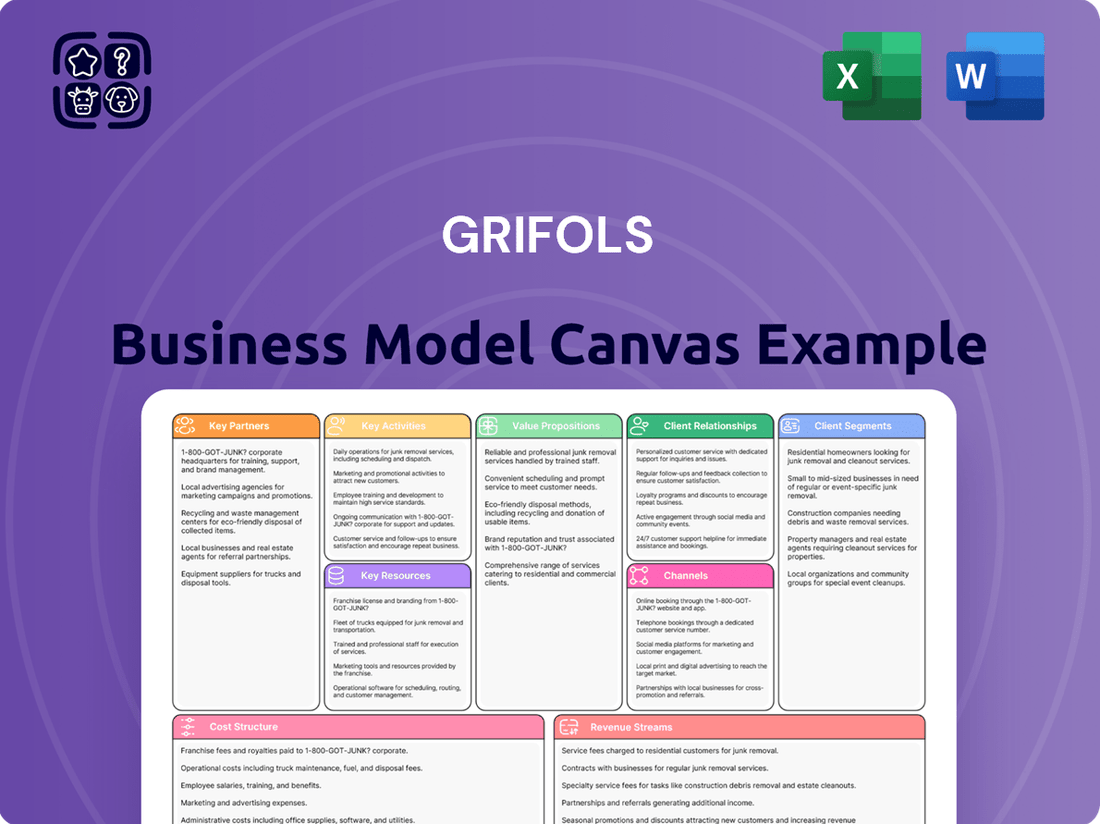

Grifols Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grifols Bundle

Uncover the intricate strategies behind Grifols's success with its comprehensive Business Model Canvas. This detailed document reveals how Grifols leverages its plasma-derived therapies and diagnostic solutions to create and deliver value to its diverse customer base. Explore the key partnerships, revenue streams, and cost structures that define its market leadership.

Ready to gain a competitive edge? Download the full Grifols Business Model Canvas to see exactly how this global healthcare leader operates. It’s your roadmap to understanding their value proposition, customer relationships, and key resources, all in a clear, actionable format.

Partnerships

Grifols' business model hinges on its extensive network of plasma donation centers, both company-owned and affiliated independent centers, which are the bedrock for sourcing human plasma. In 2024, Grifols continued to expand its global footprint, operating over 300 plasma donation centers across North America, Europe, and other regions, underscoring the scale of these critical partnerships.

These collaborations are paramount for guaranteeing a steady, high-quality influx of plasma, the essential component for Grifols' life-saving therapies. The company's ability to maintain and grow this network directly influences its production capacity and its responsiveness to the escalating global demand for plasma-derived medicines.

Grifols' collaborations with hospitals, clinics, and broader healthcare networks are fundamental to getting its plasma-derived medicines and diagnostic tools to the people who need them. These partnerships are the backbone of their distribution, ensuring widespread access to critical treatments.

These vital alliances often involve direct sales channels, participation in tender processes, and continuous support for healthcare professionals. This ensures that medical staff are well-equipped to manage patient therapies effectively, highlighting a commitment to patient care beyond just product delivery.

For instance, in 2024, Grifols continued to strengthen its relationships with major hospital systems across North America and Europe, aiming to improve patient access to its immunoglobulin therapies, which are crucial for treating rare autoimmune diseases.

Grifols actively collaborates with universities and research institutions, such as the renowned Hospital Clínic de Barcelona, to drive innovation in plasma-derived medicines and diagnostics. These partnerships are crucial for advancing scientific knowledge and developing novel treatments, leveraging academic expertise for breakthroughs in areas like neurodegenerative diseases.

In 2024, Grifols continued its commitment to R&D, with significant investment allocated to collaborations that fuel its pipeline of biopharmaceutical products. These alliances facilitate joint research projects and clinical trials, ensuring Grifols remains at the forefront of scientific discovery and therapeutic development.

Pharmaceutical and Biotech Companies

Grifols actively engages in strategic alliances with other pharmaceutical and biotech firms. These collaborations often take the form of co-development agreements, licensing arrangements, or joint manufacturing ventures for specialized products and cutting-edge technologies. Such partnerships are crucial for sharing R&D costs and accelerating market entry.

