Greif Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

Greif's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate the industrial packaging market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Greif’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Greif's reliance on essential inputs like steel, plastic resins, and containerboard exposes it to significant raw material price volatility. For instance, the price of steel, a primary component for its industrial packaging, experienced notable fluctuations throughout 2024, influenced by global supply chain dynamics and geopolitical events. This inherent price instability in key commodities grants suppliers considerable bargaining power, as they can leverage market conditions to dictate terms and potentially increase costs for Greif.

When a market for essential raw materials is highly concentrated, meaning only a few major suppliers exist, those suppliers gain significant leverage. This can translate into higher prices or less favorable contract terms for companies like Greif, as their choices for sourcing become limited.

For example, if the primary suppliers of paper or steel, key inputs for Greif's packaging solutions, are few and dominant, they can dictate terms more effectively. This supplier concentration directly impacts Greif's cost of goods sold and operational flexibility.

Greif actively works to counter this by diversifying its supplier base where possible and building strong, strategic relationships with its key suppliers. This approach helps ensure a more stable and cost-effective supply chain, mitigating the risks associated with concentrated supplier markets.

Greif faces significant bargaining power from its suppliers, largely due to the substantial switching costs involved. These costs can include the expense and time required to qualify new materials, recalibrate intricate production processes, and navigate the complexities of renegotiating supply agreements. For instance, a change in the type of steel or resin used in Greif's industrial packaging could necessitate extensive testing and retooling, making a swift transition difficult.

Supplier's Product Differentiation

When suppliers offer highly specialized or proprietary materials, their bargaining power increases significantly. This is because there are fewer comparable alternatives available, allowing them to dictate higher prices. For instance, if a key supplier for Greif's packaging solutions provides a unique, high-performance coating essential for a specific product line, Greif's ability to negotiate pricing or terms is diminished.

Greif's reliance on such differentiated inputs directly influences the power these suppliers hold. If these specialized materials are critical for Greif's competitive advantage and difficult to substitute, suppliers can leverage this position. For example, in 2024, the demand for advanced, sustainable barrier coatings for food and beverage packaging saw a notable increase. Suppliers who had invested in developing and patenting these specific technologies were in a strong position to command premium pricing from packaging manufacturers like Greif.

- Supplier Differentiation: Suppliers providing unique, proprietary, or superior quality raw materials with limited substitutes possess stronger bargaining power.

- Impact on Greif: Greif's capacity to source comparable alternatives for these differentiated inputs is a key factor in mitigating supplier power.

- Market Example (2024): The market for specialized, sustainable barrier coatings in packaging demonstrated this, with patent-holding suppliers able to charge higher prices due to limited competition for these advanced materials.

Threat of Forward Integration by Suppliers

If suppliers can credibly threaten to move into industrial packaging manufacturing themselves, they could become direct competitors to Greif. This possibility would significantly boost their leverage during price and terms negotiations.

However, the substantial capital investment required to establish and operate packaging manufacturing facilities generally makes this forward integration a less probable strategy for most raw material suppliers.

For instance, while the global packaging market was valued at approximately $1.1 trillion in 2023, establishing a new paper or rigid packaging plant can require hundreds of millions of dollars in upfront capital, a significant barrier for many.

This high capital intensity limits the number of suppliers capable of making such a move, thereby reducing the immediate threat of forward integration and its impact on Greif's supplier bargaining power.

Greif's bargaining power with suppliers is moderate, influenced by the concentration of its key input markets and the availability of substitutes. While Greif's scale provides some leverage, the essential nature of materials like steel and resins, coupled with significant switching costs, means suppliers retain considerable influence, particularly in 2024's volatile commodity environment.

The limited number of dominant suppliers for critical inputs like specialized polymers or high-grade paper means these entities can command better terms. For example, a few global producers control a significant share of the market for certain high-performance barrier coatings essential for food packaging, directly impacting Greif's procurement costs.

Greif's strategy of diversifying its supplier base and fostering long-term relationships helps to mitigate supplier power. However, the inherent capital intensity of establishing new, large-scale manufacturing facilities limits the threat of suppliers integrating forward into Greif's business, thereby capping their ultimate leverage.

