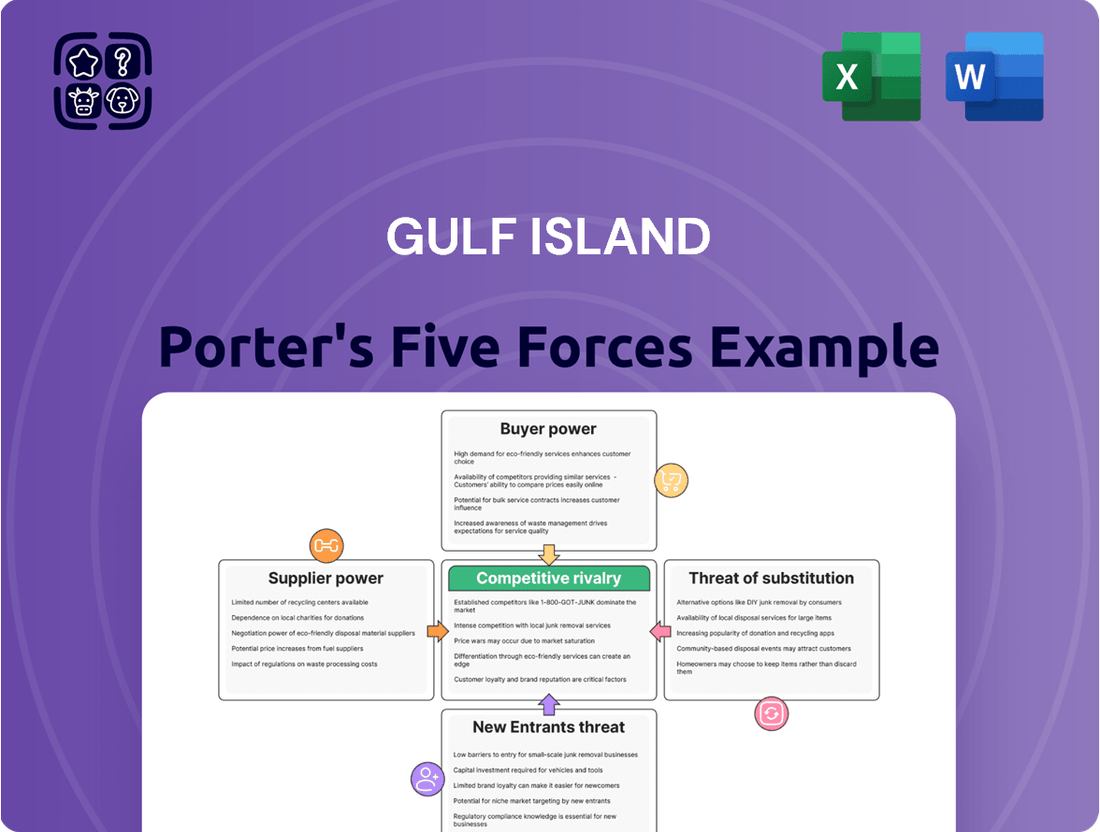

Gulf Island Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulf Island Bundle

Gulf Island's industry faces significant competitive pressures, with moderate buyer power and a notable threat from new entrants shaping its landscape. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Gulf Island’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for specialized steel and complex components crucial for offshore and industrial fabrication often exhibits supplier concentration. When a limited number of suppliers provide critical raw materials, such as specific steel grades or advanced machinery, their leverage grows. This concentration can translate into higher input costs for Gulf Island, impacting its profitability.

Gulf Island's bargaining power with suppliers is significantly impacted by switching costs for specialized inputs. If transitioning to a new provider for critical, highly customized materials or services requires substantial investment in new equipment, extensive process re-certification, or lengthy supplier vetting, Gulf Island's leverage diminishes. This makes it more challenging to negotiate favorable pricing or secure competitive bids from alternative sources, as the cost and time associated with switching can be prohibitive.

Suppliers who provide Gulf Island Fabrication with highly unique or proprietary technologies, specialized materials like advanced alloys, or critical, custom-made components for its complex offshore projects hold significant leverage. This uniqueness means Gulf Island has limited substitutes for these essential inputs, increasing its dependence on these specific suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into fabrication and directly competing with Gulf Island is typically minimal. The immense capital investment and specialized expertise needed for large-scale steel fabrication and marine vessel construction create a significant barrier to entry for most suppliers.

