceased in April 2022, meaning no new loans are being issued, and the existing portfolio is in decline.

While H&T Group continues to manage these legacy loans, the revenue and profit generated are minimal and shrinking. For instance, as of the first half of 2024, the contribution from this segment to the group's overall financials is negligible, reflecting its winding-down status.

Given its declining nature and lack of future growth potential, this segment is a prime candidate for divestiture or simply passive management until the portfolio is fully extinguished. This strategic approach allows H&T Group to focus resources on more promising areas of its business.

Within H&T Group's portfolio, certain store locations might be classified as 'dogs' in the BCG Matrix, even amidst broader expansion. These are typically sites in areas with less foot traffic or intense local competition, resulting in a low market share for the specific store and minimal contribution to the group's overall growth. For instance, if a store in a declining retail district only saw a 2% year-on-year revenue increase in 2024, compared to the group's average of 8%, it would fit this category.

Continuing to operate these underperforming locations can be a drain on resources. Capital tied up in inventory, staff, and rent at these stores could be redirected to more promising ventures. In 2024, H&T Group might have identified a few of its 250+ stores that fell into this 'dog' category, potentially showing negative year-on-year profit growth or a return on investment below the company's hurdle rate.

The strategic decision for these 'dog' locations often involves closure or relocation. This allows H&T Group to reallocate capital and management focus to 'stars' or 'question marks' with higher growth potential. For example, if a particular store's profitability declined by 15% in the last fiscal year, management would likely evaluate its viability against the cost of maintaining it.

Niche or Seldom-Used Ancillary Services

Within the H&T Group's BCG Matrix, niche or seldom-used ancillary services are likely to be categorized as 'dogs'. These are services that, while they might exist, have minimal customer engagement or revenue generation. Think of them as the less popular offerings that don't attract much attention.

These 'dogs' often represent services with very low transaction volumes, possibly due to changing market demands or a lack of strategic focus. For instance, if H&T Group offers a specialized appraisal service for a particular type of antique that is no longer widely collected, this would fit the 'dog' profile. Such services consume operational resources, including staff time and system maintenance, without yielding a proportionate return. In 2023, for example, ancillary services outside of their core pawnbroking and cheque cashing operations might have shown very low growth rates, possibly in the low single digits, if they were tracked separately and showed minimal uptake.

- Low Transaction Volume: Services with infrequent customer use, potentially less than 1% of total transactions.

- Minimal Revenue Contribution: Ancillary services might contribute less than 0.5% to the group's overall revenue.

- Resource Drain: Ongoing costs associated with maintaining these services, even if minimal, detract from more profitable areas.

- Market Irrelevance: Services that have become obsolete or are no longer in demand by the target customer base.

Highly Specialized or Obscure Pawned Items

Highly specialized or obscure pawned items, while not the core business for H&T Group, can be categorized as 'dogs' within the BCG matrix if they become unredeemed and prove difficult to sell. These items represent a low market share in terms of resale value and often demand considerable effort to liquidate.

Such items tie up valuable capital and can incur additional costs for storage or specialized valuation, negatively impacting profitability. For instance, if H&T Group's inventory includes items like vintage scientific instruments or rare collectibles that don't attract buyers, these would fall into this category.

- Low Resale Value: These items have limited appeal in the secondary market.

- High Liquidation Effort: Significant time and resources are needed to find a buyer.

- Capital Tie-up: Unsold inventory prevents capital from being reinvested in more profitable areas.

- Potential Storage Costs: Holding onto these items can incur ongoing storage expenses.

Cheque cashing services at H&T Group are considered 'dogs' due to declining demand from digital payments, resulting in a low market share and minimal growth. This segment requires careful management to avoid being a drain on resources.

Legacy unsecured personal loans, no longer issued since April 2022, are also 'dogs' with a shrinking portfolio and negligible contribution to group financials as of the first half of 2024. These are managed passively until fully extinguished.

Underperforming store locations, identified by low revenue growth (e.g., 2% YoY in 2024) or negative profit growth, represent 'dogs' that may require closure or relocation to reallocate capital effectively.

Niche ancillary services with low transaction volumes and minimal revenue contribution, such as specialized appraisal services for obsolete collectibles, also fall into the 'dog' category. These services consume resources without providing a proportionate return.

Question Marks

H&T Group, the UK's leading pawnbroker, acknowledges its lack of complete national coverage, actively pursuing expansion into new geographic regions. This strategy targets markets with high growth potential where their current market share is minimal. For instance, in 2024, H&T continued its focus on strategic acquisitions and new store openings to bolster its presence in underserved areas of the UK.

H&T Group's expansion into digital platforms beyond retail sales, such as online pawnbroking applications and advanced digital financial tools, presents a potential question mark within its BCG matrix. While the digital financial services market is experiencing robust growth, H&T's current market share in this fully digital-first arena may be modest when juxtaposed with established fintech competitors.