A prime example of this strategy is Grifols' past collaboration with Ethicon, a subsidiary of Johnson & Johnson, focusing on plasma-derived products within the biosurgery sector. Furthermore, Grifols has strategically invested in other plasma specialists, such as acquiring a significant stake in Biotest. These moves are designed to broaden Grifols' product offerings and extend its global market presence.

- Co-development and Licensing: Grifols partners with other biopharma companies to jointly develop new therapies or license existing technologies, sharing risks and rewards.

- Manufacturing Collaborations: Joint manufacturing agreements allow Grifols to leverage specialized production capabilities or expand its manufacturing footprint.

- Strategic Acquisitions: Investments in companies like Biotest demonstrate a commitment to consolidating market share and acquiring complementary assets in the plasma sector.

Suppliers and Logistics Providers

Grifols relies on a strong network of suppliers for critical materials like plasma, chemicals, and specialized equipment. In 2024, the company continued to emphasize secure and ethical sourcing, a cornerstone of its plasma-derived therapies business. Logistics partners are essential for maintaining the cold chain and ensuring the timely delivery of temperature-sensitive products worldwide.

These partnerships are vital for Grifols' ability to collect, process, and distribute plasma-derived medicines. Efficient logistics providers guarantee that raw plasma and finished products move safely and reliably across continents, upholding product integrity. For instance, Grifols' extensive plasma collection centers globally depend on these supply chain relationships to operate smoothly.

- Supplier Network: Grifols maintains relationships with numerous suppliers providing raw materials, manufacturing equipment, and essential services for its plasma fractionation and biopharmaceutical production.

- Logistics and Distribution: Partnerships with specialized logistics companies are crucial for the global, temperature-controlled transportation of plasma, intermediates, and finished medicinal products.

- Operational Efficiency: These collaborations ensure the uninterrupted flow of goods, supporting Grifols' commitment to patient access and product availability in over 100 countries.

- Risk Mitigation: A diversified supplier base and robust logistics network help mitigate supply chain disruptions, safeguarding the consistent delivery of life-saving therapies.

Grifols' Key Partnerships extend to its extensive network of plasma donation centers, both company-owned and affiliated independent centers, which are the bedrock for sourcing human plasma. In 2024, Grifols continued to expand its global footprint, operating over 300 plasma donation centers across North America, Europe, and other regions, underscoring the scale of these critical partnerships. These collaborations are paramount for guaranteeing a steady, high-quality influx of plasma, the essential component for Grifols' life-saving therapies.

What is included in the product

A comprehensive, pre-written business model tailored to Grifols' strategy, focusing on plasma-derived therapies and diagnostic solutions.

Covers customer segments, channels, and value propositions in full detail, reflecting the real-world operations and plans of the featured company.

Grifols' Business Model Canvas offers a clear, visual representation of their strategy, simplifying complex operations to pinpoint areas for improvement and innovation.

It acts as a powerful tool for Grifols to identify and address operational inefficiencies, thereby relieving pain points in their value chain.

Activities

Grifols' core activity revolves around managing its extensive global network of plasma donation centers. This involves rigorous donor screening, adherence to strict collection protocols, and efficient logistics to transport plasma to their manufacturing sites. The company consistently works to enhance its plasma supply chain, aiming to reduce the cost per liter (CPL) and increase overall yield.

In 2024, Grifols continued to invest in expanding its plasma collection capacity. The company reported a significant increase in its plasma collection volumes, a key driver for its bioscience division. This expansion is critical for meeting the growing demand for plasma-derived medicines.

Grifols' core activity involves the intricate fractionation of human plasma into life-saving therapeutic proteins like immunoglobulins, albumin, and clotting factors. This sophisticated process demands cutting-edge technology and unwavering compliance with rigorous global regulatory bodies such as the FDA and EMA.

In 2024, Grifols continued to invest heavily in optimizing its manufacturing capabilities. The company's commitment to efficiency and quality ensures a consistent supply of these vital medicines, addressing the ever-growing worldwide need for plasma-derived therapies.

Grifols' commitment to Research and Development is central to its business, with continuous investment fueling the discovery of novel plasma-derived therapies and the enhancement of existing treatments. This focus extends to pioneering diagnostic solutions, underscoring their dedication to advancing healthcare.

Significant R&D expenditure is directed towards areas like plasma fractionation, genetic engineering, and nanotechnology, aiming to drive innovation and broaden their therapeutic offerings. For instance, in 2023, Grifols reported approximately €568 million in R&D investments, reflecting a substantial commitment to future growth and product development.

Developing Diagnostic Solutions

Grifols' Diagnostic division is heavily invested in developing cutting-edge solutions for transfusion medicine. This encompasses a broad range of critical areas like blood typing, immunohematology, and hemostasis testing, all vital for ensuring blood safety and effective patient treatment.

These activities are not just about creating products; they involve a comprehensive cycle of research, rigorous development, precise manufacturing, and strategic commercialization. The instruments and reagents produced are indispensable tools for hospitals and blood banks worldwide, directly impacting patient care and the reliability of blood transfusions.

In 2024, Grifols continued to innovate within this space. For instance, their focus on automation in blood banking laboratories aims to reduce manual errors and increase throughput, a critical factor given the increasing demand for blood products and the complexity of modern diagnostic workflows. The company's commitment to advancing these technologies underscores their role in maintaining global health standards.

- Research and Development: Continuous investment in R&D to create new diagnostic assays and automated systems for blood transfusion and laboratory diagnostics.

