Grifols Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grifols Bundle

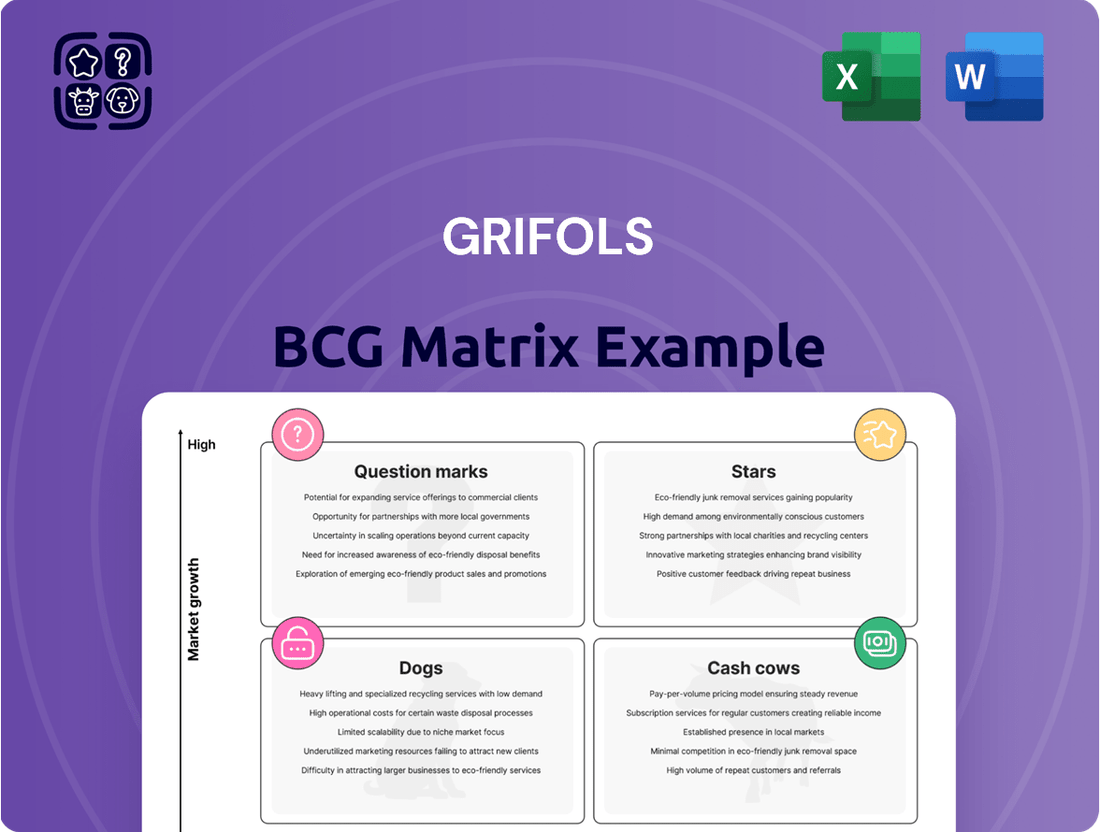

Curious about Grifols' product portfolio performance? Our BCG Matrix analysis categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market standing. Ready to unlock the full strategic picture and understand where Grifols should invest its resources for maximum growth? Purchase the complete BCG Matrix report for a comprehensive breakdown and actionable insights.

Stars

Grifols' immunoglobulin (IG) franchise, a cornerstone of its business, is a significant revenue generator. This segment, including both intravenous (IVIG) and subcutaneous (SCIG) immunoglobulin products like Xembify®, consistently shows robust growth.

The company commands a substantial share, over 20%, of the global immunoglobulin market. This market itself is experiencing impressive double-digit expansion, fueled by rising demand for treatments targeting immune system disorders.

Xembify®, a key product within the IG franchise, has demonstrated exceptional performance. It achieved a remarkable 37.3% volume growth in 2023 and accelerated further, surging nearly 60% by the first half of 2024. This surge is largely attributed to strong sales in the United States and successful market introductions in various European nations.

