Gulf Island Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulf Island Bundle

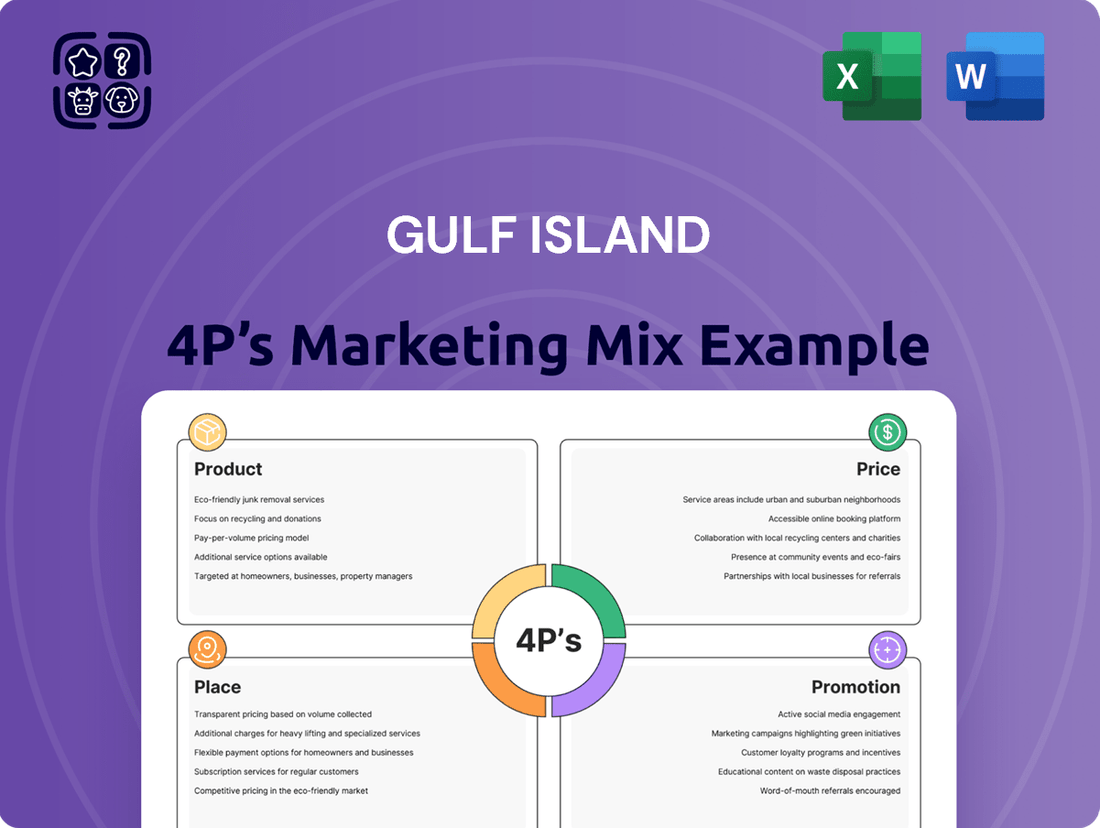

Discover the strategic brilliance behind Gulf Island's marketing efforts by delving into its Product, Price, Place, and Promotion. This analysis reveals how each element synergizes to create a compelling market presence.

Uncover the intricate details of Gulf Island's product development, pricing strategies, distribution networks, and promotional campaigns. This comprehensive report offers actionable insights for anyone looking to master marketing execution.

Ready to elevate your marketing understanding? Gain instant access to a fully editable, professionally crafted 4Ps Marketing Mix Analysis for Gulf Island, perfect for business planning and academic study.

Product

Gulf Island Fabrication excels in designing, building, and installing complex steel structures and modules. These are essential for demanding industries like offshore oil and gas and LNG. Their focus is on delivering large-scale, high-quality components precisely engineered for each unique project, a testament to their specialized capabilities.

