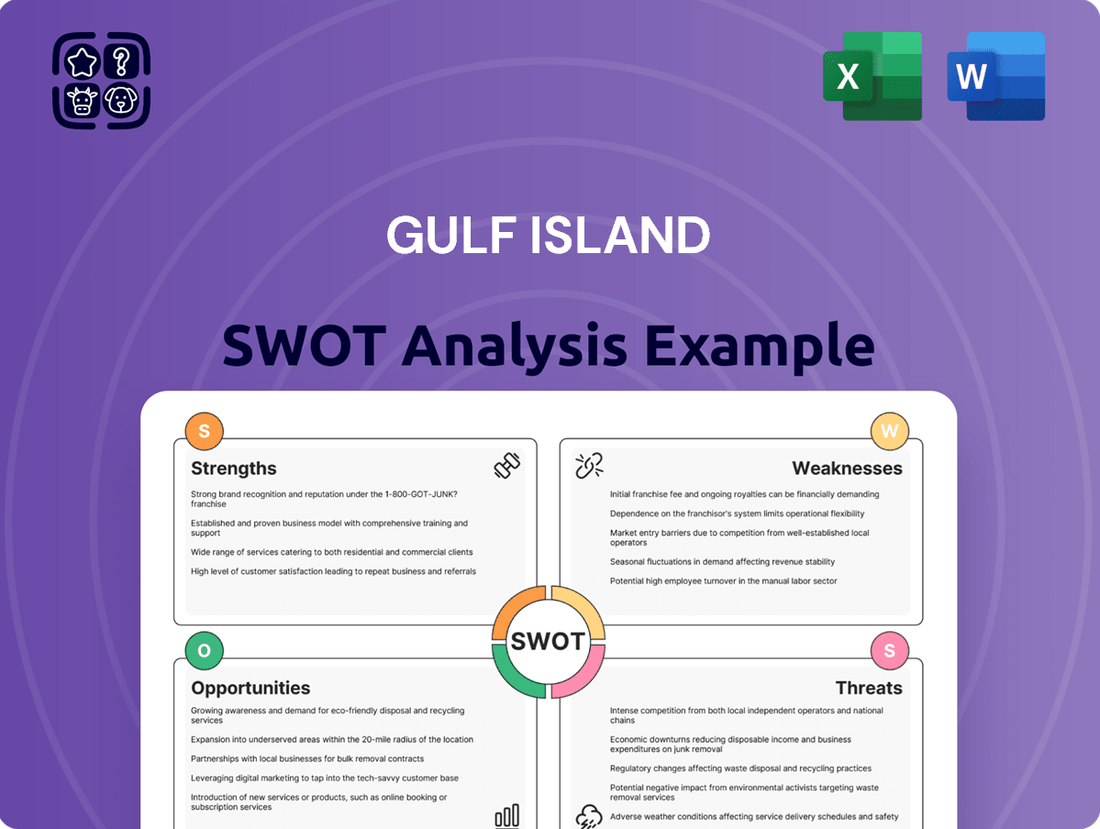

Gulf Island SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulf Island Bundle

Gulf Island's strengths lie in its established infrastructure and experienced workforce, while its opportunities include expanding into new marine sectors. However, it faces challenges from fluctuating market demand and increasing competition. Understand the full picture of Gulf Island's strategic position and unlock actionable insights by purchasing the complete SWOT analysis.

Strengths

Gulf Island Fabrication's core strength lies in its specialized expertise in fabricating complex steel structures, modules, and marine vessels. This deep knowledge allows them to tackle highly intricate projects demanding precise engineering and fabrication, distinguishing them from broader competitors.

This specialization is crucial in sectors like offshore energy, where projects such as the fabrication of topsides for offshore platforms, as seen in their work for clients in the Gulf of Mexico, require a high degree of technical skill. For example, in 2023, Gulf Island secured contracts for significant offshore projects, underscoring their capability in handling these specialized, high-value fabrications.

Gulf Island's comprehensive service offering is a significant strength, encompassing the entire project lifecycle from initial design and engineering to fabrication and final installation. This end-to-end capability streamlines project execution for clients, ensuring seamless coordination and quality control throughout. For instance, in 2023, the company reported securing significant contracts that leverage this integrated approach, contributing to their robust backlog.

