Gulf Island Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gulf Island Bundle

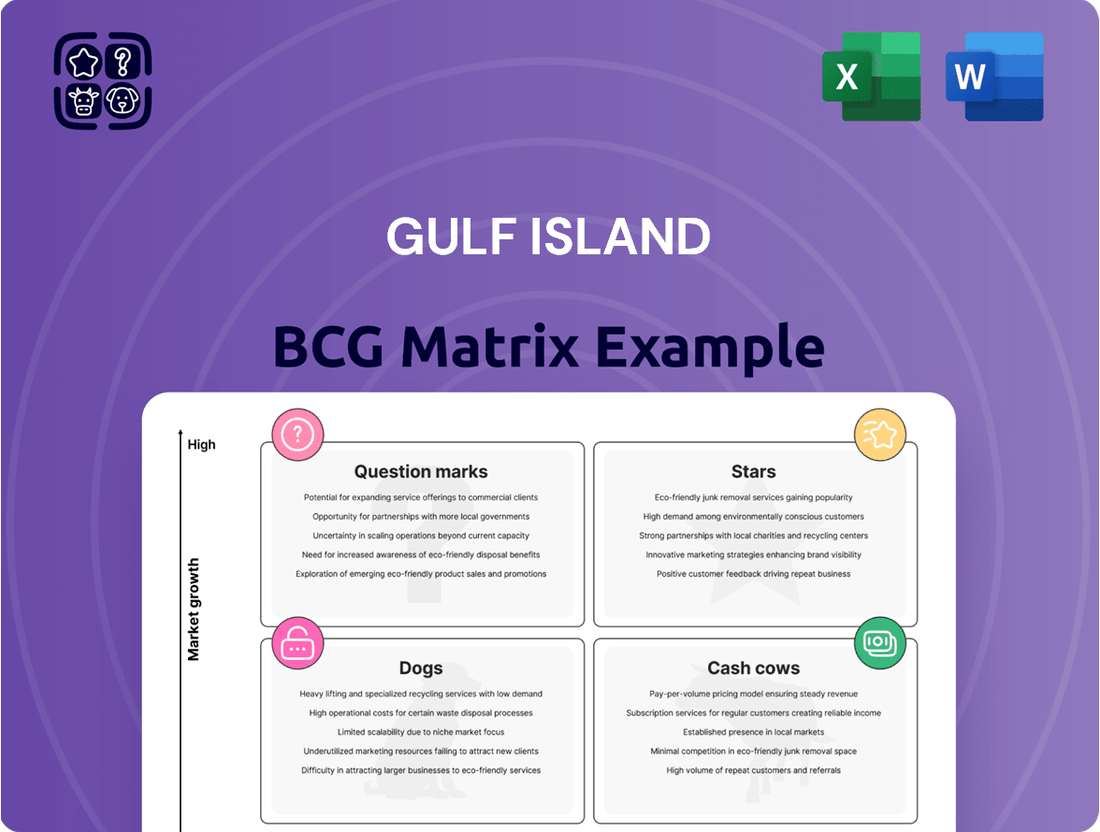

Curious about Gulf Island's product portfolio performance? This snapshot of their BCG Matrix highlights key areas of strength and potential concern, offering a glimpse into their market positioning.

To truly understand Gulf Island's strategic direction and unlock actionable insights, dive into the full BCG Matrix. This comprehensive report reveals the detailed quadrant placements for each product, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the complete picture; purchase the full Gulf Island BCG Matrix today for a strategic advantage.

Stars

Gulf Island is making a significant push into offshore wind fabrication, a sector poised for substantial expansion. This strategic move aligns with the company's diversification efforts into clean energy.

The global offshore wind market is a compelling growth area, with projections indicating a CAGR of 12.3% between 2024 and 2031. In 2024 alone, the market is valued at USD 31.8 billion, with expectations to surpass USD 55.9 billion by 2031.