- Manufacturing Excellence: Production of high-quality diagnostic instruments and reagents, adhering to strict regulatory standards for accuracy and reliability.

- Commercialization Strategy: Global marketing and sales efforts to distribute diagnostic solutions to hospitals, blood banks, and clinical laboratories.

- Innovation in Automation: Focus on developing automated platforms that streamline laboratory processes, improve efficiency, and enhance patient safety in transfusion medicine.

Global Distribution and Sales

Global Distribution and Sales is the engine that gets Grifols' life-saving plasma-derived medicines and diagnostic solutions to patients and healthcare providers worldwide. This involves navigating intricate global supply chains, managing dedicated sales teams in diverse markets, and meticulously handling regulatory approvals in each country. The goal is to ensure consistent product availability and successful market penetration while strictly adhering to local healthcare laws and standards.

In 2024, Grifols continued to focus on strengthening its global commercial operations. The company's sales of plasma-derived medicines, a core component of this activity, are a testament to its extensive distribution network. For instance, Grifols' Bioscience division, which relies heavily on this distribution, reported significant sales figures that underscore its reach. The company’s commitment to expanding its presence in key emerging markets further highlights the importance of its global distribution and sales capabilities.

- Worldwide Reach: Grifols ensures its plasma-derived medicines and diagnostic products are available across numerous countries, managing complex logistics and regulatory landscapes.

- Commercialization Strategy: The company employs dedicated sales forces to effectively market and sell its specialized healthcare solutions in diverse international markets.

- Supply Chain Management: A robust and efficient supply chain is critical for delivering sensitive biological products reliably and safely to global customers.

- Regulatory Compliance: Adherence to varying national healthcare regulations and standards is paramount for market access and continued product distribution.

Grifols' key activities are multifaceted, encompassing the entire lifecycle of plasma-derived medicines and diagnostic solutions. This includes the critical sourcing of plasma, its sophisticated manufacturing into therapeutic proteins, and the rigorous research and development needed for innovation. Furthermore, the company excels in distributing these vital products globally and developing advanced diagnostic tools for transfusion medicine.

| Key Activity | Description | 2024 Focus/Data |

| Plasma Collection | Operating a global network of donation centers, ensuring safe and efficient plasma sourcing. | Continued expansion of collection capacity, reporting increased plasma volumes. |

| Plasma Fractionation & Manufacturing | Transforming plasma into life-saving therapeutic proteins using advanced technology. | Investment in optimizing manufacturing capabilities for consistent supply of immunoglobulins and albumin. |

| Research & Development | Investing in new therapies, diagnostics, and enhancing existing treatments. | Significant R&D expenditure, focusing on plasma fractionation and diagnostic innovation. |

| Diagnostic Solutions | Developing and producing instruments and reagents for transfusion medicine and laboratory diagnostics. | Innovation in automation for blood banking to improve efficiency and patient safety. |

| Global Distribution & Sales | Ensuring worldwide availability of products through robust supply chains and market penetration. | Strengthening commercial operations and expanding presence in emerging markets. |

Delivered as Displayed

Business Model Canvas

The Grifols Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can confidently assess the comprehensive structure and content, knowing that the final deliverable will be identical. Upon completing your order, you’ll gain full access to this exact, professionally prepared Business Model Canvas, ready for immediate use and customization.

Resources

Grifols' most vital asset is its global network of plasma collection centers, which ensures a steady influx of high-quality human plasma. This raw material is the foundation for their life-saving plasma-derived medicines, directly dictating their manufacturing output and market reach.

As of late 2023, Grifols operated over 300 plasma collection centers worldwide, a significant portion of which are company-owned. This extensive infrastructure is crucial for maintaining their competitive edge in the plasma industry.

Grifols holds a substantial collection of intellectual property, notably patents covering its advanced plasma fractionation methods, groundbreaking therapeutic products, and sophisticated diagnostic technologies. This robust IP portfolio is a cornerstone of its competitive edge, safeguarding its innovations and reinforcing its leadership in the niche markets of plasma-derived therapies and transfusion diagnostics.

In 2023, Grifols continued to invest heavily in research and development, a key driver for its patent strategy. While specific R&D expenditure figures for intellectual property protection are not broken out, the company's overall commitment to innovation, which fuels patent filings, remains a strategic priority. This focus ensures its proprietary technologies are protected, allowing Grifols to maintain its market position and command premium pricing for its specialized offerings.

Grifols operates state-of-the-art manufacturing facilities crucial for its plasma-derived medicines. These sites are equipped with advanced fractionation technologies and rigorous quality control systems, ensuring the safety and efficacy of its products. In 2024, the company continued its investment in optimizing these facilities for both efficiency and yield, a critical factor in meeting global demand.

Skilled Scientific and Medical Personnel

Grifols’ highly specialized workforce is a cornerstone of its business model. This includes plasma donors, who are essential for raw material supply, alongside scientists, researchers, and medical professionals driving innovation and ensuring product safety and efficacy.

The company relies on a deep pool of manufacturing experts to produce its complex plasma-derived medicines, a process demanding precision and adherence to stringent quality standards. This human capital is critical for Grifols' ability to maintain its competitive edge in the biopharmaceutical industry.

In 2023, Grifols operated with a global workforce of approximately 24,000 employees, a testament to the scale of its specialized personnel needs across R&D, manufacturing, and commercial operations.

- Plasma Donors: The backbone of Grifols' supply chain, providing the essential raw material for its life-saving therapies.

- Scientists and Researchers: Driving innovation in plasma protein therapies and developing new treatments.

- Medical Professionals: Ensuring the safe and effective administration and application of Grifols' products.

