Greif Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greif Bundle

Unlock the strategic power of the BCG Matrix and understand your product portfolio's potential. See which products are your Stars, Cash Cows, Dogs, or Question Marks at a glance. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your business.

Stars

Greif's Customized Polymer Solutions segment, especially after integrating Ipackchem, is a definite Star. This division saw its net sales grow significantly, fueled by robust demand in key areas like agriculture and food packaging. The strategic move to acquire Ipackchem, a prominent player in jerrycans and smaller plastic containers, has broadened Greif's product offerings and market presence in this expanding sector.

Greif's emphasis on sustainable packaging, such as products with higher post-consumer resin (PCR) content and innovative modular designs like ModCan, positions it in a high-growth market segment. This focus directly addresses the escalating consumer and regulatory demand for environmentally responsible packaging options.

Greif's flexible products, like flexible intermediate bulk containers (FIBCs), are positioned as Stars within its BCG Matrix. These products are crucial for various sectors, benefiting from increasing demand driven by changing packaging requirements and the need for more efficient supply chains.

The company's strategic focus on polymer-based solutions, which encompasses its flexible packaging offerings, signals a strong commitment to growth in this area. Although precise recent growth percentages for this specific segment aren't always granularly disclosed, the overall trend indicates robust expansion potential.

High-Performance Small Plastic Containers

Following the Ipackchem acquisition, Greif's high-performance small plastic containers and jerrycans are positioned as a Star in their BCG Matrix. This segment thrives on specialized applications and the increasing demand for secure, efficient liquid and chemical transport.

The strategic acquisition of Ipackchem significantly bolstered Greif's capabilities in this high-growth market, opening doors to new customers and advanced product development. For instance, in 2024, the specialty packaging sector, which includes these high-performance containers, demonstrated robust growth, with Greif reporting a notable increase in sales from its acquired Ipackchem operations contributing to this segment's strong performance.

- Market Growth: The global market for rigid plastic packaging, including small containers and jerrycans, is projected to grow steadily, driven by demand in sectors like food and beverage, pharmaceuticals, and chemicals.

- Acquisition Synergies: Greif's integration of Ipackchem's expertise and product lines enhances its competitive edge in providing specialized, high-barrier plastic packaging solutions.

- Innovation Focus: Continued investment in material science and design for these containers supports their classification as a Star, meeting evolving regulatory and customer requirements for safety and sustainability.

Reconditioning Services Network

Greif's reconditioning services, bolstered by strategic acquisitions like Delta Containers Manchester and Enterprize Container Corporation, position this segment as a Star in its Business Growth-Share (BCG) Matrix. This expansion into reconditioning directly addresses the burgeoning circular economy, offering a sustainable approach to industrial packaging by extending the life of containers.

This service-oriented business is not only environmentally conscious but also generates consistent, recurring revenue for Greif. By facilitating the reuse of industrial packaging, Greif contributes to clients' sustainability targets while building a reliable income stream.

The reconditioning network's growth is significant, with Greif's 2024 fiscal year reporting a notable increase in its industrial packaging segment, which includes reconditioning services. This segment's performance indicates strong market demand and Greif's successful integration of acquired capabilities.

- Growing Market Share: Greif's reconditioning services are capturing a larger share of the industrial packaging market due to increased demand for sustainable solutions.

- High Growth Potential: The circular economy trend fuels rapid growth in packaging reconditioning, aligning with evolving environmental regulations and corporate sustainability goals.

- Revenue Diversification: This segment provides a stable, recurring revenue stream, complementing Greif's traditional manufacturing operations.

- Strategic Acquisitions: Acquisitions like Delta Containers Manchester and Enterprize Container Corporation have significantly expanded Greif's reconditioning capacity and geographic reach.

Greif's Customized Polymer Solutions, particularly after the Ipackchem integration, is a Star. This segment experienced substantial net sales growth in 2024, driven by strong demand in agriculture and food packaging. The acquisition of Ipackchem, a leader in jerrycans and smaller plastic containers, has significantly expanded Greif's market presence and product portfolio in this growing sector.

The company's commitment to sustainable packaging, including products with higher post-consumer resin (PCR) content and innovative designs like ModCan, places it in a high-growth market. This focus aligns with increasing consumer and regulatory pressure for eco-friendly packaging solutions.

Greif's flexible products, such as flexible intermediate bulk containers (FIBCs), are also Stars in the BCG Matrix. These are vital across various industries, benefiting from evolving packaging needs and the drive for more efficient supply chains.