Achieving significant traction and effectively competing in this dynamic sector necessitates substantial capital investment. For instance, the UK digital lending market alone was projected to reach £13.5 billion by the end of 2024, highlighting the scale of opportunity but also the competitive intensity that H&T would face.

Diversifying into new financial products beyond pawnbroking presents a significant question mark for H&T Group. Entering high-growth markets where H&T currently has minimal presence would require substantial investment in development, marketing, and navigating complex regulations.

For instance, if H&T were to consider expanding into areas like digital lending or wealth management, these ventures would likely be cash-intensive. The company's 2024 interim report showed a strong performance in its core segments, but such diversification would divert resources. The returns on these new products would remain uncertain until customer adoption and market traction are established, placing them firmly in the question mark category of the BCG matrix.

High-Value Luxury Watch Lending/Retail (Volatility Impact)

The high-value luxury watch lending and retail segment presents a potential question mark for H&T Group within the BCG framework. While the broader retail market shows resilience, the specific niche of high-end watches, both for lending and resale, has seen significant price volatility. This can impact the stability of assets held as collateral and the profitability of resale operations.

This segment offers attractive growth potential, evidenced by the global luxury watch market's projected growth. For instance, the market was valued at approximately $40 billion in 2023 and is anticipated to expand further. However, this growth is coupled with considerable risk due to fluctuating demand and the speculative nature of certain high-value timepieces.

H&T Group must navigate this volatility by carefully managing its inventory and lending exposure.

- Market Volatility: The resale value of luxury watches can fluctuate significantly, impacting the loan-to-value ratios and potential losses on repossessed items.

- Growth Potential vs. Risk: While the market is expanding, the inherent risks associated with asset depreciation need careful consideration.

- Strategic Management: H&T needs robust appraisal processes and risk mitigation strategies to ensure this segment contributes positively to sustainable growth.

- Data-Driven Approach: Continuous monitoring of market trends and pricing data is crucial for informed decision-making in this specialized area.

Strategic Acquisitions of Smaller Independent Pawnbrokers

H&T Group's stated interest in acquiring smaller independent pawnbrokers places these potential acquisitions in the question mark category of the BCG matrix. While this strategy can rapidly expand H&T's market share within the pawnbroking sector, each deal introduces significant integration challenges and demands substantial capital investment. The ultimate classification of these acquisitions as stars or dogs will hinge on their ability to achieve and sustain high market share and profitability.

For instance, H&T Group's interim results for the six months ended 30 June 2024 showed a 10% increase in revenue from acquisitions, highlighting the immediate impact of such strategic moves. However, the group also noted that successful integration requires careful management to realize the full potential of these businesses. The ongoing performance of these acquired entities will be crucial in determining their long-term contribution to H&T's portfolio.

- Strategic Rationale: Acquisitions offer a faster route to market share growth than organic expansion.

- Risk Factors: Each acquisition carries integration risks, potential overpayment, and requires significant capital outlay.

- Performance Dependency: The success of these question marks depends on their ability to become stars through effective integration and sustained profitability.

- Industry Context: The pawnbroking industry, while showing resilience, requires careful navigation of regulatory and economic shifts.

H&T Group's ventures into new digital financial tools and product diversification beyond traditional pawnbroking represent significant question marks. These areas offer substantial growth potential, as seen in the UK digital lending market's projected £13.5 billion valuation by the end of 2024, but also demand considerable investment and face intense competition from established fintech players.

The high-value luxury watch segment, while attractive with a global market valued around $40 billion in 2023, presents a question mark due to inherent price volatility and speculative demand. H&T must manage this risk through robust appraisal and inventory control to ensure profitability.

The acquisition of smaller pawnbrokers is also a question mark, offering rapid market share expansion but carrying integration challenges and capital requirements. H&T's 2024 interim results indicated a 10% revenue increase from acquisitions, underscoring their potential but also the need for careful management to realize full value.

| BCG Category | H&T Group Segment | Market Growth | Relative Market Share | Key Considerations |

|---|---|---|---|---|

| Question Mark | Digital Financial Tools | High | Low to Moderate | Requires significant investment, faces strong fintech competition. |

| Question Mark | New Financial Products (e.g., Digital Lending) | High | Low | Capital intensive, regulatory hurdles, uncertain customer adoption. |

| Question Mark | Luxury Watch Lending & Retail | Moderate to High | Moderate | Price volatility, speculative demand, requires specialized expertise. |

| Question Mark | Acquisitions of Smaller Pawnbrokers | Moderate | Low (initially for acquired entities) | Integration risks, capital outlay, success depends on post-acquisition performance. |

BCG Matrix Data Sources

Our H&T Group BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and industry-specific growth forecasts to provide a robust strategic overview.