Grifols PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grifols Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Grifols's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic decision-making. Gain a competitive edge by understanding the landscape Grifols operates within. Download the full version now for comprehensive insights that can inform your own market strategy.

Political factors

Grifols, a global leader in plasma-derived medicines, navigates a complex web of government healthcare policies that directly influence its operations and profitability. Regulations on drug pricing, for instance, can significantly impact the revenue Grifols generates from its life-saving therapies. In 2024, many countries are reviewing their pharmaceutical pricing strategies to control healthcare costs, a trend that could put pressure on Grifols' margins.

Reimbursement schemes, which determine how healthcare providers are compensated for using Grifols' products, are another critical political factor. Changes in these schemes, influenced by national healthcare spending priorities, can alter market access and demand for Grifols' plasma-based treatments. For example, shifts towards value-based healthcare models might require Grifols to demonstrate the long-term economic benefits of its therapies, a challenge that will likely intensify in 2024-2025.

The diverse political landscapes across Grifols' key markets necessitate constant adaptation. As of early 2025, governments worldwide are focusing on strengthening public health systems, often through increased investment in essential medicines. Grifols must strategically align its market access strategies with these evolving national healthcare priorities to ensure continued revenue generation and growth, particularly in regions like Europe and North America where policy shifts are frequent.

The regulatory landscape for plasma collection significantly impacts Grifols. In 2024, for instance, ongoing discussions in the U.S. Congress and by the FDA continue to shape donor eligibility criteria and compensation models, directly affecting plasma supply. These political decisions, often influenced by public health and ethical debates, are crucial for Grifols' Bioscience division, which relies heavily on this raw material.

Grifols' global plasma supply chain is highly sensitive to international trade relations and geopolitical shifts. For instance, ongoing trade tensions between major economies could lead to tariffs on raw materials or finished plasma-derived products, increasing operational costs. The company's reliance on sourcing plasma from various countries means political stability in these regions, such as the United States which is a major donor, is critical. In 2023, the U.S. accounted for a significant portion of the global plasma supply, underscoring the importance of stable political environments there.

Geopolitical instability, including conflicts or sudden policy changes in key markets, can disrupt Grifols' ability to import and export essential components and finished goods. For example, a trade dispute involving a major European market, where Grifols has substantial operations, could impact its distribution networks. The company's 2024 strategy likely includes contingency planning for such disruptions, aiming to mitigate risks associated with cross-border trade policies and political unrest in its operational territories.

Public Health Emergencies and Government Responses

Global public health emergencies, like the COVID-19 pandemic, significantly alter government priorities, redirecting resources within healthcare systems. This can impact companies like Grifols, which rely on stable supply chains and regulatory environments. For instance, during the pandemic, governments worldwide implemented travel restrictions and lockdowns, affecting the movement of personnel and raw materials crucial for pharmaceutical manufacturing.

Governments may issue directives affecting plasma donation centers, manufacturing processes, or the distribution of vital medicines. Grifols, as a major player in plasma-derived medicines, must be agile in adapting to these political mandates. The company's ability to comply with or influence these emergency measures can directly impact its operational continuity and market access. For example, some governments prioritized vaccine distribution, potentially impacting the availability of other essential medical supplies.

Grifols needs robust contingency plans to navigate such political interventions and potentially reorient its operations to support broader public health objectives. The company's 2024 and 2025 strategies will likely incorporate greater resilience against unforeseen public health crises and the associated governmental responses. This includes ensuring diversified sourcing and flexible manufacturing capabilities to meet evolving public health demands.

- Governmental focus on public health: Increased government spending and regulatory oversight in healthcare sectors are expected through 2025, driven by lessons learned from recent pandemics.

- Supply chain resilience: Political initiatives aimed at strengthening domestic pharmaceutical supply chains could create both opportunities and challenges for global manufacturers like Grifols.

- Regulatory flexibility: The potential for expedited regulatory pathways for critical medicines during health emergencies highlights the need for Grifols to maintain strong relationships with health authorities.

Pharmaceutical Industry Lobbying and Influence

The pharmaceutical industry, including major players like Grifols, actively engages in lobbying to shape policies concerning drug approval processes, patent protection, and pricing. This advocacy directly impacts the regulatory landscape and market access, influencing Grifols' strategic direction and financial performance. For instance, in 2023, the pharmaceutical industry spent an estimated $300 million on lobbying efforts in the United States alone, highlighting the significant political capital invested in influencing healthcare legislation.

The effectiveness of Grifols' lobbying is contingent on the prevailing political climate and the receptiveness of policymakers to industry concerns. Favorable legislation can accelerate drug development timelines and secure market exclusivity, while unfavorable policies, such as stricter price controls, could constrain revenue growth. The ongoing debate around drug pricing in major markets like the US and EU continues to be a key focus for pharmaceutical lobbying, with potential implications for Grifols' plasma-derived medicines and diagnostic solutions.

- Lobbying expenditure: The pharmaceutical sector's substantial lobbying investments underscore its commitment to influencing policy.

- Regulatory impact: Political decisions on drug approval and intellectual property directly affect market entry and profitability.

- Pricing pressures: Evolving government stances on drug pricing present both challenges and opportunities for companies like Grifols.