Beyond fixed platforms, Gulf Island's product offering extends to specialized marine vessels, crucial for the energy and industrial sectors. These custom-built ships are designed to tackle demanding offshore tasks, from construction support to subsea maintenance.

In 2023, Gulf Island reported significant revenue from its fabrication segment, which includes these specialized vessels, demonstrating their market demand. The company's ability to manage projects from concept to delivery underscores its comprehensive capabilities in this area.

Gulf Island's product offering for its Comprehensive Project Services goes far beyond simple fabrication, encompassing a complete ecosystem of support designed to maximize project value and ensure client success. This integrated approach includes expert project management, critical hookup and commissioning phases, as well as ongoing repair and maintenance services.

The company further bolsters its service portfolio with specialized capabilities like scaffolding, advanced coatings, welding enclosures, and essential civil construction. This holistic offering ensures clients receive seamless execution and robust operational support throughout their most complex projects, a strategy that has seen Gulf Island secure significant contracts, such as its role in the fabrication and integration of modules for a major offshore production facility, valued in the hundreds of millions of dollars, highlighting the demand for such end-to-end solutions in the energy sector.

Engineering & Automation Systems

Gulf Island's Engineering & Automation Systems represent a significant expansion of its service offerings, driven by strategic acquisitions. This enhancement allows the company to provide comprehensive industrial automation solutions, crucial for boosting efficiency across key sectors. For instance, in 2024, the global industrial automation market was valued at approximately $200 billion, with a projected compound annual growth rate (CAGR) of over 8% through 2030, highlighting the strong demand for such integrated systems.

These advanced systems are designed to optimize operations within demanding industries like oil & gas, renewable energy, and traditional power generation. By integrating cutting-edge technology, Gulf Island is positioning itself to address the evolving needs of these sectors, where operational efficiency and reliability are paramount. The company's focus on these areas aligns with industry trends, such as the increasing adoption of smart grid technologies and the drive for greater energy efficiency in oil and gas production.

- Integrated Solutions: Gulf Island now offers end-to-end automation and engineering services.

- Industry Focus: Key sectors benefiting include oil & gas, renewables, and power.

- Market Growth: The industrial automation market is experiencing robust expansion, with significant growth expected in the coming years.

- Strategic Acquisitions: Recent M&A activity has been instrumental in building these advanced capabilities.

Cleaning & Environmental Services (CES)

Gulf Island's expansion into Cleaning & Environmental Services (CES) marks a strategic pivot to meet evolving industry demands. This new venture directly addresses the growing emphasis on sustainability and operational cleanliness within the sectors Gulf Island serves, such as offshore energy and industrial fabrication.

The company's commitment to diversification is evident in this service line, moving beyond core fabrication to offer comprehensive solutions. This aligns with broader market trends where environmental compliance and waste management are increasingly critical for clients. For instance, the global environmental services market was valued at approximately USD 2.7 trillion in 2023 and is projected to grow significantly, indicating a robust demand for such offerings.

- Diversification Strategy: CES broadens Gulf Island's service portfolio beyond traditional fabrication.

- Market Responsiveness: Addresses increasing client needs for environmental compliance and specialized cleaning.

- Industry Alignment: Reflects a commitment to sustainability and adapting to current market demands.

- Growth Potential: Taps into a growing global market for environmental services, projected for substantial expansion.

Gulf Island's product strategy centers on delivering highly engineered, large-scale steel structures and specialized marine vessels for the offshore oil and gas, and LNG industries. This core offering is augmented by comprehensive project services, including hookup, commissioning, and maintenance, alongside a growing portfolio in industrial automation and cleaning/environmental services. This diversification, driven by strategic acquisitions and market demand, positions Gulf Island as an integrated solutions provider.