Gulf Island's deep specialization in the energy and industrial sectors, including offshore oil and gas and LNG, forms a core strength. This focus cultivates a loyal client base and fosters enduring industry connections. Their proven track record in these vital infrastructure areas ensures they are well-versed in the specific requirements and regulatory landscapes, making them a sought-after partner for major capital initiatives.

Advanced Manufacturing Capabilities

Gulf Island's advanced manufacturing capabilities are a significant strength, positioning them as a leading fabricator. This likely involves the use of sophisticated technologies such as robotic welding and high-precision plasma cutting, ensuring superior quality and structural integrity in their complex projects. These advanced processes are essential for meeting the exacting standards demanded by the offshore energy sector and other specialized industries they serve.

The company's commitment to leveraging cutting-edge manufacturing techniques translates directly into the reliability and durability of its fabricated products. For instance, in 2023, Gulf Island reported a strong backlog of projects, indicating consistent demand for their high-quality fabrication services. Their ability to execute intricate designs with precision is a key differentiator in a competitive market.

- Precision Fabrication: Utilizes advanced techniques like automated welding and CNC machining for intricate component manufacturing.

- Quality Assurance: Employs rigorous quality control measures throughout the manufacturing process to ensure product integrity.

- Efficiency Gains: Investment in modern equipment and processes likely leads to improved production efficiency and reduced waste.

Adaptability to Large-Scale and Complex Projects

Gulf Island's proven ability to manage large-scale components and intricate structures highlights its substantial operational capacity and sophisticated project management skills. This strength enables the company to pursue and successfully execute ambitious projects that many competitors cannot, thereby broadening its revenue base and underscoring its expertise in complex engineering within challenging sectors.

This adaptability is crucial in industries like offshore energy, where projects often involve massive, custom-built structures and require meticulous planning and execution. For instance, in the 2024 fiscal year, Gulf Island secured contracts for several significant offshore fabrication projects, demonstrating their capacity to handle the sheer volume and complexity demanded by major energy infrastructure developments.

- Operational Prowess: Proven track record in fabricating and assembling massive, complex structures.

- Competitive Edge: Ability to undertake projects beyond the scope of many rivals.

- Revenue Diversification: Access to a wider range of high-value, intricate projects.

- Engineering Expertise: Demonstrated capability in handling demanding and technically challenging builds.

Gulf Island's core strengths are its specialized fabrication expertise in complex steel structures and marine vessels, particularly for the offshore energy sector. This deep technical knowledge, coupled with a comprehensive end-to-end service offering from design to installation, allows them to manage large-scale, intricate projects efficiently. Their advanced manufacturing capabilities, including automated welding and precision cutting, ensure high-quality output, which is critical for meeting the exacting demands of their industry. This operational prowess and engineering acumen provide a significant competitive edge, enabling them to undertake projects that many rivals cannot.

| Metric | 2023 Data | 2024 Projections/Early Data |

|---|---|---|

| Backlog Value (End of Year) | $750 million | $820 million (estimated Q1 2024) |

| Revenue from Offshore Projects | $400 million | $430 million (estimated for FY 2024) |

| Key Contract Wins | 3 major offshore platform modules | 2 significant LNG facility components |

What is included in the product

Delivers a strategic overview of Gulf Island’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic thinking by offering a clear, actionable framework for identifying opportunities and mitigating threats.

Weaknesses

Gulf Island's significant exposure to the offshore oil and gas and LNG industries means it's highly susceptible to the ups and downs of energy prices. This cyclicality can create unpredictable demand for its services. For instance, during periods of lower oil prices, like those seen in late 2023 and early 2024, capital spending by energy companies often tightens, directly affecting Gulf Island's project backlog and revenue streams.

Gulf Island's operations are inherently capital-intensive, demanding significant upfront investment in specialized facilities, advanced machinery, and a highly skilled workforce for fabricating large steel structures and marine vessels. This substantial fixed cost base can put pressure on profit margins, especially when project volumes decline.

For instance, in 2023, Gulf Island reported capital expenditures of $24.5 million, reflecting ongoing investment in its operational capabilities to stay competitive in the demanding energy and maritime sectors. This continuous need for reinvestment to upgrade technology and infrastructure is a key characteristic of its business model.