Political factors significantly shape Grifols' operational environment, from drug pricing regulations to reimbursement policies. Governments worldwide are increasingly focused on controlling healthcare costs, with many reviewing pharmaceutical pricing strategies in 2024 and 2025, which could impact Grifols' revenue. The company must also navigate evolving value-based healthcare models that require demonstrating the economic benefits of its therapies.

Geopolitical shifts and international trade relations directly affect Grifols' global supply chain, particularly its reliance on plasma sourcing. Trade tensions or political instability in key regions, such as the United States which is a major plasma donor, can increase operational costs and disrupt distribution networks. Grifols' 2024 strategies likely include robust contingency planning for such disruptions.

Governmental responses to public health emergencies, including potential directives on manufacturing or distribution, necessitate agility from Grifols. The company's ability to adapt to these political mandates and ensure operational continuity is crucial, especially as governments may prioritize certain medical supplies during crises. Grifols' 2024-2025 plans emphasize resilience against unforeseen events and associated governmental actions.

Active lobbying by Grifols and the broader pharmaceutical industry aims to influence policies on drug approval, patent protection, and pricing. In 2023, the U.S. pharmaceutical industry alone reportedly spent around $300 million on lobbying, underscoring the significant investment in shaping healthcare legislation. Favorable policies can accelerate development and market access, while price controls pose revenue constraints.

| Political Factor | Impact on Grifols | 2024-2025 Relevance |

|---|---|---|

| Drug Pricing Regulations | Affects revenue and profitability of therapies. | Increased government focus on cost control globally. |

| Reimbursement Schemes | Influences market access and demand for products. | Shift towards value-based healthcare models. |

| Supply Chain Stability | Vulnerable to geopolitical shifts and trade policies. | U.S. remains a critical plasma source; political stability is key. |

| Lobbying and Advocacy | Shapes regulatory landscape and market access. | Pharmaceutical industry invests heavily to influence policy. |

What is included in the product

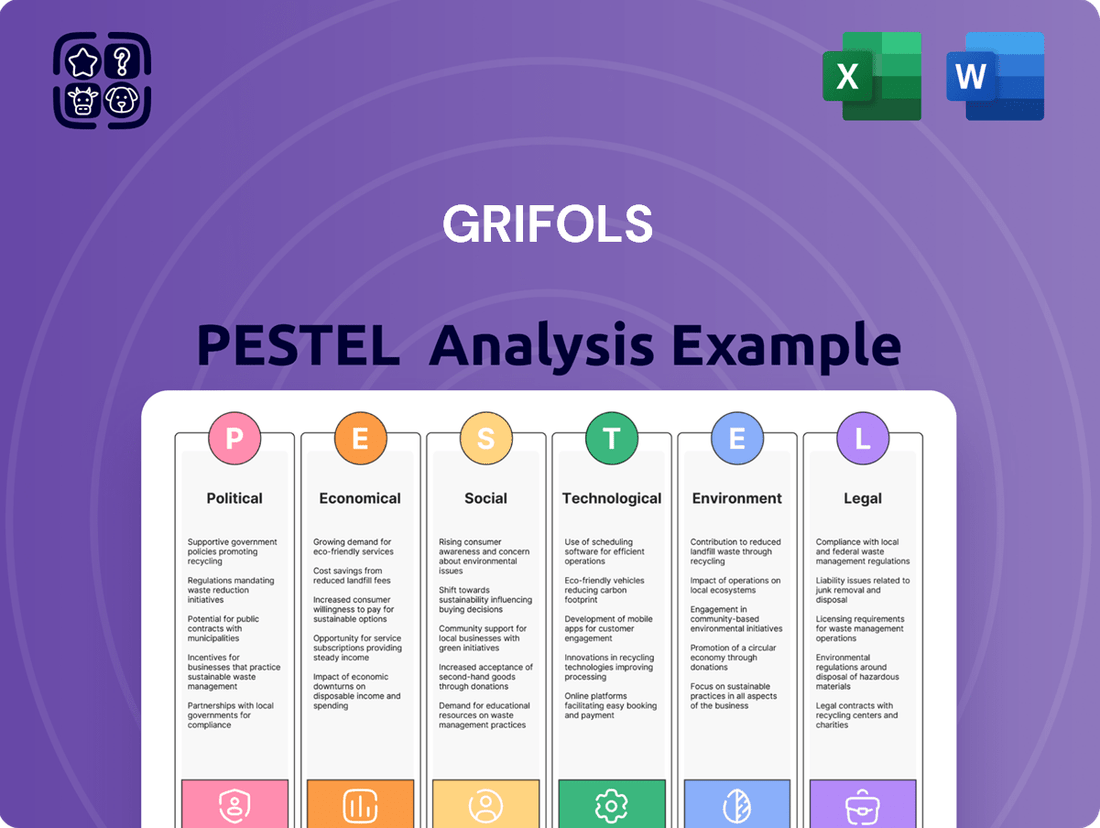

This PESTLE analysis meticulously examines the external macro-environmental forces impacting Grifols across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a comprehensive understanding of how these factors create both opportunities and threats, enabling strategic decision-making for Grifols.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively addressing the pain point of time-consuming report generation.