- Manufacturing Experts: Overseeing the complex and highly regulated production of plasma-derived medicines.

Regulatory Approvals and Licenses

Grifols' ability to operate and sell its plasma-derived therapies hinges on securing and maintaining extensive regulatory approvals and licenses. This is a critical resource given the stringent oversight in the healthcare sector.

These approvals are essential for every stage, from research and development to manufacturing and market access. Authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key gatekeepers.

As of 2024, Grifols holds numerous such authorizations across its global operations, enabling the commercialization of its vital plasma-based medicines. For instance, their plasma collection centers and manufacturing facilities are subject to continuous inspection and re-approval processes.

- FDA Approvals: Grifols products, like its immunoglobulin therapies, require specific FDA approvals for sale in the United States.

- EMA Authorizations: Similarly, marketing authorizations from the EMA are necessary for accessing the European Union market.

- Global Compliance: Maintaining compliance with diverse national health authorities worldwide is paramount for international business.

- License Renewals: Ongoing license renewals and adherence to evolving regulatory standards are continuous operational necessities.

Grifols' key resources are its extensive network of plasma collection centers, its robust intellectual property portfolio, its advanced manufacturing facilities, its specialized workforce, and its crucial regulatory approvals.

These resources are interconnected, with the plasma centers providing the raw material, IP protecting the innovations, manufacturing facilities processing the plasma, skilled personnel operating these processes, and regulatory approvals allowing market access.

The company's commitment to R&D in 2023 fueled its patent strategy, ensuring proprietary technologies are protected and allowing for premium pricing.

In 2024, Grifols continued investing in optimizing its manufacturing facilities for efficiency and yield to meet global demand.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Plasma Collection Centers | Global network ensuring steady supply of high-quality human plasma. | Over 300 centers operated globally as of late 2023. |

| Intellectual Property | Patents on fractionation methods, therapies, and diagnostic technologies. | Safeguards innovations and reinforces leadership in niche markets. |

| Manufacturing Facilities | State-of-the-art sites with advanced fractionation and quality control. | Continued investment in optimization for efficiency and yield in 2024. |

| Specialized Workforce | Plasma donors, scientists, researchers, medical professionals, manufacturing experts. | Approximately 24,000 employees globally in 2023, crucial for operations. |

| Regulatory Approvals | Authorizations from FDA, EMA, and other global health authorities. | Numerous authorizations held as of 2024, enabling market access for plasma-based medicines. |

Value Propositions

Grifols provides critical plasma-derived medicines that are a lifeline for individuals battling rare, chronic, and often severe diseases like immunodeficiencies, bleeding disorders, and neurological conditions.

These vital therapies significantly enhance the quality of life and frequently prolong the survival of patients who have few, if any, other treatment avenues available.

In 2024, Grifols continued to be a cornerstone in the treatment of these complex conditions, with plasma-derived therapies representing a substantial portion of their revenue, underscoring their indispensable role in patient care.

Grifols offers advanced diagnostic solutions that significantly bolster blood safety and streamline transfusion medicine processes. These cutting-edge tools are indispensable for hospitals and blood banks, ensuring the integrity of blood transfusions and the precision of diagnoses, ultimately safeguarding patient well-being.

The company's portfolio includes critical tests for blood typing and immunohematology. For instance, Grifols' DG(R) system for blood typing has been instrumental in reducing transfusion errors. In 2023, Grifols reported that its Bioscience division, which includes diagnostics, saw a revenue increase, underscoring the demand for these safety-critical solutions.

Grifols guarantees a consistent and safe supply of plasma, the lifeblood of its life-saving medicines. This reliability is built upon an extensive global network of plasma donation centers, meticulously managed to ensure the highest quality and safety standards. In 2024, Grifols continued to invest heavily in expanding its collection capacity, aiming to secure an even more robust supply chain for its critical therapies.

Commitment to Research and Innovation

Grifols' commitment to research and innovation is a cornerstone of its business model, driving the development of groundbreaking therapies. This focus allows them to tackle significant unmet medical needs, particularly in areas like rare diseases and autoimmune conditions. Their dedication to advancing plasma science means a constant pipeline of improved treatments for patients globally.

The company's substantial investment in research and development underscores this commitment. For example, in 2023, Grifols allocated €565 million to R&D, representing a significant portion of their revenue. This investment fuels their ability to bring novel solutions to market, enhancing patient care and solidifying their leadership in the biopharmaceutical sector.

- Significant R&D Investment: Grifols invested €565 million in research and development in 2023.

- Focus on Unmet Needs: Their innovation efforts target critical areas lacking effective treatments.

- Advancing Plasma Science: Continuous research aims to unlock the full potential of plasma-derived medicines.

- Global Patient Impact: Novel solutions are developed to benefit patients worldwide.

Global Healthcare Services and Support

Grifols' commitment extends beyond just supplying plasma-derived medicines. They provide extensive services and support to hospitals and pharmacies. This ensures their products are used correctly and efficiently, ultimately benefiting patient care.

This comprehensive support is crucial for healthcare providers. It helps them manage patients effectively and maintain the highest standards in treatment delivery. Grifols' approach adds significant value, reinforcing their role as a partner in healthcare.

- Enhanced Product Utilization: Grifols offers training and technical assistance to healthcare professionals, ensuring optimal use of their specialized therapies.

- Patient Management Solutions: They provide support services that aid in patient monitoring and adherence to treatment protocols, improving outcomes.

- Best Practice Adherence: Grifols champions the implementation of best practices in healthcare settings, contributing to safer and more effective patient care.