However, there's a slight possibility that suppliers of highly specialized components might broaden their services, which could marginally enhance their bargaining power. For instance, a supplier of advanced welding equipment or specialized coatings could potentially offer fabrication services using their proprietary technology, thereby increasing their leverage in negotiations.

In 2024, the offshore energy sector, a key market for Gulf Island, continued to see consolidation and a focus on efficiency. This environment generally discourages smaller suppliers from undertaking the massive capital outlays required for forward integration into complex fabrication, as it would necessitate competing with established players like Gulf Island.

- Low Barrier to Entry for Complex Fabrication: The substantial capital requirements and specialized technical knowledge needed for large-scale steel fabrication and marine vessel construction significantly deter most suppliers from attempting forward integration.

- Potential for Niche Integration: Suppliers of highly specialized components or technologies might find it feasible to expand their offerings into related fabrication services, thereby increasing their influence.

- Industry Dynamics in 2024: The prevailing focus on efficiency and consolidation within the offshore energy sector in 2024 made significant forward integration by suppliers into complex fabrication less likely due to the associated high costs and competitive risks.

Importance of Gulf Island to Supplier's Business

The significance of Gulf Island to a supplier's revenue stream directly impacts the supplier's bargaining power. If Gulf Island constitutes a substantial portion of a supplier's overall business, the supplier is likely to be more accommodating with pricing and terms to secure continued patronage. For instance, if a key component supplier derives over 15% of its annual sales from Gulf Island, it would be less inclined to exert strong price pressure.

Conversely, if Gulf Island represents a minor client for a supplier, perhaps less than 2% of their total sales, the supplier's incentive to offer favorable terms to Gulf Island diminishes. In such scenarios, the supplier holds greater leverage, potentially dictating higher prices or less favorable contract conditions, as the loss of Gulf Island's business would have a negligible impact on their operations.

- Supplier Dependence: High dependence of a supplier on Gulf Island's business reduces the supplier's bargaining power.

- Client Size: Gulf Island's relative size as a customer for a supplier is a key determinant of its influence.

- Revenue Concentration: Suppliers with concentrated revenue streams from Gulf Island are more likely to offer competitive terms.

Suppliers to Gulf Island Fabrication possess significant bargaining power when they provide highly specialized or unique components, as this limits Gulf Island's ability to find alternatives. This leverage is further amplified if Gulf Island represents a substantial portion of a supplier's revenue, encouraging suppliers to offer more favorable terms to retain the business. Conversely, if Gulf Island is a small client for a supplier, the supplier has less incentive to negotiate, increasing their power.

| Factor | Impact on Supplier Bargaining Power | Relevance to Gulf Island |

| Supplier Concentration | High | Limited number of providers for specialized steel and components |

| Switching Costs | High | Significant investment for Gulf Island to change suppliers for custom inputs |

| Supplier Differentiation | High | Unique or proprietary technologies and materials increase supplier leverage |

| Threat of Forward Integration | Low | High capital and expertise barriers deter suppliers from competing in fabrication |

| Supplier Dependence on Gulf Island | Low | Suppliers with significant revenue from Gulf Island are more accommodating |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Gulf Island's position in the offshore energy services sector.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Gulf Island's customer concentration, particularly within the energy sector, can significantly influence their bargaining power. For instance, if a handful of major offshore oil and gas or LNG clients account for a substantial percentage of the company's annual revenue, these clients gain leverage. This leverage translates into their ability to negotiate more favorable pricing, demanding stricter contract terms, or requesting highly specialized project execution.

Customer switching costs for complex steel structures and marine vessels are significant for Gulf Island Fabrication. These costs encompass redesign efforts, obtaining new regulatory approvals, and the potential for substantial project timeline disruptions. For instance, a delay in a critical offshore platform component could have ripple effects costing millions in lost operational revenue.

These high switching costs inherently limit the bargaining power of Gulf Island's customers. Once a fabrication contract is secured and work is in progress, the customer’s ability to easily shift to a competitor is severely curtailed due to the sunk costs and complexities involved in initiating a new relationship.

In the energy and industrial sectors where Gulf Island operates, customer price sensitivity is a significant factor. For standardized products and services, buyers often have numerous alternatives, making them highly inclined to seek the lowest possible price. This pressure can directly affect Gulf Island's profitability.