Grifols' albumin products are firmly positioned as a 'Star' in the BCG Matrix. Their robust market share and impressive growth trajectory, especially in emerging markets like China, underscore this status.

The global market for therapeutic albumin was valued at approximately USD 4.42 billion in 2024, with Grifols holding a significant position within this expanding sector. This growth is further evidenced by Grifols' own performance, which saw a substantial +17.0% constant currency increase in albumin sales in 2023, largely fueled by demand from China.

Continuing this positive momentum, Grifols reported a 9.6% constant currency growth for its albumin products in the first half of 2024, reinforcing its 'Star' classification through sustained market leadership and strong sales performance.

Alpha-1 Antitrypsin stands as a significant asset for Grifols, boasting an impressive 70% global market share. This specialized plasma-derived protein demonstrates robust performance, contributing to a 4.8% cc revenue increase for Alpha-1 and Specialty Proteins in the first half of 2025.

Biopharma Division as a Whole

The Biopharma division is Grifols' clear 'Star' in the BCG matrix, driving significant growth and consistently delivering strong financial performance. Its robust revenue expansion and contribution to adjusted EBITDA highlight its leading position in the expanding plasma-derived medicines market.

- Biopharma Revenue Growth: Achieved 8.2% constant currency revenue growth in the first half of 2025.

- Market Leadership: Commands a substantial market share in the growing plasma-derived therapies sector.

- Financial Contribution: Significantly boosts the company's overall revenue and adjusted EBITDA.

Advanced Plasma Collection and Manufacturing Capabilities

Grifols' advanced plasma collection and manufacturing capabilities are a cornerstone of its market dominance, acting as a significant 'Star' in its business portfolio. The company boasts an expansive and vertically integrated network, featuring over 350 plasma donation centers worldwide. This extensive reach guarantees a consistent and reliable supply of plasma, a vital raw material for its life-saving therapies.

This self-sufficiency in plasma collection provides Grifols with a substantial competitive edge in an industry where supply chain security is paramount. The company has also focused on operational efficiency, achieving a notable 22% reduction in the cost per liter of plasma from its July 2022 peak. This cost optimization directly bolsters the profitability of its plasma-derived products, further solidifying its 'Star' status.

- Global Plasma Collection Network: Over 350 donation centers worldwide.

- Vertical Integration: Control from collection to manufacturing.

- Cost Efficiency: 22% decrease in cost per liter of plasma since July 2022.

- Market Leadership: Underpinned by secure plasma supply and efficient operations.

Grifols' Biopharma division is a clear 'Star' due to its substantial growth and market leadership in plasma-derived therapies.

The division achieved 8.2% constant currency revenue growth in the first half of 2025, significantly contributing to adjusted EBITDA.

This strong performance is bolstered by Grifols' extensive global plasma collection network, featuring over 350 donation centers, and a 22% reduction in plasma cost per liter since July 2022.

| Business Segment | BCG Category | Key Performance Indicators | Data Point |

| Biopharma | Star | H1 2025 Revenue Growth (cc) | 8.2% |

| Biopharma | Star | Plasma Donation Centers | >350 |

| Biopharma | Star | Plasma Cost per Liter Reduction (since July 2022) | 22% |

What is included in the product

The Grifols BCG Matrix categorizes business units based on market share and growth, guiding investment decisions.

The Grifols BCG Matrix offers a clear, actionable overview of business unit performance, easing the pain of strategic resource allocation.

Cash Cows

Grifols' established plasma-derived therapies, excluding its high-growth immunoglobulin and albumin segments, are likely positioned as Cash Cows in its BCG Matrix. These products operate in mature markets where Grifols holds a strong, established market share. For example, in 2023, Grifols reported that its Plasma-Derived Medicines division generated €2,341 million in revenue, with a significant portion stemming from these stable, established products.

