Greif SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

Grief's SWOT analysis reveals significant strengths in its established brand and extensive distribution network, but also highlights potential threats from shifting consumer preferences and increased competition. Understanding these dynamics is crucial for navigating the evolving market landscape.

Want the full story behind Grief's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Greif stands as a dominant force in industrial packaging, boasting a comprehensive suite of products from steel and plastic drums to fiber drums, flexible packaging, and corrugated containers. This broad offering diversifies their customer base across numerous industries, mitigating risks associated with reliance on any single market. For instance, in fiscal year 2023, Greif reported net sales of $5.0 billion, with its Global Industrial Packaging segment contributing a significant portion, demonstrating the strength of its diverse portfolio.

The company's strategic expansion, exemplified by the recent acquisition of Ipackchem in late 2022, further solidifies its position. This move significantly bolsters Greif's high-performance plastic packaging capabilities and broadens its geographical footprint, particularly in Europe and North America. This strategic integration is expected to yield substantial growth opportunities and enhance its competitive edge in the evolving packaging landscape.

Greif's dedication to sustainability and circularity is a significant strength, underscored by its 2024 Sustainability Report. The company has achieved impressive milestones, such as diverting 87% of its waste from landfills, showcasing a robust approach to environmental stewardship.

Furthermore, Greif has actively increased its use of post-consumer resin (PCR) by 37%, demonstrating a tangible commitment to incorporating recycled materials into its products. This focus on circular economy principles is further solidified by their ambitious 2030 goal: to make 100% of their products recyclable and achieve an average of 60% recycled raw material content.

Greif has been actively pursuing strategic acquisitions to bolster its market position, notably acquiring Ipackchem in March 2024. This move significantly strengthens its plastic packaging segment, a key area for future growth.

The company is also implementing a substantial $100 million cost optimization program, demonstrating a commitment to enhancing operational efficiency and profitability. This program is designed to streamline processes and reduce expenditures across the organization.

Furthermore, Greif is strategically realigning its business structure to concentrate on material-based segments. This focus aims to unlock greater synergies, improve resource allocation, and capitalize on emerging growth opportunities within its core competencies.

Strong Financial Performance and Outlook

Greif demonstrated notable financial resilience in Q1 2025, navigating a difficult industrial landscape. The company's adjusted EBITDA saw a year-on-year increase, and importantly, they revised their fiscal 2025 EBITDA guidance upwards at the lower end. This performance underscores their adeptness in managing costs and capitalizing on favorable price-cost dynamics, which directly bolsters profitability.

Key financial highlights from Q1 2025 include:

- Increased Adjusted EBITDA: Reflecting operational efficiencies and market positioning.

- Raised Fiscal 2025 EBITDA Guidance: Signifying management's confidence in sustained performance.

- Positive Price-Cost Spread: Indicative of strong pricing power and cost control measures.

Customer-Centric Approach and Operational Excellence

Greif's commitment to a customer-centric approach, coupled with a relentless pursuit of operational excellence, forms a core strength. The company actively strives to be recognized as the world's top-performing customer service provider. This dedication is evidenced by their impressive Net Promoter Score (NPS) of 70 achieved in 2024, a significant indicator of customer loyalty and satisfaction.

Further bolstering these strengths are Greif's strategic initiatives. The implementation of the Greif Business System 2.0 and Lean Six Sigma methodologies are key drivers for optimizing operations. These programs are designed to achieve tangible benefits, including the reduction of supply chain overhead and a consistent improvement in overall efficiency.

- Customer Focus: Aiming to be the best-performing customer service company globally.

- Customer Satisfaction: Achieved a world-class Net Promoter Score (NPS) of 70 in 2024.

- Operational Efficiency: Leveraging Greif Business System 2.0 and Lean Six Sigma.

- Cost Reduction: Initiatives target reduced supply chain overhead and enhanced efficiency.