Easily shareable summary format ideal for quick alignment across teams or departments, alleviating the challenge of fragmented communication and ensuring everyone is on the same page regarding external factors.

Economic factors

Global economic growth significantly shapes healthcare spending. For instance, the International Monetary Fund projected global growth to be 3.2% in 2024, a slight rebound from 3.0% in 2023. This expansion generally translates to increased capacity for governments, insurers, and individuals to invest in healthcare, potentially benefiting companies like Grifols by driving demand for its plasma-derived therapies and diagnostic tools.

However, economic slowdowns present challenges. A contraction in economic activity can force budget reallocations away from healthcare, leading to reduced public spending and lower disposable income for individuals. This can directly impact sales volumes for Grifols' products as purchasing power diminishes and healthcare systems face tighter financial constraints.

Grifols faces significant headwinds from inflation, impacting key operational expenses. The cost of acquiring plasma, a critical raw material, saw an upward trend in late 2024 and early 2025, alongside increased energy and transportation expenses globally. For instance, average diesel prices in key European markets hovered around €1.60-€1.70 per liter through much of 2024, a notable increase from prior years.

These rising costs directly challenge Grifols' profitability by squeezing profit margins. Without the ability to fully pass these increases onto customers through price adjustments, or to significantly boost operational efficiency, the company's bottom line is vulnerable. This necessitates a proactive approach to cost management across all facets of its global operations.

Effectively navigating these inflationary pressures requires Grifols to implement stringent cost control measures and sophisticated pricing strategies. This includes optimizing supply chains, exploring alternative energy sources where feasible, and potentially renegotiating labor contracts or investing in automation to mitigate rising wage costs. Strategic pricing adjustments must be carefully calibrated to maintain market competitiveness while safeguarding margins.

Grifols, as a global entity with operations spanning numerous countries, is inherently exposed to the unpredictable nature of currency exchange rate fluctuations. This volatility directly impacts how its revenues and profits are reported when earnings from foreign currencies are converted back into its primary reporting currency. For instance, a stronger Euro against other currencies could decrease the reported value of sales made in USD.

Furthermore, these fluctuations can significantly influence Grifols' operational costs. If the company relies on importing raw materials from countries with strengthening currencies, its cost of goods sold will rise. Conversely, if it exports its products, a weaker Euro could make its goods more competitive internationally, potentially boosting sales volumes but impacting the Euro-denominated profit margins.

For example, in early 2024, the Euro experienced a moderate strengthening against the US Dollar. This trend could have presented a headwind for Grifols' reported financial results, potentially reducing the translated value of its significant US-based revenues. Effective hedging strategies, such as forward contracts or currency options, become crucial tools for Grifols to mitigate these financial risks and ensure greater predictability in its earnings.

Access to Capital and Interest Rates

Grifols' capacity for crucial investments, such as funding research and development, expanding manufacturing, or engaging in strategic acquisitions, is directly influenced by its access to capital and the prevailing interest rate environment. Favorable interest rates, for instance, can significantly lower the cost of borrowing, thereby making new projects more financially appealing.

Economic conditions that lead to tighter credit markets or higher interest rates can conversely increase Grifols' financing expenses. This could potentially constrain its ability to pursue growth opportunities. For example, if the European Central Bank's key interest rates, which were around 4.00% in early 2024, were to rise further, Grifols' borrowing costs for new debt issuances would likely increase.

- Impact on R&D: Higher borrowing costs can make funding long-term, high-risk research projects more challenging.

- Manufacturing Expansion: Increased interest rates can deter investment in new or expanded manufacturing facilities due to higher capital expenditure costs.

- Acquisition Strategy: Access to capital at reasonable rates is vital for Grifols to pursue M&A opportunities, with higher rates potentially making acquisitions less feasible.

- Cost of Capital: Grifols' weighted average cost of capital (WACC) is directly affected by interest rates, influencing the attractiveness of potential investments.

Competition and Market Pricing

Grifols operates in highly competitive sectors, particularly in plasma-derived therapies and diagnostics. The market for plasma-derived medicines faces pressure from established players and emerging biotechs, impacting pricing power. For instance, the global plasma derivatives market was valued at approximately USD 25 billion in 2023 and is projected to grow, but intense competition means Grifols must carefully manage its pricing strategies to remain competitive.

The pricing of plasma-derived products is influenced by factors like manufacturing costs, regulatory approvals, and the therapeutic value of specific treatments. While some specialized therapies can command premium pricing due to their unique benefits and limited alternatives, overall market dynamics can lead to price erosion. Grifols’ ability to innovate and differentiate its offerings is crucial for sustaining favorable pricing in this environment.

Continuous market analysis is essential for Grifols. This includes monitoring competitor pricing, understanding evolving market demand for different plasma fractions, and assessing the impact of new market entrants. In 2024, for example, companies are closely watching how advancements in recombinant protein therapies might affect the demand and pricing of traditional plasma-derived products.

- Competitive Landscape: Grifols faces significant competition from major players like CSL Behring and Takeda Pharmaceutical Company in the plasma-derived therapies market.