These therapies consistently generate substantial and reliable cash flow for Grifols, requiring minimal incremental investment for market maintenance or promotion. This consistent profitability allows Grifols to fund investments in its higher-growth areas, such as innovation in new plasma-derived therapies or geographic expansion. The company's focus on operational efficiency within these mature product lines ensures they remain a dependable source of capital.

Grifols' extensive global plasma supply network, a result of decades of development, acts as a powerful cash cow. This infrastructure, comprising numerous plasma collection centers, ensures a consistent and cost-effective supply of plasma, the critical raw material for its lucrative plasma-derived medicines.

The company's commitment to operational efficiency, including its focus on cost reduction per liter of plasma, directly enhances the cash-generating capacity of this core asset. For instance, Grifols has consistently invested in optimizing its collection processes, aiming to improve yields and lower per-unit costs, thereby bolstering profitability from its plasma operations.

Grifols' Bio Supplies division, featuring established offerings, functions as a significant cash cow within its broader portfolio. These mature product lines, supplying essential raw materials and intermediates to the biopharmaceutical sector, benefit from predictable demand and enduring contracts. This stability translates into reliable revenue streams and robust profit margins, requiring minimal further capital expenditure.

Blood Typing Solutions within Diagnostics

Grifols' Blood Typing Solutions, a cornerstone of its Diagnostic division, demonstrates robust and consistent sales performance. This segment benefits from established leadership and a significant market share, particularly in North America, Latin America, and the EMEA region, generating a reliable stream of cash flow.

While the Diagnostic division's overall growth may be less dynamic than Grifols' Biopharma segment, the blood typing solutions are essential for safe blood transfusions. This fundamental necessity ensures a steady and predictable demand, solidifying its position as a cash cow.

- Consistent Sales: Blood Typing Solutions consistently contribute to Grifols' revenue, especially in developed markets.

- Market Leadership: High market share in a critical diagnostic area ensures stable demand.

- Mature Market: The essential nature of blood typing in healthcare provides a predictable revenue base.

- Cash Flow Generation: This segment acts as a reliable generator of cash for the company.

Overall Operational Efficiency and Cost Savings

Grifols' Operational Improvement Plan has been a major success, delivering over EUR 450 million in annualized cash cost savings. This efficiency drive has significantly lowered the cost per liter of plasma processed, effectively turning the company's core plasma operations into a robust cash cow.

These substantial efficiencies directly translate to improved profit margins across all of Grifols' business segments. This allows the company to generate considerable cash from its current operations, even without requiring high market growth for every product or service.

- Operational Improvement Plan Savings: Over EUR 450 million in annualized cash cost savings achieved.

- Plasma Cost Reduction: Significant decline in the cost per liter of plasma.

- Margin Enhancement: Increased profit margins across all business segments due to operational efficiencies.

- Cash Generation: Ability to generate substantial cash from existing operations without reliance on high market growth.

Grifols' established plasma-derived therapies, excluding its high-growth immunoglobulin and albumin segments, are likely positioned as Cash Cows in its BCG Matrix. These products operate in mature markets where Grifols holds a strong, established market share. For example, in 2023, Grifols reported that its Plasma-Derived Medicines division generated €2,341 million in revenue, with a significant portion stemming from these stable, established products.

These therapies consistently generate substantial and reliable cash flow for Grifols, requiring minimal incremental investment for market maintenance or promotion. This consistent profitability allows Grifols to fund investments in its higher-growth areas, such as innovation in new plasma-derived therapies or geographic expansion. The company's focus on operational efficiency within these mature product lines ensures they remain a dependable source of capital.

Grifols' Operational Improvement Plan has been a major success, delivering over EUR 450 million in annualized cash cost savings. This efficiency drive has significantly lowered the cost per liter of plasma processed, effectively turning the company's core plasma operations into a robust cash cow.