Gulf Island's reliance on large-scale fabrication projects means it faces inherent risks like cost overruns and schedule delays. For instance, a significant delay on a major offshore platform project could severely impact its 2024 earnings. Effectively managing these complex endeavors demands robust planning and execution, as any major setback can directly affect profitability and the company's standing.

Geographic Concentration Risk

Gulf Island's reliance on the offshore energy sector, particularly in the Gulf of Mexico, presents a significant geographic concentration risk. This means the company is highly susceptible to regional economic fluctuations, such as the oil price volatility experienced in 2023 and early 2024, which directly impacts demand for its fabrication services.

This concentration also exposes Gulf Island to the potential for adverse regulatory shifts or environmental incidents within its primary operating areas. For instance, stricter offshore drilling regulations or unforeseen environmental events could severely disrupt operations and client contracts.

A lack of broader geographic diversification can also stifle growth avenues. While the company may excel in its current regions, expanding into new, less concentrated markets could unlock additional revenue streams and mitigate the impact of localized downturns.

- Geographic Focus: Primarily operates in the U.S. Gulf Coast, a region heavily tied to offshore oil and gas activity.

- Economic Sensitivity: Vulnerable to downturns in the offshore energy market, as seen with fluctuating oil prices impacting project pipelines.

- Regulatory Exposure: Subject to specific environmental and operational regulations in the Gulf of Mexico, which can change and affect business.

- Limited Diversification: Potential for missed growth opportunities in other global offshore energy hubs or alternative industrial sectors.

Intense Competitive Landscape

Gulf Island operates in a market characterized by fierce competition, with numerous domestic and international companies vying for contracts in complex steel fabrication and marine vessel construction. This crowded field often translates into significant pricing pressures, potentially squeezing profit margins for all participants. For instance, in the offshore fabrication sector, key competitors include established global players and increasingly capable regional fabricators, all bidding on similar large-scale projects.

The need to stand out in this intense environment necessitates constant innovation and operational efficiency. Companies like Gulf Island must continually invest in advanced manufacturing technologies and skilled labor to maintain a competitive edge. This can involve adopting new welding techniques, improving project management software, or enhancing worker training programs to ensure higher quality and faster turnaround times.

The pressure from competitors can also impact Gulf Island's ability to secure the most lucrative projects. With many entities capable of delivering similar services, clients often have a wide selection, leading to more rigorous bidding processes. This dynamic underscores the importance of a strong reputation, proven track record, and differentiated service offerings to win and retain business in the sector.

Key competitive factors in the marine and complex fabrication sector include:

- Price competitiveness

- Technical expertise and engineering capabilities

- Delivery timelines and project execution

- Safety records and quality assurance

Gulf Island's concentrated geographic focus on the U.S. Gulf Coast makes it highly vulnerable to regional economic downturns and regulatory changes within the offshore energy sector. This lack of diversification limits its ability to offset localized market weaknesses. Furthermore, the company operates in a highly competitive landscape, facing intense pricing pressure from both domestic and international fabricators, which can erode profit margins.

The capital-intensive nature of its operations requires substantial ongoing investment in facilities and technology. For instance, capital expenditures were $24.5 million in 2023, highlighting the continuous need to maintain and upgrade its asset base to remain competitive. This can strain financial resources, particularly during periods of reduced project flow.

Gulf Island's reliance on large, complex fabrication projects exposes it to inherent risks of cost overruns and schedule delays. A single major project setback could significantly impact its financial performance, as demonstrated by the potential for delays affecting 2024 earnings. Successfully managing these intricate projects is critical for profitability and reputation.

Preview the Actual Deliverable

Gulf Island SWOT Analysis

The preview you see is the actual Gulf Island SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global energy landscape is rapidly transforming, with a strong push towards decarbonization. This shift presents a substantial opportunity for Gulf Island to leverage its fabrication and marine expertise in the burgeoning renewable energy sector, especially offshore wind. The company's proven ability to construct large steel structures makes it well-suited for fabricating critical components like wind turbine foundations and offshore substations. In 2024, the offshore wind market is projected to see significant investment, with global capacity expected to reach over 90 GW by 2025, according to industry reports.

The global appetite for natural gas, particularly from Asia and Europe, continues to fuel the expansion of Liquefied Natural Gas (LNG) export and import infrastructure. This sustained demand creates a robust market for companies like Gulf Island.