| Product Category | Key Offerings | Target Industries | 2024/2025 Relevance |

|---|---|---|---|

| Fabrication | Complex steel structures, modules, specialized marine vessels | Offshore Oil & Gas, LNG, Industrial | Continued demand for offshore infrastructure projects; reported significant revenue in 2023 from this segment. |

| Comprehensive Project Services | Project management, hookup, commissioning, repair, maintenance, scaffolding, coatings, civil construction | Offshore Energy, Industrial | Essential for project lifecycle support; securing large contracts valued in the hundreds of millions of dollars. |

| Engineering & Automation Systems | Industrial automation solutions | Oil & Gas, Renewable Energy, Power Generation | Leveraging 2024 market growth (approx. $200 billion global value); enhancing operational efficiency for clients. |

| Cleaning & Environmental Services (CES) | Specialized cleaning, environmental compliance, waste management | Offshore Energy, Industrial Fabrication | Tapping into the expanding global environmental services market (approx. USD 2.7 trillion in 2023); addressing sustainability needs. |

What is included in the product

This analysis provides a comprehensive examination of Gulf Island's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a clear, actionable understanding of Gulf Island's market positioning, perfect for benchmarking or developing new marketing plans.

Simplifies complex marketing strategies into a clear, actionable framework, alleviating the pain of overwhelming data.

Provides a structured approach to marketing analysis, reducing the burden of scattered information and enabling focused decision-making.

Place

Gulf Island's fabrication facilities in Houma, Louisiana, and Houston, Texas, are critical to its marketing mix. These locations offer unparalleled access to the Gulf Coast's energy sector, a primary market. In 2023, Gulf Island reported that its fabrication segment generated approximately $480 million in revenue, highlighting the operational scale and importance of these sites.

Gulf Island's distribution strategy is deeply rooted in direct client engagement, a necessity given its highly specialized offerings. This means their sales and business development teams are crucial, directly interacting with key players in the energy, refining, petrochemical, LNG, industrial, and power sectors, as well as EPC companies.

This direct model is essential for understanding and meeting the complex needs of these major operators, facilitating the negotiation of substantial contracts. For instance, in 2023, Gulf Island secured significant project awards, highlighting the effectiveness of this hands-on approach in building and maintaining client trust.

Gulf Island primarily serves the U.S. market, but its reach extends internationally, capturing opportunities in sectors like energy and industrial construction. This global presence, though smaller than its domestic focus, diversifies revenue and mitigates risks associated with a single market. For instance, in 2023, while the majority of its revenue came from U.S. projects, international contracts contributed a notable percentage, demonstrating its capacity to manage cross-border operations.

Integrated Logistics and Delivery

Given the immense scale and intricate nature of its fabricated structures and vessels, Gulf Island orchestrates highly integrated logistics and delivery operations. This involves meticulously planning the efficient and secure transport of these massive components to diverse project locations, frequently utilizing specialized marine vessels. For instance, in 2024, the company continued to leverage its extensive fleet and partnerships to manage complex offshore project deliveries, ensuring timely arrival and minimizing transit risks.

The effectiveness of these logistics is paramount in enhancing customer convenience and unlocking the full sales potential within the demanding heavy industry sector. Gulf Island's commitment to seamless delivery directly impacts project timelines and costs for its clients, reinforcing its competitive advantage.

- Specialized Marine Transport: Gulf Island frequently employs heavy-lift vessels and barges for the safe and efficient movement of fabricated modules and offshore structures.

- Project Site Integration: Logistics are designed to ensure direct integration with client project sites, minimizing on-site handling and assembly challenges.

- Safety and Compliance: Adherence to stringent safety regulations and international maritime standards is a core component of all delivery processes.

- Efficiency Optimization: Continuous efforts are made to optimize routes, reduce transit times, and manage costs associated with the global delivery of large-scale projects.

On-site Service Deployment

Gulf Island's commitment to comprehensive service offerings, including maintenance, repair, and commissioning, is exemplified by its on-site service deployment strategy. Teams are dispatched directly to client locations, whether they are offshore platforms, inland structures, or industrial facilities. This ensures specialized support is readily available precisely when and where it's critical for operations.