- Strengthening Healthcare Partnerships: By offering these integrated services, Grifols solidifies its relationships with healthcare providers, moving beyond a transactional supplier role.

Grifols' core value proposition lies in its provision of life-saving plasma-derived medicines, crucial for patients with rare and chronic diseases. Their advanced diagnostic solutions enhance blood safety, and a robust plasma supply chain ensures consistent availability of these vital treatments. Furthermore, Grifols' dedication to research and development drives innovation, addressing unmet medical needs and improving patient outcomes globally.

| Value Proposition | Description | 2023/2024 Relevance |

|---|---|---|

| Life-Saving Plasma-Derived Medicines | Treating rare, chronic, and severe diseases like immunodeficiencies and bleeding disorders. | These therapies are central to Grifols' revenue, with the Bioscience division showing growth in 2023, indicating sustained demand. |

| Advanced Diagnostic Solutions | Ensuring blood safety and streamlining transfusion medicine processes. | Grifols' DG(R) system for blood typing contributes to reducing transfusion errors, a critical safety measure. |

| Reliable Plasma Supply Chain | Global network of donation centers ensuring high-quality and safe plasma. | Continued investment in expanding collection capacity in 2024 to secure robust supply for critical therapies. |

| Commitment to Research & Innovation | Developing groundbreaking therapies for unmet medical needs. | €565 million invested in R&D in 2023, fueling the development of novel treatments. |

Customer Relationships

Grifols cultivates direct engagement with hospitals, clinics, and pharmacies via dedicated sales forces and medical liaisons. This approach ensures a deep understanding of customer needs and facilitates the effective distribution of plasma-derived medicines and diagnostic solutions.

These direct interactions are crucial for delivering comprehensive product information, vital technical assistance, and ongoing medical education. By fostering trust and ensuring the correct application of their specialized offerings, Grifols strengthens its market position.

In 2024, Grifols continued to emphasize this direct channel, with sales teams actively engaging healthcare providers across its key markets. The company reported a significant portion of its revenue stemming from these established hospital and pharmacy relationships, underscoring the effectiveness of its customer-centric sales strategy.

Grifols cultivates enduring strategic alliances with healthcare systems, both nationally and regionally. These collaborations frequently encompass robust supply agreements and joint projects, fostering a stable environment for their vital medicines and diagnostic tools.

These deep-rooted relationships are crucial for guaranteeing Grifols' consistent presence within the essential supply chains of both public and private healthcare networks. For instance, in 2024, Grifols continued its focus on strengthening these partnerships, which are fundamental to its revenue stability and market penetration.

Grifols actively partners with patient advocacy groups, fostering a deep understanding of patient needs and enhancing therapy access. This patient-centric strategy cultivates loyalty and trust within patient communities.

In 2024, Grifols continued to invest in patient support programs, aiming to improve the patient journey for those relying on their therapies. These initiatives are crucial for gathering direct patient feedback, which informs product development and access strategies, ensuring patient voices are central to Grifols' operations.

Research Collaborations with Key Opinion Leaders (KOLs)

Grifols cultivates strong ties with Key Opinion Leaders (KOLs) by engaging in research collaborations, participating in scientific conferences, and establishing advisory boards. These partnerships are crucial for advancing scientific understanding and validating the effectiveness of Grifols' products.

These collaborations not only drive scientific progress but also enhance Grifols' credibility within the medical and scientific communities. In 2024, Grifols continued to invest in these relationships, recognizing their impact on product development and market acceptance.

- Research Collaborations: Grifols actively partners with leading academic institutions and researchers on studies that explore new therapeutic applications and enhance existing treatments.

- Scientific Conferences: Grifols sponsors and participates in major medical and scientific congresses, providing platforms for KOLs to present findings and discuss advancements.

- Advisory Boards: The company maintains advisory boards comprised of influential medical experts who offer strategic guidance on product development, clinical trial design, and market insights.

- Credibility and Validation: Insights and endorsements from KOLs through these collaborations serve as powerful validation for Grifols' innovative therapies.

Digital Engagement and Information Sharing

Grifols actively uses its corporate website and dedicated investor relations portals to disseminate crucial information. This includes timely updates on financial results, detailed product portfolios, and comprehensive sustainability reports, ensuring transparency for all stakeholders.

This digital engagement strategy enhances accessibility for a wide audience, ranging from individual investors and financial analysts to healthcare professionals and the general public. For instance, in 2024, Grifols reported a significant increase in website traffic to its investor relations section following key clinical trial updates.

- Digital Platforms: Corporate website and investor relations portals serve as primary channels.

- Information Dissemination: Financial results, product details, and sustainability reports are readily available.

- Stakeholder Accessibility: Enhances transparency and engagement for investors, healthcare professionals, and the public.

- 2024 Engagement: Noteworthy increase in investor portal visits observed, correlating with company news.

Grifols' customer relationships are built on deep engagement with healthcare providers, fostering strategic alliances with healthcare systems, and actively involving patient advocacy groups. This multi-faceted approach ensures product understanding, supply chain stability, and patient-centricity, all crucial for sustained market presence and revenue generation.

Channels

Grifols utilizes a dedicated direct sales force to connect with healthcare providers, offering its plasma-derived therapies and diagnostic tools. This approach enables in-depth discussions with medical professionals, ensuring they receive comprehensive product knowledge and ongoing assistance.

In 2024, Grifols continued to invest in its global sales infrastructure, recognizing the importance of direct customer relationships in the specialized biopharmaceutical market. This direct engagement is crucial for educating healthcare professionals on the benefits and proper administration of their unique product portfolio.