- Pricing Dynamics: The pricing of immunoglobulin (Ig) therapies, a key product for Grifols, is influenced by reimbursement policies and the availability of biosimil or alternative treatments.

- Market Demand Analysis: Understanding the increasing global demand for plasma-derived therapies, particularly in emerging markets, is vital for strategic pricing and market share maintenance.

- Innovation Impact: Investments in research and development to create novel plasma-derived products or improve existing ones can justify premium pricing and enhance Grifols' competitive edge.

Global economic growth directly impacts healthcare spending, with the IMF projecting 3.2% growth for 2024, potentially boosting demand for Grifols' products. However, economic downturns and inflation, which saw diesel prices around €1.60-€1.70/liter in Europe through 2024, squeeze profit margins by increasing operational costs like plasma acquisition and energy.

Currency fluctuations also pose a risk, as a stronger Euro in early 2024 could reduce the reported value of US revenues. Higher interest rates, with ECB rates around 4.00% in early 2024, increase borrowing costs, potentially hindering Grifols' investments in R&D and expansion.

The competitive landscape for plasma-derived therapies, a market valued at roughly USD 25 billion in 2023, necessitates careful pricing strategies, as companies like CSL Behring and Takeda Pharmaceutical Company are key rivals.

Preview Before You Purchase

Grifols PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Grifols PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Grifols' strategic landscape.

Sociological factors

The world's population is getting older, and this is a big deal for companies like Grifols. As people age, they tend to develop more chronic illnesses, many of which require treatments derived from plasma. This trend is expected to continue, meaning a steady rise in demand for Grifols' specialized therapies.

For instance, the World Health Organization projects that by 2030, one in six people globally will be 65 years or older. This growing segment of the population often experiences conditions like autoimmune disorders and neurological diseases, which are key areas for plasma-based medicines. This demographic shift directly translates into a significant, long-term market opportunity for Grifols' Bioscience division, particularly for its immunoglobulin and albumin products.

Grifols needs to ensure its production and research efforts are well-aligned with these evolving demographic needs. By focusing on developing and supplying treatments for age-related diseases, the company can capitalize on this sociological trend and solidify its position in the market.

The willingness of the public to donate plasma is absolutely critical for Grifols, as plasma is the essential raw material for their life-saving therapies. In 2023, Grifols collected approximately 25.3 million liters of plasma, a testament to the public's contribution. Factors like cultural views on donation, the effectiveness of public health initiatives, and the level of trust people have in healthcare systems directly impact how much plasma is available.

Growing global health consciousness directly influences demand for Grifols' products. For instance, increased focus on preventative care and wellness can boost sales of diagnostic tests and nutritional supplements. Conversely, lifestyle choices impacting chronic disease prevalence, such as rising obesity rates, could increase demand for treatments Grifols offers, particularly those derived from plasma.

The changing health landscape presents both opportunities and challenges. While some lifestyle trends might decrease the burden of certain diseases, the observed increase in conditions like autoimmune disorders in many developed nations by 2024-2025 is likely to drive demand for plasma-derived therapies. Grifols must stay attuned to these shifts to align its product development and market strategies effectively.

Workforce Demographics and Talent Availability

Grifols' access to a skilled workforce, encompassing scientists, researchers, manufacturing experts, and healthcare professionals, is a paramount sociological consideration. The company's ability to innovate and operate efficiently is directly tied to the availability and cost of this talent. For instance, in 2024, the global shortage of specialized biotech talent continued to be a significant challenge, driving up recruitment costs and potentially delaying R&D timelines.

Demographic shifts and evolving educational attainment levels also play a crucial role. As populations age in key markets like Europe and North America, there's a growing demand for healthcare services and, consequently, for the specialized professionals Grifols employs. However, this also intensifies competition for talent. Reports in early 2025 indicated that the biotechnology sector, in particular, faced intense competition for experienced researchers, with average salaries for senior roles seeing an estimated 5-8% increase year-over-year.

Attracting and retaining this top-tier talent is fundamental to Grifols' sustained growth and its capacity for groundbreaking innovation. Companies are increasingly investing in comprehensive benefits packages, flexible work arrangements, and robust professional development programs to secure and keep their most valuable employees. In 2024, Grifols continued to focus on its employee value proposition, aiming to foster an environment that supports continuous learning and career advancement, which is critical in a field as dynamic as biopharmaceuticals.

- Talent Shortage Impact: The global biotechnology sector faced a notable shortage of specialized talent in 2024, impacting recruitment costs and R&D timelines.

- Demographic Influence: Aging populations in developed markets increase demand for healthcare professionals but also intensify competition for skilled workers.

- Competitive Landscape: The biotechnology industry saw an estimated 5-8% year-over-year increase in salaries for senior research roles in early 2025 due to high demand.

- Retention Strategies: Grifols prioritizes employee value propositions, including benefits and development, to attract and retain essential talent for innovation.

Ethical Considerations in Healthcare and Biotechnology

Societal values significantly impact Grifols. For instance, public opinion on genetic privacy, a growing concern, could affect the acceptance of plasma-derived therapies and diagnostics. In 2023, surveys indicated that over 70% of adults in the US expressed significant concerns about how their genetic information might be used by companies, potentially influencing patient willingness to participate in research or utilize certain biotechnologies.