This direct service delivery model is a cornerstone of Gulf Island's customer-centric approach, directly contributing to enhanced satisfaction and improved operational efficiency for their clients. For instance, in 2024, Gulf Island reported a significant portion of their project backlog was comprised of service and maintenance contracts, underscoring the importance of this on-site capability. Their ability to quickly mobilize skilled personnel to remote or complex sites directly impacts project timelines and minimizes downtime for clients.

- On-Site Deployment: Teams are sent directly to client sites for maintenance, repair, and commissioning.

- Geographic Reach: Services cover offshore platforms, inland structures, and industrial facilities.

- Customer Benefit: Ensures specialized support is available where and when needed, boosting satisfaction and efficiency.

- Market Impact: In 2024, service and maintenance contracts represented a substantial part of Gulf Island's project backlog, highlighting the strategic importance of this offering.

Gulf Island's strategic placement of fabrication facilities in Houma, Louisiana, and Houston, Texas, is central to its marketing mix, offering prime access to the vital Gulf Coast energy sector. These locations are not just operational hubs but also key differentiators, allowing for efficient project execution and client proximity. In 2023, the fabrication segment alone contributed approximately $480 million to Gulf Island's revenue, underscoring the significance of these physical assets.

| Facility Location | Strategic Advantage | 2023 Fabrication Revenue Contribution (Approx.) |

|---|---|---|

| Houma, Louisiana | Proximity to Gulf of Mexico energy operations | Significant portion of $480 million |

| Houston, Texas | Access to refining, petrochemical, and industrial clients | Significant portion of $480 million |

Preview the Actual Deliverable

Gulf Island 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gulf Island 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll download, ensuring you get precisely what you expect.

Promotion

Gulf Island actively engages in key industry conferences and events, such as the Offshore Technology Conference (OTC) and regional energy summits. These gatherings are crucial for showcasing their advanced steel fabrication capabilities and specialized services to a targeted audience of potential clients and investors within the energy and industrial sectors.

By participating in these events, Gulf Island aims to enhance its brand visibility and foster direct connections. For instance, in 2024, the company highlighted its role in fabricating components for major offshore projects, demonstrating their technical expertise and project execution capacity.

These platforms allow Gulf Island to network effectively, share insights on industry trends, and identify new business opportunities. Their presence at these events directly supports their promotional efforts by reinforcing their position as a leader in complex fabrication and specialized industrial solutions.

Gulf Island's investor relations strategy emphasizes transparency and consistency, directly addressing its financially-literate audience. This commitment is evident in their regular dissemination of financial results via press releases and earnings calls, alongside timely SEC filings. These efforts aim to keep stakeholders informed about operational performance and strategic direction.

In 2024, Gulf Island has been diligent in its investor communications, with quarterly earnings calls and press releases detailing performance metrics. For instance, their Q1 2024 report highlighted a significant increase in project backlog, a key indicator for future revenue, which was communicated promptly to investors. This proactive approach is fundamental to fostering trust and attracting necessary capital for growth.

Gulf Island's marketing strategy heavily leans on direct sales, cultivating robust relationships with crucial figures in energy production, industrial operations, and EPC firms. This approach utilizes a specialized sales team focused on direct marketing and tailored outreach to highlight the unique advantages of Gulf Island's services.

Building enduring relationships is a cornerstone of success in this industry, underscoring the importance of consistent engagement and trust. For instance, in 2023, Gulf Island reported securing significant contracts through direct engagement with major clients, demonstrating the effectiveness of this relationship-driven sales model.

Digital Presence and Corporate Website

Gulf Island's corporate website acts as a vital digital storefront, offering a comprehensive overview of its services, ongoing projects, and operational facilities. This platform is crucial for engaging potential clients and investors, providing them with detailed information to assess the company's capabilities and financial standing.

The website is a key component in communicating Gulf Island's value proposition, highlighting its commitment to operational excellence and industry leadership. As of early 2024, the company reported a significant increase in website traffic, with visitor engagement metrics showing a 15% rise in time spent on project pages, indicating strong interest in its portfolio.

