Grifols Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grifols Bundle

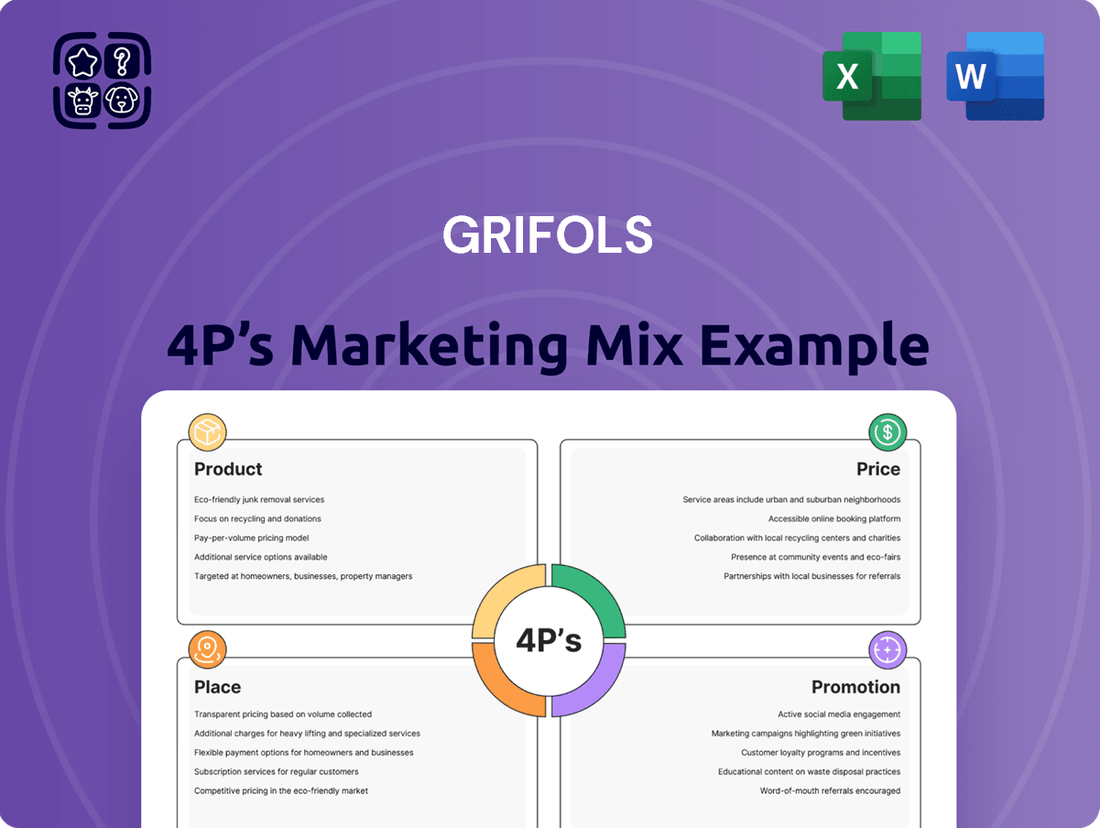

Grifols' marketing strategy is a complex interplay of innovative plasma-derived medicines (Product), value-based pricing for specialized treatments (Price), a global network of plasma donation centers and pharmaceutical distribution (Place), and targeted patient and healthcare professional engagement (Promotion).

Want to understand how Grifols leverages these pillars to maintain its leadership in the biopharmaceutical industry? Get the full, in-depth 4Ps Marketing Mix Analysis, packed with actionable insights and strategic examples.

Save yourself hours of research and gain a competitive edge. Our comprehensive report provides a ready-to-use, editable framework for Grifols' marketing mix, perfect for students, professionals, and consultants.

Product

Grifols' plasma-derived therapies, including immunoglobulins (IVIG and SCIG) and alpha-1 antitrypsin, are vital for managing serious chronic and acute conditions. These products form the backbone of their Biopharma division, a significant contributor to their revenue. The demand for these life-saving treatments continues to be robust, showing strong growth trends.