What is included in the product

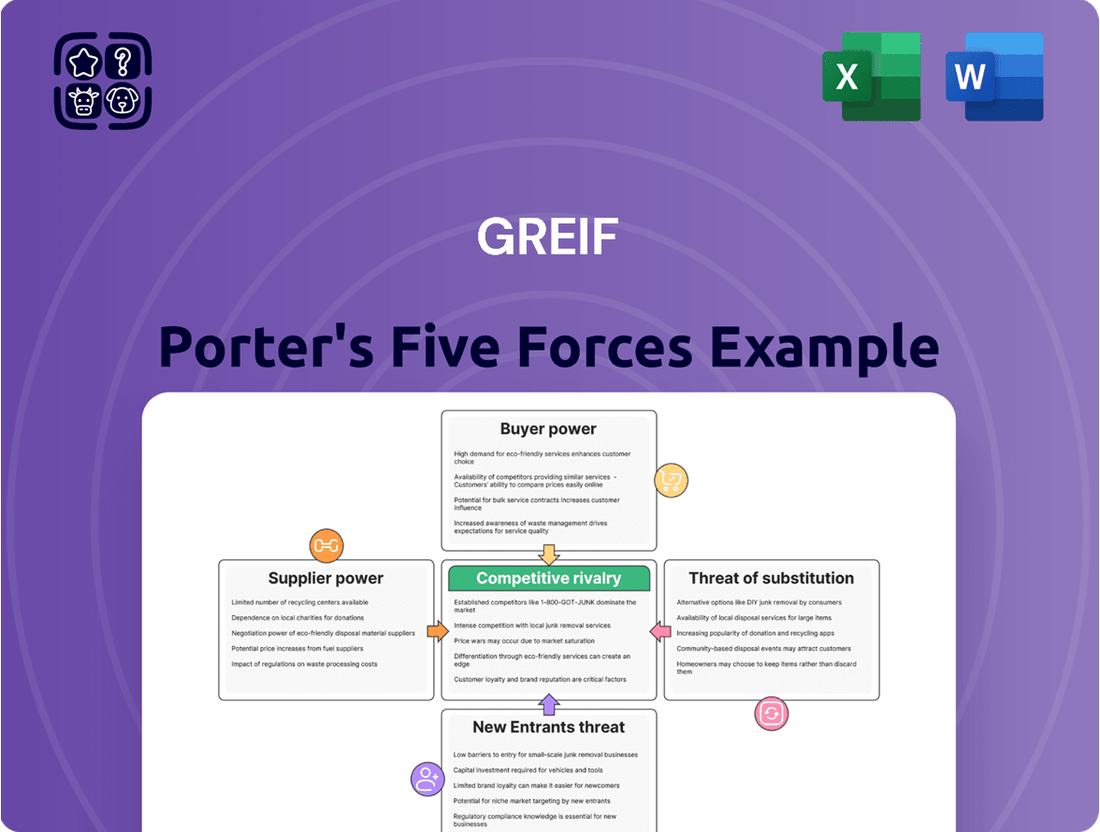

This analysis dissects the competitive forces impacting Greif, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customer concentration is a key factor in assessing the bargaining power of customers for a company like Greif. Greif serves a broad spectrum of industries, such as chemicals, pharmaceuticals, food and beverage, and agriculture. This diversification is generally positive, but if a substantial portion of Greif's revenue is derived from a small number of major clients, those key customers gain significant leverage.

These large customers can then demand lower prices or more favorable contract terms, directly impacting Greif's profitability and pricing power. For instance, if a single customer accounted for over 10% of Greif's net sales in a given year, their ability to negotiate would be considerably higher than that of smaller clients.

In the industrial packaging sector, where products are often seen as commodities, customers exhibit significant price sensitivity. This means they are quite likely to switch to a competitor if a lower price is offered, directly impacting Greif's pricing power. For instance, in 2024, the average price increase across the packaging industry faced considerable resistance, with many customers actively seeking out alternative suppliers to maintain cost control.

The availability of substitute packaging products significantly amplifies customer bargaining power against companies like Greif. When customers can easily switch to alternative drum types, intermediate bulk containers (IBCs), or even different packaging materials altogether, their reliance on Greif's specific solutions diminishes. This increased choice directly translates into greater leverage for customers to negotiate better prices and terms.