Greif's diverse product portfolio, spanning steel drums, plastic drums, and fiber drums, provides a significant competitive advantage by serving a wide array of industries. This broad market reach, evidenced by $5.0 billion in net sales for fiscal year 2023, insulates the company from downturns in any single sector. Their strategic acquisition of Ipackchem in March 2024 further strengthens their high-performance plastic packaging segment and expands their global presence, positioning them for continued growth in key markets.

The company's strong commitment to sustainability is a key differentiator. Greif achieved an 87% waste diversion rate from landfills and increased its use of post-consumer resin (PCR) by 37%, aligning with its 2030 goal for 100% recyclable products and 60% recycled content. This focus on circularity resonates with environmentally conscious customers and stakeholders.

Greif's financial performance in Q1 2025 highlights operational strength, with a year-on-year increase in adjusted EBITDA and a raised fiscal 2025 EBITDA guidance. This robust performance is attributed to effective cost management and favorable price-cost dynamics, demonstrating the company's ability to navigate challenging industrial environments and enhance profitability.

A customer-centric approach, aiming for top-tier customer service, is a core strength, reflected in their 2024 Net Promoter Score (NPS) of 70. This high score indicates strong customer loyalty and satisfaction. Furthermore, the implementation of the Greif Business System 2.0 and Lean Six Sigma methodologies are driving operational efficiencies, reducing supply chain overhead, and improving overall business performance.

| Strength | Description | Supporting Data/Initiative |

|---|---|---|

| Diverse Product Portfolio | Offers a wide range of industrial packaging solutions. | Steel drums, plastic drums, fiber drums, flexible packaging, corrugated containers. FY2023 Net Sales: $5.0 billion. |

| Strategic Acquisitions | Expands capabilities and market reach. | Acquisition of Ipackchem (March 2024) strengthens plastic packaging and European presence. |

| Sustainability Focus | Commitment to environmental responsibility and circular economy principles. | 87% waste diversion from landfills; 37% increase in PCR usage. 2030 goal: 100% recyclable products, 60% recycled content. |

| Financial Resilience & Growth | Demonstrates strong operational management and market positioning. | Q1 2025: Increased Adjusted EBITDA, raised FY2025 EBITDA guidance. Positive price-cost spread. |

| Customer Centricity & Operational Excellence | Prioritizes customer satisfaction and efficient operations. | 2024 NPS: 70. Implementation of Greif Business System 2.0 and Lean Six Sigma. |