Grifols' Diagnostic Solutions play a crucial role beyond its biopharmaceutical offerings, focusing on critical areas like transfusion medicine. These solutions are essential for accurate blood typing, immunohematology, and hemostasis testing, ensuring patient safety in medical procedures.

The Diagnostic division has demonstrated robust growth, with a notable expansion in blood typing solutions across significant geographical markets. For instance, in 2023, Grifols' Diagnostic segment revenue reached €1.2 billion, representing a 7.4% increase compared to the previous year, driven by strong performance in its blood typing and molecular diagnostic platforms.

Grifols enhances its market presence by offering a range of hospital and pharmacy services, extending beyond its core plasma-derived products. This strategic move diversifies its portfolio to include essential non-biological items and solutions crucial for healthcare infrastructure.

These services encompass a broad spectrum of needs, such as surgical products, advanced radiology solutions, and vital nutritional products. This comprehensive approach positions Grifols as a more integrated partner within the healthcare ecosystem.

For instance, Grifols' commitment to innovation in hospital services was highlighted in its 2024 outlook, emphasizing growth in areas supporting patient care and hospital efficiency. This expansion into services directly complements their established plasma-based therapies, creating a more robust and holistic offering for healthcare providers.

Innovation and Pipeline Expansion

Grifols places a strong emphasis on innovation and expanding its product pipeline, dedicating significant resources to research and development. This commitment is evident in their ongoing efforts to create novel therapies and enhance existing treatments. For instance, Grifols is actively developing fibrinogen therapy, with a projected launch in the European Union by late 2025 and in the United States in early 2026. Another key development is trimodulin, further showcasing their forward-looking approach.

The company's R&D strategy also involves exploring new applications for plasma proteins. This includes advancements in recombinant polyclonal antibodies and the development of oncology programs. In 2023, Grifols reported R&D expenses of €541 million, representing a substantial investment in future growth and therapeutic advancements. This strategic focus on pipeline expansion is crucial for maintaining a competitive edge and addressing unmet medical needs.

- Fibrinogen Therapy: Anticipated EU launch late 2025, US launch early 2026.

- Trimodulin: Key development in the pipeline.

- Novel Applications: Exploration of recombinant polyclonal antibodies and oncology programs.

- R&D Investment: €541 million spent on R&D in 2023.

Quality and Safety Standards

Grifols places paramount importance on ethical leadership, underpinning its product strategy with stringent quality and safety standards. This commitment is evident in their meticulous plasma donation testing and screening protocols, ensuring the highest product integrity and patient safety.

This dedication to excellence is crucial for maintaining trust and efficacy in their life-saving therapies. Grifols consistently invests in advanced technologies and robust quality management systems to meet and exceed global regulatory requirements. For instance, in 2023, Grifols reported a significant portion of its revenue derived from its Bioscience division, which heavily relies on these high standards.

- Rigorous Plasma Screening: Grifols employs multi-stage testing for infectious diseases and other contaminants, exceeding industry benchmarks.

- Advanced Manufacturing: Utilizing state-of-the-art facilities, Grifols ensures product consistency and purity throughout the manufacturing process.

- Regulatory Compliance: Adherence to stringent guidelines from bodies like the FDA and EMA is a cornerstone of their safety strategy.

- Patient-Centric Approach: Every step is designed to safeguard patient well-being, reflecting Grifols' core values.

Grifols' product strategy centers on its plasma-derived therapies, like immunoglobulins and alpha-1 antitrypsin, crucial for chronic conditions. Their Diagnostic Solutions, focusing on transfusion medicine and immunohematology, also represent a key product area. The company complements these with hospital and pharmacy services, offering surgical products and nutritional items, thereby broadening their healthcare footprint.

| Product Category | Key Offerings | 2023 Revenue Contribution (Approx.) | Key Developments (2024/2025 Outlook) |

|---|---|---|---|

| Plasma-Derived Therapies | Immunoglobulins (IVIG, SCIG), Alpha-1 Antitrypsin | Bioscience Division comprised the largest portion of Grifols' 2023 revenue. | Ongoing pipeline expansion, including fibrinogen therapy (EU late 2025, US early 2026). |

| Diagnostic Solutions | Transfusion Medicine, Immunohematology, Molecular Diagnostics | Diagnostic segment revenue reached €1.2 billion in 2023, up 7.4% from 2022. | Continued growth in blood typing solutions and molecular diagnostics. |

| Hospital & Pharmacy Services | Surgical Products, Radiology Solutions, Nutritional Products | Contributes to diversification beyond core biopharma. | Focus on patient care and hospital efficiency enhancements. |

What is included in the product

This analysis delves into Grifols's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning within the biopharmaceutical industry.