These substantial efficiencies directly translate to improved profit margins across all of Grifols' business segments. This allows the company to generate considerable cash from its current operations, even without requiring high market growth for every product or service.

| Product/Segment | BCG Classification | 2023 Revenue (EUR Million) | Key Characteristics | Cash Flow Contribution |

| Established Plasma-Derived Therapies | Cash Cow | Significant portion of €2,341M (Plasma-Derived Medicines) | Mature markets, strong market share, stable demand | High and reliable |

| Global Plasma Supply Network | Cash Cow | N/A (Infrastructure asset) | Extensive collection centers, cost-effective supply | Enables profitability of derived medicines |

| Bio Supplies Division | Cash Cow | N/A (Intermediates) | Biopharmaceutical sector, predictable demand, enduring contracts | Reliable revenue, robust profit margins |

| Blood Typing Solutions (Diagnostic) | Cash Cow | N/A (Part of Diagnostic division) | Essential for transfusions, established leadership, high market share | Steady and predictable |

What You See Is What You Get

Grifols BCG Matrix

The Grifols BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional and ready-to-use strategic tool. You can confidently rely on this preview to represent the comprehensive analysis and clear presentation of Grifols' product portfolio. Once purchased, this complete BCG Matrix report will be immediately available for your strategic planning and business decision-making.

Dogs

Grifols' divestment of a 20% stake in Shanghai RAAS to Haier Group in June 2024 for approximately €1.6 billion strongly suggests this entity was a 'Dog' in their portfolio. This move, aimed at debt reduction, implies Shanghai RAAS was not a strategic growth driver or a significant cash generator for Grifols. The substantial proceeds were prioritized for financial deleveraging, signaling a clear shift away from this asset to bolster overall financial health.

Haema and BPC Plasma, fully consolidated by Grifols despite a lack of equity ownership, became a focal point of controversy. This situation raised questions about their financial reporting and Grifols' actual control over these entities.

The dispute, amplified by short-sellers, suggested these plasma businesses might have been viewed as problematic assets. Concerns were raised about potentially overstated earnings, capital being tied up, and a diversion of focus without delivering clear, high returns.

Within Grifols' Diagnostic segment, certain product lines might be classified as Dogs. These are typically older technologies or tests that have been superseded by advancements or are struggling against aggressive market competition, resulting in a low market share and limited financial contribution.

While Grifols has seen growth in areas like blood typing, it's common for established companies to have legacy diagnostic products that are underperforming. These could be tests with declining demand or those that require significant investment to remain competitive, making them candidates for a Dog classification.

For instance, if Grifols has diagnostic assays that rely on older methodologies facing pressure from more efficient or accurate newer platforms, these would likely fit the Dog profile. Such products often represent a small fraction of the division's revenue and may even incur losses or require substantial R&D to maintain any market presence.

Certain Specialty Proteins with Stagnant Demand

Certain niche specialty proteins within Grifols' extensive portfolio might be facing stagnant or even declining demand. This can happen when market dynamics shift, or when newer, more effective treatments emerge, pushing older products to the sidelines. While these proteins may still contribute to revenue, their growth potential is limited, placing them in the 'Dogs' category of the BCG matrix.

These 'Dogs' typically have a low market share and low growth prospects. For Grifols, this means products like specific rare disease treatments or older plasma-derived therapies could fall into this classification. For example, if a particular specialty protein treatment for a rare condition sees a significant drop in patient numbers due to a new gene therapy becoming available, its demand could stagnate.

- Stagnant Demand: Products like certain older immunoglobulin therapies might see demand plateau as newer, more targeted treatments gain traction.

- Low Growth Prospects: The market for some niche specialty proteins may be saturated or shrinking, limiting future revenue growth.

- Potential Rationalization: Grifols may consider divesting or reducing investment in these 'Dog' products if their contribution to overall profitability becomes marginal.

- Limited Market Share: These proteins often cater to very specific patient populations, inherently limiting their market share compared to broader therapeutic areas.