What is included in the product

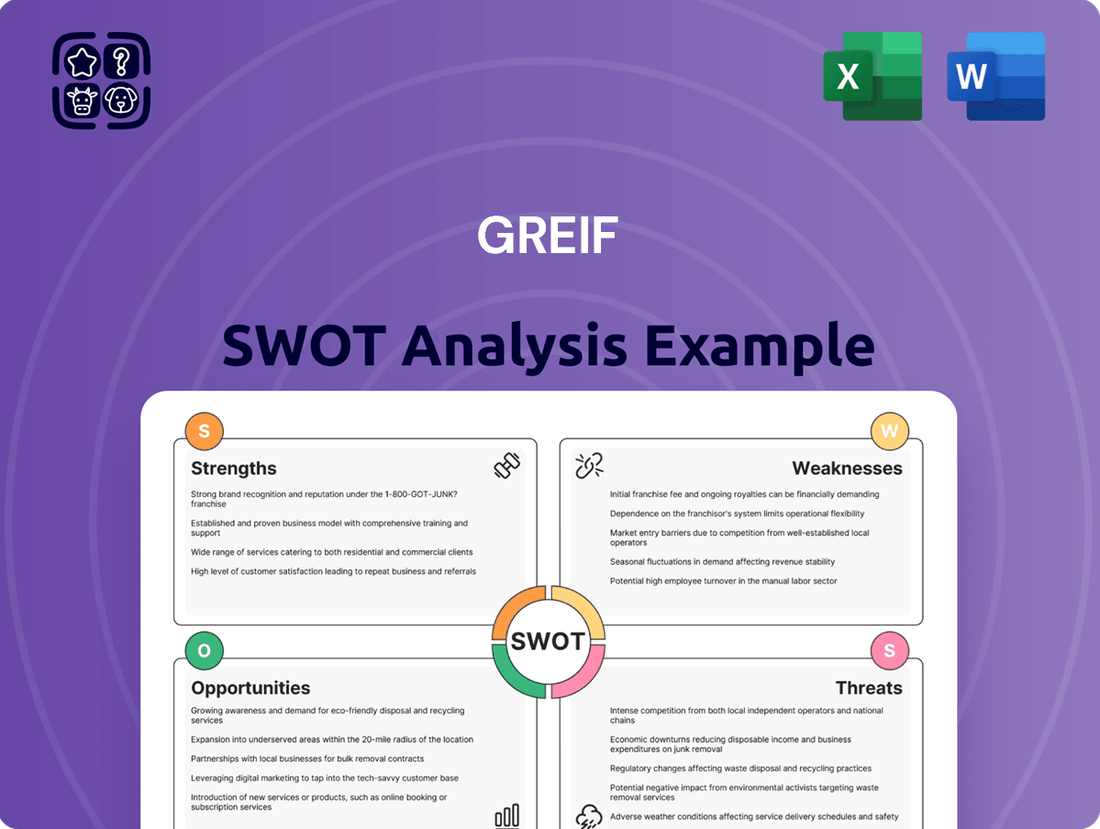

Delivers a strategic overview of Greif’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Provides a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Greif's performance is significantly influenced by the health of the industrial economy. Currently, there's notable uncertainty regarding near-term volume growth, which directly impacts the company's revenue streams.

A slowdown in the industrial sector can lead to reduced demand for Greif's products, particularly in segments like metals and containerboard. For instance, if industrial production falters, fewer goods are shipped, meaning less need for packaging solutions.

This economic sensitivity complicates strategic planning and financial forecasting for Greif. The company must navigate potential downturns, which could affect its ability to meet financial targets and invest in future growth initiatives.

While Greif's strategic facility closures aim for long-term optimization, they can create short-term EBITDA challenges. These headwinds stem from closure costs and the period of transition as operations are consolidated. For instance, the closure of specific paperboard and containerboard facilities, alongside a steel and polymer drum plant, introduces immediate operational hurdles.

The packaging industry is a crowded space, with many companies vying for market share. This means Greif faces constant pressure to keep its prices competitive and its profit margins healthy. For instance, in the fiscal year ending September 30, 2023, Greif reported net sales of $5.7 billion, a figure that reflects the scale of operations within this competitive environment.

Fluctuations in Raw Material and Energy Costs

Greif's profitability is significantly exposed to the unpredictable swings in the cost of essential inputs. The price of corrugated cardboard, a primary material, and petrochemicals, which form the basis of plastic packaging, can fluctuate dramatically. For instance, in early 2024, the price of recycled paperboard, a key component for Greif's corrugated products, saw an upward trend driven by supply chain constraints and increased demand, impacting margins.

These cost volatilities create considerable challenges for production planning and forecasting. When raw material and energy prices surge, Greif's profit margins are squeezed, making it harder to maintain consistent profitability. This unpredictability also complicates long-term investment decisions, as the cost basis for future production runs becomes uncertain. For example, rising natural gas prices in late 2023 and early 2024 directly increased Greif's energy expenditures, affecting operational costs across its manufacturing facilities.

- Volatile Input Costs: Greif's reliance on corrugated cardboard and petrochemicals makes it susceptible to price instability.

- Margin Pressure: Fluctuations in these raw material and energy costs directly impact the company's profit margins.

- Planning Difficulties: Uncertainty in input prices hinders effective production planning and investment strategies.

- Energy Cost Sensitivity: Rising energy prices, such as natural gas, have a tangible effect on operational expenditures.