By focusing on offshore wind fabrication, Gulf Island aims to establish a strong foothold in this high-growth industry, potentially developing new ventures into lucrative cash cows for the company's future.

Gulf Island's small-scale fabrication segment is a shining example of a strong performer within the BCG matrix. This area has experienced robust growth, evidenced by a 14.2% year-over-year revenue increase in Q3 2024.

The positive momentum continued into 2025, with Q1 2025 showing further expansion. This segment's ability to nearly double its adjusted EBITDA in the same period highlights exceptional operational efficiency and profitability.

The consistent growth suggests Gulf Island holds a significant market share in its specialized fabrication niche, positioning it as a key revenue driver with a promising future outlook.

Gulf Island's subsea fabrication projects are a key component of its business, showing significant growth. The company has been awarded several new contracts, demonstrating robust demand in this specialized sector. This momentum is expected to continue, with management projecting sustained strength through 2024.

The anticipated strength in subsea fabrication is largely driven by upcoming projects in major offshore regions. Specifically, developments in the Gulf of Mexico, Guyana, and Brazil are expected to fuel this demand. This trend highlights the increasing need for sophisticated fabrication services essential for deepwater exploration and production activities.

LNG Infrastructure Fabrication

LNG infrastructure fabrication is a star in the BCG matrix for Gulf Island. The global LNG infrastructure market is booming, projected to grow at a 6% compound annual growth rate between 2023 and 2028. This expansion is fueled by a significant increase in LNG demand, which is anticipated to rise by 60% by 2040.

Gulf Island's role as a fabricator for LNG operators places it directly in this high-growth sector. The company's proven expertise in constructing large-scale, complex components for LNG projects is a key differentiator.

- Market Growth: Global LNG infrastructure market CAGR of 6% (2023-2028).

- Demand Surge: Global LNG demand expected to increase by 60% by 2040.

- Gulf Island's Position: Well-positioned to capitalize on this growth due to fabrication expertise.

- Competitive Advantage: Ability to deliver complex structures for critical LNG projects.

Diversification into Clean Energy

Diversification into clean energy marks a strategic pivot for Gulf Island, moving beyond its traditional oil and gas base into high-growth markets. This expansion is fueled by global energy transition trends and favorable government policies. For example, in 2024, Gulf Island announced its involvement in developing offshore wind infrastructure, a sector projected to see significant investment. This move aims to position the company as a key player in emerging, rapidly expanding industries.

Gulf Island's clean energy ventures are designed to tap into lucrative new revenue streams. The company is actively pursuing projects in areas like renewable energy component manufacturing and installation services. These initiatives are crucial for long-term growth and sustainability, especially as the global energy landscape evolves. By 2024, the clean energy sector represented a growing portion of Gulf Island's project pipeline, reflecting this strategic emphasis.

- Strategic Expansion: Gulf Island is actively broadening its portfolio to include clean energy solutions, moving beyond its established oil and gas services.

- Market Drivers: This diversification is driven by global decarbonization efforts and supportive regulatory frameworks encouraging renewable energy adoption.

- Project Focus: The company is targeting opportunities in areas such as offshore wind, solar infrastructure, and other sustainable energy technologies.

- Growth Potential: By investing in clean energy, Gulf Island aims to capitalize on a high-growth market, securing future revenue streams and market leadership.

Gulf Island's offshore wind fabrication segment is a true star. This area has seen substantial investment and growth, with the global offshore wind market projected to grow significantly. The company's strategic focus here positions it to capture a large share of this expanding market.

The company's small-scale fabrication and LNG infrastructure fabrication segments are also performing exceptionally well, exhibiting strong growth and profitability. These areas represent significant opportunities for Gulf Island, contributing substantially to its overall performance and future outlook.