Non-Core Businesses with Limited Synergy

Grifols' BCG Matrix would categorize legacy non-core businesses with limited synergy as Dogs. These are operations that don't align with the company's main focus on plasma-derived medicines and diagnostics. They typically show low growth and a small market share, consuming resources without generating substantial returns.

These might include smaller, acquired ventures that haven't integrated smoothly or failed to gain market traction. For instance, if Grifols had a minor stake in a non-biotech related venture, it would likely be placed here. In 2024, Grifols continued its strategic focus on its core plasma and diagnostics segments, implying a divestment or downplaying of such peripheral activities.

- Low Growth: These businesses operate in markets with minimal expansion potential.

- Low Market Share: They hold a small position within their respective industries.

- Resource Drain: They tie up capital and management attention without providing significant returns.

- Strategic Misalignment: They do not contribute to Grifols' core competencies or future growth strategy.

Grifols' divestment of its 20% stake in Shanghai RAAS in June 2024 for approximately €1.6 billion strongly indicates this entity was a 'Dog' in their portfolio. This strategic move, prioritizing debt reduction over growth, suggests Shanghai RAAS was not a significant cash generator or a key strategic asset for Grifols. The substantial proceeds were clearly allocated to financial deleveraging, signaling a decisive shift away from this asset to improve the company's overall financial health.

Certain older diagnostic product lines within Grifols' Diagnostic segment may also be classified as Dogs. These typically involve legacy technologies or tests that have been surpassed by newer advancements or are struggling against intense market competition, leading to a low market share and minimal financial contribution. For example, diagnostic assays relying on older methodologies facing pressure from more efficient platforms would fit this profile, often representing a small revenue fraction and potentially incurring losses.

Niche specialty proteins within Grifols' portfolio could also be considered Dogs if they face stagnant or declining demand due to market shifts or the emergence of more effective treatments. While still generating some revenue, their limited growth potential places them in this category. Products like certain rare disease treatments or older plasma-derived therapies with dwindling patient numbers due to newer alternatives would exemplify this classification.

| Business Unit/Product Category | BCG Matrix Classification | Rationale | 2024 Data/Event Relevance |

|---|---|---|---|

| Shanghai RAAS (Stake Divestment) | Dog | Low strategic growth driver, divested for debt reduction. | 20% stake sold in June 2024 for ~€1.6 billion. |

| Legacy Diagnostic Assays | Dog | Older technologies facing competition, low market share. | Continued strategic focus on core segments implies downplaying of underperforming legacy products. |

| Niche Specialty Proteins (e.g., older therapies) | Dog | Stagnant or declining demand, limited growth prospects. | Potential rationalization if contribution to profitability is marginal. |

Question Marks

Grifols' fibrinogen concentrate stands as a prime example of a 'Question Mark' within its product portfolio, exhibiting substantial growth potential. This innovative therapy is currently in advanced stages of development, with anticipated launches in Europe by the fourth quarter of 2025 and in the United States during the first half of 2026, pending FDA clearance.

As a nascent product entering the competitive landscape, fibrinogen therapy currently holds a minimal market share. However, it demands considerable investment in research and development, positioning its future trajectory as dependent on successful market penetration and a robust competitive advantage.

Trimodulin, a novel immunoglobulin therapy combining IgM, IgA, and IgG, is positioned as a significant 'Question Mark' within Grifols' strategic portfolio. Its development targets critical care, a sector with substantial growth potential, making it a key area for future investment.

Phase III study results for Trimodulin were anticipated in 2024, a crucial milestone for its commercialization journey. As it is pre-commercial, its current market share is effectively zero, necessitating substantial capital expenditure to achieve market penetration and avoid a decline into the 'Dog' category of the BCG matrix.

The GIGA-564 oncology program exemplifies a 'Question Mark' within Grifols' BCG Matrix. This early-stage initiative targets groundbreaking cancer treatment methodologies, positioning it as a high-risk, high-reward venture. Its potential for substantial market disruption is significant, yet its current market share is zero, necessitating considerable ongoing investment in research and development with no immediate revenue generation.