For instance, in 2024, the global energy services market experienced intense competition, with many companies vying for contracts. This competitive landscape amplifies customer price sensitivity, as buyers can readily switch suppliers if pricing is not favorable. Gulf Island, like its peers, must navigate these demands.

However, this sensitivity isn't uniform across all offerings. When it comes to highly specialized or critical components and services, such as complex engineering solutions or unique fabrication capabilities, customers may be less focused on price and more on reliability, expertise, and delivery timelines. This reduces their bargaining power in those specific areas.

Threat of Backward Integration by Customers

The threat of Gulf Island's customers performing fabrication in-house, known as backward integration, is generally low. This is primarily because the specialized nature of complex steel and marine fabrication demands substantial capital investment, highly specific expertise, and extensive, purpose-built facilities. These barriers make it economically unfeasible for most customers to replicate Gulf Island's capabilities.

The significant upfront costs associated with establishing and maintaining fabrication yards, coupled with the need for skilled labor and advanced technology, act as strong deterrents. For instance, building a modern fabrication facility can easily run into hundreds of millions of dollars, a cost that few clients would absorb to bring such a specialized process in-house.

This low threat of backward integration strengthens Gulf Island's bargaining power. Customers are therefore less likely to exert pressure by threatening to bring fabrication operations in-house, allowing Gulf Island to maintain more favorable terms in its contracts.

Key factors contributing to this low threat include:

- High Capital Requirements: Establishing fabrication facilities requires immense financial outlay, often exceeding billions of dollars for large-scale operations.

- Specialized Expertise: The intricate processes involved in steel and marine fabrication demand a highly skilled workforce and deep technical knowledge.

- Extensive Facilities: Clients would need to invest in large, specialized yards, heavy lifting equipment, and advanced welding and cutting technologies.

- Regulatory Compliance: Meeting stringent industry and safety regulations for fabrication adds another layer of complexity and cost for potential in-house operations.

Availability of Substitute Products/Services for Customers

Customers' bargaining power is influenced by the availability of substitutes. While direct, large-scale steel structure fabrication substitutes are scarce, customers can explore alternative energy production methods or industrial processes that lessen the demand for these fabricated components. For instance, a shift towards modular construction in certain energy sectors could reduce the need for extensive custom steel work. In 2024, the global modular construction market was valued at approximately $221.6 billion, indicating a growing trend that could impact traditional fabrication demand.

Furthermore, customers possess leverage if they can source similar fabrication services from international providers. This global competition can drive down prices and improve service terms for domestic buyers. For example, if a project requires specialized offshore structures, a client might compare bids from fabricators in Asia or Europe, potentially benefiting from lower labor costs or different regulatory environments. This option enhances the customer's ability to negotiate favorable terms with Gulf Island.

The bargaining power of customers is also amplified by the potential to delay or scale back projects if satisfactory terms cannot be met. If substitute solutions become more cost-effective or if financing for large capital projects tightens, customers may have less incentive to proceed with traditional fabrication. This was a notable factor in late 2023 and early 2024 for some energy infrastructure projects facing economic uncertainty.

- Limited direct substitutes for large-scale steel structures.

- Customers can explore alternative energy production or industrial processes.

- International fabricators offer a competitive alternative, increasing customer leverage.

- The global modular construction market's growth (valued at ~$221.6 billion in 2024) presents a potential indirect substitute.

Gulf Island's customers wield significant bargaining power due to several factors. High switching costs for specialized fabrication limit their ability to easily change suppliers once a project begins. Price sensitivity is also a key driver, especially for more standardized components, as evidenced by the competitive energy services market in 2024 where buyers readily sought the lowest prices.

However, this power is somewhat tempered when customers require highly specialized or critical components, where reliability and expertise become more important than cost. The threat of customers performing fabrication in-house is very low due to the immense capital investment, specialized skills, and extensive facilities required, making backward integration economically unfeasible for most clients.

The availability of international fabricators and the growing trend in modular construction, valued at approximately $221.6 billion in 2024, offer customers alternative avenues, thereby increasing their leverage in negotiations with Gulf Island.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Concentration | Increases power if few major clients dominate revenue. | Clients accounting for substantial revenue can negotiate favorable terms. |

| Switching Costs | Decreases power due to high costs (redesign, approvals, delays). | Project delays in critical components can cost millions in lost revenue. |

| Price Sensitivity | Increases power, especially for standardized items. | Intense competition in the 2024 energy services market amplified this. |

| Threat of Backward Integration | Decreases power as in-house fabrication is economically unfeasible. | Building specialized fabrication facilities can cost hundreds of millions. |

| Availability of Substitutes | Increases power through international competition and alternative processes. | Global modular construction market valued at ~$221.6 billion in 2024. |

Preview the Actual Deliverable

Gulf Island Porter's Five Forces Analysis

This preview shows the exact Gulf Island Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including threats of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry. This detailed breakdown is ready for your immediate use and strategic planning.