The reconditioning services segment, strengthened by acquisitions like Delta Containers Manchester and Enterprize Container Corporation, is another Star. This expansion into reconditioning taps into the growing circular economy, offering a sustainable method to extend the life of industrial containers.

This service-based business model not only supports environmental goals but also generates consistent, recurring revenue. By enabling the reuse of industrial packaging, Greif aids clients in meeting their sustainability targets while building a reliable income stream.

The growth of the reconditioning network is noteworthy, with Greif reporting a significant increase in its industrial packaging segment, which encompasses reconditioning services, during its 2024 fiscal year. This performance highlights robust market demand and the successful integration of acquired capabilities.

| Segment | BCG Classification | Key Drivers | 2024 Performance Indicators |

| Customized Polymer Solutions (incl. Ipackchem) | Star | Demand in agriculture & food packaging, sustainable packaging trends, acquisition synergies | Significant net sales growth, expanded market presence |

| Flexible Packaging (FIBCs) | Star | Evolving supply chain needs, demand for efficient logistics | Robust expansion potential |

| Reconditioning Services | Star | Circular economy growth, sustainability regulations, recurring revenue model | Notable increase in industrial packaging segment sales, expanded capacity and reach |

What is included in the product

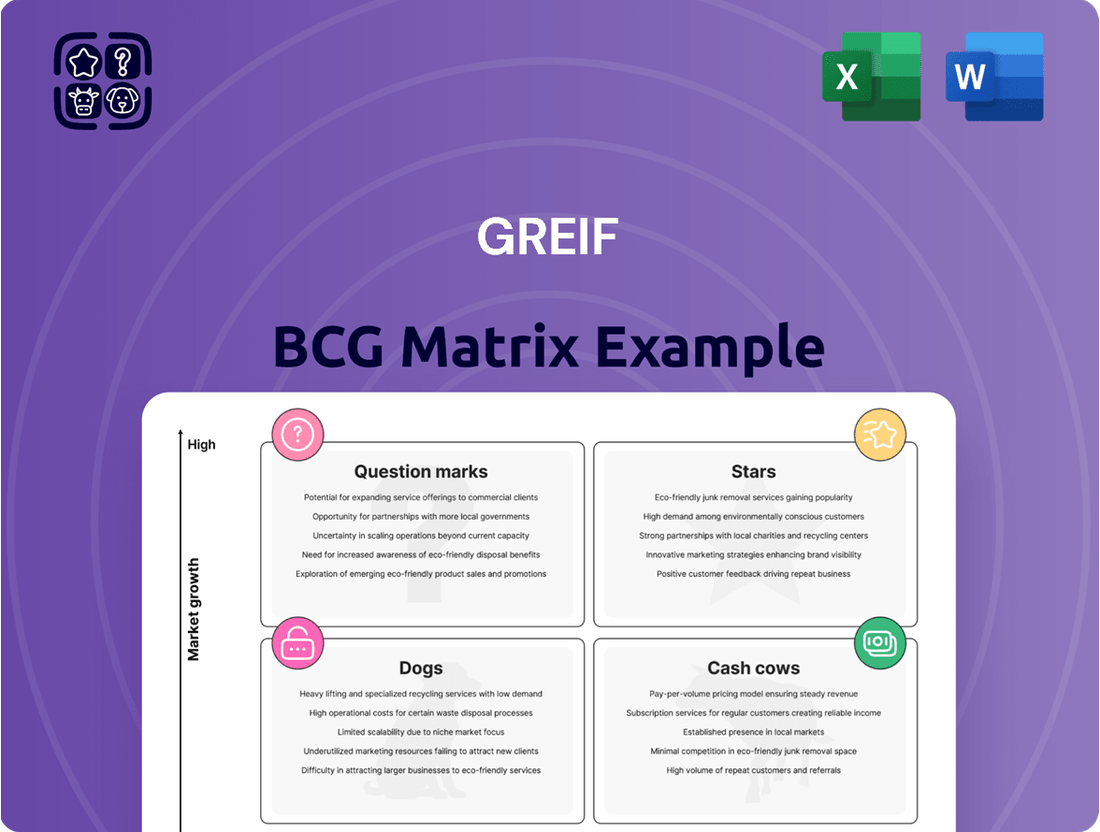

The Greif BCG Matrix categorizes business units by market share and growth rate, guiding strategic decisions.

A clear Greif BCG Matrix visualizes your portfolio, easing the pain of resource allocation decisions.

Cash Cows

Greif's steel drums are a classic example of a Cash Cow within their product portfolio. This segment holds a significant share in the mature industrial packaging market, consistently generating reliable cash flow. Because demand is well-established, the need for extensive promotional spending is minimal, allowing Greif to benefit from this stable revenue stream.