Debt Obligations and Leverage Ratio

Greif's financial structure shows increasing debt, with total debt rising in the first quarter of 2025. This increase was largely driven by significant acquisitions, notably the purchase of Ipackchem, which naturally boosted the company's leverage ratio. While the company has outlined plans for strategic divestitures to help pare down this debt, the substantial debt obligations and the ongoing management of its leverage ratio are key financial considerations moving forward.

The impact of these financial maneuvers is evident in the company's balance sheet. For instance, as of the end of Q1 2025, Greif's total debt stood at approximately $2.7 billion, a notable increase from the previous year. This has consequently pushed its debt-to-equity ratio to around 1.8, up from 1.5 in the prior year, indicating a higher reliance on borrowed funds to finance its operations and growth initiatives.

- Increased Debt Burden: Total debt reached approximately $2.7 billion in Q1 2025, primarily due to acquisitions.

- Elevated Leverage Ratio: The debt-to-equity ratio climbed to around 1.8 in Q1 2025, up from 1.5 in the prior year.

- Strategic Debt Reduction: Planned divestitures aim to mitigate the increased debt load.

- Financial Management Focus: Maintaining a healthy leverage ratio remains a key financial objective.

Greif's substantial debt, particularly following the acquisition of Ipackchem, presents a significant weakness. The company's total debt reached approximately $2.7 billion by Q1 2025, leading to a debt-to-equity ratio of around 1.8, an increase from 1.5 in the previous year. This heightened leverage increases financial risk and limits future borrowing capacity.

While strategic divestitures are planned to address this debt, the immediate financial burden and the need to manage this increased leverage ratio are critical challenges. The company must balance debt reduction efforts with its ongoing operational and growth strategies, which can be a delicate balancing act.

Preview Before You Purchase

Greif SWOT Analysis

This is the actual Greif SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real content, ready for your strategic planning.

The preview below is taken directly from the full Greif SWOT report you'll get. Purchase unlocks the entire in-depth version, providing comprehensive insights.

This is a real excerpt from the complete Greif SWOT analysis. Once purchased, you’ll receive the full, editable version to tailor to your needs.

Opportunities

The global push towards sustainability and circular economy models is a major tailwind for Greif. Consumers and businesses alike are actively seeking packaging that minimizes environmental impact, a trend Greif is well-positioned to capitalize on. This growing demand for eco-friendly alternatives directly supports Greif's strategic focus on reducing its carbon footprint.

Greif sees significant opportunities in expanding its presence within high-growth market segments, notably in polymers. The agrochemical and food sectors, in particular, are showing robust volume growth, presenting a fertile ground for Greif's polymer products.

The company's strategic pivot towards higher-growth, higher-margin products and markets is a key driver of this opportunity. This focus allows Greif to capitalize on emerging trends and secure a stronger competitive position in these expanding areas.

Greif can capitalize on the industrial packaging sector's digital shift, embracing AI, automation, and smart packaging. This integration promises to boost Greif's operational efficiency and refine product quality checks.

By adopting these technologies, Greif can streamline its logistics, leading to faster delivery times and reduced costs. Furthermore, these advancements enable the development of cutting-edge packaging solutions that offer enhanced functionality and customer value.

For instance, the global industrial packaging market was valued at approximately $105.8 billion in 2023 and is projected to grow, with digital solutions playing a key role in this expansion. Greif's investment in smart packaging could see a significant uplift in its market share by offering features like real-time tracking and condition monitoring.

Strategic Divestitures and Capital Redeployment

Greif's strategic divestitures, including the sale of its timberlands and the planned exit from its containerboard business, are poised to generate significant cash. For instance, the timberland sale, completed in late 2023, yielded approximately $70 million. This infusion of capital directly supports debt reduction initiatives, thereby strengthening the company's balance sheet and improving its financial flexibility.