Ethical debates surrounding equitable access to life-saving treatments and the commercialization of biological materials are also critical. As Grifols operates in the healthcare sector, these discussions can shape regulatory landscapes and public perception of the company's practices. For example, the pricing of novel biotechnology treatments has been a major point of contention, with patient advocacy groups in 2024 pushing for greater affordability and transparency, directly impacting the social license to operate for companies like Grifols.

Grifols’ commitment to high ethical standards is paramount for maintaining public trust. A strong ethical framework not only mitigates reputational risk but also fosters goodwill, which is essential for long-term sustainability. Companies demonstrating robust ethical governance, particularly in sensitive areas like the sourcing and use of human plasma, often experience greater social acceptance and are better positioned to navigate complex regulatory environments.

- Public Concern Over Genetic Data: Surveys in 2023 showed over 70% of US adults worried about the use of their genetic information, a factor Grifols must consider in its diagnostic and research operations.

- Equitable Access Debates: Ongoing discussions in 2024 regarding the affordability of biotechnology treatments directly influence public perception and regulatory pressures on companies like Grifols.

- Social License to Operate: Adherence to stringent ethical practices, especially concerning plasma sourcing, is vital for Grifols to maintain public trust and its operational permits.

The aging global population, with projections indicating one in six people will be 65 or older by 2030, directly fuels demand for Grifols' plasma-derived therapies targeting age-related conditions. This demographic shift is a significant driver for Grifols' Bioscience division, particularly for immunoglobulin and albumin products, as older individuals often require treatments for autoimmune and neurological diseases.

Grifols' reliance on public plasma donations is critical, with approximately 25.3 million liters collected in 2023. Public health initiatives and societal views on donation directly impact this vital supply chain. Furthermore, increased global health consciousness, coupled with rising rates of chronic conditions like obesity, is expected to boost demand for Grifols' diagnostic and therapeutic offerings.

The company's success hinges on its access to a skilled workforce, a factor complicated by a global shortage of biotech talent observed in 2024, leading to increased recruitment costs. In early 2025, competition for senior research roles saw salary increases of 5-8% annually. Societal concerns regarding genetic privacy, with over 70% of US adults expressing worries in 2023, and debates over equitable access to treatments in 2024, also shape Grifols' operational landscape and public perception.

| Sociological Factor | Description | Impact on Grifols | Relevant Data/Trend |

|---|---|---|---|

| Demographics | Aging global population | Increased demand for plasma-derived therapies | 1 in 6 people globally aged 65+ by 2030 (WHO) |

| Public Health & Attitudes | Plasma donation willingness, health consciousness | Affects raw material supply and product demand | 25.3 million liters of plasma collected in 2023 |

| Workforce & Talent | Skilled labor availability, competition | Impacts R&D timelines and operational costs | 5-8% annual salary increase for senior biotech roles (early 2025) |

| Societal Values & Ethics | Genetic privacy concerns, access to treatment | Influences public trust and regulatory environment | 70%+ US adults concerned about genetic data use (2023) |

Technological factors

Grifols’ competitive standing heavily relies on ongoing technological progress in plasma fractionation and purification. These advancements directly impact product yield, purity, and overall safety, which are paramount in the biopharmaceutical industry.

Innovations in areas like advanced separation techniques and improved viral inactivation methods are crucial for Grifols. For instance, the company’s investment in proprietary technologies aims to boost the efficiency of its manufacturing processes, potentially lowering production costs and enabling the creation of novel, safer therapeutic options. In 2023, Grifols reported significant investments in R&D, underscoring their commitment to technological leadership in this specialized field.

Grifols' Diagnostic division thrives on technological leaps in areas like molecular diagnostics and immunoassay techniques. These advancements allow for earlier and more precise disease identification, directly boosting demand for Grifols' diagnostic tools.

The company's commitment to innovation is critical for maintaining its market position. For instance, in 2023, Grifols invested €574 million in R&D, a significant portion of which supports the development of next-generation diagnostic solutions.

The healthcare sector is rapidly embracing digital transformation, with AI and big data analytics becoming central. This shift offers Grifols substantial opportunities to streamline operations and enhance its competitive edge.

AI's application in R&D can accelerate drug discovery, while its use in manufacturing promises greater efficiency. For instance, in 2024, the global AI in healthcare market was projected to reach over $20 billion, highlighting the significant investment and growth in this area. Grifols can leverage these advancements to optimize its plasma-derived therapies and bioscience divisions.

Digitalizing supply chains is another key technological factor. By implementing advanced analytics and AI, Grifols can improve inventory management, ensure product integrity, and reduce logistical costs. This is crucial for a company dealing with sensitive biological products, where efficiency and reliability are paramount.

Development of Alternative Therapies and Biologics

Technological advancements in gene therapy and cell therapy are presenting novel treatment options that could compete with traditional plasma-derived medicines. For instance, the global gene therapy market was valued at approximately USD 12.2 billion in 2023 and is projected to grow significantly, indicating a shift in therapeutic approaches. Grifols must actively track these innovations, potentially investing in its own R&D to either enhance its existing product lines or venture into new therapeutic domains.