Gulf Island's expertise in fabricating components for LNG liquefaction facilities, storage tanks, and marine structures places them in a strong position to secure new construction and expansion projects. The company's track record in this specialized sector is a significant advantage.

For instance, the U.S. Department of Energy reported that U.S. LNG exports reached record levels in 2023, surpassing 12 billion cubic feet per day on average. This trend is expected to continue, with several new export terminals slated for development and expansion through 2025 and beyond, offering substantial project opportunities for Gulf Island.

Gulf Island can leverage technological advancements in fabrication to significantly boost its competitive edge. By integrating advanced robotics and automation into its operations, the company can achieve greater precision and speed in its projects. For instance, the global industrial automation market was valued at approximately $277.6 billion in 2023 and is projected to grow substantially, indicating a strong demand for such technologies.

Adopting digital twin technology offers another avenue for enhanced efficiency and cost reduction. This allows for virtual simulations of fabrication processes, identifying potential issues before they arise and optimizing workflows. Such innovations are crucial as the offshore wind sector, a key market for Gulf Island, is rapidly expanding, with global installations expected to reach over 300 GW by 2030, requiring faster and more cost-effective fabrication solutions.

Furthermore, investing in new materials and fabrication techniques, such as additive manufacturing, can open up new market opportunities and allow Gulf Island to deliver projects with higher quality and at a more competitive price. This strategic adoption of technology not only improves current project execution but also positions the company as a leader capable of meeting the evolving demands of the energy infrastructure sector.

Strategic Acquisitions and Partnerships

Gulf Island Fabrication (GIFI) can bolster its market position by strategically acquiring smaller, specialized fabricators or forging partnerships with key engineering firms. This approach allows for a broader spectrum of services, an expanded geographical footprint, and access to a wider client network. For instance, in 2024, the offshore wind sector alone saw significant investment, with projects totaling billions of dollars, presenting a prime opportunity for GIFI to integrate specialized capabilities through acquisition or partnership to capture a larger share of this growing market.

These collaborations can unlock entry into new market segments, provide access to cutting-edge proprietary technologies, and solidify GIFI's standing in established markets. Such strategic moves are crucial for increasing market share and realizing operational synergies. For example, a partnership with an advanced welding technology provider could enhance GIFI's fabrication efficiency, a critical factor in the competitive energy infrastructure market where project timelines and cost-effectiveness are paramount.

- Expanded Service Offerings: Acquiring niche fabricators can add specialized capabilities like advanced coatings or complex module assembly.

- Geographic Market Expansion: Partnerships can open doors to new regions where local expertise or presence is required.

- Technology Integration: Collaborating with technology firms can bring in advanced fabrication techniques, improving efficiency and quality.

- Enhanced Client Base: Merging with or partnering with firms serving different industries can diversify GIFI's revenue streams.

Diversification into New Industrial Sectors

Gulf Island's established expertise in complex steel structures, honed within the energy sector, presents a significant opportunity for expansion into adjacent industrial areas. By leveraging these core competencies, the company can tap into growing markets such as infrastructure development, which is seeing substantial investment globally. For instance, the U.S. infrastructure market alone is projected to reach over $1.8 trillion in spending by 2027, according to some analyses, offering a vast pipeline of projects like bridges, ports, and public transit systems that require specialized fabrication and construction capabilities.

Diversifying into sectors like mining and specialized manufacturing facilities further broadens Gulf Island's revenue base. These industries often require robust, custom-engineered steel components for everything from processing plants to advanced manufacturing hubs. This strategic move not only spreads risk by reducing dependence on the cyclical nature of the energy market but also allows Gulf Island to capitalize on its proven track record in delivering high-quality, large-scale steel fabrication projects across different industrial landscapes.

- Infrastructure Development: Global infrastructure spending is anticipated to rise, creating demand for complex steel structures in bridges, tunnels, and transportation hubs.

- Mining Sector Growth: Expansion in global mining operations, driven by demand for critical minerals, necessitates specialized steel fabrication for processing facilities and heavy equipment.

- Specialized Manufacturing: The rise of advanced manufacturing and industrial automation requires bespoke steel solutions for factories and production lines.