Gulf Island's ventures into clean energy, particularly offshore wind fabrication, are poised for stellar growth. This strategic diversification aligns with global energy trends and positions the company for long-term success in a rapidly expanding sector.

| Business Segment | BCG Category | Key Performance Indicators | Market Outlook |

|---|---|---|---|

| Offshore Wind Fabrication | Star | Significant investment, robust growth potential | Global offshore wind market CAGR of 12.3% (2024-2031) |

| Small-Scale Fabrication | Star | 14.2% YoY revenue increase (Q3 2024), EBITDA nearly doubled | Strong niche market share, promising future |

| LNG Infrastructure Fabrication | Star | Proven expertise in complex components, high demand | Global LNG infrastructure market CAGR of 6% (2023-2028) |

What is included in the product

This analysis categorizes Gulf Island's business units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The Gulf Island BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex business unit analysis.

Cash Cows

Gulf Island's established offshore oil and gas fabrication business is a quintessential Cash Cow within its BCG portfolio. This segment leverages decades of experience, solidifying its position as a dominant player in fabricating intricate steel structures for a mature industry.

Despite the sector's moderate growth, Gulf Island commands a significant market share, a testament to its enduring reputation and operational excellence. This translates into a reliable and substantial generation of cash flow, a hallmark of a successful Cash Cow.

For context, in 2024, the offshore oil and gas construction market, while facing evolving energy landscapes, continued to rely on experienced fabricators for critical infrastructure projects. Gulf Island's consistent performance in this area underscores its ability to convert its high market share into robust earnings.

Gulf Island's Project Management & Maintenance Services are a classic Cash Cow. These services, covering everything from hookup and commissioning to ongoing repair and maintenance for industrial and energy clients, generate a predictable and stable income.

This segment benefits from a high market share in a mature market. For instance, in 2024, Gulf Island reported significant revenue from its maintenance and support operations, which are crucial for the longevity of existing infrastructure.

The steady cash flow from these operations requires minimal reinvestment for growth, allowing the company to allocate capital to other areas of its business. This stability is a hallmark of a strong Cash Cow, providing reliable financial support.

Gulf Island's Traditional Industrial Fabrication segment extends beyond the energy sector, offering specialized steel structures and modules for diverse industrial applications. This area likely represents a stable revenue stream, benefiting from consistent demand and mature market dynamics. For instance, in 2023, Gulf Island reported that its Fabrication segment, which includes industrial work, contributed significantly to its overall backlog, highlighting the ongoing demand for these services.

Specialized Module Fabrication

Gulf Island's Specialized Module Fabrication segment is a classic Cash Cow. This division holds a substantial market share within a niche market focused on creating large, complex modules for industries like oil and gas, and renewable energy. These projects are high-value, leveraging Gulf Island's proprietary knowledge and extensive experience, which translates into robust profit margins and consistent cash flow.

The demand for these specialized fabrication services, while not experiencing rapid growth, remains steady. This stability, coupled with the company's established expertise, allows Gulf Island to generate significant cash with relatively low investment needs. For instance, in 2024, the company continued to secure key contracts in this segment, contributing significantly to its overall financial performance.

- Market Dominance: Gulf Island commands a strong position in the fabrication of large, intricate industrial modules.

- High Profitability: Proprietary knowledge and specialized skills lead to substantial profit margins.

- Consistent Demand: The need for these complex modules remains stable across various mature industries.

- Cash Generation: This segment reliably produces strong cash flows with minimal reinvestment requirements.

Recurring Repair and Civil Construction Services

Gulf Island's recurring repair and civil construction services are a prime example of a Cash Cow within the BCG matrix. These offerings are vital for the upkeep of aging infrastructure across the energy and industrial sectors, ensuring a consistent and predictable demand. This reliability is further bolstered by the company's established high market share in these essential services, translating into a steady and dependable generation of cash flow.

The predictable nature of these services, often secured through long-term contracts, provides a stable revenue stream. For instance, Gulf Island's involvement in maintaining critical energy infrastructure means they are often contracted for ongoing maintenance and repair work, insulating them from the cyclical downturns that can affect other parts of the business. This consistent demand makes them a reliable source of funds for the company.