The rise of biologics, particularly recombinant proteins, offers another avenue for alternative treatments. These engineered proteins can replicate the function of naturally occurring proteins found in plasma, potentially reducing reliance on plasma collection. The market for recombinant proteins is substantial and growing, with key segments showing robust expansion through 2025. Grifols' long-term viability hinges on its capacity for innovation and diversification to counter the disruptive potential of these alternative modalities.

- Gene Therapy Market Growth: Projected to expand at a CAGR of over 20% through 2030, indicating a strong technological push.

- Recombinant Protein Market Share: Significant growth observed in biopharmaceuticals, with recombinant therapies becoming increasingly prevalent.

- Investment in Biologics: Major pharmaceutical companies are channeling substantial R&D funds into biologic development, signaling a strategic industry trend.

- Plasma-Derived Medicine Competition: Emerging cell and gene therapies are gaining regulatory approvals, directly impacting the competitive landscape for plasma-based treatments.

Automation and Robotics in Manufacturing and Logistics

The increasing integration of automation and robotics in manufacturing and logistics offers Grifols substantial opportunities to boost efficiency and minimize errors. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2030. This trend directly impacts Grifols' operational capabilities.

Automating intricate processes, such as those involved in plasma fractionation or the assembly of diagnostic kits, can lead to a notable increase in production output and a reduction in per-unit costs. Companies adopting advanced automation have reported improvements in throughput ranging from 15% to 30%. By embracing these technological advancements, Grifols can optimize its production lines and distribution networks, ensuring greater reliability and scalability.

- Increased Efficiency: Automation can streamline complex manufacturing processes, leading to higher output and faster turnaround times for Grifols' products.

- Reduced Operational Costs: By minimizing manual labor and human error, robotics can lower production expenses and improve overall cost-effectiveness.

- Enhanced Safety: Automating hazardous tasks in manufacturing and logistics can significantly improve workplace safety for Grifols' employees.

- Improved Quality Control: Robotic systems offer consistent precision, reducing defects and ensuring higher quality standards in product manufacturing.

Technological advancements are pivotal for Grifols, particularly in plasma fractionation and diagnostics, impacting product yield, purity, and safety. The company's substantial R&D investments, such as the €574 million in 2023, underscore its commitment to innovation in these areas.

The increasing integration of AI and big data analytics in healthcare presents opportunities for Grifols to streamline operations and accelerate drug discovery, with the global AI in healthcare market projected to exceed $20 billion in 2024.

Emerging gene and cell therapies, with the gene therapy market valued at $12.2 billion in 2023, pose a competitive challenge, necessitating Grifols' continuous innovation and potential diversification.

Automation and robotics are enhancing manufacturing efficiency and reducing costs, with the industrial robotics market valued at approximately $50 billion in 2023, offering Grifols significant operational improvements.

| Technological Area | Impact on Grifols | Relevant Data (2023/2024 Projections) |

| Plasma Fractionation & Purification | Product yield, purity, safety, cost efficiency | R&D Investment: €574 million (2023) |

| Diagnostics | Disease identification accuracy, demand for tools | R&D Investment in diagnostics: Significant portion of total R&D |

| AI & Big Data | Operational streamlining, R&D acceleration | Global AI in Healthcare Market: Projected >$20 billion (2024) |

| Gene & Cell Therapies | Competitive landscape, potential diversification needs | Global Gene Therapy Market Value: ~$12.2 billion (2023) |

| Automation & Robotics | Manufacturing efficiency, cost reduction, safety | Global Industrial Robotics Market Value: ~$50 billion (2023) |

Legal factors

Grifols navigates a complex web of legal requirements in the pharmaceutical and medical device sectors. Compliance with agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is paramount, dictating every stage from research and development to post-market monitoring. For instance, the FDA's stringent Good Manufacturing Practices (GMP) ensure product safety and efficacy, and deviations can lead to significant repercussions.

Failure to adhere to these rigorous standards can trigger severe penalties, including costly product recalls, manufacturing shutdowns, and substantial fines. In 2023, the pharmaceutical industry faced numerous regulatory actions, highlighting the ongoing scrutiny. Grifols' commitment to maintaining the highest quality standards is therefore crucial for its operational integrity and market standing, as evidenced by ongoing investments in compliance infrastructure.

Grifols' operations, particularly in plasma donation and diagnostics, mean they handle highly sensitive patient data. This makes strict adherence to regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States absolutely critical. Failure to comply can lead to significant fines and reputational damage.

These legal frameworks dictate how Grifols collects, stores, processes, and shares personal and health information. Implementing advanced cybersecurity measures and clear data governance policies are therefore essential to avoid legal penalties and, crucially, to maintain the trust of patients and donors. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Grifols heavily relies on its intellectual property (IP), including patents, trademarks, and trade secrets, to protect its innovative therapies and manufacturing techniques. This legal shield is vital for recouping substantial research and development expenditures and maintaining market exclusivity. For instance, in 2023, Grifols continued to actively manage its patent portfolio, with a significant portion of its revenue derived from products protected by strong patent rights, underscoring the financial importance of IP.