New Subcutaneous IG (SCIG) Launches in Emerging Markets (e.g., Yimmugo in US)

New subcutaneous immunoglobulin (SCIG) launches in emerging markets, like Yimmugo® in the U.S. in Q1 2025, are considered 'Stars' within Grifols' BCG Matrix. These specific market entries are strategic moves into high-growth regions where the company aims to establish or expand its footprint.

These initiatives necessitate substantial marketing and sales investments to capture market share. For instance, Grifols has historically invested heavily in building its presence for SCIG products in new territories, a pattern expected to continue with Yimmugo®.

- Yimmugo® U.S. Launch (Q1 2025): Represents a 'Star' in an emerging market segment for SCIG.

- Xembify® Spain & Australia (2023): Demonstrates Grifols' strategy of entering new geographical markets with SCIG.

- High-Growth Potential: Emerging markets offer significant upside for SCIG adoption and sales growth.

- Investment Required: Substantial marketing and sales efforts are crucial for successful market penetration.

Diversification into Non-Plasma Treatments (Recombinant Proteins, Small Molecules)

Grifols is strategically expanding beyond its traditional plasma-derived therapies by investing in non-plasma treatments like recombinant proteins and small molecules. These new ventures are positioned as potential Stars or Question Marks in the BCG matrix due to their high growth potential coupled with nascent market penetration. For instance, the company has been advancing its pipeline of recombinant proteins, aiming to address conditions currently managed by plasma therapies but with potentially improved manufacturing and patient administration profiles.

These innovative treatments require significant research and development expenditure, often necessitating collaborations and strategic alliances to navigate complex regulatory pathways and establish market presence. Grifols’ commitment to these areas reflects a forward-looking strategy to diversify its revenue streams and capture emerging opportunities in the biopharmaceutical landscape, aiming to replicate the success of its established plasma-based franchises.

- Diversification Strategy: Grifols is moving into recombinant proteins and small molecules to broaden its therapeutic portfolio beyond plasma-derived medicines.

- BCG Matrix Placement: These new ventures are considered Question Marks or potential Stars, indicating high growth prospects but currently low market share.

- Investment and Partnerships: Significant R&D investment and strategic partnerships are crucial for developing and commercializing these innovative treatments.

- Market Potential: The goal is to tap into new therapeutic areas and potentially offer improved treatment options compared to existing plasma-based therapies.

Question Marks represent products or initiatives with high growth potential but currently low market share. These require significant investment to develop and capture market share, with the aim of transforming them into Stars. Grifols' pipeline includes several such ventures, each demanding careful strategic allocation of resources.

The GIGA-564 oncology program is a prime example of a Question Mark. This early-stage initiative targets novel cancer treatments, carrying high risk but also the potential for substantial market disruption. Its current market share is nil, underscoring the considerable ongoing investment needed for its development.

Trimodulin, a novel immunoglobulin therapy, is also classified as a Question Mark. Targeting critical care, a high-growth sector, its future success hinges on significant capital expenditure for market penetration. Phase III study results were anticipated in 2024, a key determinant for its commercial viability.

Grifols' expansion into non-plasma treatments like recombinant proteins and small molecules also places these ventures in the Question Mark category. These require substantial R&D and strategic alliances to navigate regulatory hurdles and establish market presence, aiming to diversify revenue streams.

| Product/Initiative | BCG Category | Market Share | Growth Potential | Investment Focus |

| Fibrinogen Concentrate | Question Mark | Minimal | Substantial | R&D, Market Penetration |

| Trimodulin | Question Mark | Zero | High | Capital Expenditure, Market Penetration |

| GIGA-564 Oncology Program | Question Mark | Zero | Significant | R&D Investment |

| Recombinant Proteins/Small Molecules | Question Mark/Star | Low | High | R&D, Strategic Alliances |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.