Grifols effectively utilizes its deep-rooted relationships within hospital and pharmacy distribution networks to guarantee efficient product delivery to patients. This robust infrastructure is crucial for handling specialized biological products that require precise temperature control and timely arrival at healthcare facilities.

The company collaborates with key intermediaries like major pharmaceutical wholesalers and specialized logistics providers. For instance, in 2024, Grifols continued to rely on partners who manage complex supply chains, ensuring that its plasma-derived therapies, such as those for hemophilia and immune deficiencies, maintain their integrity from manufacturing to administration.

These partnerships are vital for managing inventory levels across numerous healthcare sites and adhering to stringent cold chain requirements, a critical factor for biologicals. In 2024, Grifols' commitment to supply chain excellence meant investing in and optimizing these distribution channels to meet growing global demand for its life-saving treatments.

Grifols operates a vast network of plasma collection centers, both company-owned and affiliated, which are fundamental to its business model. These centers are the primary source of the plasma Grifols needs to produce its life-saving therapies, acting as the crucial first step in its value chain.

By strategically placing these centers in areas with high donor potential, Grifols ensures a consistent and reliable supply of this vital raw material. For instance, as of late 2023 and into 2024, Grifols has continued to expand its collection footprint, aiming to bolster its plasma supply to meet growing global demand for its plasma-derived medicines.

Online and Digital Platforms

Grifols leverages its corporate website and dedicated investor relations portals as primary online channels. These platforms serve as crucial hubs for disseminating financial reports, product details, and company updates, fostering transparency and broad stakeholder engagement.

The company's digital presence is vital for reaching a global audience, including individual investors, financial professionals, and business strategists. In 2024, Grifols continued to enhance these platforms to provide easy access to key information, supporting informed decision-making.

- Corporate Website: Serves as the central information repository for company news, sustainability reports, and corporate governance.

- Investor Relations Portal: Offers detailed financial statements, annual reports, and presentations for investors.

- Digital Communication: Facilitates direct engagement with shareholders and the financial community through webcasts and online Q&A sessions.

Conferences, Trade Shows, and Medical Journals

Grifols actively participates in major international medical conferences and trade shows. For example, in 2024, they showcased their latest advancements in plasma-derived therapies and diagnostic solutions at events like the American Society of Hematology (ASH) Annual Meeting. This engagement is key to reaching healthcare professionals and potential partners.

Publishing research in peer-reviewed medical journals is another core channel. Grifols consistently shares clinical trial results and scientific findings, reinforcing their commitment to evidence-based medicine. This builds credibility and informs the scientific community about the efficacy and safety of their products.

These channels are instrumental for Grifols in establishing thought leadership and raising market awareness for their innovative healthcare offerings. By presenting at these forums, they directly engage with key stakeholders, gather market intelligence, and foster collaborations that drive future growth.

Key benefits of these channels include:

- Dissemination of Scientific Data: Sharing clinical trial outcomes and research findings.

- New Product Showcasing: Presenting innovative therapies and diagnostic tools to the medical community.

- Engagement with Stakeholders: Interacting directly with physicians, researchers, and industry peers.

- Thought Leadership: Positioning Grifols as a leader in its therapeutic areas.

Grifols leverages a multifaceted channel strategy to reach its diverse stakeholder base. This includes a direct sales force engaging healthcare providers, robust distribution networks for efficient product delivery, and a strong digital presence for information dissemination. Furthermore, active participation in medical conferences and publication of research findings solidify its market position.

Customer Segments

Patients with rare and chronic diseases represent the foundational customer segment for Grifols' Bioscience division. These individuals, often facing life-altering conditions like primary immunodeficiencies, alpha-1 antitrypsin deficiency, hemophilia, and various neurological disorders, depend on Grifols' plasma-derived therapies for their ongoing treatment and to significantly enhance their quality of life.

The demand for these specialized treatments remains robust, with Grifols reporting a 7.2% increase in Bioscience revenue in the first quarter of 2024, reaching €658 million. This growth underscores the critical need and consistent reliance of this patient group on Grifols' innovative therapeutic solutions.

Hospitals and clinics are core customers for Grifols, as they are the settings where their plasma-derived medicines and diagnostic solutions are most frequently used. These healthcare providers rely on Grifols for critical treatments in areas like immunology, hematology, and intensive care, making them essential partners in patient care.

In 2024, the global hospital market continued to be a major driver for the pharmaceutical and healthcare sectors. For instance, the plasma derivatives market, a key area for Grifols, was projected to see significant growth, with estimates suggesting it could reach over $30 billion by 2025, indicating robust demand from these institutions.

Blood banks and transfusion centers are vital partners for Grifols' Diagnostic division. These institutions depend on Grifols' advanced testing solutions for blood typing, immunohematology, and hemostasis to guarantee the safety and compatibility of blood transfusions. In 2024, the global blood transfusion market continued its steady growth, driven by an aging population and increasing demand for complex medical procedures.

Grifols' diagnostic tools are essential for these centers to accurately identify blood groups and screen for infectious diseases, a critical step in preventing transfusion-related adverse events. The company's commitment to innovation ensures these facilities have access to reliable and efficient testing methods, supporting their mission to provide life-saving blood products. The demand for automated and high-throughput diagnostic systems remains a key trend among these customers.

Healthcare Professionals (Physicians, Pharmacists, Nurses)

Healthcare professionals, including physicians, pharmacists, and nurses, are pivotal influencers and users of Grifols' plasma-derived medicines and diagnostic solutions. While they may not be the direct financial purchasers, their recommendation and administration of Grifols' products directly impact sales and patient well-being. Grifols actively engages these professionals through extensive medical education programs and robust scientific support to foster trust and drive product adoption.