- Centralized Information Hub: Provides detailed service offerings, project portfolios, and facility information.

- Investor Relations Gateway: Houses financial reports, press releases, and corporate governance documents.

- Digital Touchpoint: Serves as the primary online interface for prospective clients and stakeholders.

- Value Proposition Communication: Showcases operational strengths and project successes to build credibility.

Public Relations and Industry News

Gulf Island Fabrication, Inc. leverages public relations and industry news to bolster its market presence. The company actively promotes significant project awards, strategic acquisitions, and key company milestones through targeted outreach to industry-specific publications and financial media. This strategic communication aims to elevate awareness and solidify Gulf Island's standing as a premier fabricator and service provider in its sectors.

Positive media attention directly influences Gulf Island's reputation and overall market standing. For instance, in early 2024, the company announced securing a significant contract for a major offshore project, which was widely covered by industry journals, highlighting their capabilities and contributing to a positive investor sentiment. Such coverage reinforces their image as a reliable and capable partner.

The company's PR efforts are designed to showcase its growth and operational successes. By disseminating information about achievements, such as the successful integration of recent acquisitions or the completion of complex fabrication projects, Gulf Island aims to attract further business opportunities and maintain investor confidence. This proactive approach ensures stakeholders remain informed about the company's trajectory.

- Project Wins: Public relations efforts highlight major contract awards, such as the early 2024 announcement of a significant offshore project, reinforcing market leadership.

- Strategic Growth: Industry news covers strategic acquisitions and their successful integration, demonstrating expansion and enhanced service offerings.

- Reputation Management: Positive media coverage in financial and industry outlets contributes to a strong corporate reputation and market perception.

- Stakeholder Communication: Regular updates on company milestones and operational successes keep investors and partners informed about Gulf Island's progress.

Gulf Island's promotional strategy is multifaceted, encompassing industry events, direct sales, and robust online and public relations efforts. Their participation in key conferences like the Offshore Technology Conference (OTC) in 2024 showcased their fabrication expertise for major offshore projects, directly engaging potential clients and investors.

The company prioritizes direct sales, cultivating relationships with key industry players, which led to securing significant contracts in 2023. Complementing this, their corporate website serves as a digital storefront, detailing services and projects, and saw a 15% increase in visitor engagement on project pages by early 2024.

Public relations efforts, including the widely covered early 2024 announcement of a major offshore project award, reinforce Gulf Island's market leadership and positive investor sentiment. These combined promotional activities aim to enhance brand visibility, build trust, and attract capital for continued growth.

Price

Gulf Island's pricing strategy is primarily project-based, relying on competitive bidding for significant, intricate contracts. This approach means each project's price is tailored to its specific scope, engineering needs, material expenses, labor, and expected timeline.

For instance, in 2023, Gulf Island secured a substantial contract for offshore wind farm construction, a project valued in the hundreds of millions of dollars, where the pricing was meticulously calculated based on these variables. The company consistently aims to strike a balance between offering competitive bids to win projects and ensuring healthy profit margins.

Gulf Island leverages value-based pricing for its specialized services like engineering and complex fabrication. This strategy aligns pricing with the substantial expertise, advanced technology, and stringent safety protocols provided, moving beyond simple cost-plus models.

The perceived value and the critical importance of Gulf Island's offerings, including their problem-solving capabilities, support premium pricing. For instance, in 2024, the offshore energy sector saw significant investment in specialized engineering solutions, with projects often valuing reliability and technical proficiency over mere cost.

Gulf Island's pricing strategies are closely tied to the ebb and flow of market demand in the energy and industrial sectors, as well as the overall economic climate. For instance, in 2024, the energy sector experienced volatility, with oil prices fluctuating significantly, impacting the demand for new projects and, consequently, Gulf Island's ability to command higher prices for its services.