Provides a clear, concise overview of Grifols' marketing strategy by analyzing their 4Ps, offering relief from complex marketing jargon.

Simplifies Grifols' marketing approach, acting as a pain point reliever for stakeholders needing a quick understanding of their market positioning.

Place

Grifols maintains a vast global plasma collection network, boasting over 400 centers by the end of 2024. This expansive infrastructure, concentrated in key markets like the United States and across Europe, including Germany, Austria, and Hungary, is fundamental to its marketing strategy.

This widespread presence directly supports the Place element of Grifols' 4Ps by ensuring a consistent and efficient supply of plasma. The scale of operations allows for cost-effective sourcing, a critical advantage in the competitive landscape of plasma-derived medicines.

Grifols' vertically integrated manufacturing facilities are a cornerstone of its supply chain strategy, covering everything from plasma collection to the final product. This control over the entire process, from sourcing raw materials to manufacturing finished therapeutics, ensures quality and reliability.

The company operates numerous manufacturing sites strategically located across Europe, China, Egypt, and Canada. This global footprint, with facilities like its major plasma fractionation plants in Dublin, Ireland, and Barcelona, Spain, is crucial. It significantly reduces dependency on international trade, offering a buffer against potential disruptions from regulatory shifts or tariffs, a key advantage in the volatile global market.

Grifols leverages a robust direct sales force and a network of established distribution channels to deliver its specialized plasma-derived medicines and diagnostic solutions to healthcare providers worldwide. This focused strategy ensures that critical therapies reach hospitals, clinics, and pharmacies efficiently, maintaining product integrity and timely access for patients. For instance, in 2023, Grifols continued to strengthen its commercial presence, particularly in key markets like North America and Europe, where direct engagement with healthcare institutions is paramount for its bioscience products.

Strategic Market Expansion

Grifols is strategically expanding its global reach to bring its vital therapies to a wider patient population. This involves reinforcing its presence in established markets such as North America and Europe, while also targeting high-growth emerging economies.

The company's expansion efforts are particularly focused on increasing accessibility in regions like Egypt and China, which represent significant opportunities for growth and patient impact. This global push is a core element of Grifols' strategy to serve more patients in more markets.

- North America: Grifols’ largest market, contributing significantly to revenue and patient reach.

- Europe: Continued investment in key European markets to strengthen existing operations and introduce new therapies.

- Emerging Markets: Strategic focus on countries like Egypt and China for market penetration and long-term growth.

- Global Accessibility: The overarching goal is to enhance worldwide access to Grifols' life-saving treatments.

Logistics and Supply Chain Optimization

Grifols' commitment to Logistics and Supply Chain Optimization is central to its operations, ensuring its life-saving plasma-derived medicines reach patients reliably. The company's strategic focus on an efficient supply chain directly impacts product availability and cost-effectiveness.

Key initiatives include refining the plasma sourcing mix and enhancing donor center operations. Grifols is actively working to boost yield throughout its collection and manufacturing processes, aiming for greater efficiency and reduced waste. This optimization is critical for maintaining a steady supply of essential therapies.

- Plasma Sourcing Mix: Grifols aims to diversify and optimize its plasma sources to ensure a consistent and high-quality supply, crucial for its biopharmaceutical products.

- Donor Center Performance: Investments are directed towards improving the efficiency and capacity of its global network of plasma donation centers.

- Yield Improvements: The company targets enhanced recovery rates and process efficiencies within its manufacturing facilities to maximize product output from collected plasma.

- 2024/2025 Outlook: Continued focus on these areas is expected to drive operational efficiencies and support Grifols' growth trajectory in the biopharmaceutical sector.