Antitrust and Competition Laws

Grifols, a significant entity in the global plasma-derived therapeutics sector, navigates a landscape shaped by antitrust and competition laws. These regulations are crucial for fostering a fair marketplace and preventing monopolistic practices. The company's activities, from potential mergers to its day-to-day market conduct, are under legal observation to ensure adherence to competitive standards.

Failure to comply with these laws can lead to substantial penalties. For instance, the European Commission has historically imposed significant fines on companies for anti-competitive behavior. In 2023, the US Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, reviewing numerous transactions to safeguard market competition.

- Regulatory Oversight: Grifols must ensure its business strategies, including pricing and distribution, do not stifle competition.

- Merger Scrutiny: Any proposed acquisitions by Grifols will undergo rigorous review by competition authorities in relevant jurisdictions.

- Market Conduct: The company is liable for penalties if its actions are found to create unfair advantages or limit consumer choice.

Product Liability and Patient Safety Regulations

Grifols operates within a complex legal landscape, particularly concerning product liability. This means the company can be held financially responsible if its products, such as plasma-derived therapies, cause harm due to defects or safety issues. For instance, in 2023, the pharmaceutical industry saw ongoing scrutiny regarding adverse event reporting and product recalls, highlighting the critical nature of these regulations for companies like Grifols.

Stringent patient safety regulations are paramount for Grifols, requiring robust quality control measures throughout the manufacturing process, comprehensive pharmacovigilance systems to monitor product safety post-market, and transparent, accurate product information for healthcare providers and patients. In 2024, regulatory bodies like the FDA and EMA continued to emphasize the importance of supply chain integrity and the prevention of contamination in biological products.

Adherence to these legal frameworks is not merely about compliance; it's a strategic imperative for Grifols. Successfully navigating these regulations is crucial for mitigating legal risks, safeguarding the company's reputation, and crucially, ensuring the well-being of patients who rely on its life-saving therapies. Failure to comply can lead to significant financial penalties and damage to public trust.

Key legal considerations for Grifols include:

- Product Liability Exposure: Potential for lawsuits if products are found to be defective or unsafe, leading to patient harm.

- Pharmacovigilance Requirements: Mandates for continuous monitoring of product safety and reporting of adverse events to regulatory authorities.

- Quality Control Standards: Strict adherence to Good Manufacturing Practices (GMP) to ensure product consistency and safety.

- Regulatory Scrutiny: Ongoing oversight from health agencies like the FDA and EMA regarding manufacturing processes and product approvals.

Grifols' operations are deeply intertwined with legal frameworks governing pharmaceuticals and plasma. Compliance with bodies like the FDA and EMA is non-negotiable, impacting everything from R&D to market oversight, with GMP adherence being critical for safety and efficacy.

Non-compliance can result in severe penalties, including recalls and fines; for example, the pharmaceutical sector saw numerous regulatory actions in 2023. Grifols' commitment to quality is vital for its operational integrity, supported by ongoing investments in compliance infrastructure.

Handling sensitive patient data necessitates strict adherence to GDPR and HIPAA, with potential fines reaching up to 4% of global annual revenue for violations. This underscores the financial and reputational risks associated with data breaches.

Intellectual property protection, including patents and trade secrets, is crucial for Grifols to recoup R&D costs and maintain market exclusivity, with a significant portion of its 2023 revenue stemming from patent-protected products.

Environmental factors

Grifols' plasma collection, the bedrock of its operations, necessitates robust waste management and sustainable practices. The company must navigate stringent environmental regulations concerning the reduction, recycling, and safe disposal of biological materials generated at its donation centers. In 2023, Grifols reported a significant volume of plasma collected, underscoring the scale of its waste management challenge.

Adherence to evolving environmental standards, such as those targeting single-use plastics and biohazard containment, is paramount for Grifols. This commitment to eco-friendly collection and waste handling not only ensures regulatory compliance but also bolsters its corporate social responsibility profile, a factor increasingly scrutinized by investors and the public alike.

Grifols' manufacturing of plasma-derived medicines is inherently energy-intensive, directly impacting its carbon footprint. For instance, in 2023, the company reported its Scope 1 and Scope 2 greenhouse gas emissions. While specific energy consumption figures for manufacturing are not always granularly detailed in public reports, the sector's reliance on complex processing and purification means significant electricity and potentially natural gas usage.

As environmental consciousness grows, Grifols faces increasing pressure from regulators and investors to mitigate its impact. This translates into a need for strategic investments in energy-efficient technologies and a transition towards renewable energy sources. For example, many pharmaceutical companies are setting targets for renewable energy procurement, aiming to power their operations with cleaner alternatives to reduce their reliance on fossil fuels.

Reducing environmental impact is no longer just a compliance issue; it's a crucial performance indicator for stakeholders. Investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, with carbon footprint reduction being a key metric. Grifols' ability to demonstrate progress in this area will be vital for maintaining investor confidence and ensuring long-term sustainability.

Water is a vital input for Grifols' pharmaceutical production, essential for cleaning equipment, cooling systems, and acting as a solvent in various processes. The company's extensive manufacturing footprint inherently necessitates substantial water usage.