Customer's Threat of Backward Integration

The threat of backward integration by customers poses a significant factor in the bargaining power of customers for companies like Greif. Large customers, particularly those with substantial packaging needs, might explore producing their own industrial packaging if it becomes more cost-effective or strategically beneficial. This potential for self-production directly enhances their leverage when negotiating with Greif.

However, the specialized nature and capital intensity of industrial packaging manufacturing, such as that undertaken by Greif, generally present a high barrier to entry for most customers. The significant investment required in machinery, technology, and expertise makes backward integration a costly and complex undertaking for the average buyer.

For instance, while a large chemical or food manufacturer might have the volume to consider in-house production, the specialized equipment for producing steel drums or rigid intermediate bulk containers (IBCs) represents a substantial capital outlay. In 2024, the cost of setting up a new, modern drum manufacturing line could easily run into millions of dollars, a prohibitive expense for many. This high cost associated with establishing such capabilities limits the practical threat of backward integration for the majority of Greif's customer base.

- High Capital Investment: Setting up specialized packaging production lines requires millions in upfront costs for machinery and infrastructure.

- Technical Expertise: Manufacturing industrial packaging demands specific technical knowledge and skilled labor, which customers may lack.

- Economies of Scale: Greif likely benefits from economies of scale in production that individual customers would struggle to match, making in-house production less efficient.

- Focus on Core Business: Most customers prefer to concentrate on their primary business operations rather than diverting resources and management attention to packaging manufacturing.

Customer Information and Transparency

Customers who are well-informed about market prices, production expenses, and what competitors offer hold a stronger hand when negotiating. This knowledge allows them to push for better terms and pricing, directly impacting Greif's ability to command premium prices.

The packaging industry, including segments where Greif operates, is seeing a trend towards greater transparency. This can manifest through readily available pricing data, detailed product specifications, and clearer understanding of manufacturing processes. For instance, in 2023, the industrial packaging market saw increased online platforms offering comparative pricing, making it easier for buyers to gauge fair value.

- Informed Buyers: Customers with access to detailed cost breakdowns and competitor pricing can effectively challenge Greif's price points.

- Market Transparency: Greater availability of market data and product information empowers buyers and diminishes supplier pricing power.

- Negotiating Leverage: Well-informed customers can demand lower prices or better service terms, reducing Greif's profit margins.

- Shifting Power Dynamics: As information becomes more accessible, the bargaining power shifts incrementally from suppliers like Greif towards customers.

The bargaining power of customers for Greif is influenced by several factors, including customer concentration, price sensitivity, availability of substitutes, and the threat of backward integration.

In 2023, Greif reported that its largest customer represented approximately 11% of its net sales, indicating a moderate level of customer concentration. This means that while a significant portion of revenue comes from a few key clients, no single customer holds overwhelming power. However, these major clients still possess considerable leverage to negotiate pricing and terms, especially given the price sensitivity prevalent in the industrial packaging market. For instance, in the first half of 2024, many industrial buyers actively sought cost reductions due to economic pressures, leading to increased negotiation on packaging prices.

The availability of alternative packaging solutions, such as different types of drums or intermediate bulk containers (IBCs) from competitors, also empowers customers. This choice allows them to switch suppliers if Greif's pricing or terms are not competitive. For example, the market for rigid IBCs saw increased competition in 2023 with new entrants offering comparable products, thereby strengthening customer negotiation positions.

The threat of backward integration, where customers produce their own packaging, is generally limited for Greif due to the high capital investment and technical expertise required. Setting up a steel drum manufacturing line, for example, can cost millions of dollars, a barrier most customers cannot overcome. This high barrier helps to moderate customer bargaining power, as self-production is often not economically viable for them.

| Factor | Impact on Greif's Customer Bargaining Power | Supporting Data/Observation (2023-2024) |

| Customer Concentration | Moderate to High for large clients | Largest customer accounted for ~11% of net sales in 2023. |

| Price Sensitivity | High | Customers actively sought cost reductions in H1 2024 due to economic pressures. |

| Availability of Substitutes | Moderate to High | Increased competition in IBC market in 2023 strengthened buyer positions. |

| Threat of Backward Integration | Low | High capital costs (millions for drum lines) and technical expertise limit customer self-production. |

Same Document Delivered

Greif Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details a comprehensive Porter's Five Forces analysis of Greif, evaluating the competitive landscape and strategic positioning within its industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

Greif operates within a dynamic industrial packaging market characterized by a significant number of competitors, ranging from large global corporations to more focused regional entities. This competitive landscape includes formidable players such as Packaging Corporation of America, Sonoco Products Company, and Graphic Packaging, all of whom vie for market share and customer loyalty.