These vital customer segments are critical for ensuring Grifols' therapies reach patients effectively. For instance, in 2024, Grifols continued its focus on providing comprehensive training for nurses administering its immunoglobulin therapies, a key product line. This dedication to professional development is essential for patient safety and optimal treatment outcomes, directly influencing the perceived value and usage of Grifols' offerings.

- Physicians: Prescribers of Grifols' plasma-derived therapies, influencing treatment protocols and patient access.

- Pharmacists: Dispensers of Grifols' medications, ensuring correct dosage and patient counseling.

- Nurses: Administrators of Grifols' products, requiring specialized training for safe and effective delivery.

- Key Engagement: Grifols invests in medical education and scientific exchange to support these professionals in their practice.

Research and Academic Institutions

Research and academic institutions represent a key customer segment for Grifols' Bio Supplies division. These entities rely on Grifols for critical biological products essential for their scientific endeavors.

These institutions utilize Grifols' specialized components, such as plasma-derived proteins and other biological materials, to conduct groundbreaking research and advance drug development pipelines. For instance, academic labs might use Grifols' albumin for cell culture media or for studying protein interactions.

The demand from this sector is driven by the continuous need for high-quality, reliable biological inputs for experiments and the development of new therapies. Grifols' ability to provide consistent and well-characterized materials is vital for the reproducibility and success of academic research.

- Academic Research: Universities and research centers utilize Grifols' bio-supplies for fundamental scientific studies, contributing to the broader understanding of diseases and biological processes.

- Drug Development: Pharmaceutical research arms within academic settings employ these components in the early stages of drug discovery and preclinical testing.

- Biotechnology Innovation: Grifols supports the development of novel biotechnological applications by providing essential biological building blocks.

The primary customer segments for Grifols are patients with rare and chronic diseases, hospitals and clinics, blood banks, transfusion centers, healthcare professionals, and research institutions. These diverse groups rely on Grifols for essential plasma-derived therapies, diagnostic solutions, and biological supplies.

Grifols' Bioscience division directly serves patients with conditions like immunodeficiencies and hemophilia, who require ongoing plasma-based treatments. The company's Bioscience revenue growth in Q1 2024, up 7.2% to €658 million, highlights the consistent demand from this critical patient population.

Hospitals and clinics are key purchasers, utilizing Grifols' medicines in various medical specialties. The broader plasma derivatives market, a core area for Grifols, was projected to exceed $30 billion by 2025, reflecting strong institutional demand.

| Customer Segment | Key Needs/Interactions | 2024 Relevance/Data Point |

| Patients with Rare/Chronic Diseases | Access to life-sustaining plasma-derived therapies | Grifols' Bioscience revenue up 7.2% in Q1 2024 |

| Hospitals & Clinics | Plasma-derived medicines, diagnostic solutions for patient care | Plasma derivatives market projected over $30 billion by 2025 |

| Blood Banks & Transfusion Centers | Blood typing, immunohematology, hemostasis testing solutions | Steady growth in global blood transfusion market |

| Healthcare Professionals | Product information, training, safe administration of therapies | Continued focus on training nurses for immunoglobulin therapies |

| Research & Academic Institutions | High-quality biological products for scientific research | Demand driven by need for reliable biological inputs in drug development |

Cost Structure

Plasma acquisition is Grifols' most substantial expense. This encompasses payments to donors, the running of collection centers, and the complex logistics involved in getting that plasma to their processing facilities. In 2023, Grifols continued to focus on managing these costs, aiming to optimize their cost per liter of plasma.

Manufacturing and production costs for Grifols are substantial, driven by the intricate process of plasma fractionation. These expenses include not only the plasma itself but also other raw materials, utilities powering specialized facilities, and the skilled labor required for manufacturing and rigorous quality control. For instance, in 2023, Grifols' cost of sales was €4.3 billion, reflecting the significant investment in these operational necessities.

Grifols dedicates substantial resources to Research and Development, a cornerstone of its strategy to innovate in plasma-derived therapies and diagnostic solutions. This commitment fuels the discovery of new treatments and advancements in healthcare technology.

These R&D expenses encompass a wide range of activities, including the rigorous process of clinical trials, fundamental scientific research, compensation for highly skilled R&D personnel, and the acquisition of advanced laboratory equipment. In 2023, Grifols reported R&D expenses of €546 million, highlighting the significant investment in future growth and product pipelines.

Sales, Marketing, and Distribution Costs

Grifols' sales, marketing, and distribution costs are substantial, reflecting the global nature of its operations and the specialized handling required for its biological products. These expenses are critical for reaching diverse markets and ensuring consistent product availability to healthcare providers and patients worldwide.

In 2023, Grifols reported selling, general, and administrative expenses, which encompass these costs, at €1,488 million. This figure highlights the significant investment in maintaining a robust global sales force, executing targeted marketing campaigns, navigating complex regulatory landscapes, and managing the intricate logistics of distributing plasma-derived medicines.

- Global Sales Force: Maintaining a presence in over 100 countries requires a significant investment in sales personnel and infrastructure.

- Marketing and Regulatory Affairs: Costs associated with promoting products and ensuring compliance with varying international regulations are substantial.

- Complex Logistics: The specialized cold chain requirements for biological products add considerable expense to distribution.

- Market Penetration: These expenditures are directly tied to Grifols' ability to penetrate new markets and expand its customer base.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Grifols encompass essential overhead like executive compensation, legal services, and IT infrastructure. These costs are crucial for the company's overall functioning but aren't directly linked to manufacturing or research. Grifols actively pursues operational efficiencies to manage these expenditures. For instance, in 2023, Grifols reported G&A expenses amounting to €357.9 million, representing a slight increase from €350.5 million in 2022, reflecting ongoing investments in corporate functions while maintaining a focus on cost control.