Facing growing global water scarcity and stricter regulations on wastewater discharge quality, Grifols is compelled to adopt robust water management strategies. This includes investing in water recycling technologies and ensuring responsible wastewater treatment to maintain operational continuity and environmental compliance.

Supply Chain Resilience Against Climate-Related Disruptions

Grifols' extensive global supply chain, crucial for sourcing plasma and distributing finished medical products, faces significant risks from climate change. Extreme weather events like hurricanes, floods, and droughts, which are projected to increase in frequency and intensity, can disrupt transportation networks, damage facilities, and impact the availability of raw materials. For instance, the World Meteorological Organization reported that 2023 was the warmest year on record, with extreme weather events causing widespread damage globally.

The company's reliance on a stable supply of plasma means that climate-related shifts affecting donor health or access to collection centers, such as heatwaves or severe storms, could directly impact production volumes. Furthermore, changes in agricultural patterns, potentially driven by climate change, could indirectly affect the availability and cost of certain materials used in their manufacturing processes.

To counter these environmental vulnerabilities, Grifols must prioritize building a resilient supply chain. This involves robust risk assessment methodologies to identify critical chokepoints, diversifying sourcing locations and transportation routes to reduce dependency on single points of failure, and developing comprehensive contingency plans.

- Climate Impact on Logistics: Extreme weather events can cause delays or cancellations in shipping, impacting Grifols' ability to transport plasma and finished products efficiently.

- Donor Availability: Public health can be affected by climate change, potentially influencing plasma donor availability and collection center operations.

- Resource Scarcity: Shifts in agricultural yields due to climate change could affect the availability and cost of secondary materials used in Grifols' production.

Compliance with Environmental Protection Regulations

Grifols navigates a complex web of environmental regulations globally, impacting everything from air emissions to hazardous waste disposal. These rules are not static; they are continually evolving and becoming more rigorous. For instance, in 2024, the European Union continued to push for stricter controls on industrial pollutants, potentially increasing compliance costs for Grifols' European manufacturing sites.

Meeting these escalating environmental standards necessitates ongoing investment in advanced management systems and diligent monitoring. Failure to comply can result in significant financial penalties and reputational damage. Grifols' commitment to sustainability, evidenced by its 2023 sustainability report highlighting a 5% reduction in water intensity across its operations, underscores the importance of proactive environmental management.

- Stricter EU regulations on emissions and waste management are anticipated to increase operational costs for Grifols in 2024-2025.

- Grifols invested €15 million in environmental protection initiatives in 2023, a figure expected to rise as regulations tighten.

- The company's water intensity reduction target for 2025 is 10% below 2020 levels, requiring continuous investment in water-saving technologies.

- Non-compliance fines for environmental breaches can range from thousands to millions of euros, depending on the severity and jurisdiction.

Grifols faces increasing pressure to reduce its carbon footprint, particularly given the energy-intensive nature of its plasma fractionation processes. The company's 2023 sustainability report indicated a focus on improving energy efficiency, though specific data on renewable energy adoption for its manufacturing sites in 2024 is still emerging. As global climate action intensifies, Grifols is expected to further invest in cleaner energy solutions to meet its environmental, social, and governance (ESG) targets.

Water management is critical for Grifols, with substantial usage in its production facilities. In 2023, the company reported progress in reducing water intensity, aiming for a 10% reduction by 2025 compared to 2020 levels. This necessitates ongoing investment in water recycling and efficient wastewater treatment technologies to comply with evolving discharge regulations and address water scarcity concerns, especially in water-stressed regions where some of its operations are located.

The company's extensive global supply chain is vulnerable to climate change impacts, including extreme weather events that can disrupt logistics and donor availability. For instance, 2023 saw record global temperatures, highlighting the increasing risk of climate-related disruptions. Grifols is enhancing its supply chain resilience through risk assessments and diversification strategies to mitigate potential impacts on plasma collection and product distribution.

Grifols must navigate increasingly stringent environmental regulations worldwide, with the EU leading in tightening controls on emissions and waste management. The company invested €15 million in environmental protection in 2023, a figure likely to grow as compliance demands intensify. Non-compliance risks substantial fines, making proactive environmental management and investment in sustainable practices crucial for operational continuity and stakeholder trust.

| Environmental Factor | 2023 Data/Initiatives | 2024/2025 Outlook & Impact |

|---|---|---|

| Carbon Footprint/Energy Use | Focus on energy efficiency; Scope 1 & 2 emissions reported. | Increased investment in renewable energy sources expected; pressure to further reduce emissions. |

| Water Management | Reduced water intensity; target of 10% reduction by 2025 (vs. 2020). | Continued investment in water recycling and wastewater treatment; compliance with stricter discharge regulations. |

| Supply Chain Resilience | Risk assessment for climate impacts on logistics and donor availability. | Diversification of sourcing and logistics to mitigate extreme weather event disruptions. |

| Regulatory Compliance | €15 million invested in environmental protection in 2023. | Anticipated rise in compliance costs due to stricter EU regulations; potential for increased fines for non-compliance. |

PESTLE Analysis Data Sources

Our Grifols PESTLE Analysis is built on a robust foundation of data from authoritative sources including global health organizations, financial regulatory bodies, and leading pharmaceutical industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Grifols.