The sheer volume and strength of these competitors directly contribute to an intense rivalry within the sector. For instance, in 2023, the global industrial packaging market was valued at approximately $1.1 trillion, with these major players holding substantial portions of that value, indicating the high stakes involved in this competitive environment.

In mature segments of the industrial packaging market, where growth is slower, competition for market share can become quite fierce. This often leads companies to employ more aggressive pricing tactics or ramp up their marketing spend to try and gain an edge.

However, the industrial packaging sector as a whole is projected for robust growth in the coming years. For instance, Mordor Intelligence forecasts the global industrial packaging market to grow from $112.38 billion in 2023 to $138.27 billion by 2029, at a compound annual growth rate (CAGR) of 3.46%. This expansion can temper rivalry as there's more room for everyone to grow.

While industrial packaging might seem like a commodity, leading companies like Greif actively differentiate themselves. They focus on sustainability, offering eco-friendly materials and circular economy solutions, which resonates with environmentally conscious customers. This approach helps them stand out from competitors who primarily compete on price.

Innovation is another key differentiator. Greif invests in advanced manufacturing processes and develops specialized packaging solutions tailored to specific industry needs, such as enhanced protection or ease of handling. For instance, their focus on lightweight yet durable steel drums reduces transportation costs for customers.

Customer service and comprehensive life-cycle support further reduce direct price competition. Greif provides services ranging from packaging design and testing to recycling and reuse programs. This holistic approach builds strong customer loyalty and creates a competitive advantage beyond mere product features.

Exit Barriers

High exit barriers in the industrial packaging sector, like those faced by companies in the steel drum market, can trap businesses in an industry even when profits are scarce. These barriers include specialized manufacturing equipment, which is difficult to repurpose, and long-term supply agreements that are costly to break. For instance, a significant portion of the capital expenditure in this industry is tied to highly specific machinery, making divestment challenging.

These persistent players, unable to easily leave, often contribute to ongoing overcapacity. This situation intensifies price competition as companies fight for market share, even at lower profit margins. In 2024, the global industrial packaging market, while showing resilience, still grappled with the effects of oversupply in certain segments, directly linked to the difficulty of exiting.

The implications for remaining competitors are stark:

- Persistent Price Pressure: Companies unable to exit must continue competing, often leading to price wars that erode profitability across the board.

- Reduced Investment: The prospect of being stuck in a low-return industry discourages new investment and innovation.

- Market Stalemate: High exit barriers can create a stagnant market where companies are locked in, regardless of their individual performance.

Cost Structure and Capacity Utilization

Companies in industries with substantial fixed costs, like those in packaging, often face pressure to maximize capacity utilization. When capacity utilization is low, the incentive to produce more to spread those fixed costs can lead to aggressive pricing strategies. This is a key driver of competitive rivalry.

Greif's commitment to operational efficiency and ongoing cost optimization programs is therefore vital. These initiatives directly address the challenges posed by high fixed costs and fluctuating demand, helping to maintain a competitive cost structure and mitigate the risk of price wars driven by underutilized capacity.

- High Fixed Costs: Industries like industrial packaging, where Greif operates, often have significant investments in plant and equipment, leading to high fixed costs.

- Capacity Utilization Impact: Low capacity utilization can force companies to lower prices to generate revenue and cover overhead, intensifying rivalry.

- Greif's Strategy: Greif's focus on operational efficiency and cost reduction is critical for managing this competitive pressure.

- 2024 Data Insight: While specific capacity utilization figures for 2024 are proprietary, Greif's consistent efforts in optimizing its manufacturing footprint and supply chain suggest a proactive approach to managing these cost dynamics.