- Predictable Demand: Essential maintenance and repair services for aging infrastructure in energy and industrial sectors create a consistent need.

- Long-Term Contracts: Many of these services are secured through multi-year agreements, ensuring revenue stability.

- High Market Share: Gulf Island's strong position in these niche services allows for efficient operations and consistent cash generation.

- Revenue Stability: These services contribute significantly to Gulf Island's overall revenue, acting as a stable financial foundation.

Gulf Island's offshore oil and gas fabrication business is a prime Cash Cow. This segment benefits from a high market share in a mature industry, generating substantial and reliable cash flow. For example, in 2024, the company continued to leverage its expertise in fabricating complex steel structures for critical infrastructure, contributing significantly to its financial stability.

The Project Management & Maintenance Services also function as a Cash Cow, offering predictable income from hookup, commissioning, and ongoing repair work. In 2024, these operations were a key revenue driver, demonstrating consistent performance and requiring minimal reinvestment for growth, thereby supporting other business ventures.

Gulf Island's Specialized Module Fabrication is another strong Cash Cow, holding a significant market share in a niche area. These high-value projects, utilizing proprietary knowledge, yield robust profit margins and consistent cash. The company secured key contracts in this segment throughout 2024, reinforcing its role as a stable financial contributor.

Preview = Final Product

Gulf Island BCG Matrix

The Gulf Island BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections—just the comprehensive, professionally formatted strategic analysis ready for your immediate use. You can trust that the insights and layout are exactly as presented, allowing you to confidently integrate this valuable tool into your business planning and decision-making processes without any further editing or adjustments required.

Dogs

The former Shipyard Division at Gulf Island represents a classic example of a Dogs category in the BCG Matrix. Its operations were largely concluded by the end of 2023, with a final wind-down expected by March 2025 as warranty periods for ferry projects expire. This strategic exit is underscored by the division's minimal revenue generation in late 2024 and early 2025, confirming its status as a low-growth, low-market-share segment.

Legacy marine vessel construction, as part of Gulf Island's BCG Matrix, falls into the Dogs category. This designation reflects that these are remnants of past operations, no longer strategically relevant or profitable. The company is actively winding down this segment, as it ties up valuable capital with negligible future returns.

Non-Strategic, Low-Volume Projects in the Gulf Island BCG Matrix represent initiatives that don't align with the company's core competencies or high-growth areas. These often include smaller fabrication jobs or specialized services that, while potentially necessary, don't drive significant revenue or profit. For instance, if Gulf Island's core business is large-scale offshore construction, a one-off repair of a small vessel would fit here.

These projects typically exhibit low revenue and profit margins, meaning the return on investment is minimal. They can tie up valuable resources, such as skilled labor, equipment, and management attention, that could be better allocated to more promising ventures. In 2024, companies like Gulf Island are increasingly scrutinizing such projects to optimize operational efficiency.

The strategy for these projects is often to minimize or eliminate them entirely. By doing so, Gulf Island can free up capital and personnel to focus on its Stars and Cash Cows, thereby enhancing overall profitability and strategic positioning. This pruning process is crucial for maintaining a lean and effective operational structure.

Underperforming Niche Fabrication

Underperforming niche fabrication segments represent areas where Gulf Island has struggled to maintain a significant market presence or profitability. These might include specialized components for industries experiencing technological shifts or facing intense global competition. For instance, if a particular type of custom-engineered part for a legacy industrial sector has seen its demand plummet due to newer, more efficient alternatives, it would fall into this category.

These segments are characterized by consistently low market share and profitability, often due to declining demand or escalating competition. The cost of revitalizing these niches, through significant investment in new technology or market repositioning, may outweigh the potential returns. For example, if a niche fabrication area requires substantial retooling to meet evolving industry standards and the market size is too small to justify the capital expenditure, it becomes a prime candidate for divestment.