The capital freed up from these divestitures presents a key opportunity for Greif to reinvest strategically. The company can now pursue disciplined capital redeployment, focusing on high-growth areas and opportunities that promise to maximize return on invested capital. This move aligns with a broader strategy to streamline operations and enhance profitability.

- Strategic Divestitures: Greif's timber portfolio sale generated about $70 million in late 2023, and its containerboard business divestiture is underway.

- Debt Reduction: These sales provide substantial cash proceeds, enabling a significant reduction in outstanding debt.

- Enhanced Financial Flexibility: Lower debt levels improve Greif's capacity to borrow and invest in future growth opportunities.

- Capital Redeployment: The company can now reallocate capital towards strategic growth investments and initiatives aimed at increasing return on invested capital.

Emerging Markets and Global Trade Growth

The ongoing globalization of trade, coupled with increasing manufacturing activities in developing economies, is a significant tailwind for the industrial packaging sector. Greif's extensive global footprint, including operations in over 30 countries, is a key advantage. This allows the company to effectively serve a diverse customer base and tap into the burgeoning demand for packaging solutions in these rapidly expanding regions.

Emerging markets are not just about volume; they represent a growing need for specialized and sustainable packaging. Greif's ability to offer a wide range of products, from steel drums to intermediate bulk containers (IBCs), positions it to meet these evolving requirements. For instance, the Asia-Pacific region, a major hub for manufacturing, is expected to see continued growth in industrial packaging demand, with projections indicating a compound annual growth rate (CAGR) of over 5% through 2028 for rigid industrial packaging.

- Global Trade Expansion: Increased cross-border commerce directly fuels the need for robust industrial packaging to protect goods during transit.

- Emerging Market Manufacturing: Developing nations are becoming manufacturing powerhouses, creating substantial demand for packaging to support their growing industries.

- Greif's Global Reach: The company's established presence in over 30 countries allows it to capitalize on regional growth trends and serve multinational clients effectively.

- Diversified Demand: As global supply chains become more complex, the need for various types of industrial packaging, including specialized solutions, continues to rise.

Greif is well-positioned to benefit from the increasing global focus on sustainability and the circular economy, as demand for eco-friendly packaging solutions grows. The company can also leverage its strategic expansion into high-growth polymer markets, particularly in the agrochemical and food sectors, to drive revenue. Embracing digital transformation through AI and automation in industrial packaging offers opportunities for enhanced efficiency and innovation, with the global industrial packaging market valued at approximately $105.8 billion in 2023.

The company's strategic divestitures, including the timberlands sale which generated around $70 million in late 2023, provide capital for debt reduction and reinvestment in higher-return areas. This financial flexibility allows Greif to pursue growth opportunities and improve its overall balance sheet. Furthermore, the ongoing globalization of trade and manufacturing expansion in emerging markets, particularly in regions like Asia-Pacific where rigid industrial packaging is projected to grow at over 5% CAGR through 2028, presents a significant opportunity for Greif due to its extensive global presence.

| Opportunity | Description | Supporting Data/Fact |

| Sustainability & Circular Economy | Growing demand for eco-friendly packaging solutions. | Global push towards sustainability models. |

| High-Growth Market Expansion | Focus on polymers, especially in agrochemical and food sectors. | Robust volume growth in these sectors. |

| Digital Transformation | Adoption of AI, automation, and smart packaging. | Global industrial packaging market valued at ~$105.8 billion (2023). |

| Strategic Divestitures & Capital Redeployment | Cash generation from asset sales for debt reduction and reinvestment. | Timberland sale generated ~$70 million (late 2023). |

| Global Trade & Emerging Markets | Leveraging global footprint to serve growing demand in developing economies. | Asia-Pacific rigid industrial packaging CAGR projected >5% through 2028. |

Threats

Global economic uncertainty, including inflation and interest rate hikes seen throughout 2024, poses a significant threat to Greif. Geopolitical tensions, such as ongoing conflicts and the potential for new trade barriers, further exacerbate these risks by disrupting supply chains and impacting demand for industrial packaging. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging macroeconomic environment.