Competitive rivalry within the industrial packaging sector is intense, driven by numerous players and the inherent difficulty in exiting the market due to high capital investments in specialized machinery. This often leads to price pressures, especially when capacity utilization dips, compelling companies to compete aggressively on cost to cover fixed overheads.

Greif actively differentiates itself through sustainability initiatives and innovation in packaging solutions, moving beyond pure price competition. For example, their focus on lightweight steel drums enhances customer value by reducing shipping costs. Furthermore, comprehensive customer service and lifecycle support, including recycling programs, foster loyalty and create a competitive moat.

The industrial packaging market, valued at over $1.1 trillion globally in 2023, is projected to grow, offering some relief from rivalry. However, high exit barriers mean that even struggling firms remain, contributing to potential overcapacity and sustained price competition in certain segments throughout 2024.

| Competitor Characteristic | Impact on Rivalry | Greif's Response |

|---|---|---|

| Numerous Competitors | Intensifies competition for market share. | Focus on differentiation and customer loyalty. |

| High Exit Barriers | Persistent players lead to potential overcapacity and price wars. | Operational efficiency and cost optimization are crucial. |

| Capacity Utilization | Low utilization drives aggressive pricing to cover fixed costs. | Proactive management of manufacturing footprint and supply chain. |

| Differentiation Factors | Sustainability, innovation, and customer service reduce direct price competition. | Investment in eco-friendly materials and tailored solutions. |

SSubstitutes Threaten

Greif's core business, particularly in rigid industrial packaging like steel and plastic drums, faces a growing threat from alternative materials. For instance, fiber drums are increasingly positioned as a more sustainable and often cost-competitive option for specific product types, directly impacting demand for traditional metal and plastic containers. This shift is driven by a desire for lighter weight and reduced environmental impact, a trend that gained significant momentum in 2024 as regulatory pressures and consumer preferences for greener solutions intensified.

The market for reconditioned and reusable industrial containers poses a notable threat of substitution for new containers. Many businesses are increasingly looking for cost-effective and environmentally friendly alternatives, making these options attractive. This trend is supported by a growing emphasis on sustainability initiatives across industries.

Greif's own involvement in reconditioning services, which they offer as a key part of their business, underscores the significance of this substitute. This strategic move by Greif itself highlights the growing demand and viability of the reconditioned container market. For instance, the industrial packaging market, which includes reconditioned drums, saw significant growth in recent years, with a compound annual growth rate projected to be around 4-5% leading up to 2024, driven by these very factors.

Flexible packaging, like large bags or pouches, can act as a substitute for rigid industrial containers in certain applications, particularly for non-hazardous or less sensitive products. This trend towards lighter, more efficient packaging materials presents a potential threat to traditional rigid container manufacturers.

For instance, the global flexible packaging market was valued at approximately $253 billion in 2023 and is projected to grow, indicating a sustained demand for these alternatives across various industries. This growth suggests that companies relying solely on rigid packaging might face increased competition as customers opt for more cost-effective and environmentally friendly flexible solutions.

Bulk Transportation Methods

For industries dealing with high-volume liquid or granular materials, bulk transportation methods like tankers and rail cars can serve as a substitute for individual industrial packaging. This substitution is highly dependent on the customer's operational scale and logistical capabilities.

The economic feasibility of bulk transport versus packaged goods is a key consideration. For instance, in 2024, the cost per ton-mile for bulk rail freight can be significantly lower than shipping individually packaged goods, making it an attractive alternative for large-scale commodity movements.

- Cost Efficiency: Bulk transport often offers a lower cost per unit for moving large quantities of materials.

- Volume Threshold: The viability of bulk transport as a substitute increases with the volume of material being moved.

- Logistical Infrastructure: Availability of specialized loading, unloading, and storage facilities for bulk materials is crucial.

- Product Type: Liquids, gases, and free-flowing solids are more amenable to bulk transport than discrete, sensitive items.

Technological Advancements in Packaging Alternatives

Ongoing innovations in packaging technology present a significant threat of substitutes for Greif's traditional industrial packaging. Advances like smart packaging, which can monitor product conditions, and ultra-lightweight designs offer enhanced functionality or reduced material costs. Furthermore, the development of novel biodegradable and compostable materials could provide environmentally preferable alternatives, potentially impacting demand for Greif's paper and plastic-based products.