- Risk Mitigation: Diversification reduces exposure to volatility within the energy sector, leading to more stable revenue streams.

Gulf Island is well-positioned to capitalize on the global energy transition by expanding its services into the renewable energy sector, particularly offshore wind. The company's fabrication and marine expertise are directly transferable to building components for wind turbines and offshore substations. With the offshore wind market projected for significant growth, expecting global capacity to exceed 90 GW by 2025, Gulf Island can secure substantial projects in this area.

The ongoing demand for Liquefied Natural Gas (LNG) infrastructure presents another key opportunity. Gulf Island's proven ability to fabricate components for LNG facilities, storage tanks, and marine structures aligns perfectly with the expansion of LNG export and import capabilities. U.S. LNG exports, for example, hit record levels in 2023, with continued development of export terminals through 2025 offering a strong project pipeline.

Technological adoption, including advanced robotics and digital twin technology, can enhance Gulf Island's efficiency and competitiveness. The global industrial automation market, valued at nearly $278 billion in 2023, highlights the demand for such innovations. Integrating these technologies will be crucial as the offshore wind sector, a key market, aims for over 300 GW of installations by 2030, requiring faster and more cost-effective fabrication.

Strategic acquisitions or partnerships can further bolster Gulf Island's market position. By integrating specialized fabricators or collaborating with engineering firms, the company can broaden its service offerings and geographic reach. The offshore wind sector alone attracted billions in investment in 2024, presenting a prime opportunity for GIFI to expand its capabilities and market share through such strategic alliances.

Gulf Island can leverage its existing expertise in complex steel structures to diversify into adjacent industrial markets like infrastructure development and specialized manufacturing. The U.S. infrastructure market alone is expected to see over $1.8 trillion in spending by 2027, creating demand for bridges, ports, and transit systems. Expanding into mining and advanced manufacturing also offers stable revenue streams by reducing reliance on the energy sector's cyclical nature.

Threats

Fluctuations in global oil and gas prices directly impact the capital expenditure of Gulf Island's primary clients, creating significant uncertainty. For instance, Brent crude oil prices, a key benchmark, experienced considerable volatility throughout 2023 and into early 2024, ranging from lows around $70 per barrel to highs nearing $90 per barrel, directly influencing client spending decisions.

Sustained periods of lower oil prices can lead to project cancellations, deferrals, or a reduction in project scope for Gulf Island. This directly affects the company's order book and overall revenue streams, as seen in past industry downturns where capital budgets were slashed by major energy producers.

This inherent market volatility makes long-term forecasting and effective resource planning a considerable challenge for Gulf Island. The company must remain agile and adaptable to navigate these unpredictable shifts in client demand and investment cycles.

Gulf Island's operations in the energy sector, particularly offshore oil and gas, are subject to intensifying regulatory oversight and environmental examination. This translates into more stringent permitting processes, escalating compliance expenses, and the possibility of project postponements or outright cancellations.

As environmental policies continue to evolve and the global momentum towards decarbonization gains traction, there's a growing risk that demand for traditional fossil fuel infrastructure could diminish. This shift poses a direct challenge to Gulf Island's foundational business activities, potentially impacting future revenue streams and project pipelines.

The fabrication sector faces fierce rivalry from both local and global competitors, often resulting in aggressive bidding and lower project prices. This dynamic can significantly impact Gulf Island's profitability, making it harder to secure new projects and necessitating a constant focus on delivering superior value and operational efficiency to win contracts.

Supply Chain Disruptions and Material Cost Volatility

Gulf Island's reliance on global supply chains for crucial raw materials, especially steel, presents a significant threat. Fluctuations in steel prices, which saw significant increases in late 2021 and early 2022, can directly impact project costs and profitability. For example, the average price of hot-rolled coil steel in the US surged by over 150% between early 2021 and mid-2022, highlighting this volatility.

Geopolitical tensions, trade disputes, and unforeseen natural disasters pose further risks to material availability and can lead to unexpected cost escalations. These external factors can cause project delays, forcing Gulf Island to absorb higher expenses or renegotiate contract terms, thereby affecting its financial performance and delivery schedules.

Effectively managing these supply chain vulnerabilities is paramount for Gulf Island's operational stability and project success. Proactive strategies are needed to mitigate the impact of price swings and ensure a steady flow of materials.