To maintain their strong position in this segment, Greif is actively investing in automation within their metals division. For instance, in fiscal year 2023, Greif reported that their Industrial Packaging segment, which includes steel drums, generated approximately $4.7 billion in net sales, showcasing the substantial contribution of these foundational products.

Fibre drums, much like steel drums, represent a foundational and mature product line for Greif, firmly positioning them as a Cash Cow within the company's portfolio. Their consistent performance signifies a strong, stable contribution to Greif's overall financial health.

These drums command a substantial market share across various industrial applications, translating into predictable and robust profit generation and cash flow for Greif. Their established presence underscores their continued relevance and profitability.

Fibre drums are critical components for numerous sectors, benefiting from Greif's well-developed supply chains and deeply ingrained customer relationships. This established ecosystem further solidifies their Cash Cow status.

Greif's traditional corrugated containers, particularly those catering to mature North American sectors such as food and building products, are strong contenders for Cash Cows within the BCG Matrix. Despite potentially slower overall growth in the paper packaging market, Greif's deep-rooted market position and honed operational efficiencies in this segment are key drivers of reliable cash flow.

The company's strategic focus on optimizing its mill network directly supports the profitability of this business line, ensuring continued strong performance. For instance, Greif's commitment to efficiency in 2023 contributed to a robust performance in its Paper Packaging segment, underscoring the stable cash-generating nature of its traditional corrugated offerings.

Containerboard Production (prior to divestiture)

Prior to its announced divestiture, Greif's containerboard production was a significant Cash Cow for the company. This segment consistently delivered robust sales and EBITDA, underscoring its strong standing in a mature market and its reliable cash-generating capabilities. For instance, in fiscal year 2023, the Paper Packaging segment, which includes containerboard, reported net sales of $2.7 billion, contributing significantly to Greif's overall financial performance.

The strategic decision to divest this business aimed at refining Greif's portfolio and strengthening its balance sheet by reducing debt. Despite the divestiture, the historical performance of containerboard production highlights its role as a powerful cash generator for the company.

- Strong Market Position: Containerboard production benefited from a stable, mature market, allowing for consistent sales and profitability.

- EBITDA Generation: The segment consistently produced substantial Earnings Before Interest, Taxes, Depreciation, and Amortization, reflecting efficient operations.

- Cash Flow Driver: Historically, this business was a primary source of cash for Greif, funding other strategic initiatives or debt reduction.

- Divestiture Rationale: The sale was a strategic move to focus on core businesses and improve financial flexibility, rather than a reflection of the segment's past performance.

Industrial Packaging Services (Logistics, Warehousing)

Greif's industrial packaging services, encompassing logistics and warehousing, function as a cash cow within its business portfolio. These operations capitalize on the company's established infrastructure and existing client relationships, generating consistent revenue in a mature, albeit vital, market segment. They also serve to deepen customer loyalty.

These integrated services are not only revenue generators but also strategic complements to Greif's core rigid and flexible packaging products. By offering end-to-end solutions, Greif enhances its value proposition, making it a more indispensable partner for its customers.

- Revenue Stability: Greif's logistics and warehousing segments provide a predictable and steady income stream, characteristic of cash cow businesses. In 2023, Greif reported total net sales of $5.9 billion, with its Industrial Packaging segment, which includes these services, being a significant contributor.

- Market Position: Operating in a low-growth but essential market, these services benefit from established demand and Greif's strong market presence. The industrial packaging market, while mature, continues to see consistent demand driven by global trade and manufacturing.

- Synergistic Value: The integration of logistics and warehousing with packaging manufacturing creates operational efficiencies and strengthens customer relationships, fostering stickiness and reducing churn.

- Profitability: While not high-growth, these mature businesses typically exhibit strong profitability due to optimized operations and economies of scale.

Greif's steel drums are a prime example of a Cash Cow, holding a significant share in a mature market and consistently generating reliable cash flow with minimal need for extensive promotion. In fiscal year 2023, Greif's Industrial Packaging segment, which includes steel drums, generated approximately $4.7 billion in net sales, highlighting the substantial contribution of these foundational products.

Fibre drums also function as a Cash Cow, commanding a substantial market share across various industrial applications, leading to predictable and robust profit generation. Their established presence and Greif's well-developed supply chains solidify their role as consistent revenue contributors.

Greif's traditional corrugated containers, particularly those serving mature North American sectors, are strong Cash Cows due to the company's deep-rooted market position and operational efficiencies. The company's focus on optimizing its mill network further supports the profitability of this business line, ensuring continued strong performance.