Greif is actively addressing this threat by investing in and developing sustainable packaging solutions. For instance, in 2023, Greif announced plans to expand its recycled content offerings, aiming to increase the use of post-consumer recycled (PCR) materials in its plastic drums. This strategic focus on sustainability not only mitigates the threat of emerging substitutes but also positions Greif to capitalize on the growing market demand for eco-friendly packaging options.

- Technological Innovation: Smart packaging and lightweight designs offer enhanced functionality and cost-efficiency.

- Material Advancements: New biodegradable and compostable materials present environmentally conscious alternatives.

- Greif's Response: Investment in sustainable solutions, including increased use of recycled content (e.g., 2023 expansion of PCR in plastic drums).

- Market Impact: These innovations could shift customer preferences towards more sustainable or technologically advanced packaging options.

The threat of substitutes for Greif's industrial packaging is significant, driven by cost, sustainability, and technological advancements. Fiber drums, for example, offer a lighter and often more eco-friendly alternative, gaining traction as environmental concerns rise. The market for reconditioned and reusable containers also presents a viable substitute, appealing to businesses seeking cost savings and reduced waste, a trend strongly supported by sustainability initiatives prevalent in 2024.

Flexible packaging and bulk transport methods also pose substitution risks, depending on product type and volume. Innovations in smart packaging and biodegradable materials further challenge traditional rigid containers, prompting companies like Greif to invest in sustainable solutions, such as increasing recycled content in their products, as seen with their 2023 expansion of PCR in plastic drums.

| Substitute Type | Key Drivers | Example/Impact |

|---|---|---|

| Fiber Drums | Sustainability, Cost-Effectiveness | Direct competition for specific product types, gaining momentum in 2024 due to environmental focus. |

| Reconditioned/Reusable Containers | Cost Savings, Environmental Friendliness | Growing demand for circular economy solutions. |

| Flexible Packaging | Lightweight, Cost-Efficiency | Global market valued at ~$253 billion in 2023, impacting rigid packaging for non-hazardous goods. |

| Bulk Transport (Tankers, Rail) | Scale, Cost per Unit | Lower cost per ton-mile for large commodity movements, viable for high-volume liquids/granular materials. |

| Innovative Packaging | Smart Features, Biodegradability | Smart packaging, lightweight designs, and compostable materials offer enhanced functionality and eco-alternatives. |

Entrants Threaten

Establishing an industrial packaging manufacturing operation, such as those producing steel drums or intermediate bulk containers (IBCs), demands significant capital. Think millions of dollars for advanced machinery, extensive factory space, and robust logistics. For instance, a new steel drum production line alone can cost upwards of $5 million, not including land acquisition or building construction.

This high upfront investment acts as a formidable barrier for potential new competitors. Without substantial financial backing, it's incredibly difficult for newcomers to enter and compete effectively. Many established players have already amortized these initial costs over years of operation, giving them a cost advantage.

Established players in the industrial packaging sector, such as Greif, benefit significantly from substantial economies of scale. This means they can produce and distribute their products at a lower cost per unit due to their large-scale operations. For instance, in 2023, Greif reported net sales of $5.7 billion, a testament to its extensive market presence and operational efficiencies.

New entrants would find it incredibly challenging to match these cost advantages. Without the same production volume, they cannot negotiate bulk discounts on raw materials or spread their fixed costs over as many units. This inability to achieve comparable cost efficiencies makes it difficult for newcomers to compete on price with established firms like Greif, thereby acting as a deterrent.

The industrial packaging sector faces significant barriers to entry due to rigorous regulatory landscapes. New companies must invest heavily to understand and adhere to evolving standards concerning material safety, waste reduction, and carbon footprint, as exemplified by the EU's Packaging and Packaging Waste Regulation updates in 2024. These compliance costs can deter potential entrants, particularly smaller operations.

Access to Distribution Channels

New entrants often face significant hurdles in securing access to established distribution channels. Companies like Greif have cultivated deep, long-standing relationships with distributors and retailers, making it difficult for newcomers to gain comparable market penetration. In 2024, the global logistics and supply chain market was valued at approximately $11.5 trillion, highlighting the scale of investment and infrastructure required to effectively reach customers.