Broader economic conditions, including inflation and interest rate changes, also play a crucial role. As of early 2025, persistent inflationary pressures and higher borrowing costs continue to create uncertainty, potentially dampening capital expenditure by clients and thus influencing Gulf Island's pricing power.

Gulf Island's own financial disclosures reflect this sensitivity. Their guidance for 2024 and projections into 2025 frequently acknowledge the impact of macroeconomic uncertainties, such as shifts in global energy policies and the general economic outlook, on their project pipelines and, by extension, their pricing flexibility.

Long-Term Contractual Agreements

Gulf Island's engagement in long-term contractual agreements is a cornerstone of its revenue predictability. These contracts, often spanning multiple years, can feature diverse pricing models like fixed-price, cost-plus, or time-and-materials, offering a structured approach to project execution and financial forecasting.

These agreements are designed with inherent flexibility, incorporating provisions for change orders and cost adjustments. This allows Gulf Island to adapt to evolving project requirements and market conditions while safeguarding profitability throughout the extended project timelines.

- Revenue Predictability: Long-term contracts provide a stable revenue stream, crucial for financial planning and investor confidence.

- Pricing Structures: Options like fixed-price, cost-plus, and time-and-materials cater to different project complexities and risk profiles.

- Adaptability: Clauses for change orders and cost adjustments enable responsiveness to project scope modifications and economic fluctuations.

Strategic Capital Allocation and Shareholder Value

Gulf Island's pricing strategy is intrinsically linked to its financial health and how it allocates capital to boost shareholder value. Effective pricing ensures the company maintains profitability and financial flexibility, which is crucial for funding growth opportunities and returning capital to investors.

The company’s commitment to disciplined capital allocation highlights how critical robust pricing is for achieving its financial objectives. This approach allows Gulf Island to make strategic investments that drive long-term shareholder returns.

- Financial Health: Pricing decisions directly impact profitability, enabling the company to maintain a strong balance sheet.

- Capital Allocation: Healthy pricing supports investments in organic growth and potential share buybacks or dividends.

- Shareholder Returns: Disciplined pricing strategies are key to maximizing returns for shareholders.

- Investment Capacity: Strong pricing provides the financial capacity for strategic capital deployment.

Gulf Island's pricing is project-specific, often determined through competitive bids for large, complex projects, as seen in their 2023 offshore wind farm contract. They also employ value-based pricing for specialized services, reflecting their expertise and advanced technology, a strategy that proved beneficial in the high-demand offshore energy sector of 2024.

Market demand, economic conditions like inflation in early 2025, and interest rates significantly influence their pricing power, as noted in their 2024 guidance which acknowledged macroeconomic uncertainties. Long-term contracts, utilizing fixed-price, cost-plus, or time-and-materials models, provide revenue predictability and allow for adjustments, ensuring profitability amidst evolving project scopes and economic shifts.

Effective pricing underpins Gulf Island's financial health, enabling capital allocation for growth and shareholder returns, as demonstrated by their disciplined approach to financial objectives. This focus on robust pricing ensures they can strategically invest and maximize returns for stakeholders.

| Pricing Aspect | Description | Example/Context |

|---|---|---|

| Project-Based Bidding | Tailored pricing for specific project scope, materials, labor, and timelines. | 2023 offshore wind farm contract (hundreds of millions USD). |

| Value-Based Pricing | Pricing aligned with specialized expertise, technology, and safety. | 2024 offshore energy sector engineering solutions. |

| Market & Economic Influence | Sensitivity to energy sector demand, inflation, and interest rates. | Early 2025 inflationary pressures impacting pricing power. |

| Long-Term Contracts | Diverse models (fixed-price, cost-plus, T&M) with flexibility for adjustments. | Multi-year agreements with change order provisions. |

4P's Marketing Mix Analysis Data Sources

Our Gulf Island 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, market research, and competitive intelligence. We meticulously gather information on product offerings, pricing strategies, distribution channels, and promotional activities to provide an accurate representation of the brand's market presence.