Rivalry Among Competitors

Gulf Island navigates a landscape populated by numerous competitors within the oil and gas equipment and services sector. Key players such as Tetra Technologies, Oil States International, and TechnipFMC are prominent, contributing to a moderately intense competitive environment. While these larger entities offer a broad range of services, Gulf Island carves out its niche in specialized fabrication, differentiating its offerings.

The structural steel fabrication market is poised for robust expansion, with an anticipated compound annual growth rate (CAGR) of 9.0% between 2025 and 2029. This growth is largely fueled by significant investments in infrastructure renewal projects and the expanding energy sector.

A burgeoning market environment can often temper competitive rivalry. As companies have the opportunity to grow their revenues by capturing new demand rather than by directly taking market share from existing players, the intensity of direct competition may lessen.

Gulf Island distinguishes itself by focusing on complex steel structures, modules, and marine vessels, providing end-to-end services from initial design through to final delivery. This strategic specialization in intricate, large-scale projects helps to mitigate direct competition based purely on price, setting them apart from competitors involved in more standardized fabrication.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the Gulf Island industry. These barriers, including specialized assets like shipyards and fabrication yards, long-term contracts, and substantial capital investments, make it difficult and costly for companies to leave the market. This can lead to prolonged periods of intense competition, even when profitability is low, as firms are reluctant to absorb the financial penalties associated with exiting.

The presence of these exit barriers means that companies might continue to operate at reduced capacity or with lower margins rather than face the substantial costs of closure. For instance, a company with a large, specialized shipyard might find it prohibitively expensive to sell or repurpose, forcing it to remain active in a competitive landscape. This persistence can suppress overall industry returns and intensify the struggle for market share among the remaining players.

- Specialized Assets: Gulf Island's reliance on extensive shipyard and fabrication yard infrastructure represents a significant capital commitment that is difficult to liquidate or redeploy.

- Long-Term Contracts: Existing contractual obligations can bind companies to operations, even in unfavorable market conditions, preventing a swift exit.

- Capital Investment: The sheer scale of investment required for facilities and equipment creates a substantial financial hurdle for any firm considering leaving the sector.

- Intensified Rivalry: These factors collectively trap companies in the market, leading to sustained competitive pressure and potentially lower profitability for all participants.

Strategic Objectives of Competitors

Competitors' strategic objectives significantly shape the intensity of rivalry within the industry. For instance, companies prioritizing aggressive market share expansion or diversifying into burgeoning sectors like renewable energy infrastructure directly impact competitive pressures. Gulf Island's own strategic pivot towards smaller-scale fabrication and a move beyond traditional oil and gas operations reflects an awareness of these evolving competitor strategies and market dynamics.

The competitive landscape for Gulf Island is characterized by a mix of players with varying strategic aims. Some competitors might be focused on achieving cost leadership through operational efficiencies, while others are actively pursuing diversification into adjacent or new markets, such as offshore wind or other forms of renewable energy infrastructure. This pursuit of new revenue streams can intensify rivalry as companies vie for emerging opportunities.

Gulf Island's stated strategy to focus on small-scale fabrication and expand its service offerings beyond the oil and gas sector is a clear indicator of its response to these competitive pressures. This diversification aims to mitigate risks associated with a single industry and capture growth in new areas. For example, as of early 2024, the global renewable energy sector has seen significant investment, with project pipelines expanding, creating new battlegrounds for fabrication and construction firms.

- Aggressive Market Share Expansion: Some competitors are actively trying to grow their share of the existing oil and gas fabrication market, leading to price competition.

- Diversification into Renewables: A notable trend is competitors moving into renewable energy infrastructure projects, such as offshore wind farms, creating new competitive arenas.

- Cost Leadership Strategies: Companies focused on operational efficiency and economies of scale aim to undercut rivals on price for standard fabrication projects.

- Gulf Island's Strategic Response: Gulf Island's move into smaller-scale fabrication and non-oil and gas sectors is a direct reaction to these competitive dynamics, seeking to find less contested market segments and new growth avenues.