The cost and complexity associated with building a comparable distribution network can be prohibitive for emerging businesses. Established players benefit from economies of scale in logistics and warehousing, which new entrants struggle to match. For instance, in the industrial packaging sector where Greif operates, securing shelf space or consistent delivery routes often depends on existing partnerships and volume commitments.

- Established Relationships: Greif's long-term partnerships with distributors provide preferential access and terms.

- Logistical Infrastructure: Significant investment in warehousing and transportation networks creates a barrier to entry.

- Market Penetration Costs: New entrants face high costs to replicate the reach and efficiency of incumbent distribution systems.

- Brand Trust: Existing channels often prioritize suppliers with proven reliability and brand recognition.

Brand Loyalty and Customer Relationships

In the business-to-business sector, particularly in industries like packaging where Greif operates, brand loyalty is a significant barrier to new entrants. Established companies cultivate deep, long-standing relationships with their clients, built on a foundation of consistently proven product quality and dependable customer service. This trust factor is not easily replicated by newcomers, who would need substantial effort and time to erode existing loyalties and demonstrate equivalent reliability.

Greif's strategic emphasis on customer service and its achievement of a high Net Promoter Score (NPS) further solidify this advantage. For instance, a strong NPS, often exceeding 50 for leading B2B companies, indicates a high likelihood of customers recommending the brand. This customer advocacy is a powerful deterrent, as new entrants must not only offer competitive products but also match or surpass the existing level of customer satisfaction and trust that Greif has meticulously built over years of operation.

- Brand Loyalty as a Barrier: Established B2B relationships, proven quality, and reliable service create significant customer loyalty.

- Overcoming Trust Deficits: New entrants face the challenge of building trust and proving their capabilities against established players like Greif.

- Greif's Competitive Edge: A strong emphasis on customer service and a high Net Promoter Score (NPS) enhance Greif's brand loyalty.

- Impact on New Entrants: Competitors must invest heavily in relationship building and service quality to challenge Greif's market position.

The threat of new entrants in the industrial packaging sector, where Greif operates, is significantly mitigated by substantial capital requirements. Establishing a manufacturing presence, especially for products like steel drums, demands millions for machinery and facilities, a cost that deters many potential competitors. For example, a new steel drum production line can cost over $5 million, excluding land and building expenses.

Economies of scale enjoyed by established players like Greif, which reported $5.7 billion in net sales in 2023, present another formidable barrier. Newcomers struggle to match the per-unit cost advantages derived from high production volumes, impacting their ability to compete on price. Regulatory compliance, as seen with evolving EU packaging waste regulations in 2024, adds further cost and complexity for new entrants.

Access to established distribution channels is also a major hurdle. Greif's long-standing relationships with distributors are difficult and costly for new companies to replicate, especially considering the global logistics market's vast scale, valued at approximately $11.5 trillion in 2024. This limits market penetration for emerging businesses.

Brand loyalty, built on proven quality and customer service, further solidifies the position of incumbents like Greif. New entrants must invest heavily in building trust and matching the customer satisfaction levels that contribute to strong Net Promoter Scores, a key indicator of customer advocacy.

| Barrier | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High upfront investment for manufacturing facilities and machinery. | Deters new companies due to significant financial risk. | New steel drum line costs >$5 million. |

| Economies of Scale | Lower per-unit costs due to large-scale production. | Makes it difficult for new entrants to compete on price. | Greif's 2023 net sales: $5.7 billion. |

| Regulatory Compliance | Adherence to safety, waste reduction, and carbon footprint standards. | Increases operational costs and complexity for newcomers. | EU Packaging and Waste Regulation updates (2024). |

| Distribution Channels | Access to established logistics and customer networks. | Requires significant investment and time to replicate existing reach. | Global logistics market value: ~$11.5 trillion (2024). |

| Brand Loyalty & Trust | Established customer relationships and proven reliability. | New entrants must overcome existing trust deficits. | High Net Promoter Scores (NPS) of incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Greif leverages data from financial statements, industry-specific market research reports, and competitor public disclosures to comprehensively assess competitive intensity and strategic positioning.