- Declining Demand: Specific niche fabrication areas, such as components for older offshore oil and gas platforms, may experience reduced demand as the industry shifts towards newer technologies or consolidates.

- Increased Competition: The entry of lower-cost international fabricators into specialized markets can erode Gulf Island's market share and profitability in certain niches.

- Resource Optimization: Exiting these underperforming niches allows Gulf Island to reallocate capital and operational resources to more promising growth areas within its portfolio.

- Profitability Challenges: Consistently low margins in these segments indicate that they are not contributing effectively to the company's overall financial health, making strategic withdrawal a sensible option.

Divested or Phasing-Out Business Lines

Gulf Island Fabrication, Inc. (GIFI) has strategically divested or is phasing out business lines that no longer align with its core focus on enhancing durability and predictability. This includes assets beyond its primary shipyard operations that have demonstrated low growth prospects and a limited fit within the company's market share objectives.

These divestitures represent a deliberate shedding of non-contributing assets, signaling a commitment to optimizing the company's portfolio. For instance, in the fiscal year 2023, Gulf Island reported a net loss of $29.5 million, partly influenced by the costs associated with restructuring and managing these less profitable segments.

- Divested Assets: Business lines or assets that have been sold off due to poor performance or strategic misalignment.

- Phasing Out: Operations or segments that are being gradually wound down to reallocate resources to more promising areas.

- Strategic Focus: The company's emphasis on durability and predictability drives the decision to exit underperforming ventures.

- Past Investments: These represent historical capital allocations that did not meet long-term strategic goals or market expectations.

The Dogs in Gulf Island's BCG Matrix represent business segments with low market share and low growth potential. These are typically legacy operations or niche projects that no longer contribute significantly to revenue or profitability. For example, the company's final wind-down of its former Shipyard Division by March 2025, following minimal revenue generation in late 2024, exemplifies this category. These segments tie up capital and resources that could be better deployed in more promising areas.

Question Marks

Gulf Island's foray into high-tech manufacturing fabrication positions it as a potential "Question Mark" in the BCG Matrix. This sector offers substantial growth prospects, with the global advanced manufacturing market projected to reach $2.1 trillion by 2028, growing at a CAGR of 7.5%.

However, as a relatively new entrant, Gulf Island likely holds a modest market share. Capturing significant market share will necessitate substantial capital investment in advanced machinery, skilled labor development, and robust sales and marketing efforts. For example, companies like ASML, a leader in semiconductor manufacturing equipment, invest billions annually in R&D to maintain their competitive edge.

The challenge for Gulf Island is to effectively leverage these investments to transition from a Question Mark to a Star. This requires a clear strategy for technological advancement and customer acquisition within these burgeoning high-tech industries.

Gulf Island's New Infrastructure Fabrication segment is positioned as a 'Question Mark' within its BCG matrix. The company is actively pursuing growth in new infrastructure markets outside its traditional energy focus, recognizing significant expansion potential. This strategic pivot aims to tap into burgeoning sectors with high future demand.

While Gulf Island leverages its established fabrication capabilities, achieving substantial market share in these varied infrastructure projects presents a challenge. It will necessitate considerable capital investment and a well-defined strategic approach to penetrate these new arenas effectively. The company's expertise in fabrication is a strong foundation, but market entry requires focused execution.

This segment embodies high growth prospects due to the expanding infrastructure landscape, yet currently exhibits low market penetration for Gulf Island. For instance, in 2024, the global infrastructure market was projected to reach trillions of dollars, with significant investments in renewable energy, transportation, and digital infrastructure, areas where Gulf Island is seeking to increase its footprint.

Gulf Island's Cleaning and Environmental Services (CES) business line is positioned as a Question Mark within the BCG Matrix. This new venture supports the growing decommissioning needs in the Gulf of Mexico, a sector experiencing significant expansion due to regulatory mandates and the aging of offshore infrastructure. The market itself is robust, with projections indicating continued strong growth through 2024 and beyond as operators address their environmental responsibilities.