Historically, Greif's containerboard production was a significant Cash Cow, delivering robust sales and EBITDA in a mature market, though it has since been divested. In fiscal year 2023, the Paper Packaging segment, which included containerboard, reported net sales of $2.7 billion, underscoring its past cash-generating power.

Industrial packaging services, including logistics and warehousing, act as a cash cow by capitalizing on established infrastructure and client relationships to generate consistent revenue in a vital, albeit mature, market segment. These services also enhance customer loyalty and provide synergistic value to Greif's core packaging products.

| Product/Service | BCG Category | Market Share | Market Growth | Cash Flow Generation |

|---|---|---|---|---|

| Steel Drums | Cash Cow | High | Low | High |

| Fibre Drums | Cash Cow | High | Low | High |

| Corrugated Containers (Traditional) | Cash Cow | High | Low | High |

| Industrial Packaging Services | Cash Cow | High | Low | High |

Delivered as Shown

Greif BCG Matrix

The Greif BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed to guide strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool for your business planning.

Dogs

The A1 uncoated recycled paperboard machine in Austell, Georgia, is classified as a Dog within Greif's BCG Matrix. Greif announced the permanent cessation of production for this machine, a move driven by escalating operational costs and a noticeable downturn in demand from key sectors like furniture, book publishing, and binder manufacturing.

This situation clearly points to a low-growth market segment coupled with a weak competitive position for this specific asset. For instance, the paper and packaging industry, while generally stable, experienced some headwinds in specific segments during 2024 due to shifts in consumer spending and increased input costs, impacting products with less robust demand drivers.

The Fitchburg, MA containerboard and uncoated recycled paperboard (URB) mill, which Greif decided to permanently close, exemplifies a Dog in the BCG matrix. This operation faced significant challenges due to high operating costs and the necessity for substantial capital investment.

These factors, coupled with a market characterized by low demand for its products, rendered the mill unprofitable. Consequently, Greif’s decision to divest this asset underscores its classification as a Dog, indicating a business unit with low market share and low growth prospects.

Delta Petroleum Company, Inc., divested by Greif in Q3 2024, fits the profile of a Dog in the BCG Matrix. Despite being a sound business, its divestment signals it wasn't aligned with Greif's core growth objectives.

The company catered to more cyclical markets, indicating a stagnant or unpredictable market environment for this segment within Greif's broader portfolio. This strategic move reflects a focus on higher-potential areas for the company.

Underperforming Paperboard and Containerboard Production Facilities

Greif's strategic decision to close underperforming paperboard and containerboard production facilities signifies these assets are likely Dogs in the BCG Matrix. This means they possess low market share within their respective segments and operate in industries experiencing minimal growth.

These facilities are characterized by their inability to generate sufficient returns, often consuming cash without contributing meaningfully to overall profitability. Greif's move to shutter these operations is a direct component of a larger initiative focused on cost optimization and streamlining its operational footprint. For instance, in fiscal year 2023, Greif announced plans to close several facilities as part of its ongoing portfolio optimization, aiming to improve overall operational efficiency and financial performance.

- Low Market Share: These facilities typically hold a small percentage of sales in their specific paperboard or containerboard markets.

- Low Market Growth: The segments in which these facilities operate are not expanding significantly, limiting revenue potential.

- Cash Consumption: They require ongoing investment for maintenance and operations but yield poor returns, acting as cash drains.

- Cost Optimization: Closures are a strategic move to reduce operational expenses and reinvest capital in more promising areas of the business.

Legacy Products with Declining Demand

Greif's portfolio likely includes legacy products facing a long-term decline in demand. This is often due to shifts in consumer preferences or the evolution of end-user industries. For instance, the company's decision to close certain paperboard machines in 2023 was attributed to reduced demand in specific markets, indicating the presence of such products.

These products typically exhibit low growth potential and may see their market share gradually erode. For Greif, this segment represents a challenge where continued investment might not yield significant returns.

- Products in industries with secular decline: Packaging solutions for sectors like print media or certain types of traditional retail packaging may fall into this category.

- Low market share and growth: These products would likely show minimal revenue growth year-over-year and hold a small percentage of their respective markets.

- Impact of technological shifts: Advancements in digital media or changes in product delivery methods can reduce the need for older packaging formats.

- Strategic divestment potential: While not explicitly stated, such products are often candidates for divestiture if they do not align with Greif's long-term strategic goals.