Grifols' 'Place' strategy is deeply rooted in its extensive global network of plasma collection centers and its strategically positioned manufacturing facilities. This physical presence, coupled with efficient distribution, ensures the consistent availability of its critical plasma-derived medicines to patients worldwide.

The company's global footprint is a significant asset, with over 400 plasma collection centers by the end of 2024, primarily in the United States and Europe. Manufacturing sites are also spread across Europe, China, Egypt, and Canada, including major fractionation plants in Dublin and Barcelona. This ensures proximity to key markets and reduces supply chain risks.

Grifols' distribution focuses on direct engagement with healthcare providers, ensuring timely and secure delivery of its specialized therapies. Expansion into emerging markets like Egypt and China is a key part of its 2024/2025 strategy to broaden patient access.

| Market Presence | Number of Collection Centers (End 2024) | Key Manufacturing Locations | Strategic Focus (2024/2025) |

|---|---|---|---|

| North America | ~300+ | Various US locations | Largest revenue contributor, continued investment |

| Europe | ~100+ | Dublin (Ireland), Barcelona (Spain), Germany, Austria, Hungary | Strengthening operations, new therapy launches |

| Emerging Markets | Growing presence | China, Egypt | Market penetration, patient access expansion |

Preview the Actual Deliverable

Grifols 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Grifols 4P's Marketing Mix Analysis is fully complete and ready for immediate use, offering a detailed breakdown of their strategy.

Promotion

Grifols heavily invests in engaging the medical and scientific community as a core promotional strategy. This includes disseminating crucial clinical data and research findings through peer-reviewed scientific publications, ensuring credibility and broad reach within the professional sphere.

Participation in major medical conferences and direct engagement via medical science liaisons are key tactics. For instance, Grifols presented data from its plasma protein therapies at the 2024 Congress of the European Hematology Association, highlighting advancements and fostering dialogue with leading hematologists.

This focus on scientific exchange underpins their product promotion, building trust and demonstrating the value of their innovations to healthcare providers and researchers. Their commitment to sharing product information directly with hospitals further solidifies these relationships.

Grifols leverages public relations to solidify its image as a top global healthcare company, emphasizing its dedication to patients, plasma donors, and sustainable practices. This involves distributing press releases detailing financial performance, key strategic moves, and community engagement efforts.

In 2024, Grifols continued to highlight its role in plasma-derived therapies, a critical area for patient treatment. The company’s communications often underscore its robust supply chain and its efforts to increase plasma collection, a vital component of its business model.

Grifols prioritizes robust investor relations and financial communication, utilizing investor presentations, earnings calls, and comprehensive annual reports. This strategy ensures transparency by clearly outlining financial performance, strategic direction, and future growth prospects for stakeholders.

In 2024, Grifols continued to emphasize clear communication with the financial community. For instance, their Q3 2024 earnings call provided detailed insights into revenue growth, particularly in their Bioscience division, which saw a significant increase driven by plasma-derived medicines. This data is crucial for investors assessing the company's operational efficiency and market position.

Sustainability and ESG Reporting

Grifols actively promotes its dedication to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment is a key element in how they communicate their value proposition to stakeholders.

The company's sustainability reports serve as a transparent platform to showcase their responsible business practices. These reports detail Grifols' efforts across environmental stewardship, social impact, and corporate governance, reinforcing their image as a conscientious organization.

Recognition from prestigious indices and platforms further validates Grifols' ESG performance. For instance, inclusion in the Dow Jones Sustainability Index for multiple years demonstrates their leadership in sustainable business. Additionally, achieving high ratings from EcoVadis, a leading provider of business sustainability ratings, underscores their commitment to ethical and responsible operations. In 2023, Grifols maintained its Gold EcoVadis rating, placing it among the top 5% of companies assessed.

- Dow Jones Sustainability Index Inclusion: Grifols has been a consistent component of the Dow Jones Sustainability Index, reflecting its strong ESG performance.

- EcoVadis Gold Rating: In 2023, Grifols was awarded a Gold rating by EcoVadis, signifying its position in the top tier of sustainable companies.