Automation and Engineering Services (from ENGlobal acquisition)

The automation and engineering services segment, bolstered by the April 2025 acquisition of ENGlobal Corporation's relevant assets, positions Gulf Island within a dynamic market. These services are crucial for sectors like oil & gas and renewable energy, both experiencing significant growth trajectories. For instance, the global industrial automation market was projected to reach approximately $315 billion by 2024, with significant contributions from energy sectors.

However, Gulf Island's market presence in these specific automation and engineering capabilities is still developing. This means the business unit likely falls into the 'Question Mark' category of the BCG matrix. It operates in a high-growth industry but currently holds a relatively low market share under the Gulf Island brand. Strategic investment and effective integration of ENGlobal's operations will be key to increasing market penetration.

- Market Growth: High, driven by oil & gas and renewable energy sectors.

- Market Share: Nascent for Gulf Island post-acquisition.

- Strategic Focus: Integration and investment to build market presence.

- Potential: Significant if market share can be effectively captured.

Government Services (from ENGlobal acquisition)

The acquisition of ENGlobal brought government services businesses into Gulf Island's portfolio, marking a strategic diversification. This sector is known for its stability, though it can also be quite competitive. Gulf Island's current market share in this newly acquired segment is relatively small, indicating a need for focused investment to build its presence and win contracts.

For 2024, Gulf Island is likely assessing the revenue potential and contract win rates within these government services. While specific figures for this segment's contribution to Gulf Island's overall revenue post-acquisition are still emerging, the government sector typically offers long-term contracts that can provide a predictable revenue stream. For instance, many defense and infrastructure-related government contracts span several years, offering a degree of revenue visibility that complements other cyclical business segments.

- Market Position: Gulf Island's market share in government services is currently low, presenting an opportunity for growth.

- Revenue Potential: The government sector often provides stable, long-term contracts, contributing to predictable revenue.

- Competitive Landscape: While stable, the government services market is competitive, requiring strategic efforts to secure contracts.

- Strategic Focus: Investment will be crucial for Gulf Island to expand its footprint and establish a stronger position in this new segment.

Gulf Island's expansion into high-tech manufacturing fabrication places it in a 'Question Mark' category due to its newness and potential for high growth but currently low market share. The global advanced manufacturing market is projected for robust growth, with significant investment needed to gain traction.

Similarly, the New Infrastructure Fabrication segment operates as a 'Question Mark,' targeting high-growth areas with substantial capital investment requirements to build market penetration. The Cleaning and Environmental Services (CES) business is also a 'Question Mark,' addressing a growing market driven by regulatory needs but requiring strategic investment for Gulf Island to capture its share.

The automation and engineering services segment, enhanced by recent acquisitions, represents another 'Question Mark.' While operating in a high-growth market, Gulf Island's market share is still developing, necessitating strategic investment for expansion. The government services sector, a recent diversification, also positions Gulf Island as a 'Question Mark' with a low current market share requiring focused investment to build its presence.

| Business Segment | BCG Category | Market Growth | Market Share | Strategic Imperative |

| High-Tech Manufacturing Fabrication | Question Mark | High (Global market projected to reach $2.1 trillion by 2028) | Low (New entrant) | Invest to gain market share |

| New Infrastructure Fabrication | Question Mark | High (Global infrastructure market trillions in 2024) | Low | Capital investment and market penetration strategy |

| Cleaning and Environmental Services (CES) | Question Mark | High (Ongoing demand for decommissioning) | Low | Strategic investment to capture market needs |

| Automation and Engineering Services | Question Mark | High (Global industrial automation market ~ $315 billion by 2024) | Low (Developing presence) | Integration and investment for market penetration |

| Government Services | Question Mark | Stable | Low (New segment) | Focused investment to build presence and win contracts |

BCG Matrix Data Sources

Our Gulf Island BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.