The competitive rivalry within Gulf Island's operating environment is moderately intense, influenced by the presence of established players like Tetra Technologies and TechnipFMC. While these larger firms offer broad services, Gulf Island differentiates itself through specialized fabrication of complex structures and marine vessels. The market for structural steel fabrication is projected for strong growth, with a 9.0% CAGR anticipated between 2025 and 2029, driven by infrastructure and energy sector investments, which can temper direct competition by allowing for revenue growth through new demand.

High exit barriers, including specialized assets like shipyards and significant capital investments, trap companies in the market, leading to sustained competitive pressure and potentially lower profitability. Competitors' strategic objectives, such as aggressive market share expansion or diversification into renewables, also shape rivalry. Gulf Island's strategy to focus on smaller-scale fabrication and non-oil and gas sectors is a direct response to these dynamics, aiming to capture growth in less contested segments.

| Key Competitors | Specialization Focus | Strategic Trend Impacting Rivalry |

| Tetra Technologies | Water management, completion fluids, well intervention services | Diversification into new energy sectors |

| Oil States International | Oilfield products and services | Focus on operational efficiency and cost leadership |

| TechnipFMC | Subsea, surface, and onshore/offshore projects | Pursuit of large-scale integrated projects and renewable energy infrastructure |

| Gulf Island | Specialized fabrication, modules, marine vessels | Pivot to smaller-scale fabrication and non-oil/gas sectors |

SSubstitutes Threaten

While steel remains the bedrock for Gulf Island's large-scale fabrication projects, the threat of alternative materials is present, albeit with limitations. Advancements in composite materials or novel construction techniques could offer substitutes in certain applications. For instance, high-strength polymers or advanced concrete formulations are gaining traction in construction, but their suitability for the extreme conditions and precise engineering required in offshore platforms or complex industrial facilities is still under development.

However, for the core business of fabricating massive, intricate structures for the energy and industrial sectors, direct substitutes that match steel's unique combination of strength, durability, and cost-effectiveness at scale are currently scarce. Gulf Island's reliance on steel is deeply rooted in its proven performance and established supply chains for these demanding applications.

The global energy landscape is undergoing a significant transformation, with a notable shift towards renewable energy sources. This transition away from traditional fossil fuels, particularly offshore oil and gas, presents a potential substitute threat to Gulf Island Fabrication. As demand for conventional energy infrastructure wanes, so too might the need for the company's core fabrication services in this sector.

For instance, in 2024, investments in renewable energy projects continued to surge. The International Energy Agency (IEA) reported that global clean energy investment was projected to reach $2 trillion in 2024, a substantial increase from previous years. This growing investment in alternatives like offshore wind farms, solar power, and battery storage directly competes with the historical demand drivers for Gulf Island's services in the oil and gas sector.

However, Gulf Island is proactively addressing this threat by diversifying its business. The company is strategically expanding its focus beyond oil and gas, venturing into sectors such as renewable energy and infrastructure. This strategic pivot aims to leverage its fabrication expertise for emerging energy technologies, mitigating the risks associated with a declining fossil fuel market and capitalizing on new growth opportunities.

For massive energy corporations or industrial conglomerates, the option of in-house fabrication, though requiring substantial capital, presents a potential substitute for outsourcing to companies like Gulf Island Fabrication. However, the highly specialized skills and the sheer scale of operations that Gulf Island possesses often make outsourcing the more economically sensible and efficient choice for their clientele.

Modularization and Standardization

Increased modularization and standardization in construction and industrial projects can indeed pose a threat by potentially reducing the need for Gulf Island's specialized, complex fabrication. This trend favors suppliers adept at mass-produced modules, which might undercut demand for highly customized solutions. For instance, the offshore wind sector, a key market for Gulf Island, is seeing a push towards standardized foundation designs to drive down costs and accelerate deployment.

Gulf Island's competitive advantage lies in its ability to handle intricate and specialized structures, a niche that may be eroded if the industry increasingly opts for simpler, standardized components. This shift could lead to a reduction in the perceived value of bespoke fabrication services, impacting Gulf Island's pricing power and market share in certain segments.

- Threat of Substitutes: Modularization and Standardization

- The growing trend towards modular construction and standardized components across various heavy industrial sectors presents a significant threat.

- This can diminish the demand for Gulf Island's core competency in complex, customized fabrication, as clients may increasingly opt for simpler, mass-produced modules.