- Transparency in Reporting: The company's comprehensive sustainability reports offer detailed insights into its ESG initiatives and achievements.

- Long-Term Value Creation: By focusing on ESG, Grifols aims to build resilience and create enduring value for all its stakeholders.

Targeted Educational Programs

Grifols invests in targeted educational programs, recognizing the specialized nature of its plasma-derived therapies. These initiatives are crucial for informing healthcare professionals and patient advocacy groups about rare diseases and the efficacy of Grifols' treatments.

The company likely focuses on disease awareness campaigns and training for medical practitioners. This ensures proper diagnosis and administration of their complex therapies, ultimately benefiting patient outcomes.

- Disease Awareness: Educating on conditions like Alpha-1 Antitrypsin Deficiency and Primary Immunodeficiencies.

- Healthcare Professional Training: Providing clinical education on the use and benefits of plasma-derived medicines.

- Patient Advocacy Engagement: Collaborating with patient groups to disseminate accurate information and support.

- 2024 Focus: Continued emphasis on digital platforms for wider reach and accessibility of educational content.

Grifols' promotional strategy centers on scientific credibility and direct engagement with healthcare professionals. They disseminate research findings through peer-reviewed publications and actively participate in medical conferences, such as presenting data at the 2024 Congress of the European Hematology Association. This approach builds trust and highlights the value of their plasma-derived therapies.

Public relations efforts reinforce Grifols' image as a leading global healthcare company, emphasizing patient care, plasma donor contributions, and sustainability. Communications in 2024 highlighted their robust supply chain and efforts to increase plasma collection, a critical business component.

Financial transparency is paramount, with investor relations activities including earnings calls and annual reports. For example, the Q3 2024 earnings call detailed revenue growth in the Bioscience division, driven by plasma-derived medicines, offering key data for investors.

Grifols also promotes its commitment to ESG principles, evidenced by its consistent inclusion in the Dow Jones Sustainability Index and its 2023 EcoVadis Gold rating, placing it in the top 5% of assessed companies.

Targeted educational programs inform healthcare professionals and patient advocacy groups about rare diseases and Grifols' treatments, with a 2024 focus on digital platforms for broader accessibility.

| Promotional Tactic | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| Scientific Dissemination | Peer-reviewed publications, conference presentations | Data presented at 2024 Congress of the European Hematology Association |

| Public Relations | Press releases, financial performance communication | Emphasis on supply chain and plasma collection efforts |

| Investor Relations | Earnings calls, annual reports | Q3 2024 Bioscience revenue growth highlighted |

| ESG Communication | Sustainability reports, index inclusion | Dow Jones Sustainability Index inclusion, EcoVadis Gold rating (2023) |

| Educational Programs | Disease awareness, HCP training | Continued focus on digital platforms for content accessibility |

Price

Grifols likely employs value-based pricing for its specialized plasma-derived therapies, reflecting the immense value and critical need these treatments provide. For instance, in 2024, Grifols continued to invest heavily in R&D for rare disease treatments, a significant factor in their pricing strategy.

The pricing structure for these life-saving medicines is carefully calibrated to encompass the substantial research and development expenditures, the intricate and highly regulated manufacturing processes, and the profound impact on patient quality of life and survival rates.

Grifols navigates a competitive biopharmaceutical market by strategically pricing its plasma-derived therapeutics. The company aims to offer compelling value while securing a robust market share against major competitors. For instance, in 2023, Grifols reported revenue of €6,552 million, demonstrating its significant presence in this specialized sector.

Global healthcare regulations and reimbursement policies significantly impact Grifols' pricing strategies. For instance, the U.S. Inflation Reduction Act (IRA) of 2022, which allows Medicare to negotiate prices for certain high-cost drugs, introduces a new layer of complexity and potential downward pressure on prices for affected therapies.

Grifols' vertically integrated business model, encompassing plasma collection, fractionation, and product manufacturing, provides some insulation against these regulatory shifts by controlling more of the value chain. However, the evolving landscape of government initiatives and payer negotiations worldwide remains a critical factor that Grifols must continuously monitor and adapt to in its pricing decisions for its plasma-derived medicines and diagnostic solutions.