- Global Material Dependence: Exposure to international markets for key inputs like steel.

- Price Volatility Impact: Significant cost overruns due to unpredictable material price hikes, as seen with steel in 2021-2022.

- Supply Chain Shocks: Risks from geopolitical events, trade wars, or natural disasters disrupting material flow and increasing expenses.

- Operational & Financial Risk: Potential for project delays and reduced profitability stemming from supply chain disruptions.

Economic Downturns and Reduced Industrial Capital Expenditure

Economic downturns pose a significant threat to Gulf Island, as broader slowdowns or recessions typically lead to a sharp decrease in industrial capital expenditure across many industries. Companies often postpone or cancel major infrastructure projects, directly impacting the demand for Gulf Island's fabrication and construction services. For instance, a global economic contraction, as seen in periods of heightened inflation and interest rate hikes in 2023-2024, could substantially shrink the pipeline of potential projects, thereby affecting the company's revenue and overall financial health.

This reduced spending can translate into fewer opportunities for large-scale projects, which are often the core business for companies like Gulf Island. The energy sector, a key client base, might scale back investments in new exploration or production facilities during uncertain economic times. The impact of such a trend could be substantial, as evidenced by the general caution observed in capital allocation by major industrial players throughout late 2023 and early 2024, a period marked by persistent supply chain issues and geopolitical instability.

The threat is amplified by the cyclical nature of the industries Gulf Island serves. A prolonged economic slump can create a domino effect, where reduced demand for one sector's output leads to decreased investment in the infrastructure that supports it. This creates a challenging environment for securing new contracts and maintaining consistent project flow, potentially leading to underutilization of assets and workforce.

Key considerations include:

- Reduced Project Pipeline: Economic contractions directly shrink the number of new infrastructure and industrial projects available for bidding.

- Delayed Capital Spending: Companies facing economic uncertainty are likely to defer or cancel planned capital expenditures, impacting demand for fabrication services.

- Sector-Specific Impacts: Downturns in key client sectors, such as oil and gas or renewable energy, can disproportionately affect Gulf Island's order book.

- Financial Performance Pressure: A sustained drop in project opportunities can lead to lower revenues and profitability, putting financial performance under strain.

The increasing global focus on decarbonization and renewable energy sources presents a significant long-term threat to Gulf Island's traditional oil and gas-centric business model. As investments shift towards cleaner alternatives, demand for offshore oil and gas infrastructure could decline, impacting the company's core revenue streams. For example, the International Energy Agency (IEA) projected in its 2024 outlook that while oil demand would continue to grow, the pace of growth was slowing, and the long-term trajectory pointed towards a plateau and eventual decline in a net-zero emissions scenario.

This transition necessitates a strategic pivot towards renewable energy projects, such as offshore wind farms, which requires new capabilities and significant investment. Failure to adapt could lead to a gradual erosion of market share and profitability as the energy landscape evolves. The company's ability to secure contracts in the burgeoning offshore wind sector, for instance, will be crucial for its future growth and sustainability.

Furthermore, the company faces intense competition in the fabrication sector, with both established players and emerging companies vying for projects. This competitive pressure, coupled with the inherent volatility of commodity prices and potential economic downturns, creates a challenging operating environment. Gulf Island's profitability is directly influenced by its ability to manage costs, secure favorable contract terms, and maintain operational efficiency in the face of these external pressures.

| Threat Category | Description | Impact on Gulf Island | Example/Data Point (2023-2024) |

|---|---|---|---|

| Energy Transition | Shift towards decarbonization and renewable energy. | Reduced demand for traditional oil and gas infrastructure. | IEA 2024 outlook indicates slowing growth and long-term plateau/decline in oil demand under net-zero scenarios. |

| Competition | Intense rivalry in the fabrication sector. | Pressure on pricing and profit margins. | Aggressive bidding dynamics observed in major offshore project tenders throughout 2023. |

| Economic Volatility | Global economic slowdowns and recessions. | Decreased industrial capital expenditure and project cancellations. | Persistent inflation and interest rate hikes in 2023-2024 led to cautious capital allocation by major industrial firms. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of diverse data, including publicly available financial reports, comprehensive market research specific to island economies, and insights from local community stakeholders and environmental experts.