- For example, in the energy infrastructure sector, there is a discernible move towards more standardized platform designs and components to achieve economies of scale and faster project execution.

- This shift could impact Gulf Island's revenue streams if it cannot effectively pivot or if its specialized services become less economically attractive compared to standardized alternatives.

Global Sourcing and Lower-Cost Countries

Customers might explore sourcing fabrication from lower-cost countries, presenting a potential substitute to domestic fabrication services offered by Gulf Island. This global sourcing trend is driven by the pursuit of cost reduction, a persistent theme in many industries.

However, the attractiveness of these lower-cost alternatives is often tempered by significant practical considerations. For complex projects, the added costs and risks associated with logistical challenges, stringent quality control requirements, and extended project timelines can outweigh initial price advantages.

For instance, in 2024, the global shipping costs saw fluctuations, impacting the total landed cost of fabricated components. While some regions offered lower labor rates, the total cost of ownership, including freight and potential delays, remained a critical factor for Gulf Island's clientele.

- Global Sourcing Potential: Customers can seek fabrication services from countries with lower labor costs, potentially substituting Gulf Island's offerings.

- Mitigating Factors: Logistical complexities, the need for rigorous quality assurance, and the critical nature of project timelines for intricate structures often favor established, domestic fabricators.

- Cost Analysis: While labor costs might be lower abroad, the total cost of ownership, including shipping and risk management, can make local sourcing more competitive for complex projects.

The threat of substitutes for Gulf Island's core fabrication services is multifaceted. While direct material substitutes for large-scale steel structures remain limited due to performance requirements, the broader energy transition presents a significant challenge. As investments shift towards renewables, the demand for oil and gas infrastructure, a key market for Gulf Island, is expected to decline.

Furthermore, the increasing trend towards modularization and standardization in construction can reduce the need for highly specialized, custom fabrication. This could favor competitors offering mass-produced components. For example, the offshore wind sector is increasingly adopting standardized foundation designs to lower costs and speed up deployment, potentially impacting Gulf Island's niche market.

Global sourcing also poses a threat, as customers may look to lower-cost countries for fabrication. However, for complex projects, the total cost of ownership, including logistics and quality control, often favors established domestic fabricators like Gulf Island. For instance, in 2024, while labor costs in some regions were lower, fluctuating global shipping costs and the need for stringent quality assurance remained critical considerations for clients.

| Substitute Type | Impact on Gulf Island | Key Considerations | 2024 Data/Trend |

|---|---|---|---|

| Renewable Energy Transition | Decreased demand for oil & gas infrastructure fabrication | Shift in global energy investment | Global clean energy investment projected to reach $2 trillion in 2024 (IEA) |

| Modularization & Standardization | Reduced need for complex, custom fabrication | Preference for mass-produced components | Offshore wind sector adopting standardized foundation designs |

| Global Sourcing (Lower-Cost Countries) | Potential loss of business due to price competition | Logistics, quality control, project timelines are critical factors | Fluctuating global shipping costs impacting total landed cost |

Entrants Threaten

The fabrication of complex steel structures, modules, and marine vessels for the offshore and energy sectors demands immense capital. New entrants must invest heavily in state-of-the-art fabrication yards, specialized heavy-lift equipment, and advanced welding and machining technologies. For instance, establishing a fabrication facility capable of handling large offshore modules can easily run into hundreds of millions of dollars, a significant hurdle for smaller or less capitalized companies.

Established players like Gulf Island Fabrication, Inc. leverage significant economies of scale in areas such as material sourcing, manufacturing efficiency, and project execution. For instance, in 2023, Gulf Island reported total revenues of $375.6 million, demonstrating the scale of operations necessary to achieve cost competitiveness in the fabrication industry. New entrants would require substantial upfront capital and accumulated experience to match these operational efficiencies and cost structures, posing a considerable barrier.

New companies entering the Gulf Island market face a significant hurdle in securing access to established distribution channels and cultivating strong customer relationships. These relationships, built over years with major energy producers, LNG operators, and EPC companies, represent a substantial barrier to entry, requiring considerable time and investment to replicate.

Proprietary Technology and Expertise

Gulf Island's deep specialization in engineering, fabricating, and installing complex, large-scale components creates a significant barrier to entry. This involves proprietary knowledge, highly specialized welding techniques, and intricate project management skills that new competitors would find exceedingly difficult and time-consuming to develop and master.