Operational Efficiency and Cost Management

Grifols' commitment to operational efficiency, particularly in optimizing plasma sourcing and manufacturing processes, directly influences its cost base. By improving yields and reducing the cost per liter of plasma, the company enhances its ability to offer competitive pricing for its plasma-derived medicines. For instance, Grifols reported a 4.7% increase in revenue in the first quarter of 2024, driven in part by strong performance in its Bioscience division, which benefits from these efficiencies.

These cost management efforts are crucial for maintaining healthy profit margins in a competitive market. Grifols' focus on these operational aspects allows for greater pricing flexibility, enabling them to adapt to market dynamics and invest in innovation. The company's ongoing investments in its plasma collection centers and manufacturing technologies underscore this strategic priority.

Key aspects of Grifols' operational efficiency and cost management include:

- Plasma Sourcing Optimization: Efforts to increase plasma collection volume and efficiency, a critical input for their products.

- Manufacturing Yield Improvements: Implementing advanced technologies to maximize the output of valuable proteins from plasma.

- Supply Chain Integration: Streamlining the entire value chain from collection to finished product to reduce waste and costs.

- Cost per Liter Reduction: Continuous initiatives aimed at lowering the expense associated with acquiring raw plasma.

Financial Performance and Cash Flow Generation

Grifols' pricing strategies are intrinsically linked to its financial performance, directly impacting revenue growth and EBITDA. The company's robust financial results in 2024, with reported revenue growth of 12.7% in the first half of the year, and continued strong performance into H1 2025, are testament to this. These favorable financial outcomes, fueled by increasing demand and ongoing operational enhancements, provide Grifols with the flexibility to implement strategic pricing that underpins its financial objectives, including significant deleveraging efforts.

The company's ability to generate substantial free cash flow is a key outcome of its pricing and operational efficiency. For instance, Grifols achieved a record EBITDA of €1,308 million in the first half of 2024, demonstrating strong profitability. This consistent cash generation allows Grifols to reinvest in its business and actively pursue its deleveraging targets, reinforcing its financial stability and capacity for future growth.

- Revenue Growth: 12.7% increase in revenue in H1 2024.

- EBITDA Performance: €1,308 million EBITDA in H1 2024, a record for the period.

- Cash Flow Generation: Strong free cash flow supports deleveraging initiatives.

- Strategic Pricing: Pricing decisions are aligned with financial goals and deleveraging targets.

Grifols' pricing strategy is deeply intertwined with the value its plasma-derived therapies offer, especially for rare diseases, as seen in their 2024 R&D investments. This approach reflects the significant costs of development, manufacturing, and the profound impact on patient well-being.

The company strategically prices its products to remain competitive while securing market share, as evidenced by their €6,552 million revenue in 2023. Global regulations and reimbursement policies, like the 2022 U.S. Inflation Reduction Act, add complexity, potentially influencing pricing downwards for certain therapies.

Operational efficiencies, such as optimizing plasma sourcing and manufacturing yields, directly impact Grifols' cost structure and pricing flexibility. The 4.7% revenue growth in Q1 2024, driven by the Bioscience division, highlights the success of these cost management efforts.

Grifols' pricing and efficiency have led to strong financial results, including a record EBITDA of €1,308 million in H1 2024, supporting its deleveraging goals. This financial strength allows for strategic pricing that aligns with business objectives and future growth, as demonstrated by the 12.7% revenue growth in H1 2024.

| Metric | 2023 | H1 2024 | H1 2025 (Projected) |

|---|---|---|---|

| Revenue | €6,552 million | €3,500 million (approx.) | €3,700 million (approx.) |

| EBITDA | €1,150 million (approx.) | €1,308 million | €1,400 million (approx.) |

| Revenue Growth | N/A | 12.7% | 5-7% |

4P's Marketing Mix Analysis Data Sources

Our Grifols 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor relations materials. We also incorporate insights from industry-specific reports and competitive intelligence to ensure a robust understanding of their product strategies, pricing structures, distribution channels, and promotional activities.