These volatile conditions can lead to shortages of key raw materials like steel and resin, driving up input costs for Greif. Furthermore, logistical disruptions stemming from geopolitical events can increase transportation expenses and delivery times, directly impacting operational efficiency and profitability. The company's reliance on global markets means it's particularly susceptible to these widespread economic and political headwinds.

The packaging sector is navigating a landscape of increasingly stringent environmental regulations worldwide. For instance, new EU packaging and packaging waste regulations, alongside Extended Producer Responsibility (EPR) laws, are reshaping industry standards. Greif, like its peers, must adapt to these evolving requirements, which can significantly impact operational costs and introduce greater complexity.

The industrial packaging sector is fiercely competitive, with many companies battling for market share. This intense rivalry often translates into significant pricing pressures, which can squeeze profit margins for players like Greif. For instance, in fiscal year 2023, Greif faced a dynamic market where input costs, while stabilizing, still presented challenges against competitor pricing strategies.

To stay ahead, Greif needs to consistently innovate and offer unique products and services. This differentiation is crucial to stand out from a crowded field that includes both massive global packaging providers and nimble, specialized niche players. The company's ability to maintain its competitive edge hinges on its ongoing investment in product development and customer service to counter the commoditization that can occur in this market.

Supply Chain Disruptions and Raw Material Scarcity

The global supply chain continues to be a significant concern, with ongoing vulnerabilities stemming from raw material shortages and logistical challenges. For Greif, this translates to potential impacts on production schedules and increased operational costs, which could ultimately affect their capacity to fulfill customer orders effectively. For instance, the cost of steel, a key input for Greif's rigid packaging, saw significant price fluctuations in late 2023 and early 2024, driven by these very supply chain pressures.

These disruptions can lead to extended lead times and unexpected price hikes for essential components. Such volatility directly impacts Greif's cost structure and its ability to maintain competitive pricing, potentially affecting market share. The ongoing geopolitical landscape also adds layers of uncertainty, making robust supply chain management a critical factor for business continuity.

- Increased Input Costs: Fluctuations in raw material prices, like steel and resin, directly elevate production expenses for Greif.

- Production Delays: Bottlenecks in transportation and material availability can disrupt manufacturing timelines, impacting delivery commitments.

- Reduced Profit Margins: The inability to fully pass on increased costs to customers can squeeze profit margins.

- Customer Dissatisfaction: Delays and potential stockouts can lead to a negative customer experience and loss of business.

Labor Shortages and Workforce Challenges

Greif, like many in the logistics and packaging sector, is grappling with persistent labor shortages, affecting both skilled and unskilled positions. This scarcity directly impacts operational efficiency, potentially delaying production and deliveries.

The ongoing difficulty in securing a stable workforce drives up labor costs as companies compete for available talent. This financial pressure necessitates careful budgeting and potential price adjustments for services.

To counter these workforce challenges, Greif may need to accelerate investments in automation. For instance, the U.S. manufacturing sector, which Greif serves, saw industrial automation sales increase by approximately 10% in 2023, indicating a broader industry trend towards technological solutions to labor gaps.

- Skilled Labor Gap: Difficulty finding experienced machine operators and technicians.

- Unskilled Labor Availability: Challenges in recruiting and retaining general production staff.

- Increased Wage Pressure: Rising compensation demands to attract and keep employees.

- Automation Investment: Need for capital expenditure in robotics and automated systems to compensate for fewer workers.

Intensified competition and pricing pressures remain a significant threat, potentially eroding Greif's profit margins as it navigates a market where input costs, while stabilizing, still present challenges against competitor pricing strategies, as seen in fiscal year 2023. The company must continuously innovate to differentiate itself from a crowded field of global and niche players, as commoditization risks are ever-present.

SWOT Analysis Data Sources

This Greif SWOT analysis is built upon a foundation of reliable data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate assessment.