Dogs in Greif's BCG Matrix represent business units or assets with low market share in low-growth industries. These segments are characterized by minimal expansion potential and a weak competitive standing, often leading to cash consumption without significant returns. Greif's strategic decisions, such as closing the Fitchburg mill or divesting Delta Petroleum in 2024, highlight their approach to managing these underperforming assets by focusing resources on more promising ventures.

| Asset/Business Unit | BCG Classification | Reasoning | Status/Action |

|---|---|---|---|

| A1 Uncoated Recycled Paperboard Machine, Austell, GA | Dog | Escalating operational costs, reduced demand in key sectors. | Permanent cessation of production. |

| Fitchburg, MA Containerboard and URB Mill | Dog | High operating costs, substantial capital investment needed, low product demand. | Permanent closure and divestment. |

| Delta Petroleum Company, Inc. | Dog | Catered to cyclical markets, not aligned with core growth objectives. | Divested in Q3 2024. |

Question Marks

Greif's new digital customer portal, introduced in January 2024, is currently positioned as a Question Mark within its business portfolio. The portal's success hinges on its ability to gain significant traction and demonstrably improve customer engagement and operational efficiency.

While the portal represents a strategic investment in digital transformation, its market acceptance and the resulting impact on Greif's revenue streams and competitive standing are still being evaluated. The company has allocated substantial resources, but the definitive return on this digital initiative remains an open question as adoption rates and direct financial benefits are yet to materialize fully.

Greif's strategic acquisitions in emerging markets or technologies would fit the Question Mark category. These are ventures in high-growth areas where Greif currently holds a low market share, necessitating substantial investment to achieve leadership. For instance, consider a hypothetical acquisition of a sustainable packaging startup in Southeast Asia; it offers immense growth potential but requires significant capital to establish a strong foothold.

Greif's strategic move into niche, high-growth industrial packaging applications positions its offerings as potential Stars within the BCG matrix. This involves targeting specialized sectors with rapidly evolving demands, such as advanced electronics or specialized pharmaceuticals, where innovative materials and designs are paramount. These ventures, while currently holding a smaller market share, represent significant future growth potential.

For instance, Greif's recent investments in sustainable packaging solutions, including fiber-based alternatives for sensitive goods, reflect this expansion strategy. In 2024, the industrial packaging market saw a notable uptick in demand for eco-friendly options, with sustainability initiatives driving an estimated 8% growth in specific segments. Capturing a larger share in these emerging areas will necessitate continued, substantial marketing and R&D investment.

Development of Advanced Recycling Technologies for Packaging

Greif's investment in advanced recycling technologies for its packaging portfolio, encompassing steel, paper, and rigid plastic, could be classified as a Question Mark in the BCG Matrix. While the global market for sustainable packaging solutions is projected to reach $400 billion by 2027, the economic feasibility and scalability of novel recycling processes for these diverse materials remain uncertain. Significant research and development expenditure, coupled with substantial capital outlays, would be necessary to establish these technologies, with their future market share and profitability yet to be determined.

- Market Growth: The sustainable packaging market is expanding, with a compound annual growth rate (CAGR) of approximately 6.5% expected through 2027.

- Technological Uncertainty: Advanced recycling methods, such as chemical recycling, are still in early stages of commercialization, facing challenges in efficiency and cost-competitiveness.

- Capital Intensity: Implementing new recycling infrastructure can require investments ranging from tens to hundreds of millions of dollars per facility.

- Regulatory Landscape: Evolving regulations around recycled content and waste management could impact the adoption and profitability of these technologies.

Geographic Expansion into Untapped High-Growth Regions

Geographic expansion into untapped high-growth regions for Greif would be classified as a Star or Question Mark in the BCG Matrix, depending on its current market share in those regions. These strategic moves involve significant capital outlay for infrastructure and market development, aiming to capture nascent demand. For instance, Greif's reported strong performance in Europe, the Middle East, and Africa in recent years (as of early 2024) suggests these could be prime candidates for further targeted expansion, potentially transitioning from Question Marks to Stars if successful.

- Strategic Focus: Entering emerging economies with low Greif market share but high growth potential.

- Investment Needs: Requires substantial capital for infrastructure, market entry, and local alliances.

- Potential Classification: Fits into Star or Question Mark categories of the BCG Matrix.

- Illustrative Regions: Europe, Middle East, and Africa show promising performance, indicating areas for focused growth initiatives.

Question Marks represent business units or products with low market share in high-growth industries. Greif's new digital customer portal, launched in January 2024, exemplifies this, requiring substantial investment to gain traction and prove its value in a rapidly evolving digital landscape. Similarly, strategic acquisitions in emerging markets or new technologies, like a hypothetical sustainable packaging startup in Southeast Asia, also fall into this category due to their high growth potential but current low market penetration for Greif.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.