- Corporate Management Salaries: Compensation for leadership and administrative staff.

- Legal and Professional Fees: Costs associated with legal counsel, auditing, and consulting.

- IT Infrastructure and Support: Expenses for technology systems and their maintenance.

- Other Operational Overheads: Including office rent, utilities, and insurance not tied to production.

Grifols' cost structure is heavily influenced by its core business of plasma-derived medicines. The most significant expenses are the acquisition of plasma and the subsequent manufacturing and production processes. These operational necessities, along with substantial investments in research and development and global sales and marketing, form the backbone of Grifols' expenditures. The company actively manages these costs to maintain efficiency and support its strategic growth initiatives.

| Cost Category | 2023 Expense (Millions €) | Key Components |

|---|---|---|

| Plasma Acquisition | (Not separately disclosed but largest component) | Donor payments, collection center operations, logistics |

| Manufacturing & Production | 4,300 (Cost of Sales) | Plasma fractionation, raw materials, utilities, skilled labor, quality control |

| Research & Development | 546 | Clinical trials, scientific research, R&D personnel, lab equipment |

| Sales, General & Administrative | 1,488 | Global sales force, marketing, regulatory affairs, complex logistics |

| General & Administrative (Specific) | 357.9 | Executive compensation, legal fees, IT infrastructure, operational overheads |

Revenue Streams

Grifols' primary revenue stream stems from the sale of plasma-derived medicines, a critical component of its Biopharma division. This segment consistently drives growth, offering a diverse portfolio of plasma protein therapies. In 2023, Grifols reported significant revenue from its Biopharma segment, underscoring its importance.

Grifols generates revenue from its Diagnostic division through the sale of instruments, reagents, and associated services. These offerings are critical for transfusion medicine, immunohematology, and hemostasis testing, playing a vital role in ensuring blood safety within healthcare systems. For instance, in 2023, Grifols' Diagnostic division reported sales of €1,238 million, highlighting the significant contribution of this revenue stream.

The Bio Supplies division at Grifols brings in money by selling biological products. These are used by other companies and research places for their own work and to make things. Think of it like selling raw ingredients for scientific projects.

This segment's revenue comes from things like intermediate plasma products, which are crucial for developing medicines, and other biological components. In 2023, Grifols' Biosupplies segment generated €1.2 billion in revenue, showing its significant contribution to the company's overall financial performance and its role in supporting the broader life sciences ecosystem.

Hospital and Pharmacy Services

Grifols generates revenue from hospital and pharmacy services, offering more than just its core plasma-derived medicines. These services can include specialized equipment, training, and ongoing support, which are crucial for the effective use and management of Grifols' products within healthcare settings. This approach significantly bolsters their value proposition, moving beyond simple product transactions.

For instance, Grifols provides critical services to hospitals and pharmacies that facilitate the administration and optimal use of their therapies. These might encompass:

- Specialized equipment provision: Supplying necessary tools and devices for product handling and administration.

- Training and education: Offering comprehensive programs for healthcare professionals on product usage and patient care.

- Technical and logistical support: Ensuring seamless integration and ongoing operational efficiency for their clients.

Licensing and Collaboration Agreements

Grifols generates revenue through licensing its proprietary technologies and products to other entities. This strategy allows the company to monetize its innovations without direct market entry for every application.

Collaborations with other pharmaceutical and biotech firms also contribute to revenue. These partnerships enable Grifols to share development costs, access new markets, and leverage complementary expertise. For instance, in 2023, Grifols continued to explore strategic alliances to bolster its pipeline and expand its global footprint.

These licensing and collaboration agreements are crucial for expanding Grifols' market reach indirectly and maximizing the value of its intellectual property. Such arrangements are a key component of its growth strategy, allowing it to benefit from its R&D investments across a wider spectrum of opportunities.

- Licensing Revenue: Monetizing proprietary technologies and products.

- Collaboration Income: Revenue sharing from joint ventures and partnerships.

- Market Expansion: Leveraging partner networks for broader reach.

- IP Monetization: Maximizing return on research and development investments.

Grifols' revenue streams are diverse, primarily driven by its Biopharma and Diagnostic divisions. The Biopharma segment, focused on plasma-derived medicines, is the largest contributor, with sales of €4,703 million in 2023. The Diagnostic division generated €1,238 million in 2023, offering instruments and reagents for transfusion medicine.

Further revenue is generated through the Bio Supplies segment, which brought in €1.2 billion in 2023, providing biological products for research and development. Additionally, Grifols earns from hospital and pharmacy services, licensing its technologies, and strategic collaborations, which enhance market reach and IP monetization.

| Revenue Stream | Description | 2023 Revenue (Millions €) |

|---|---|---|

| Biopharma | Sale of plasma-derived medicines | 4,703 |

| Diagnostic | Instruments, reagents, and services for transfusion medicine | 1,238 |

| Bio Supplies | Sale of biological products and intermediate plasma products | 1,200 |

| Hospital & Pharmacy Services | Equipment, training, and support for product use | N/A |

| Licensing & Collaborations | Monetizing technologies and partnerships | N/A |

Business Model Canvas Data Sources

The Grifols Business Model Canvas is informed by a blend of internal financial data, extensive market research on the plasma and pharmaceutical industries, and strategic insights derived from competitive analysis. This multi-faceted approach ensures each component of the canvas is grounded in actionable intelligence.