The company's established track record and the inherent complexities of its operations, particularly in sectors like offshore energy infrastructure, mean that replicating its capabilities would require substantial investment in specialized equipment, skilled labor, and years of on-the-job learning. For instance, the capital expenditure for a single advanced fabrication facility can easily run into hundreds of millions of dollars, a hurdle most new entrants cannot easily clear.

- Proprietary Technology: Gulf Island possesses unique engineering designs and fabrication processes honed over years of experience, making it hard for newcomers to match efficiency and quality.

- Specialized Expertise: The company's workforce has developed advanced welding and construction techniques critical for large-scale, high-tolerance projects, a skill set not readily available in the market.

- High Capital Requirements: Establishing the necessary infrastructure, including advanced machinery and testing facilities, demands significant upfront capital, deterring many potential entrants.

Government Policy and Regulations

Government policy and regulations present a significant barrier to entry for new companies looking to operate in Gulf Island's core markets. Stringent environmental regulations, for instance, often require substantial upfront investment in compliance technology and ongoing monitoring, which can deter smaller, less capitalized entrants. In 2024, the energy sector continued to see increased scrutiny on emissions and waste management, with new directives impacting project approvals.

Safety standards in the energy and industrial sectors, especially for complex offshore and liquefied natural gas (LNG) projects, are exceptionally high. New entrants must demonstrate a robust safety culture and infrastructure, often requiring certifications and audits that are time-consuming and expensive to obtain. Permitting processes themselves can be lengthy and complex, adding considerable lead time and uncertainty to new market entries.

- Regulatory Hurdles: Navigating environmental, safety, and permitting requirements adds significant complexity and cost for new entrants in the energy and industrial sectors.

- Compliance Costs: Adhering to strict standards, particularly for offshore and LNG projects, necessitates substantial investment in technology, training, and certification.

- Market Entry Time: Lengthy and intricate permitting processes can delay market entry, creating a competitive advantage for established players with existing approvals.

- 2024 Trends: Increased focus on emissions and waste management in the energy sector in 2024 amplified the financial and operational demands on new participants.

The threat of new entrants in Gulf Island's fabrication sector is considerably low due to substantial capital requirements for establishing advanced fabrication yards and specialized equipment, often costing hundreds of millions of dollars. Furthermore, the need to match economies of scale, as demonstrated by Gulf Island's 2023 revenue of $375.6 million, requires significant upfront investment and accumulated experience to achieve cost competitiveness.

Existing customer relationships with major energy producers and EPC companies, built over years, represent a significant barrier, demanding considerable time and investment for new firms to replicate. Gulf Island's deep specialization in complex engineering, fabrication, and installation, coupled with proprietary knowledge and advanced techniques, creates a formidable hurdle for potential competitors seeking to develop similar capabilities and master intricate project management skills.

Stringent government regulations and high safety standards, particularly for offshore and LNG projects, add further complexity and cost. In 2024, increased scrutiny on emissions and waste management in the energy sector amplified compliance demands. Navigating these regulatory hurdles, including lengthy permitting processes, necessitates substantial investment in technology, training, and certification, thereby limiting new market entries.

| Barrier Type | Description | Impact on New Entrants | Example Data/Context |

|---|---|---|---|

| Capital Requirements | Establishing state-of-the-art fabrication yards and heavy-lift equipment. | Very High - Requires hundreds of millions in upfront investment. | Fabrication facility costs can exceed $100 million. |

| Economies of Scale | Achieving cost competitiveness through efficient sourcing and manufacturing. | High - Difficult for new entrants to match established cost structures. | Gulf Island's 2023 revenue of $375.6 million indicates significant scale. |

| Customer Relationships | Securing long-term contracts with major energy clients. | High - Takes years to build trust and replicate established relationships. | Dependence on repeat business from key oil and gas majors. |

| Specialized Expertise | Mastering complex engineering, welding, and project management. | Very High - Requires significant investment in training and R&D. | Proprietary welding techniques for high-tolerance offshore structures. |

| Regulatory & Safety Standards | Meeting stringent environmental, safety, and permitting requirements. | High - Involves substantial compliance costs and time. | 2024 energy sector trends increased focus on emissions compliance. |

Porter's Five Forces Analysis Data Sources

Our Gulf Island Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific trade publications, and government economic data. We also incorporate insights from market research firms specializing in the energy and infrastructure sectors.